Rf Gan Radio Frequency Gallium Nitride Market Report

Published Date: 31 January 2026 | Report Code: rf-gan-radio-frequency-gallium-nitride

Rf Gan Radio Frequency Gallium Nitride Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Rf Gan Radio Frequency Gallium Nitride market, covering key insights, market dynamics, and future forecasts for the period of 2023 to 2033.

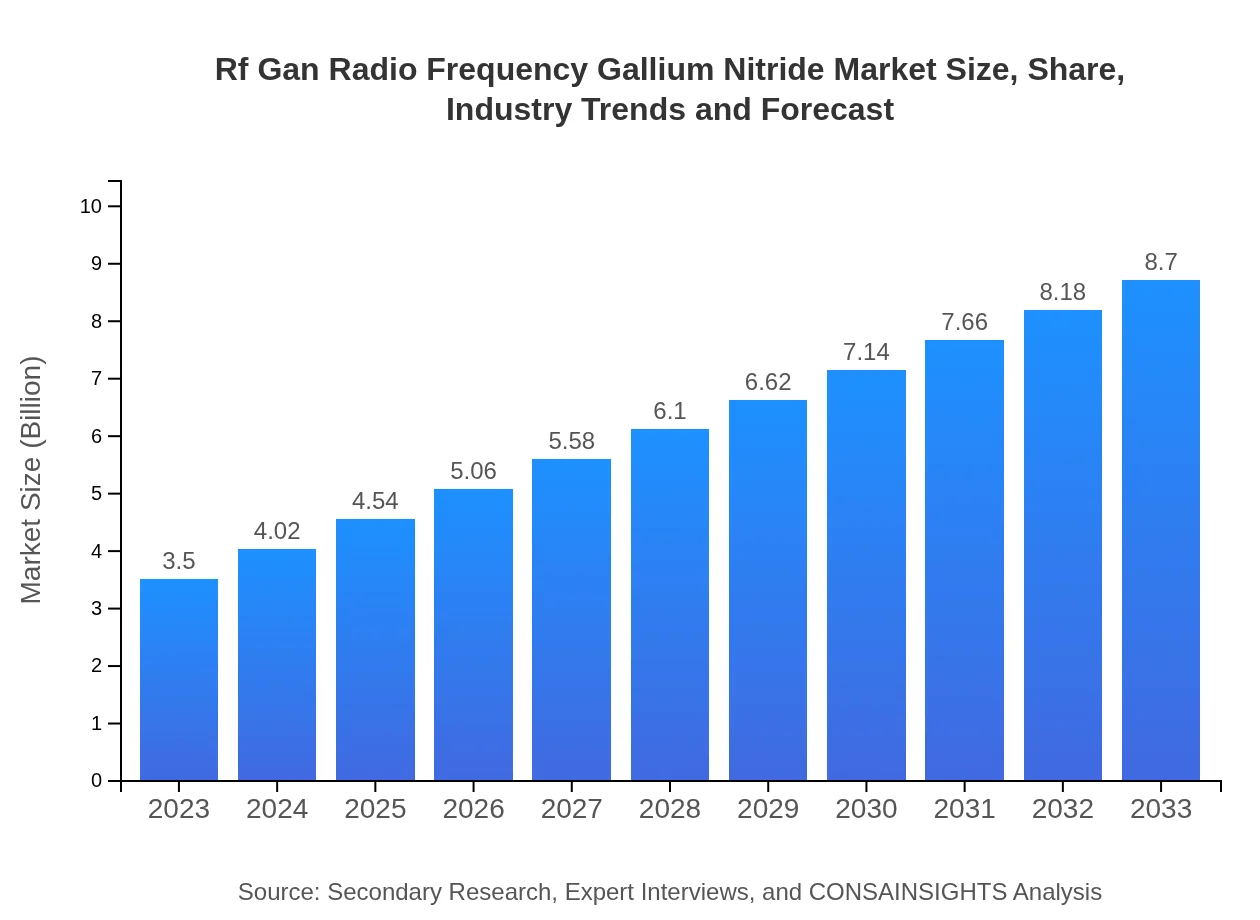

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Qorvo, Inc., Broadcom Inc., NXP Semiconductors, Infineon Technologies, Transphorm Inc. |

| Last Modified Date | 31 January 2026 |

Rf Gan Radio Frequency Gallium Nitride Market Overview

Customize Rf Gan Radio Frequency Gallium Nitride Market Report market research report

- ✔ Get in-depth analysis of Rf Gan Radio Frequency Gallium Nitride market size, growth, and forecasts.

