Remote Asset Management Market Report

Published Date: 22 January 2026 | Report Code: remote-asset-management

Remote Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Remote Asset Management market, covering insights on market size, growth trends, and competitive landscape from 2023 to 2033, along with regional performances and segment specifics.

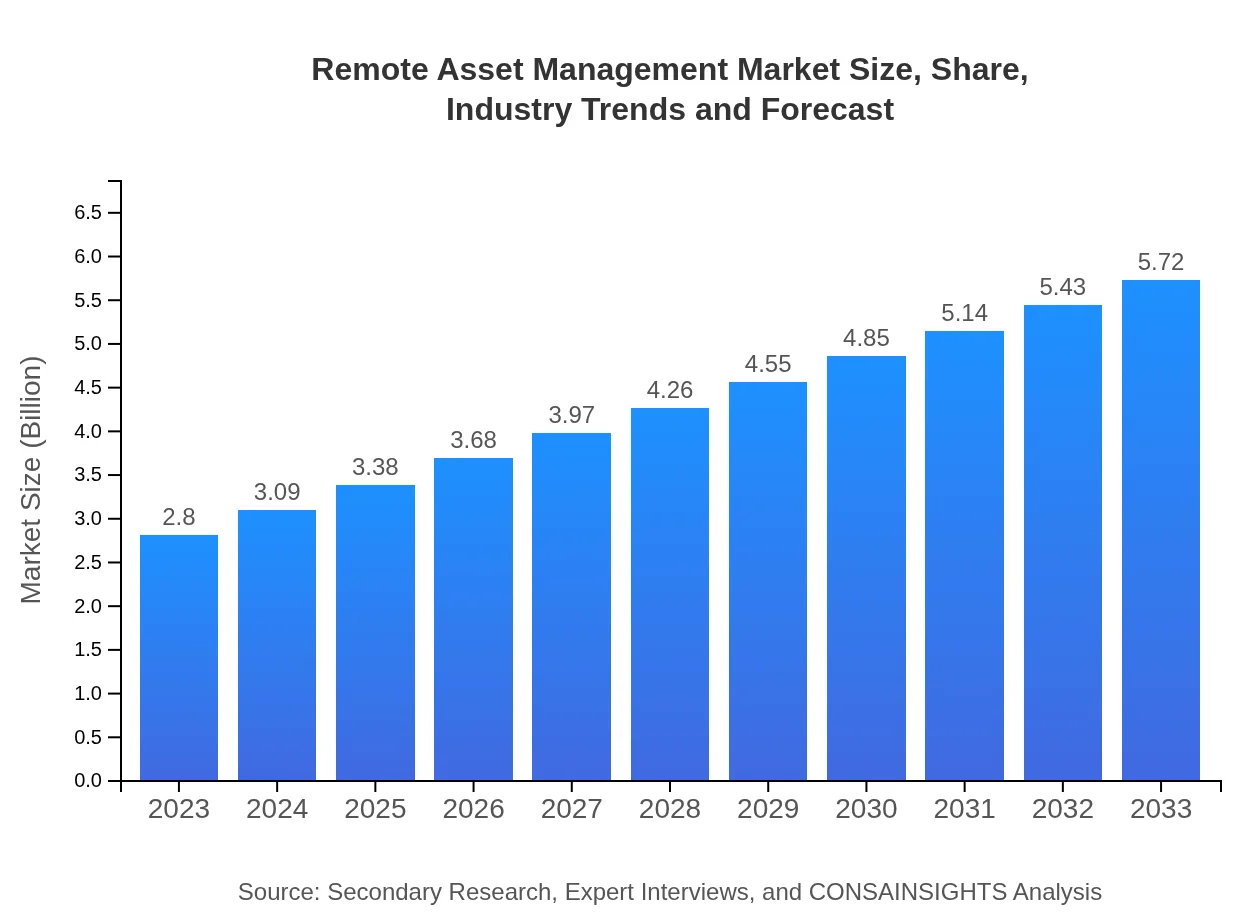

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $5.72 Billion |

| Top Companies | IBM, SAP, Cisco, Siemens |

| Last Modified Date | 22 January 2026 |

Remote Asset Management Market Overview

Customize Remote Asset Management Market Report market research report

- ✔ Get in-depth analysis of Remote Asset Management market size, growth, and forecasts.

