Refrigerated Transport Market Report

Published Date: 22 January 2026 | Report Code: refrigerated-transport

Refrigerated Transport Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Refrigerated Transport market, highlighting market size, growth rates, industry trends, and forecasts for the period 2023 to 2033. Insights into various segments, regional performance, and key players in the industry are also covered.

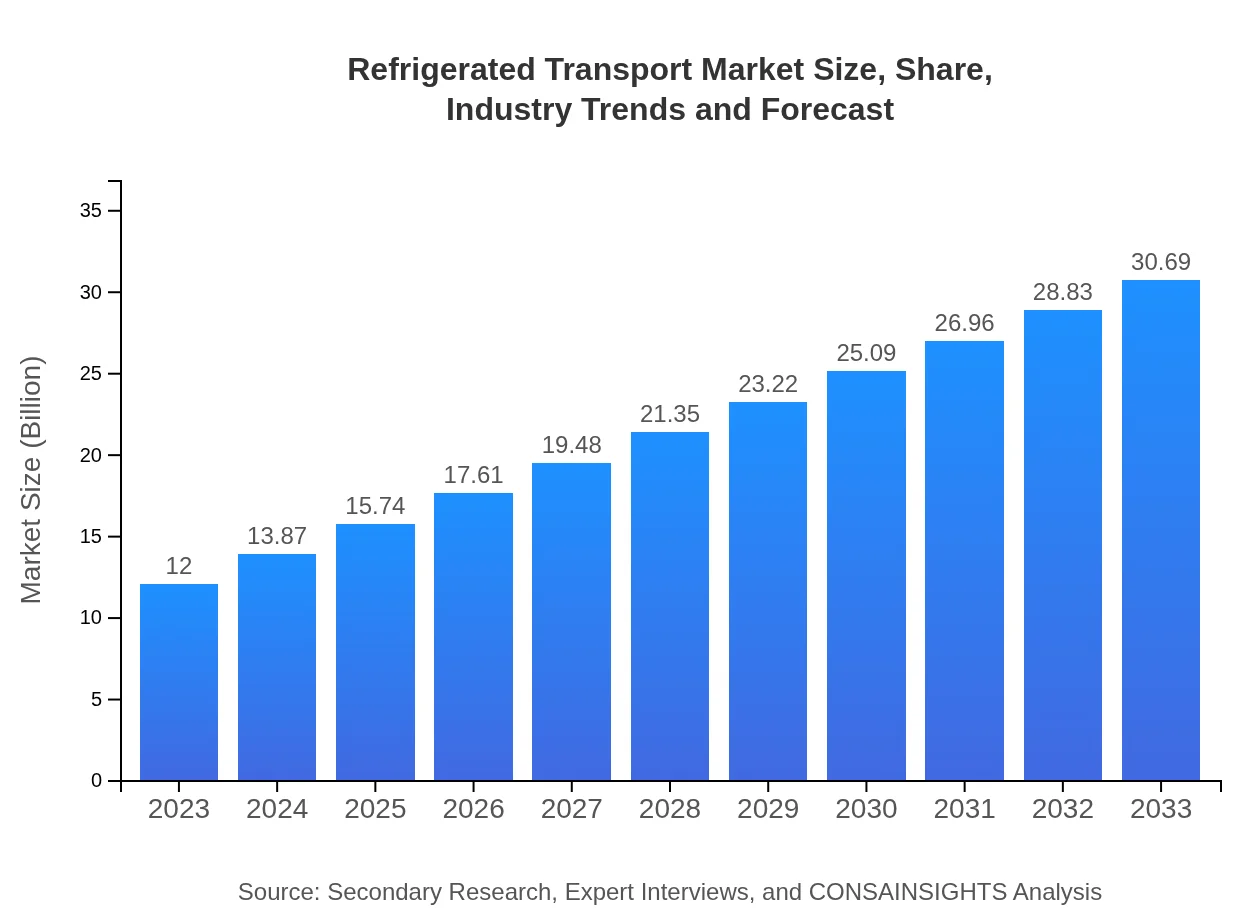

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Carrier Global, Thermo King, DHL Supply Chain, Crown Equipment Corporation |

| Last Modified Date | 22 January 2026 |

Refrigerated Transport Market Overview

Customize Refrigerated Transport Market Report market research report

- ✔ Get in-depth analysis of Refrigerated Transport market size, growth, and forecasts.

