Recovery Drinks Market Report

Published Date: 31 January 2026 | Report Code: recovery-drinks

Recovery Drinks Market Size, Share, Industry Trends and Forecast to 2033

This report provides an insightful analysis of the Recovery Drinks market, covering key trends, technological advancements, and detailed forecasts from 2023 to 2033. With a focus on market size, regional dynamics, and competitive landscape, it aims to equip stakeholders with essential data for strategic decision-making.

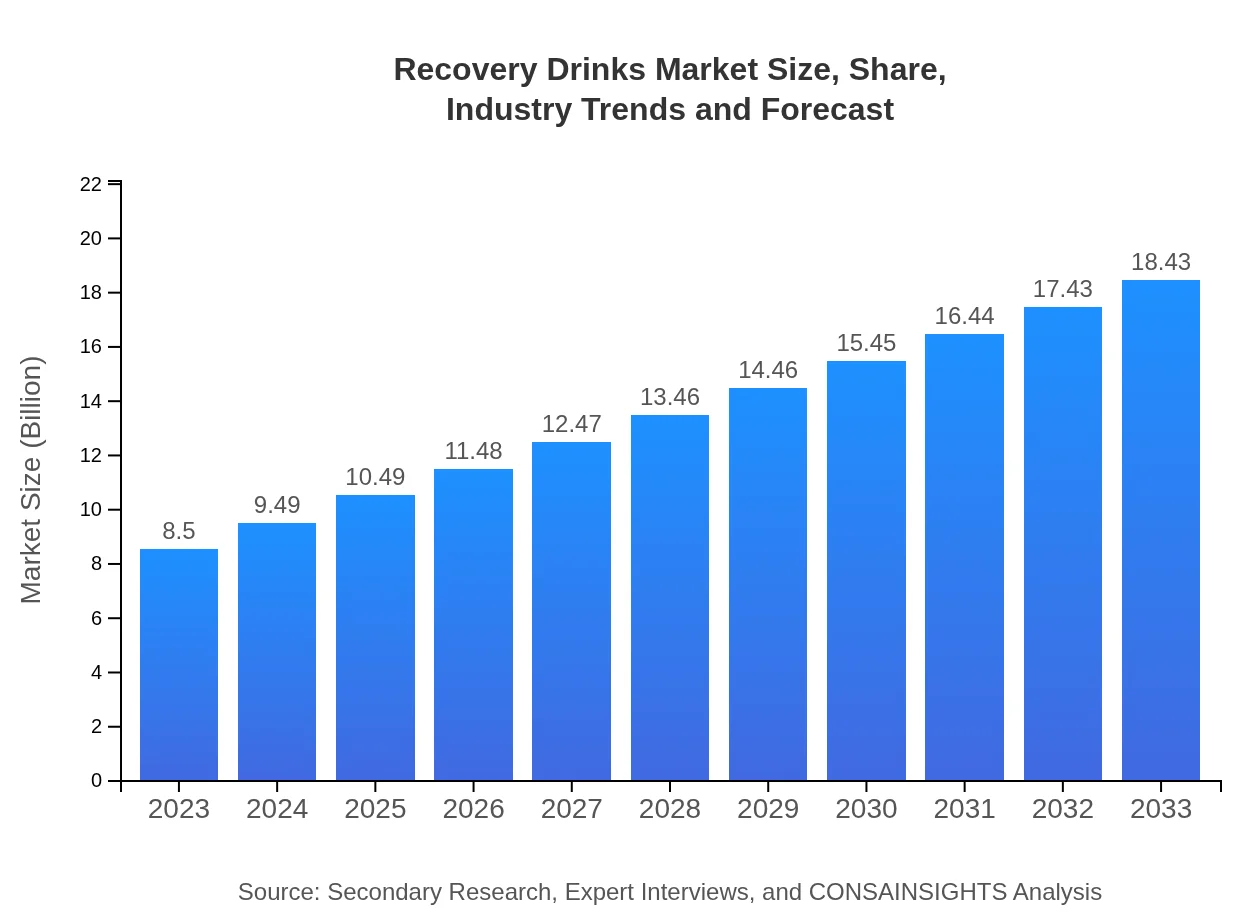

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $18.43 Billion |

| Top Companies | Gatorade (PepsiCo), Powerade (Coca-Cola), Isostar, Optimum Nutrition, Nuun |

| Last Modified Date | 31 January 2026 |

Recovery Drinks Market Overview

Customize Recovery Drinks Market Report market research report

- ✔ Get in-depth analysis of Recovery Drinks market size, growth, and forecasts.

