Remote Weapon Station Market Report

Published Date: 31 January 2026 | Report Code: remote-weapon-station

Remote Weapon Station Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Remote Weapon Station market, covering market conditions, size, segmentation, regional analysis, and future trends from 2023 to 2033. It highlights key players and technological advancements affecting the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

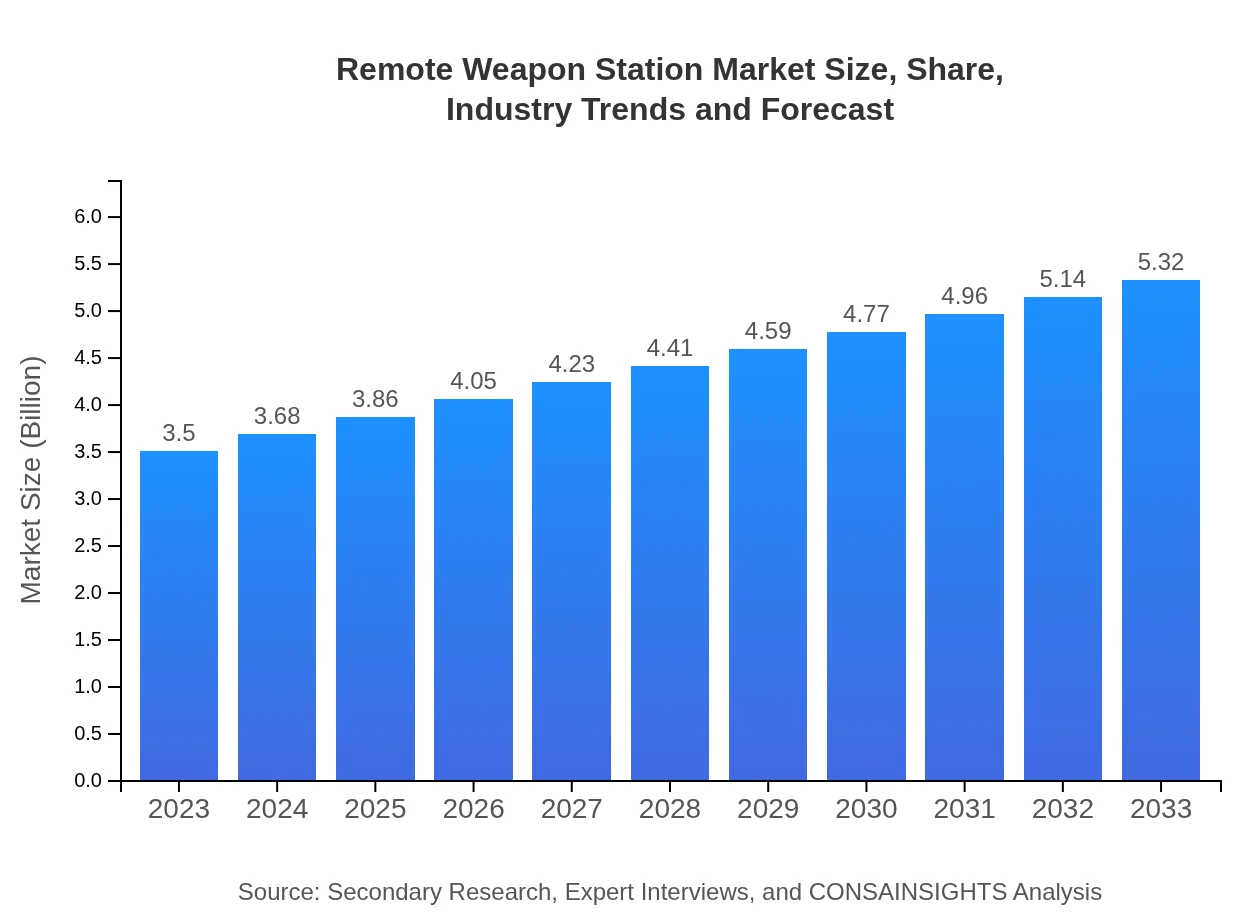

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $5.32 Billion |

| Top Companies | General Dynamics, Northrop Grumman, Thales Group, Rheinmetall |

| Last Modified Date | 31 January 2026 |

Remote Weapon Station Market Overview

Customize Remote Weapon Station Market Report market research report

- ✔ Get in-depth analysis of Remote Weapon Station market size, growth, and forecasts.

