Revenue Cycle Management Market Report

Published Date: 31 January 2026 | Report Code: revenue-cycle-management

Revenue Cycle Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Revenue Cycle Management (RCM) market, spanning the years 2023 to 2033. It covers market size, growth trends, technology innovations, segmentation, and regional insights, delivering a comprehensive overview to stakeholders in the RCM sector.

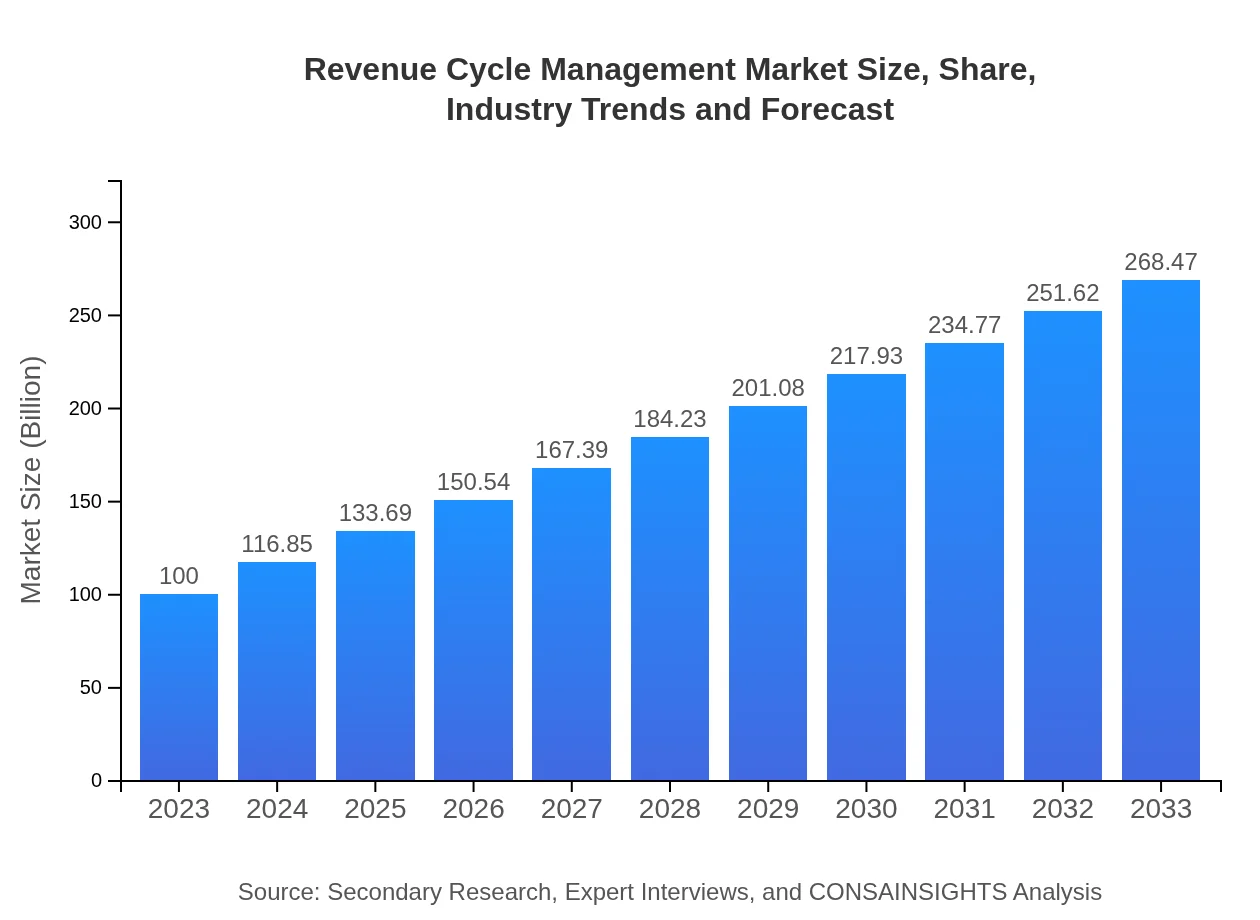

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $268.47 Billion |

| Top Companies | Cerner Corporation, McKesson Corporation, Optum360, Allscripts Healthcare Solutions |

| Last Modified Date | 31 January 2026 |

Revenue Cycle Management Market Overview

Customize Revenue Cycle Management Market Report market research report

- ✔ Get in-depth analysis of Revenue Cycle Management market size, growth, and forecasts.