- ✔ Understand Recovery Drinks's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Recovery Drinks

What is the Market Size & CAGR of Recovery Drinks market in 2023?

Recovery Drinks Industry Analysis

Recovery Drinks Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Recovery Drinks Market Analysis Report by Region

Europe Recovery Drinks Market Report:

The European Recovery Drinks market is anticipated to grow from $2.56 billion in 2023 to $5.56 billion in 2033. The demand is bolstered by an increasing focus on health and wellness, along with the growing popularity of sports and outdoor activities, especially among millennials.Asia Pacific Recovery Drinks Market Report:

In the Asia Pacific region, the Recovery Drinks market is projected to grow from $1.76 billion in 2023 to $3.81 billion in 2033. Factors such as rising disposable incomes, urbanization, and an increase in health awareness are driving demand for recovery drinks in countries like China, India, and Japan.North America Recovery Drinks Market Report:

North America holds a significant share of the Recovery Drinks market, with estimations of growth from $2.73 billion in 2023 to $5.92 billion by 2033. The U.S. and Canada are leading the charge, driven by a strong fitness culture, robust health and wellness trends, and the availability of diverse product offerings.South America Recovery Drinks Market Report:

The South American market for Recovery Drinks is expected to expand from $0.81 billion in 2023 to $1.76 billion in 2033. This region is witnessing growing participation in fitness activities and an increasing trend towards healthier beverage options, particularly among the youth.Middle East & Africa Recovery Drinks Market Report:

The Middle East and Africa region has a smaller yet fast-growing Recovery Drinks market, forecasted to rise from $0.64 billion in 2023 to $1.39 billion by 2033. The growth is driven by a shift towards healthier lifestyles and increased awareness of nutrition as part of fitness regimes.Tell us your focus area and get a customized research report.

