Rigid Packaging Market Report

Published Date: 22 January 2026 | Report Code: rigid-packaging

Rigid Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Rigid Packaging market from 2023 to 2033, covering market size, growth rates, industry trends, and forecasts, along with regional insights and competitive landscape.

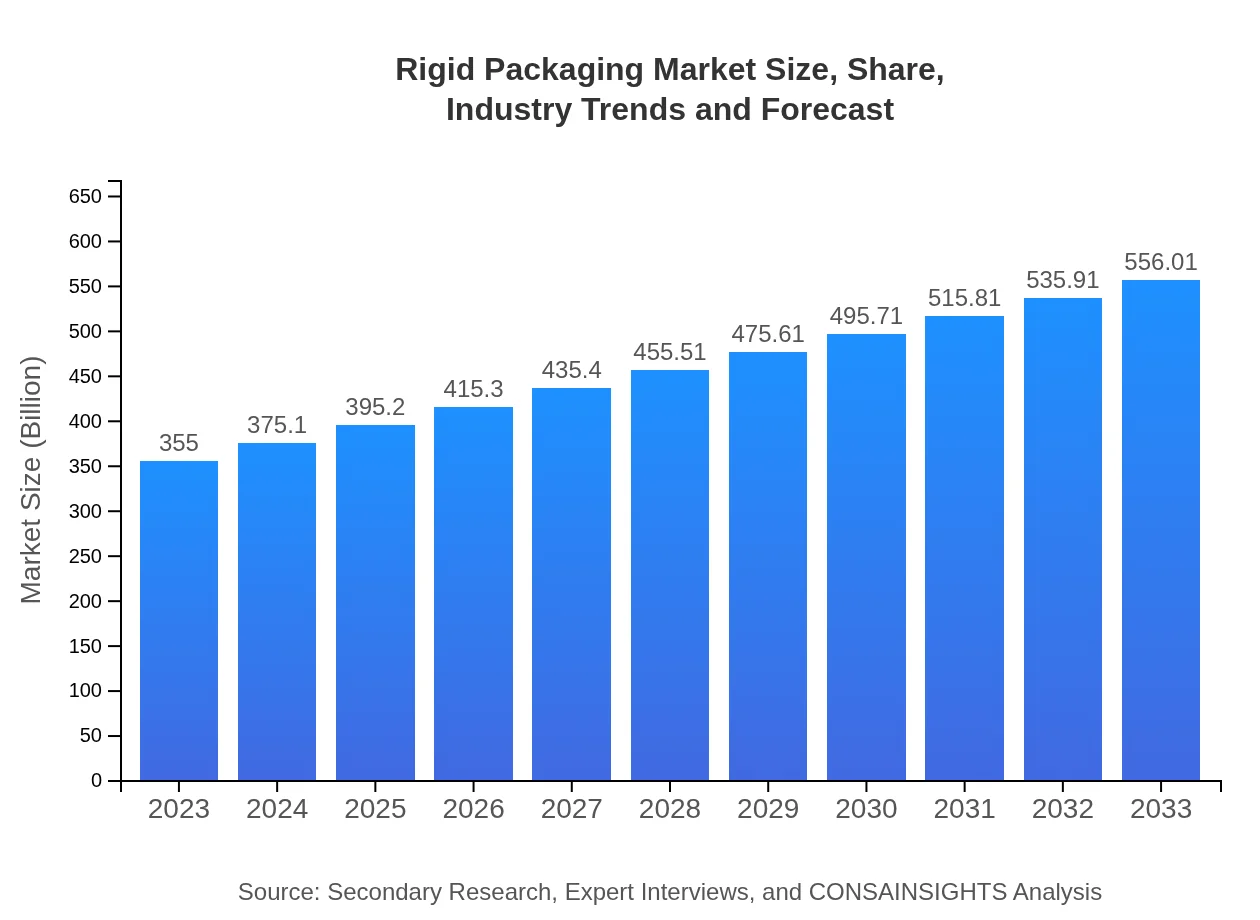

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $355.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $556.01 Billion |

| Top Companies | Amcor Plc, Tetra Pak International S.A., Berry Global, Inc., Sealed Air Corporation |

| Last Modified Date | 22 January 2026 |

Rigid Packaging Market Overview

Customize Rigid Packaging Market Report market research report

- ✔ Get in-depth analysis of Rigid Packaging market size, growth, and forecasts.

