Remote Sensing Services Market Report

Published Date: 31 January 2026 | Report Code: remote-sensing-services

Remote Sensing Services Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers the Remote Sensing Services market from 2023 to 2033, providing insights into market size, growth trends, segmentation, regional dynamics, and leading players in the industry.

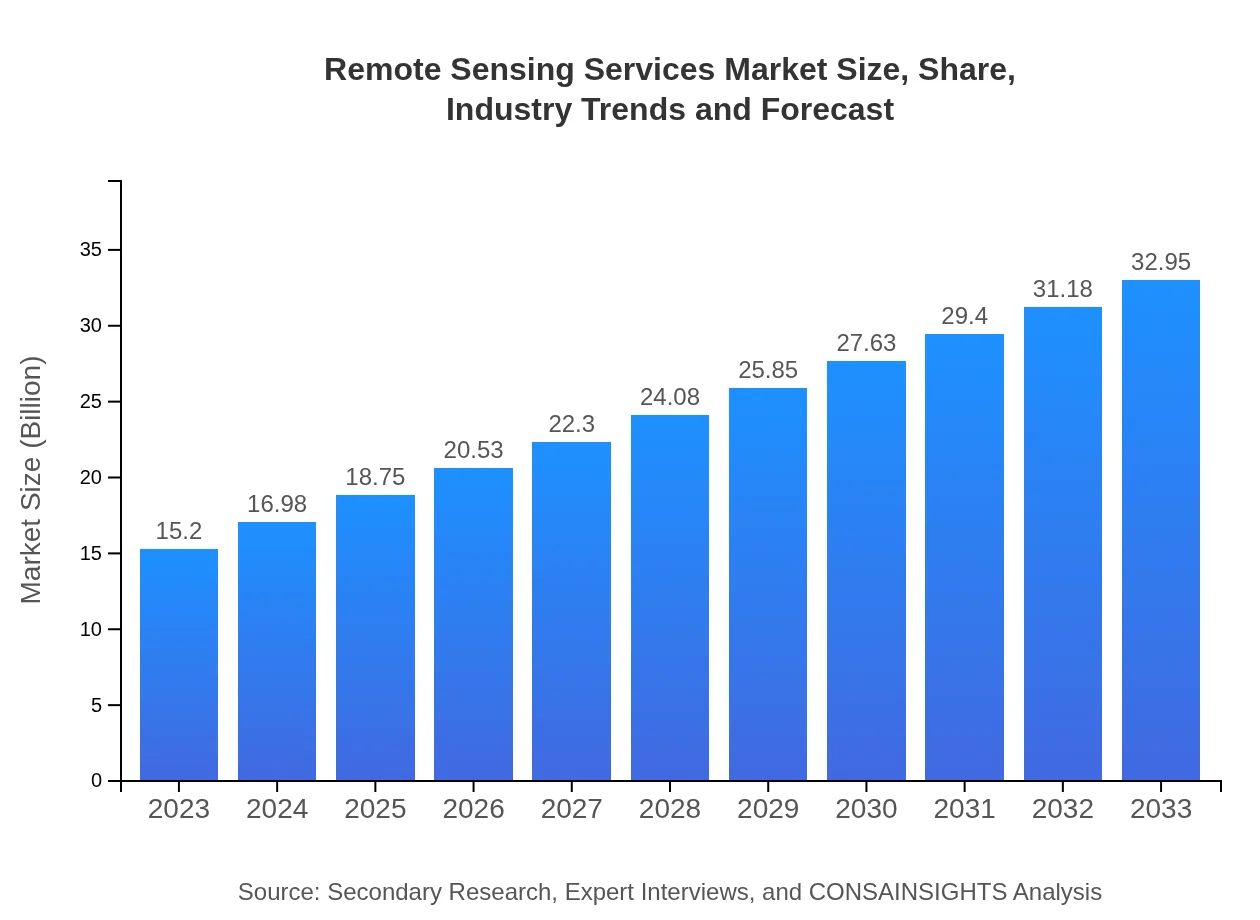

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $32.95 Billion |

| Top Companies | Maxar Technologies, Airbus Defence and Space, Esri, Planet Labs |

| Last Modified Date | 31 January 2026 |

Remote Sensing Services Market Overview

Customize Remote Sensing Services Market Report market research report

- ✔ Get in-depth analysis of Remote Sensing Services market size, growth, and forecasts.

