Regtech Market Report

Published Date: 31 January 2026 | Report Code: regtech

Regtech Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Regtech market, covering market size, segmentation, regional insights, and future trends from 2023 to 2033, offering key insights for stakeholders.

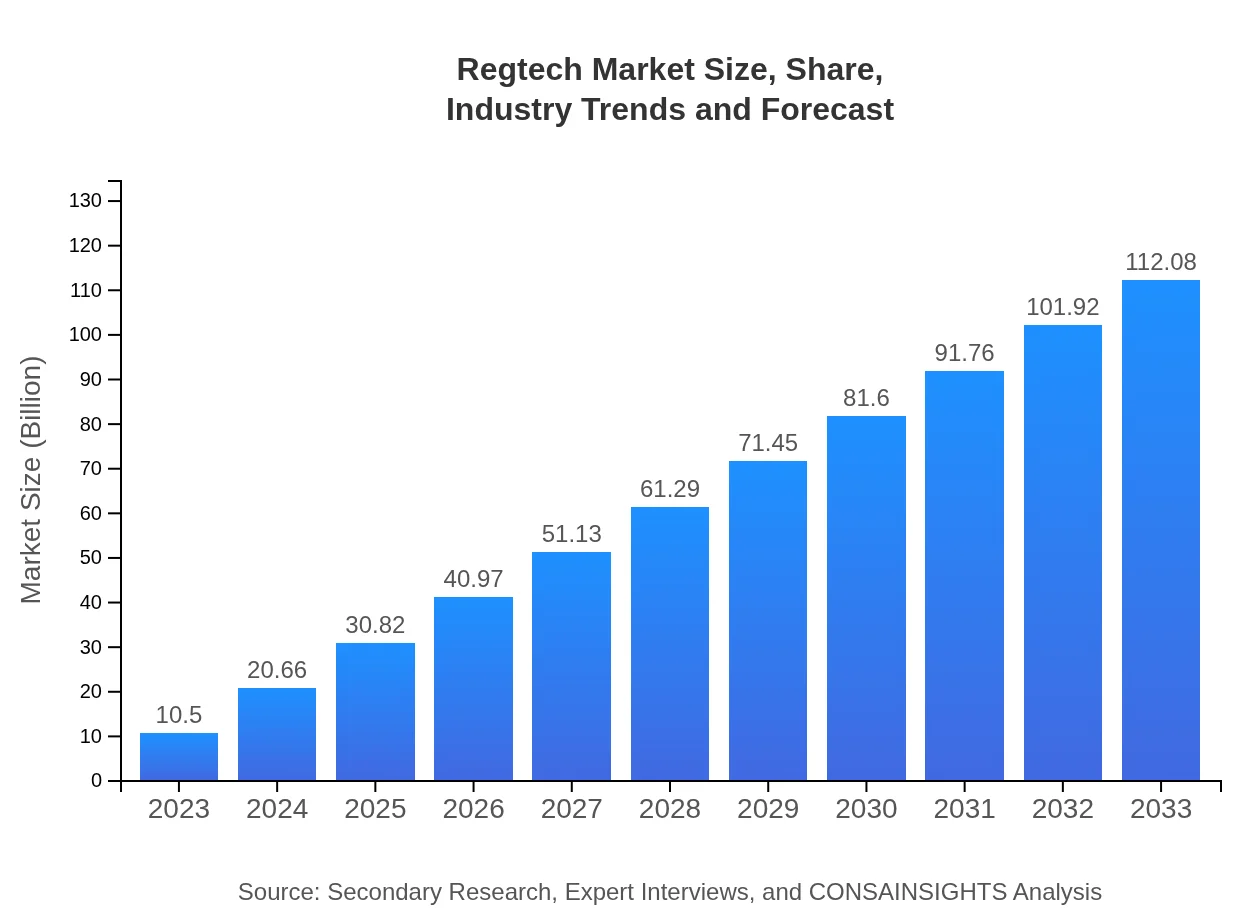

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 25% |

| 2033 Market Size | $112.08 Billion |

| Top Companies | ComplyAdvantage, Fenergo, Trulioo |

| Last Modified Date | 31 January 2026 |

Regtech Market Overview

Customize Regtech Market Report market research report

- ✔ Get in-depth analysis of Regtech market size, growth, and forecasts.