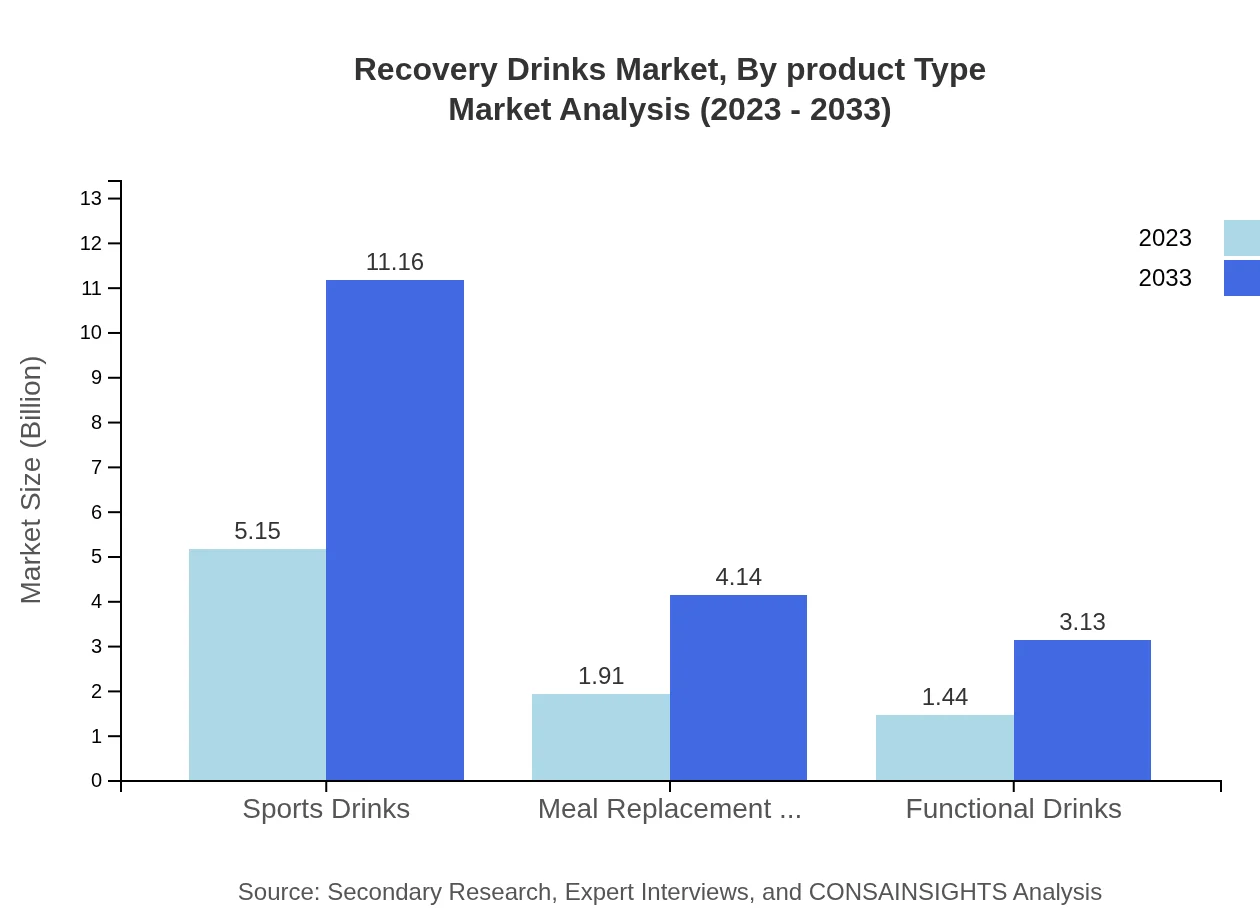

Recovery Drinks Market Analysis By Product Type

In terms of product type, sports drinks are expected to dominate the market, growing from $5.15 billion in 2023 to $11.16 billion in 2033, holding a market share of approximately 60.57%. Meal replacement drinks are also gaining traction, projected to rise from $1.91 billion to $4.14 billion within the same period, maintaining a share of 22.45%. Functional drinks, with a focus on health benefits, are expected to expand from $1.44 billion to $3.13 billion.