- ✔ Understand Remote Sensing Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Remote Sensing Services

What is the Market Size & CAGR of Remote Sensing Services market in 2033?

Remote Sensing Services Industry Analysis

Remote Sensing Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Remote Sensing Services Market Analysis Report by Region

Europe Remote Sensing Services Market Report:

The European market for Remote Sensing Services is also robust, with a valuation of $4.74 billion in 2023 anticipated to increase to $10.27 billion by 2033. Regulatory frameworks around environmental protection and urbanization initiatives propel demand in this market.Asia Pacific Remote Sensing Services Market Report:

In the Asia Pacific region, the Remote Sensing Services market was valued at $2.58 billion in 2023 and is expected to reach $5.60 billion by 2033. The growth in this region is led by economic development and increased investments in satellite technology for agriculture, urban planning, and natural resource management.North America Remote Sensing Services Market Report:

North America has the largest share of the Remote Sensing Services market, with a market size of $5.68 billion in 2023, growing to $12.31 billion by 2033. The region's focus on advanced research and technological innovations in environmental monitoring and disaster management lead the market forward.South America Remote Sensing Services Market Report:

South America represents a growing market with an estimated value of $0.99 billion in 2023, projected to reach $2.14 billion by 2033. The central drivers include deforestation monitoring and the necessity for efficient management of agricultural resources amid climate change challenges.Middle East & Africa Remote Sensing Services Market Report:

In the Middle East and Africa, the market size is estimated at $1.21 billion in 2023, growing to $2.63 billion by 2033. The increasing focus on resource management, particularly in water-scarce regions, supports significant demand for remote sensing services.Tell us your focus area and get a customized research report.

