Refining Industry Automation And Software Market Report

Published Date: 22 January 2026 | Report Code: refining-industry-automation-and-software

Refining Industry Automation And Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Refining Industry Automation and Software market, covering crucial insights, market trends, and future forecasts from 2023 to 2033.

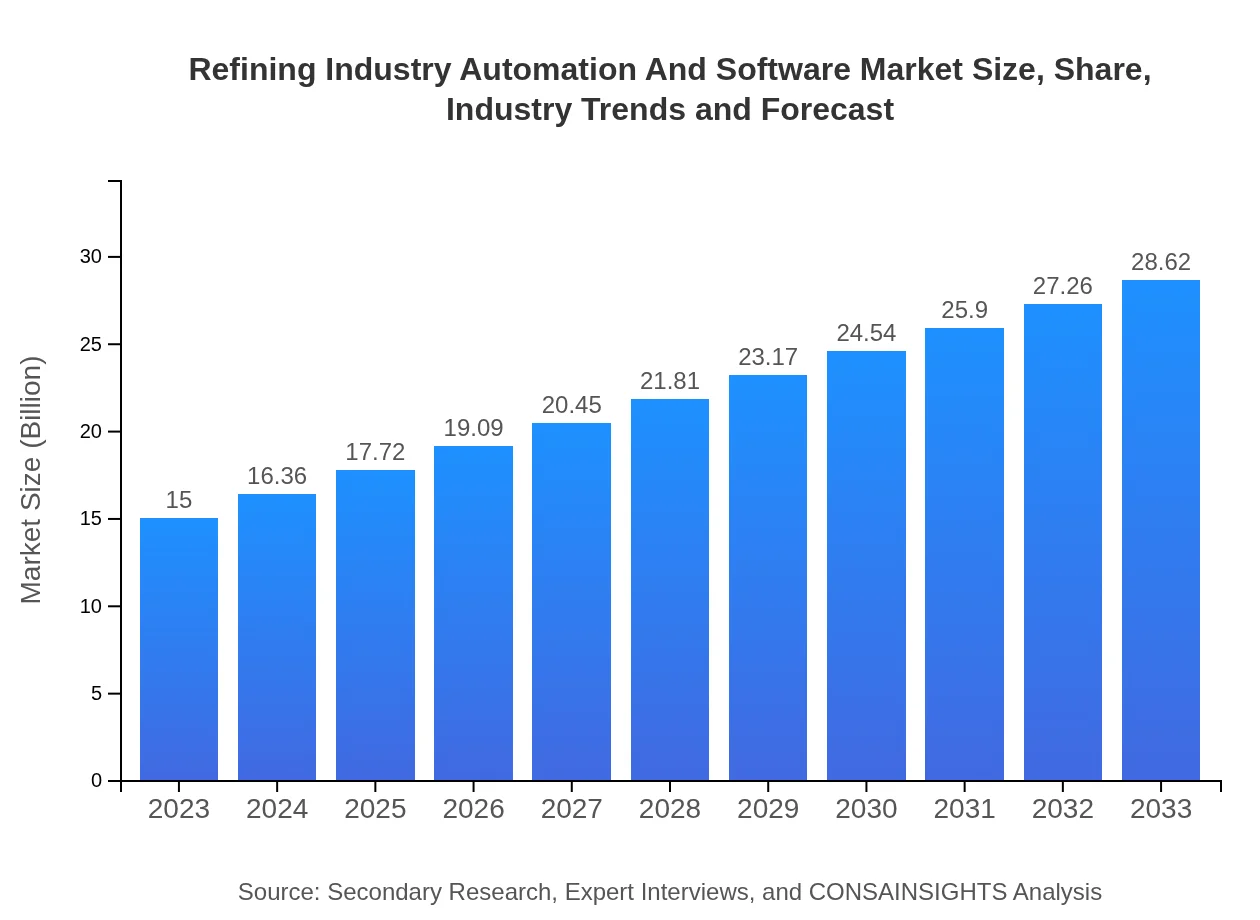

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $28.62 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Emerson Electric Co., Schneider Electric, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Refining Industry Automation And Software Market Overview

Customize Refining Industry Automation And Software Market Report market research report

- ✔ Get in-depth analysis of Refining Industry Automation And Software market size, growth, and forecasts.

