Refurbished Medical Devices Market Report

Published Date: 31 January 2026 | Report Code: refurbished-medical-devices

Refurbished Medical Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Refurbished Medical Devices market, offering insights into market size, growth forecasts, regional analysis, and the impact of technological advancements from 2023 to 2033.

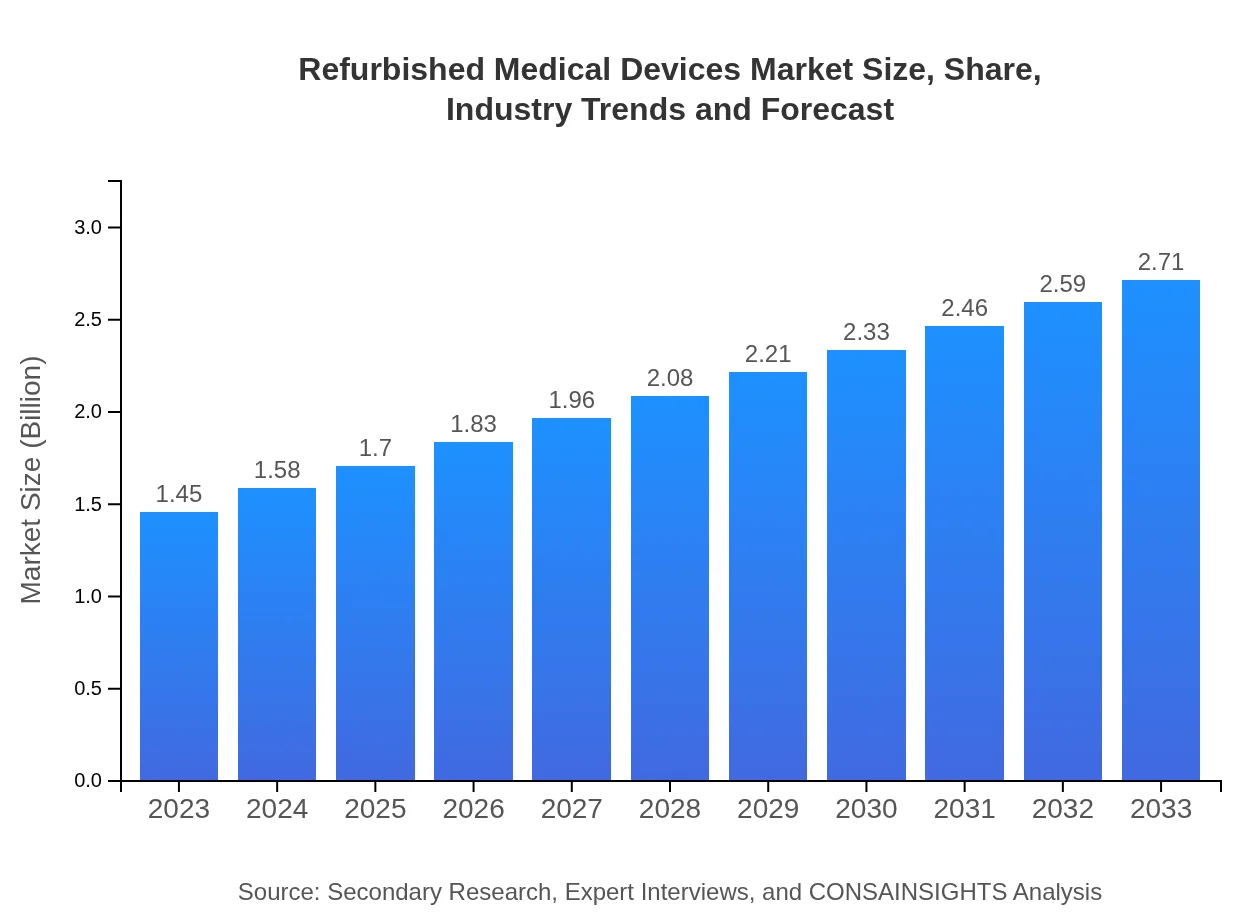

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.45 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $2.71 Billion |

| Top Companies | GE Healthcare, Siemens Healthineers, Fujifilm Medical Systems, Philips Healthcare |

| Last Modified Date | 31 January 2026 |

Refurbished Medical Devices Market Overview

Customize Refurbished Medical Devices Market Report market research report

- ✔ Get in-depth analysis of Refurbished Medical Devices market size, growth, and forecasts.