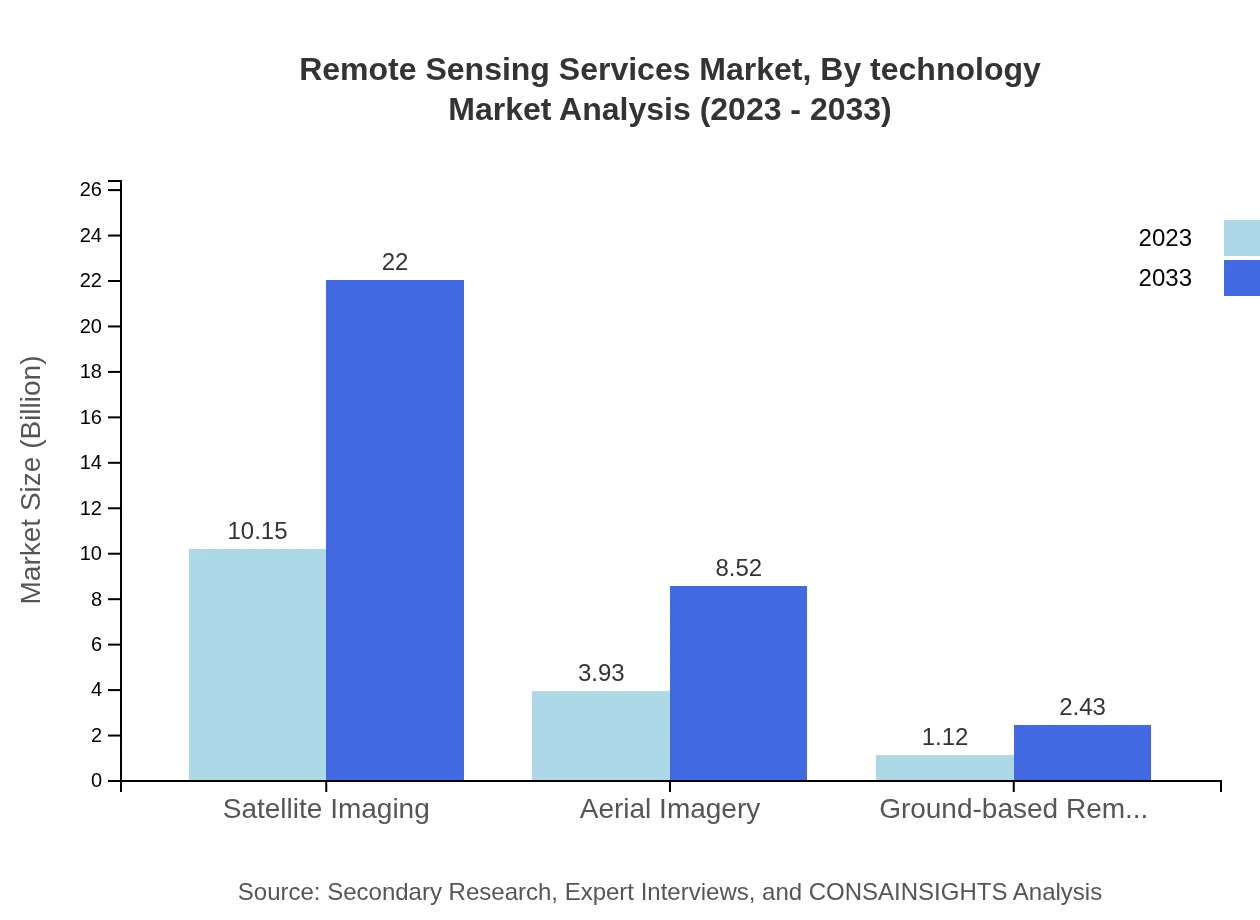

Remote Sensing Services Market Analysis By Technology

The Remote Sensing Services Market is predominantly segmented into three technologies: Satellite Imaging, Aerial Imagery, and Ground-based Remote Sensing. Satellite Imaging currently leads with a market share of 66.77% in 2023 and is expected to maintain this dominance through 2033. Aerial Imagery accounts for 25.85%, serving diverse applications in urban planning and agriculture. Ground-based Remote Sensing, though smaller, offers crucial localized data with a share of 7.38%.

