Rfid And Barcode Printer Market Report

Published Date: 31 January 2026 | Report Code: rfid-and-barcode-printer

Rfid And Barcode Printer Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the RFID and Barcode Printer market, covering market overview, size, CAGR, industry analysis, segmentation, and trends from 2023 to 2033.

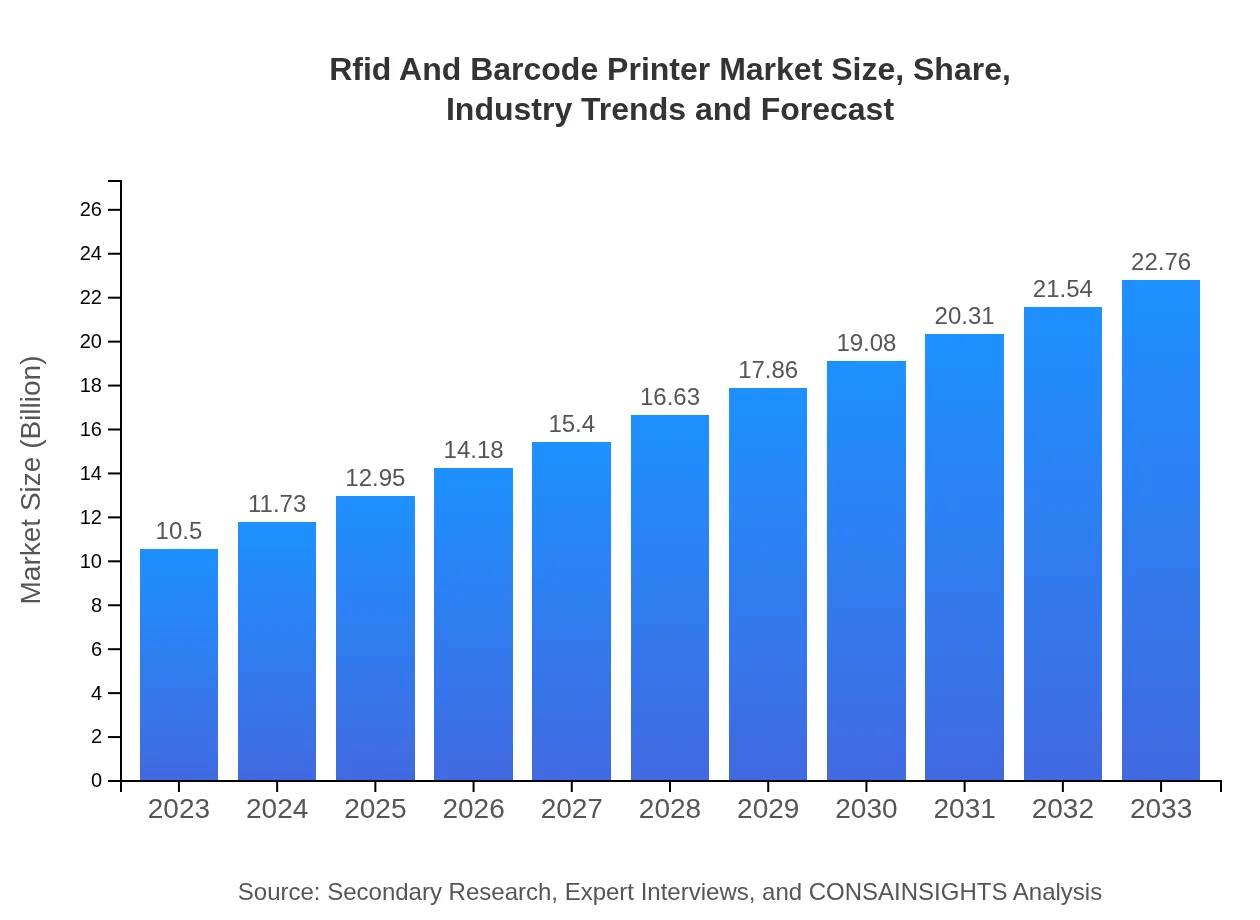

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Zebra Technologies, Honeywell International Inc., SATO Holdings Corporation, Canon Inc. |

| Last Modified Date | 31 January 2026 |

RFID And Barcode Printer Market Overview

Customize Rfid And Barcode Printer Market Report market research report

- ✔ Get in-depth analysis of Rfid And Barcode Printer market size, growth, and forecasts.

