Rf Components Market Report

Published Date: 31 January 2026 | Report Code: rf-components

Rf Components Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the RF Components market, highlighting key insights and trends from 2023 to 2033. It includes market size, growth forecasts, and competitive landscape, enabling stakeholders to make informed decisions.

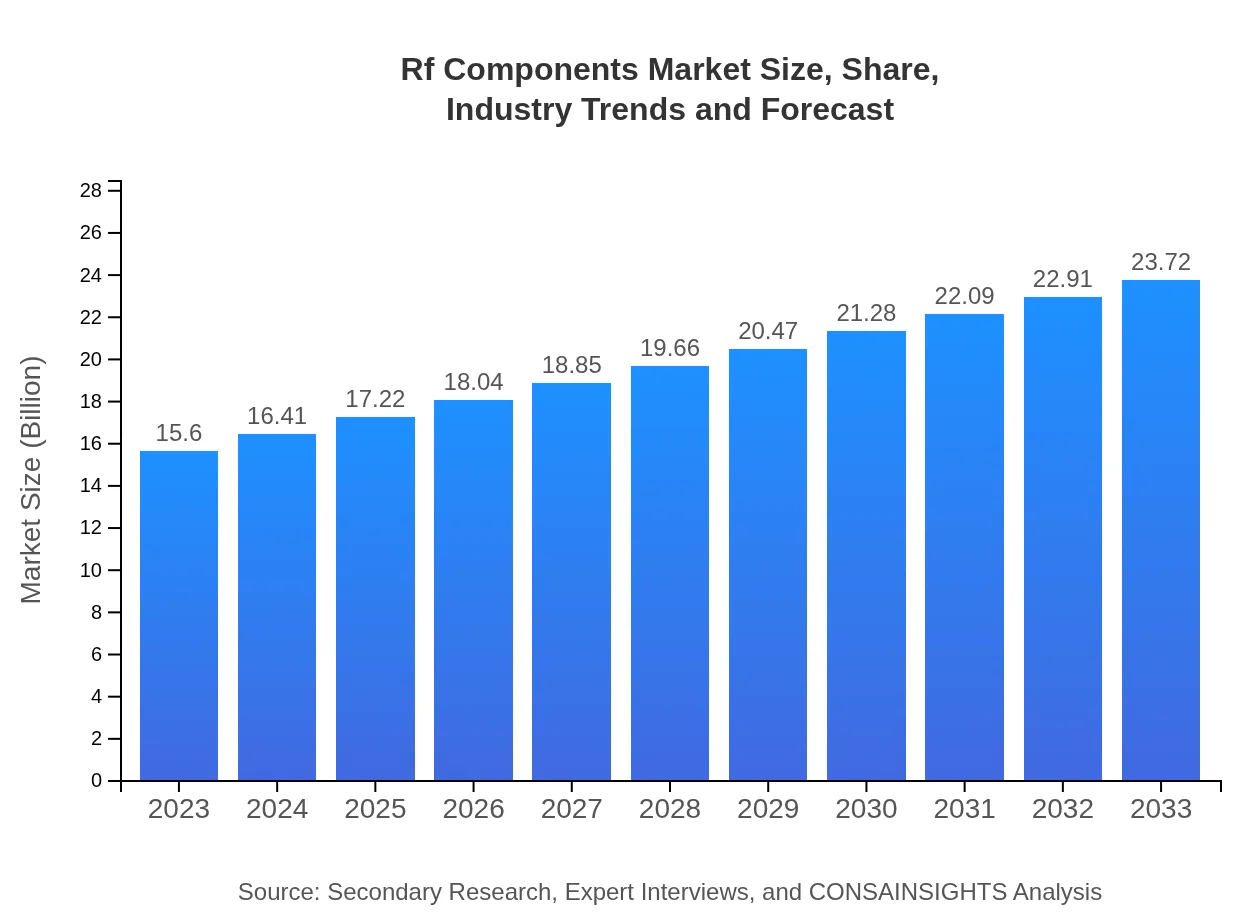

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $23.72 Billion |

| Top Companies | Qorvo Inc., Skyworks Solutions, Inc., Analog Devices, Inc., Infineon Technologies AG |

| Last Modified Date | 31 January 2026 |

RF Components Market Overview

Customize Rf Components Market Report market research report

- ✔ Get in-depth analysis of Rf Components market size, growth, and forecasts.

