Respiratory Disease Testing Market Report

Published Date: 31 January 2026 | Report Code: respiratory-disease-testing

Respiratory Disease Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the respiratory disease testing market, offering insights on market size, growth forecasts, and regional dynamics, covering the period from 2023 to 2033.

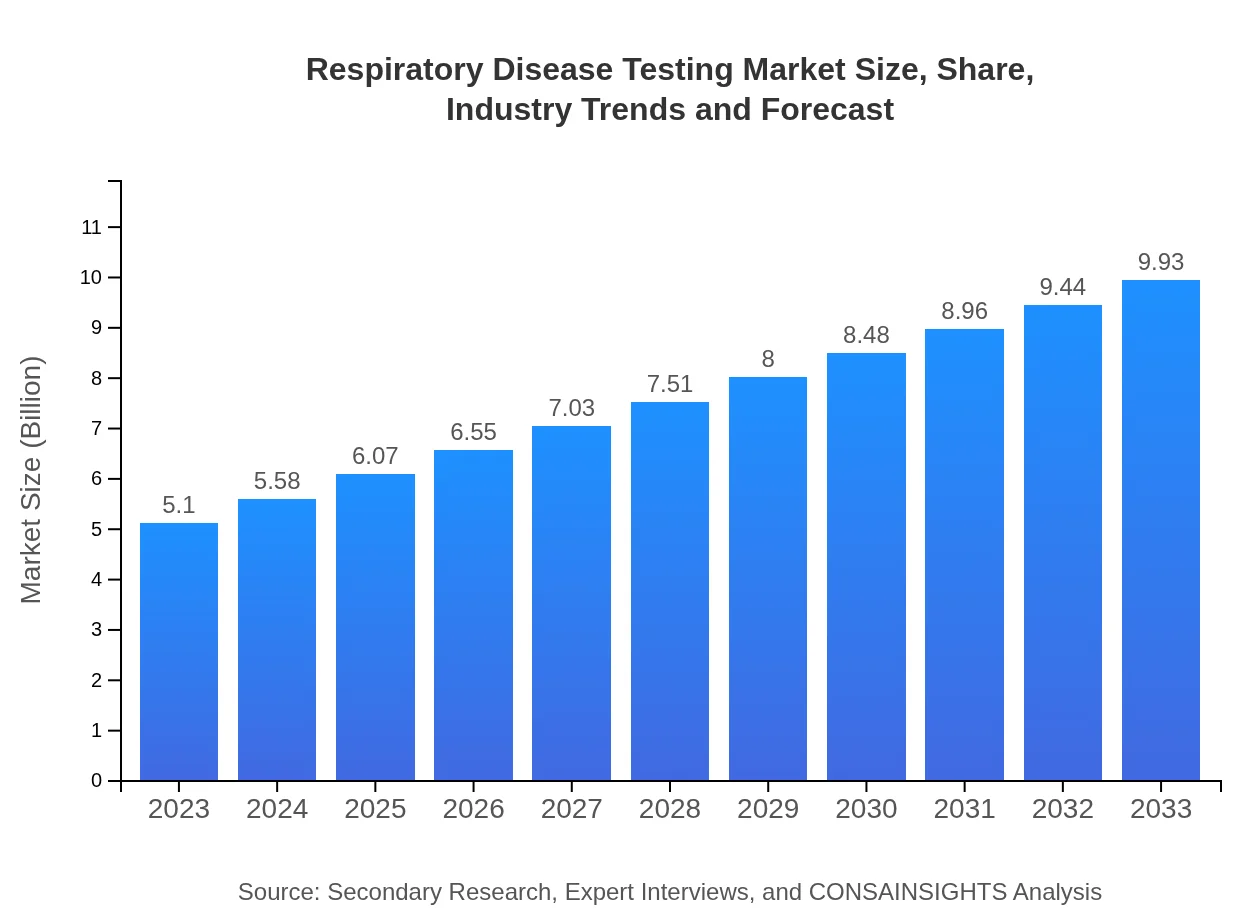

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.10 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $9.93 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers, BD (Becton, Dickinson and Company) |

| Last Modified Date | 31 January 2026 |

Respiratory Disease Testing Market Overview

Customize Respiratory Disease Testing Market Report market research report

- ✔ Get in-depth analysis of Respiratory Disease Testing market size, growth, and forecasts.