- ✔ Understand Rfid And Barcode Printer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rfid And Barcode Printer

What is the Market Size & CAGR of RFID And Barcode Printer market in Year?

RFID And Barcode Printer Industry Analysis

RFID And Barcode Printer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

RFID And Barcode Printer Market Analysis Report by Region

Europe Rfid And Barcode Printer Market Report:

The European RFID and Barcode Printer market faced a size of $2.93 million in 2023, projected to reach $6.36 million by 2033. Key drivers include stringent regulations, supply chain enhancements, and adoption of advanced printing technologies.Asia Pacific Rfid And Barcode Printer Market Report:

The Asia Pacific RFID and Barcode Printer market size in 2023 was approximately $2.06 million and is expected to reach $4.47 million by 2033, reflecting strong growth due to rising industrial automation and increased e-commerce activities in countries like China and India.North America Rfid And Barcode Printer Market Report:

In North America, the market was estimated at $3.83 million in 2023 and is expected to grow to $8.31 million by 2033. The region benefits from technological advancements and a mature market with increased demand from retail and healthcare sectors.South America Rfid And Barcode Printer Market Report:

The South American market for RFID and Barcode Printers was valued at $0.87 million in 2023, projected to grow to $1.88 million by 2033. Growth factors include the ongoing digital transformation across several key industries.Middle East & Africa Rfid And Barcode Printer Market Report:

The Middle East and Africa market was valued at $0.80 million in 2023, with expected growth to $1.74 million by 2033. Factors include increasing investments in various sectors and growing awareness of RFID and barcode solutions.Tell us your focus area and get a customized research report.