- ✔ Understand Revenue Cycle Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Revenue Cycle Management

What is the Market Size & CAGR of Revenue Cycle Management market in 2023?

Revenue Cycle Management Industry Analysis

Revenue Cycle Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Revenue Cycle Management Market Analysis Report by Region

Europe Revenue Cycle Management Market Report:

The European Revenue Cycle Management market is anticipated to grow from $27.55 billion in 2023 to $73.96 billion by 2033, fueled by the increasing digital transformation in healthcare, ongoing regulatory reforms, and the need for efficient billing and coding systems.Asia Pacific Revenue Cycle Management Market Report:

In 2023, the Asia Pacific Revenue Cycle Management market is projected to reach $18.73 billion, growing to approximately $50.28 billion by 2033. This region is witnessing rapid urbanization, increasing healthcare access, and government initiatives aimed at improving healthcare efficiency, driving the RCM market's growth.North America Revenue Cycle Management Market Report:

North America, leading the global market, is estimated to account for $38.76 billion in 2023, with projections to reach $104.06 billion by 2033. Factors such as high healthcare spending, sophisticated healthcare IT infrastructure, and strict regulatory requirements drive the RCM market's expansion.South America Revenue Cycle Management Market Report:

The South American Revenue Cycle Management market is expected to grow from $6.75 billion in 2023 to $18.12 billion by 2033. The rising adoption of healthcare IT solutions, coupled with a focus on improving healthcare infrastructure, is creating a favorable environment for RCM services.Middle East & Africa Revenue Cycle Management Market Report:

The Middle East and Africa market for Revenue Cycle Management is set to increase from $8.21 billion in 2023 to $22.04 billion by 2033. The region's growing healthcare sector, investment in health technology, and the rising prevalence of chronic diseases are critical factors driving this growth.Tell us your focus area and get a customized research report.

