Rfid Antenna Market Report

Published Date: 31 January 2026 | Report Code: rfid-antenna

Rfid Antenna Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Rfid Antenna market from 2023 to 2033, covering market size, growth trends, regional insights, and key players in the industry.

| Metric | Value |

|---|---|

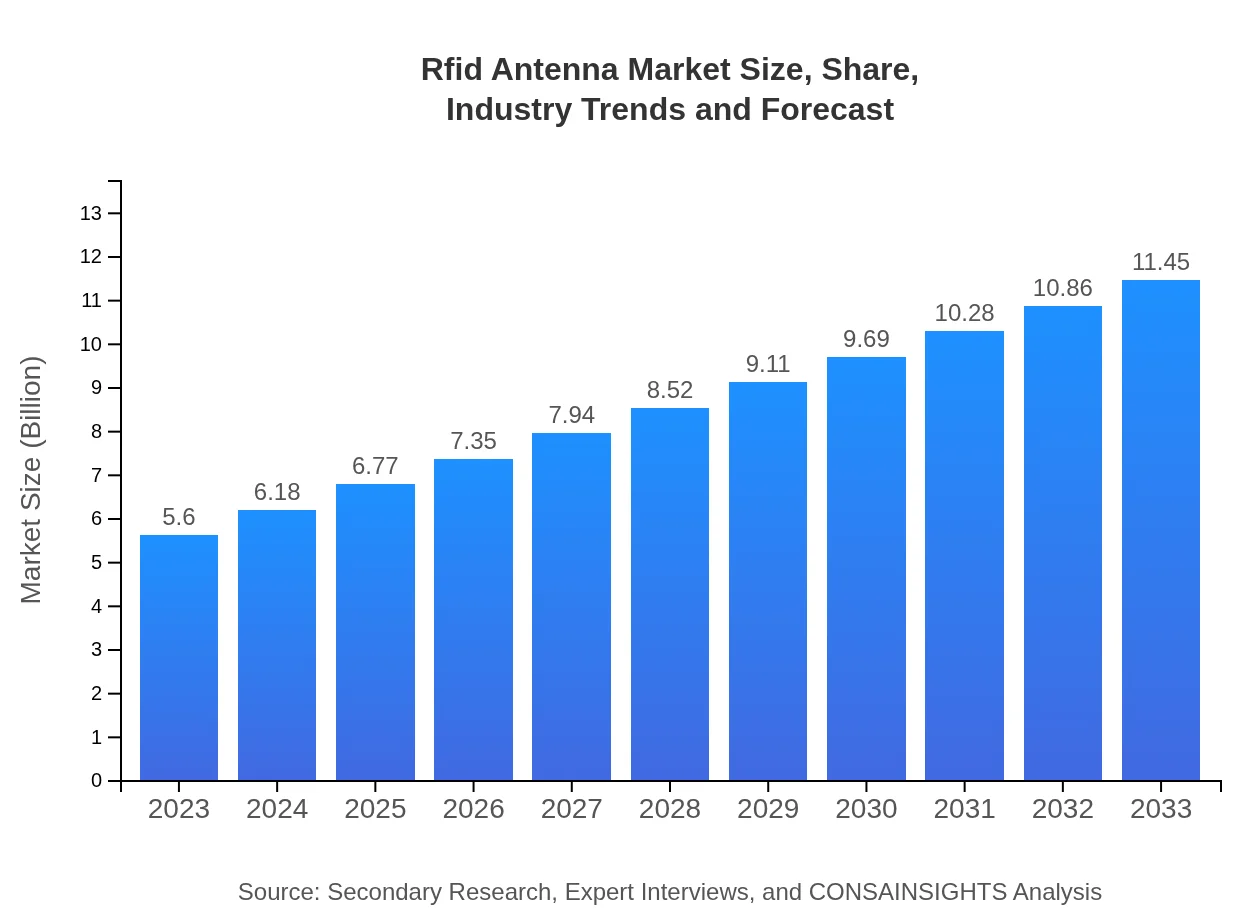

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Impinj, Inc., Alien Technology, Zebra Technologies, SML RFID |

| Last Modified Date | 31 January 2026 |

Rfid Antenna Market Overview

Customize Rfid Antenna Market Report market research report

- ✔ Get in-depth analysis of Rfid Antenna market size, growth, and forecasts.