- ✔ Understand Rigid Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rigid Packaging

What is the Market Size & CAGR of Rigid Packaging market in 2023?

Rigid Packaging Industry Analysis

Rigid Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rigid Packaging Market Analysis Report by Region

Europe Rigid Packaging Market Report:

Europe's market in 2023 is estimated at $95.46 billion, expected to increase to $149.51 billion by 2033. The region's growth is propelled by stringent regulations on packaging waste and a substantial shift towards sustainable practices among consumers and manufacturers.Asia Pacific Rigid Packaging Market Report:

In 2023, the Asia Pacific region's Rigid Packaging market is valued at $70.08 billion, with expectations to grow to $109.76 billion by 2033. This surge is fueled by rising urbanization, disposable incomes, and an expanding manufacturing base, particularly in China and India. The region also embraces sustainable packaging initiatives to meet consumer preferences.North America Rigid Packaging Market Report:

North America dominates the Rigid Packaging market with a valuation of $136.07 billion in 2023 and anticipated growth to $213.12 billion by 2033. Factors contributing to this include technological advancements in packaging solutions and robust demand across food, beverage, and healthcare sectors.South America Rigid Packaging Market Report:

The South American market for Rigid Packaging stood at $10.40 billion in 2023, projected to reach $16.29 billion by 2033. Growth in this region is driven by increasing consumption in the food and beverage sector, alongside a shift toward eco-friendly packaging solutions.Middle East & Africa Rigid Packaging Market Report:

In 2023, the Middle East and Africa Rigid Packaging market is valued at $42.99 billion, projected to expand to $67.33 billion by 2033. Increased government focus on packaging standards, coupled with a growing population, drives demand, particularly in food and healthcare industries.Tell us your focus area and get a customized research report.