- ✔ Understand Remote Weapon Station's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Remote Weapon Station

What is the Market Size & CAGR of Remote Weapon Station market in 2023?

Remote Weapon Station Industry Analysis

Remote Weapon Station Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Remote Weapon Station Market Analysis Report by Region

Europe Remote Weapon Station Market Report:

The European RWS market begins at $1.00 billion in 2023 and is projected to grow to $1.52 billion by 2033. Countries like the UK and France are enhancing their military capabilities, leading to increased procurement of advanced remote weapon systems.Asia Pacific Remote Weapon Station Market Report:

In 2023, the Asia Pacific RWS market was valued at $0.68 billion and is projected to grow to $1.04 billion by 2033. Regions like China and India are heavily investing in defense modernization, expanding their inventory of automated systems.North America Remote Weapon Station Market Report:

North America represents a significant portion of the RWS market, valued at $1.25 billion in 2023 and forecasted to rise to $1.90 billion by 2033. The U.S. military's commitment to adopting unmanned solutions and modernization drives this growth.South America Remote Weapon Station Market Report:

The South American market is relatively smaller, starting at $0.28 billion in 2023 and expected to reach $0.42 billion by 2033. Brazil and Argentina are notable as they seek to enhance their defense capabilities amid rising concerns over security.Middle East & Africa Remote Weapon Station Market Report:

In 2023, the market in the Middle East and Africa is expected to be worth $0.29 billion, with a growth forecast to $0.44 billion by 2033. Nations in this region are focused on upgrading their defense technology to address regional conflicts and security challenges.Tell us your focus area and get a customized research report.