- ✔ Understand Refurbished Medical Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Refurbished Medical Devices

What is the Market Size & CAGR of Refurbished Medical Devices market in 2033?

Refurbished Medical Devices Industry Analysis

Refurbished Medical Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Refurbished Medical Devices Market Analysis Report by Region

Europe Refurbished Medical Devices Market Report:

In Europe, the market is forecasted to escalate from $0.41 billion in 2023 to $0.76 billion in 2033. The growing trend of hospitals opting for refurbished equipment to better manage budgets while maintaining quality care contributes to this market growth.Asia Pacific Refurbished Medical Devices Market Report:

The Asia Pacific region is witnessing substantial growth, projected to grow from $0.30 billion in 2023 to $0.55 billion in 2033. The increasing awareness regarding cost-effective solutions in healthcare, along with rising investments in healthcare infrastructure, is propelling this market.North America Refurbished Medical Devices Market Report:

North America holds a significant share of the market, anticipated to grow from $0.52 billion in 2023 to $0.98 billion in 2033. High healthcare expenditure and an established regulatory framework supporting refurbished devices are key factors driving this growth.South America Refurbished Medical Devices Market Report:

In South America, the market is expected to expand from $0.11 billion in 2023 to $0.21 billion in 2033. The demand for refurbished medical devices is driven by public health initiatives focusing on affordability and accessibility.Middle East & Africa Refurbished Medical Devices Market Report:

The Middle East and Africa market is projected to rise from $0.12 billion in 2023 to $0.22 billion in 2033. Increasing health concerns and a shift towards more economical solutions in the region’s healthcare segment are emphasizing the need for refurbished medical devices.Tell us your focus area and get a customized research report.