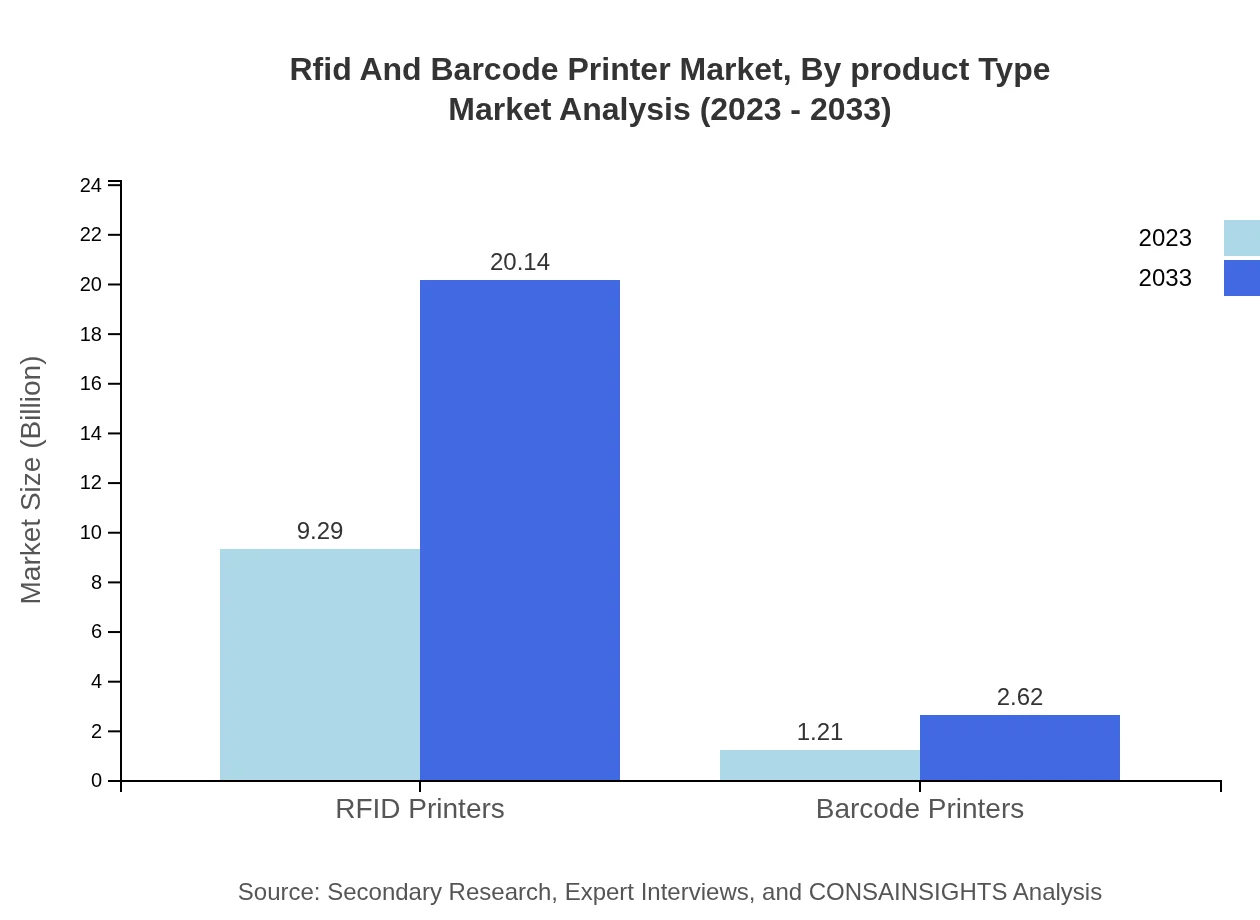

Rfid And Barcode Printer Market Analysis By Product Type

The RFID and Barcode Printer market is primarily segmented into RFID Printers and Barcode Printers. RFID Printers constitute a significant share, accounting for 88.47% in 2023, and projected to maintain this dominance with a market size reaching $20.14 million by 2033. Barcode Printers, while smaller, grow from $1.21 million in 2023 to $2.62 million by 2033, capturing 11.53% market share.