- ✔ Understand Remote Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Remote Asset Management

What is the Market Size & CAGR of Remote Asset Management market in 2023?

Remote Asset Management Industry Analysis

Remote Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Remote Asset Management Market Analysis Report by Region

Europe Remote Asset Management Market Report:

Europe's market for Remote Asset Management is projected to expand from $0.77 billion in 2023 to $1.57 billion by 2033. Governments' initiatives toward digitalizing their economies and improving operational efficiencies fuel this growth.Asia Pacific Remote Asset Management Market Report:

The Asia Pacific region, valued at approximately $0.58 billion in 2023, is projected to grow to $1.19 billion by 2033. This increase is driven by rapid industrialization and the adoption of advanced technologies, particularly in countries such as China and India.North America Remote Asset Management Market Report:

North America is expected to witness robust growth, rising from $0.92 billion in 2023 to approximately $1.87 billion by 2033. The presence of key technology players and a strong emphasis on automation contribute significantly to this momentum.South America Remote Asset Management Market Report:

In South America, the Remote Asset Management market is anticipated to grow from $0.22 billion in 2023 to $0.44 billion by 2033. Strategic initiatives to modernize industries and improve infrastructure play a pivotal role in this region's growth.Middle East & Africa Remote Asset Management Market Report:

In the Middle East and Africa, the market is expected to grow from $0.31 billion in 2023 to $0.64 billion by 2033, driven by investments in telecommunications and a push towards sustainable asset management practices.Tell us your focus area and get a customized research report.