- ✔ Understand Rf Gan Radio Frequency Gallium Nitride's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rf Gan Radio Frequency Gallium Nitride

What is the Market Size & CAGR of Rf Gan Radio Frequency Gallium Nitride market in 2023?

Rf Gan Radio Frequency Gallium Nitride Industry Analysis

Rf Gan Radio Frequency Gallium Nitride Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rf Gan Radio Frequency Gallium Nitride Market Analysis Report by Region

Europe Rf Gan Radio Frequency Gallium Nitride Market Report:

The European market is expected to grow from $1.21 billion in 2023 to approximately $3.01 billion by 2033. The region's emphasis on sustainable technologies and advanced communication systems supports the adoption of GaN solutions across multiple sectors.Asia Pacific Rf Gan Radio Frequency Gallium Nitride Market Report:

The Asia Pacific region is expected to experience robust growth, rising from a market value of $0.55 billion in 2023 to an estimated $1.37 billion in 2033. This surge is largely driven by increasing smartphone penetration, the expansion of 5G networks, and rising manufacturing capabilities in leading countries like China, Japan, and South Korea.North America Rf Gan Radio Frequency Gallium Nitride Market Report:

North America is anticipated to maintain a significant market presence, with projected growth from $1.22 billion in 2023 to $3.02 billion in 2033. The region's strong defense spending and the ongoing development of high-performance telecommunications systems contribute to this positive trend.South America Rf Gan Radio Frequency Gallium Nitride Market Report:

In South America, the Rf Gan Radio Frequency Gallium Nitride market is projected to grow from $0.17 billion in 2023 to $0.42 billion by 2033. This growth is facilitated by increasing investments in telecommunications infrastructure and government initiatives aimed at improving connectivity.Middle East & Africa Rf Gan Radio Frequency Gallium Nitride Market Report:

In the Middle East and Africa, the market is projected to grow from $0.35 billion in 2023 to $0.88 billion by 2033. The increasing focus on enhancing telecommunications infrastructure and defense capabilities is driving the demand for GaN devices in these regions.Tell us your focus area and get a customized research report.