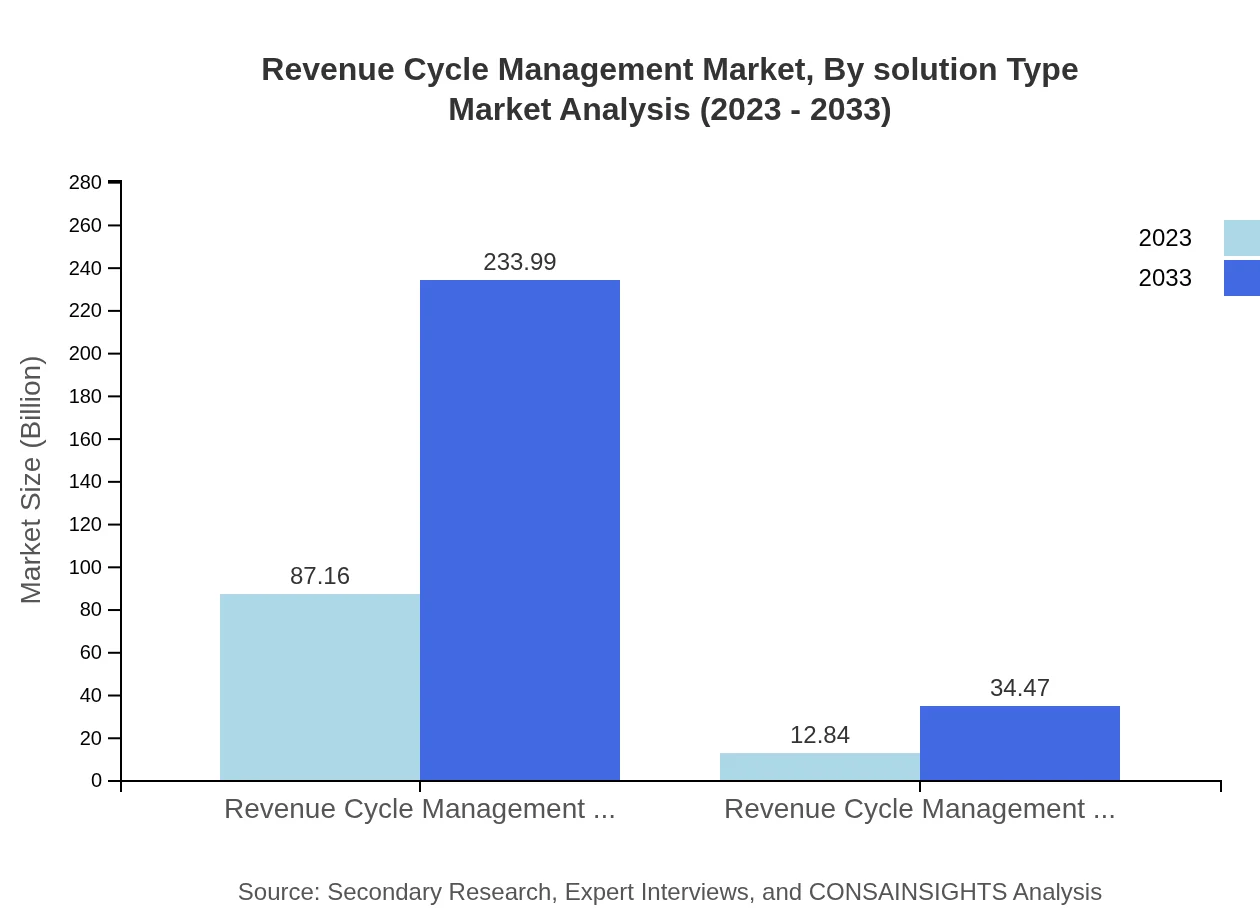

Revenue Cycle Management Market Analysis By Solution Type

The Revenue Cycle Management market by solution type segments into software and services. As of 2023, software dominates with a market size of $87.16 billion, predicted to reach $233.99 billion by 2033, highlighting the growing reliance on integrated RCM systems. Services contribute $12.84 billion in 2023 and are expected to rise to $34.47 billion by 2033, due to the increasing complexity of healthcare billing and the necessity for specialized management solutions.