- ✔ Understand Regtech's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Regtech

What is the Market Size & CAGR of Regtech market in 2023?

Regtech Industry Analysis

Regtech Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Regtech Market Analysis Report by Region

Europe Regtech Market Report:

The European Regtech market is valued at 3.01 billion in 2023, anticipated to grow to 32.16 billion by 2033. The implementation of comprehensive regulations such as GDPR has driven the need for compliance technologies, propelling growth in this segment.Asia Pacific Regtech Market Report:

In 2023, the Regtech market in Asia Pacific is valued at 2.28 billion, with projections to grow to 24.38 billion by 2033. The region's increasing regulatory frameworks and burgeoning fintech sector are key growth drivers. Governments are actively promoting digital regulations, fostering an environment ripe for Regtech innovation.North America Regtech Market Report:

North America leads the Regtech industry with a market valuation of 3.53 billion in 2023, projected to reach 37.69 billion by 2033. The region benefits from being home to key regulatory bodies and a culture of technology adoption, making it the prime market for Regtech solutions.South America Regtech Market Report:

In South America, the Regtech market size is estimated to be 0.30 billion in 2023, expanding to 3.25 billion by 2033. The adoption of digital banking and payments has increased the demand for regulatory solutions amid rising fraud risks, prompting innovation in compliance technology.Middle East & Africa Regtech Market Report:

The Regtech market in the Middle East and Africa stands at 1.37 billion in 2023, with estimations of reaching 14.60 billion by 2033. Increasing investments in financial technology and proactive approaches to regulatory compliance are key factors contributing to market growth.Tell us your focus area and get a customized research report.

