Revenue Assurance Market Report

Published Date: 31 January 2026 | Report Code: revenue-assurance

Revenue Assurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Revenue Assurance market, covering key insights, market trends, and forecasts for the period from 2023 to 2033. It includes segmented data and regional analysis to offer valuable information for stakeholders in the industry.

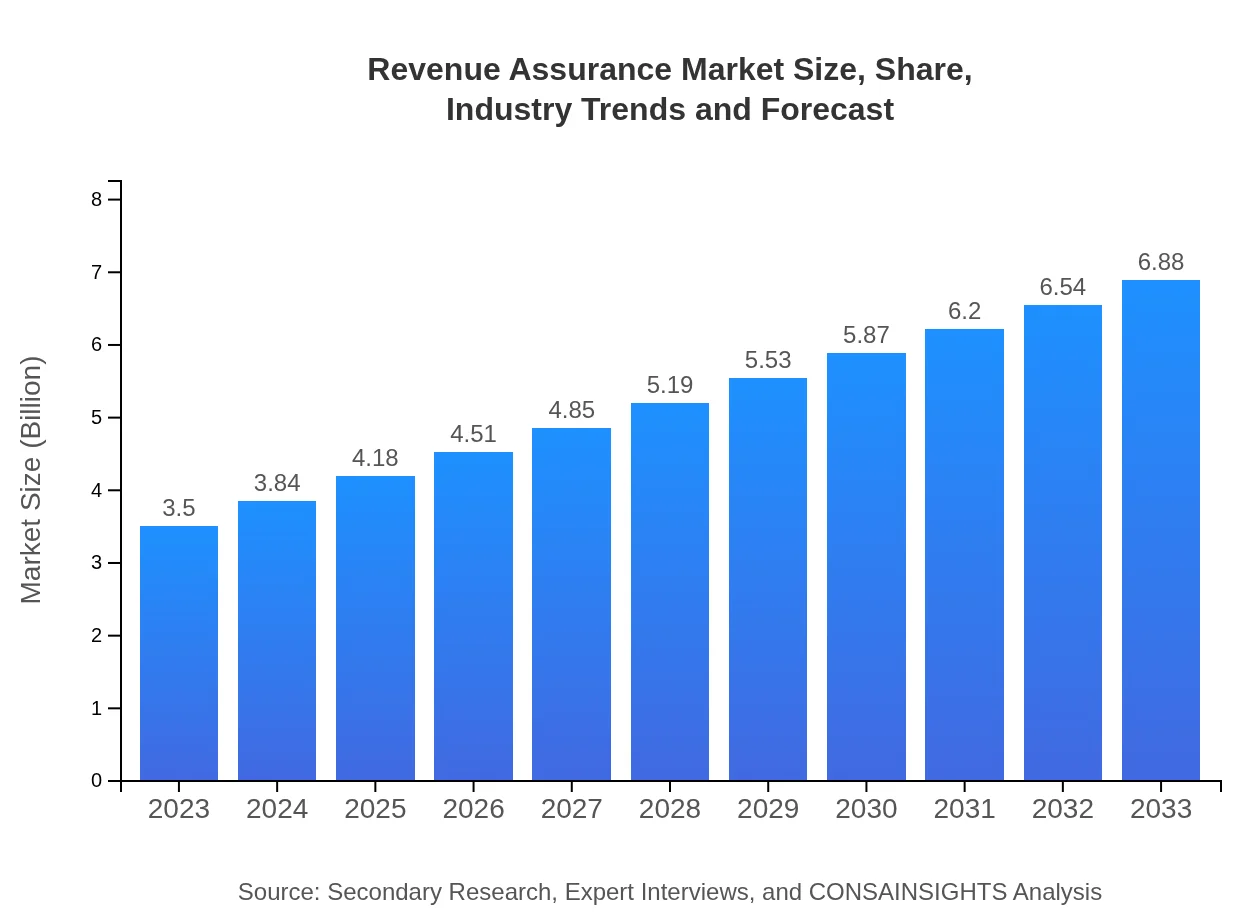

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Subex Limited, Cognizant, Amdocs |

| Last Modified Date | 31 January 2026 |

Revenue Assurance Market Overview

Customize Revenue Assurance Market Report market research report

- ✔ Get in-depth analysis of Revenue Assurance market size, growth, and forecasts.

