Retinal Surgery Devices Market Report

Published Date: 31 January 2026 | Report Code: retinal-surgery-devices

Retinal Surgery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Retinal Surgery Devices market, covering key insights, industry trends, regional specifics, and market forecasts up to 2033.

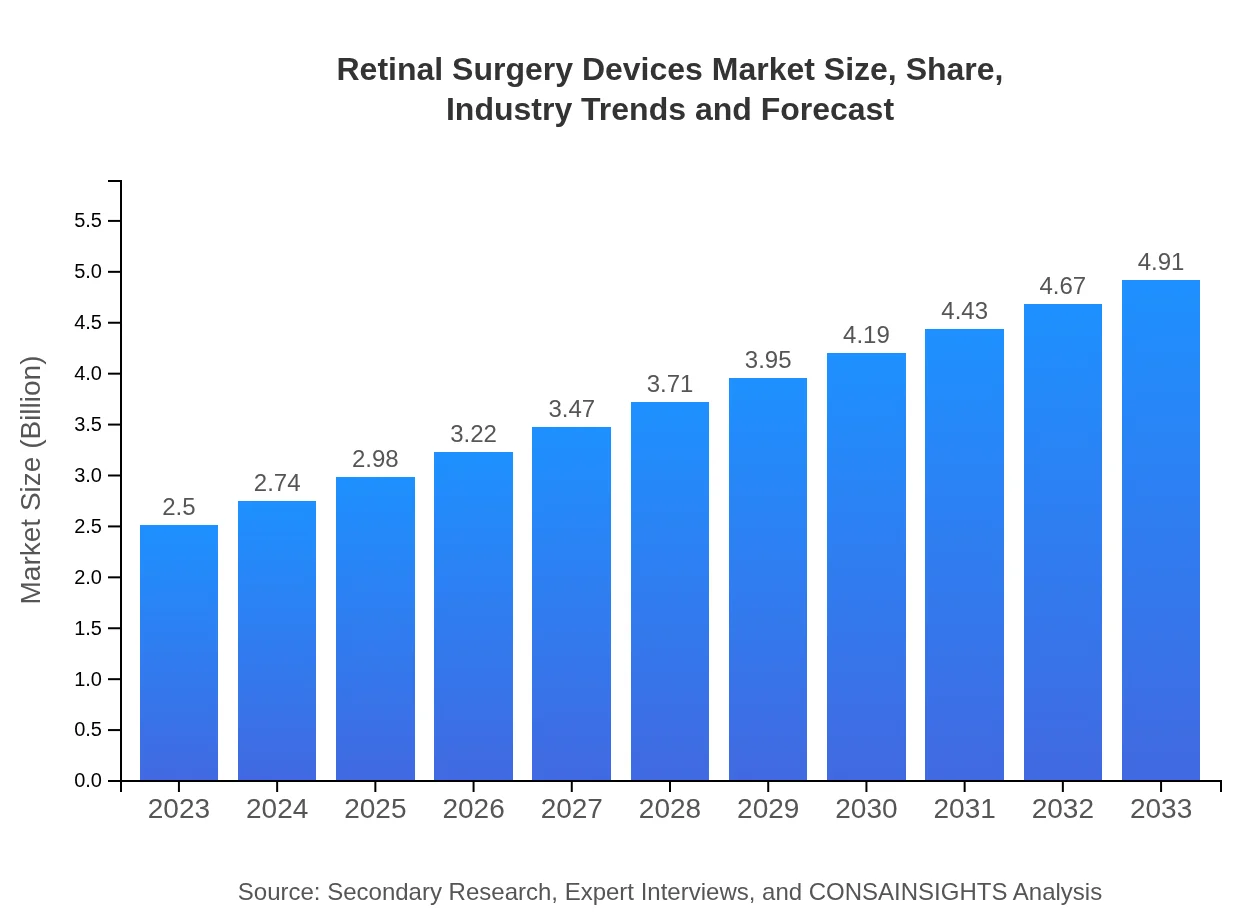

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Alcon Inc., Bausch + Lomb, Carl Zeiss AG, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Retinal Surgery Devices Market Overview

Customize Retinal Surgery Devices Market Report market research report

- ✔ Get in-depth analysis of Retinal Surgery Devices market size, growth, and forecasts.