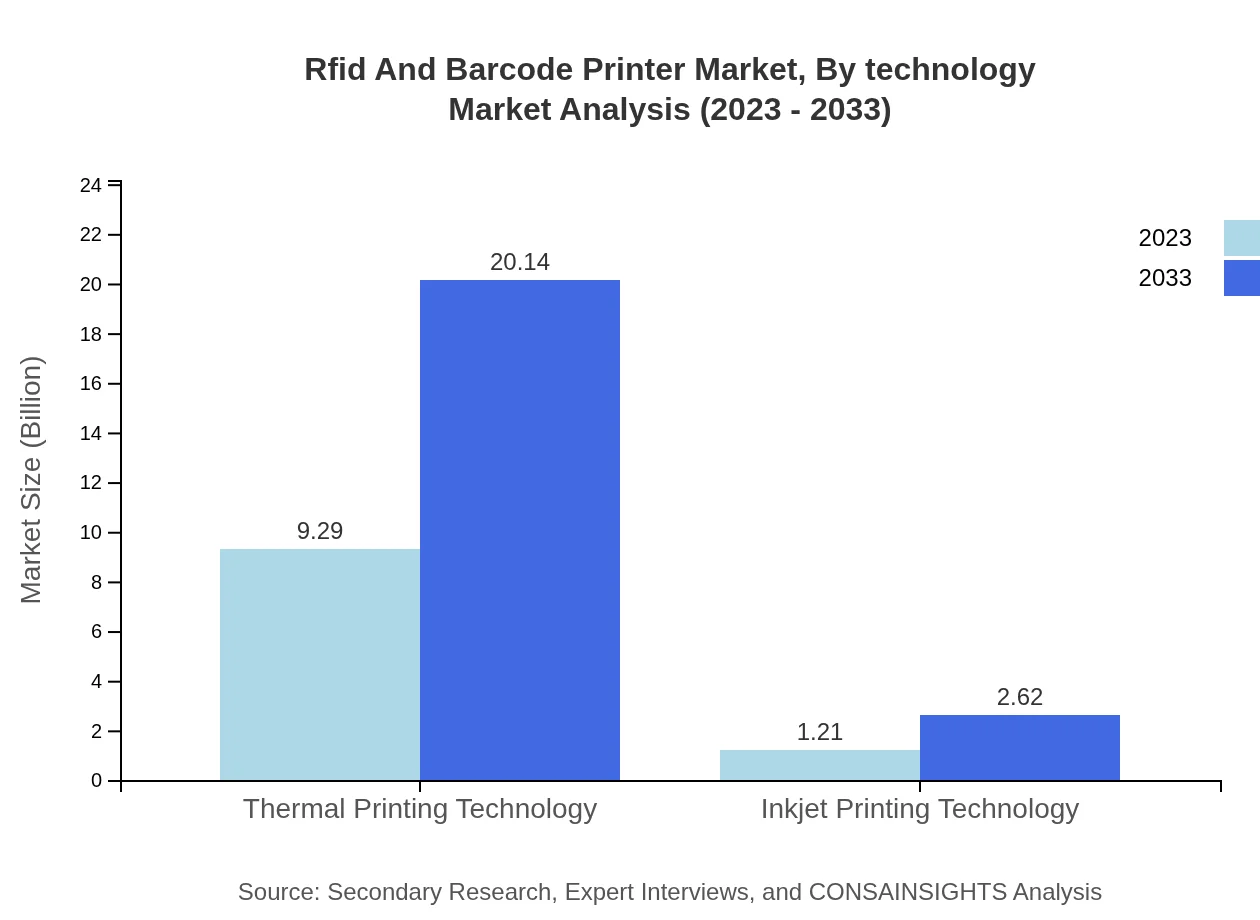

Rfid And Barcode Printer Market Analysis By Technology

The market is largely driven by Thermal Printing Technology, which dominates the segment with a share of 88.47% in 2023, expanding to $20.14 million by 2033. In contrast, Inkjet Printing Technology holds a smaller segment with a market size growing from $1.21 million in 2023 to $2.62 million by 2033, securing 11.53%.