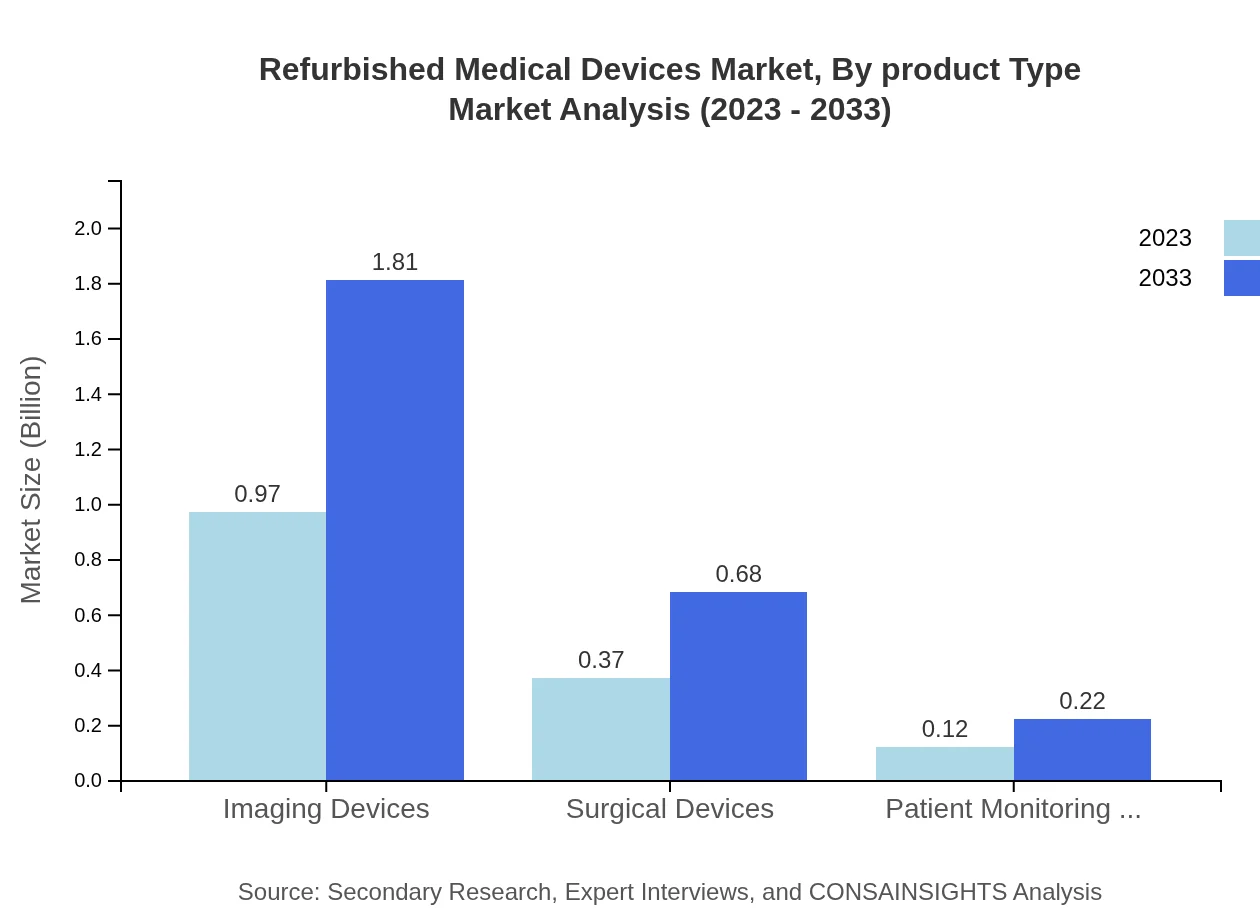

Refurbished Medical Devices Market Analysis By Product Type

By product type, imaging devices dominate the market, growing from $0.97 billion in 2023 to $1.81 billion in 2033. Surgical devices also show robust growth, from $0.37 billion to $0.68 billion over the same period. The demand for patient monitoring devices is increasing, reflecting a shift toward remote patient management.