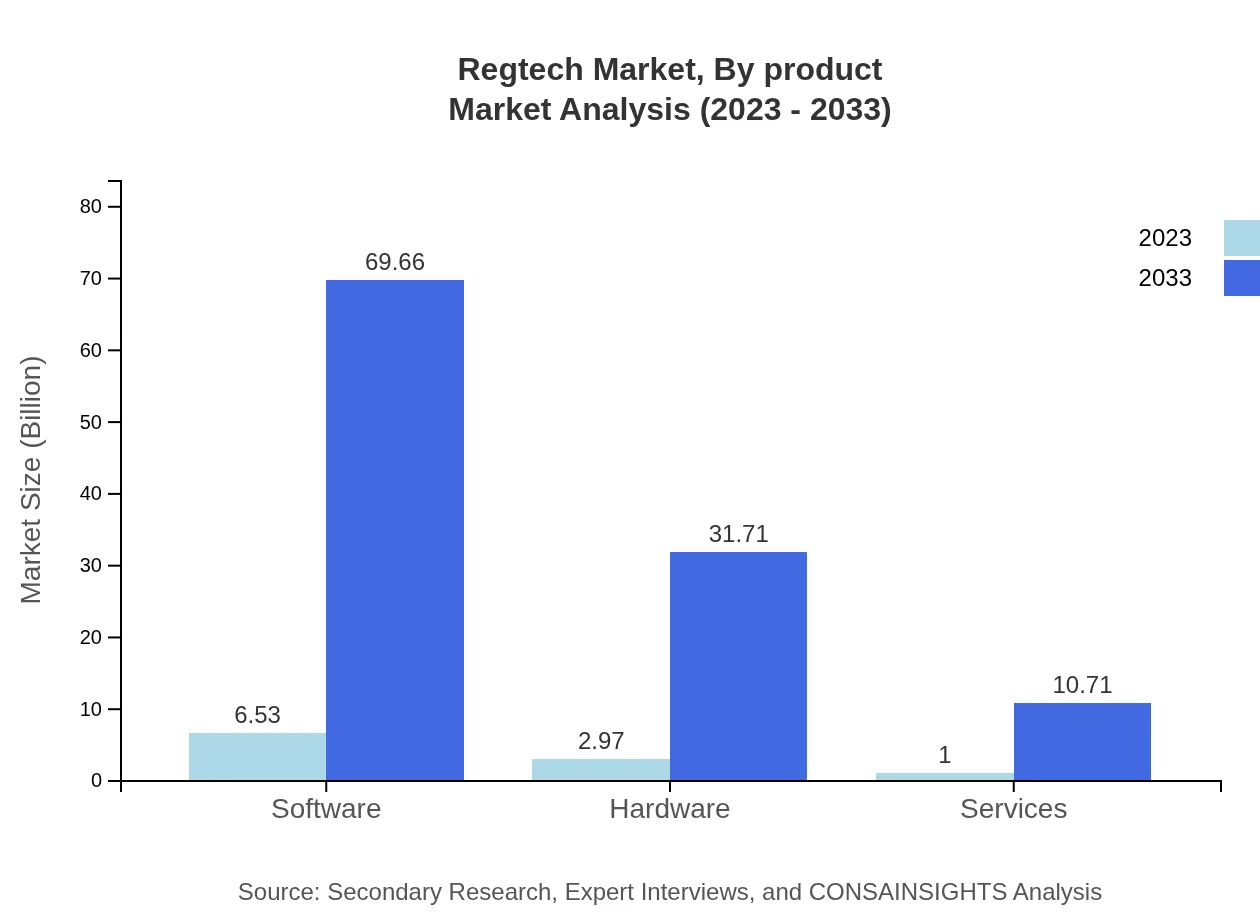

Regtech Market Analysis By Product

The software segment dominates the Regtech market with a market size of 6.53 billion in 2023 and expected growth to 69.66 billion by 2033, holding a 62.15% market share. Hardware and services, though smaller at 2.97 billion and 1.00 billion respectively, are essential for complete compliance solutions.