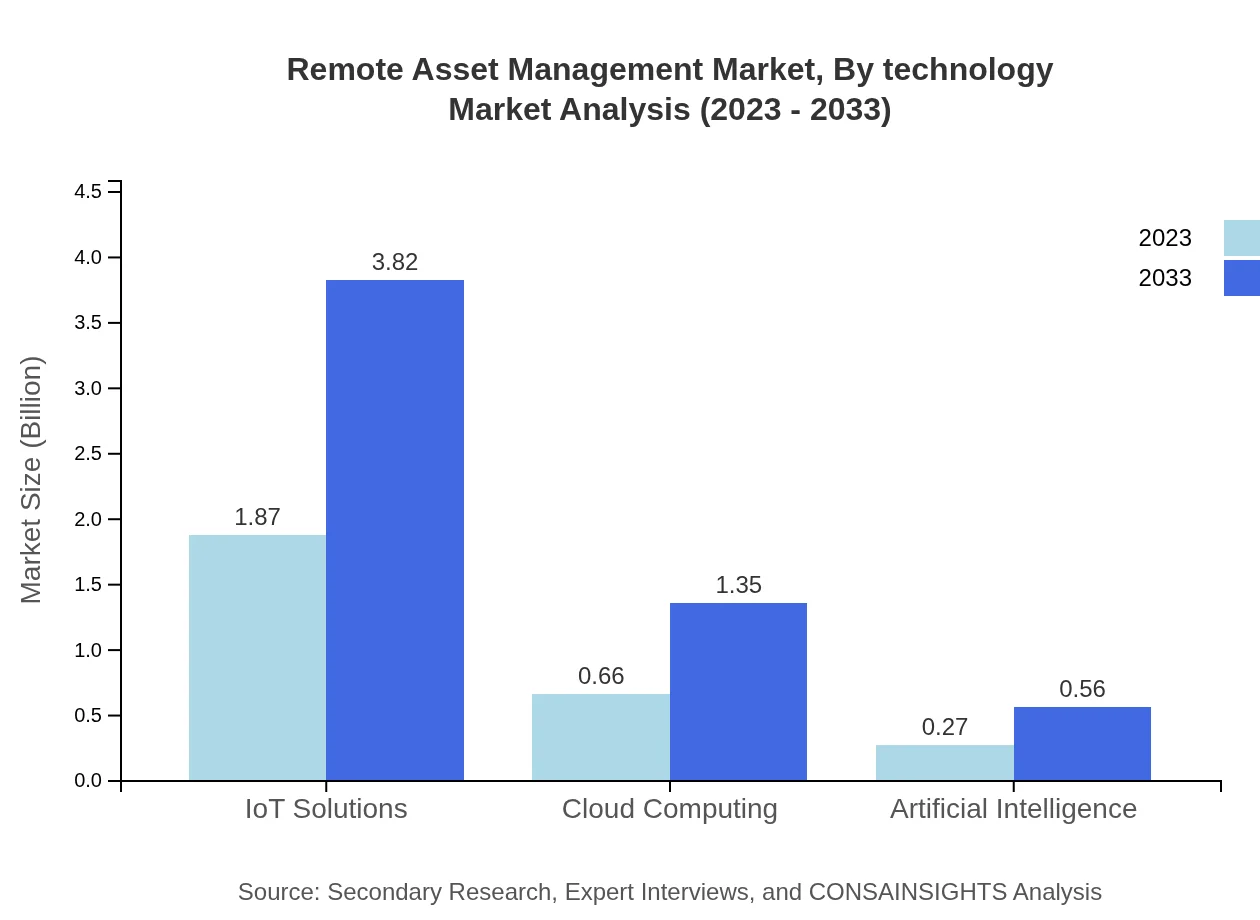

Remote Asset Management Market Analysis By Technology

In the Remote Asset Management market, IoT Solutions dominate with a projected market size of $1.87 billion in 2023, growing to $3.82 billion by 2033. This segment accounts for 66.66% market share in 2023 and is expected to maintain its dominance driven by increasing connectivity. Cloud Computing follows with a market size of $0.66 billion in 2023, anticipated to grow to $1.35 billion by 2033, representing 23.56% market share. Meanwhile, technologies like Artificial Intelligence contribute a more modestly growing share of 9.78%.