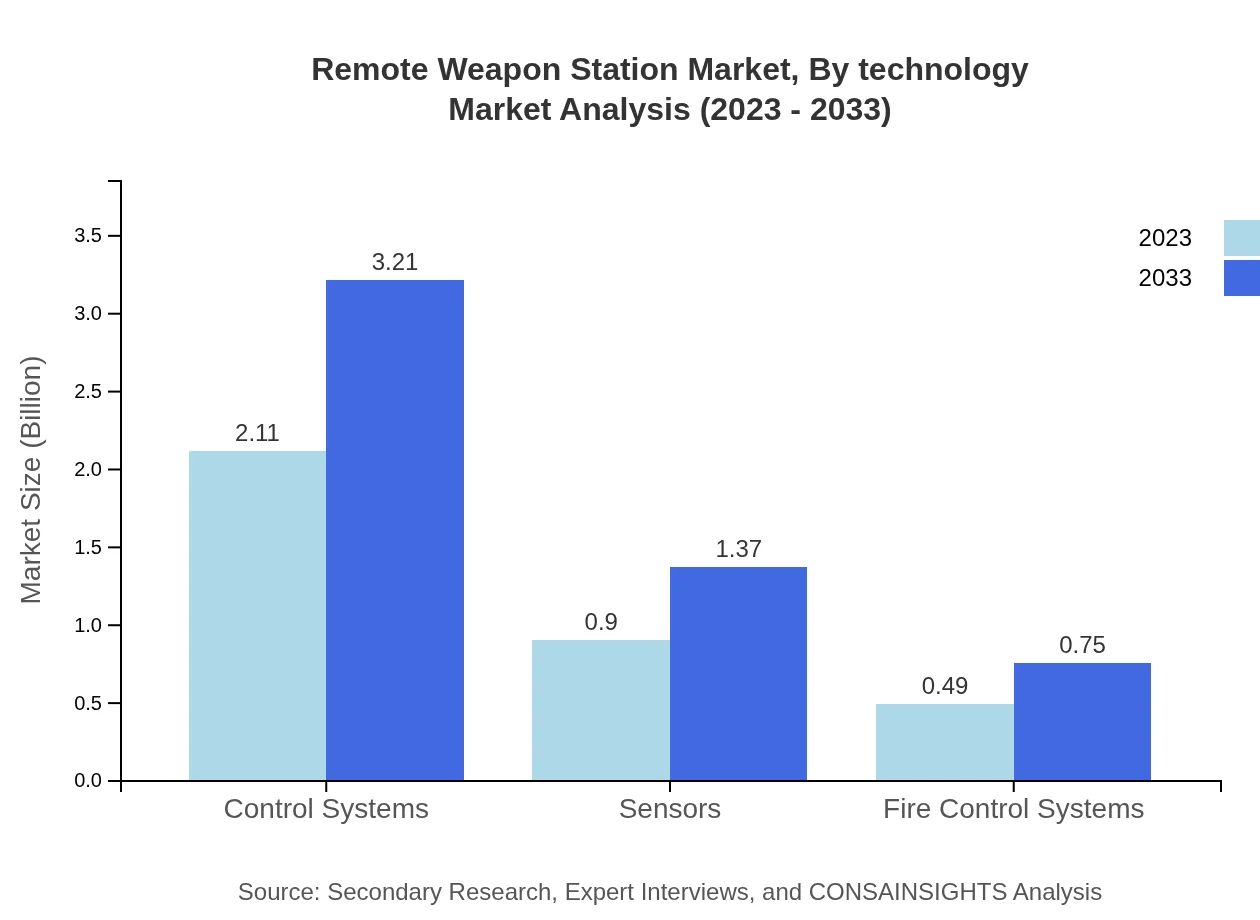

Remote Weapon Station Market Analysis By Technology

Technological advancements play a crucial role in the Remote Weapon Station market, with significant contributions from control systems, sensors, and fire control systems. In 2023, control systems are expected to lead the market with a share of 60.24%, translating to $2.11 billion. Enhanced sensor technologies, accounting for 25.73% of the market share, are equally critical as they facilitate precise targeting capabilities.

