Regulatory Reporting And Compliance Market Report

Published Date: 31 January 2026 | Report Code: regulatory-reporting-and-compliance

Regulatory Reporting And Compliance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Regulatory Reporting and Compliance market, spanning the years 2023 to 2033. It includes insights on market size, growth trends, segmentation, regional analysis, and key players shaping the industry.

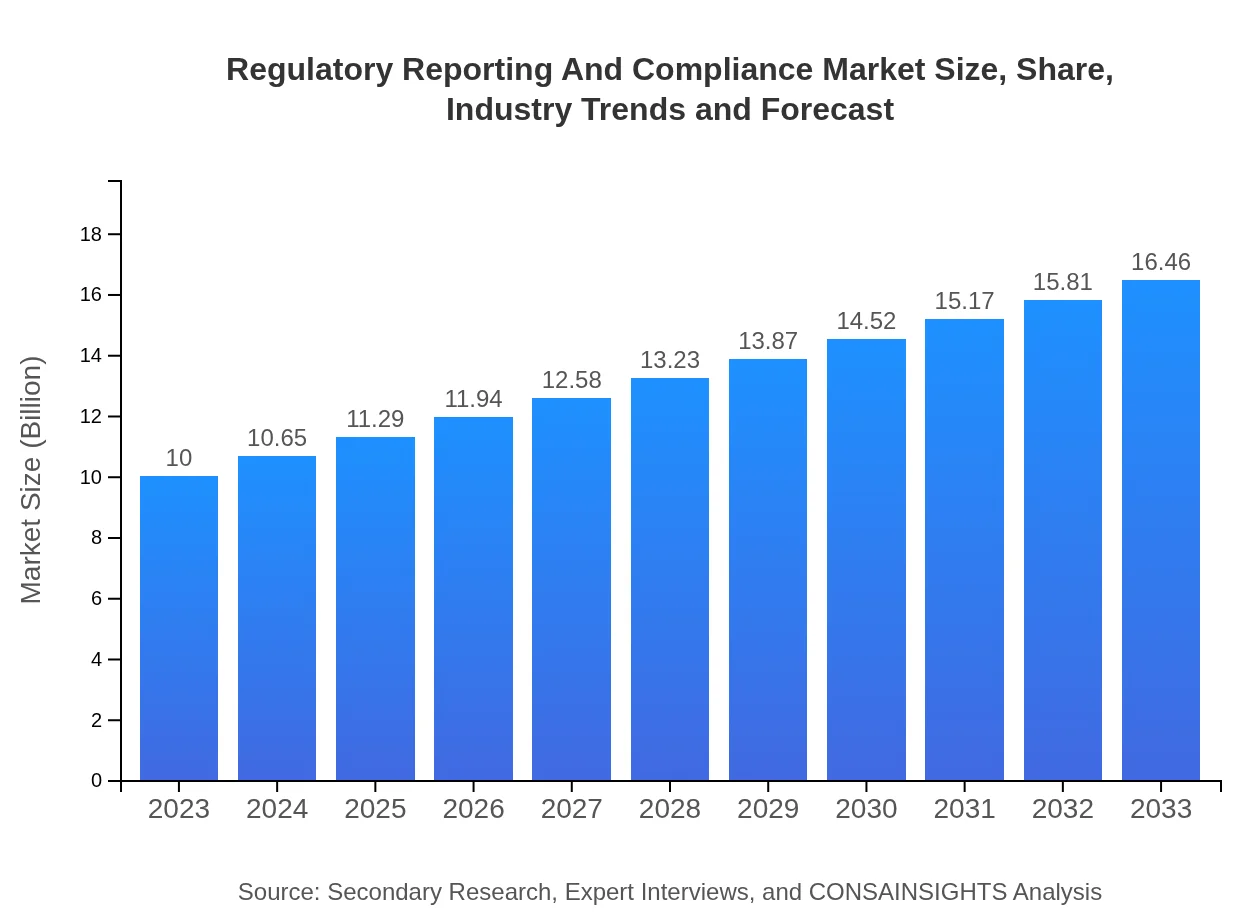

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Thomson Reuters, Oracle Corporation, SAP SE, Wolters Kluwer, IBM |

| Last Modified Date | 31 January 2026 |

Regulatory Reporting And Compliance Market Overview

Customize Regulatory Reporting And Compliance Market Report market research report

- ✔ Get in-depth analysis of Regulatory Reporting And Compliance market size, growth, and forecasts.