- ✔ Understand Refining Industry Automation And Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Refining Industry Automation And Software

What is the Market Size & CAGR of Refining Industry Automation And Software market in 2023?

Refining Industry Automation And Software Industry Analysis

Refining Industry Automation And Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Refining Industry Automation And Software Market Analysis Report by Region

Europe Refining Industry Automation And Software Market Report:

In 2023, Europe dominated the market at approximately $4.41 billion, expected to see significant growth to $8.41 billion by 2033. Stringent environmental regulations and a push for operational efficiency are key drivers for market growth in this region.Asia Pacific Refining Industry Automation And Software Market Report:

In 2023, the Asia Pacific market was valued at approximately $3.24 billion, expected to grow to $6.18 billion by 2033. The region is witnessing a surge in refinery modernization and investment in advanced automation technologies, propelled by increasing fuel demand and economic growth in emerging markets.North America Refining Industry Automation And Software Market Report:

The North American market was valued at $4.93 billion in 2023, forecasted to reach $9.40 billion by 2033. This growth can be attributed to the presence of major refining companies and a rising focus on technological advancements, particularly in the U.S.South America Refining Industry Automation And Software Market Report:

South America accounted for a market size of about $1.39 billion in 2023, projected to rise to $2.66 billion by 2033. Growth in this region is driven by increased investments in refining capacity and the need for better operational efficiency in local refineries.Middle East & Africa Refining Industry Automation And Software Market Report:

The Middle East and Africa market held a size of about $1.04 billion in 2023, anticipated to grow to $1.98 billion by 2033. The region's refining sector is modernizing rapidly, driven by technological investments in automation and software solutions.Tell us your focus area and get a customized research report.