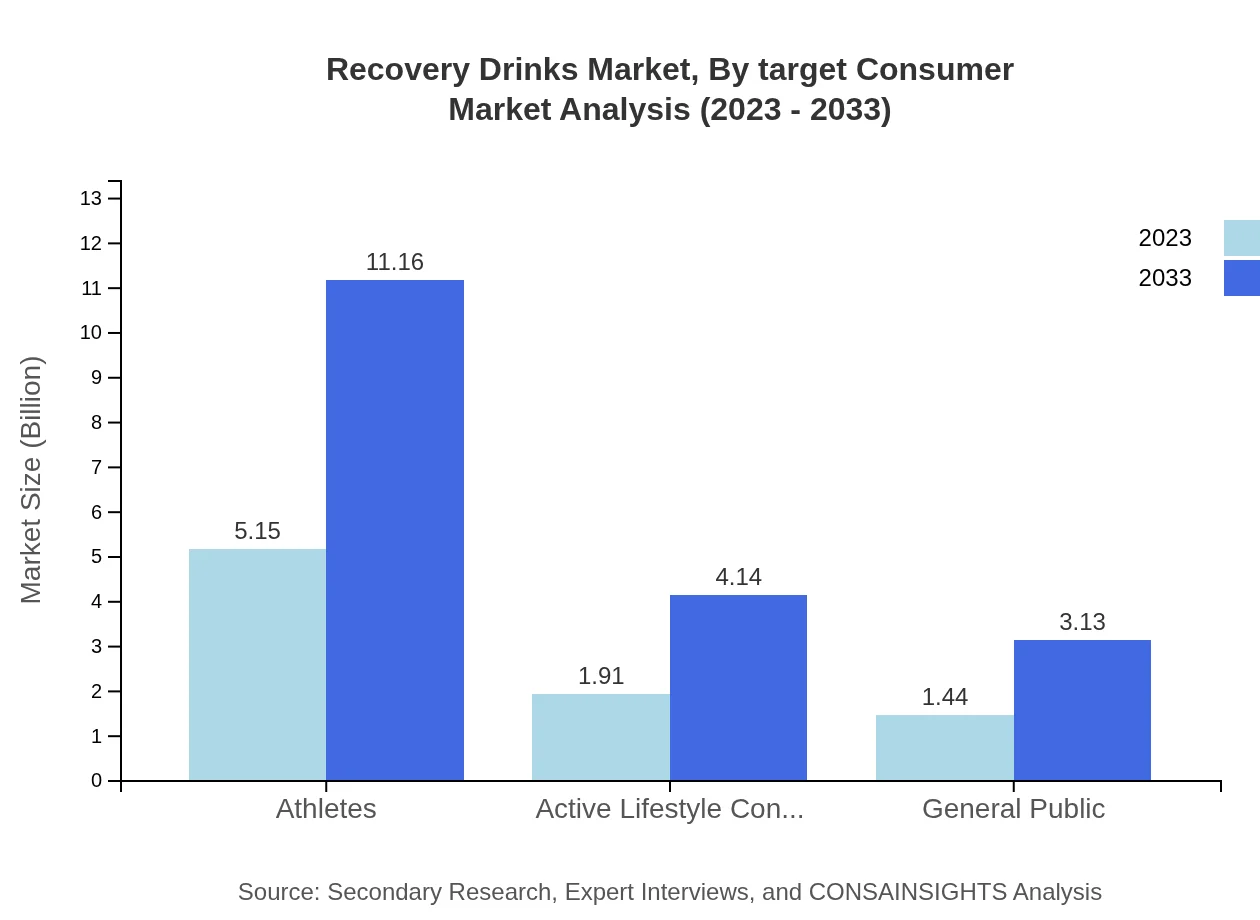

Recovery Drinks Market Analysis By Target Consumer

The target consumer analysis reveals that athletes account for the largest segment, representing a market size of $5.15 billion in 2023 and projected to reach $11.16 billion by 2033. Active lifestyle consumers and the general public have significant shares as well, with expected growth from $1.91 billion to $4.14 billion and $1.44 billion to $3.13 billion respectively, indicating a broadening consumer base.