- ✔ Understand Refrigerated Transport's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Refrigerated Transport

What is the Market Size & CAGR of Refrigerated Transport market in 2023?

Refrigerated Transport Industry Analysis

Refrigerated Transport Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Refrigerated Transport Market Analysis Report by Region

Europe Refrigerated Transport Market Report:

The European market is expected to see substantial growth, moving from $3.67 billion in 2023 to $9.38 billion by 2033. Stringent food safety regulations and the increasing prevalence of online grocery shopping are key trends propelling this market.Asia Pacific Refrigerated Transport Market Report:

The Asia Pacific refrigerated transport market is undergoing significant growth, projected to expand from $2.32 billion in 2023 to $5.95 billion by 2033. This growth is fueled by rising consumer incomes, increasing urbanization, and growing demand for fresh food products. Countries like China and India are experiencing rapid growth in e-commerce, necessitating enhanced cold chain logistics.North America Refrigerated Transport Market Report:

North America demonstrates a robust market, anticipated to grow from $4.07 billion in 2023 to $10.40 billion in 2033. Factors contributing to this growth include a well-established infrastructure, technological innovations, and increasing demand for perishable goods across varying retail sectors.South America Refrigerated Transport Market Report:

In South America, the market is expected to progress from $0.46 billion in 2023 to $1.18 billion in 2033. The growth is primarily driven by improvements in food processing and agriculture, alongside a greater focus on supply chain transparency and food safety.Middle East & Africa Refrigerated Transport Market Report:

The Middle East and Africa market is projected to grow from $1.48 billion in 2023 to $3.79 billion by 2033, driven by advancements in transport infrastructure and the emergence of new logistics service providers focusing on cold chain transport.Tell us your focus area and get a customized research report.