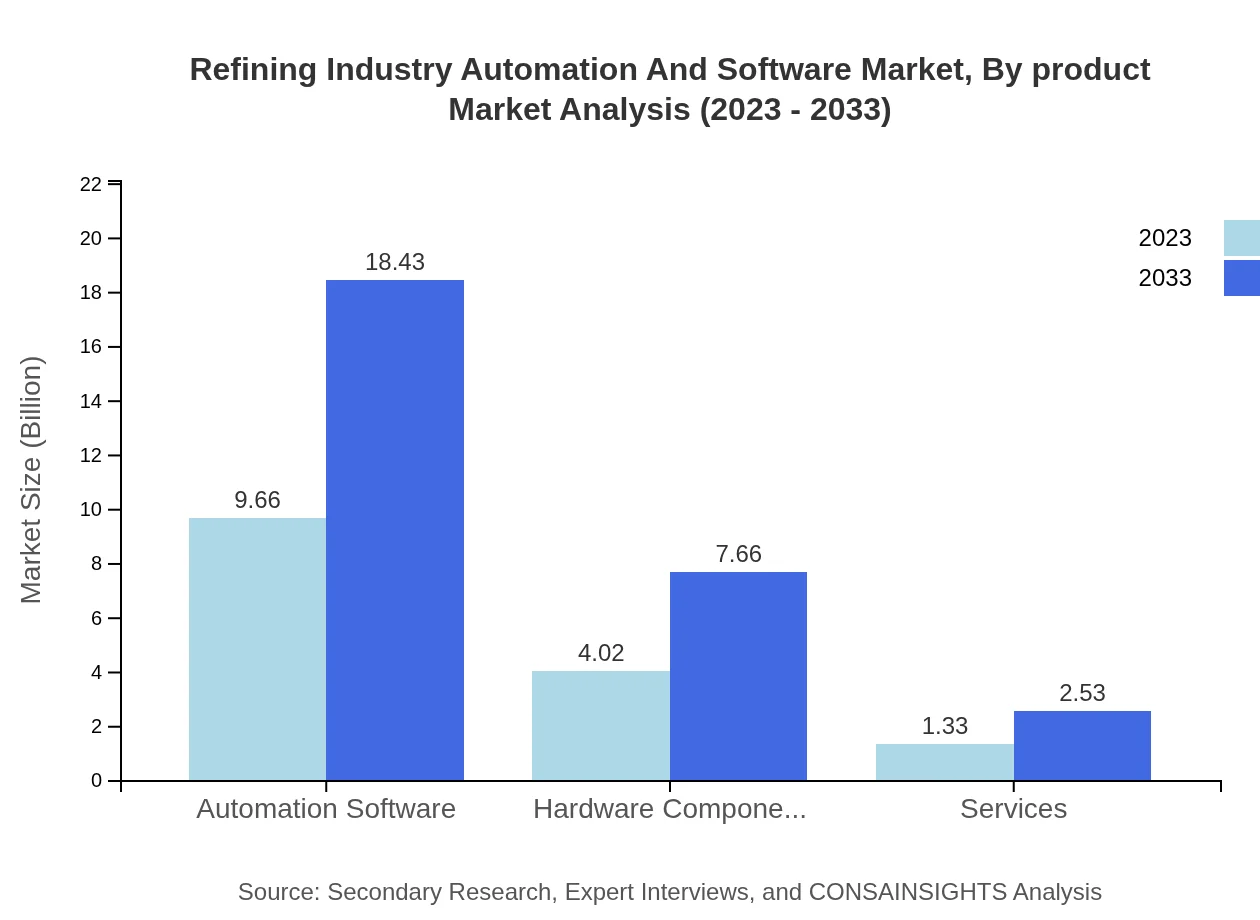

Refining Industry Automation And Software Market Analysis By Product

The Refining Industry Automation and Software market consists primarily of automation software, hardware components, and services. In 2023, automation software accounted for a market size of $9.66 billion (64.38% market share), with a projection of $18.43 billion (64.38% share) by 2033. Hardware components followed, with a market size of $4.02 billion (26.77% share) in 2023, expected to rise to $7.66 billion (26.77% share) by 2033. Services also play a critical role, starting at $1.33 billion (8.85% share) in 2023 and anticipated to reach $2.53 billion (8.85% share) by 2033.