- ✔ Understand Rf Components's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rf Components

What is the Market Size & CAGR of RF Components market in 2023?

RF Components Industry Analysis

RF Components Market Segmentation and Scope

Tell us your focus area and get a customized research report.

RF Components Market Analysis Report by Region

Europe Rf Components Market Report:

In Europe, the market is estimated to be $5.61 billion in 2023, growing to $8.54 billion by 2033. This region benefits from strict regulatory standards that drive the adoption of advanced RF technologies in telecommunications and medical devices.Asia Pacific Rf Components Market Report:

In the Asia Pacific region, the RF Components market is valued at $2.88 billion in 2023, projected to grow to $4.39 billion by 2033. This growth is driven by increasing investments in telecommunications infrastructure and the rising demand for consumer electronics. Countries like China, Japan, and India are at the forefront, investing heavily in developing 5G networks and advanced manufacturing capabilities.North America Rf Components Market Report:

North America is a leading market for RF Components, valued at $5.05 billion in 2023 and anticipated to grow to $7.67 billion by 2033. The presence of major players and significant R&D investment, particularly in aerospace, defense, and telecommunications sectors, are key growth drivers.South America Rf Components Market Report:

The RF Components market in South America is relatively modest, with a valuation of $1.20 billion in 2023, expected to reach $1.82 billion by 2033. The growth in this region is fueled by expanding telecommunications services and increasing awareness of IoT applications.Middle East & Africa Rf Components Market Report:

The RF Components market in the Middle East and Africa holds a value of $0.85 billion in 2023, projected to increase to $1.30 billion by 2033. Growing investments in telecom infrastructure and the rise of smart technologies are pivotal to this growth trajectory.Tell us your focus area and get a customized research report.