- ✔ Understand Retinal Surgery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Retinal Surgery Devices

What is the Market Size & CAGR of Retinal Surgery Devices market in 2023-2033?

Retinal Surgery Devices Industry Analysis

Retinal Surgery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Retinal Surgery Devices Market Analysis Report by Region

Europe Retinal Surgery Devices Market Report:

Europe is anticipated to experience growth from $0.67 billion in 2023 to $1.31 billion by 2033, benefiting from strong regulatory support for medical devices alongside rising incidents of age-related ocular disorders; this region is expected to maintain a significant share of the market.Asia Pacific Retinal Surgery Devices Market Report:

The Asia Pacific market is forecasted to grow from $0.49 billion in 2023 to $0.96 billion by 2033, driven by rising healthcare expenditure and increasing awareness of eye health. Technological advancements and government initiatives aimed at reducing blindness also support market expansion in this region.North America Retinal Surgery Devices Market Report:

In North America, the market is projected to rise sharply from $0.96 billion in 2023 to $1.89 billion by 2033. This growth is fueled by advanced healthcare facilities, high spending on innovative surgical devices, and a large patient demographic seeking retinal treatment.South America Retinal Surgery Devices Market Report:

The South American market, though smaller, is expected to expand from $0.04 billion in 2023 to $0.08 billion by 2033 due to increasing investments in healthcare infrastructure and the growing prevalence of diabetes in the region.Middle East & Africa Retinal Surgery Devices Market Report:

The Middle East and Africa market, although smaller, is expected to grow from $0.34 billion in 2023 to $0.67 billion by 2033. Increased focus on healthcare improvements and rising rates of diabetic complications are propelling market development in this region.Tell us your focus area and get a customized research report.