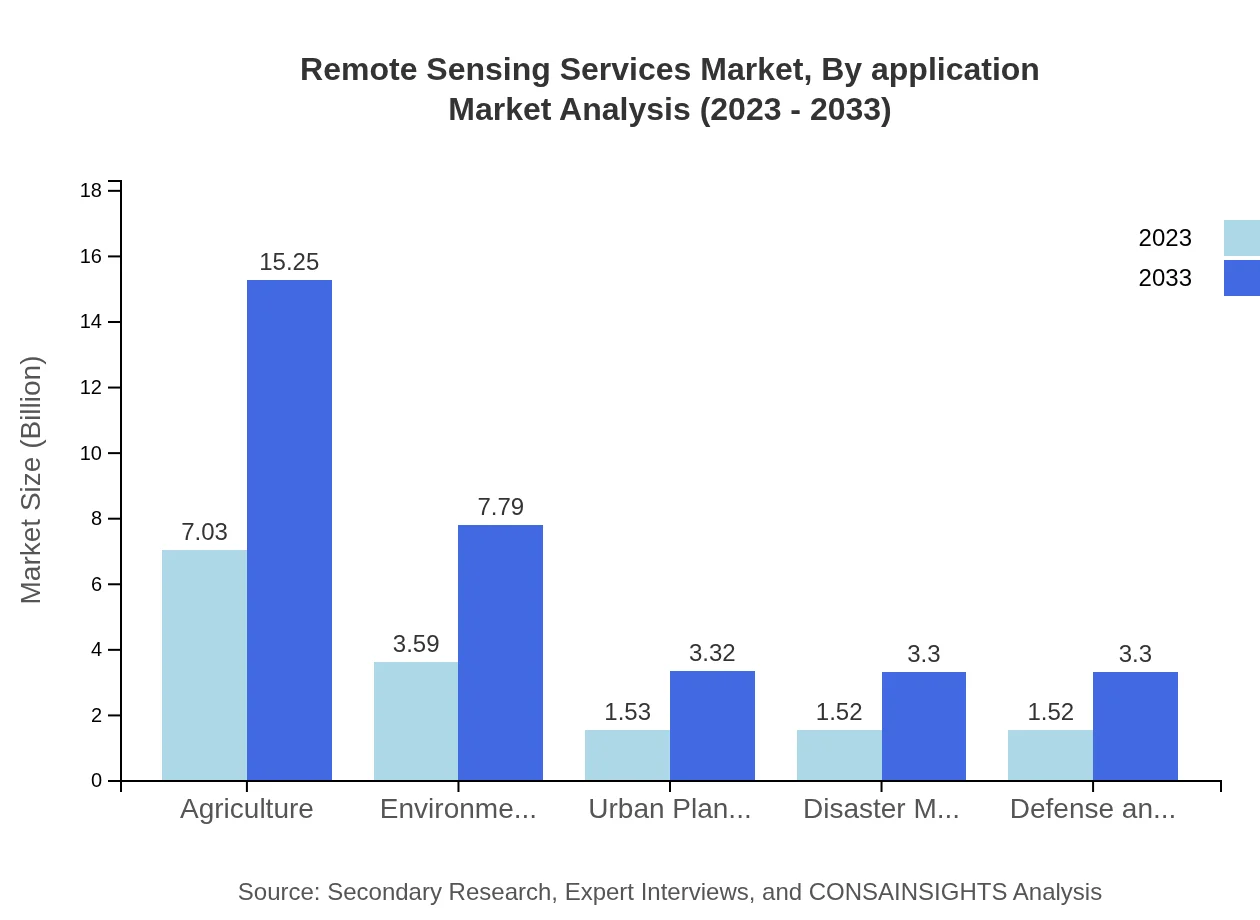

Remote Sensing Services Market Analysis By Application

The market is further segmented by application into sectors including Agriculture, Environmental Monitoring, Urban Planning, Disaster Management, and Defense & Security. Agriculture holds a significant market share of 46.28% in 2023, as farmers increasingly employ remote sensing to optimize yields. Environmental Monitoring follows with 23.63%, serving to track climate changes and habitat preservation efforts. Each application area is experiencing substantial growth as technology becomes more accessible.