- ✔ Understand Respiratory Disease Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Respiratory Disease Testing

What is the Market Size & CAGR of Respiratory Disease Testing market in 2023?

Respiratory Disease Testing Industry Analysis

Respiratory Disease Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Respiratory Disease Testing Market Analysis Report by Region

Europe Respiratory Disease Testing Market Report:

The European respiratory disease testing market is estimated at $1.56 billion in 2023, with forecasts suggesting growth to $3.04 billion by 2033. The region benefits from well-established healthcare networks and a high demand for innovative diagnostic solutions.Asia Pacific Respiratory Disease Testing Market Report:

In the Asia Pacific region, the respiratory disease testing market was valued at approximately $0.95 billion in 2023 and is expected to grow to $1.85 billion by 2033. The increase is driven by rising respiratory disease prevalence, urbanization, and advancements in healthcare infrastructure.North America Respiratory Disease Testing Market Report:

North America represents one of the largest markets, valued at about $1.87 billion in 2023, projected to reach $3.65 billion by 2033. This growth is fueled by a high prevalence of respiratory diseases, advanced healthcare systems, and innovation in testing technologies.South America Respiratory Disease Testing Market Report:

The South American market is comparatively smaller, with a 2023 value of $0.35 billion, anticipated to rise to $0.67 billion by 2033. Challenges include limited healthcare access in some areas, though growth is supported by increasing government investment in healthcare.Middle East & Africa Respiratory Disease Testing Market Report:

In the Middle East and Africa, the market stood at $0.37 billion in 2023, expecting an increase to $0.72 billion by 2033. The region faces some healthcare challenges but is seeing growth as health authorities emphasize improved diagnostic capabilities.Tell us your focus area and get a customized research report.