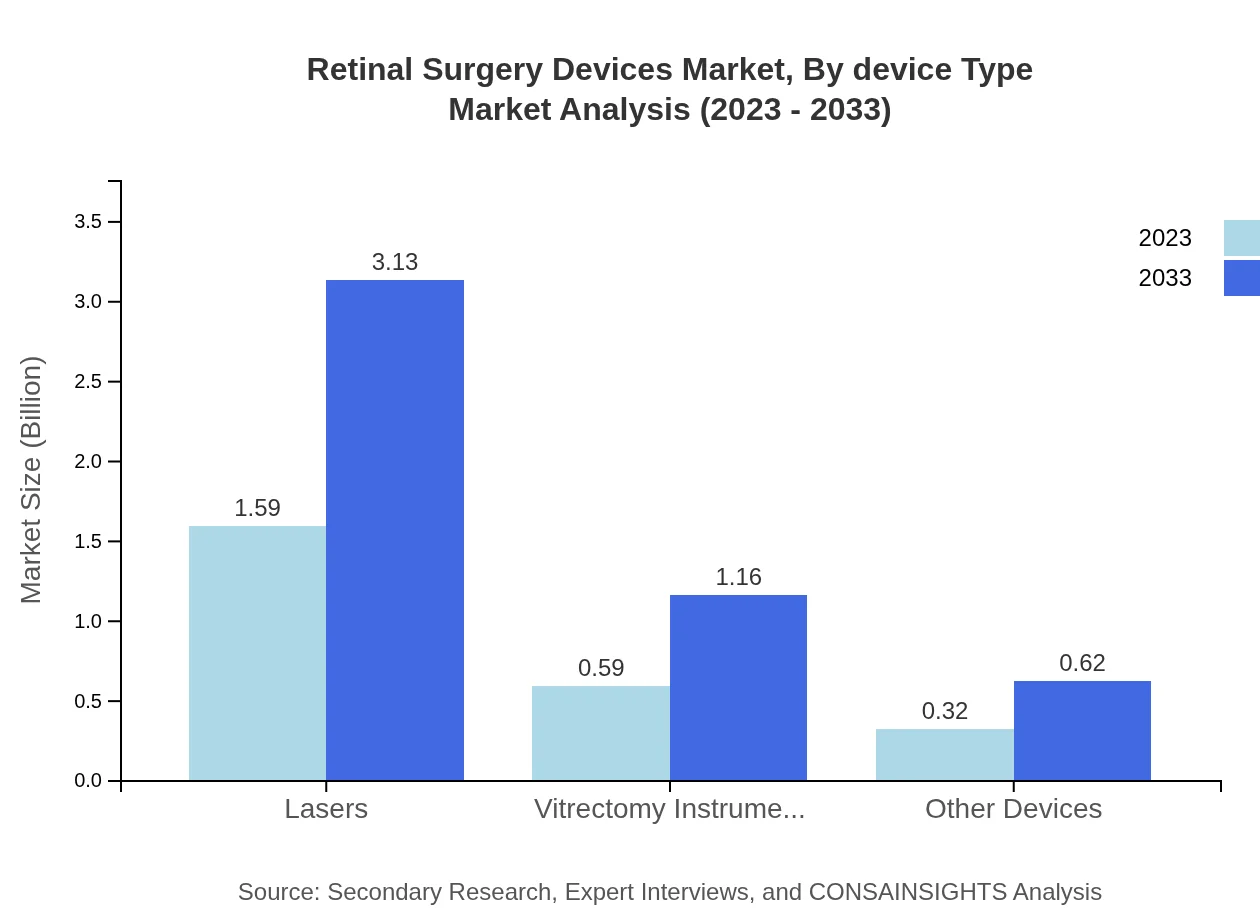

Retinal Surgery Devices Market Analysis By Device Type

Among device types, surgical lasers dominate the market with a contribution projected at $1.59 billion in 2023, rising to $3.13 billion by 2033, accounting for 63.74% market share. Vitrectomy instruments and other devices also play crucial roles with respective shares of 23.63% and 12.63%. Minimally invasive techniques lead the market by surgical approach, showcasing a move toward patient-friendly procedures.