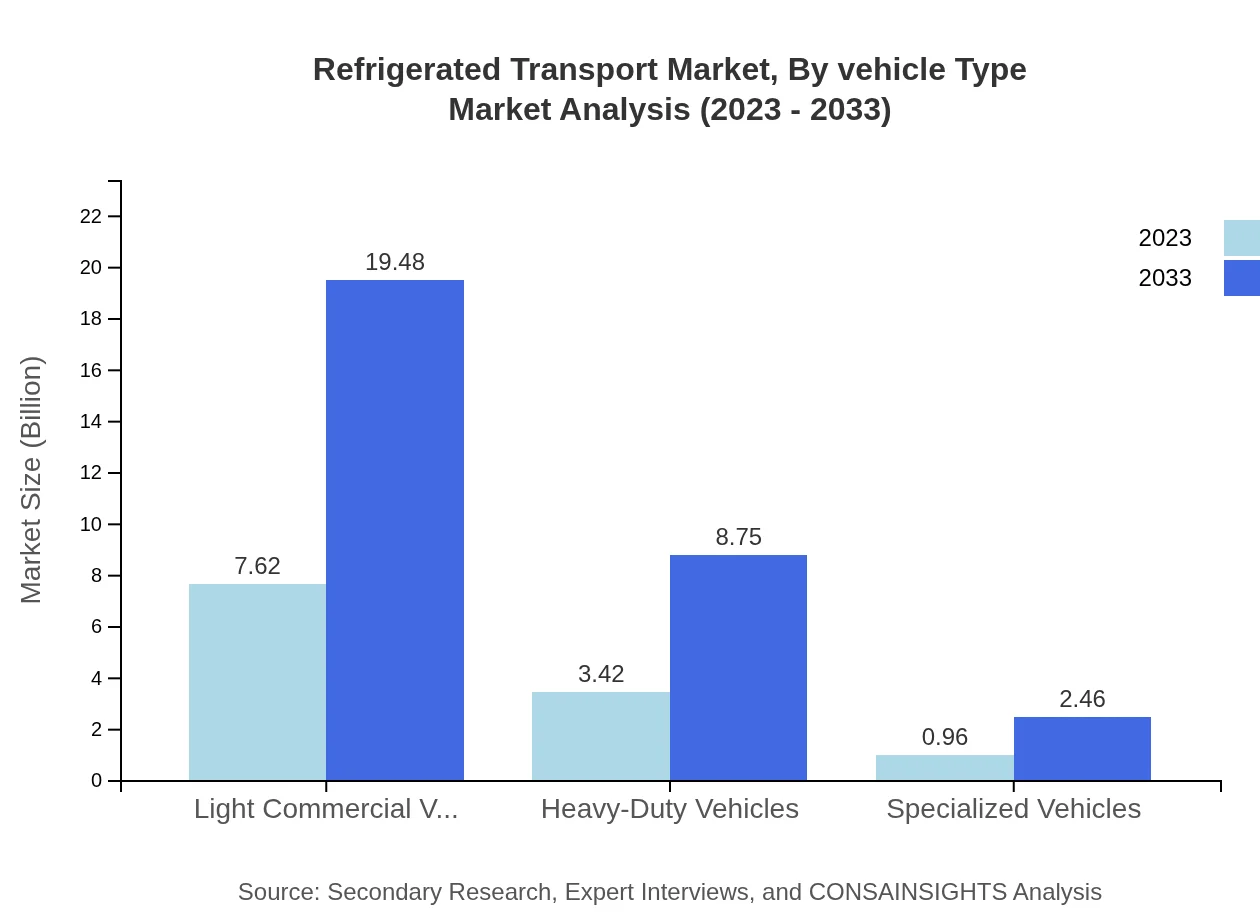

Refrigerated Transport Market Analysis By Vehicle Type

The analysis demonstrates that light commercial vehicles hold a significant share of the market, expected to grow from $7.62 billion in 2023 to $19.48 billion by 2033. Heavy-duty vehicles and specialized vehicles are also crucial, with heavy-duty vehicles expanding from $3.42 billion to $8.75 billion within the same period.