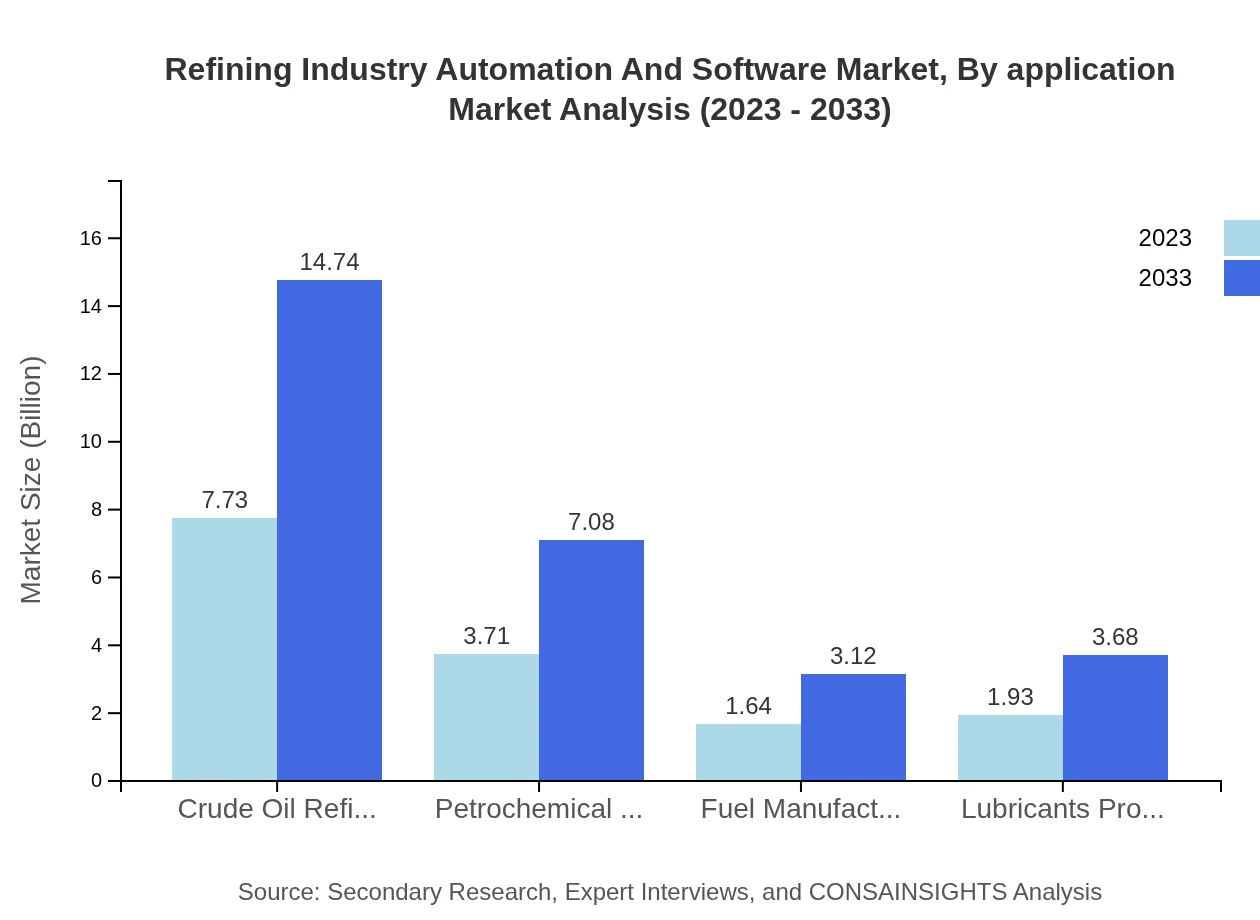

Refining Industry Automation And Software Market Analysis By Application

By application, the market predominantly serves crude oil refining, which is projected to grow from $7.73 billion (51.51% market share) in 2023 to $14.74 billion (51.51% share) by 2033. Petrochemical production is another significant segment, expected to expand from $3.71 billion (24.72% share) to $7.08 billion (24.72% share) during the same period. Other important applications include fuel manufacturing and lubricants production, highlighting the diverse nature of applications in the industry.