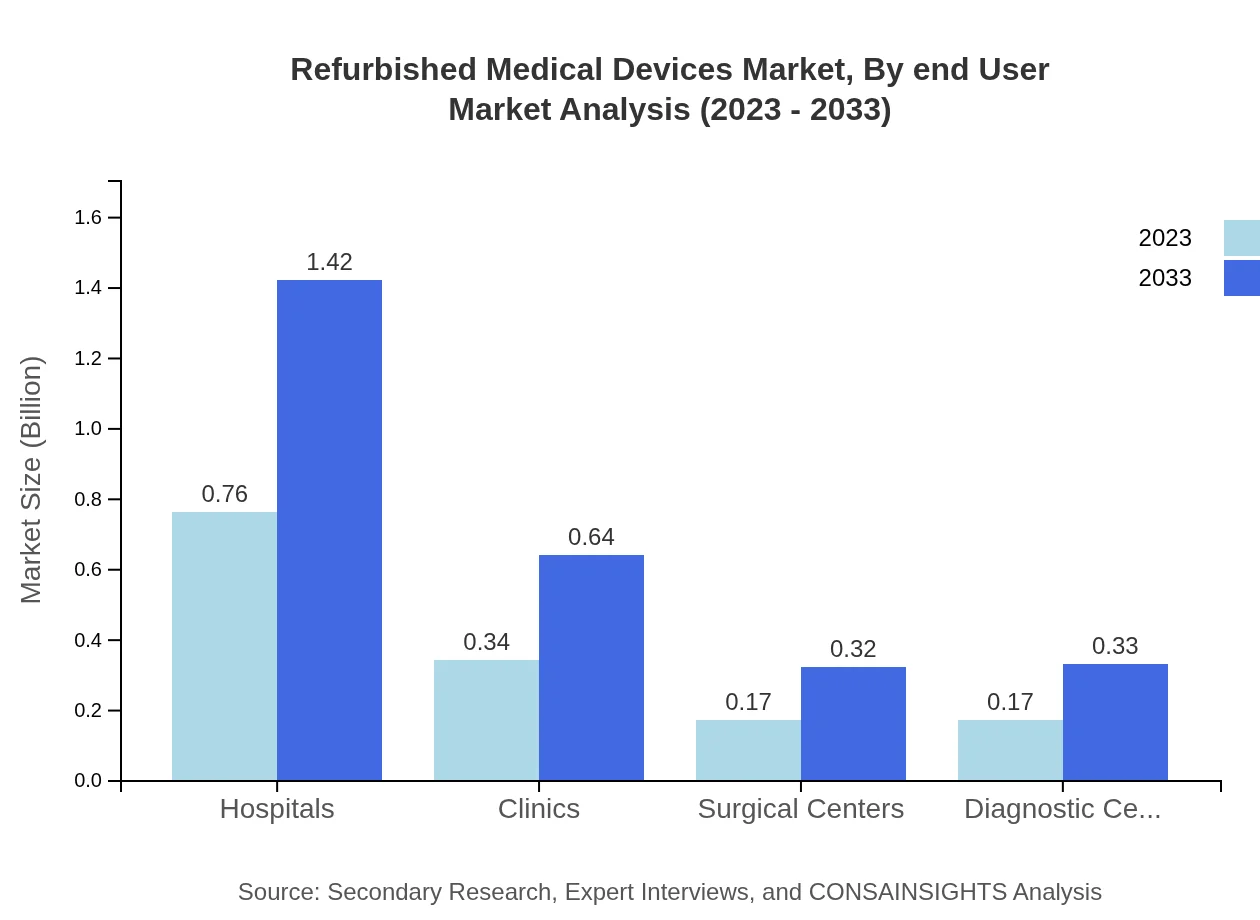

Refurbished Medical Devices Market Analysis By End User

Hospitals account for the largest market share, with growth expectations from $0.76 billion in 2023 to $1.42 billion in 2033. Clinics and diagnostic centers represent significant segments as well, with shares of 23.73% and 12.05%, respectively, indicating strong adoption across various healthcare facilities.