- ✔ Understand Rfid Antenna's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rfid Antenna

What is the Market Size & CAGR of Rfid Antenna market in 2033?

Rfid Antenna Industry Analysis

Rfid Antenna Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rfid Antenna Market Analysis Report by Region

Europe Rfid Antenna Market Report:

Europe is experiencing robust growth in the Rfid Antenna market, with projections of increasing from USD 1.64 billion in 2023 to USD 3.34 billion in 2033. Key factors include stringent regulations on inventory management and traceability requirements across industries, fostering the adoption of RFID technology.Asia Pacific Rfid Antenna Market Report:

The Rfid Antenna market in Asia Pacific is anticipated to grow significantly, from USD 1.18 billion in 2023 to USD 2.42 billion in 2033. This growth is attributed to rapid industrialization, rising adoption of RFID solutions in manufacturing and retail, and government initiatives promoting smart manufacturing technologies.North America Rfid Antenna Market Report:

The North American market, with a value of USD 1.94 billion in 2023, is expected to reach USD 3.97 billion in 2033. The region benefits from advanced technological adoption, particularly in logistics, healthcare, and retail sectors, underscored by significant investments in integrated RFID systems.South America Rfid Antenna Market Report:

In South America, the market is projected to expand from USD 0.38 billion in 2023 to USD 0.77 billion by 2033. The growth is driven by increasing awareness of operational efficiencies and improving infrastructure capabilities to support RFID technologies.Middle East & Africa Rfid Antenna Market Report:

The Rfid Antenna market in the Middle East and Africa is anticipated to grow from USD 0.46 billion in 2023 to USD 0.95 billion by 2033 due to increasing retail and logistics sectors and rising investment in smart solutions.Tell us your focus area and get a customized research report.

