Risk Analytics Market Report

Published Date: 31 January 2026 | Report Code: risk-analytics

Risk Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Risk Analytics market, covering market size, growth trends, segmentation, and forecasts for the years 2023 to 2033. Insights into technology, regional distributions, and key industry players are also discussed.

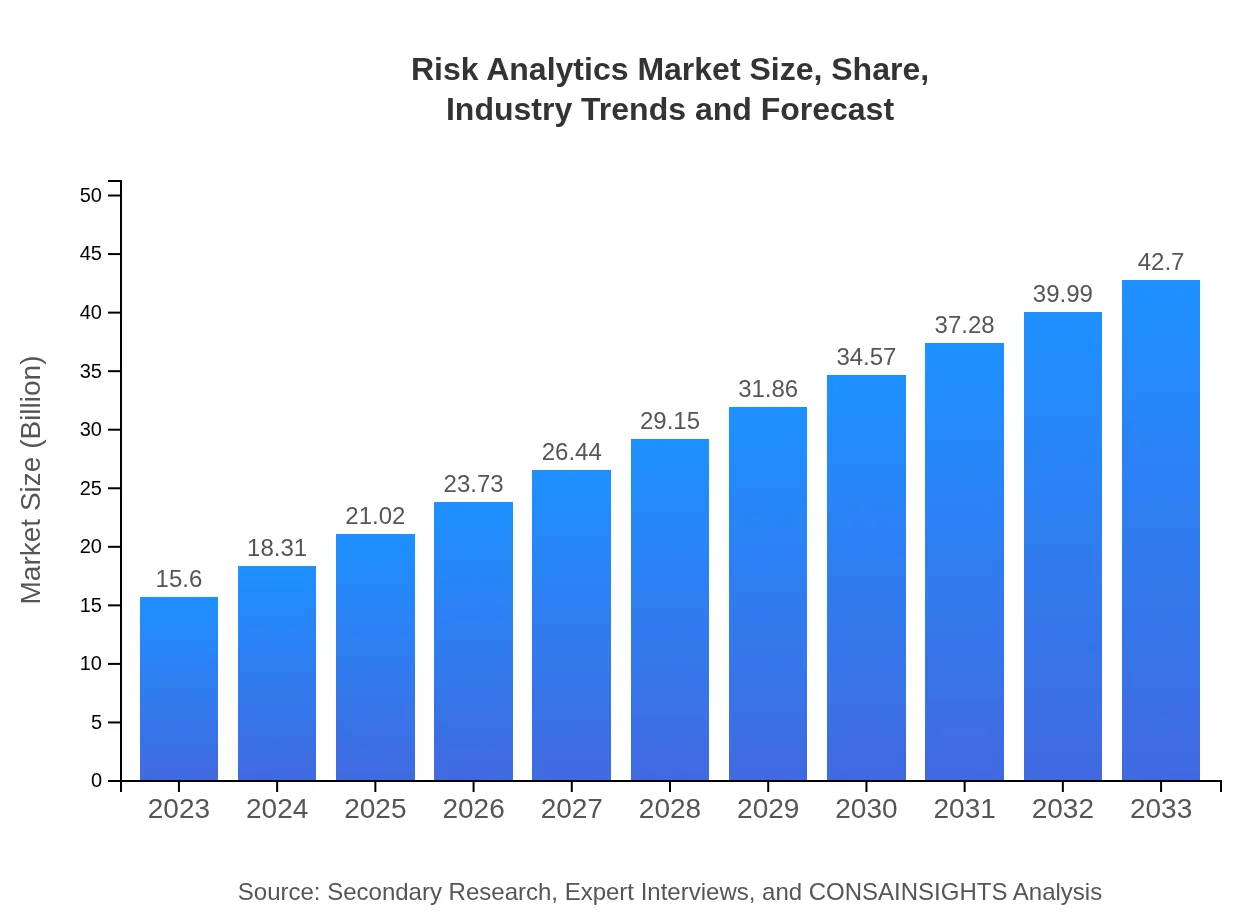

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $42.70 Billion |

| Top Companies | SAS Institute, IBM, FICO, Oracle |

| Last Modified Date | 31 January 2026 |

Risk Analytics Market Overview

Customize Risk Analytics Market Report market research report

- ✔ Get in-depth analysis of Risk Analytics market size, growth, and forecasts.