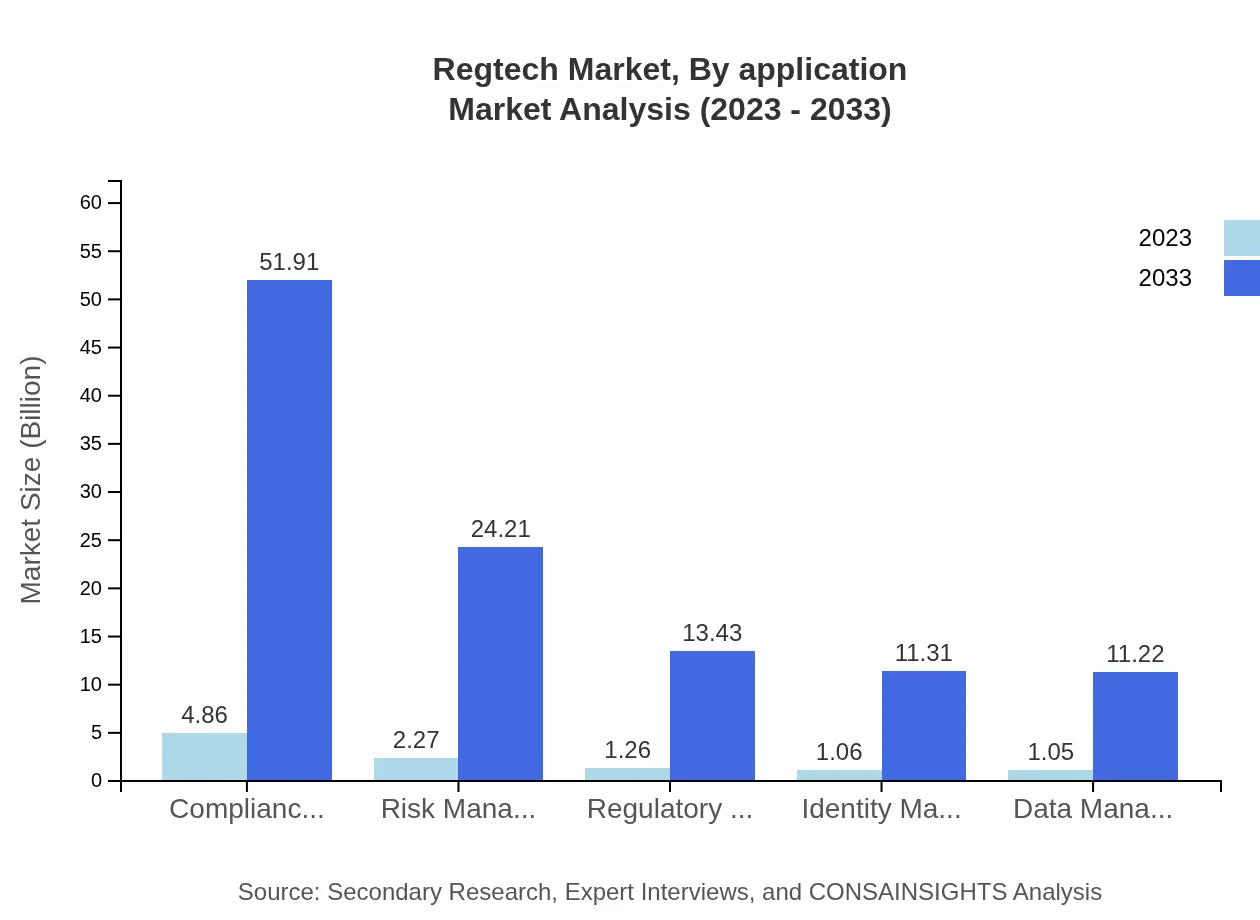

Regtech Market Analysis By Application

In the Regtech application segment, banking leads with a market size of 4.86 billion in 2023, expected to reach 51.91 billion by 2033. This is followed by insurance and financial services, which are rapidly adopting Regtech solutions to enhance compliance and risk management.