- ✔ Understand Revenue Assurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Revenue Assurance

What is the Market Size & CAGR of Revenue Assurance market in 2023 - 2033?

Revenue Assurance Industry Analysis

Revenue Assurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Revenue Assurance Market Analysis Report by Region

Europe Revenue Assurance Market Report:

Europe's Revenue Assurance market is poised for growth from $0.87 billion in 2023 to $1.71 billion by 2033. The region is focused on compliance and operational efficiency due to regulatory pressures and an increasing emphasis on digital transformation across industries.Asia Pacific Revenue Assurance Market Report:

The Revenue Assurance market in the Asia Pacific region is forecasted to grow from $0.69 billion in 2023 to $1.37 billion by 2033. The growth is driven by the rapid digitalization of businesses and increasing regulatory frameworks. Countries like India and China are investing in advanced analytics to boost Revenue Assurance, thus contributing to the overall regional growth.North America Revenue Assurance Market Report:

The Revenue Assurance market in North America is projected to expand significantly, from $1.36 billion in 2023 to $2.67 billion by 2033. This region is characterized by a high adoption rate of advanced technology and stringent regulations, leading to a mature market landscape with a strong emphasis on compliance and risk management.South America Revenue Assurance Market Report:

In South America, the market size is expected to increase from $0.21 billion in 2023 to $0.41 billion by 2033. This growth is attributed to the increasing need for revenue protection in various sectors, particularly in utilities and telecommunications, influenced by a burgeoning consumer base and economic development initiatives.Middle East & Africa Revenue Assurance Market Report:

The Middle East and Africa market is anticipated to grow from $0.37 billion in 2023 to $0.72 billion by 2033. Key factors influencing this growth include the need for enhanced revenue collection methods and increased investments in technology to combat revenue leakages.Tell us your focus area and get a customized research report.