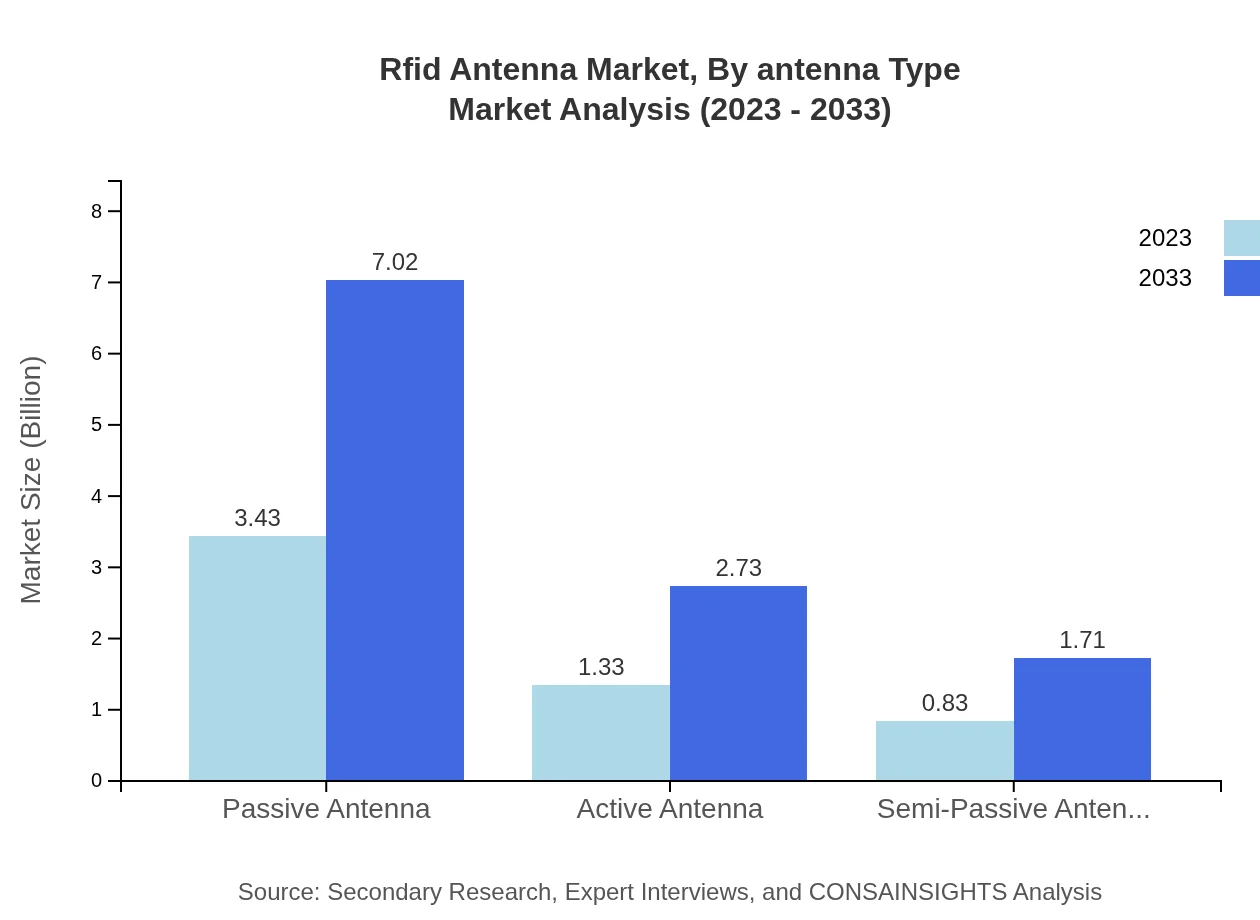

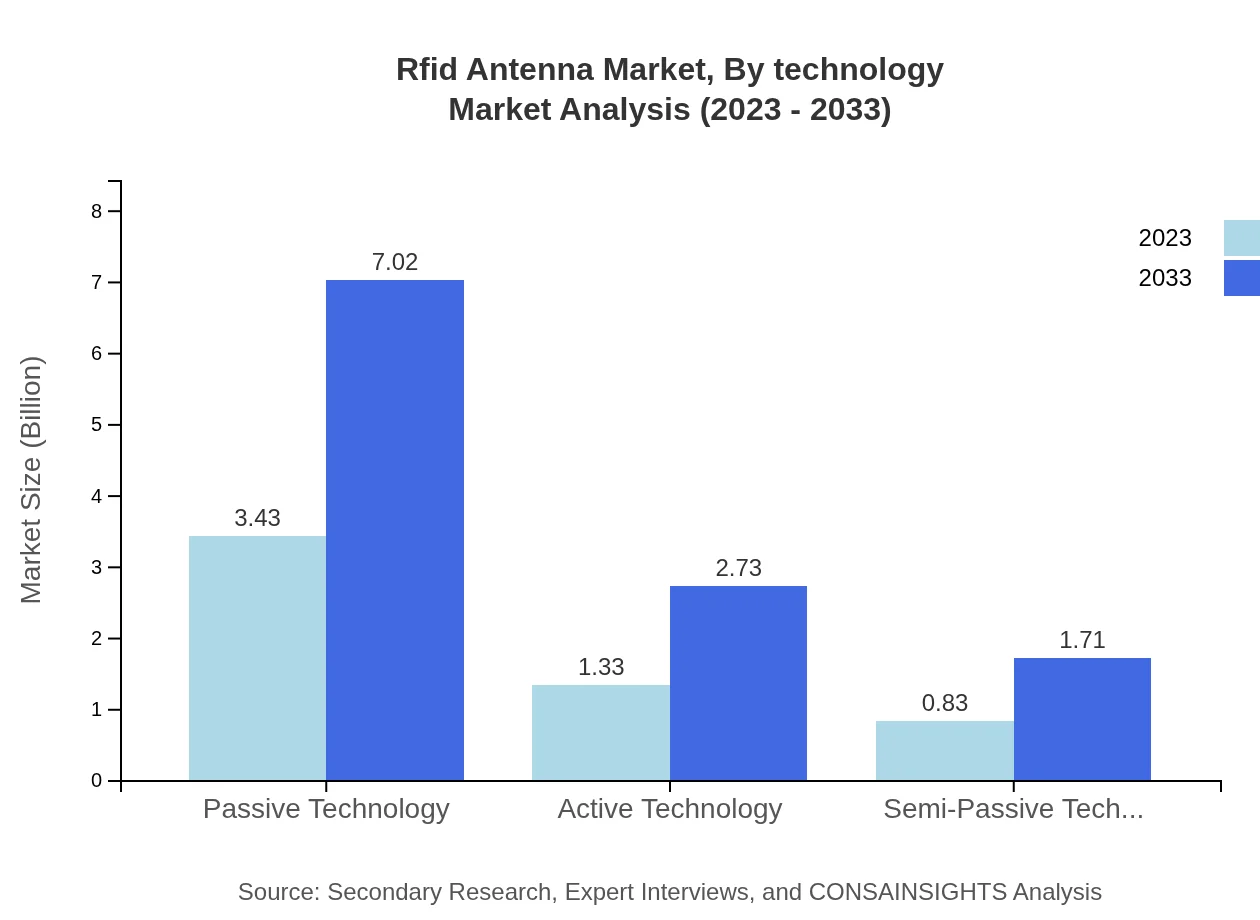

Rfid Antenna Market Analysis By Antenna Type

The RFID Antenna market is notably influenced by the type of antennas used, with passive antennas representing a significant market share. In 2023, passive antennas commanded a major portion, with revenues of USD 3.43 billion and an expected growth to USD 7.02 billion by 2033.

