Retail Point Of Sale Market Report

Published Date: 31 January 2026 | Report Code: retail-point-of-sale

Retail Point Of Sale Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Retail Point Of Sale (POS) market, offering insights from 2023 through 2033, including detailed market analysis, size forecasts, segmentation, regional dynamics, industry trends, and insights into leading market players.

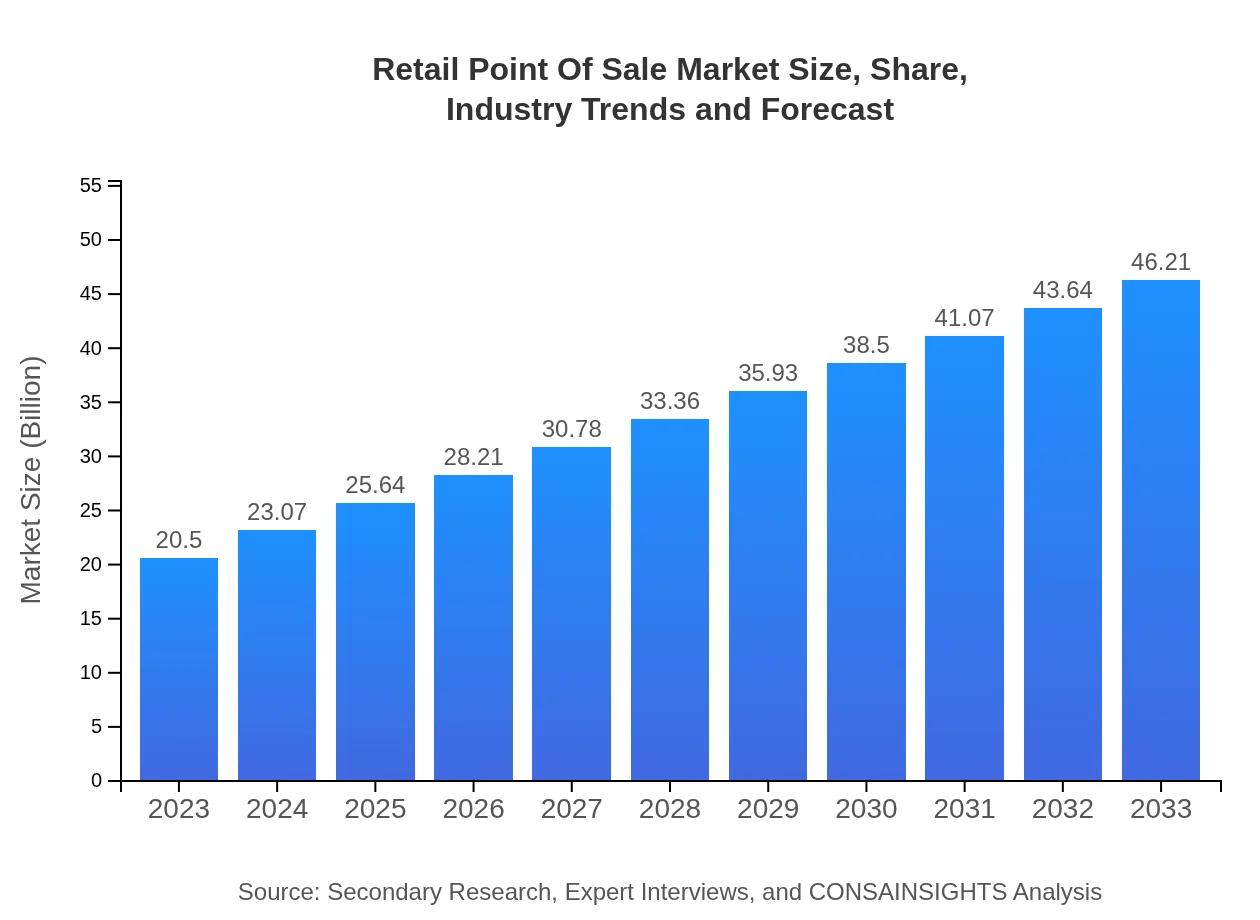

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $46.21 Billion |

| Top Companies | Square, Inc., Shopify Inc., Toast, Inc., Verifone Systems, Inc., NCR Corporation |

| Last Modified Date | 31 January 2026 |

Retail Point Of Sale Market Overview

Customize Retail Point Of Sale Market Report market research report

- ✔ Get in-depth analysis of Retail Point Of Sale market size, growth, and forecasts.