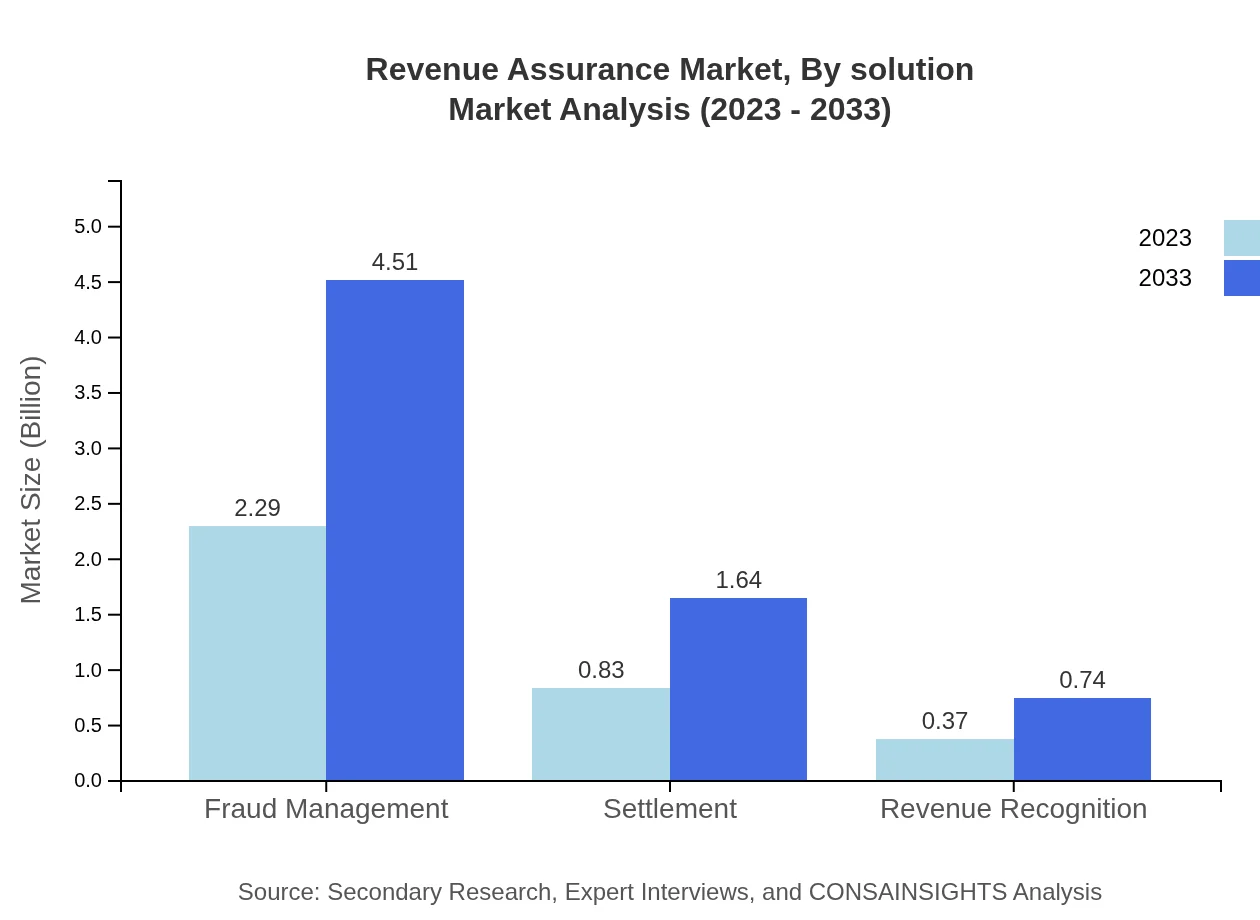

Revenue Assurance Market Analysis By Solution

In 2023, the Revenue Assurance market by solution is dominated by solutions related to fraud management, estimated at $2.29 billion, with a projected size of $4.51 billion by 2033, representing an essential focus for organizations seeking to protect and optimize revenue streams.