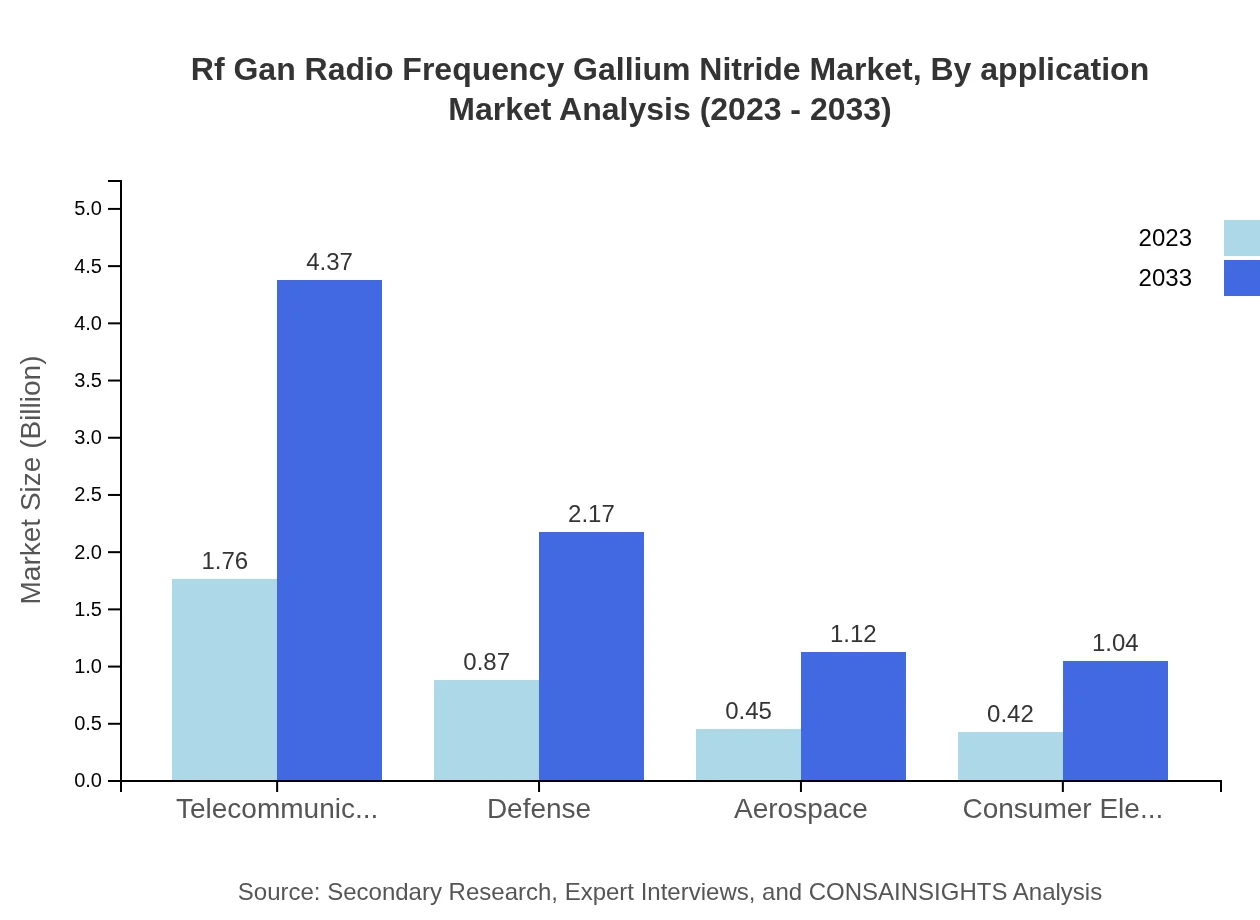

Rf Gan Radio Frequency Gallium Nitride Market Analysis By Application

The RF GaN market is segmented into several applications, including telecommunications, defense, aerospace, industrial, and commercial. The telecommunications sector is expected to hold the largest share in the market, driven by the demand for efficient RF solutions to support burgeoning mobile networks. The defense and aerospace sectors also represent significant growth opportunities due to their need for high-reliability components.