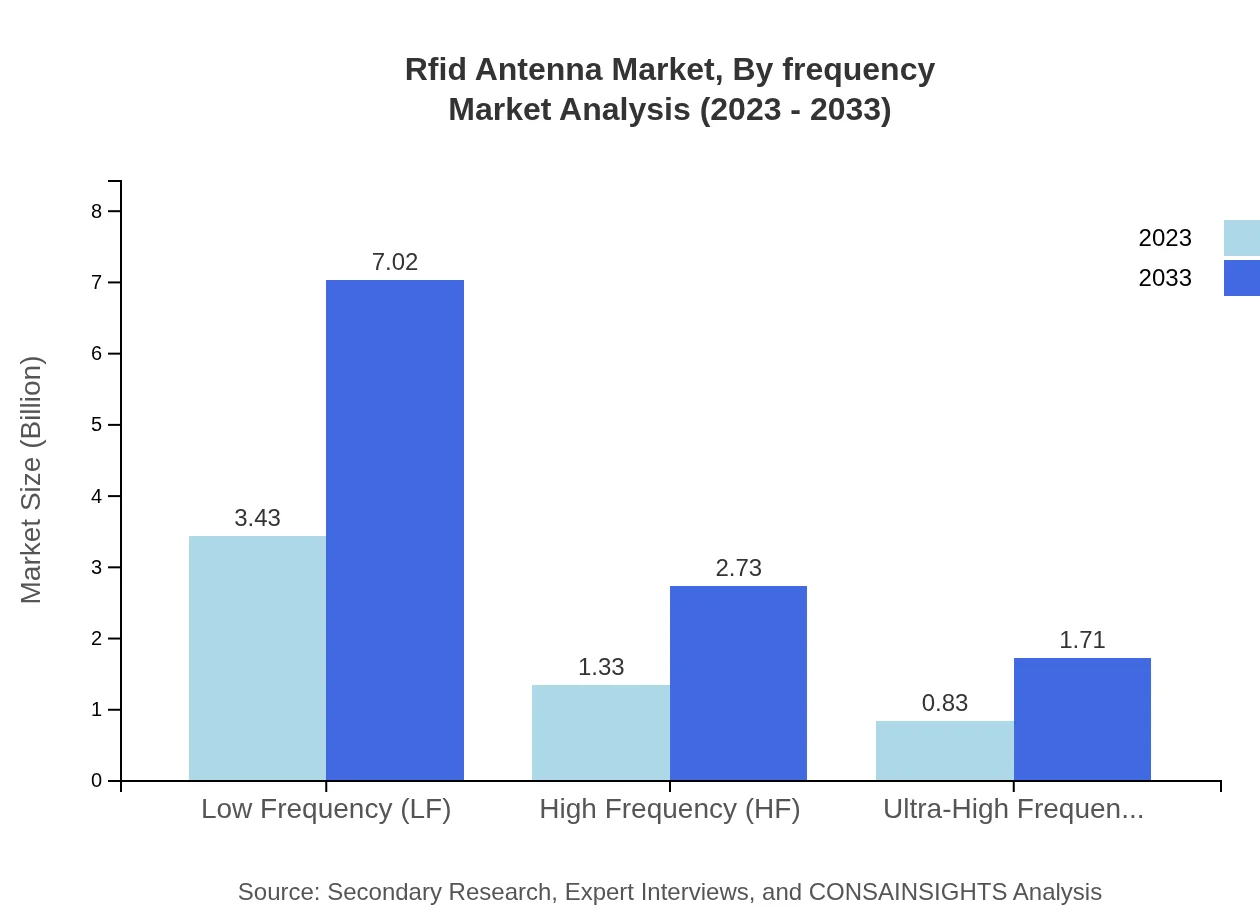

Rfid Antenna Market Analysis By Frequency

In the frequency segment, Low Frequency (LF) antennas lead the market, valued at USD 3.43 billion in 2023 and projecting to USD 7.02 billion by 2033. The distribution of frequencies plays a vital role in determining antenna deployment based on application needs.