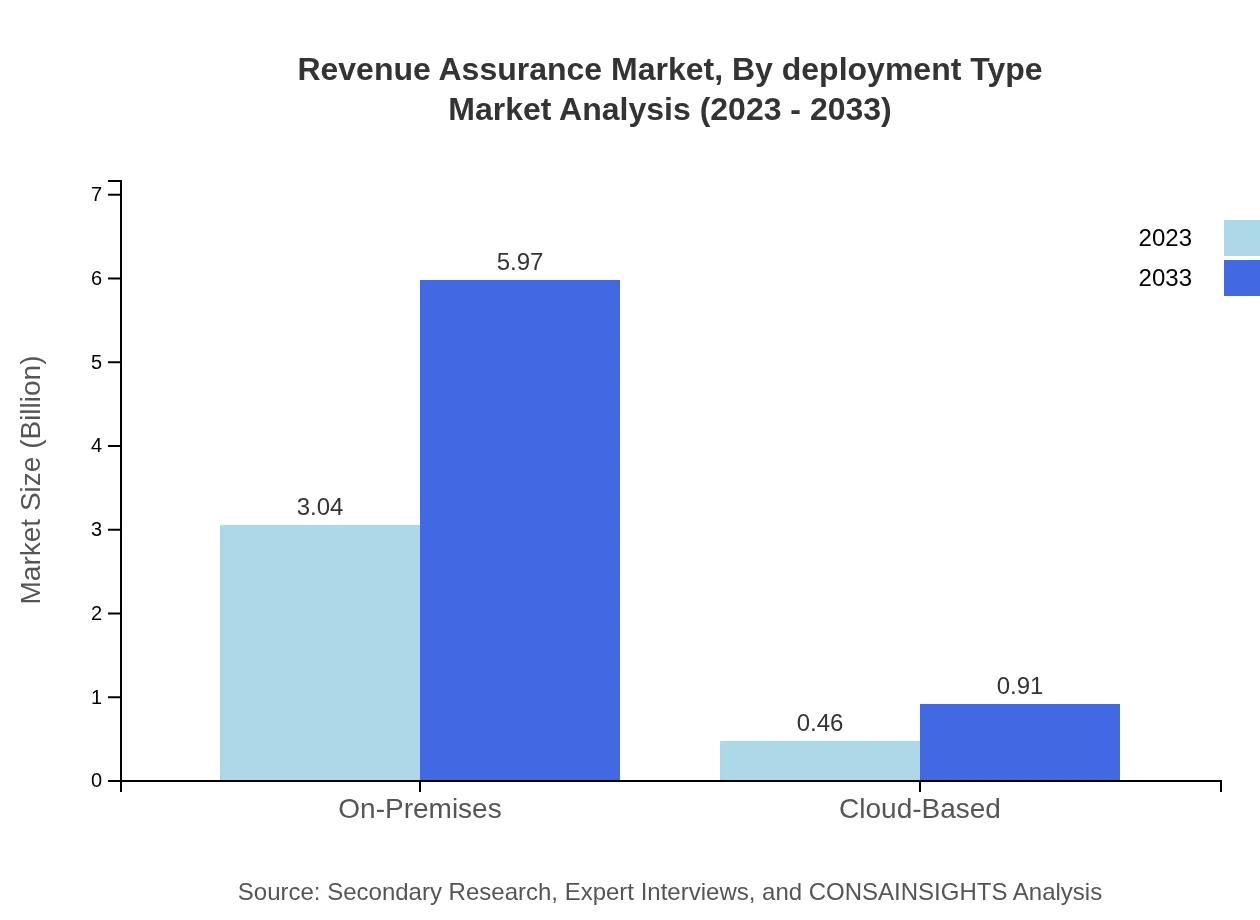

Revenue Assurance Market Analysis By Deployment Type

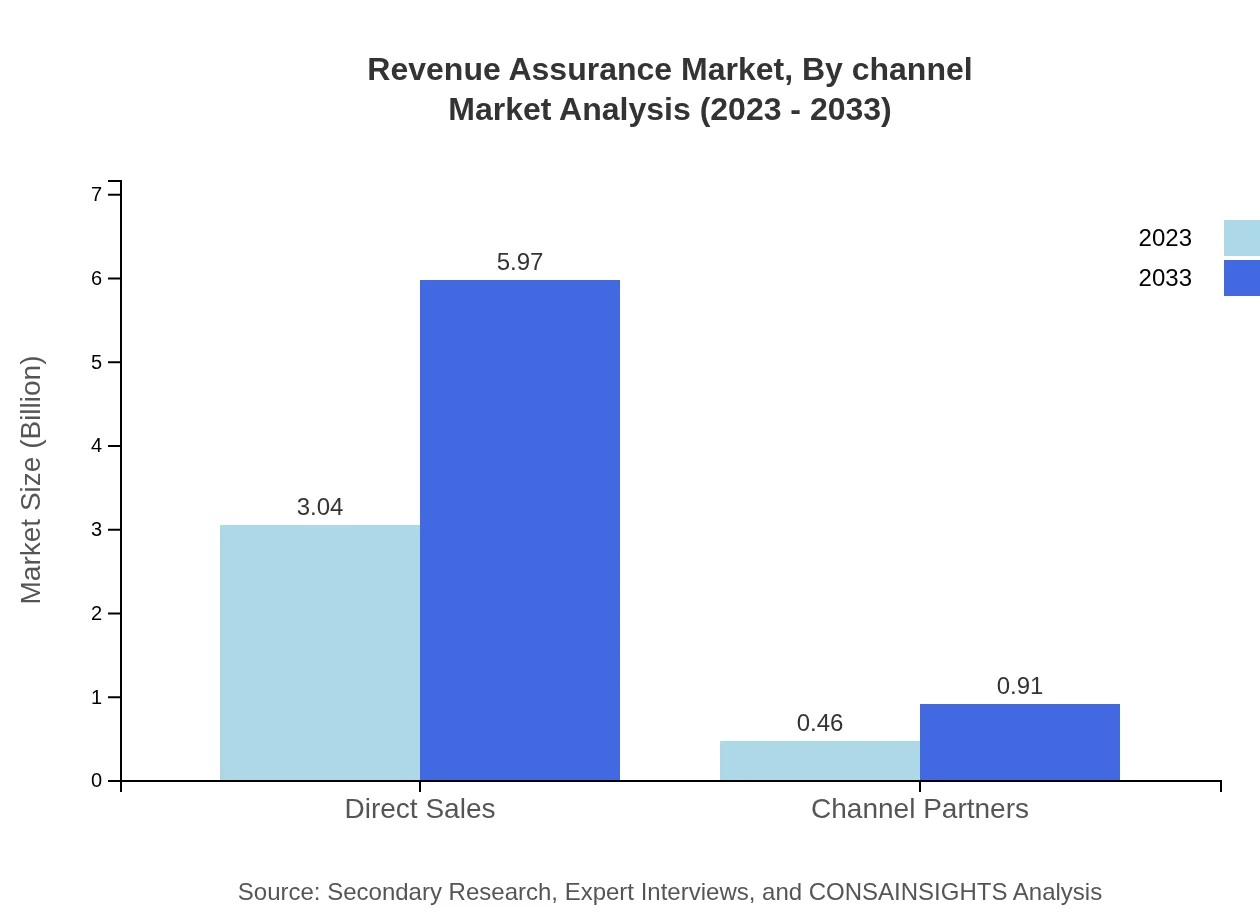

On-premises deployment remains a significant segment, estimated at $3.04 billion in 2023 and projected to grow to $5.97 billion by 2033, indicating high market confidence in traditional systems. Cloud-based solutions are also showing incremental growth, projected to reach $0.91 billion by 2033.