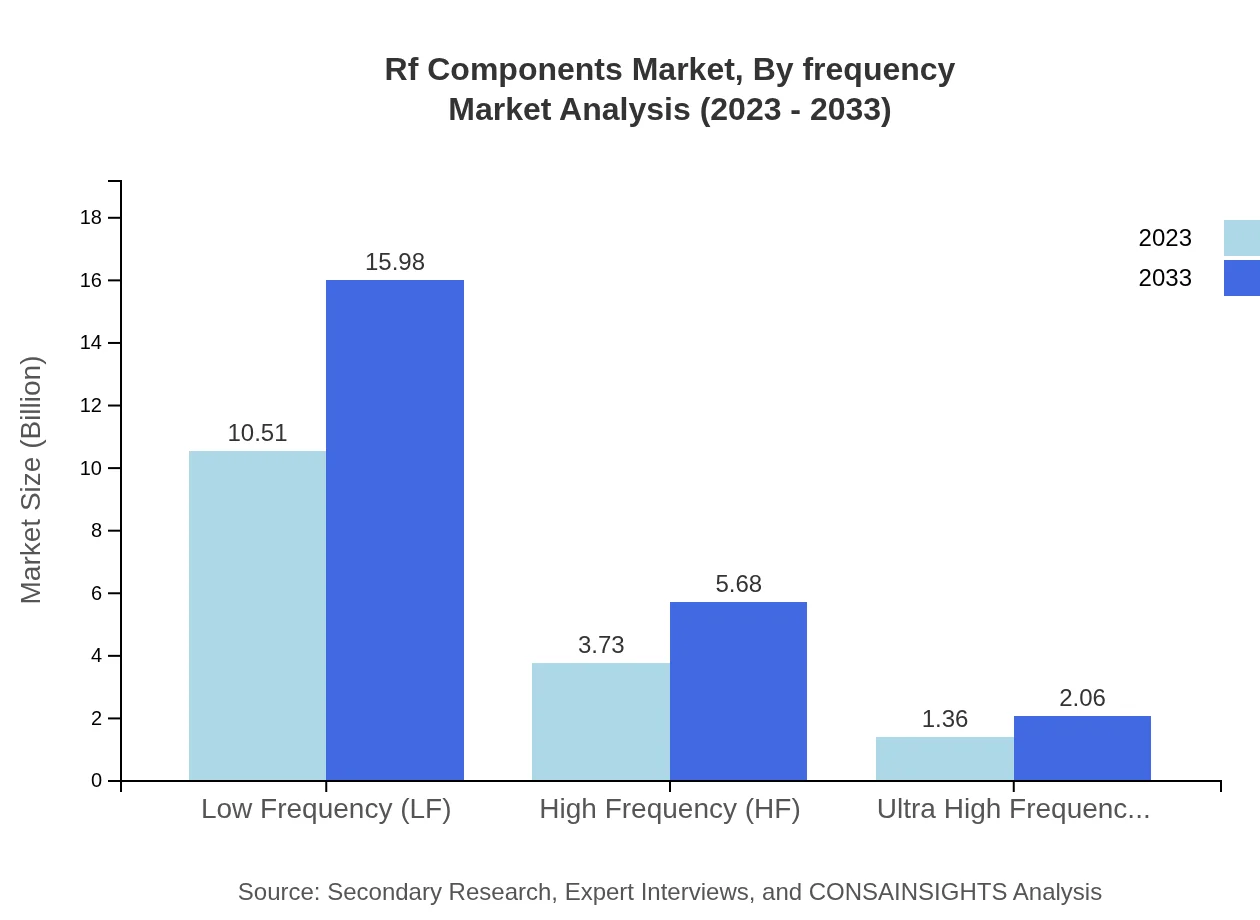

Rf Components Market Analysis By Frequency

The RF Components market, segmented by frequency, highlights significant investments in Low Frequency (LF), High Frequency (HF), and Ultra High Frequency (UHF) components. LF components represented a market size of $10.51 billion in 2023 and are projected to grow to $15.98 billion, maintaining a share of 67.37% throughout the forecast period. HF components are expected to grow from $3.73 billion in 2023 to $5.68 billion, while UHF components are improving in significance, increasing from $1.36 billion to $2.06 billion in the same period.