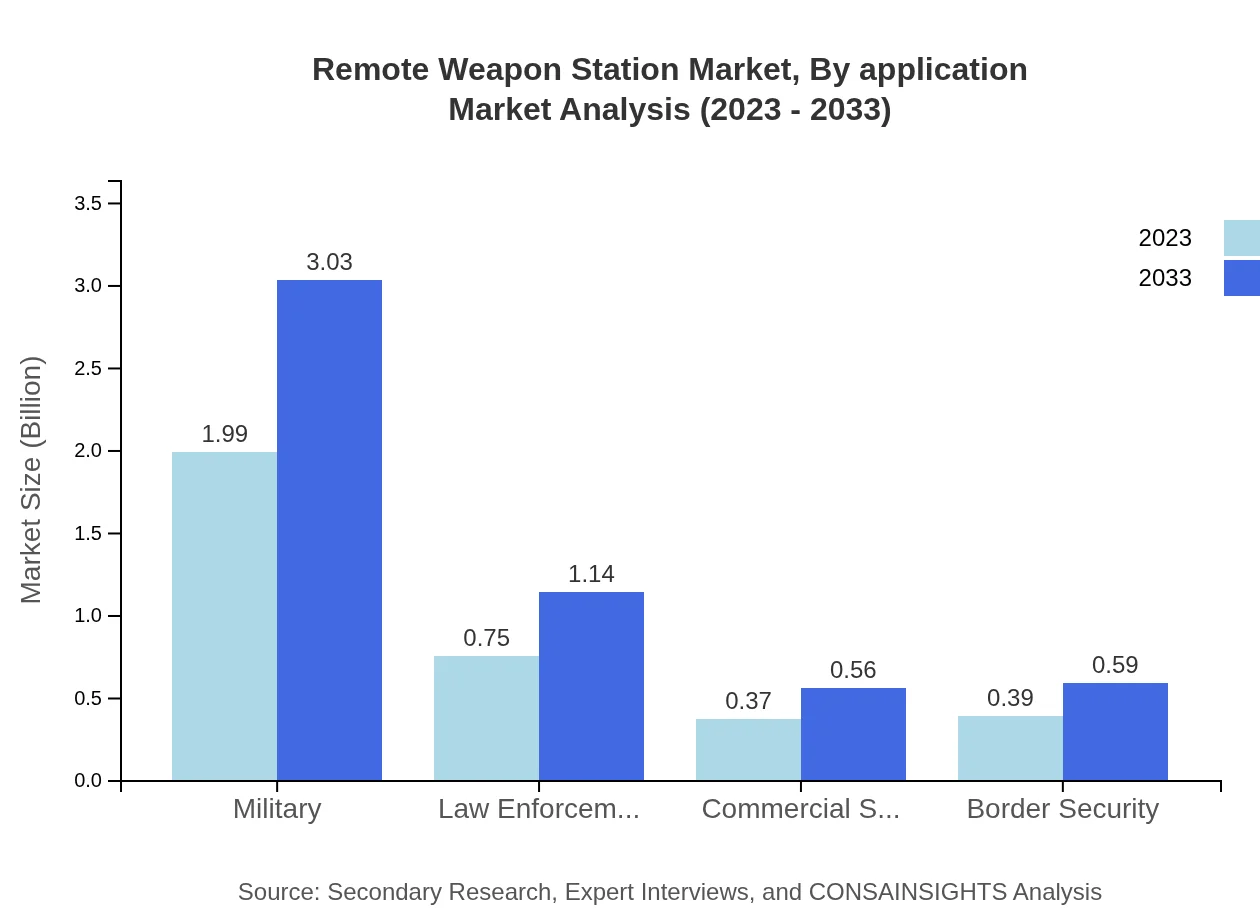

Remote Weapon Station Market Analysis By Application

The application segment is dominated by the government and military sector, which is projected to have a size of $2.11 billion in 2023, representing 60.24% of the total market. Law enforcement applications, accounting for 21.51% of the market share, are gaining traction as urban security initiatives increasingly incorporate unmanned systems.