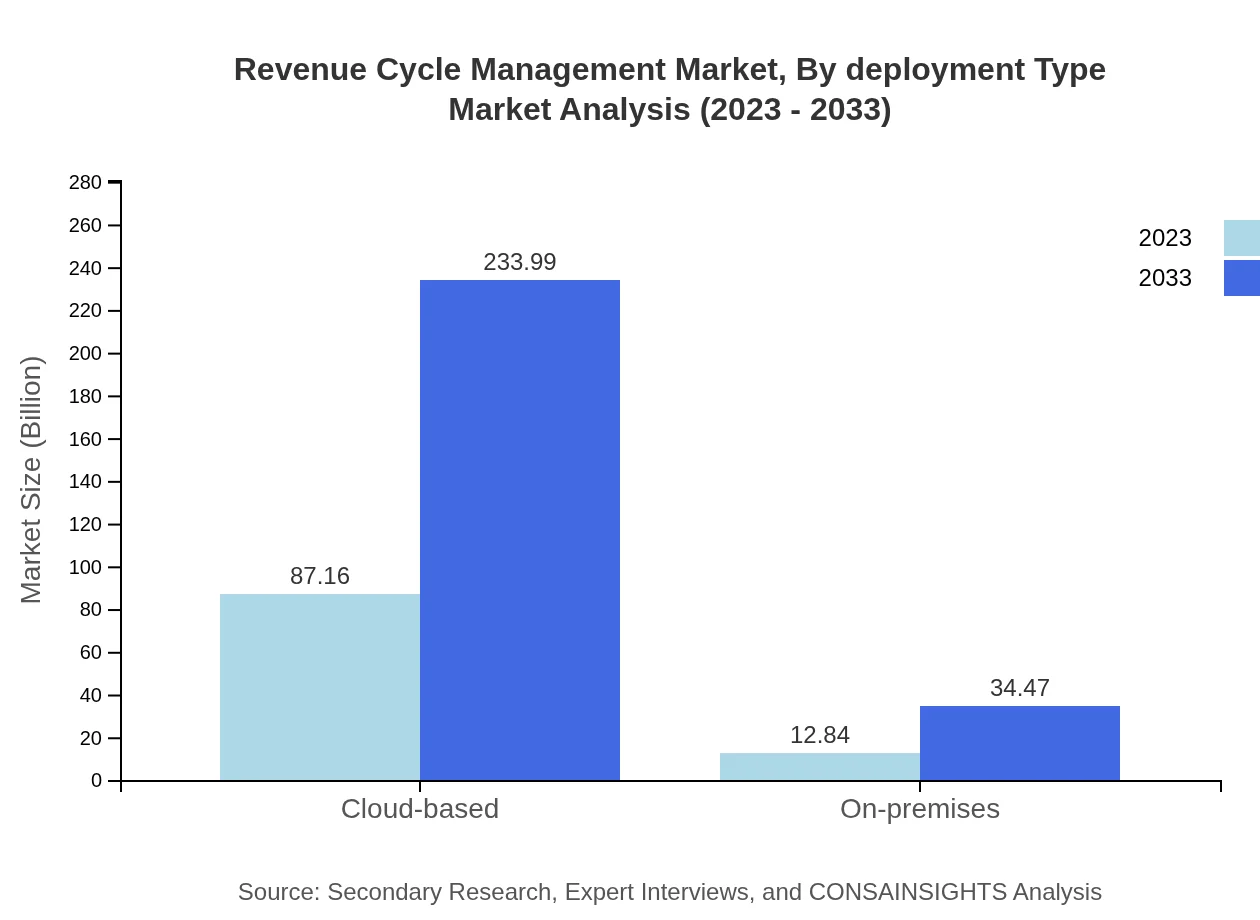

Revenue Cycle Management Market Analysis By Deployment Type

The deployment type segment of the Revenue Cycle Management market consists of cloud-based and on-premises solutions. In 2023, cloud-based solutions dominate the market at $87.16 billion, anticipated to grow to $233.99 billion by 2033, attributable to their scalability and reduced operational costs. Conversely, on-premises solutions, valued at $12.84 billion in 2023, are projected to rise to $34.47 billion by 2033, although their growth rate is slower compared to cloud offerings.