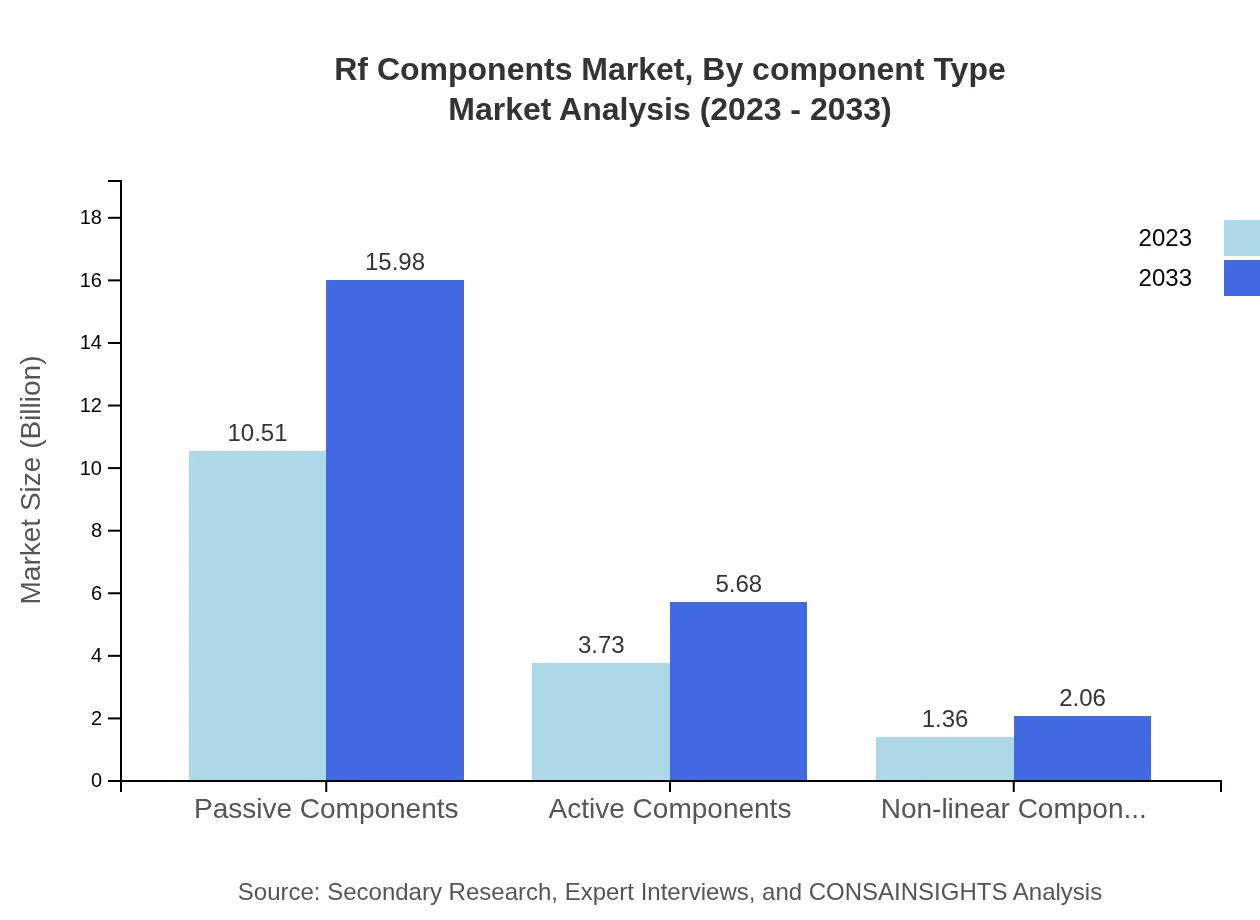

Rf Components Market Analysis By Component Type

The RF Components market is divided by component type into Passive, Active, and Non-linear Components. Passive Components dominate the market with a size of $10.51 billion in 2023 and a forecasted growth to $15.98 billion, accounting for 67.37% market share. Active Components follow with $3.73 billion in 2023, predicted to grow to $5.68 billion. Non-linear Components show slower growth from $1.36 billion to $2.06 billion.