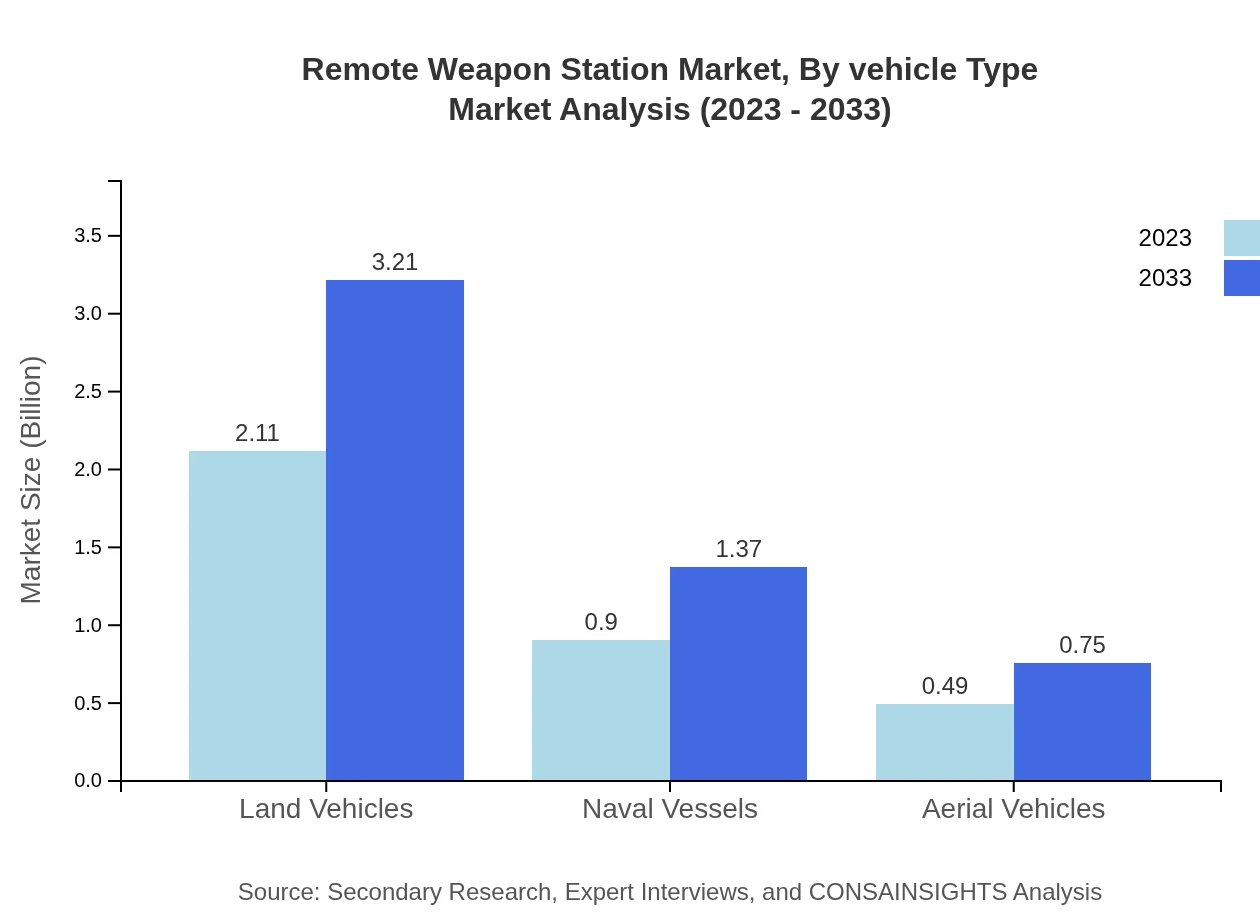

Remote Weapon Station Market Analysis By Vehicle Type

Remote Weapon Stations deployed on land vehicles represent the largest segment, valued at $2.11 billion in 2023. Naval vessels and aerial vehicles are also significant, indicating a trend towards multi-platform integration for tactical flexibility. Land vehicles hold a considerable share due to their extensive use in military operations.