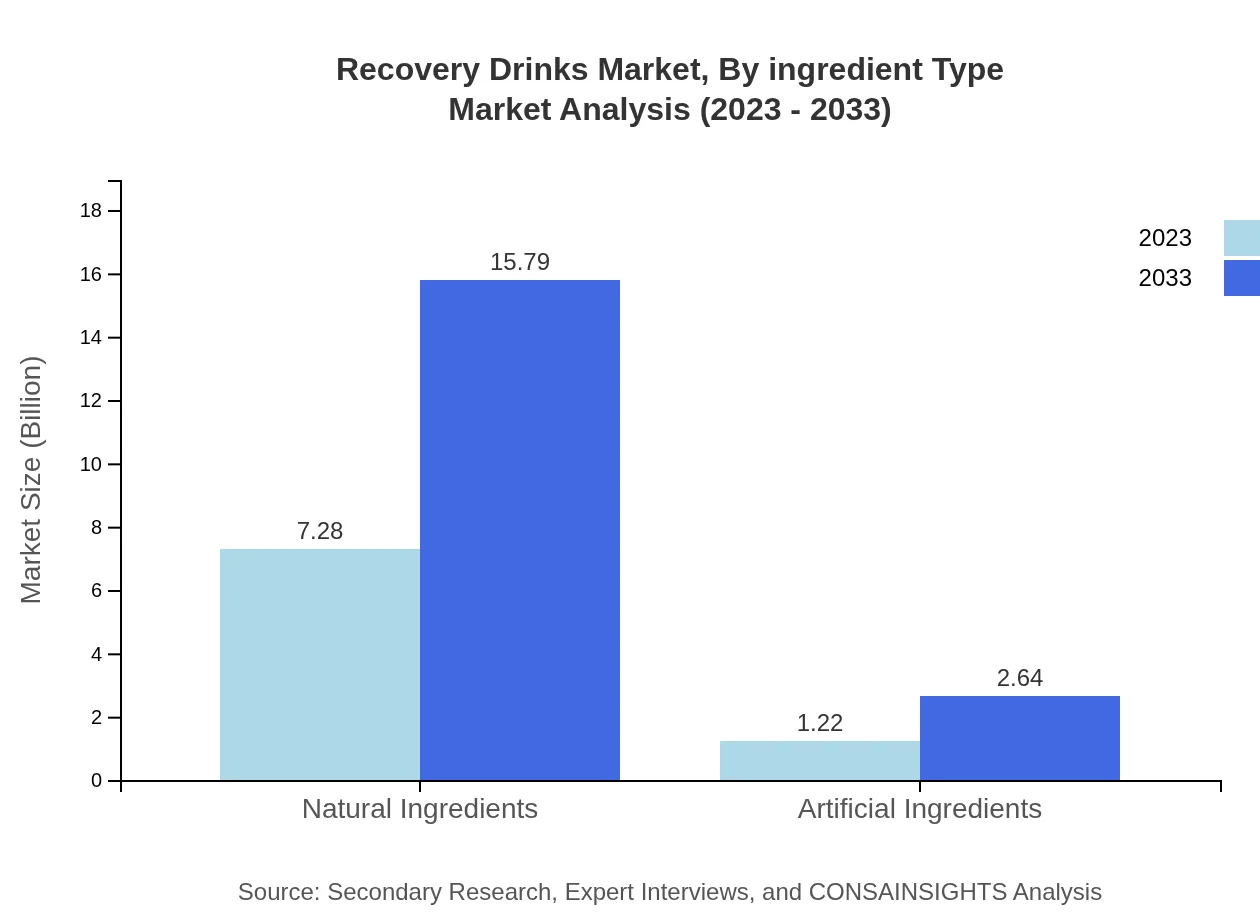

Recovery Drinks Market Analysis By Ingredient Type

Natural ingredients dominate the Recovery Drinks market, with a size of $7.28 billion in 2023, forecasted to reach $15.79 billion by 2033, capturing about 85.67% of the market share. On the other hand, products with artificial ingredients, although growing, are estimated to expand from $1.22 billion to $2.64 billion, accounting for 14.33% of the market.