- ✔ Understand Retail Point Of Sale's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Retail Point Of Sale

What is the Market Size & CAGR of Retail Point Of Sale market in 2023?

Retail Point Of Sale Industry Analysis

Retail Point Of Sale Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Retail Point Of Sale Market Analysis Report by Region

Europe Retail Point Of Sale Market Report:

Europe's Retail POS market is valued at $6.31 billion in 2023, anticipated to climb to $14.22 billion by 2033. The region's emphasis on customer experience and the integration of innovative payment solutions are key growth drivers.Asia Pacific Retail Point Of Sale Market Report:

In 2023, the Asia Pacific region's Retail POS market is valued at $3.48 billion, with a forecasted size of $7.85 billion by 2033. The region experiences rapid digitization and a burgeoning retail sector, particularly in countries like China and India, driving growth.North America Retail Point Of Sale Market Report:

North America holds a substantial market share with a value of $7.88 billion in 2023, projected to reach $17.76 billion by 2033. The adoption of advanced POS platforms and cloud solutions is prevalent among retailers seeking operational efficiencies and enhanced customer experiences.South America Retail Point Of Sale Market Report:

The South American market is positioned at $1.05 billion in 2023 and expected to grow to $2.37 billion by 2033. The rise in retail automation and improved payment infrastructure supports expansion in this region.Middle East & Africa Retail Point Of Sale Market Report:

In the Middle East and Africa, the market is valued at $1.78 billion in 2023, predicting a growth to $4.02 billion by 2033, propelled by increasing consumer spending and a shift towards digital payment solutions.Tell us your focus area and get a customized research report.