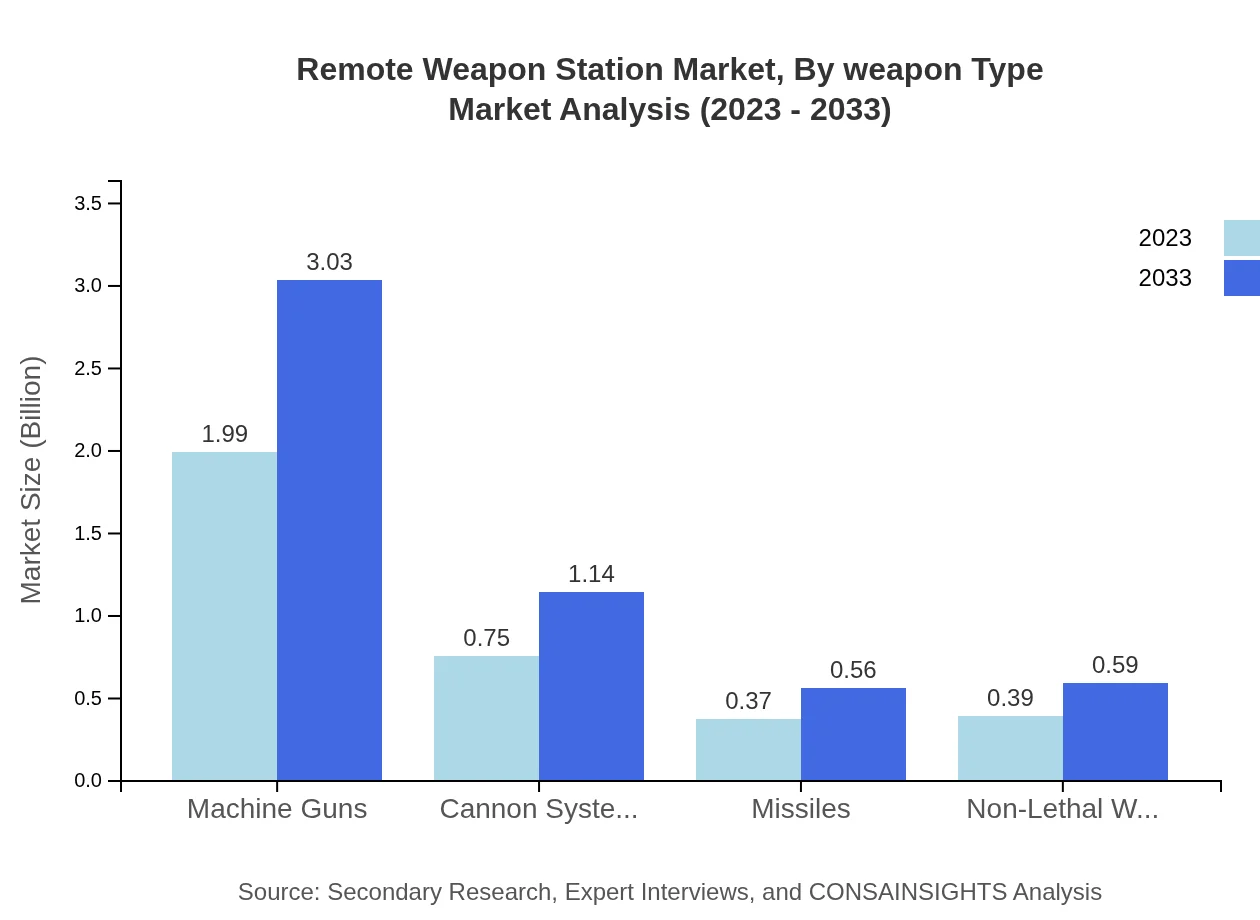

Remote Weapon Station Market Analysis By Weapon Type

Machine guns represent the dominant weapon type within the RWS market, valued at approximately $1.99 billion in 2023, capturing a substantial share of 56.93%. Following closely are cannon systems, which are increasingly adopted due to their effectiveness in various combat scenarios.