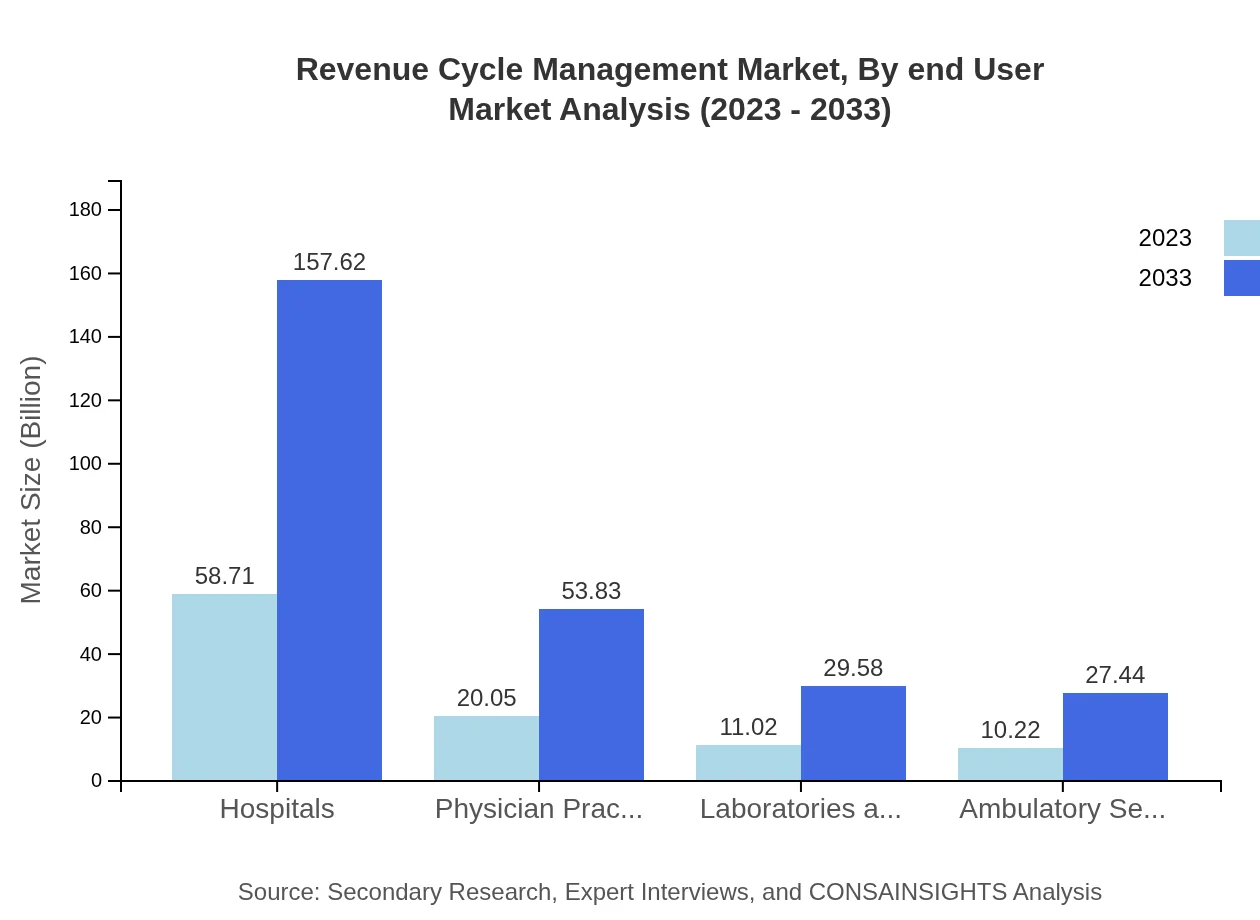

Revenue Cycle Management Market Analysis By End User

End-users of the Revenue Cycle Management market include hospitals, physician practices, laboratories, and ambulatory service centers. Hospitals hold the largest market share, valued at $58.71 billion in 2023 and projected to reach $157.62 billion by 2033. Physician practices follow, with a size of $20.05 billion in 2023, expected to grow to $53.83 billion by 2033. Laboratories and diagnostics represent a segment worth $11.02 billion in 2023, forecasted to reach $29.58 billion by 2033. Ambulatory service centers hold a share of $10.22 billion in 2023, projected to increase to $27.44 billion by the end of the decade.