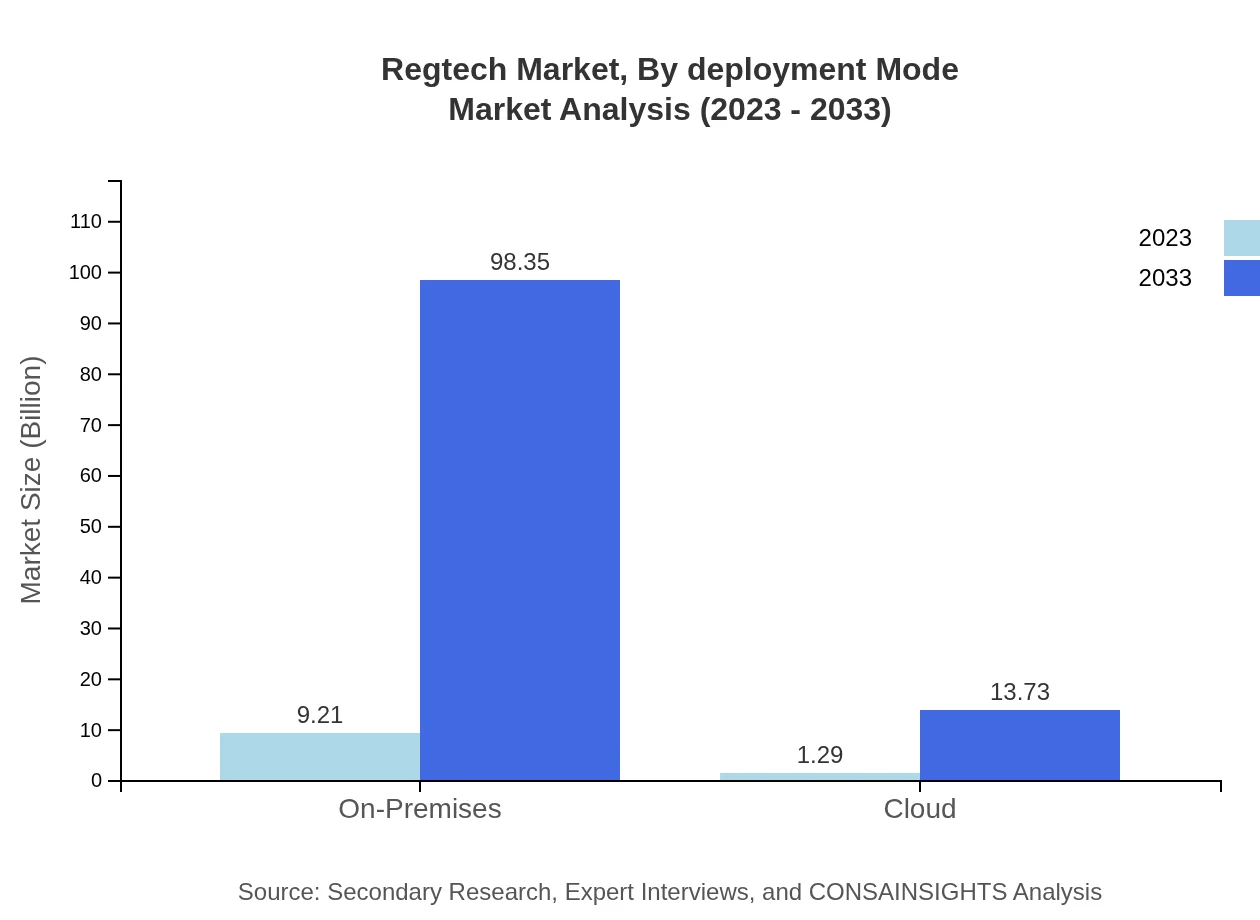

Regtech Market Analysis By Deployment Mode

The deployment model shows a strong preference for on-premises solutions at 9.21 billion in 2023, anticipated to rise to 98.35 billion by 2033. Cloud solutions, with a market size of 1.29 billion, are gradually gaining traction due to their flexibility and scalability.