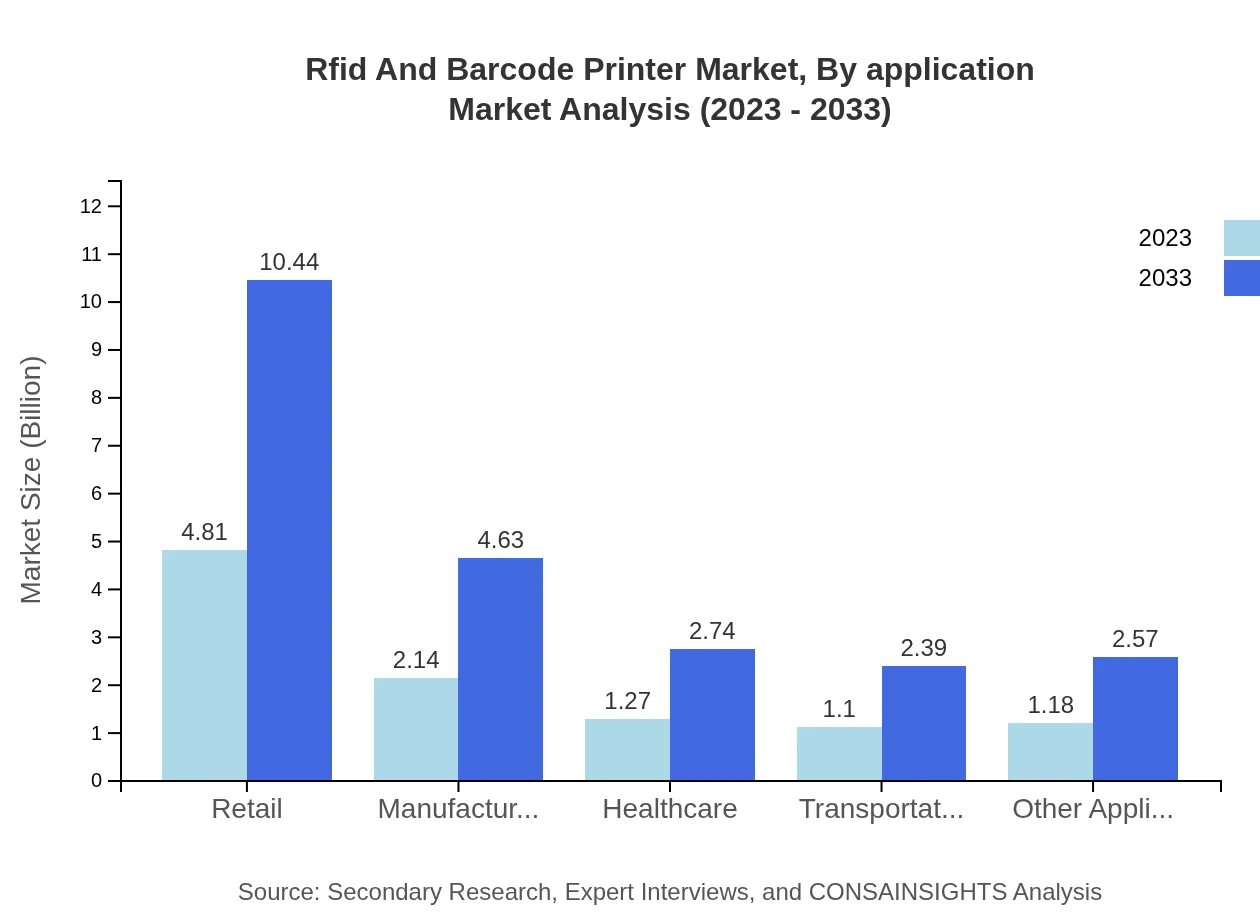

Rfid And Barcode Printer Market Analysis By Application

Key applications influencing the market include Retail, Manufacturing, Healthcare, and Transportation & Logistics. Retail, with a market size of $4.81 million in 2023, is projected to reach $10.44 million by 2033, holding a significant 45.85% market share.