- ✔ Understand Risk Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Risk Analytics

What is the Market Size & CAGR of Risk Analytics market in 2023 and 2033?

Risk Analytics Industry Analysis

Risk Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Risk Analytics Market Analysis Report by Region

Europe Risk Analytics Market Report:

Europe's Risk Analytics market is set to expand from $4.93 billion in 2023 to $13.49 billion by 2033. The increasing relevance of data privacy regulations, such as GDPR, necessitates comprehensive risk analytics solutions.Asia Pacific Risk Analytics Market Report:

The Asia Pacific region's Risk Analytics market is projected to grow from $2.97 billion in 2023 to $8.13 billion in 2033, driven by the rapid digital transformation of businesses and increased regulatory compliance requirements across nations.North America Risk Analytics Market Report:

North America holds a substantial share of the Risk Analytics market, anticipated to grow from $5.32 billion in 2023 to $14.56 billion in 2033. This growth is propelled by the region's strong financial services industry and heightened focus on cybersecurity.South America Risk Analytics Market Report:

In South America, the Risk Analytics market is expected to rise from $0.49 billion in 2023 to $1.35 billion in 2033, with public and private organizations seeking sophisticated risk management solutions to face economic uncertainty.Middle East & Africa Risk Analytics Market Report:

In the Middle East and Africa, the Risk Analytics market is expected to increase from $1.89 billion in 2023 to $5.17 billion in 2033, as organizations increasingly acknowledge the importance of risk management amid geopolitical and economic challenges.Tell us your focus area and get a customized research report.