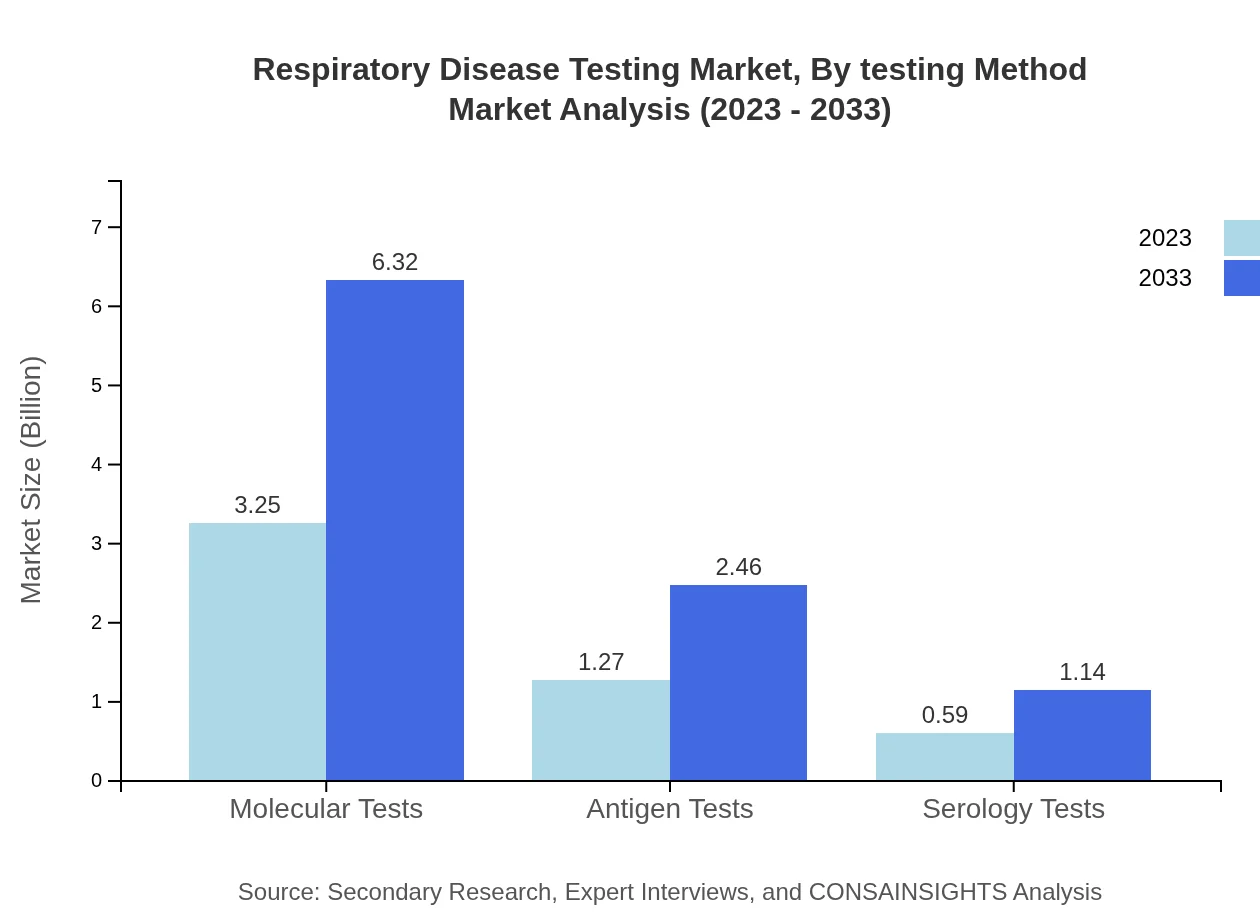

Respiratory Disease Testing Market Analysis By Testing Method

The market is significantly dominated by molecular tests, accounting for $3.25 billion in 2023 and expected to reach $6.32 billion by 2033. Antigen tests and serology tests follow, with anticipated growth reflecting the urgent need for rapid and reliable results.