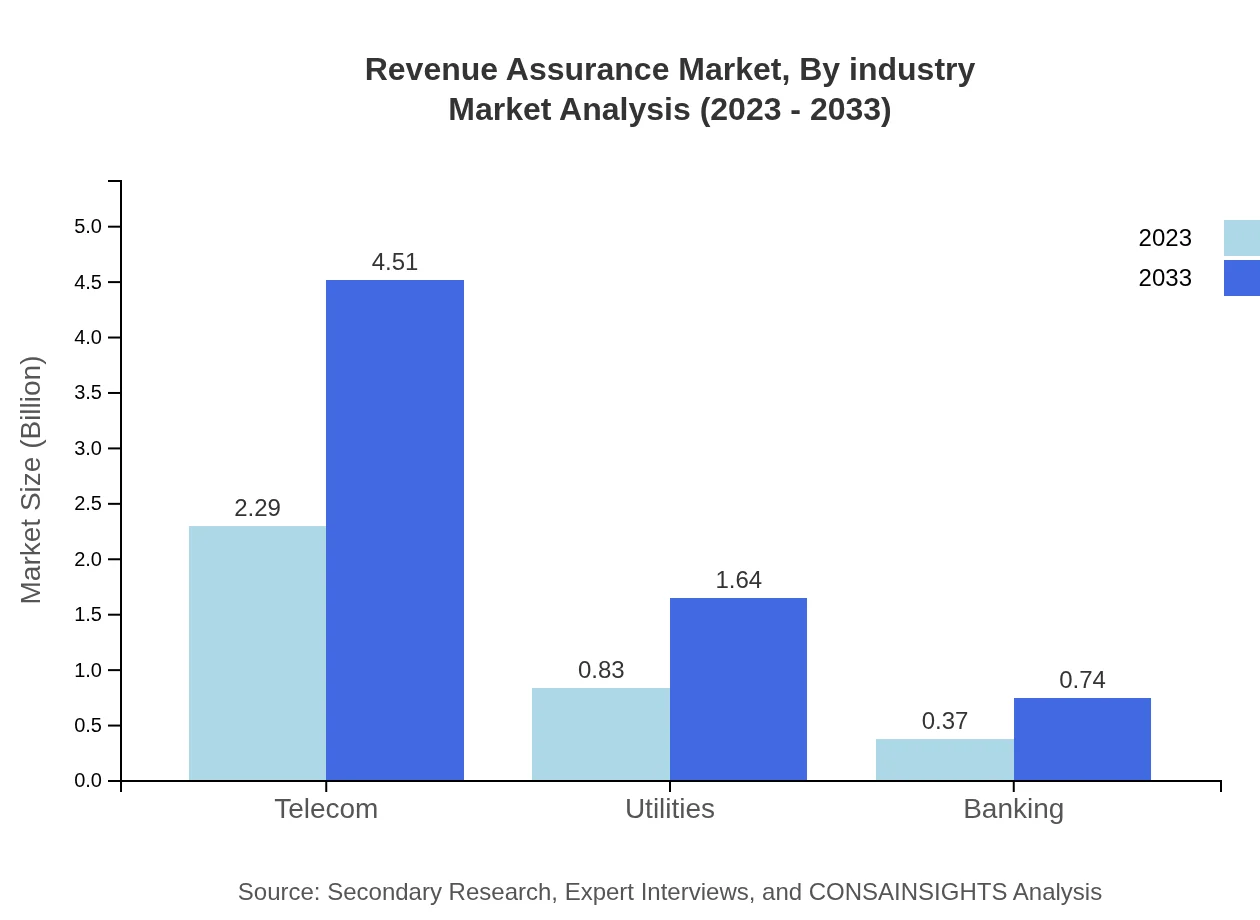

Revenue Assurance Market Analysis By Industry

The telecom industry leads the Revenue Assurance market, valued at $2.29 billion in 2023, with expectations to double in size by 2033. Similarly, the utility sector is gaining traction, with a significant rise in the need for Revenue Assurance practices as energy demand grows.