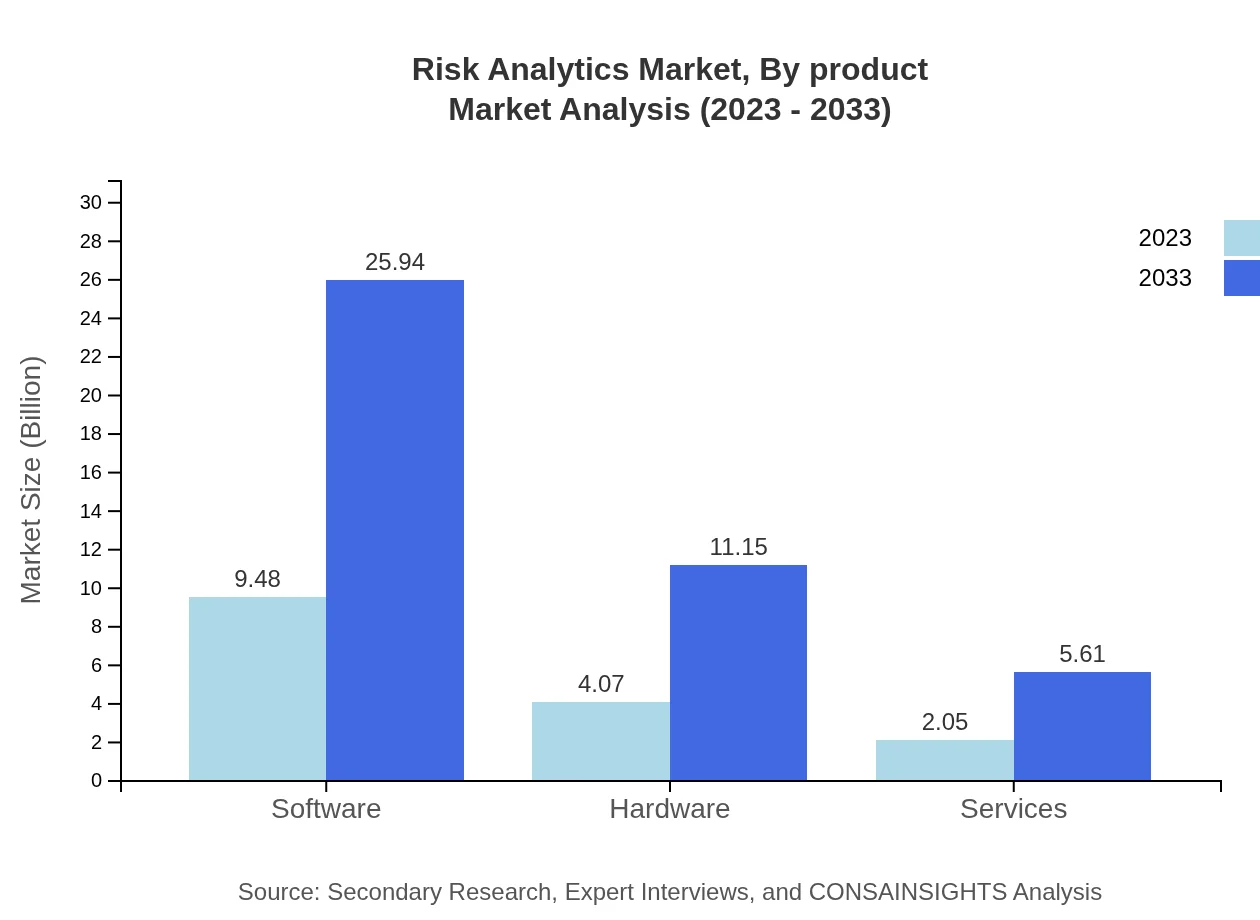

Risk Analytics Market Analysis By Product

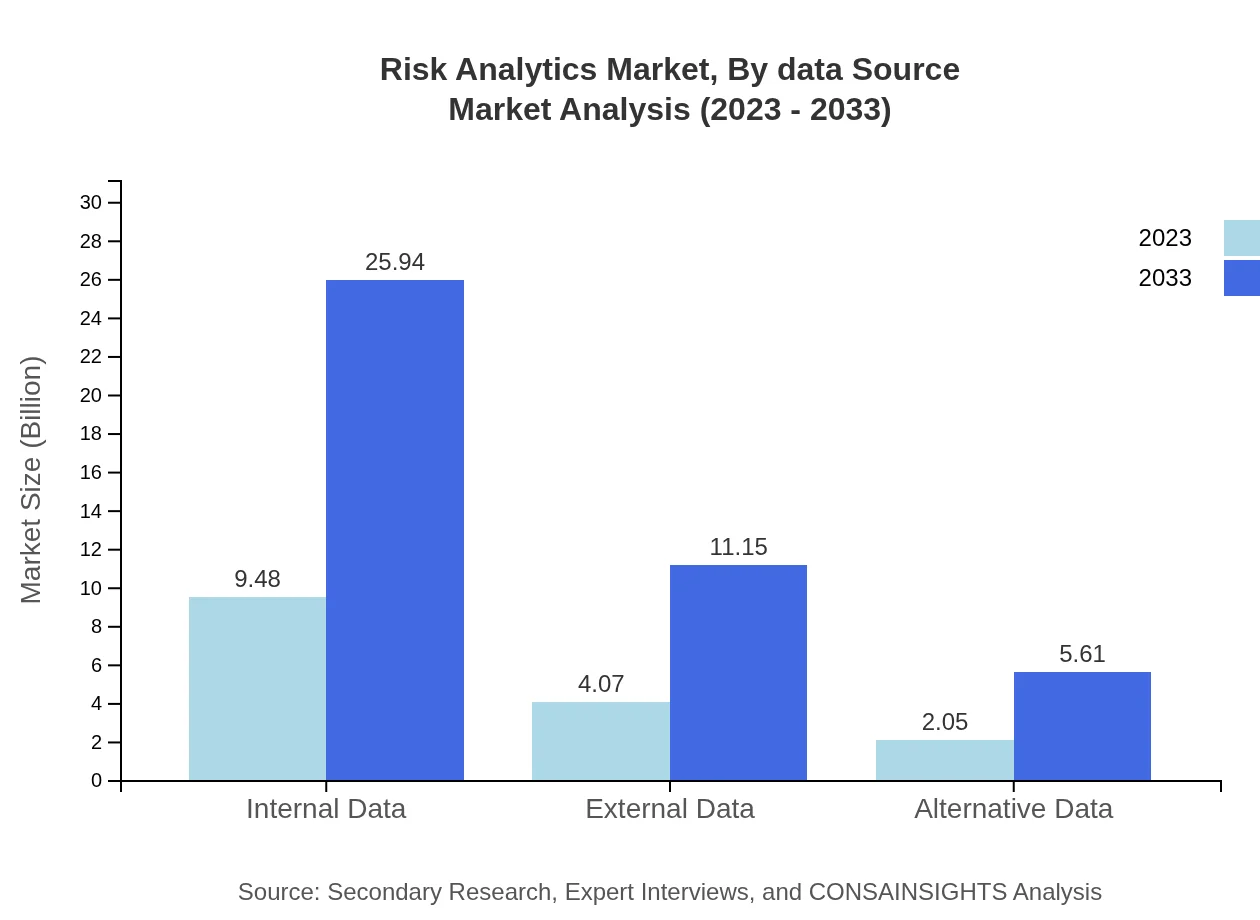

The product segmentation reflects significant differences in market dynamics. Software leads the segment with an expected growth from $9.48 billion in 2023 to $25.94 billion in 2033 due to increasing reliance on data-driven strategies. Hardware and services segments also show robust growth, with hardware’s market increasing from $4.07 billion to $11.15 billion and services from $2.05 billion to $5.61 billion over the same period.