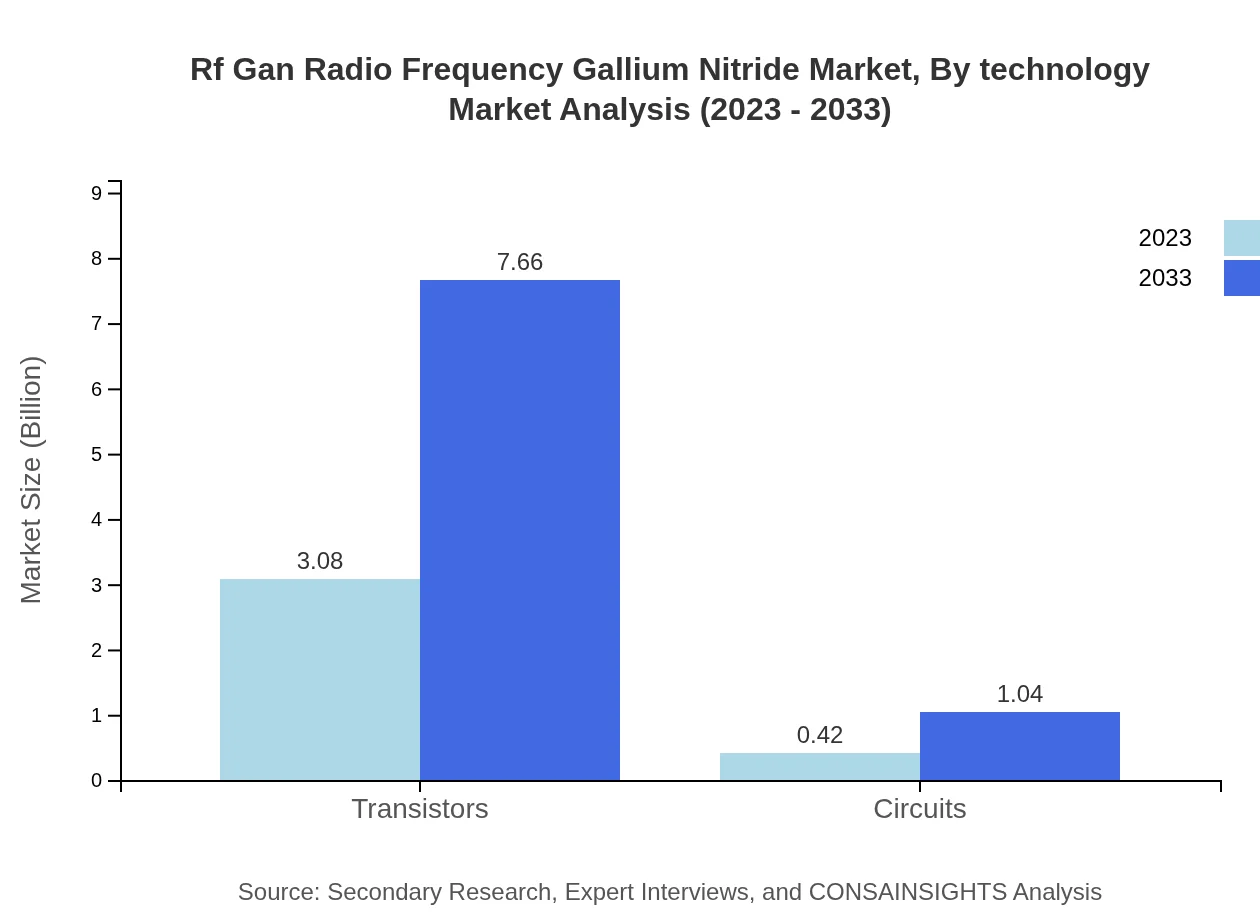

Rf Gan Radio Frequency Gallium Nitride Market Analysis By Technology

The market is categorized by technology, focusing predominantly on HEMT technology, which is recognized for its high efficiency and power capabilities. This technology accounts for a substantial portion of the market share and is essential for applications requiring heightened performance under challenging conditions.