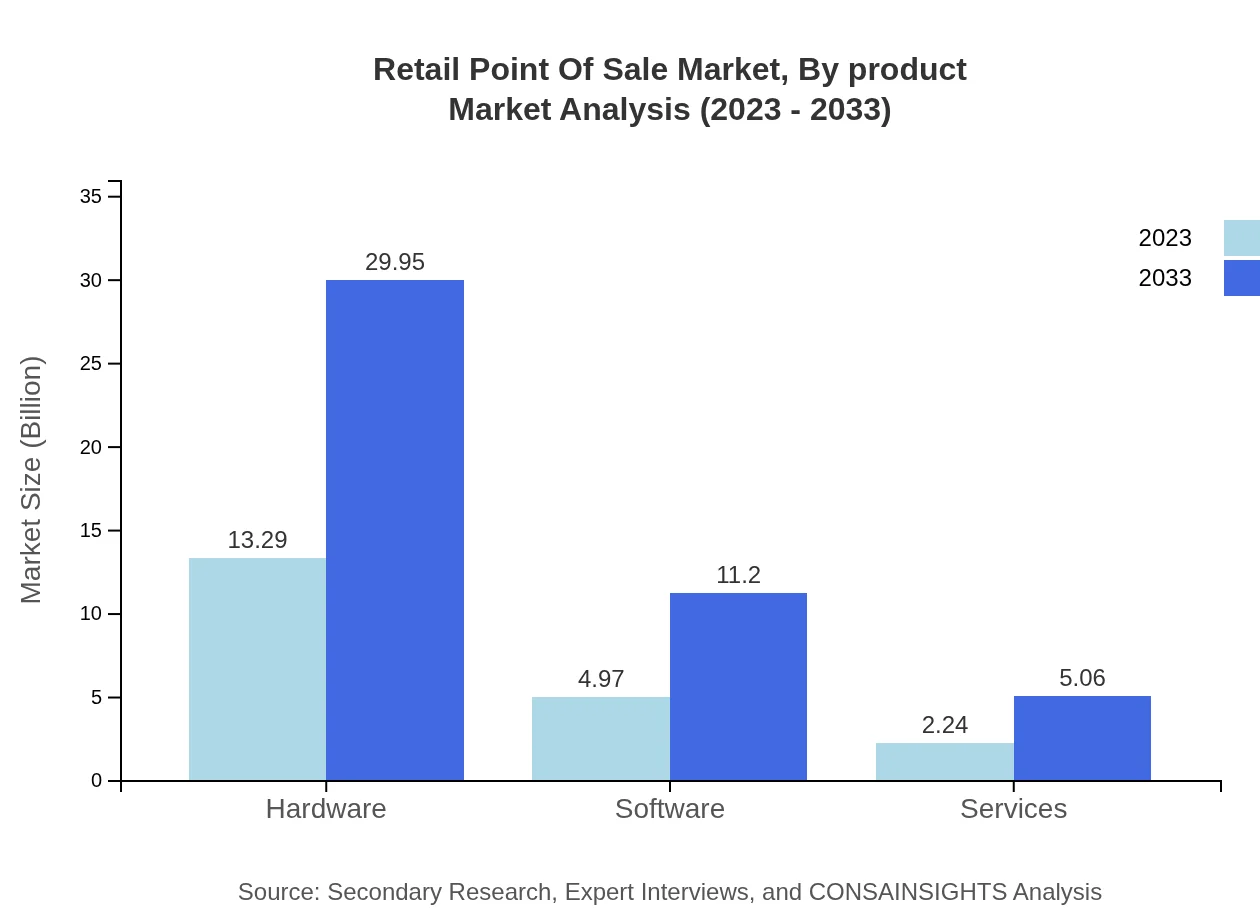

Retail Point Of Sale Market Analysis By Product

The hardware segment of the Retail POS market holds a dominant position with a size of $13.29 billion in 2023 and expected growth to $29.95 billion by 2033, retaining a market share of 64.81%. Software and services segments are also expanding, reflecting increasing demand for integrated solutions. Software market size forecasts indicate growth from $4.97 billion in 2023 to $11.20 billion in 2033, while services are expected to rise from $2.24 billion to $5.06 billion in the same period.