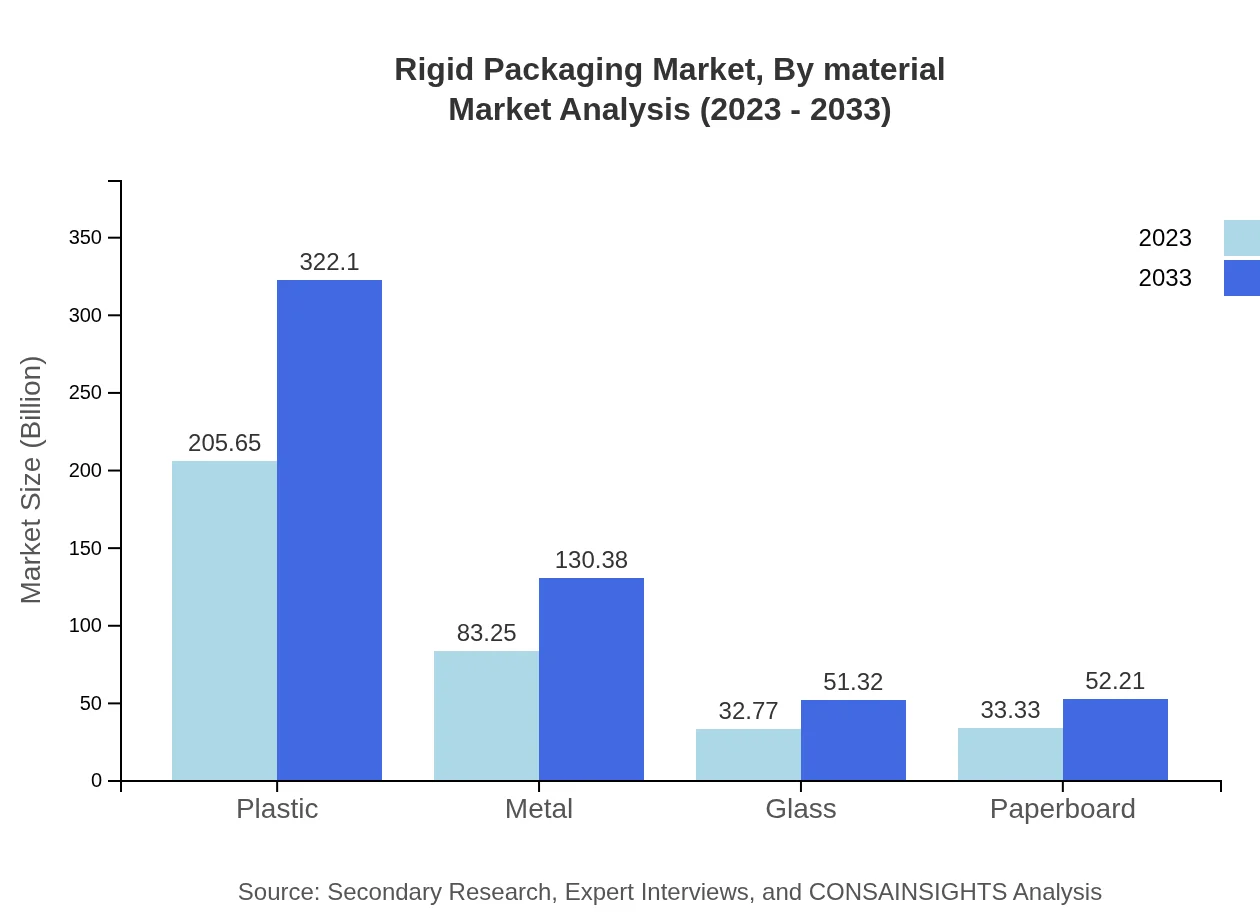

Rigid Packaging Market Analysis By Material

The Rigid Packaging market by material indicates plastic dominating the sector with a share of 57.93% in 2023, projected to grow from $205.65 billion to $322.10 billion by 2033. Other materials such as metal, glass, and paperboard also contribute significantly with improving market shares as manufacturers aim for sustainability and innovation.