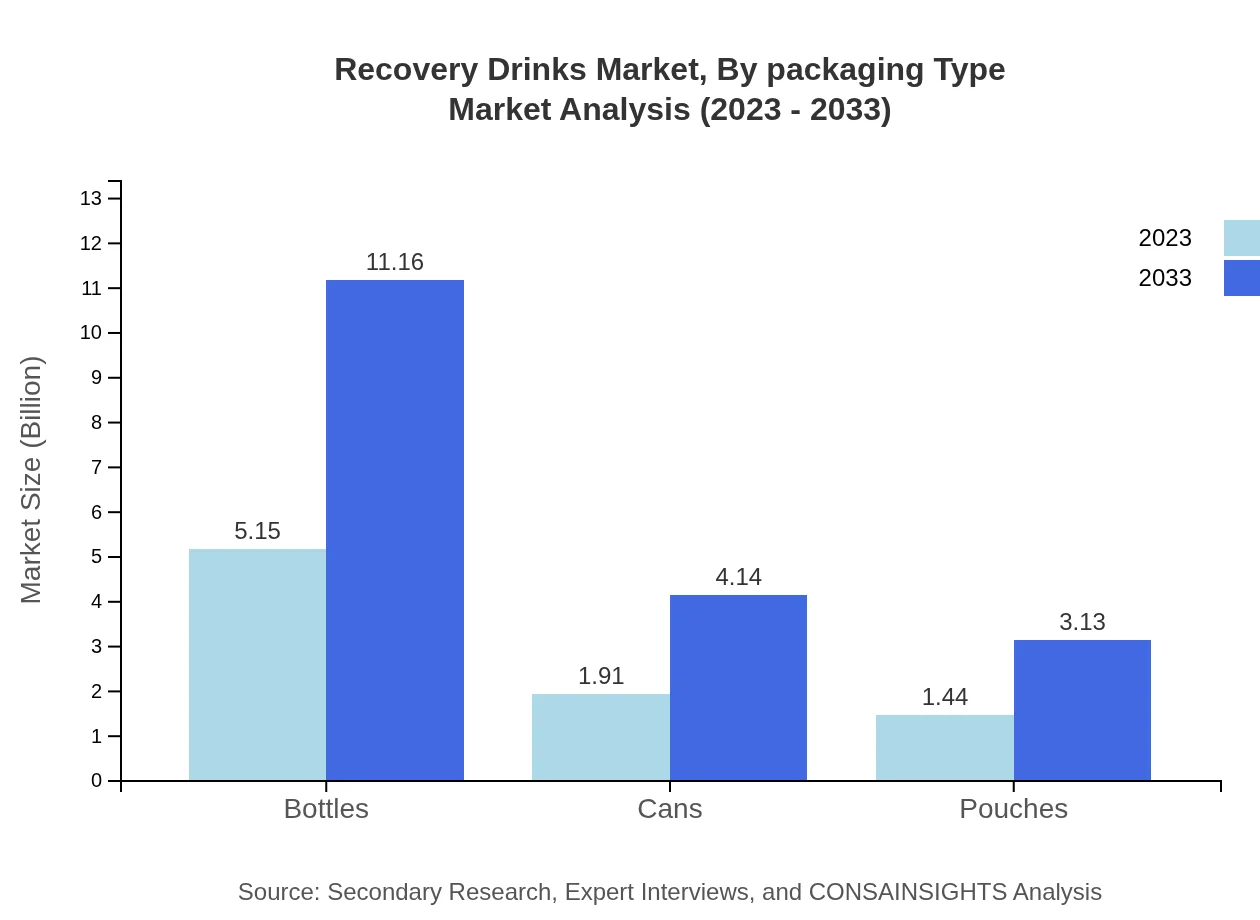

Recovery Drinks Market Analysis By Packaging Type

Packaging plays a vital role, with bottles leading the market with a size of $5.15 billion in 2023, expected to grow to $11.16 billion by 2033. Cans and pouches are also important, with respective forecasts of growth from $1.91 billion to $4.14 billion and $1.44 billion to $3.13 billion.