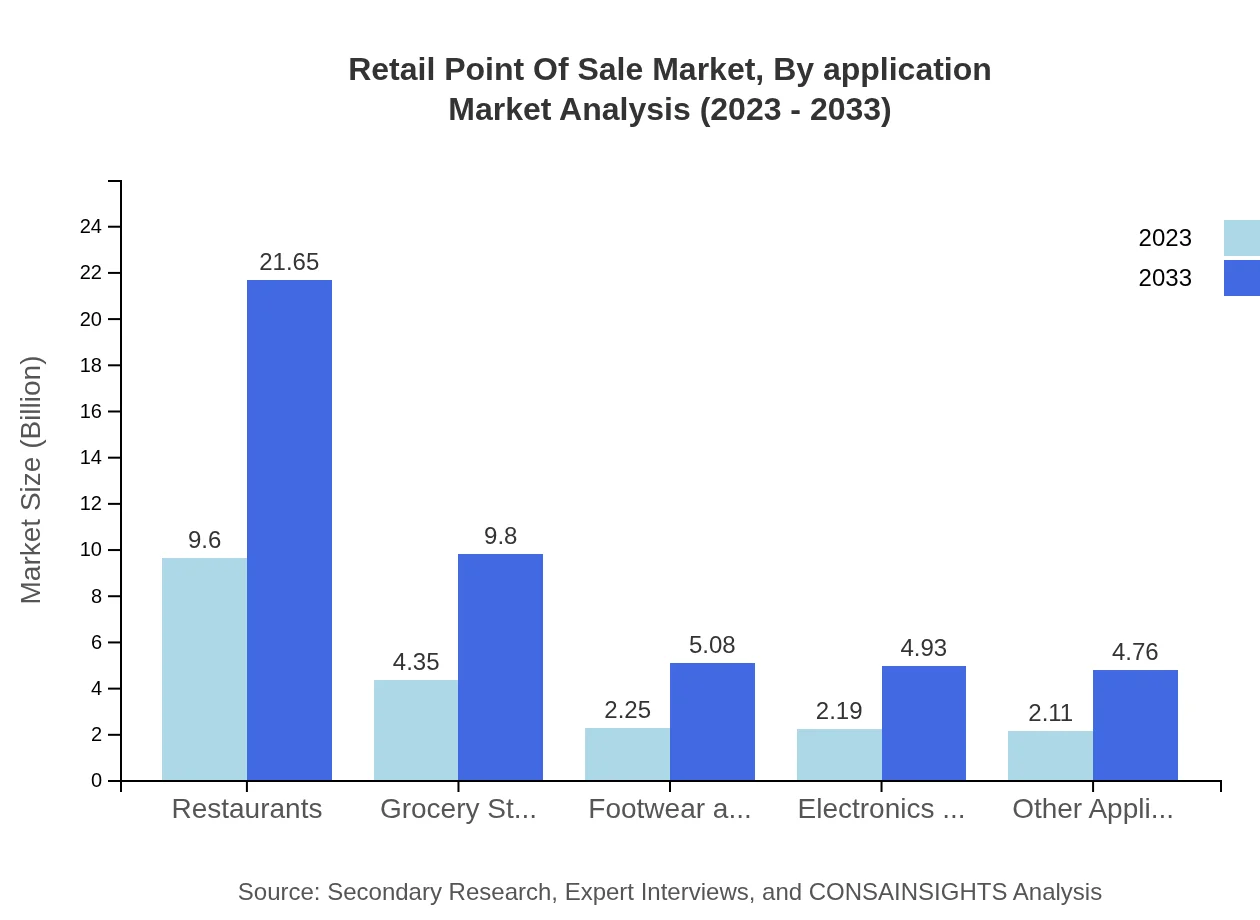

Retail Point Of Sale Market Analysis By Application

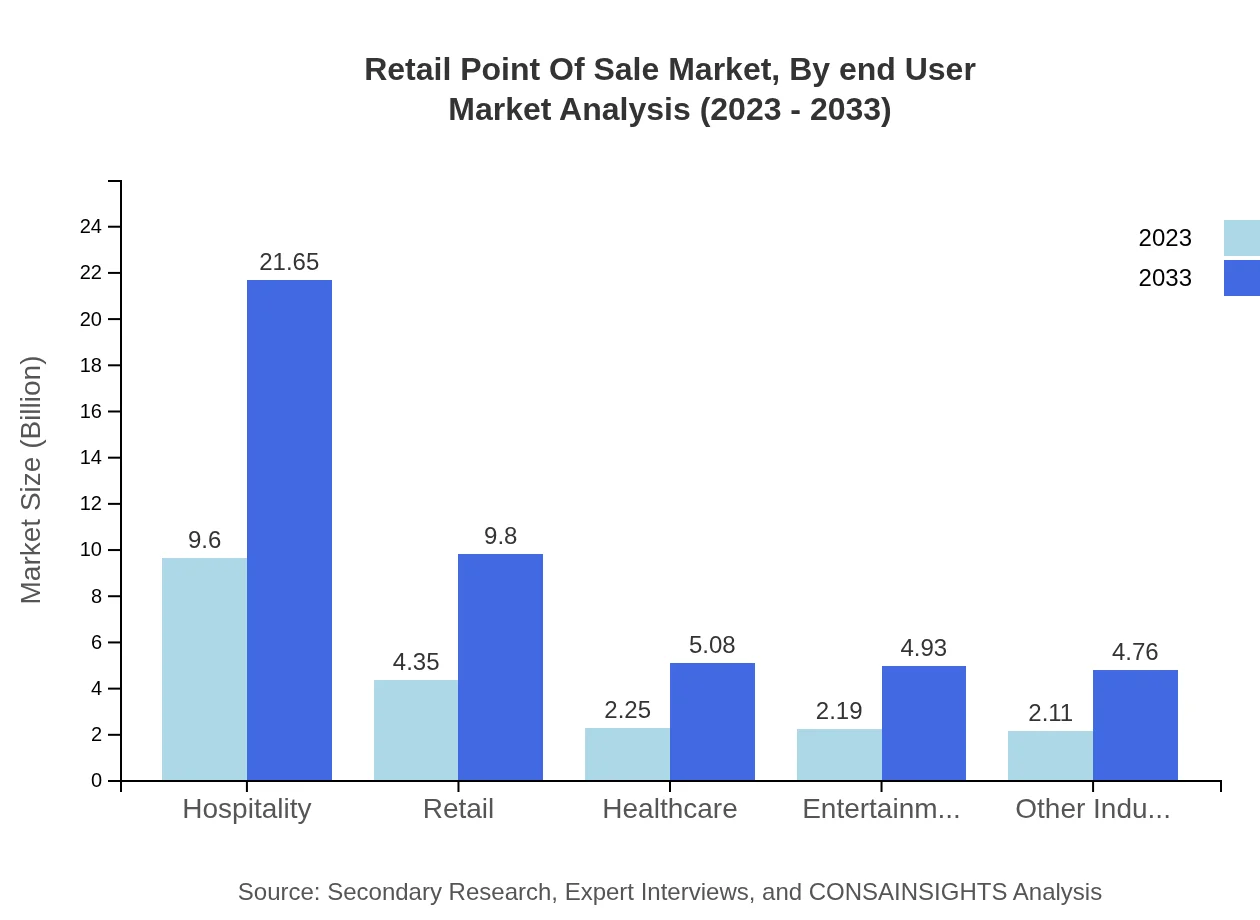

In applications, the hospitality sector emerges as a major user of POS systems, growing from $9.60 billion in 2023 to $21.65 billion by 2033. Retail applications also hold a significant share, with projected growth from $4.35 billion to $9.80 billion. The healthcare sector’s demand is expected to rise significantly as well, from $2.25 billion to $5.08 billion, highlighting diverse application needs across industries.