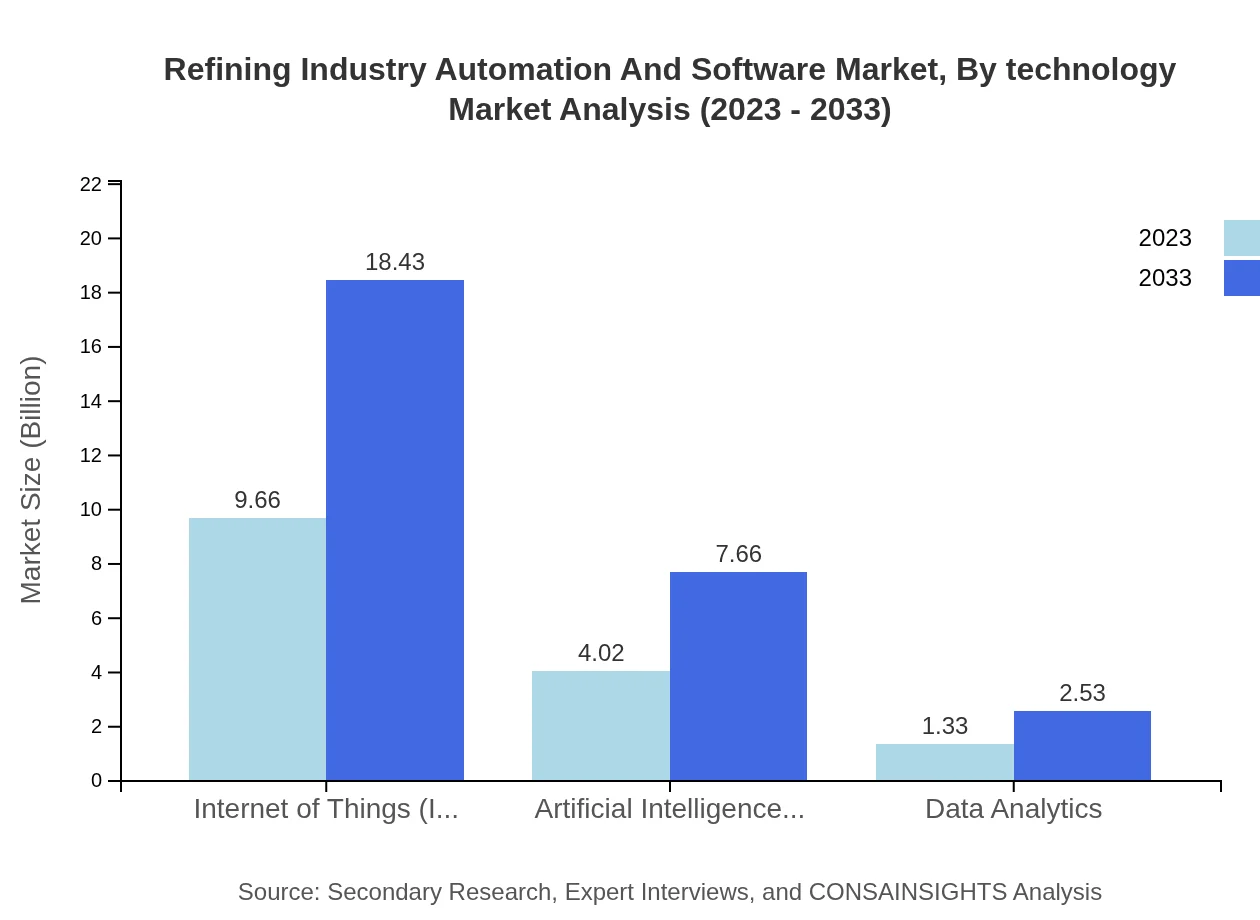

Refining Industry Automation And Software Market Analysis By Technology

Technology significantly influences market trends, with automation software, IoT, AI, and data analytics leading the way. For instance, the IoT segment is anticipated to grow from $9.66 billion (64.38% market share) in 2023 to $18.43 billion (64.38% share) by 2033, while AI and machine learning technologies are also expanding, from $4.02 billion (26.77% share) to $7.66 billion (26.77% share). This advancement is crucial in streamlining refinery operations.