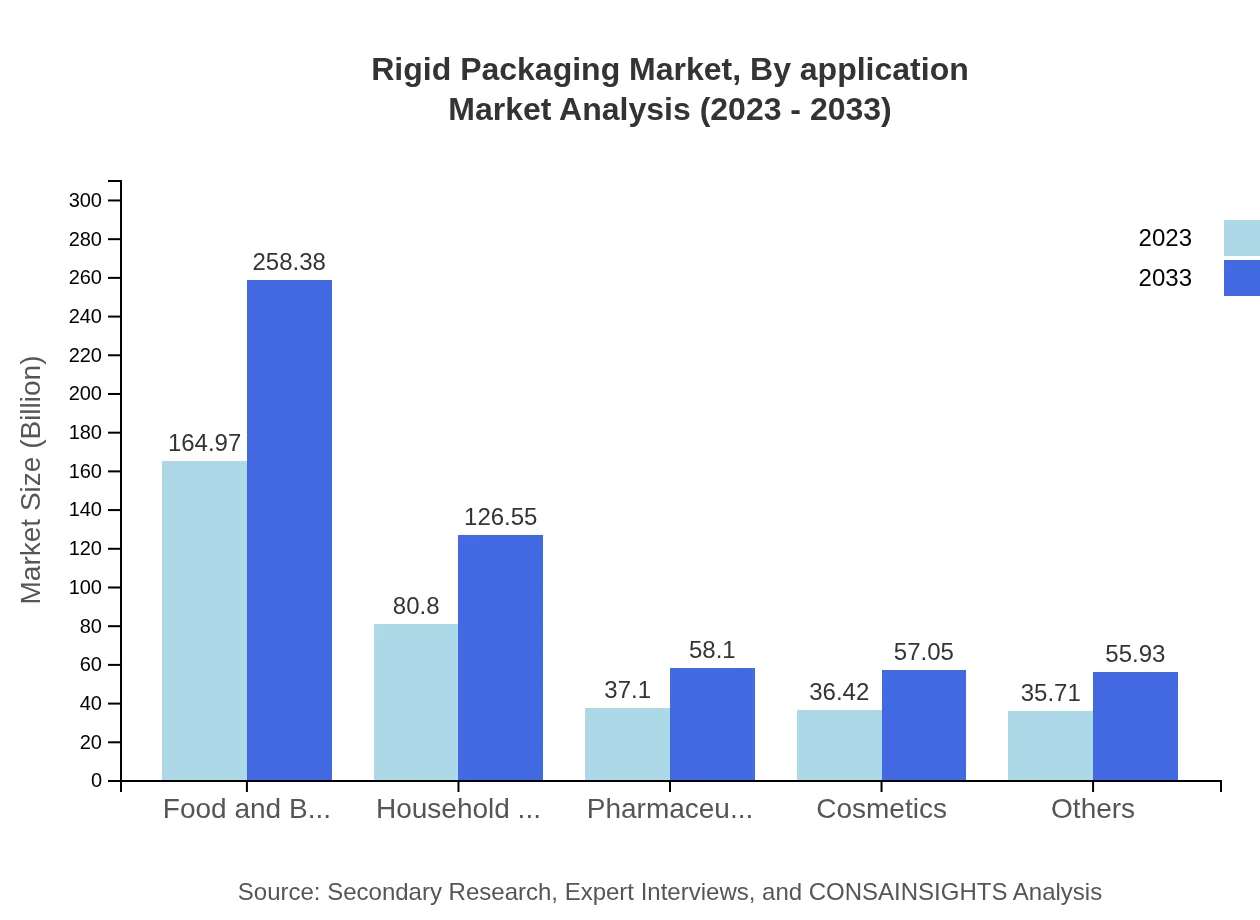

Rigid Packaging Market Analysis By Application

In terms of application, the Food Industry leads with a market share of 46.47% in 2023. Following closely are the Beverage Industry and Personal Care segments, all benefiting from the increased demand for packaged goods. Projections indicate growth in these sectors as health-conscious packaging becomes a priority.