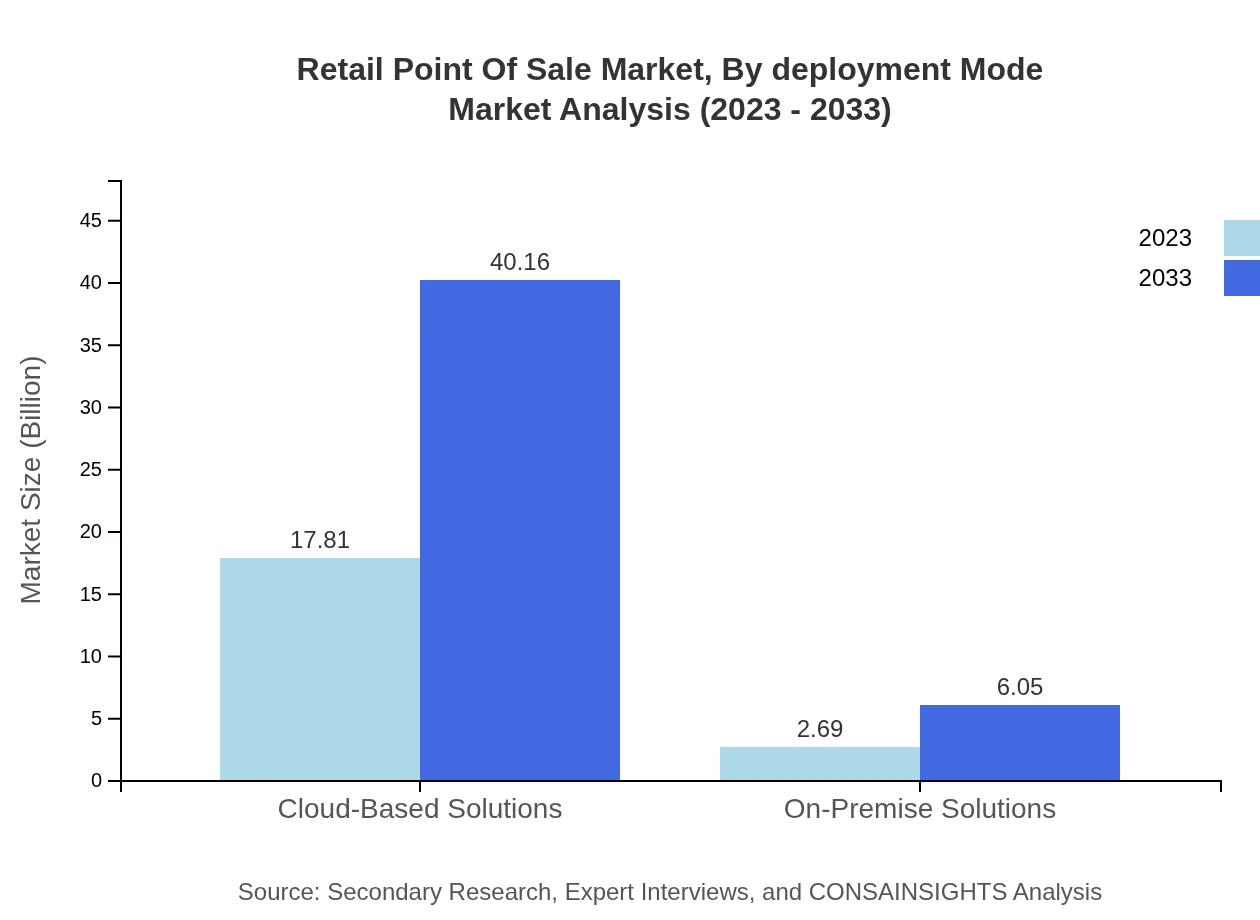

Retail Point Of Sale Market Analysis By Deployment Mode

The Retail POS market is primarily dominated by cloud-based solutions, expected to grow from $17.81 billion in 2023 to $40.16 billion by 2033, commanding an impressive market share of 86.9%. In contrast, on-premise solutions are anticipated to grow from $2.69 billion to $6.05 billion, reflecting a trend towards flexibility and remote accessibility in retail operations.

Retail Point Of Sale Market Analysis By End User

End-user industries such as restaurants and grocery stores heavily invest in POS technologies, with the restaurant sector projected to maintain a market share of 46.85%, growing from $9.60 billion in 2023 to $21.65 billion by 2033. Additionally, grocery store applications are expected to rise from $4.35 billion to $9.80 billion, reflecting shifts in consumer shopping habits.