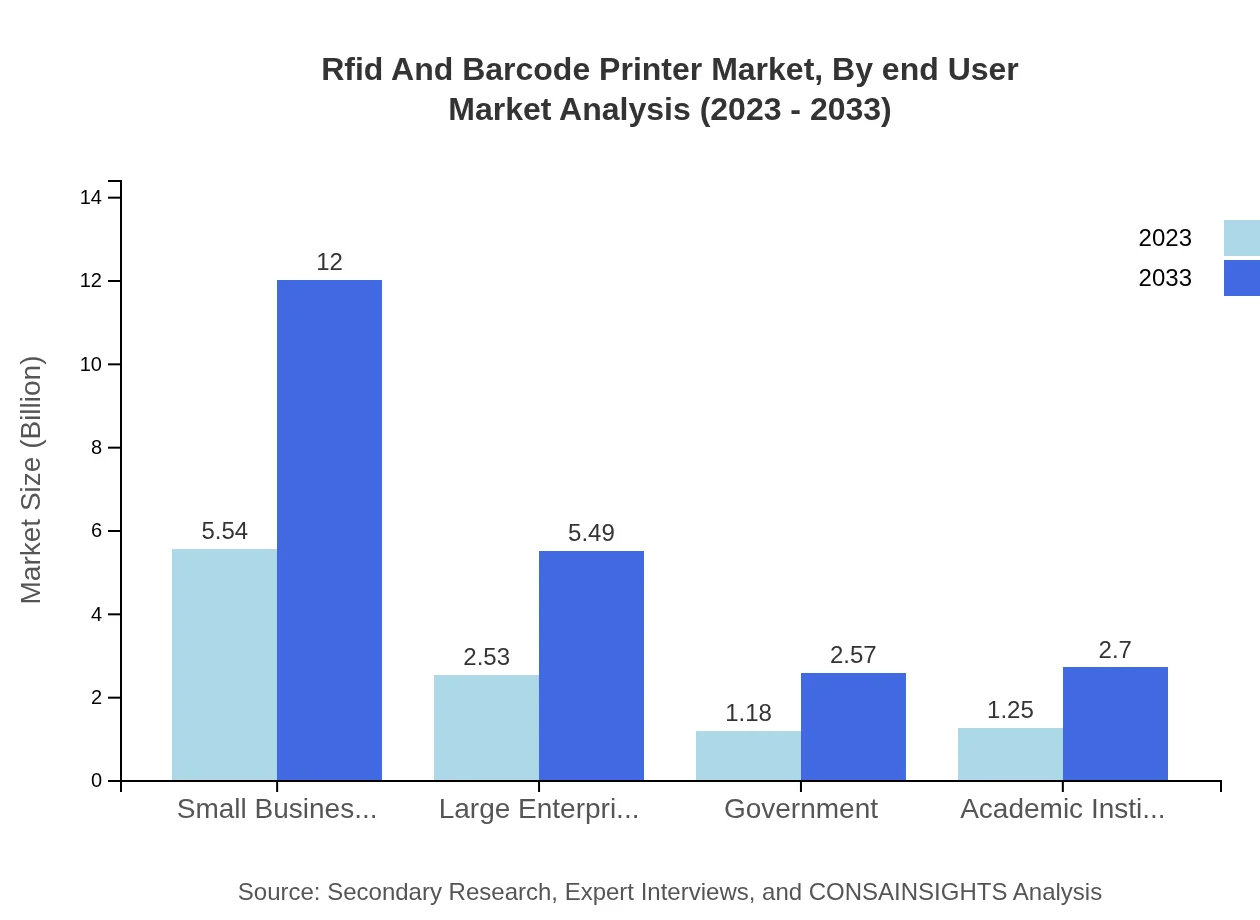

Rfid And Barcode Printer Market Analysis By End User

End-users include Small Businesses, Large Enterprises, Government, and Academic Institutions. Small Businesses lead the market with a size of $5.54 million in 2023, projected to grow to $12 million by 2033, representing a 52.73% share.