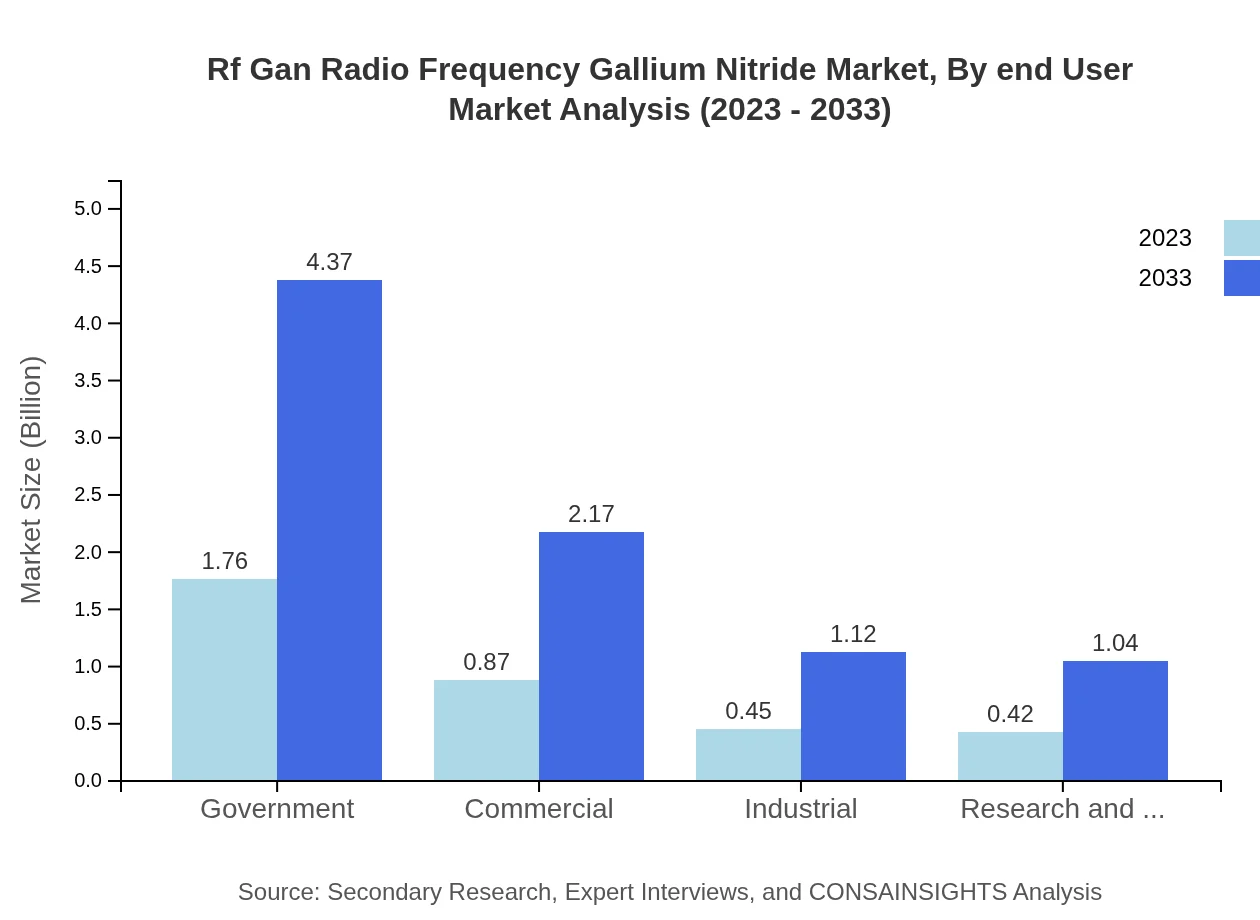

Rf Gan Radio Frequency Gallium Nitride Market Analysis By End User

End-user industries include commercial, industrial, government, telecommunications, defense, aerospace, and more, each presenting unique challenges and demands. The telecommunications sector remains the largest consumer of RF GaN products, relying on these advanced components for 4G and upcoming 5G network deployments.