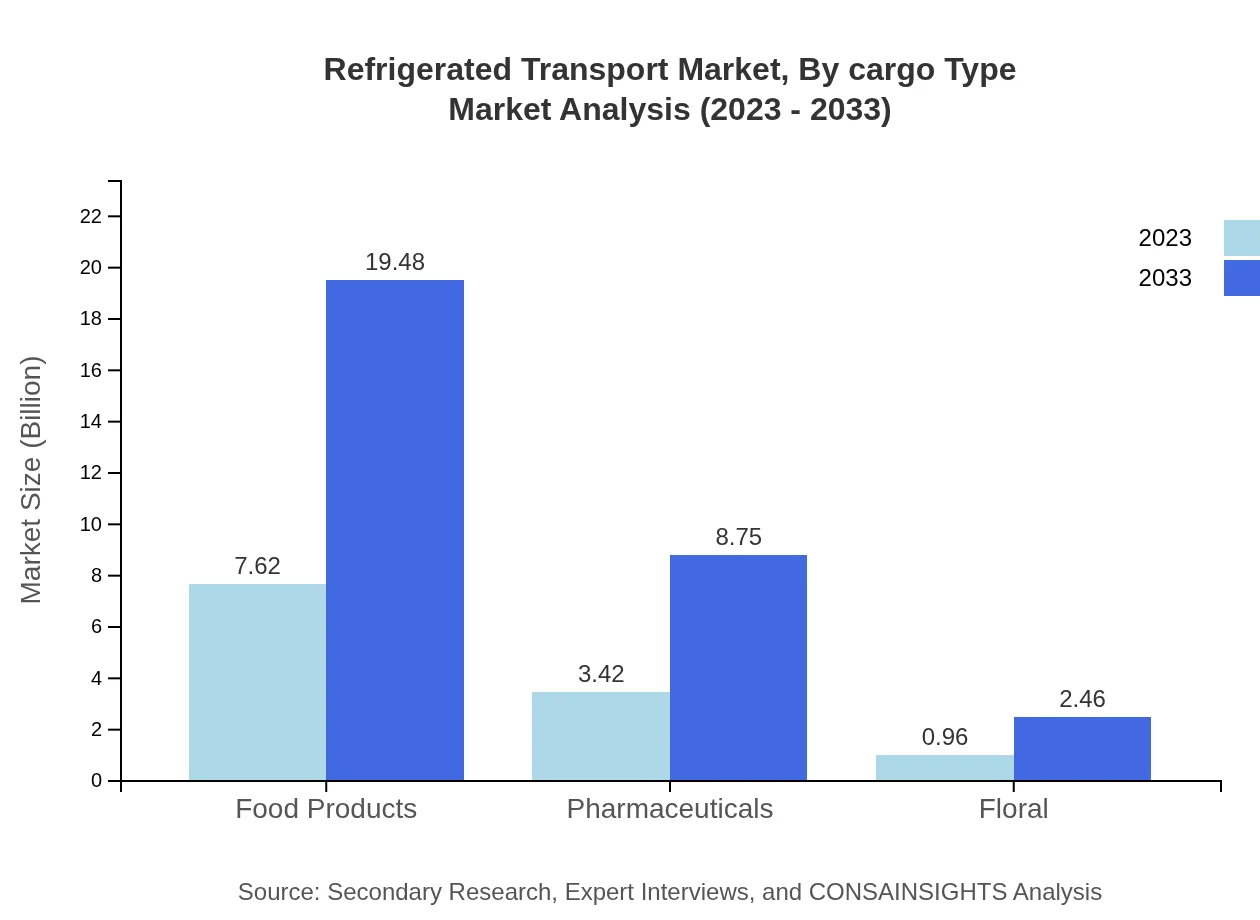

Refrigerated Transport Market Analysis By Cargo Type

Food products are projected to dominate the market, with a market size growing from $7.62 billion in 2023 to $19.48 billion in 2033. Pharmaceuticals are also a notable segment, expected to grow from $3.42 billion to $8.75 billion due to increasing health product demand.