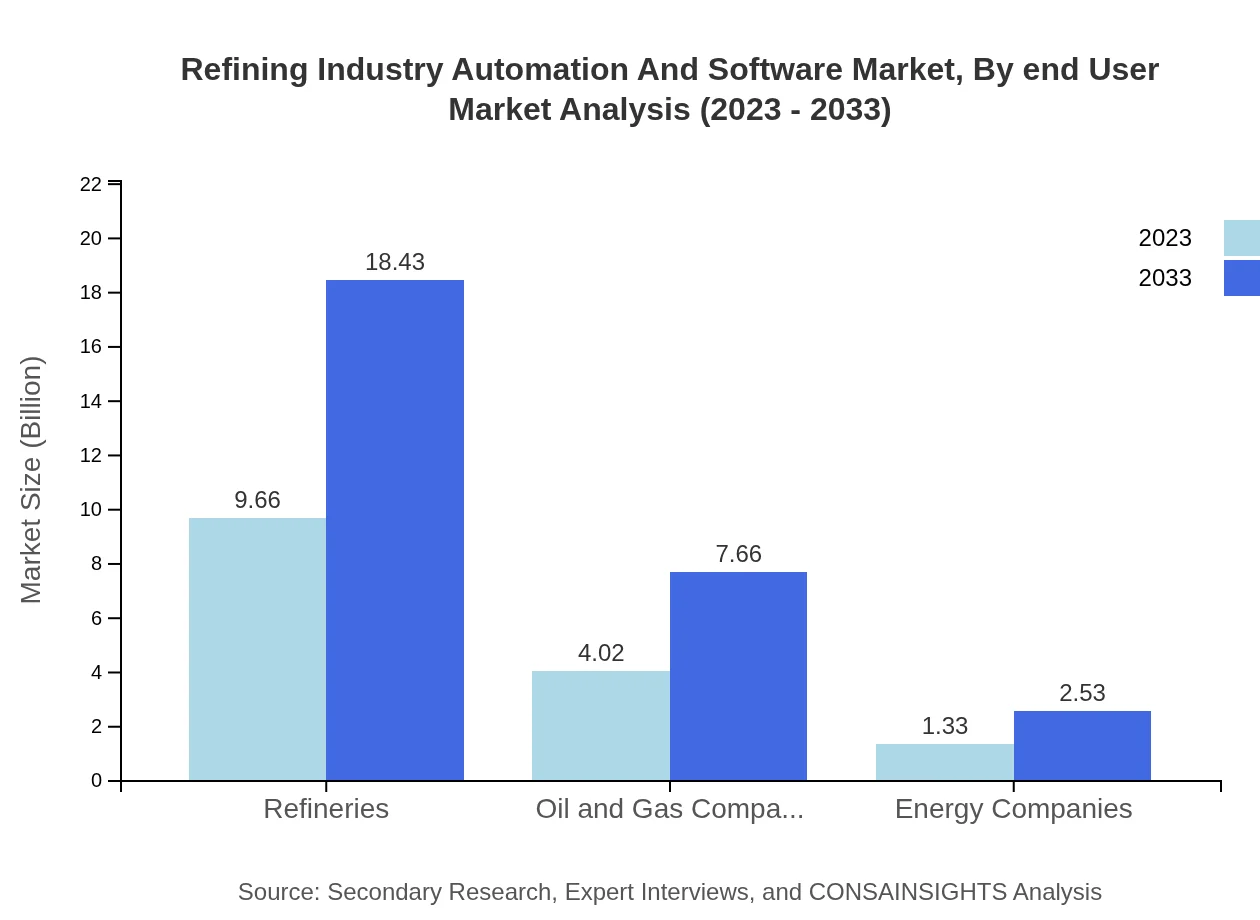

Refining Industry Automation And Software Market Analysis By End User

Various end-users, including refineries, oil and gas companies, and energy firms, utilize automation and software solutions. In 2023, refineries accounted for a significant portion of the market at approximately $9.66 billion (64.38% share), projected to grow to $18.43 billion (64.38% share) by 2033. Oil and gas companies represented $4.02 billion (26.77% share), expected to grow to $7.66 billion (26.77% share). These insights illustrate the crucial role of end-users in driving the market.