- ✔ Understand Regulatory Reporting And Compliance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Regulatory Reporting And Compliance

What is the Market Size & CAGR of Regulatory Reporting And Compliance market in 2023?

Regulatory Reporting And Compliance Industry Analysis

Regulatory Reporting And Compliance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Regulatory Reporting And Compliance Market Analysis Report by Region

Europe Regulatory Reporting And Compliance Market Report:

In 2023, Europe holds a market size of $3.11 billion, projected to rise to $5.12 billion by 2033. The European Union’s stringent regulations, like GDPR and MiFID II, drive market demand for compliant reporting systems. Companies in industries such as finance and energy are heavily investing in compliance technologies to navigate these regulations effectively.Asia Pacific Regulatory Reporting And Compliance Market Report:

In 2023, the Asia Pacific Regulatory Reporting and Compliance market is valued at $1.82 billion, with projections indicating growth to $2.99 billion by 2033. The regulatory landscape in this region is rapidly evolving, with countries like India and China implementing stringent compliance frameworks as they experience economic growth. The rise of FinTech companies and digital banking is also propelling market growth as regulatory bodies intensify focus on consumer protection.North America Regulatory Reporting And Compliance Market Report:

North America is the largest market for Regulatory Reporting and Compliance, valued at $3.61 billion in 2023, growing to $5.94 billion by 2033. The high regulatory burden in the financial sector, particularly in the U.S., is a major driver for compliance solutions. Furthermore, trends in sustainability reporting and environmental regulations are gaining traction, compelling firms to enhance their reporting capabilities.South America Regulatory Reporting And Compliance Market Report:

The South American market reached $0.94 billion in 2023 and is expected to grow to $1.55 billion by 2033. Countries like Brazil are enhancing their regulatory requirements, particularly in financial services, which encourages businesses to adopt robust reporting solutions. However, challenges exist in areas such as enforcement consistency and development of regulatory frameworks.Middle East & Africa Regulatory Reporting And Compliance Market Report:

The Middle East and Africa market stands at $0.53 billion in 2023, with expectations of growth to $0.87 billion by 2033. Regulatory environments vary significantly across the region, with countries like South Africa leading in compliance advancements. However, market growth is hindered by instabilities in certain regions, which pose challenges to compliance adherence.Tell us your focus area and get a customized research report.