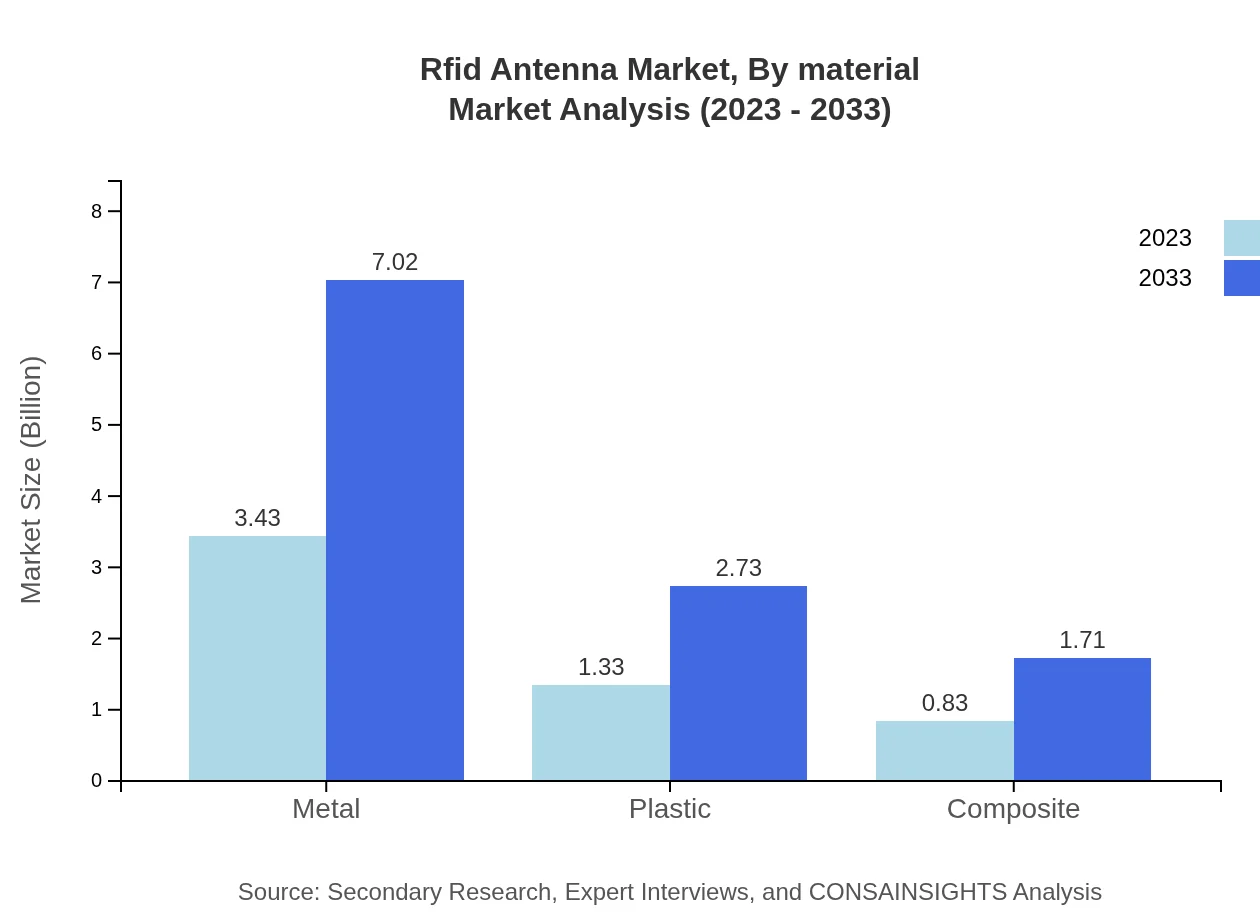

Rfid Antenna Market Analysis By Material

The material segment indicates that metal antennas dominate with a projected market size of USD 3.43 billion in 2023, expanding to USD 7.02 billion by 2033. Metal materials provide optimal performance in terms of signal propagation and durability.