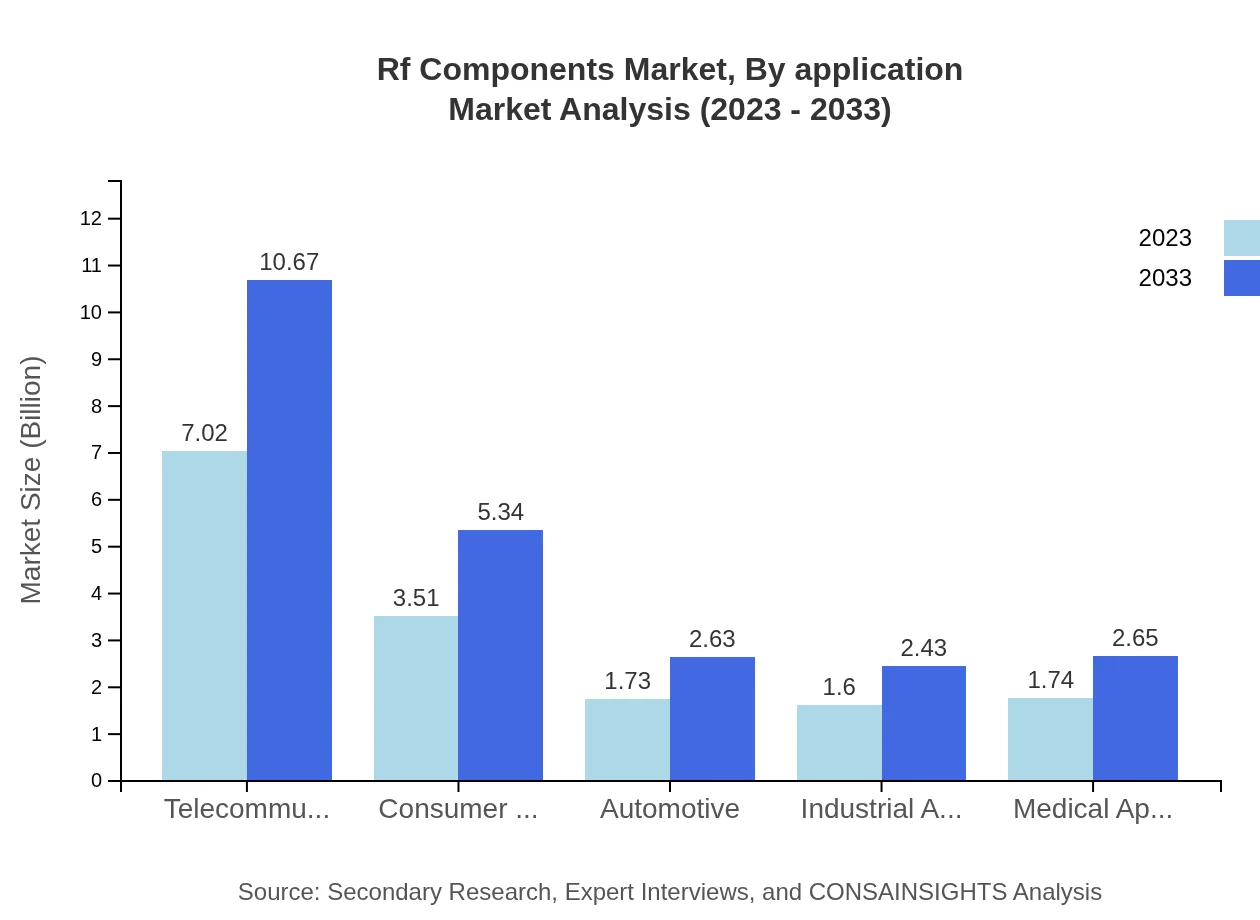

Rf Components Market Analysis By Application

In the application segment, Telecommunications represent a key area with a size of $7.02 billion in 2023, projected to reach $10.67 billion by 2033, sustaining a share of 44.97%. Aerospace applications follow at $3.51 billion initially, expected to burgeon to $5.34 billion, showcasing 22.52% market share, while Medical Devices comprise $1.73 billion, expanding to $2.63 billion, reflecting 11.1% market share increase as healthcare demands grow.