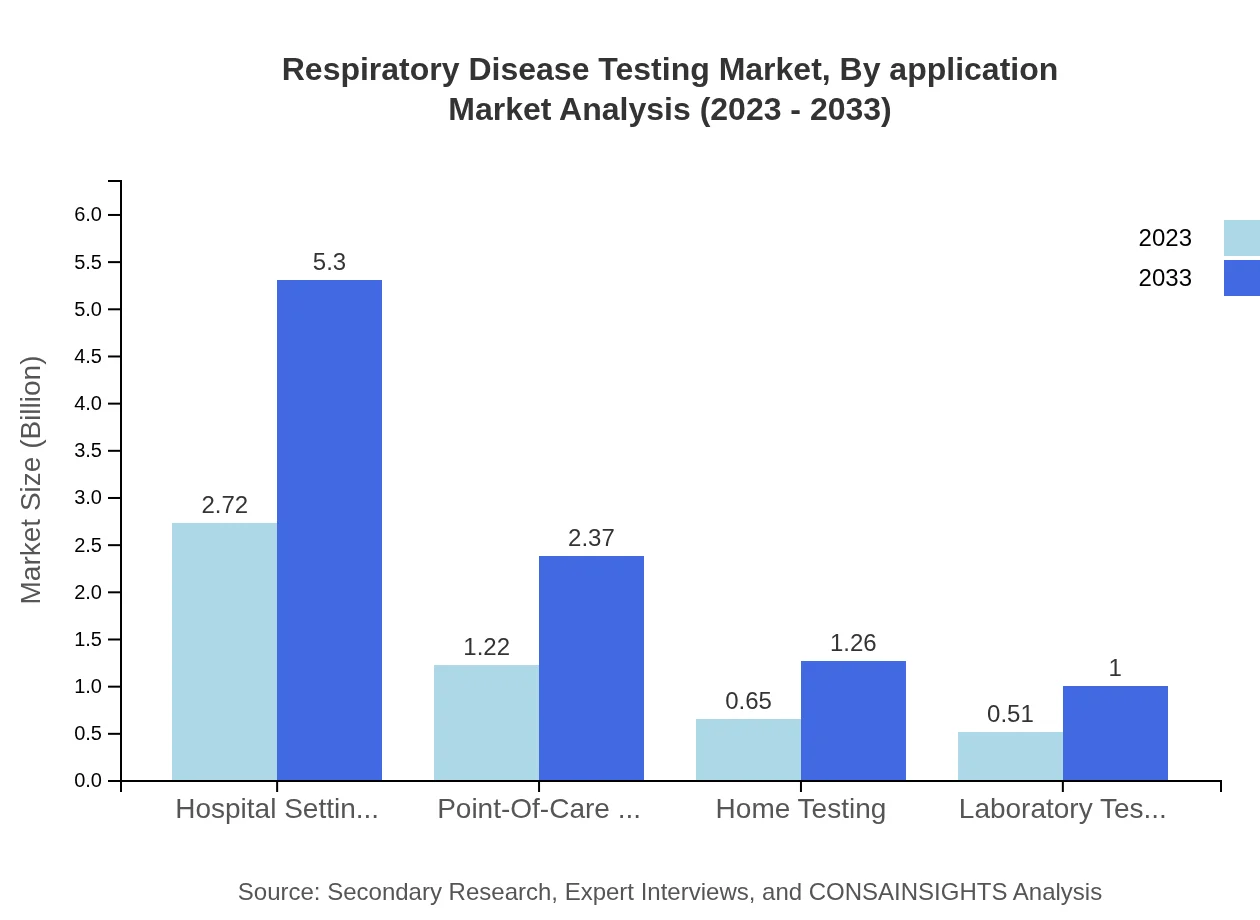

Respiratory Disease Testing Market Analysis By Application

Applications in clinical diagnostics represent a considerable share, with COVID-19 testing continually impacting the market landscape. Increasing home testing and point-of-care applications also signify shifting consumer preferences toward accessibility.