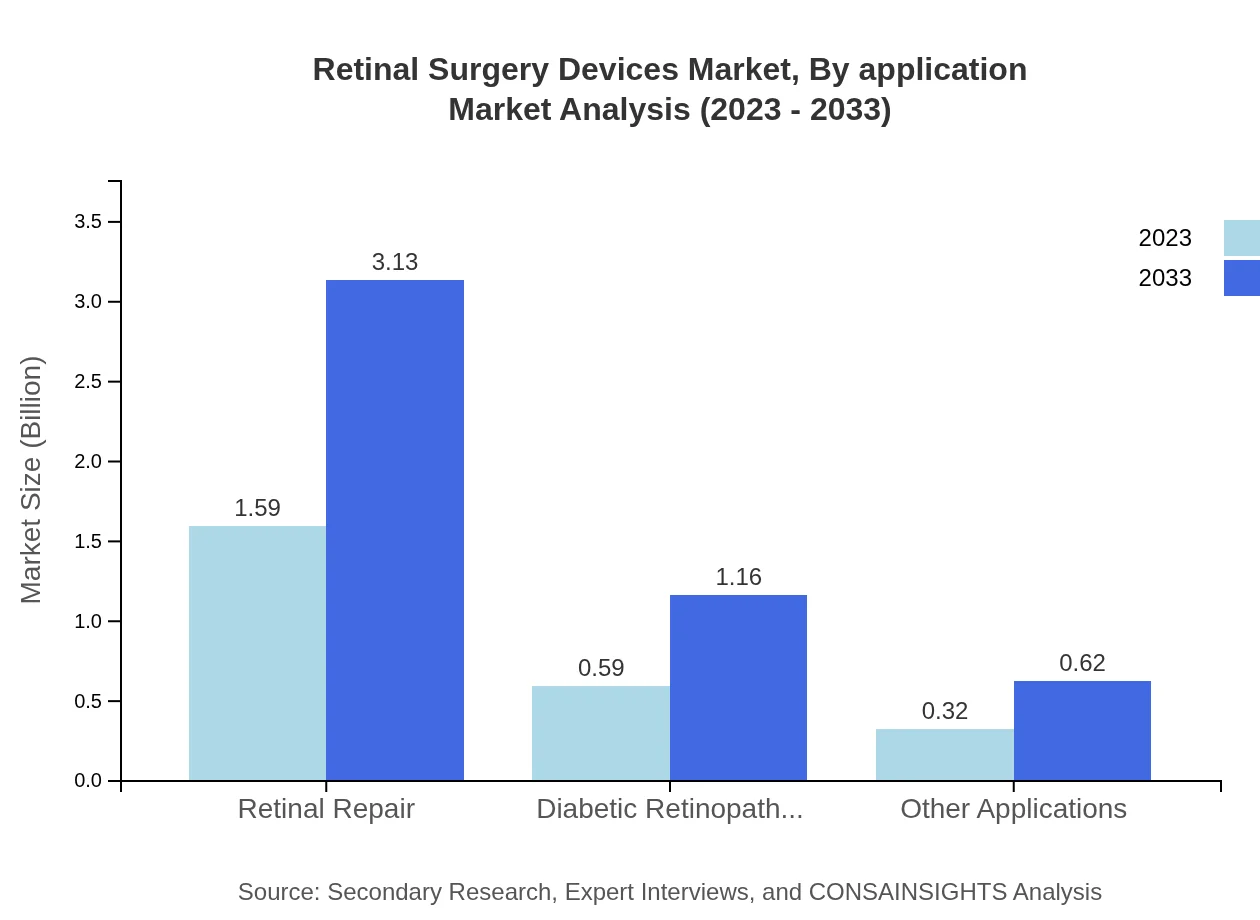

Retinal Surgery Devices Market Analysis By Application

The retinal repair segment leads in application type, with revenue figures expected to increase from $1.59 billion in 2023 to $3.13 billion by 2033, maintaining a steady share of 63.74%. Diabetic retinopathy treatments also show robust growth, making up 23.63% of the market share, reflecting a direct response to the rising cases of diabetes globally.