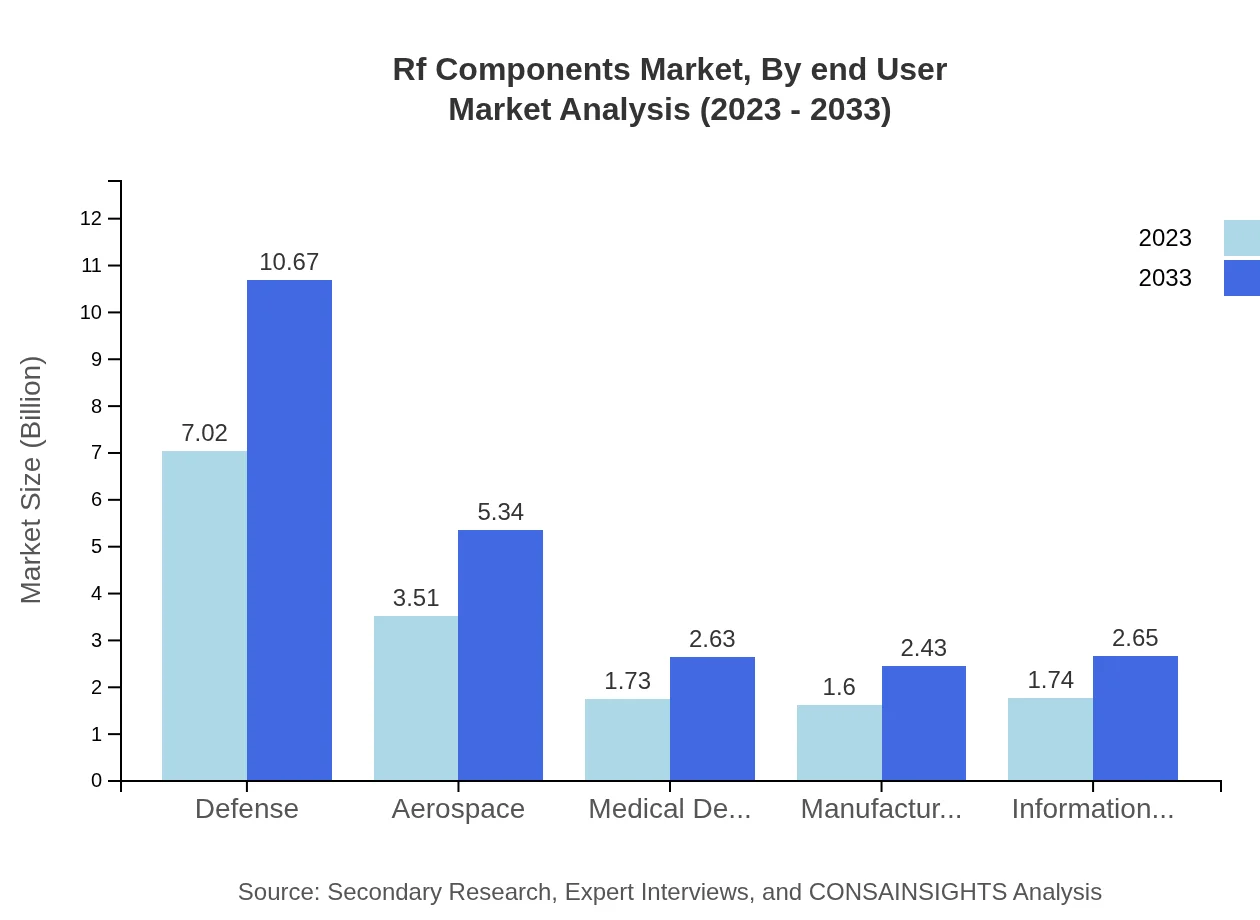

Rf Components Market Analysis By End User

The end-user segment reveals that Defense constitutes a notable share of the market with a size of $7.02 billion in 2023, growing to $10.67 billion by 2033, firmly holding 44.97%. Other critical sectors include Automotive, which is expected to grow from $1.73 billion to $2.63 billion and Medical Applications, from $1.74 billion to $2.65 billion, reflecting the increasing integration of RF technology in various industries.

RF Components Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in RF Components Industry

Qorvo Inc.:

Qorvo is a leading global provider of innovative RF solutions that enable mobile, infrastructure, and aerospace applications. Their strong focus on R&D allows them to stay ahead with cutting-edge technology.Skyworks Solutions, Inc.:

Skyworks Solutions designs and manufactures analog and mixed-signal semiconductors for RF and mobile communications. Their products are crucial for connecting people worldwide through wireless networks.Analog Devices, Inc.:

Analog Devices is renowned for its high-performance analog, mixed-signal, and digital signal processing solutions. Their RF technology is widely used in telecommunications, automotive, and medical devices.Infineon Technologies AG:

Infineon is a key player focused on semiconductor solutions. They provide RF solutions for automotive, industrial, and security applications, emphasizing energy efficiency and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of rf Components?

The RF Components market is projected to reach approximately $15.6 billion by 2033, growing at a CAGR of 4.2% from 2023. The market reflects increasing demand across telecommunications, aerospace, and consumer electronics industries.

What are the key market players or companies in this rf Components industry?

Key players in the RF Components industry include major manufacturers like Analog Devices, Qorvo, Murata Manufacturing, and Broadcom. These companies lead in technological advancements and production capabilities, contributing significantly to market expansion and innovation.

What are the primary factors driving the growth in the rf Components industry?

Factors driving growth in the RF components industry include the surge in demand for advanced telecommunications, the expansion of wireless network infrastructure, and the increasing implementation of Internet of Things (IoT) technologies in various sectors.

Which region is the fastest Growing in the rf Components?

The Asia Pacific region is the fastest-growing in the RF components market, with projected growth from $2.88 billion in 2023 to $4.39 billion by 2033. The rapid adoption of technology and manufacturing capabilities boosts regional growth prospects.

Does ConsaInsights provide customized market report data for the rf Components industry?

Yes, ConsaInsights offers customized market report data for the RF components industry. Tailored insights help businesses access specific data relevant to their operational needs, market strategies, and investment decisions.

What deliverables can I expect from this rf Components market research project?

Expected deliverables from this RF components market research project include comprehensive market analysis reports, segmentation insights by region and type, key player profiles, and strategic recommendations based on the latest market trends and forecasts.

What are the market trends of rf Components?

Current market trends in RF components reflect advancements in 5G technologies, increased investments in aerospace and defense sectors, and a focus on miniaturization of components for consumer electronics, driving innovation and competitive growth.