Retail Point Of Sale Market Analysis By Technology

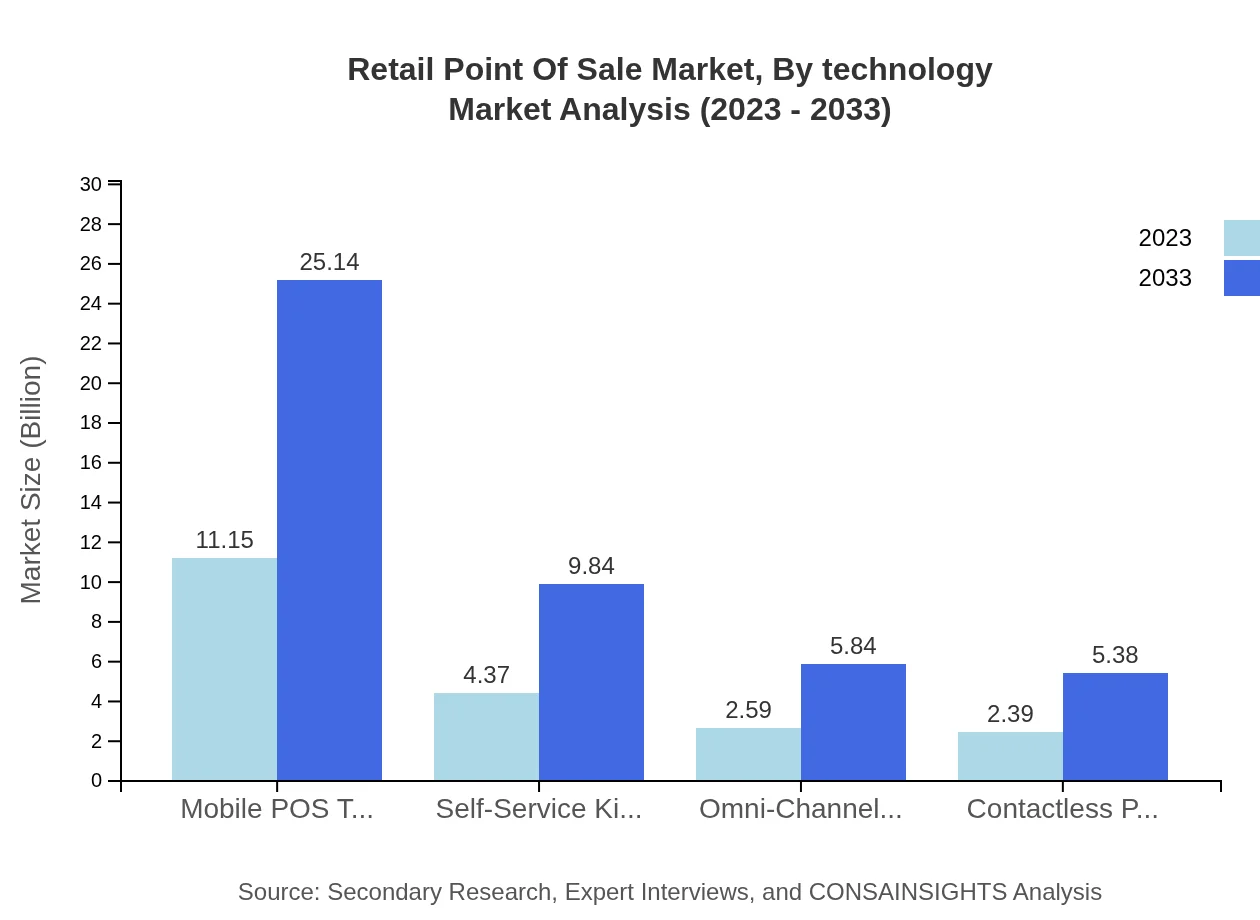

Emerging technologies such as mobile POS and self-service kiosks play a crucial role in the Retail POS landscape. The mobile POS market is expected to grow from $11.15 billion in 2023 to $25.14 billion by 2033, capturing a market share of 54.41%. Self-service kiosks will also grow substantially, from $4.37 billion to $9.84 billion, driven by consumer preferences for expedited, contactless transactions.

Retail Point Of Sale Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Retail Point Of Sale Industry

Square, Inc.:

Square provides comprehensive POS systems that are highly adaptable for various types of businesses, enhancing transaction capabilities and customer interaction through innovative technology.Shopify Inc.:

Shopify offers a cloud-based POS solution that combines e-commerce and in-store sales, empowering retailers with integrated business management tools.Toast, Inc.:

Toast is a leading restaurant management platform that provides a POS solution tailored to the food service industry, featuring online ordering and delivery capabilities.Verifone Systems, Inc.:

Verifone specializes in payment and commerce solutions, delivering customized POS systems that enhance payment processing for retail environments.NCR Corporation:

NCR provides a range of POS solutions catering to retail and hospitality, focused on connected technology that promotes customer engagement and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of retail Point Of Sale?

The retail point-of-sale market is projected to reach a size of $20.5 billion in 2023, with a CAGR of 8.2% expected during the forecast period. This growth reflects increasing demand for efficient transaction processes in retail environments.

What are the key market players or companies in the retail point Of Sale industry?

Key players in the retail point-of-sale market include corporations like Square, Verifone, Intuit, and NCR. These companies specialize in providing hardware and software solutions that enhance payment processing capabilities across various retail sectors.

What are the primary factors driving the growth in the retail point Of Sale industry?

Growth in the retail point-of-sale industry is primarily driven by the increasing adoption of mobile payment solutions, advancements in technology, and the need for enhanced customer experience through faster and more efficient transactions.

Which region is the fastest Growing in the retail point Of Sale market?

The fastest-growing region in the retail point-of-sale market is expected to be Europe, with a market projected to grow from $6.31 billion in 2023 to $14.22 billion by 2033. Rapid digitization in retail contributes significantly to this growth.

Does ConsaInsights provide customized market report data for the retail point Of Sale industry?

Yes, ConsaInsights does offer customized market report data tailored to the retail point-of-sale industry, allowing businesses to obtain specific insights and analyses that align with their unique requirements and strategic goals.

What deliverables can I expect from this retail point Of Sale market research project?

From this retail point-of-sale market research project, you can expect detailed reports outlining market size, growth forecasts, competitive analysis, industry trends, and segment-wise breakdowns among various retail channels.

What are the market trends of retail point Of Sale?

Market trends in retail point-of-sale include the shift towards cloud-based solutions, increased focus on mobile POS systems, and the growing importance of omnichannel approaches to enhance customer engagement.