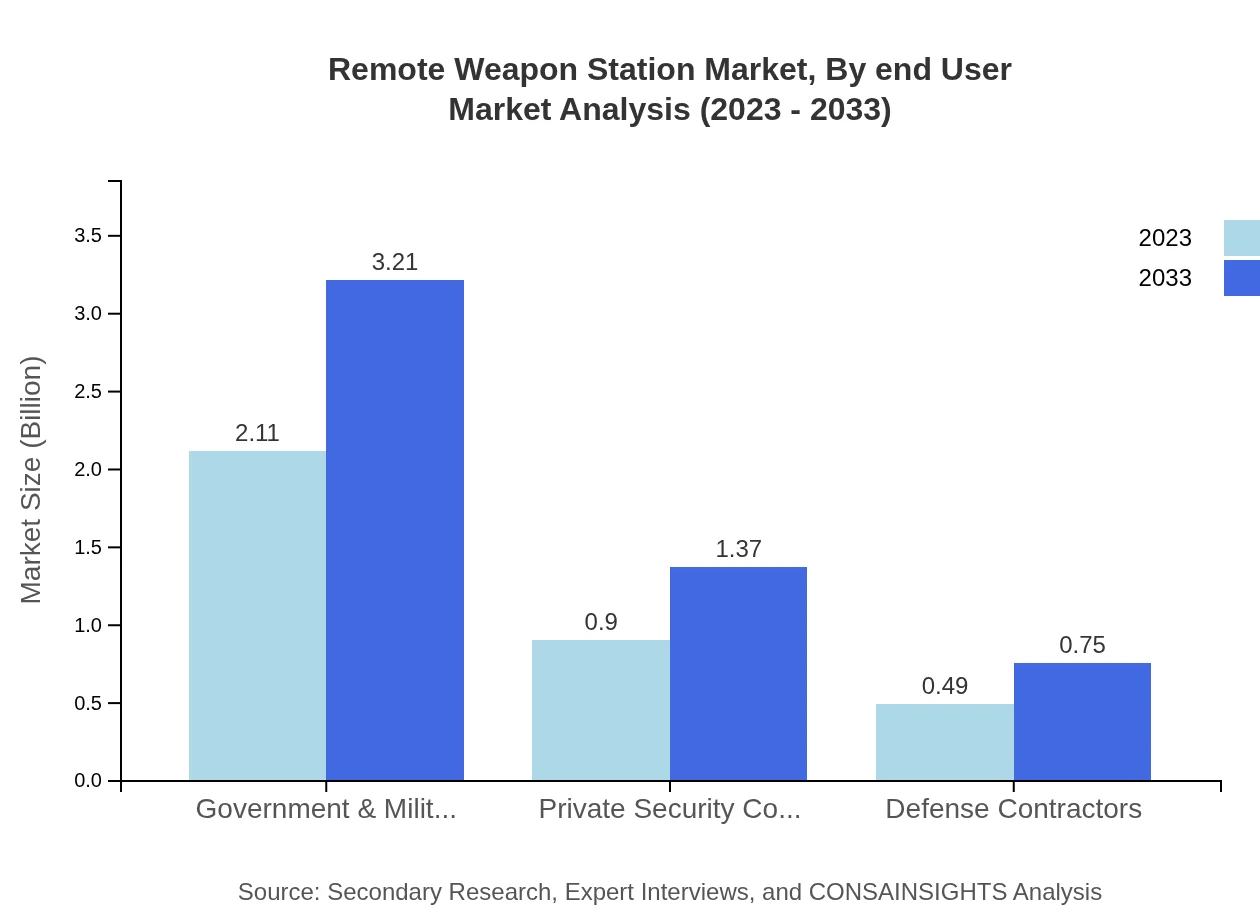

Remote Weapon Station Market Analysis By End User

The government and military sector remains the predominant end-user of Remote Weapon Stations, holding a market size of $2.11 billion in 2023. Private security companies and defense contractors also contribute significantly, indicating broad applications in both government-led and private sector defense solutions.

Remote Weapon Station Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Remote Weapon Station Industry

General Dynamics:

A leader in defense and aerospace, General Dynamics designs and manufactures advanced weapon systems, including Remote Weapon Stations, enhancing operational capabilities for various military applications.Northrop Grumman:

Specialized in aerospace and defense technology, Northrop Grumman develops innovative RWS solutions that integrate advanced sensors and automated systems, ensuring superior tactical performance.Thales Group:

Thales is a global security and aerospace leader, providing sophisticated RWS solutions equipped with cutting-edge technology, bridging the gap between virtual and physical combat operations.Rheinmetall:

The German defense contractor known for its ground combat systems, including Remote Weapon Stations, Rheinmetall focuses on modernization and innovative technology for defense solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of remote Weapon Station?

The remote weapon station market is currently valued at approximately $3.5 billion in 2023. It is projected to grow at a CAGR of 4.2% from 2023 to 2033, driven by advancements in military technology and increased defense budgets globally.

What are the key market players or companies in the remote Weapon Station industry?

Key players in the remote weapon station industry include major defense contractors such as Lockheed Martin, Northrop Grumman, and Rheinmetall. These companies lead the market with innovative technologies and extensive contracts with government and military sectors.

What are the primary factors driving the growth in the remote weapon station industry?

Growth in the remote weapon station industry is driven by rising defense spending, advancements in automation technology, and increasing demand for unmanned systems. Enhanced surveillance capabilities and tactical advantages in warfare are also significant contributors.

Which region is the fastest Growing in the remote weapon station?

The fastest-growing region in the remote weapon station market is projected to be Asia Pacific. Market size is expected to grow from $0.68 billion in 2023 to $1.04 billion by 2033, reflecting an increased focus on modernization of military capabilities.

Does ConsaInsights provide customized market report data for the remote weapon station industry?

Yes, ConsaInsights offers customized market report data that can be tailored to specific needs within the remote weapon station industry, providing insights based on regional dynamics, market segments, and competitive landscapes.

What deliverables can I expect from this remote weapon station market research project?

Clients can expect comprehensive reports including market size analyses, CAGR forecasts, regional breakdowns, and segment data. Additionally, insights into competitive strategies and market trends will be included in the final deliverables.

What are the market trends of remote weapon station?

Current market trends in the remote weapon station sector include increased investments in modernization by military forces, adoption of unmanned systems, and integration of advanced technologies like AI and robotics to enhance operational efficiency.