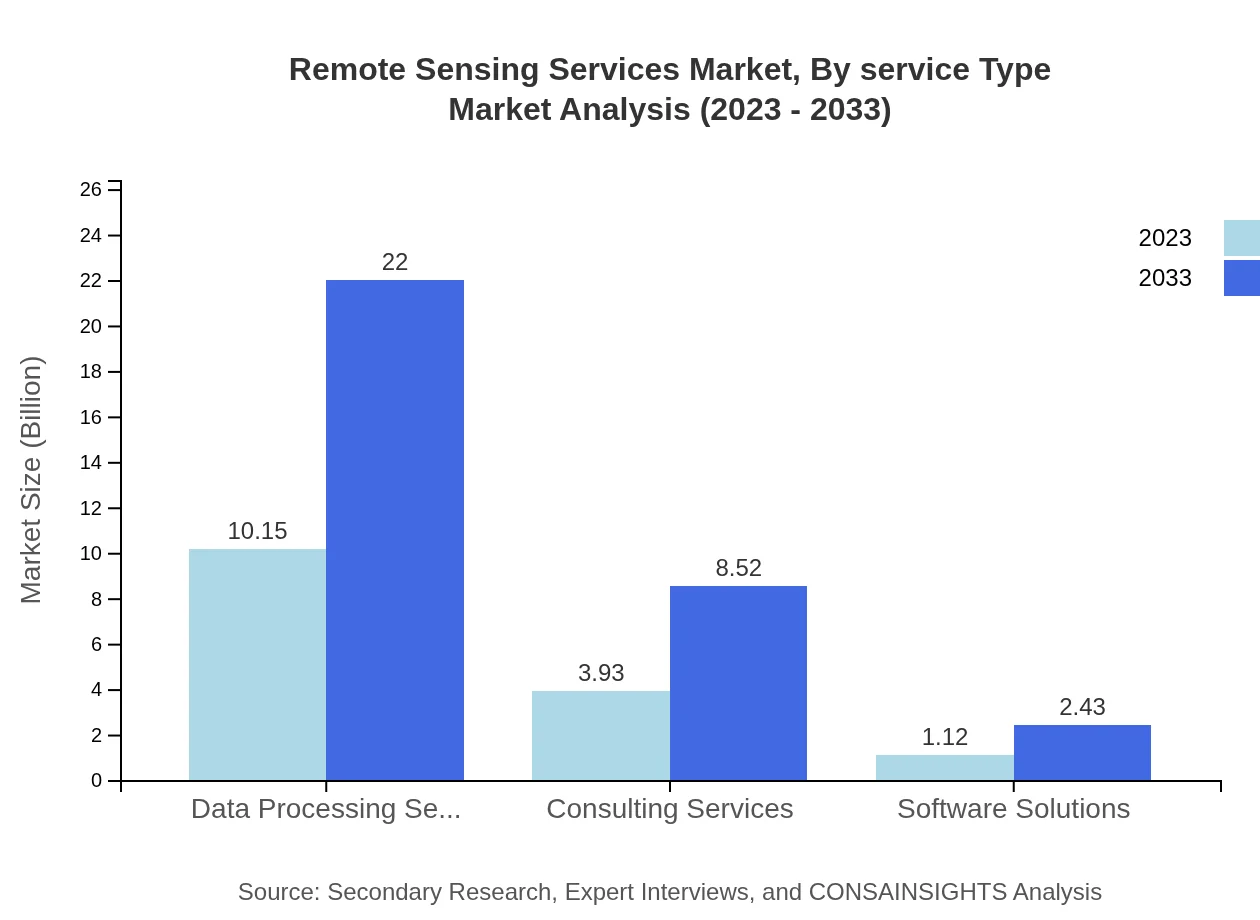

Remote Sensing Services Market Analysis By Service Type

Service types in this market can be categorized into Data Processing Services, Consulting Services, and Software Solutions. Data Processing Services dominate the market with a significant share of 66.77%. Consulting Services form 25.85% of the market, offering expertise to various industries on effective application usage. Software Solutions, while smaller, are increasingly critical in managing data analytics.