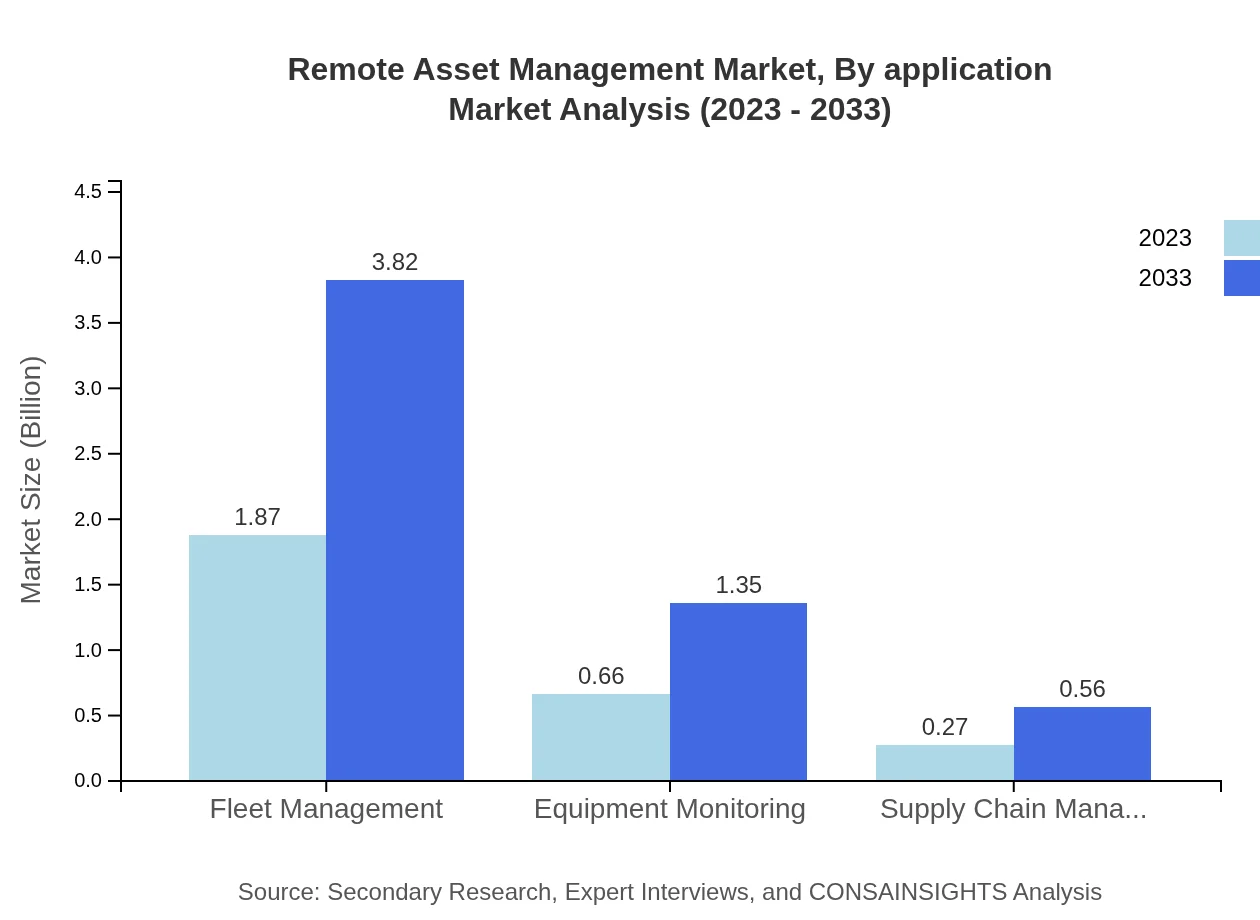

Remote Asset Management Market Analysis By Application

The manufacturing sector represents the largest application segment, with a market size of $1.42 billion in 2023, expected to reach $2.90 billion by 2033, holding 50.65% of the market share. Transportation follows with a market value of $0.68 billion in 2023, growing to $1.39 billion by 2033, reflecting a market share of 24.37%. The energy sector, construction, and others also contribute significantly, emphasizing the importance of remote management across diverse applications.