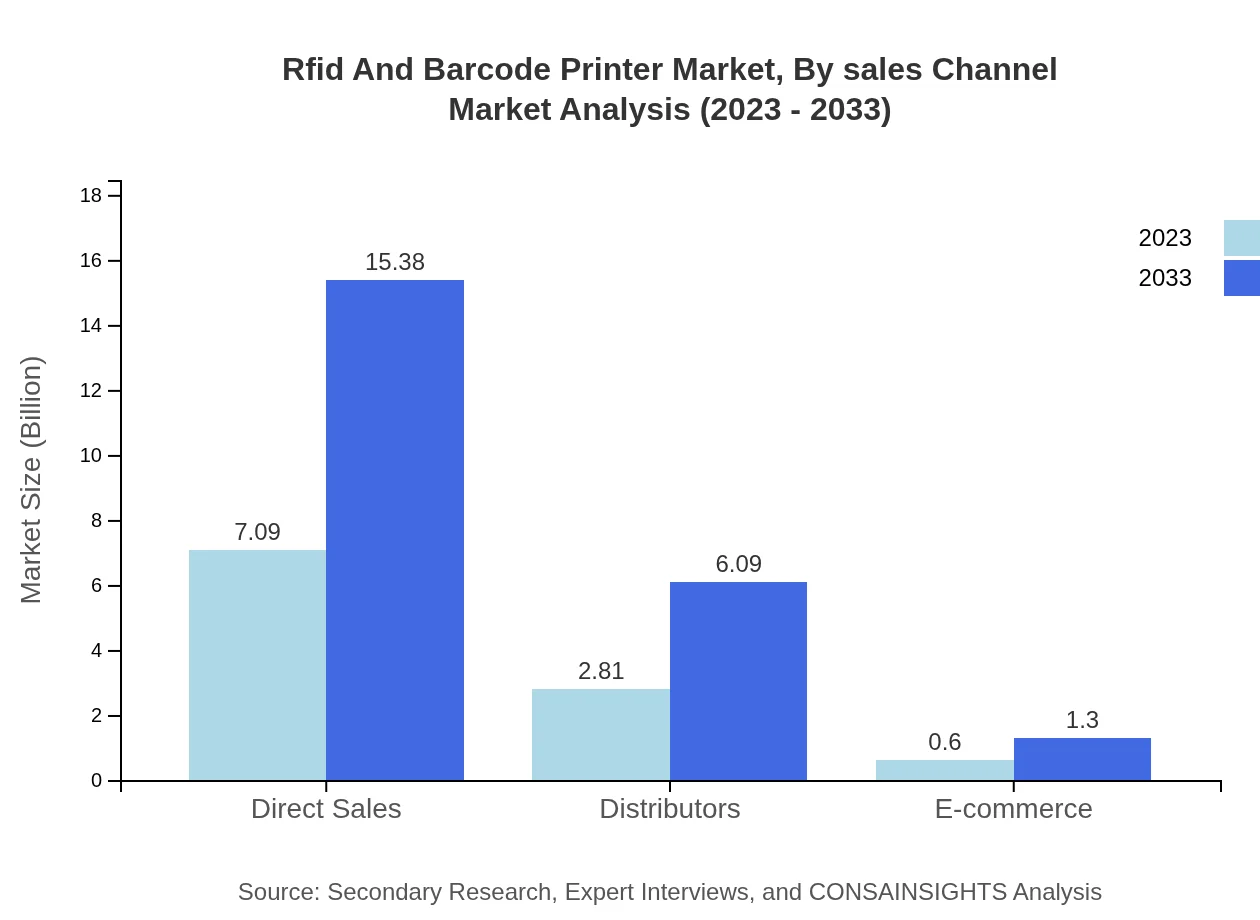

Rfid And Barcode Printer Market Analysis By Sales Channel

The market is segmented by sales channels into Direct Sales, Distributors, and E-commerce. Direct Sales dominate the market with a size of $7.09 million in 2023, growing to $15.38 million by 2033, accounting for 67.57% market share.

RFID And Barcode Printer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in RFID And Barcode Printer Industry

Zebra Technologies:

A leading provider of RFID and barcode printing solutions, Zebra Technologies is known for its innovative products and extensive industry experience.Honeywell International Inc.:

Honeywell specializes in advanced scanning and mobility solutions, enhancing productivity with a range of RFID and barcode printers.SATO Holdings Corporation:

SATO focuses on auto-ID and labeling solutions, offering a variety of RFID and barcode printers tailored to diverse customer needs.Canon Inc.:

Canon provides imaging and printing solutions, including high-quality barcode printers designed for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of rfid And Barcode Printer?

The global RFID and Barcode Printer market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 7.8%. By 2033, this market is expected to significantly expand, making it a key segment in the printing technology sector.

What are the key market players or companies in this rfid And Barcode Printer industry?

The RFID and Barcode Printer market features several key players, including prominent manufacturers and technology providers. Leading companies focus on innovation and customer tailored solutions to maintain competitive advantages and cater to diverse market needs.

What are the primary factors driving the growth in the rfid And Barcode Printer industry?

Factors driving growth in the RFID and Barcode Printer industry include increased demand for inventory management solutions, advancements in printing technology, and the rising need for automated data capture in various sectors such as retail, healthcare, and logistics.

Which region is the fastest Growing in the rfid And Barcode Printer?

The North America region is anticipated to be the fastest-growing market for RFID and Barcode Printers, projected to grow from $3.83 billion in 2023 to $8.31 billion by 2033. This growth is fueled by technological advancements and increasing adoption in various industries.

Does ConsaInsights provide customized market report data for the rfid And Barcode Printer industry?

Yes, ConsaInsights offers customized market report data tailored for the RFID and Barcode Printer industry. Clients can request specifications that match their needs, benefiting from comprehensive data analysis and insights.

What deliverables can I expect from this rfid And Barcode Printer market research project?

From the RFID and Barcode Printer market research project, you can expect detailed reports including market size, trends analysis, competitor insights, regional performance data, and strategic recommendations for market entry or expansion.

What are the market trends of rfid And Barcode Printer?

Key market trends in the RFID and Barcode Printer industry include the shift towards thermal printing technologies, increased integration of IoT for smart inventory solutions, and the growing preference for eco-friendly printing options in response to sustainability demands.