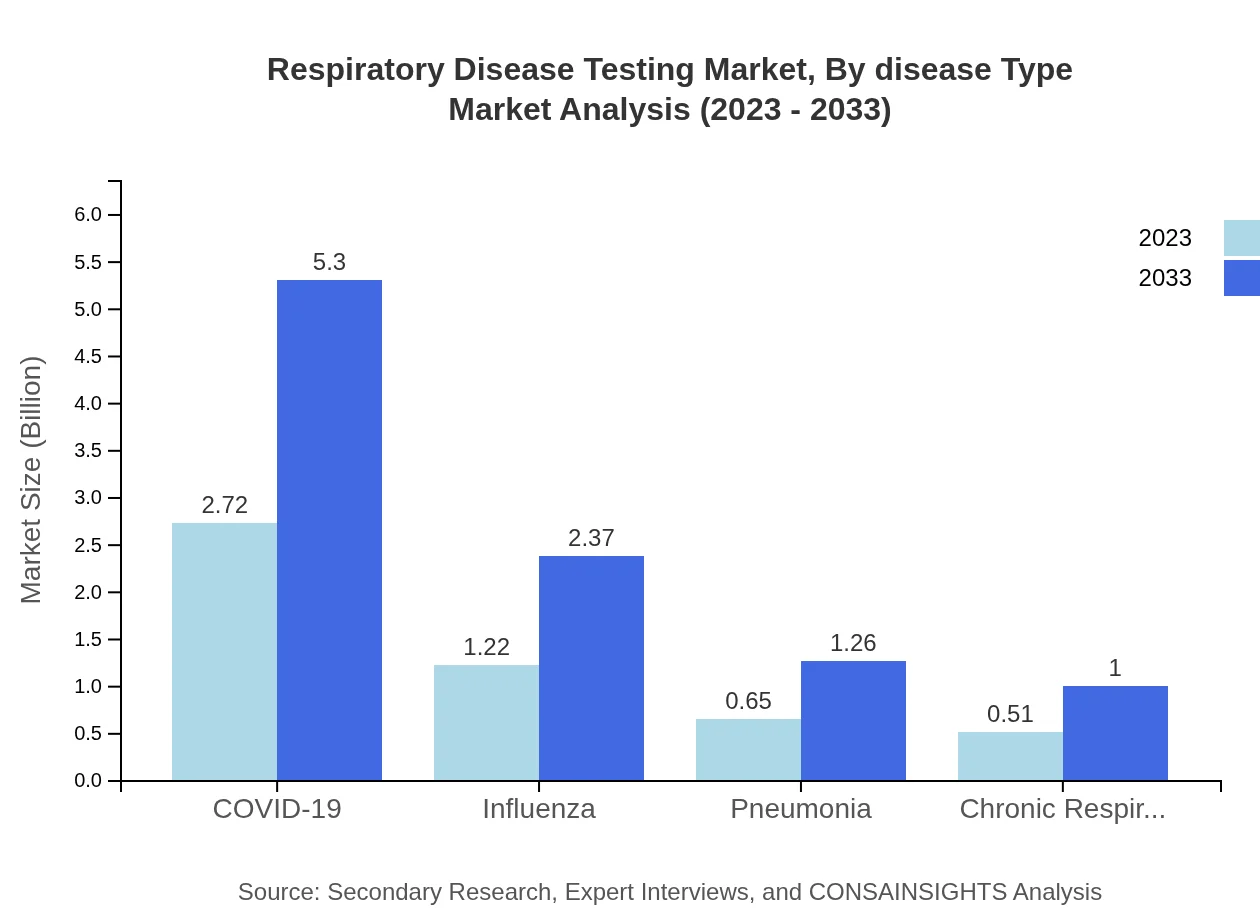

Respiratory Disease Testing Market Analysis By Disease Type

The testing market covers various disease types, with COVID-19 leading the segment, representing 53.41% market share in 2023. Other significant areas include influenza (23.89%) and chronic respiratory diseases (10.05%), emphasizing the need for diverse testing capabilities.