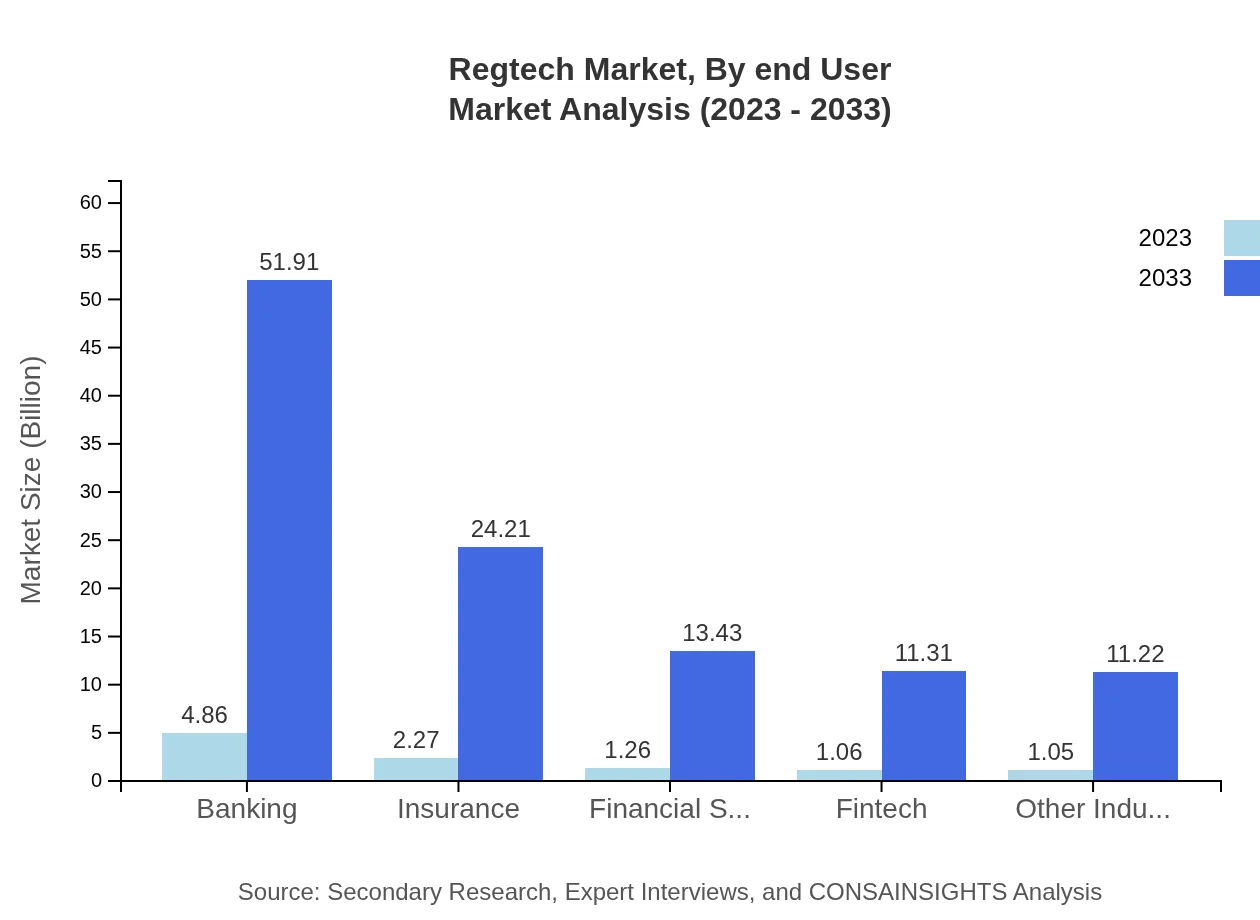

Regtech Market Analysis By End User

Various industries are adopting Regtech solutions, with banking as the largest end-user market valued at 4.86 billion in 2023, projected to soar to 51.91 billion by 2033. The urgency for effective compliance in dynamic regulatory environments drives demand across all sectors.