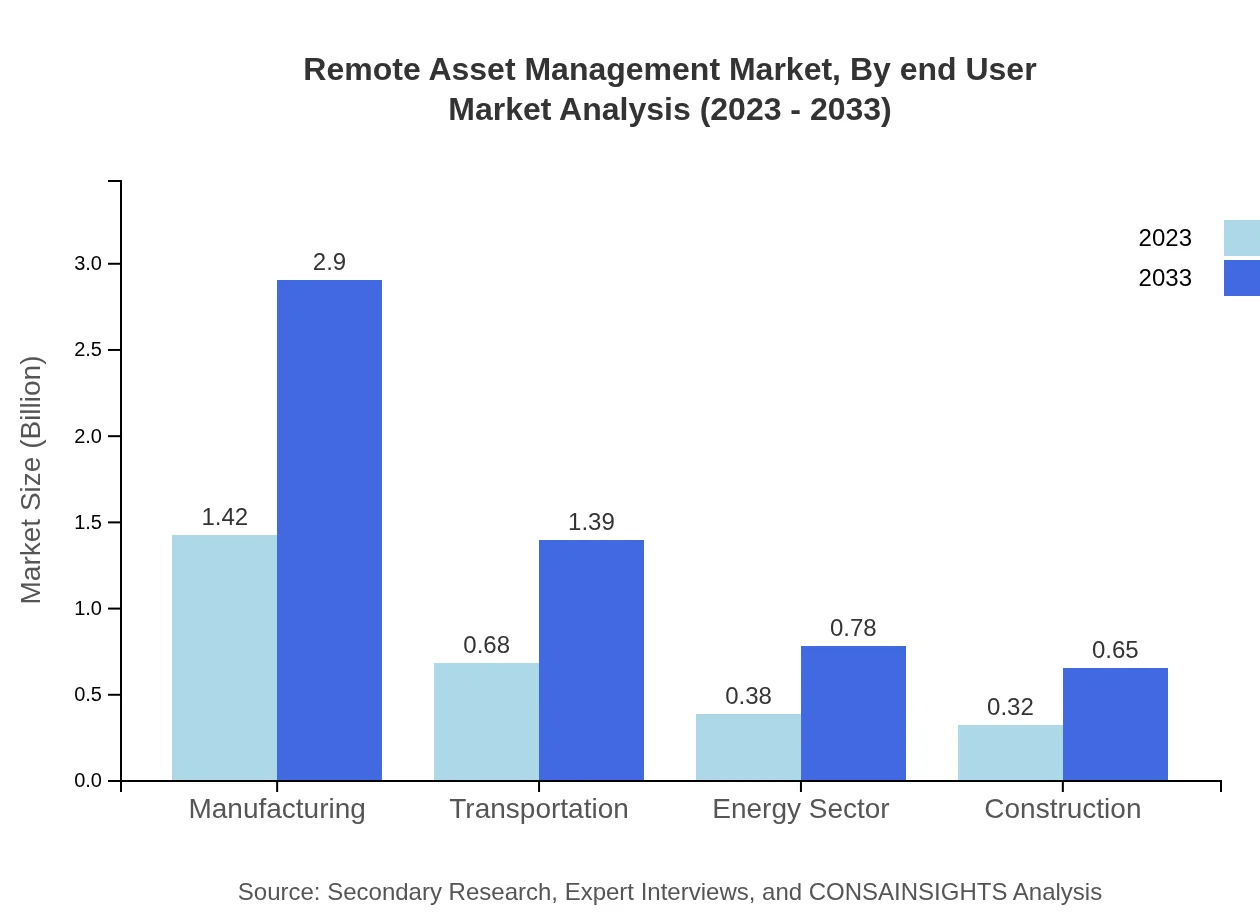

Remote Asset Management Market Analysis By End User

End-user segments highlight manufacturing, transportation, and energy as key contributors to growth, with the manufacturing segment expected to hold the highest market share due to the increasing adoption of automation technology. The focus on operational efficiency drives end-users to leverage remote asset management solutions prominently, ensuring asset longevity and service quality.