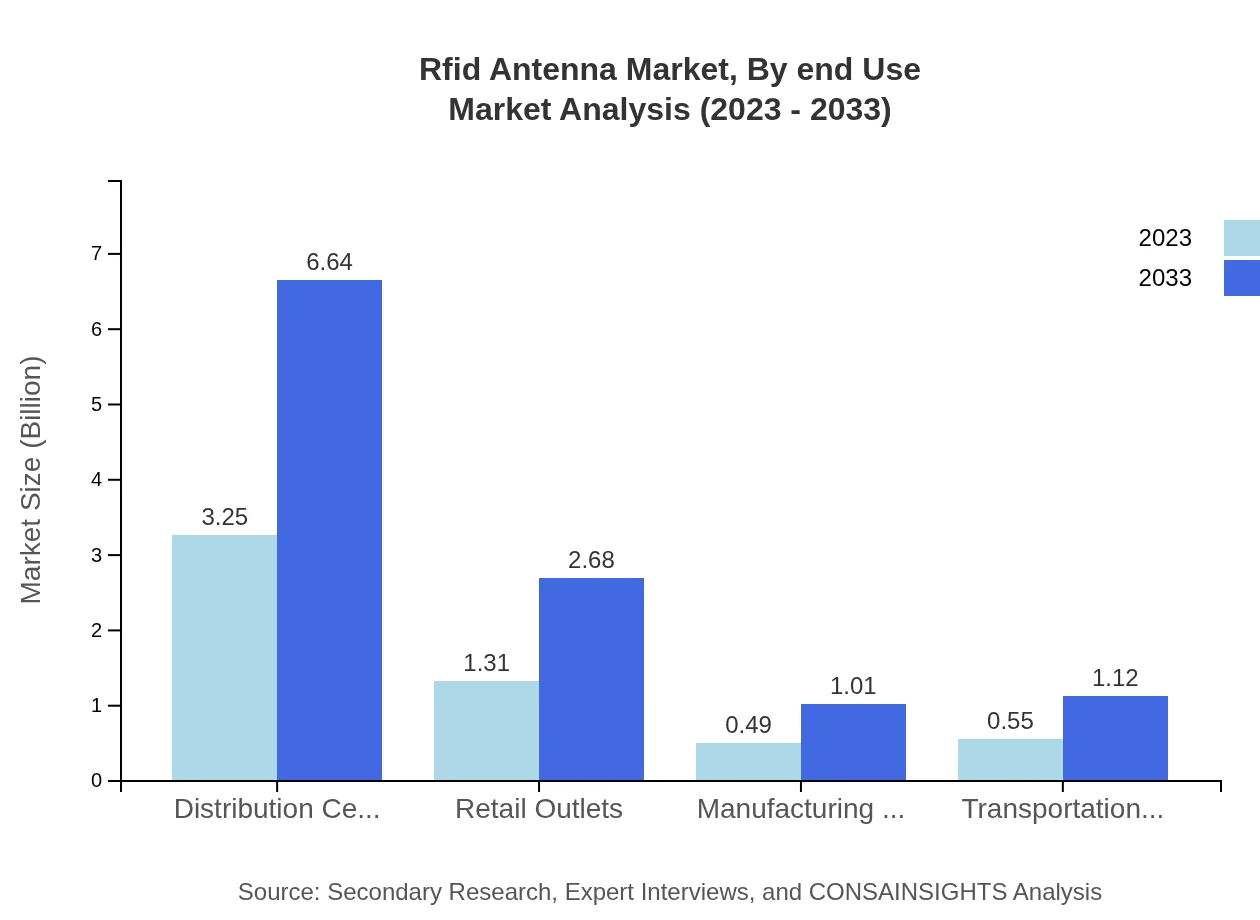

Rfid Antenna Market Analysis By End Use

Distribution centers have emerged as key end-users of RFID antennas, accounting for a market size of USD 3.25 billion in 2023, expected to rise to USD 6.64 billion by 2033. This segment's growth is fueled by the increasing needs for real-time inventory tracking.

Rfid Antenna Market Analysis By Technology

Based on technology, passive technology dominates the RFID Antenna market, with a share of USD 3.43 billion in 2023, continuing to grow significantly. Any advancement in technology such as semi-passive and active antennas also showcases promising growth potential.

Rfid Antenna Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rfid Antenna Industry

Impinj, Inc.:

Impinj is a leading provider of Rfid solutions, specializing in Rfid readers and antenna technologies, helping enterprises optimize their inventory and asset management processes.Alien Technology:

Alien Technology is well-known for its innovative Rfid products and solutions, including a variety of antennas that cater to different application needs within industries.Zebra Technologies:

Zebra Technologies is a global leader in Rfid and barcode technology with a broad portfolio of Rfid antennas designed for diverse environments and applications.SML RFID:

SML RFID specializes in Rfid solutions, including antennas that enhance product visibility and inventory accuracy for varied sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of RFID antenna?

The RFID antenna market is projected to grow from $5.6 billion in 2023 to significant heights by 2033, with a robust CAGR of 7.2%. This growth indicates increasing adoption in various industries, driven by advancements in RFID technology.

What are the key market players or companies in the RFID antenna industry?

Key players in the RFID antenna industry include major technology firms and manufacturers that specialize in RFID systems. Their innovative developments and market strategies significantly influence competition and technological advancements within the market.

What are the primary factors driving the growth in the RFID antenna industry?

The RFID antenna industry is driven by factors such as increasing demand for automation in manufacturing and retail, enhanced tracking functionalities, and technological advancements. The push for operational efficiency and real-time data access greatly boosts market growth.

Which region is the fastest Growing in the RFID antenna market?

The Asia Pacific region is the fastest-growing market for RFID antennas, expanding from $1.18 billion in 2023 to $2.42 billion by 2033. This rapid growth is attributed to increased adoption in logistics and manufacturing sectors across the region.

Does ConsaInsights provide customized market report data for the RFID antenna industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the RFID antenna sector. Clients can request bespoke analyses that cater to niche segments or geographic regions to enhance strategic decision-making.

What deliverables can I expect from this RFID antenna market research project?

Expect comprehensive deliverables including a detailed market analysis report, segmentation data by region and application, competitive landscape insights, and growth forecasts. These deliverables enable informed decisions and strategic planning.

What are the market trends of RFID antenna?

Current market trends for RFID antennas include a shift towards miniaturization, increased use in supply chain management, and the integration of IoT capabilities. These trends reflect a growing focus on efficiency and connectivity in various industries.