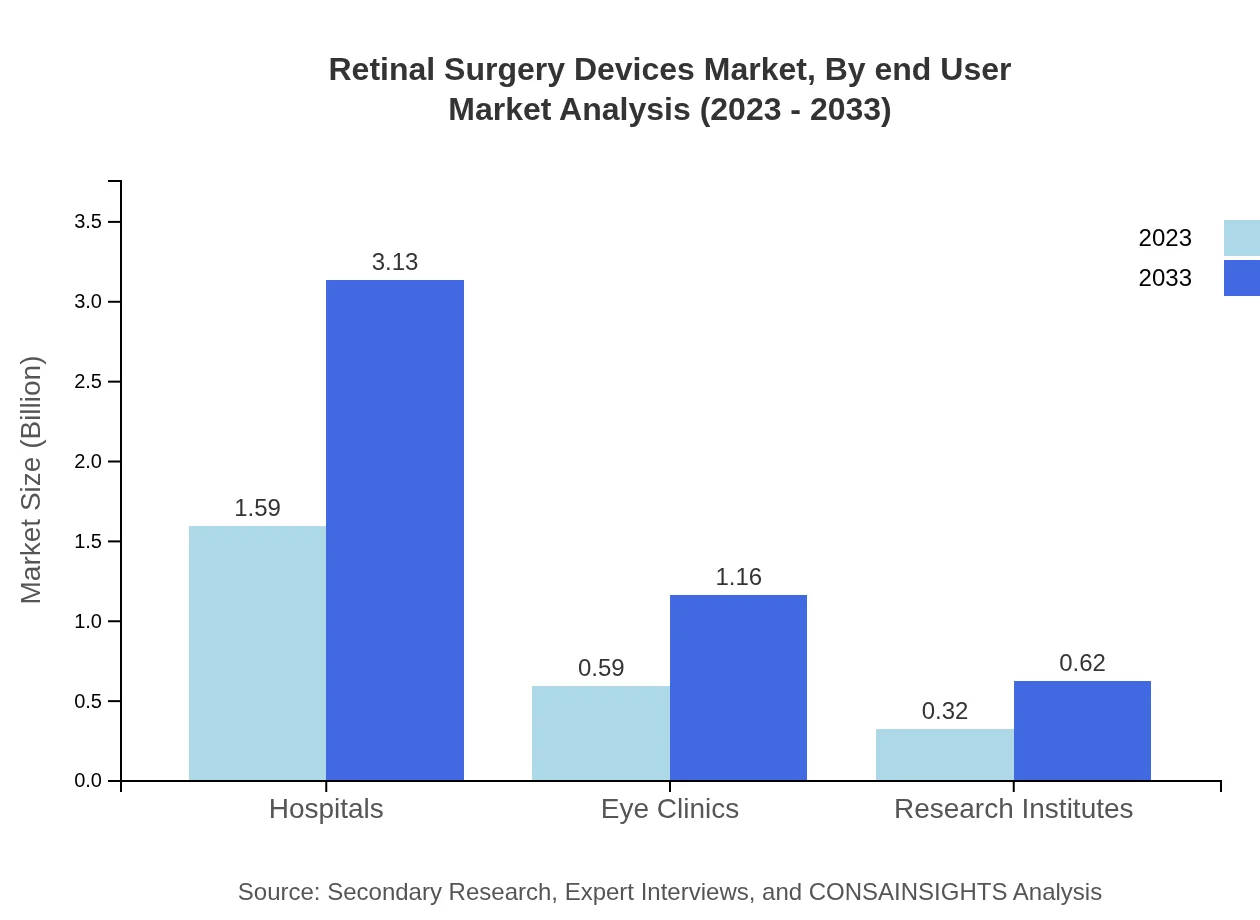

Retinal Surgery Devices Market Analysis By End User

The hospitals segment is the primary end-user of retinal surgery devices, generating a market value of $1.59 billion in 2023 and projected to reach $3.13 billion in 2033, holding a share of 63.74%. Eye clinics follow closely, with emerging interest in specialized facilities addressing increasing surgical procedures.