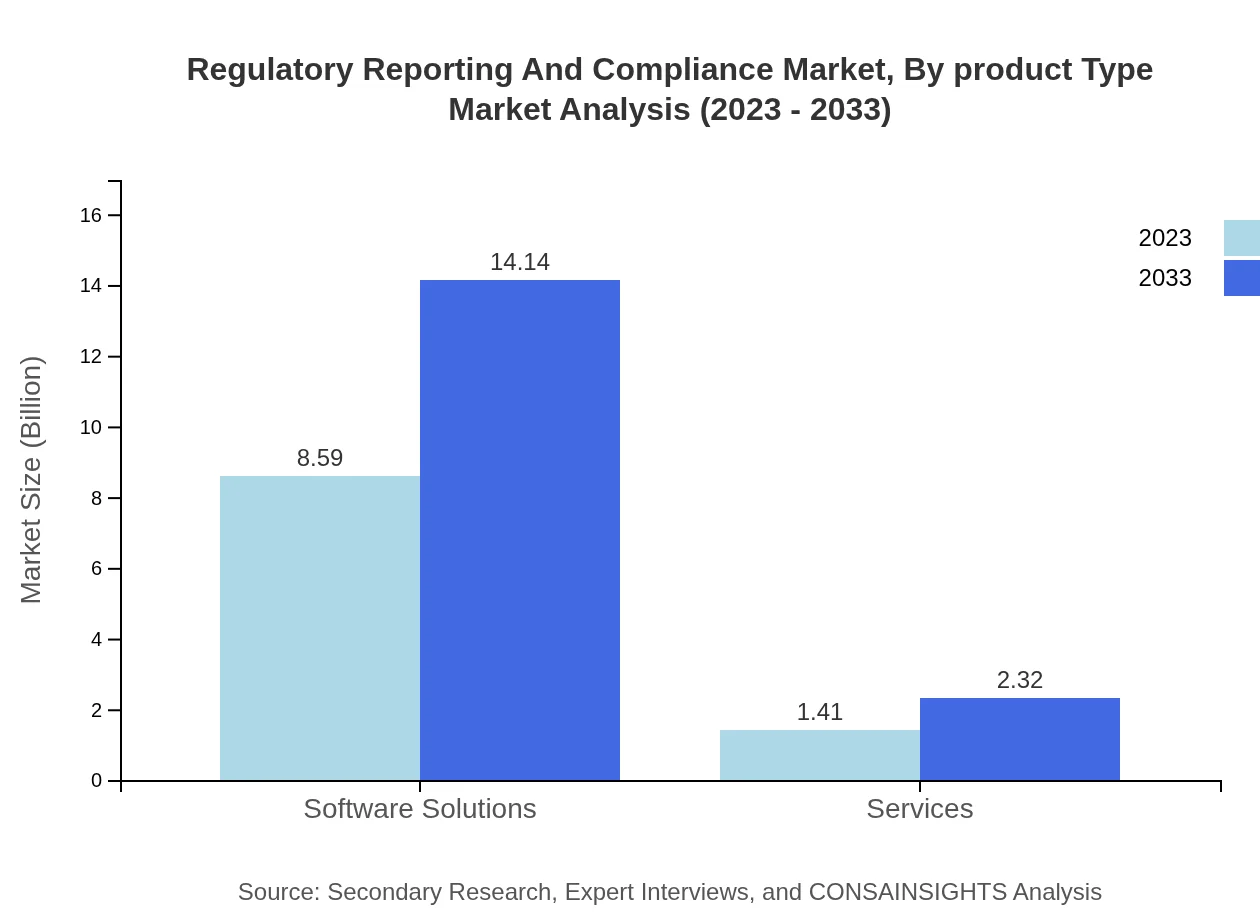

Regulatory Reporting And Compliance Market Analysis By Product Type

The market is primarily driven by software solutions, which accounted for approximately 85.93% of the share in 2023, valued at $8.59 billion projected to rise to $14.14 billion by 2033. These solutions facilitate automation and integration across compliance processes. Service offerings complement software solutions, accounting for about 14.07% of the share, with growth driven by demand for consulting and implementation services.