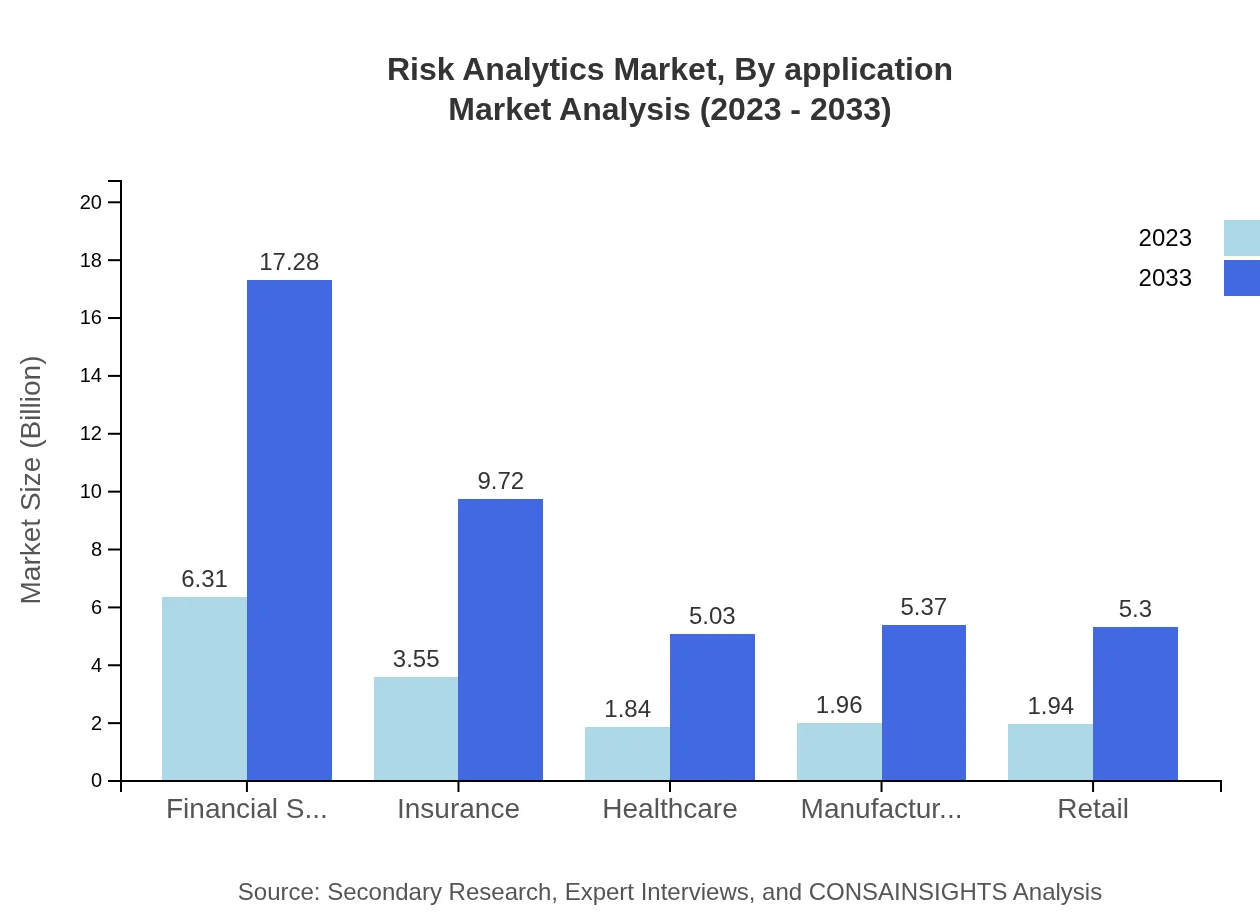

Risk Analytics Market Analysis By Application

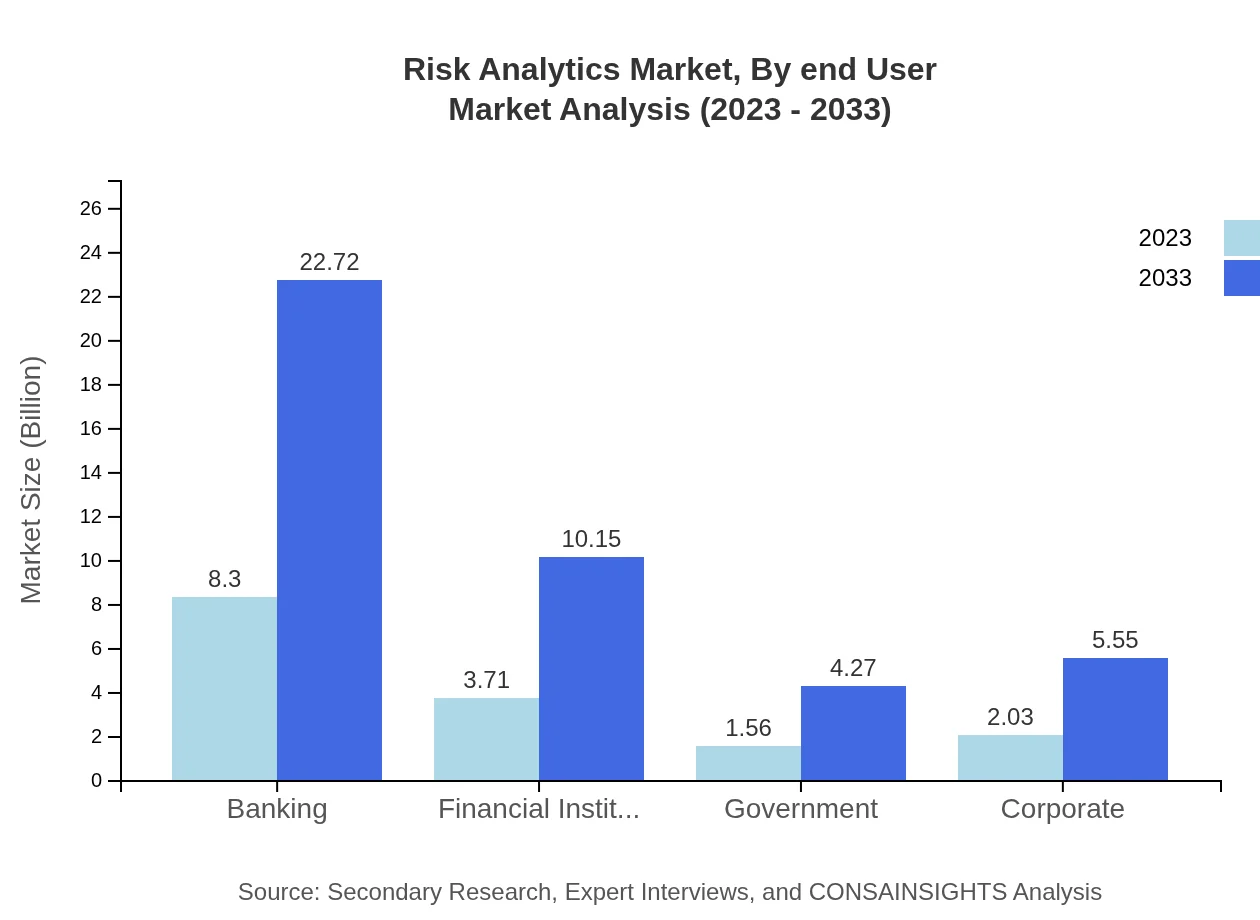

The Risk Analytics market is categorized into various applications including banking, insurance, financial services, and healthcare. The banking segment exhibits major growth potential, increasing from $8.30 billion in 2023 to $22.72 billion by 2033, emphasizing the need for effective risk assessments amid evolving financial landscapes.