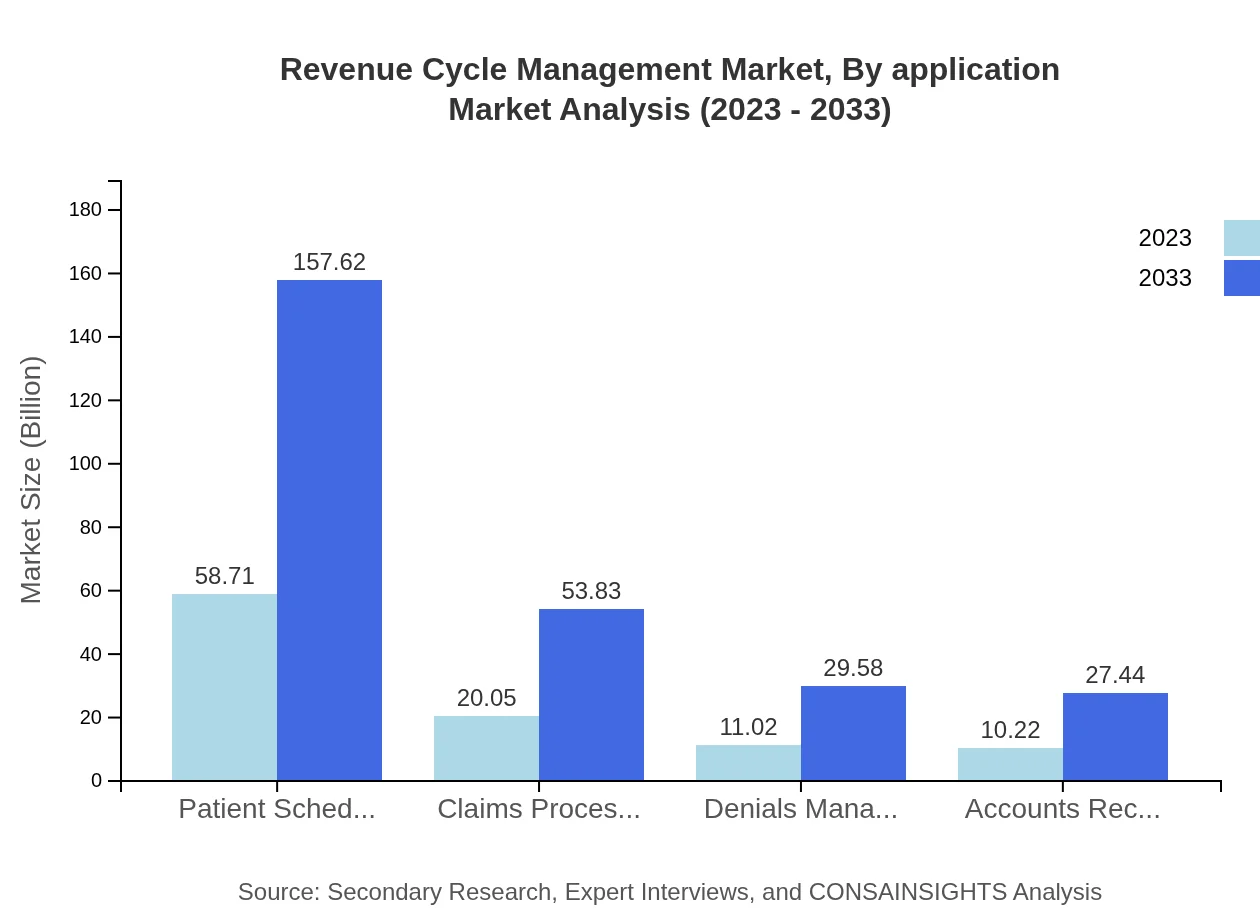

Revenue Cycle Management Market Analysis By Application

Applications within the Revenue Cycle Management market include patient scheduling, claims processing, denials management, and accounts receivable management. Patient scheduling leads this segment with a market value of $58.71 billion in 2023, forecasted to reach $157.62 billion by 2033. Claims processing is valued at $20.05 billion in 2023, anticipated to grow to $53.83 billion by 2033, while denials management and accounts receivable management contribute $11.02 billion and $10.22 billion, respectively.

Revenue Cycle Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Revenue Cycle Management Industry

Cerner Corporation:

Cerner Corporation offers comprehensive health information technology solutions, focusing on streamlining revenue cycle processes for healthcare providers and enhancing operational efficiencies.McKesson Corporation:

McKesson is a leading healthcare services and information technology company, specializing in pharmacy solutions and revenue cycle management services.Optum360:

A subsidiary of UnitedHealth Group, Optum360 provides innovative solutions in revenue cycle management, focusing on healthcare analytics, claims processing, and billing solutions.Allscripts Healthcare Solutions:

Allscripts offers a comprehensive portfolio of EHR and RCM solutions, facilitating improved financial performance and patient care for healthcare providers.We're grateful to work with incredible clients.

FAQs

What is the market size of Revenue Cycle Management?

The Global Revenue Cycle Management market is projected to reach approximately $100 billion by 2033, with a robust CAGR of 10%. This growth reflects the increasing need for optimized revenue processes in the healthcare industry.

What are the key market players or companies in the Revenue Cycle Management industry?

Key players in the Revenue Cycle Management industry include major healthcare technology companies, analytics firms, and specialized RCM service providers. Their competitive strategies focus on product innovation, partnerships, and expanding service portfolios to capture market share.

What are the primary factors driving the growth in the Revenue Cycle Management industry?

Key growth drivers include an increasing emphasis on optimizing healthcare revenues, the need for regulatory compliance, the rise of digital health technologies, and the growing complexity of medical billing systems, fueling innovation and adoption in RCM solutions.

Which region is the fastest Growing in the Revenue Cycle Management market?

The fastest-growing region in the Revenue Cycle Management market is North America, with a projected market growth from $38.76 billion in 2023 to $104.06 billion by 2033. Factors driving growth in this region include advanced healthcare infrastructure and increasing healthcare costs.

Does ConsaInsights provide customized market report data for the Revenue Cycle Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Revenue Cycle Management industry. This allows businesses to gain insights relevant to their unique market challenges and opportunities.

What deliverables can I expect from this Revenue Cycle Management market research project?

Anticipated deliverables include comprehensive market analysis reports, growth projections, segmentation insights, competitive landscape assessments, and strategic recommendations that provide actionable insights for stakeholders in the Revenue Cycle Management sector.

What are the market trends of Revenue Cycle Management?

Current trends in the Revenue Cycle Management sector include increased adoption of cloud-based solutions, automated billing systems, integration of AI for efficient claims processing, and a focus on patient-centric revenue strategies to enhance financial performance.