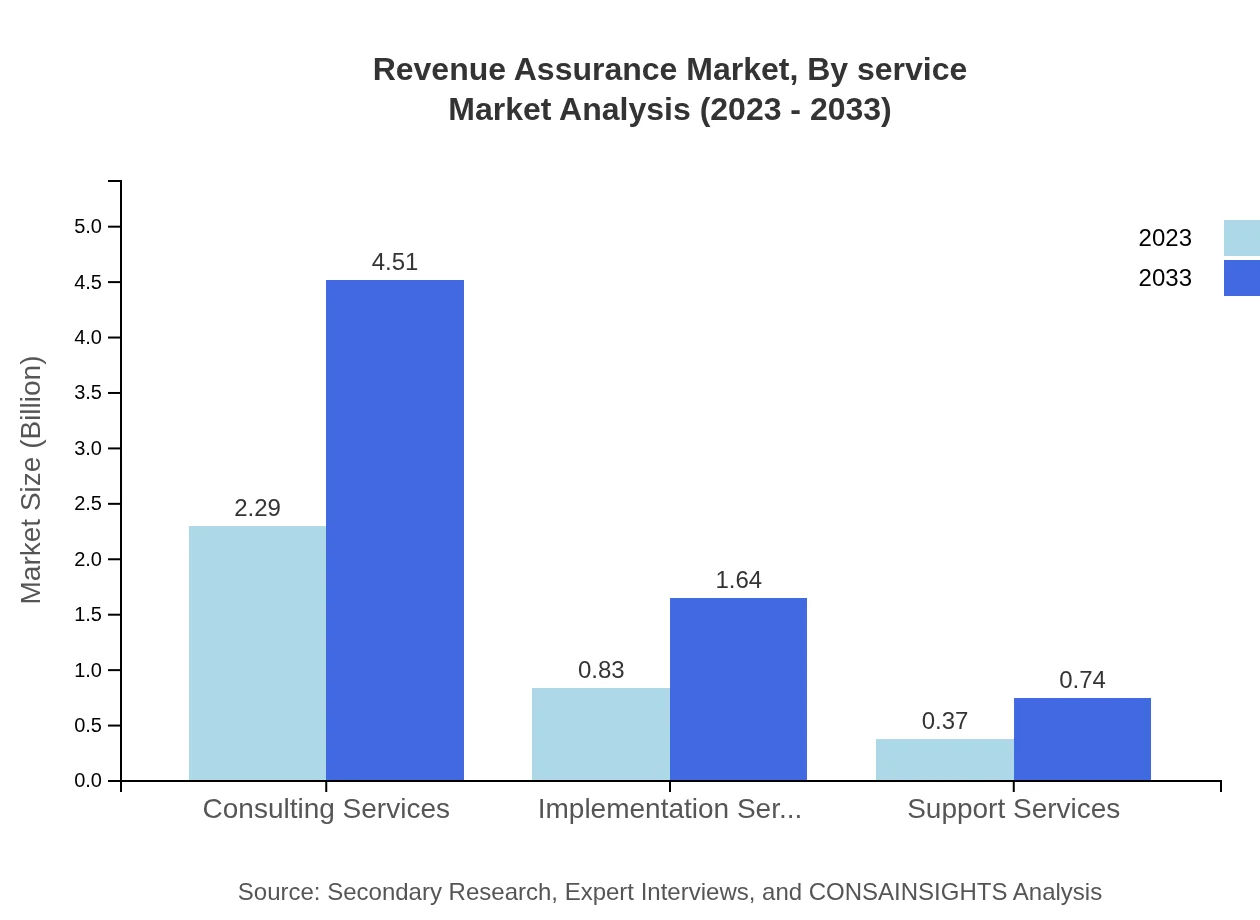

Revenue Assurance Market Analysis By Service

Consulting services in Revenue Assurance are paving the way for innovative solutions, projected to grow from $2.29 billion in 2023 to $4.51 billion. Implementation and support services are essential to ensure seamless integration and optimal usage of Revenue Assurance solutions.

Revenue Assurance Market Analysis By Channel

Direct sales are pivotal in the Revenue Assurance market, accounting for 86.84% of the market share in 2023. Channel partnerships are gradually rising, reflecting an expanding ecosystem that enhances customer reach and service delivery.

Revenue Assurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Revenue Assurance Industry

Subex Limited:

A pioneer in Revenue Assurance software, Subex provides comprehensive solutions that help telecommunications and enterprise business organizations to optimize revenues through innovative analytics and fraud management.Cognizant:

Cognizant offers a range of consulting and technology services, focusing heavily on enhancing Revenue Assurance capabilities across various sectors, effective at minimizing revenue leakage through their tailored solutions.Amdocs:

A leader in customer experience solutions, Amdocs provides end-to-end Revenue Assurance solutions specifically tailored for telecom operators, enabling them to enhance revenue protection significantly.We're grateful to work with incredible clients.

FAQs

What is the market size of Revenue Assurance?

The global Revenue Assurance market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 6.8% through 2033. This highlights a significant expansion in the industry, driven by increased need for financial security and integrity.

What are the key market players or companies in the Revenue Assurance industry?

Key players in the Revenue Assurance industry include major telecommunications companies, software providers, and consulting firms specializing in financial integrity solutions. Their collaboration and innovation drive the industry's growth trajectory, helping businesses mitigate revenue losses due to errors and fraud.

What are the primary factors driving the growth in the Revenue Assurance industry?

The growth in the Revenue Assurance industry is driven by rising fraud incidents, increasing complexities in billing systems, and the need for compliance with regulatory standards. As businesses strive to enhance revenue transparency, the deployment of efficient assurance solutions becomes crucial.

Which region is the fastest Growing in the Revenue Assurance market?

The Asia Pacific region is experiencing significant growth in the Revenue Assurance market, with projections indicating an increase from $0.69 billion in 2023 to $1.37 billion by 2033. This growth reflects the rapid digital transformation and investment in analytics within this region.

Does ConsaInsights provide customized market report data for the Revenue Assurance industry?

Yes, ConsaInsights offers customized market reports tailored specifically for the Revenue Assurance industry. Clients can request in-depth insights and tailored data to meet their unique business needs and strategic goals in understanding this dynamic market.

What deliverables can I expect from this Revenue Assurance market research project?

Deliverables from the Revenue Assurance market research project typically include comprehensive reports, executive summaries, market forecasts, analysis of trends, and competitive landscapes, ensuring stakeholders have actionable insights to support decision-making and strategy formulation.

What are the market trends of Revenue Assurance?

Current trends in the Revenue Assurance market include the adoption of AI and machine learning for predictive analysis, a shift towards cloud-based solutions, and increasing collaboration between sectors like telecom, utilities, and banking to enhance overall financial resilience.