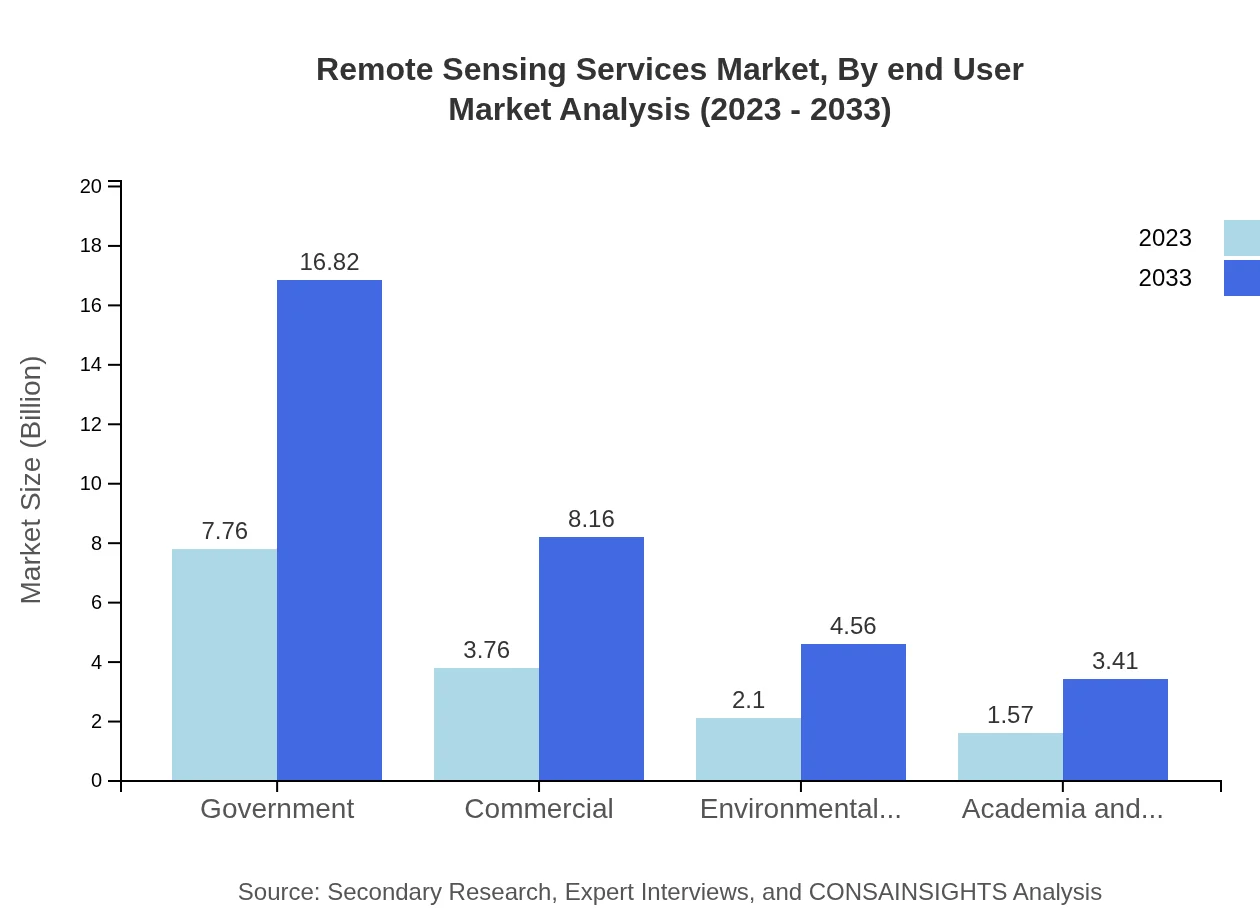

Remote Sensing Services Market Analysis By End User

End-users of the Remote Sensing Services include Government agencies, Environmental Agencies, Academia and Research Institutions, and Commercial enterprises. Government accounts for 51.06% of the market in 2023, leading in adopting remote sensing for policymaking and urban development. Environmental Agencies, with 13.84%, leverage data for monitoring and conservation efforts. The significance of each segment reflects the growing reliance on precise geographic data across sectors.

Remote Sensing Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Remote Sensing Services Industry

Maxar Technologies:

Maxar is a leading provider of satellite imagery and geospatial information, known for its high-resolution Earth observation satellites that support various sectors, including defense, intelligence, and infrastructure monitoring.Airbus Defence and Space:

Airbus is a prominent player in the aerospace sector, offering satellite services that generate high-value data for environmental and security applications worldwide, enhancing governmental and commercial decision-making processes.Esri:

Esri is a market leader in GIS software, providing advanced mapping and spatial analytics tools that incorporate remote sensing data for various applications in urban planning, environmental management, and resource allocation.Planet Labs:

Planet Labs operates a fleet of Earth imaging satellites to deliver high-frequency satellite imagery, supporting industries from agriculture to forestry and providing insights for sustainable resource management.We're grateful to work with incredible clients.

FAQs

What is the market size of Remote Sensing Services?

The Remote Sensing Services market is valued at approximately $15.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.8%, signaling robust growth potential as technological advancements boost demand.

What are the key market players or companies in the Remote Sensing Services industry?

Key players include major satellite corporations, aerospace firms, and environmental technology companies. Entities specializing in geospatial analytics, data processing, and analysis solutions form a substantial part of this competitive landscape.

What are the primary factors driving the growth in the Remote Sensing Services industry?

Growth drivers include increasing demand for accurate data in agriculture, environmental monitoring, urban planning, and disaster management, alongside technological advancements in satellite and aerial imaging capabilities aiding efficiency.

Which region is the fastest Growing in the Remote Sensing Services?

The Asia Pacific region is the fastest-growing market, expanding from $2.58 billion in 2023 to $5.60 billion by 2033, driven by increased investments in technology and applications across various sectors.

Does ConsaInsights provide customized market report data for the Remote Sensing Services industry?

Yes, ConsaInsights offers tailored market reports to meet specific client needs, allowing customization on parameters such as data granularity, geographical focus, and segmentation for enhanced decision-making.

What deliverables can I expect from this Remote Sensing Services market research project?

Deliverables include detailed market analysis reports, segmentation data, forecasts, and strategic insights, all accompanied by actionable recommendations tailored to your business objectives and market conditions.

What are the market trends of Remote Sensing Services?

Key trends involve advancements in satellite imagery technologies, increased integration of AI for data processing, and a growing emphasis on sustainability and environmental monitoring practices among government and commercial sectors.