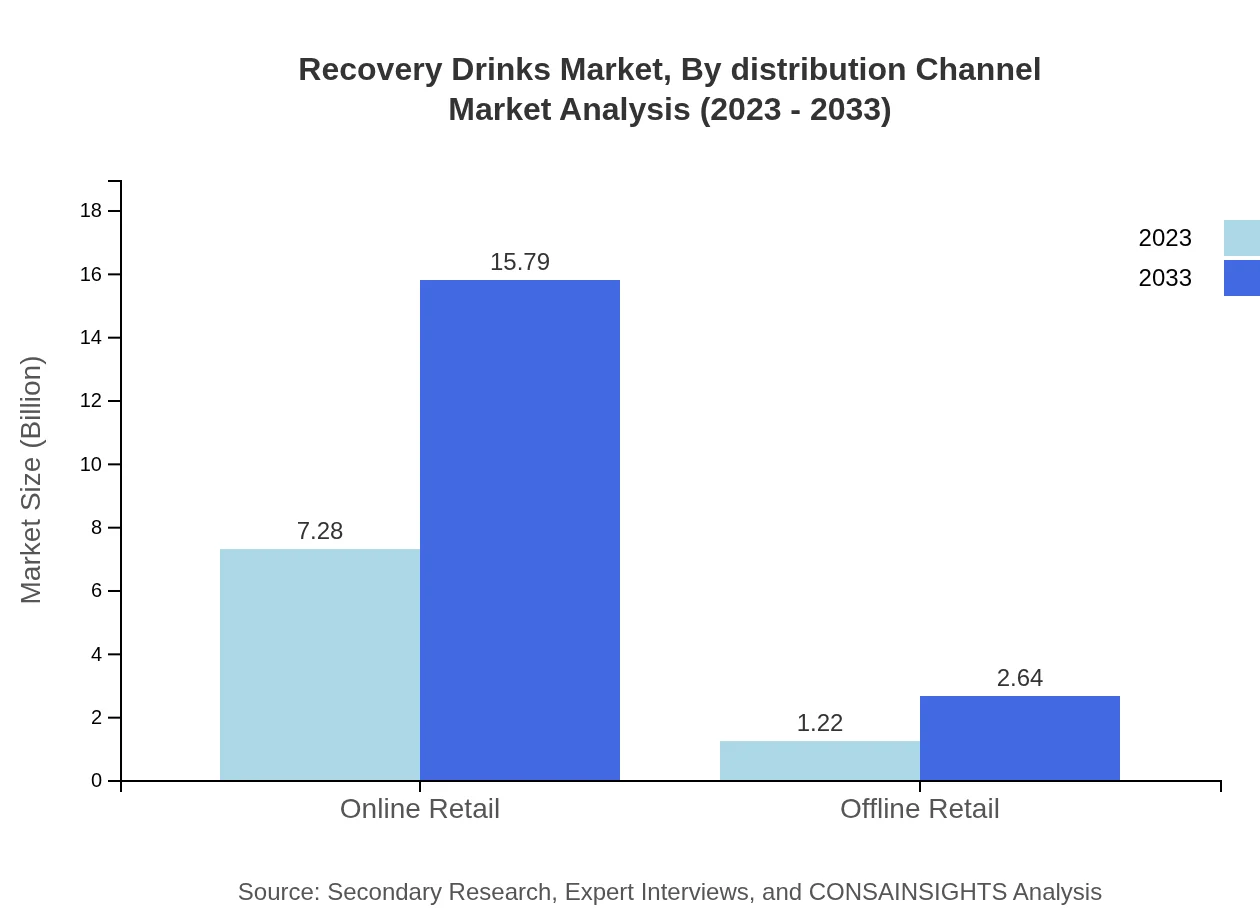

Recovery Drinks Market Analysis By Distribution Channel

The distribution channel breakdown shows a significant preference for online retail, with a market size of $7.28 billion projected to reach $15.79 billion by 2033, maintaining a share of 85.67%. Offline retail, although growing from $1.22 billion to $2.64 billion, will hold a smaller segment share at 14.33%.

Recovery Drinks Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Recovery Drinks Industry

Gatorade (PepsiCo):

Known for its sports drinks, Gatorade is a leader in recovery beverages with extensive marketing and product diversification targeting athletes and active consumers.Powerade (Coca-Cola):

A prominent competitor in the sports drink sector, Powerade focuses on hydration and performance recovery, leveraging strong distribution channels.Isostar:

This brand specializes in sports nutrition and energy drinks, offering a wide range of products formulated for athletes and fitness enthusiasts.Optimum Nutrition:

Recognized for protein and meal replacement drinks, Optimum Nutrition has established a foothold in the recovery market, emphasizing quality and ingredient transparency.Nuun:

Nuun focuses on electrolyte tablets that appeal to health-conscious consumers, enhancing hydration and recovery in a convenient format.We're grateful to work with incredible clients.

FAQs

What is the market size of the recovery drinks industry?

The recovery drinks market is currently valued at approximately $8.5 billion, with an anticipated compound annual growth rate (CAGR) of 7.8%. This growth indicates strong demand for recovery beverages across various consumer segments.

What are the key market players or companies in the recovery drinks industry?

Key players in the recovery drinks market include major beverage companies specializing in sports, functional, and meal replacement drinks, providing a diverse range of products that cater to athletes and active consumers multi-channel strategies.

What are the primary factors driving growth in the recovery drinks industry?

The growth of the recovery drinks industry is primarily driven by rising health consciousness, increased sports participation, and growing demand for nutrient-rich recovery solutions. Additionally, innovations in flavors and ingredients also contribute substantially to market expansion.

Which region is the fastest Growing in the recovery drinks market?

The fastest-growing region in the recovery drinks market is projected to be Asia-Pacific, with significant growth anticipated, increasing from $1.76 billion in 2023 to $3.81 billion by 2033, reflecting growing health trends and lifestyle changes in emerging markets.

Does ConsaInsights provide customized market report data for the recovery drinks industry?

Yes, ConsaInsights offers customized market report data for the recovery drinks industry, tailoring insights to meet specific client needs, such as focus on regional trends, competitive analysis, and consumer preferences, ensuring actionable strategies.

What deliverables can I expect from this recovery drinks market research project?

Deliverables from the recovery drinks market research project typically include detailed market analysis reports, segment performance data, competitor profiling, and forecasts, providing comprehensive insights that help inform strategic decisions and market entry.

What are the market trends of recovery drinks?

Key market trends in recovery drinks include a shift towards natural ingredients, convenience-focused packaging, and the rise of online retail channels. Segment growth indicates preferences for sports drinks and meal replacements, reflecting consumer inclination towards effective recovery solutions.