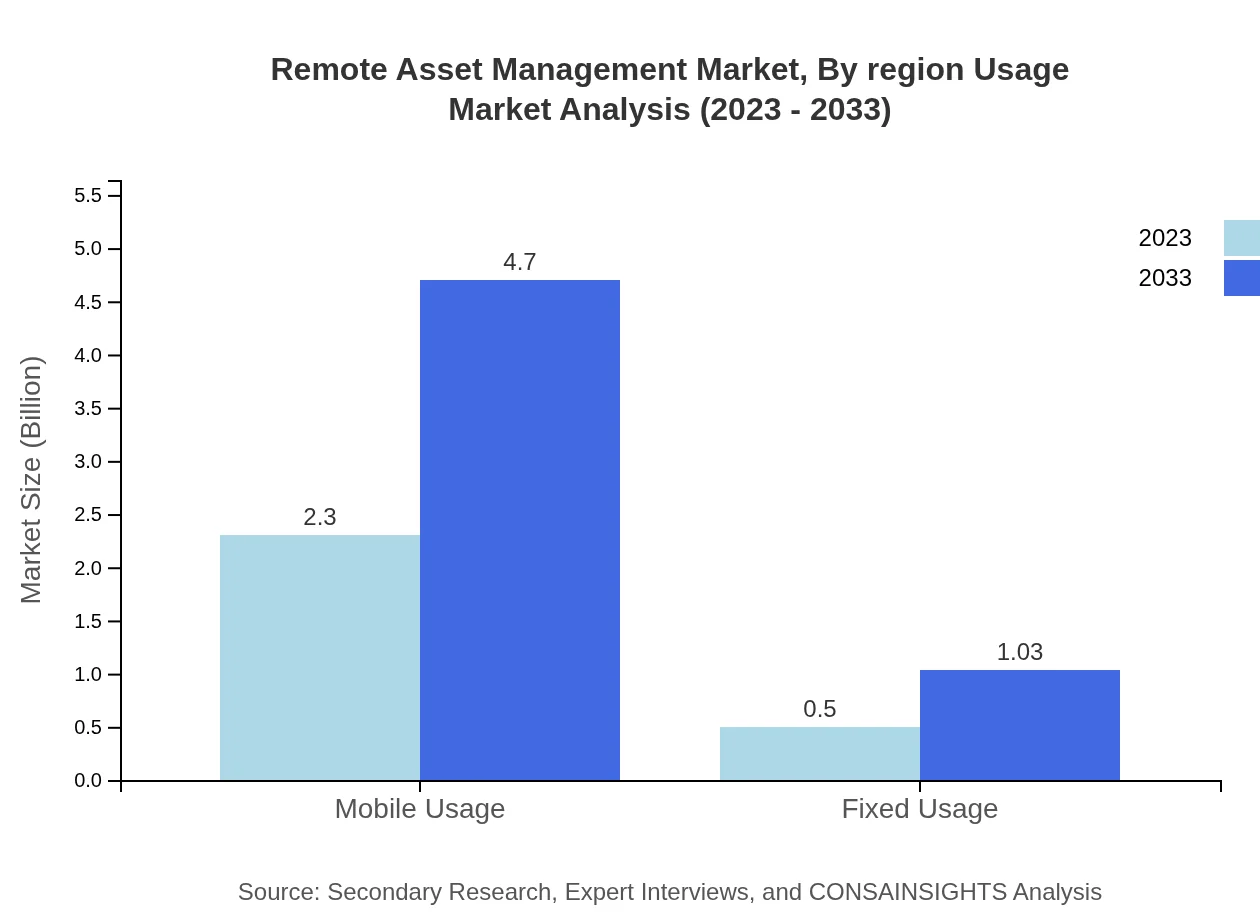

Remote Asset Management Market Analysis By Region Usage

Mobile usage dominates at 82.09% of the market share in 2023, with expected growth to 82.09% by 2033. Fixed usage remains significantly lower, with a share of 17.91%. This highlights a growing reliance on mobile applications for remote asset management, driven by the need for real-time data access and on-the-go management capabilities.