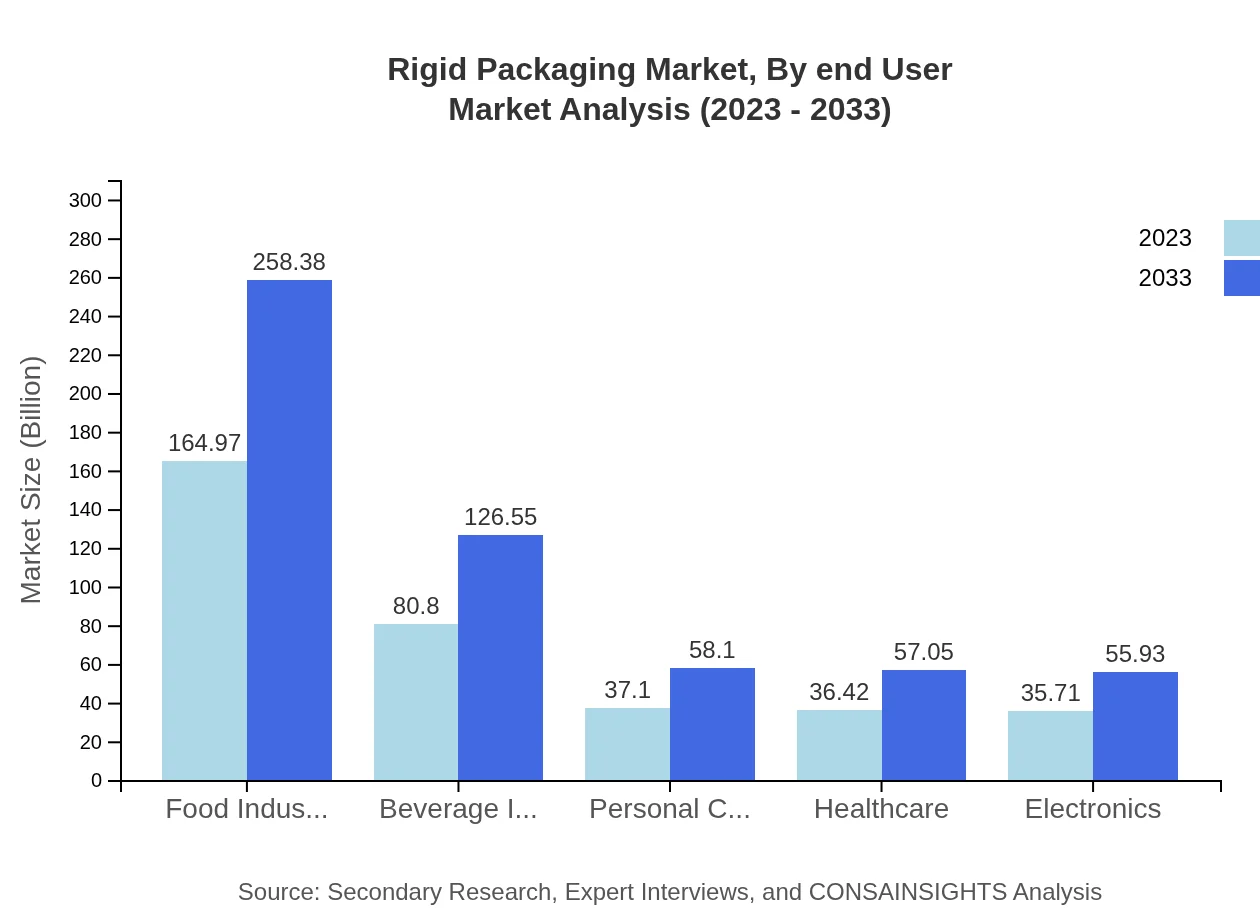

Rigid Packaging Market Analysis By End User

The Food and Beverage sector is a significant end-user in the Rigid Packaging market, accounting for a substantial portion of market share across regions. Other industries such as Cosmetics and Pharmaceuticals are also growing, with customization and functionality often dictating buying decisions.