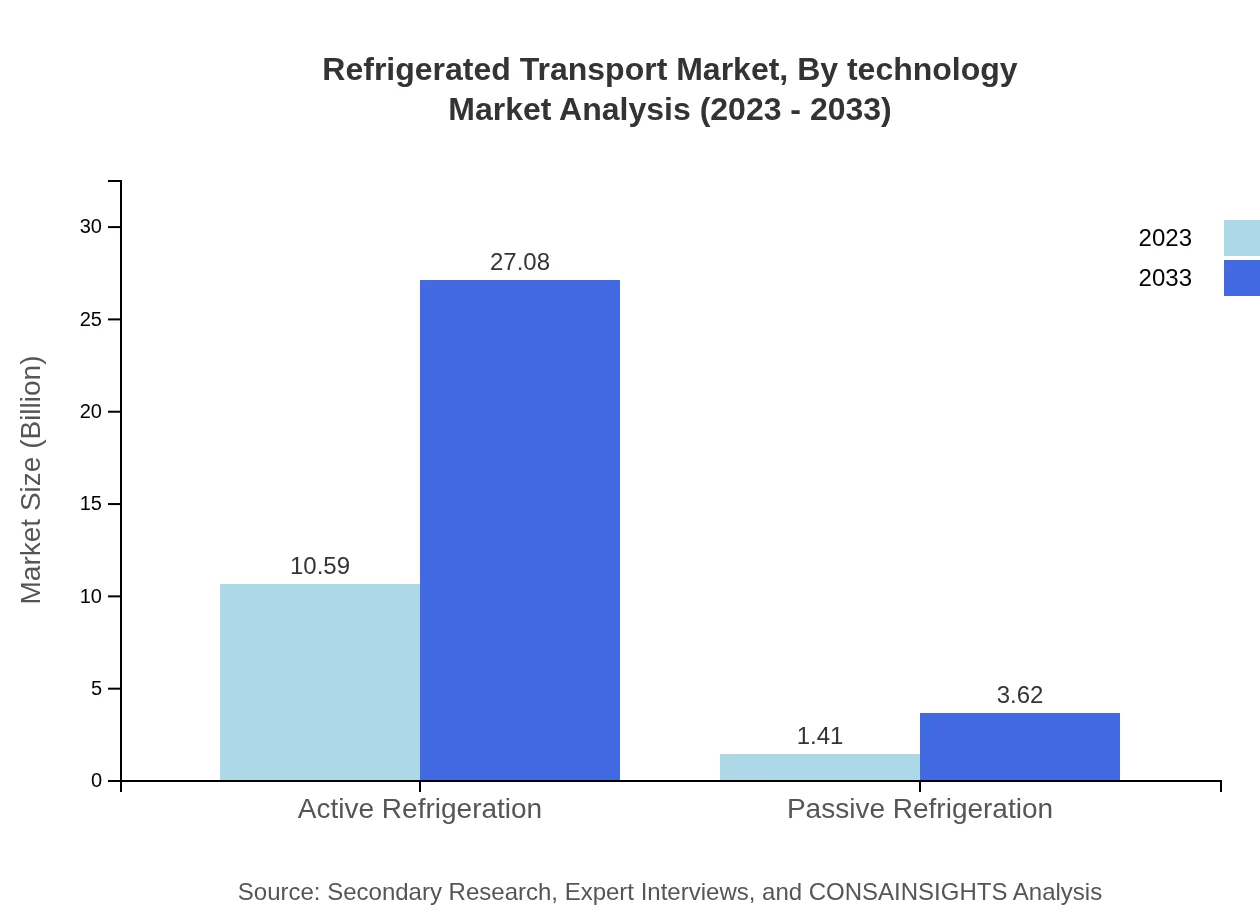

Refrigerated Transport Market Analysis By Technology

Active refrigeration technology continues to lead the market with a share of 88.21% in 2023, projected to reach $27.08 billion by 2033. Passive refrigeration, while smaller, is expected to show steady growth from $1.41 billion to $3.62 billion, reflecting its niche application in certain segments.