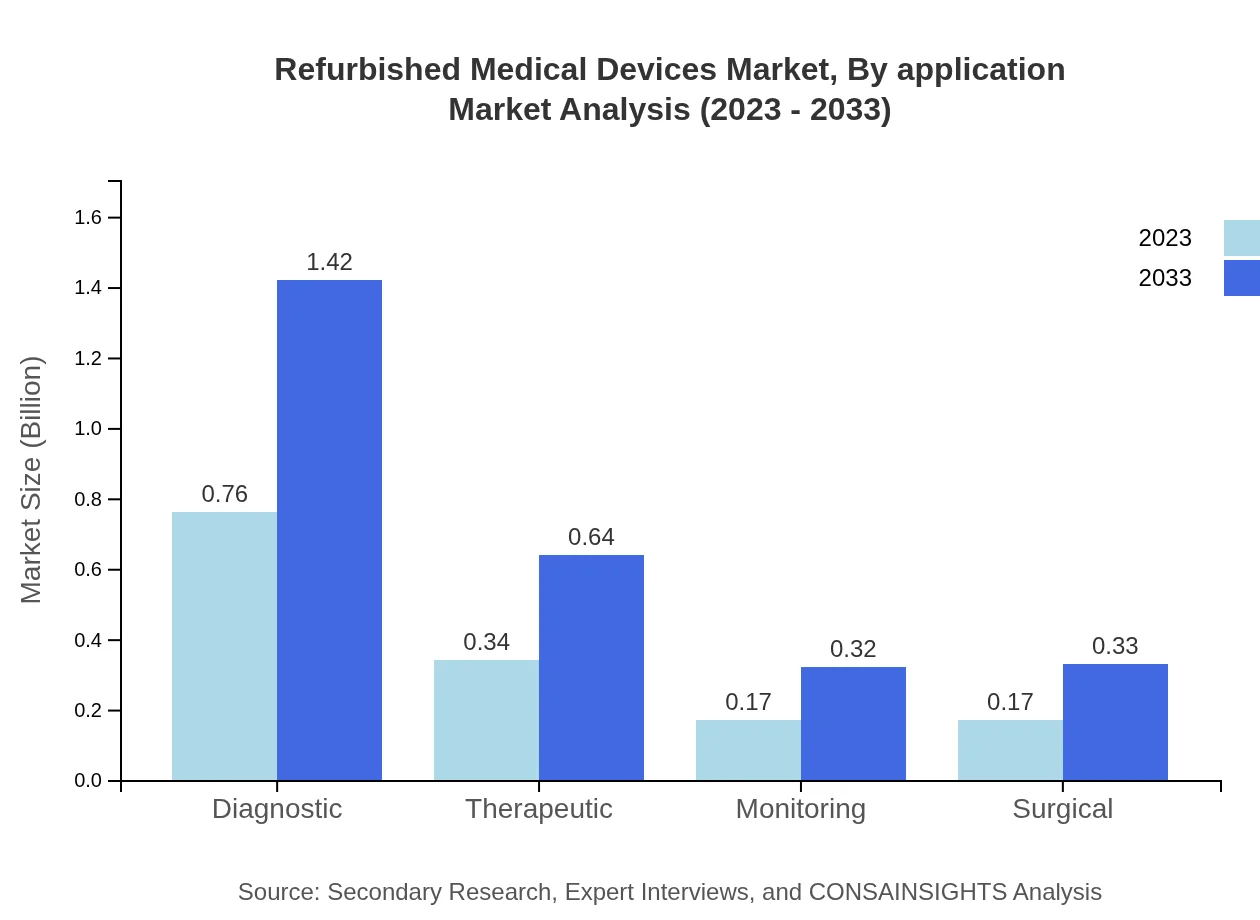

Refurbished Medical Devices Market Analysis By Application

In terms of application, therapeutic uses dominate with increasing demand across all regions. Diagnostic applications, which also show substantial growth, serve as critical components in hospital settings. This segment is projected to remain pivotal due to constant advances in diagnostic technology.