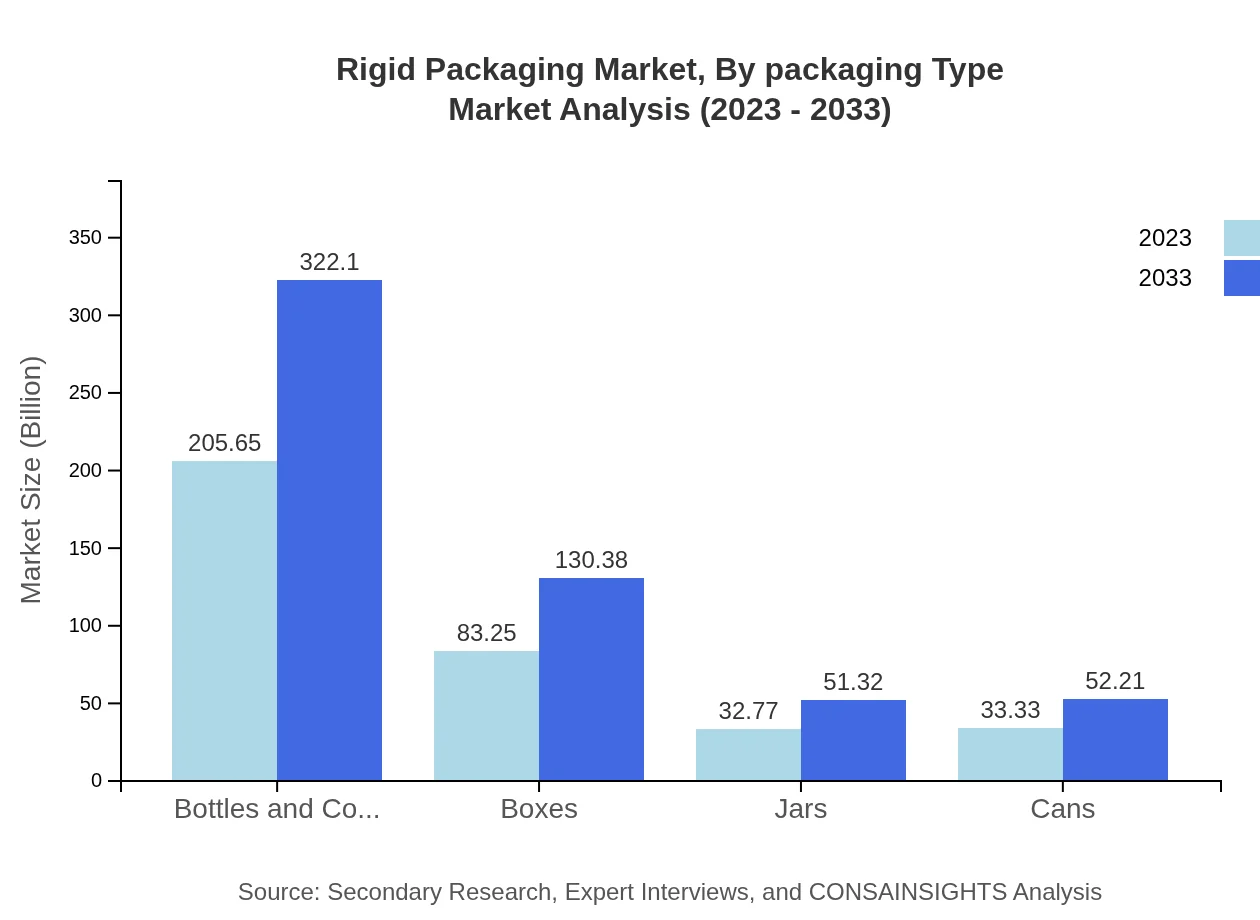

Rigid Packaging Market Analysis By Packaging Type

Among packaging types, Bottles and Containers lead the segment, making up 57.93% of the market in 2023. Jars and Boxes also hold considerable shares, and all three are expected to see growth as demand for safe, durable, and aesthetically pleasing packaging rises.