Remote Asset Management Market Analysis By Service Model

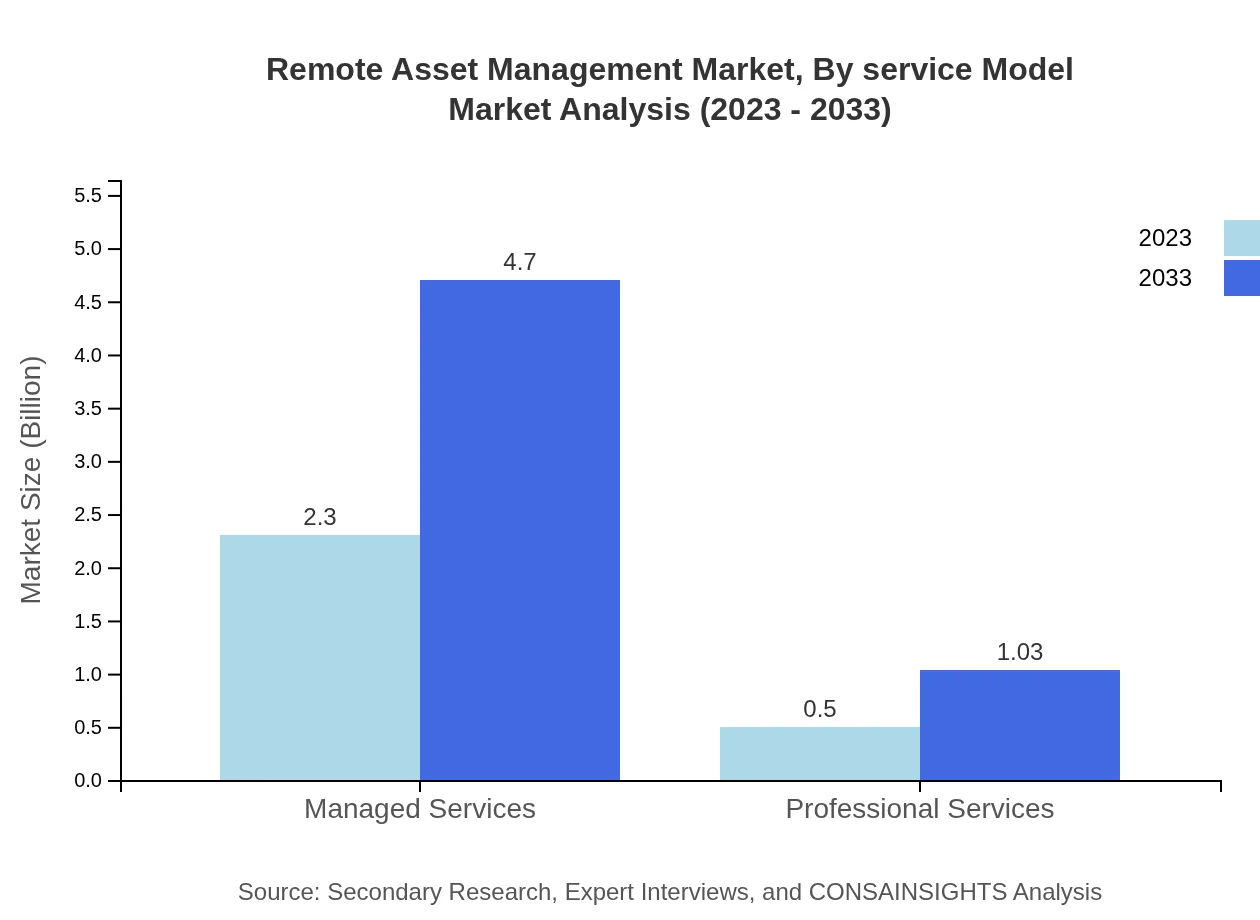

Managed services constitute a significant portion of the market, accounting for 82.09% market share in 2023 and projected to remain unchanged through 2033. Professional services, while smaller, are expected to grow from a market size of $0.50 billion in 2023 to $1.03 billion by 2033, emphasizing the critical role of expert support in implementing remote asset management solutions.

Remote Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Remote Asset Management Industry

IBM:

IBM offers comprehensive remote asset management solutions leveraging AI and IoT technologies, helping businesses enhance their operational efficiencies and predictive maintenance capabilities.SAP:

SAP provides innovative asset management solutions that integrate with enterprise systems to improve asset utilization and support real-time asset monitoring.Cisco:

Cisco’s IoT platform delivers robust solutions for remote asset management focusing on secure connectivity and network infrastructure, essential for critical asset operations.Siemens :

Siemens specializes in digital solutions for asset management, enabling industries to optimize their operations with predictive insights and enhanced operational analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of remote Asset Management?

The remote asset management market is valued at approximately $2.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2%, indicating robust growth ahead as adoption across industries increases.

What are the key market players or companies in this remote Asset Management industry?

Key players in the remote asset management industry include Siemens AG, IBM Corporation, GE Digital, and Microsoft, among others, who innovate continually to enhance remote management solutions.

What are the primary factors driving the growth in the remote Asset Management industry?

Growth is driven by increased demand for IoT solutions, optimization of resource management, efficiency improvements across sectors, and the push for greater visibility in asset management processes.

Which region is the fastest Growing in the remote Asset Management?

The Asia Pacific region is expected to demonstrate the fastest growth from 2023 to 2033, expanding from $0.58 billion in 2023 to $1.19 billion, fueled by rapid technological advancements.

Does ConsaInsights provide customized market report data for the remote Asset Management industry?

Yes, ConsaInsights offers tailored market reports and insights in the remote asset management sector, ensuring that specific needs and parameters are met for various clients.

What deliverables can I expect from this remote Asset Management market research project?

Clients can expect comprehensive reports, market forecasts, competitive analysis, regional insights, and strategic recommendations tailored to aid decision-making.

What are the market trends of remote Asset Management?

Key trends include a rising emphasis on mobile usage, integration of AI technologies, and the shift towards cloud-based solutions, shaping the future landscape of remote asset management.