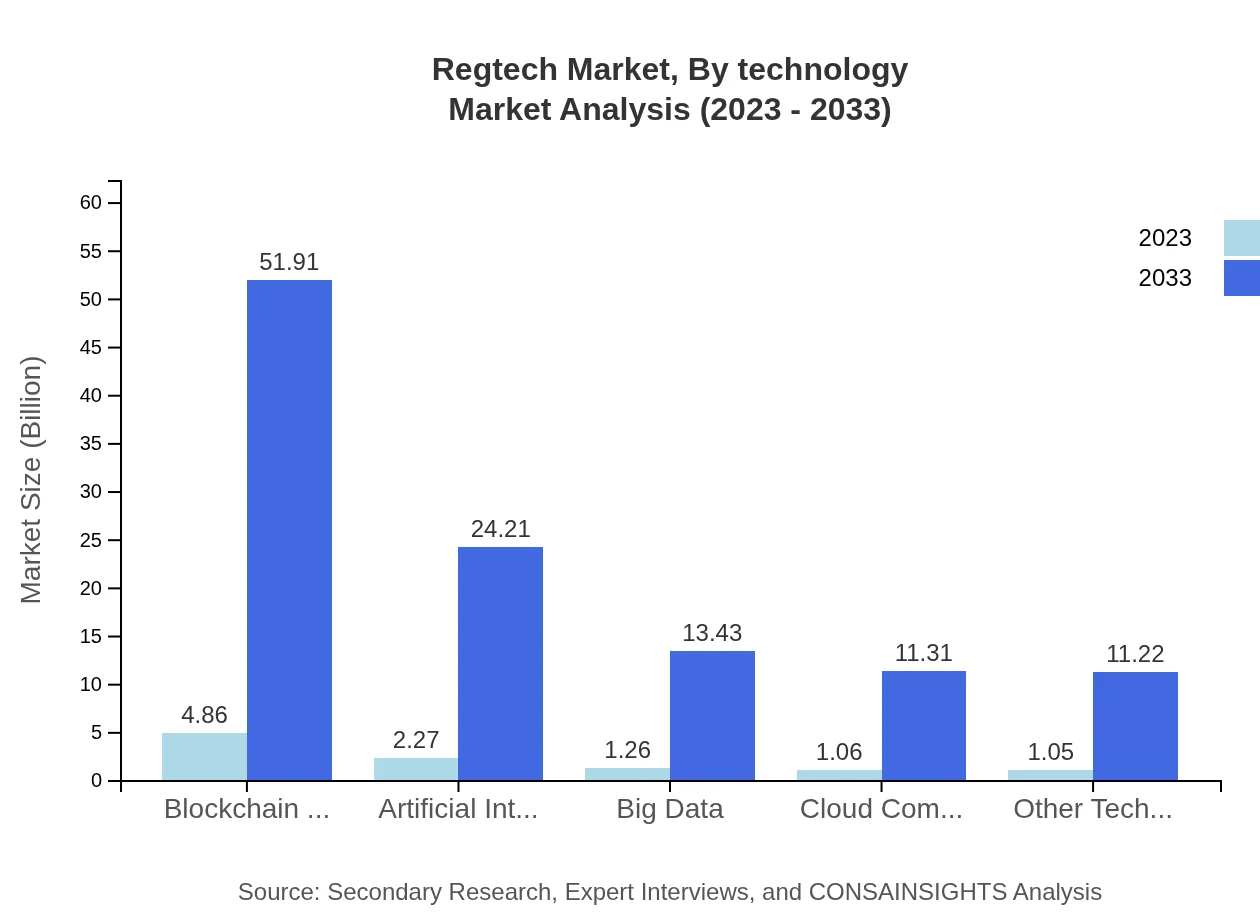

Regtech Market Analysis By Technology

Key technologies within Regtech include blockchain, artificial intelligence, and big data analytics, which are pivotal in modern compliance solutions. Blockchain, valued at 4.86 billion in 2023, is set for remarkable growth to 51.91 billion by 2033, establishing itself as a cornerstone of regulatory technology.

Regtech Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Regtech Industry

ComplyAdvantage:

A leading Regtech company specializing in AI-driven compliance and risk management solutions, addressing anti-money laundering, and screening compliance challenges.Fenergo:

Fenergo provides client lifecycle management solutions to financial institutions, helping them comply efficiently with regulations while enhancing the customer experience.Trulioo:

Trulioo specializes in identity verification services, providing real-time access to multiple data sources to ensure compliance in KYC processes.We're grateful to work with incredible clients.

FAQs

What is the market size of Regtech?

The Regtech market is projected to grow from an estimated size of $10.5 billion in 2023, with a remarkable CAGR of 25%. It is expected to reach significant heights by 2033, transforming the regulatory landscape.

What are the key market players or companies in the Regtech industry?

Key players in the Regtech industry include established firms such as NICE Actimize, Thomson Reuters, and Fenergo, along with innovative startups like Chainalysis and ComplyAdvantage, providing diverse solutions for regulatory compliance.

What are the primary factors driving the growth in the Regtech industry?

The Regtech industry is driven by increasing regulatory complexity, demand for compliance efficiency, rising cyber threats, and advancements in technology such as AI and blockchain, enhancing regulatory processes and risk management.

Which region is the fastest Growing in the Regtech?

Asia Pacific is the fastest-growing region in the Regtech market, anticipated to grow from $2.28 billion in 2023 to $24.38 billion by 2033. North America also shows significant growth potential.

Does ConsaInsights provide customized market report data for the Regtech industry?

Yes, ConsaInsights offers customized market report data for the Regtech industry, tailored to meet specific client needs, providing comprehensive insights on market trends, sizing, and competitive analysis.

What deliverables can I expect from this Regtech market research project?

Deliverables from the Regtech market research project include detailed market analysis reports, competitive landscape assessments, future growth forecasts, and tailored recommendations for strategic decision-making.

What are the market trends of Regtech?

Current market trends in Regtech include increased adoption of AI and machine learning for compliance automation, growth in cloud-based services, and rising investments in cybersecurity measures for data protection.