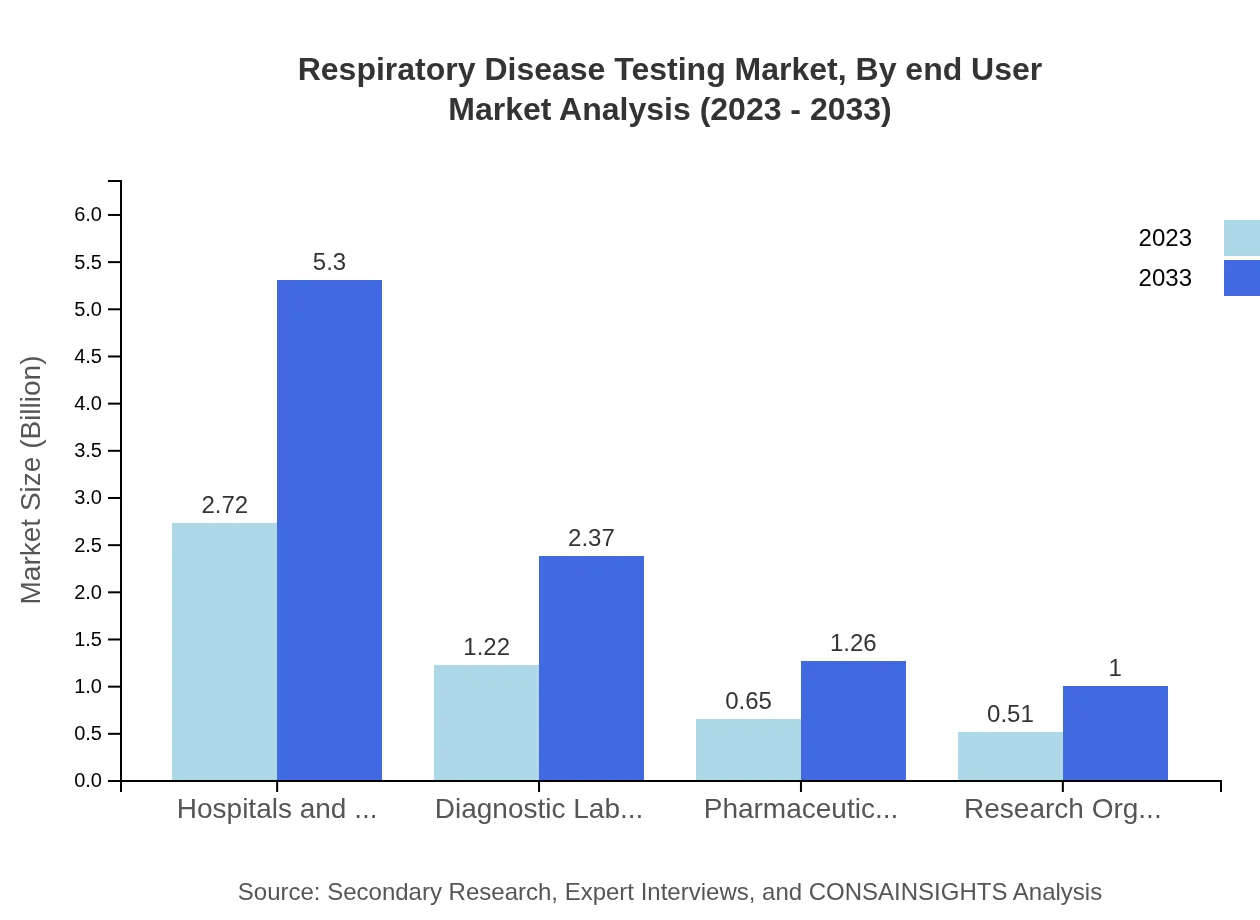

Respiratory Disease Testing Market Analysis By End User

Hospitals and clinics comprise the largest end-user segment, holding a market share of 53.41% as of 2023, reflecting their role in acute care settings. Diagnostic laboratories and home testing are also growing in significance, driven by technological advancements and patient-centered care models.

Respiratory Disease Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Respiratory Disease Testing Industry

Roche Diagnostics:

A leading player in the molecular diagnostics market, Roche offers a comprehensive portfolio of respiratory disease testing solutions, contributing to better diagnostics and patient management.Abbott Laboratories:

Abbott is renowned for its innovative diagnostic tools and rapid testing technologies, significantly impacting respiratory disease testing across various healthcare settings.Thermo Fisher Scientific:

This company is recognized for its advanced molecular testing products and solutions, enhancing the capabilities of laboratories and healthcare providers worldwide.Siemens Healthineers:

Focused on delivering high-quality screening and diagnostics, Siemens is pivotal in the advancement of respiratory disease testing methodologies.BD (Becton, Dickinson and Company):

BD has made substantial contributions to the respiratory diagnostics field, notably through its point-of-care testing solutions that improve accessibility and effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of respiratory Disease Testing?

The global respiratory disease testing market is projected to reach approximately $5.1 billion by 2033, growing at a CAGR of 6.7% from its current valuation. This growth is fueled by rising healthcare demands and advancements in diagnostic technologies.

What are the key market players or companies in the respiratory Disease Testing industry?

Key players in the respiratory disease testing market include diagnostics manufacturers, technology firms, and pharmaceutical companies. These organizations drive innovation and product development, contributing significantly to the industry's expansion through strategic collaborations and research initiatives.

What are the primary factors driving the growth in the respiratory Disease Testing industry?

The growth in the respiratory disease testing industry is driven by increasing respiratory diseases prevalence, advancement in testing technologies, and growing awareness of early diagnosis. Additionally, the ongoing global health initiatives and funding aims to improve diagnostic capabilities play a pivotal role.

Which region is the fastest Growing in the respiratory Disease Testing?

The North American region is currently the fastest-growing market, with growth projections moving from approximately $1.87 billion in 2023 to $3.65 billion by 2033. This growth is attributed to high healthcare expenditures, a robust healthcare infrastructure, and innovative diagnostic technologies.

Does ConsaInsights provide customized market report data for the respiratory Disease Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the respiratory disease testing industry. This allows stakeholders to make informed decisions based on relevant market trends, competitor analysis, and targeted insights.

What deliverables can I expect from this respiratory Disease Testing market research project?

From the respiratory disease testing market research project, you can expect comprehensive deliverables including detailed reports, market forecasts, segmentation analyses, competitive landscape reviews, and strategic recommendations that guide decision-making.

What are the market trends of respiratory Disease Testing?

Current trends in the respiratory disease testing market include an increased adoption of molecular tests, technological advancements in diagnostics, a shift toward home testing solutions, and a focus on enhancing point-of-care testing capabilities, ensuring quicker and more efficient diagnostics.