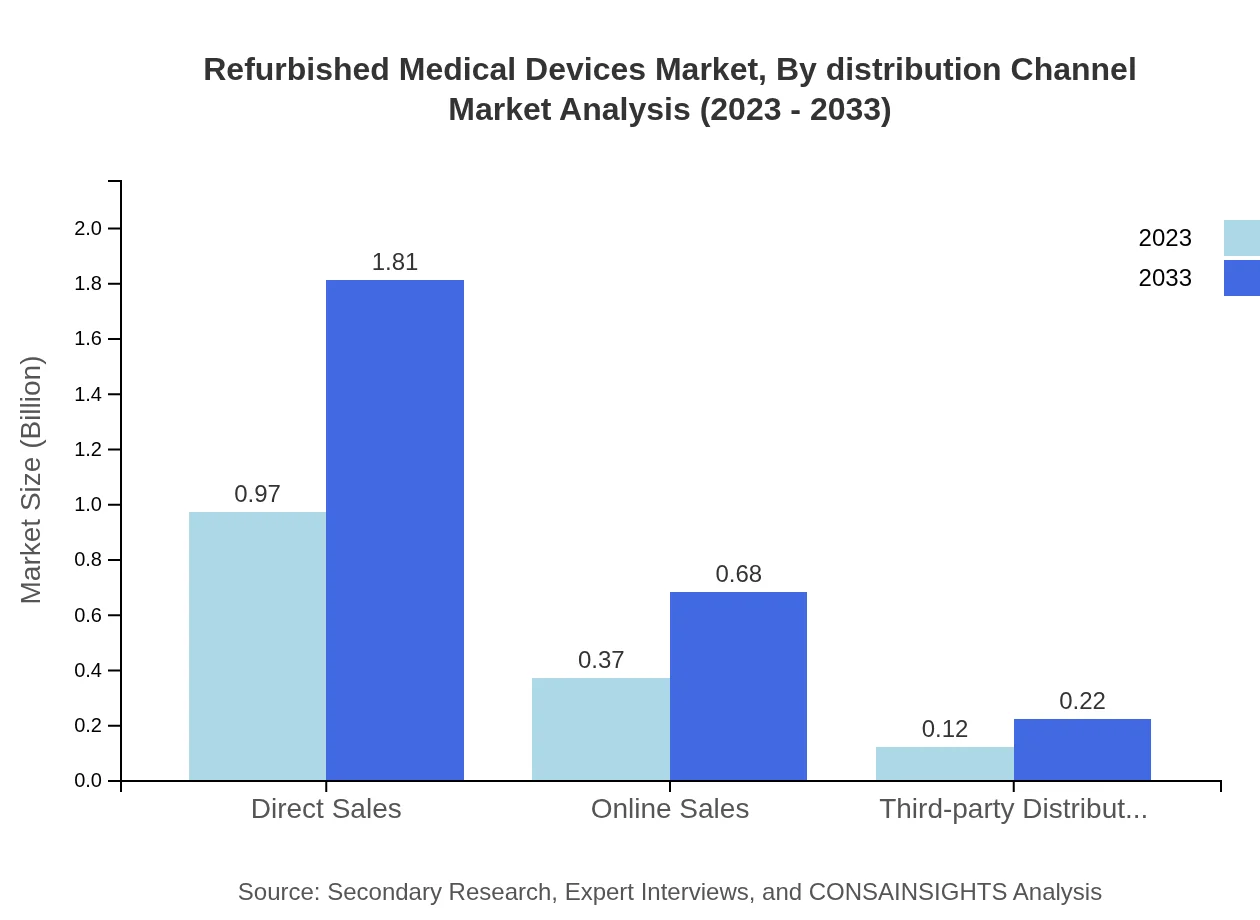

Refurbished Medical Devices Market Analysis By Distribution Channel

Direct sales currently represent the largest distribution channel, from $0.97 billion in 2023 to a projected $1.81 billion in 2033. Online sales are increasingly being adopted due to digital health trends, and third-party distributors continue to ensure broad market access, particularly in emerging economies.

Refurbished Medical Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Refurbished Medical Devices Industry

GE Healthcare:

A leading manufacturer of medical technologies and refurbishment services, GE Healthcare is committed to improving patient outcomes with its advanced solutions and refurbished devices, focusing on sustainability.Siemens Healthineers:

Siemens Healthineers specializes in imaging services and technology, providing high-quality refurbished devices that meet strict regulatory standards to enhance global healthcare access.Fujifilm Medical Systems:

Fujifilm offers a wide range of refurbished medical devices, ensuring quality and dependability in imaging and diagnostic equipment, leveraging technological innovations to enhance service delivery.Philips Healthcare:

Philips provides a broad portfolio of refurbished medical devices, focusing on accessibility and patient outcomes, heavily investing in R&D to ensure advanced refurbishing technology.We're grateful to work with incredible clients.

FAQs

What is the market size of refurbished medical devices?

The global market size for refurbished medical devices is estimated at $1.45 billion in 2023, with a projected CAGR of 6.3% through 2033. This growth reflects an increasing demand for cost-effective healthcare solutions.

What are the key market players or companies in this refurbished medical devices industry?

Key players in the refurbished medical devices industry include GE Healthcare, Siemens Healthineers, Philips Healthcare, and IBM Watson Health. These companies hold significant market shares and drive innovation and quality in refurbished medical technologies.

What are the primary factors driving the growth in the refurbished medical devices industry?

Growth in this industry is driven by rising healthcare costs, increasing demand for cost-effective medical solutions, advancements in technology, and government regulations promoting the use of refurbished devices to improve healthcare accessibility.

Which region is the fastest Growing in the refurbished medical devices market?

Europe is currently experiencing rapid growth in the refurbished medical devices market, projected to increase from $0.41 billion in 2023 to $0.76 billion by 2033, reflecting a significant demand in healthcare facilities.

Does ConsaInsights provide customized market report data for the refurbished medical devices industry?

Yes, ConsaInsights offers customized market report data for the refurbished medical devices industry tailored to specific business needs, including detailed analysis, trends, forecasts, and market segmentation.

What deliverables can I expect from this refurbished medical devices market research project?

Deliverables typically include comprehensive reports detailing market size, forecasts, industry trends, competitive landscape, regional analysis, and insights into consumer behavior regarding refurbished medical devices.

What are the market trends of refurbished medical devices?

Key market trends include increased acceptance of refurbished devices by healthcare providers, technological advancements enhancing device quality, and a rising focus on sustainability and cost-effectiveness in medical equipment procurement.