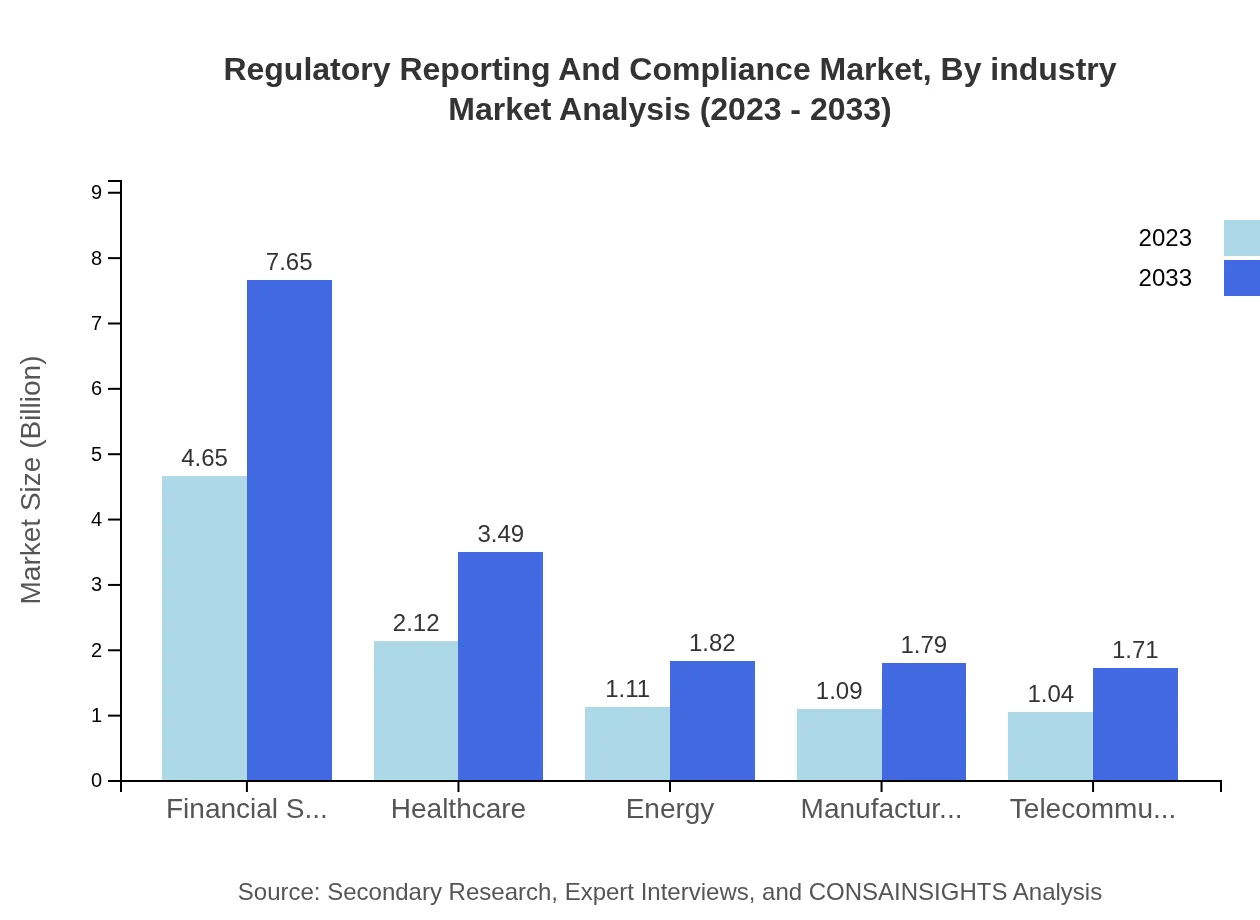

Regulatory Reporting And Compliance Market Analysis By Industry

The financial services sector dominates the Regulatory Reporting and Compliance market, with a size of $4.65 billion in 2023 and expected to reach $7.65 billion by 2033, consistently holding around 46.48% share. Healthcare follows with $2.12 billion, projected to grow to $3.49 billion. Regulatory pressures are particularly strong in these sectors, necessitating meticulous compliance strategies.