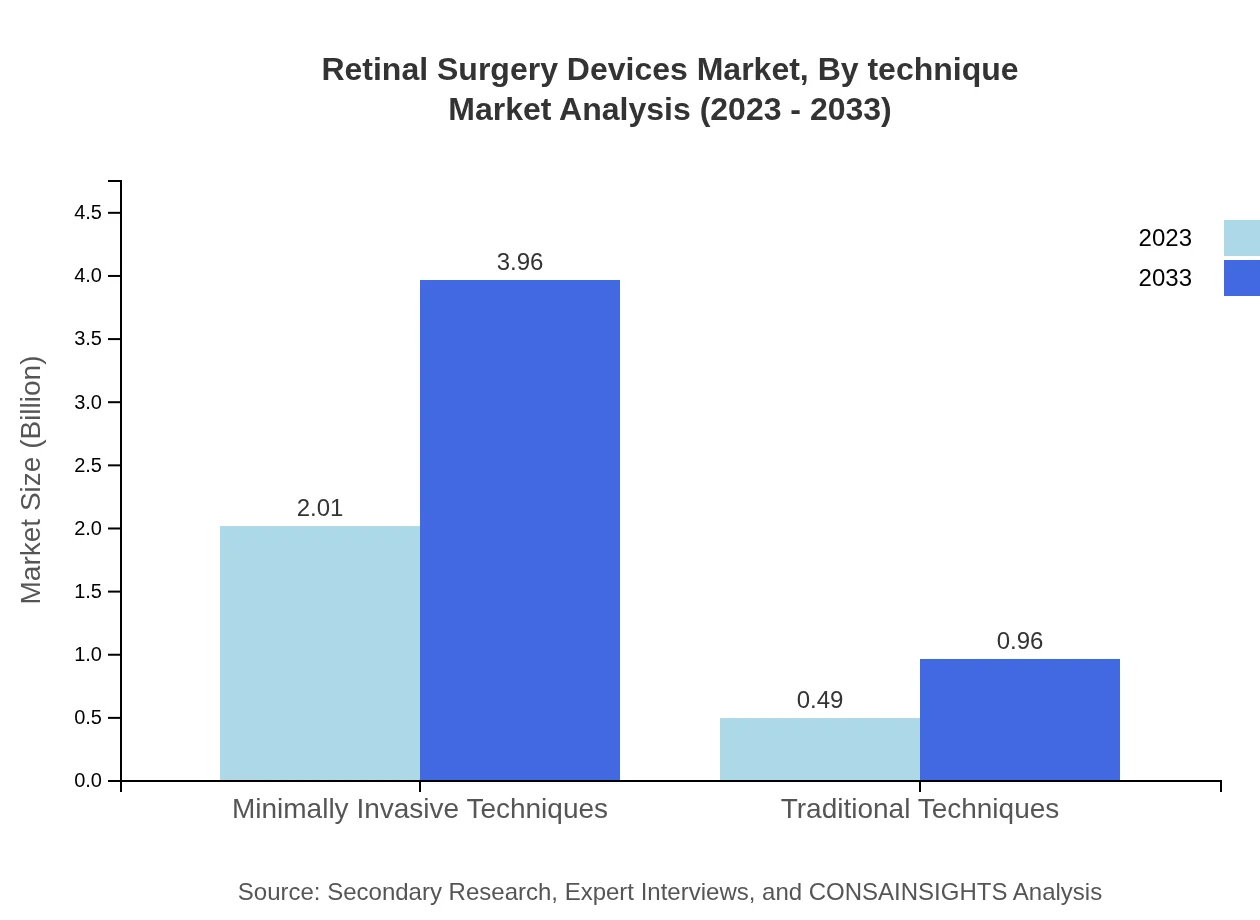

Retinal Surgery Devices Market Analysis By Technique

Minimally invasive techniques dominate in terms of surgical approach, with a market value of $2.01 billion in 2023 projected to grow to $3.96 billion by 2033, reflecting 80.56% share. Traditional techniques continue to be relevant but are slowly declining in preference as technology advances.

Retinal Surgery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Retinal Surgery Devices Industry

Alcon Inc.:

Alcon, a leader in eye care, develops innovative devices and therapeutics for vision correction, prominently featuring retinal surgical devices.Bausch + Lomb:

Bausch + Lomb specializes in eye health products and solutions, with a strong focus on retinal surgery technologies and instruments.Carl Zeiss AG:

Carl Zeiss AG, renowned for its optical systems, offers advanced visualization systems and surgical devices for retinal procedures.Johnson & Johnson:

With a diversified portfolio, Johnson & Johnson also invests in and develops cutting-edge retinal surgical devices and treatments.We're grateful to work with incredible clients.

FAQs

What is the market size of retinal Surgery Devices?

The retinal surgery devices market is currently valued at approximately $2.5 billion in 2023 and is expected to grow at a CAGR of 6.8% through 2033, highlighting significant potential for expansion over the next decade.

What are the key market players or companies in the retinal Surgery Devices industry?

Key players in the retinal surgery devices market include major companies that invest in R&D and provide innovative technologies, although specific company names are not listed here. These firms continuously strive to enhance patient outcomes and expand their market presence.

What are the primary factors driving the growth in the retinal Surgery Devices industry?

Growth in the retinal surgery devices market is driven by the increasing prevalence of retinal diseases, advancements in surgical technologies, and growing healthcare expenditure aimed at improving patient care and treatment outcomes in ophthalmology.

Which region is the fastest Growing in the retinal Surgery Devices market?

The fastest-growing region in the retinal surgery devices market is expected to be North America, where the market size will expand from $0.96 billion in 2023 to $1.89 billion by 2033, showcasing a robust demand for advanced surgical solutions.

Does ConsaInsights provide customized market report data for the retinal Surgery Devices industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific research needs within the retinal surgery devices industry, allowing clients to gain insights relevant to their interests and strategic goals.

What deliverables can I expect from this retinal Surgery Devices market research project?

Expect comprehensive deliverables including detailed reports, market size analyses, segment insights, competitive landscape assessments, and future growth forecasts, providing a holistic view of the retinal surgery devices market.

What are the market trends of retinal Surgery Devices?

Current market trends in retinal surgery devices include a shift towards minimally invasive techniques, increased adoption of laser-based technologies, and growing investments in research, leading to innovative solutions addressing various retinal conditions.