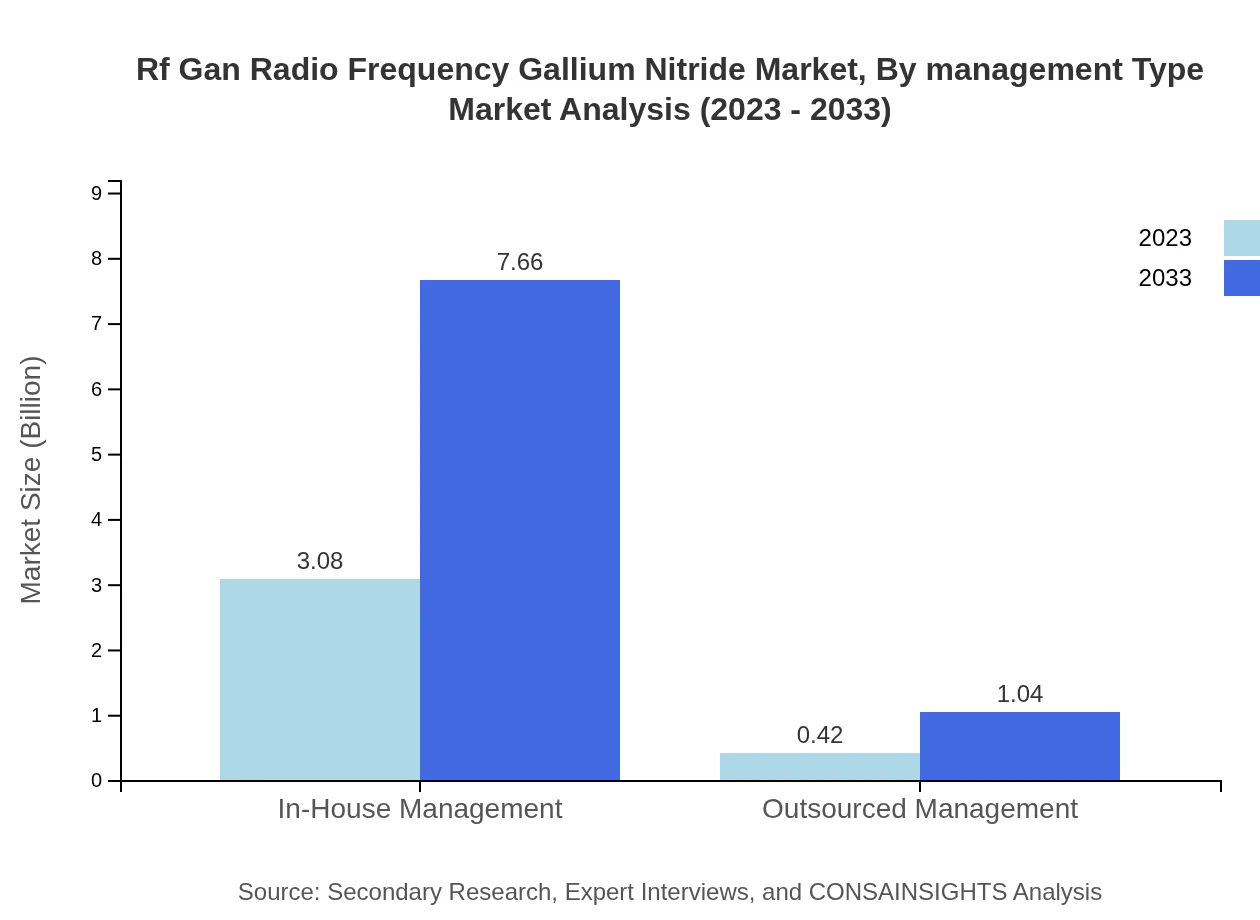

Rf Gan Radio Frequency Gallium Nitride Market Analysis By Management Type

The RF GaN market is divided into in-house and outsourced management types. In-house management approaches are preferred by firms focusing on proprietary technology development, while numerous businesses are now adopting outsourced management strategies to leverage specialized expertise and improve cost efficiency.