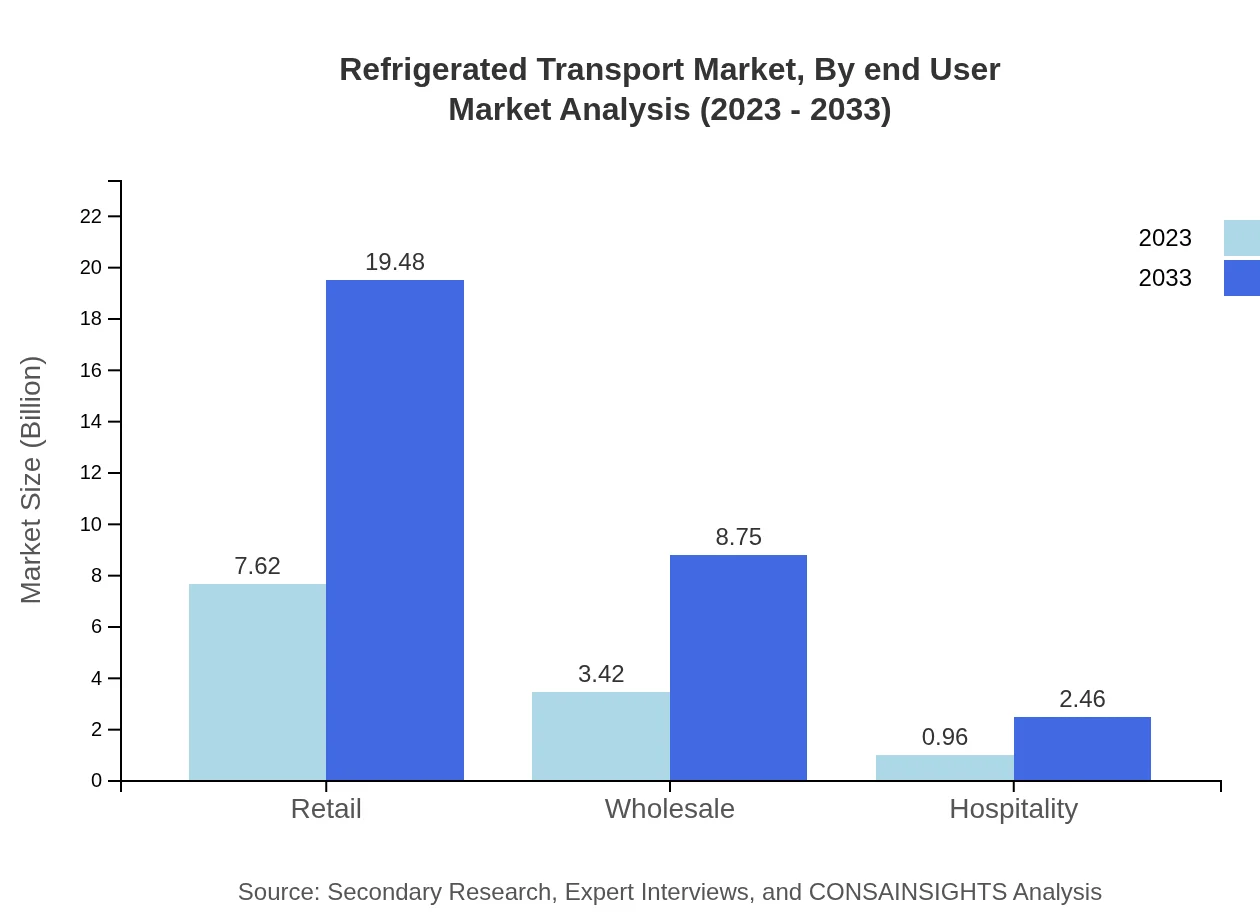

Refrigerated Transport Market Analysis By End User

The retail sector is a major end-user, projected to maintain its dominance with market growth from $7.62 billion in 2023 to $19.48 billion in 2033. The wholesale and hospitality sectors are also important contributors, with respective market sizes increasing significantly over the forecast period.

Refrigerated Transport Market Analysis By Region Segment

Global Refrigerated Transport Market, By Region Segment Market Analysis (2023 - 2033)

Regional dynamics highlight varying growth rates, with North America leading due to robust logistics frameworks, while Asia Pacific showcases rapid adoption of cold chain technologies. Europe remains strong due to regulatory frameworks favoring food safety, and Latin America presents opportunities arising from agricultural growth.

Refrigerated Transport Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Refrigerated Transport Industry

Carrier Global:

A leading provider of HVAC, refrigeration, and fire and security solutions, Carrier Global plays a vital role in enhancing cold chain logistics with innovative technologies.Thermo King:

Specializing in transport temperature control solutions, Thermo King offers products and services aimed at preserving the integrity of climate-sensitive goods throughout distribution.DHL Supply Chain:

A global leader in logistics and supply chain management, DHL is known for its advanced refrigerated transport solutions that cater to various industries, providing end-to-end services.Crown Equipment Corporation:

Crown is recognized for its material handling solutions, including refrigerated transport systems that ensure optimal temperature control during product handling and storage.We're grateful to work with incredible clients.

FAQs

What is the market size of refrigerated transport?

The global refrigerated transport market is projected at $12 billion in 2023, with a robust CAGR of 9.5% expected through 2033. This signifies strong demand and an increasing need for effective cold chain logistics.

What are the key market players or companies in the refrigerated transport industry?

Key players in the refrigerated transport industry include established logistics companies, manufacturers of refrigerated vehicles, and technology firms specializing in cold chain management and temperature control solutions.

What are the primary factors driving the growth in the refrigerated transport industry?

Growth in the refrigerated transport industry is driven by rising consumer demand for perishable goods, advancements in refrigeration technology, increased e-commerce activity, and stringent food safety regulations necessitating reliable cold chain logistics.

Which region is the fastest Growing in the refrigerated transport market?

North America emerges as the fastest-growing region in the refrigerated transport market, projected to grow from $4.07 billion in 2023 to $10.40 billion by 2033, highlighting significant advancements in logistics and food distribution.

Does ConsaInsights provide customized market report data for the refrigerated transport industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the refrigerated transport industry, enabling clients to gain insights reflecting their unique business contexts and market segments.

What deliverables can I expect from the refrigerated transport market research project?

Deliverables from the refrigerated transport market research project typically include comprehensive market analysis, segmented data by region and application, competitive landscape insights, and forecasts spanning the next decade.

What are the market trends of refrigerated transport?

Key market trends in refrigerated transport include increasing demand for sustainable shipping solutions, investment in IoT and smart logistics technologies, and the growth of online grocery services enhancing cold chain logistics.