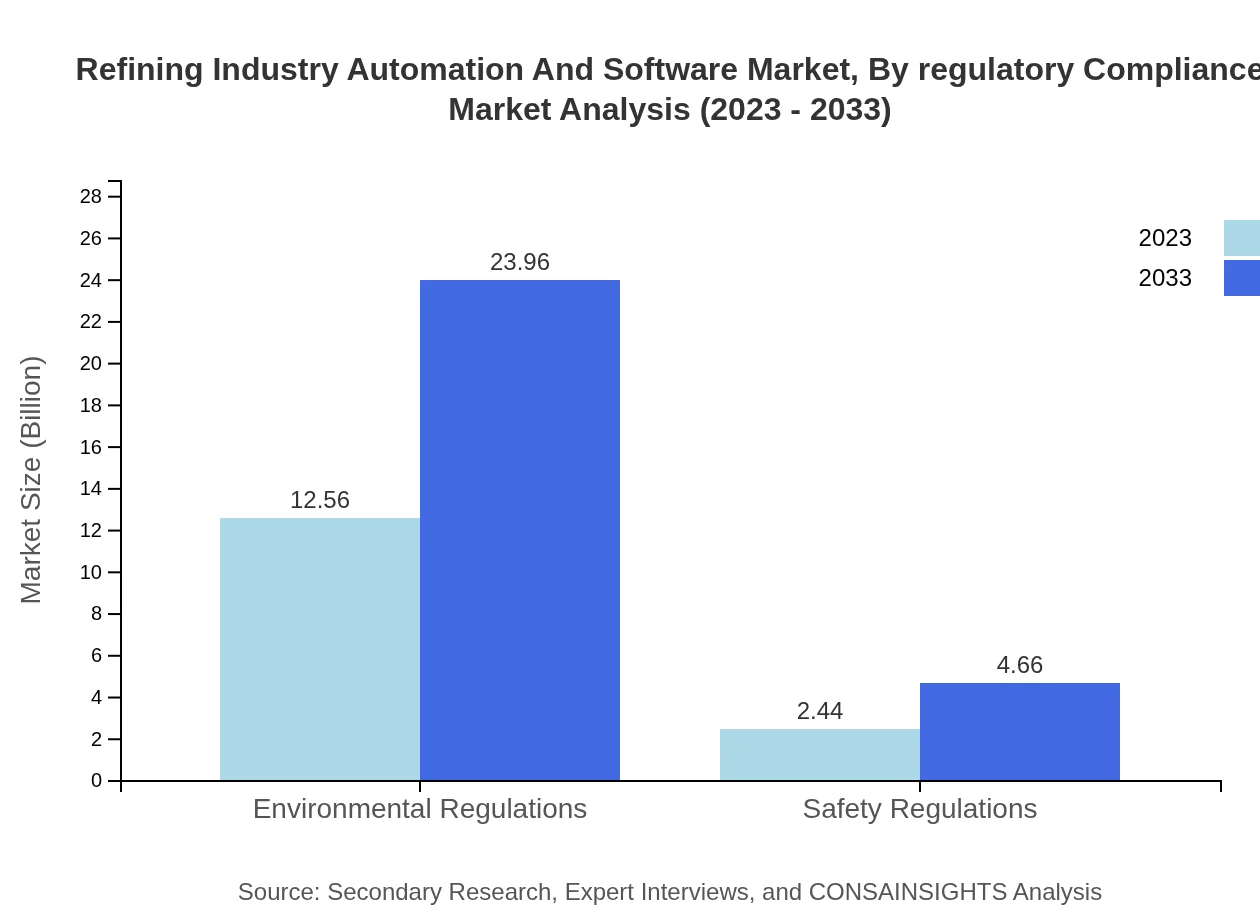

Refining Industry Automation And Software Market Analysis By Regulatory Compliance

Regulatory compliance is a vital segment in the refining industry, focusing on safety and environmental standards. Noteworthy is the environmental regulations component, which in 2023 had a market size of $12.56 billion (83.71% share), projected to rise to $23.96 billion (83.71% share) by 2033. Safety regulations also contribute, anticipated to grow from $2.44 billion (16.29% share) to $4.66 billion (16.29% share). This segment emphasizes the importance of compliance solutions that meet stringent industry standards.

Refining Industry Automation And Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Refining Industry Automation And Software Industry

Honeywell International Inc.:

A leader in automation technologies, Honeywell offers software solutions that enhance productivity and safety in refining processes.Siemens AG:

Siemens provides cutting-edge automation solutions and software designed to optimize operations within the refining and petrochemical sectors.Emerson Electric Co.:

Emerson is known for its comprehensive automation solutions that improve efficiency and sustainability for global refining operations.Schneider Electric:

Specializing in energy management and automation solutions, Schneider Electric ensures safety and compliance in refineries.ABB Ltd.:

ABB offers a wide array of automation technologies for the refining industry, focusing on enhancing operational reliability and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of refining Industry Automation And Software?

The refining industry automation and software market is projected to reach a size of $15 billion by 2033, growing at a CAGR of 6.5% from the base market size.

What are the key market players or companies in this refining Industry Automation And Software industry?

Key players in the refining industry automation and software market include major oil and gas corporations, technology providers specializing in industrial automation and software solutions.

What are the primary factors driving the growth in the refining Industry Automation And Software industry?

Growth in this industry is driven by increasing investments in refining capacity, advancements in automation technology, and a strong emphasis on efficiency and safety regulations compliance.

Which region is the fastest Growing in the refining Industry Automation And Software?

The Asia Pacific region is the fastest-growing in the refining industry automation and software market, expected to grow from $3.24 billion in 2023 to $6.18 billion by 2033.

Does ConsaInsights provide customized market report data for the refining Industry Automation And Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the refining industry automation and software sector.

What deliverables can I expect from this refining Industry Automation And Software market research project?

Expect comprehensive reports, including market analysis, forecasts, competitive landscape insights, regional breakdowns, and segmentation data for informed decision-making.

What are the market trends of refining Industry Automation And Software?

Current trends include increased digitalization with IoT, adoption of AI for predictive maintenance, and a focus on sustainability and regulatory compliance in operations.