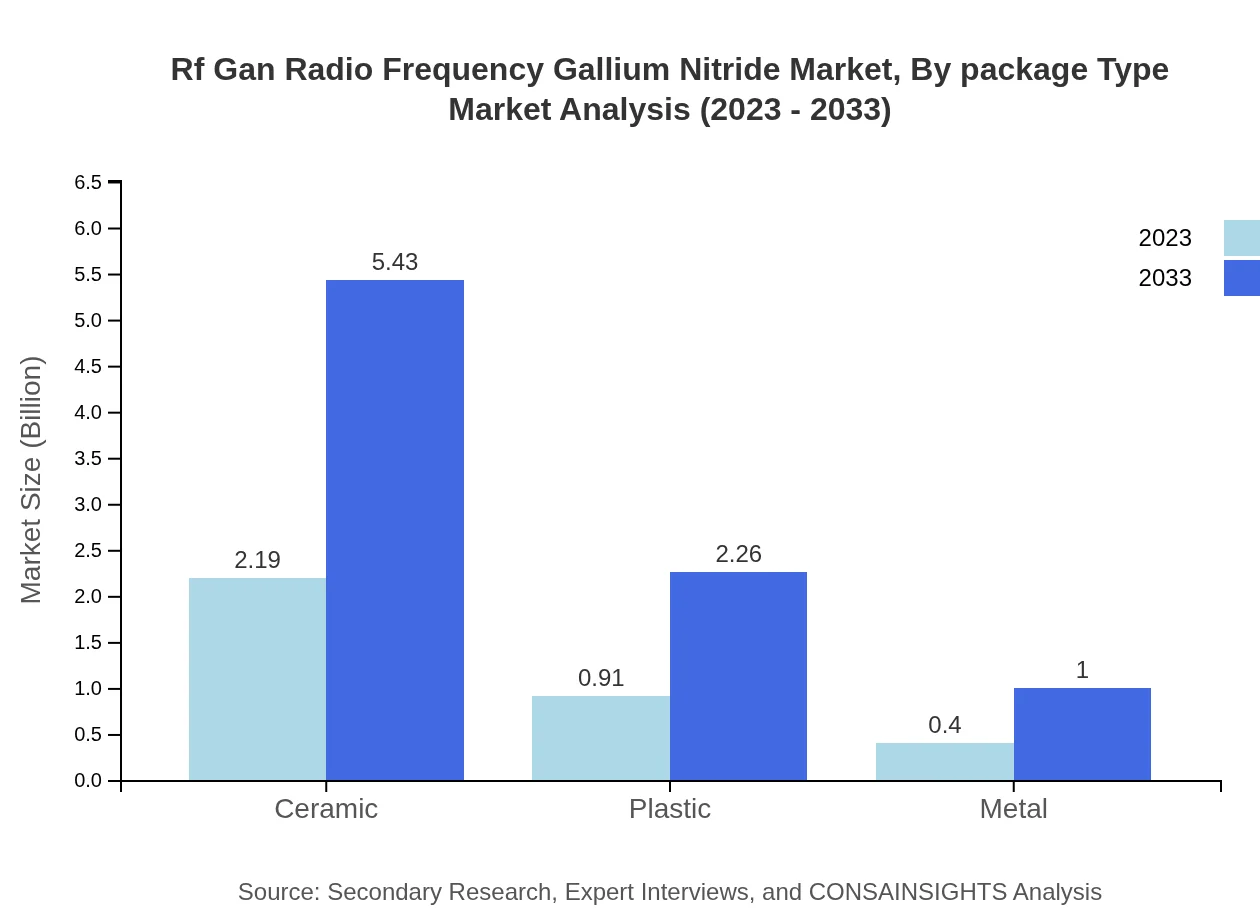

Rf Gan Radio Frequency Gallium Nitride Market Analysis By Package Type

Packaging types in the RF GaN market include ceramic, plastic, and metal packages. Ceramic packaging is the most dominant segment due to its excellent thermal conductivity and reliability in high-power applications. However, plastic and metal packages are also gaining traction as manufacturers seek to balance performance and cost.

Rf Gan Radio Frequency Gallium Nitride Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rf Gan Radio Frequency Gallium Nitride Industry

Qorvo, Inc.:

A leading provider of innovative RF solutions, focusing on high-performance GaN devices and amplifiers for telecommunications and defense applications.Broadcom Inc.:

Specializes in semiconductor and infrastructure software solutions, with a notable portfolio in RF GaN technology catered to multiple sectors.NXP Semiconductors:

Offers a wide range of RF GaN products targeting the aerospace and defense markets, renowned for high efficiency and reliability.Infineon Technologies:

This company provides comprehensive high-performance semiconductor solutions, including GaN technology for power applications.Transphorm Inc.:

Focuses on GaN power devices aimed at commercial and industrial applications, known for energy efficiency advancements.We're grateful to work with incredible clients.

FAQs

What is the market size of rf Gan Radio Frequency Gallium Nitride?

The RF GaN technology market is projected to reach approximately $3.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.2% from 2023, where it stands at around 3.5 billion. This growth is indicative of increasing demand and technological advancements.

What are the key market players or companies in this rf Gan Radio Frequency Gallium Nitride industry?

Key players in the RF GaN market include major semiconductor companies like Cree, NXP Semiconductors, Qorvo, and Analog Devices. These companies are leaders due to their innovative product offerings and strong capabilities in high-frequency applications, making them pivotal in driving market growth.

What are the primary factors driving the growth in the rf Gan Radio Frequency Gallium Nitride industry?

Growth in the RF GaN industry is driven by rising demand for high-efficiency power amplifiers, increasing adoption in aerospace and defense applications, and advancements in consumer electronics. Additionally, the burgeoning telecommunications sector further propels the demand for GaN-based technologies.

Which region is the fastest Growing in the rf Gan Radio Frequency Gallium Nitride?

The fastest-growing region for RF GaN technology is Europe, with its market projected to grow from $1.21 billion in 2023 to $3.01 billion by 2033. The region's focus on advanced telecommunications and defense systems is a significant driver of this growth.

Does Consainsights provide customized market report data for the rf Gan Radio Frequency Gallium Nitride industry?

Yes, Consainsights offers customized market report data tailored to the specific needs of clients in the RF GaN industry. This customization ensures that businesses receive insights aligned with their strategic goals and market interests.

What deliverables can I expect from this rf Gan Radio Frequency Gallium Nitride market research project?

Deliverables from the RF GaN market research project include a comprehensive report, market forecasts, segment analysis, competitive landscape assessments, and recommendations for strategic direction, ensuring stakeholders are well-informed for decision-making.

What are the market trends of rf Gan Radio Frequency Gallium Nitride?

Market trends in RF GaN technology include increasing utilization in 5G networks, advancements in power electronics, and a shift towards miniaturized devices. Additionally, sustainable manufacturing practices are gaining traction, reflecting a growing focus on environmental considerations within technology.