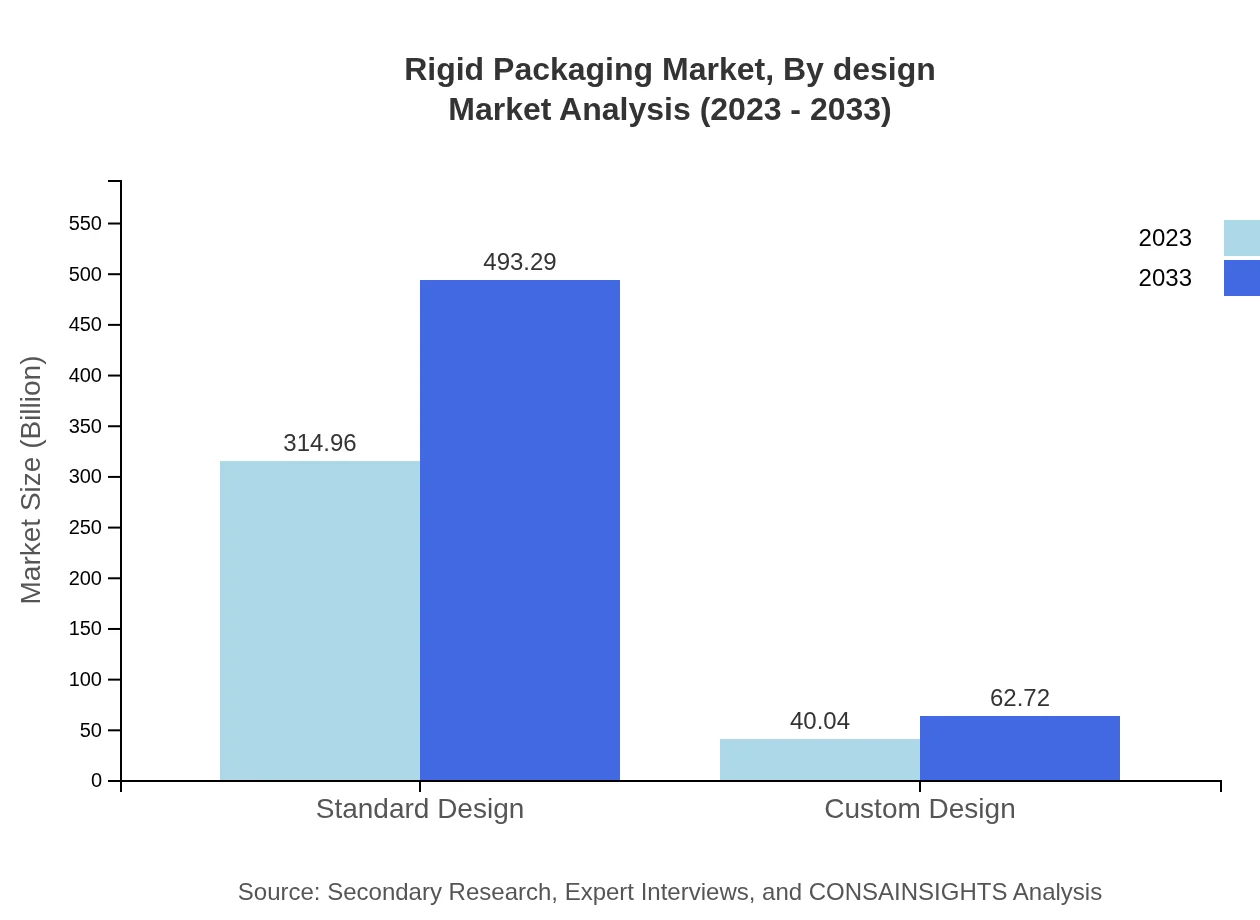

Rigid Packaging Market Analysis By Design

Standard Design packaging maintains a stronghold in the market, representing a significant portion of overall sales. As market competition increases, Custom Design packaging is gaining traction, particularly in sectors that value brand uniqueness and consumer engagement.

Rigid Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rigid Packaging Industry

Amcor Plc:

A global leader in responsible packaging solutions, Amcor specializes in developing innovative and sustainable packaging for various industries, from food and beverage to pharmaceuticals.Tetra Pak International S.A.:

Renowned for its advanced packaging technology, Tetra Pak focuses on providing solutions that ensure food safety and extend shelf life, thus playing a pivotal role in the Rigid Packaging market.Berry Global, Inc.:

Berry Global is committed to sustainable packaging, offering a diverse range of rigid and flexible packaging products catering to the needs of various sectors including consumer goods and healthcare.Sealed Air Corporation:

Specializing in protective packaging, Sealed Air is influential in both rigid and flexible segments, offering tailored solutions that enhance product protection and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of rigid Packaging?

The rigid packaging market is projected to reach a size of $355 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.5% from its current state in 2023.

What are the key market players or companies in this rigid Packaging industry?

Key players in the rigid packaging industry include significant companies involved in production across segments such as food, beverages, and pharmaceuticals. These companies maintain innovation in materials and design to meet consumer demands.

What are the primary factors driving the growth in the rigid Packaging industry?

Growth in the rigid packaging industry is driven by factors such as rising demand for sustainable packaging solutions, increased consumer emphasis on product safety and shelf life, and advancements in packaging technologies.

Which region is the fastest Growing in the rigid Packaging?

The fastest-growing region in the rigid packaging market is North America, projected to grow from $136.07 billion in 2023 to $213.12 billion by 2033, reflecting robust demand across various sectors.

Does ConsaInsights provide customized market report data for the rigid Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the rigid packaging industry, ensuring clients receive pertinent insights for their strategic planning.

What deliverables can I expect from this rigid Packaging market research project?

Expect detailed market analysis reports, trend forecasts, competitive landscape assessments, and insights into consumer behavior, along with segment-wise breakdowns and profitable recommendations.

What are the market trends of rigid Packaging?

Key trends include increasing demand for eco-friendly materials, technological advancements in packaging solutions, and a shift toward convenience-driven designs in food and beverage sectors.