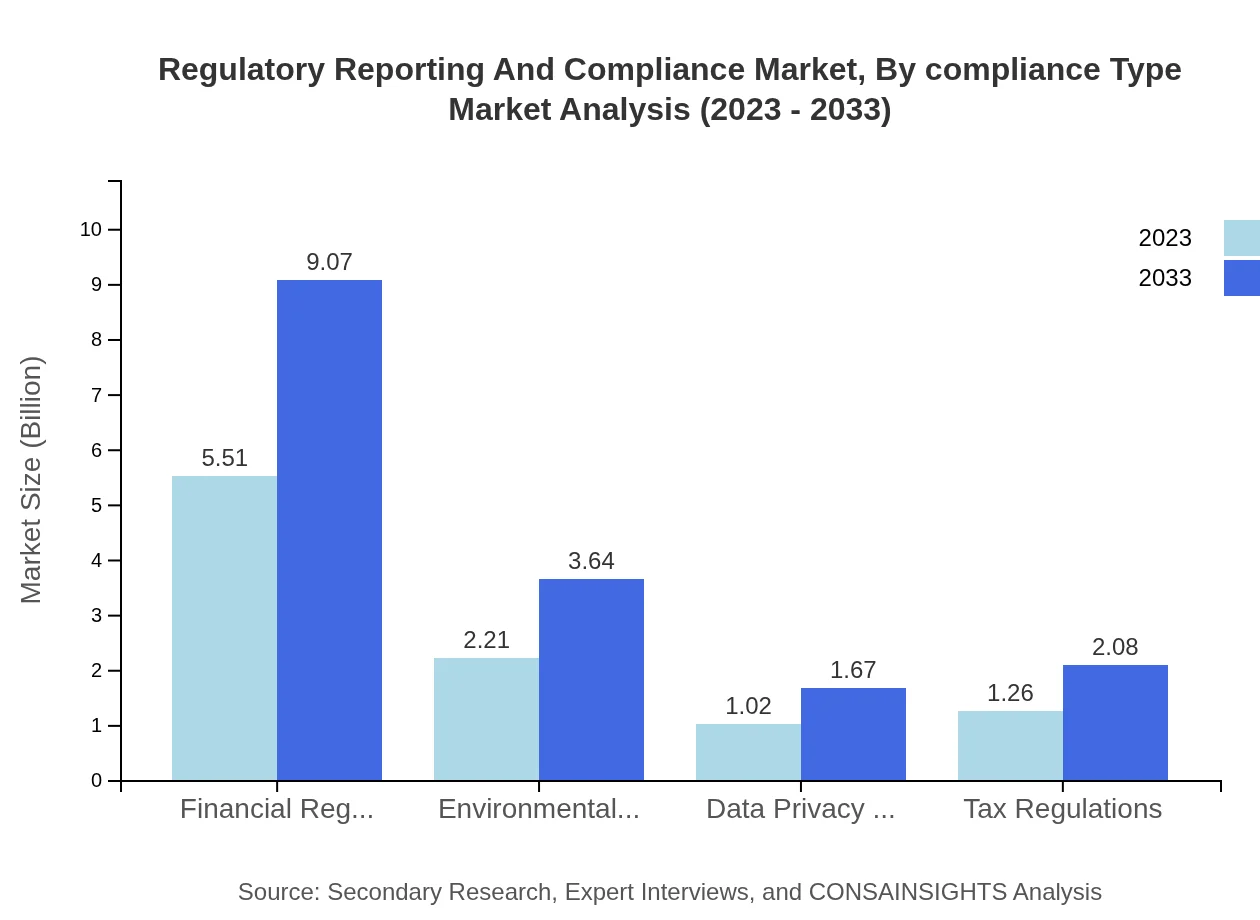

Regulatory Reporting And Compliance Market Analysis By Compliance Type

Financial regulations form the largest compliance category, representing 55.09% share in 2023 with a market size of $5.51 billion, anticipated to grow to $9.07 billion by 2033. Environmental regulations and data privacy regulations also show significant growth trends, reflecting the increasing importance of sustainability and privacy in regulatory frameworks.

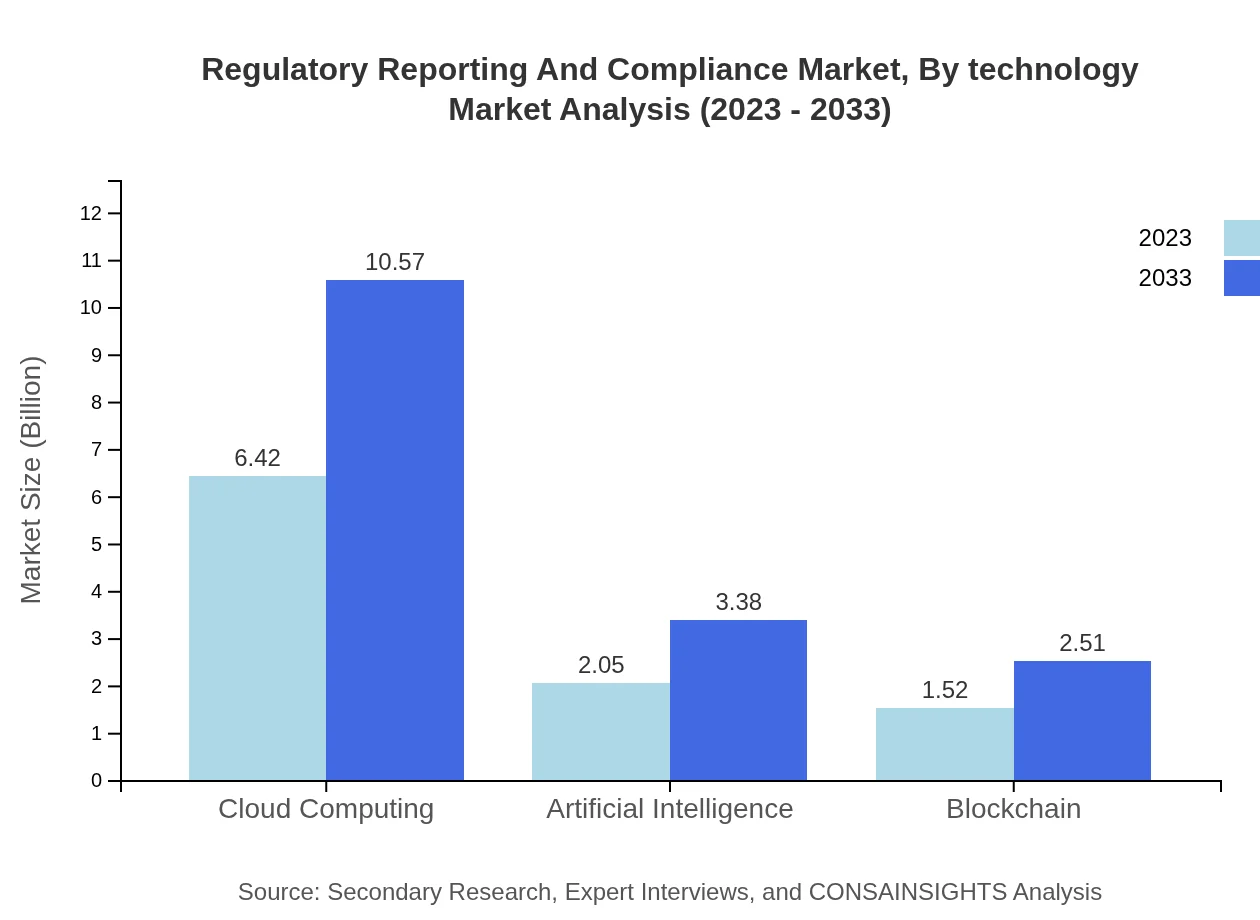

Regulatory Reporting And Compliance Market Analysis By Technology

The integration of advanced technologies like AI and blockchain is transforming compliance solutions. AI, valued at $2.05 billion in 2023, is projected to grow to $3.38 billion, while blockchain technology focuses on transparency and authenticity, anticipated to grow from $1.52 billion to $2.51 billion. Cloud computing technology dominates the segment, valued at $6.42 billion and expected to reach $10.57 billion, illustrating the importance of scalable and accessible solutions in compliance.

Regulatory Reporting And Compliance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Regulatory Reporting And Compliance Industry

Thomson Reuters:

A leading provider of regulatory compliance solutions, Thomson Reuters offers a range of software tools that help organizations manage their regulatory responsibilities effectively.Oracle Corporation:

Oracle offers comprehensive Cloud-based solutions and applications tailored to enhance compliance and reporting across various industries.SAP SE:

SAP provides robust software solutions focused on automating compliance reporting and improving transparency for businesses globally.Wolters Kluwer:

Known for its insights into regulatory changes, Wolters Kluwer supplies efficient reporting solutions and compliance management software across multiple sectors.IBM:

IBM employs advanced technologies like AI and blockchain in its compliance solutions, providing innovative tools for regulatory reporting challenges.We're grateful to work with incredible clients.

FAQs

What is the market size of regulatory Reporting And Compliance?

The regulatory reporting and compliance market is valued at approximately $10 billion in 2023, with a projected growth rate of 5% CAGR, indicating significant expansion over the coming decade.

What are the key market players or companies in the regulatory Reporting And Compliance industry?

Key market players in this sector include major global firms like Thomson Reuters, Wolters Kluwer, and FIS, which provide essential software and services for compliance and reporting requirements.

What are the primary factors driving the growth in the regulatory Reporting And Compliance industry?

Growth in regulatory reporting and compliance is fueled by increasing regulatory complexities, growing data privacy concerns, and the rising adoption of technology solutions among businesses aiming for efficiency and compliance.

Which region is the fastest Growing in the regulatory Reporting And Compliance?

The fastest-growing region in the regulatory reporting and compliance market is expected to be Europe, increasing from $3.11 billion in 2023 to $5.12 billion by 2033, demonstrating strong growth potential.

Does ConsaInsights provide customized market report data for the regulatory Reporting And Compliance industry?

Yes, ConsaInsights offers tailored market reports for regulatory reporting and compliance, allowing clients to access specific data according to their unique needs and market parameters.

What deliverables can I expect from this regulatory Reporting And Compliance market research project?

Deliverables from the regulatory reporting market research project typically include comprehensive reports, presentation slides, market analysis, insights into trends, and forecasts by region and segments.

What are the market trends of regulatory Reporting And Compliance?

Current market trends in regulatory reporting and compliance include increased automation, a shift towards cloud-based solutions, enhanced regulatory technology integrations, and a stronger focus on data security and privacy compliance.