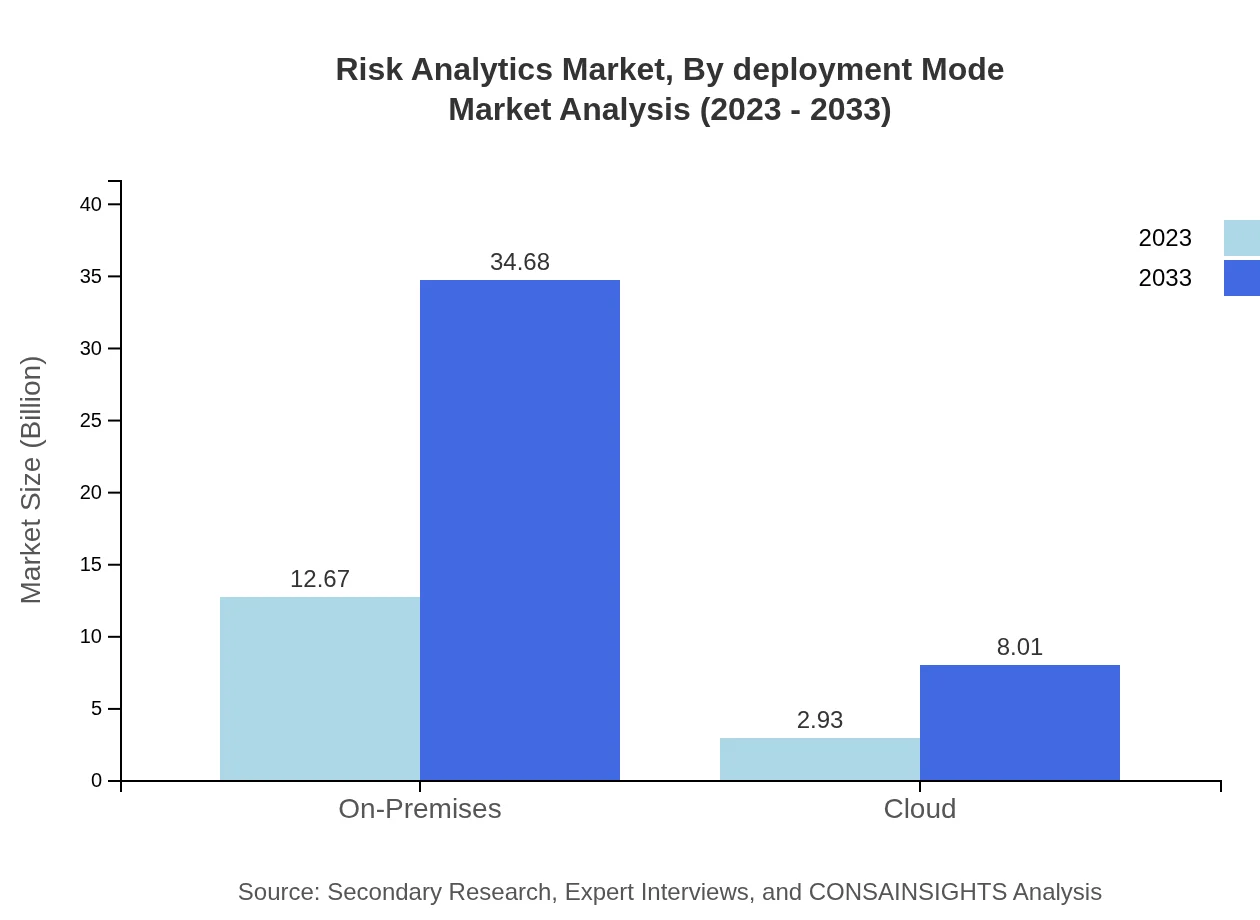

Risk Analytics Market Analysis By Deployment Mode

Deployment modes are primarily segmented into on-premises and cloud-based solutions. On-premises solutions are dominant, growing from $12.67 billion in 2023 to $34.68 billion in 2033, while cloud solutions are also gaining traction, projected to increase from $2.93 billion to $8.01 billion.

Risk Analytics Market Analysis By End User

End-users of risk analytics encompass a diverse range of sectors, including financial institutions, government bodies, and corporations. Financial services stand out with a market size expanding from $6.31 billion in 2023 to $17.28 billion in 2033, driven by regulatory changes and competitive pressures.

Risk Analytics Market Analysis By Data Source

In terms of data sources, internal data maintains the largest market share, growing from $9.48 billion to $25.94 billion. Meanwhile, external data and alternative data sources also contribute with segment sizes growing from $4.07 billion to $11.15 billion and from $2.05 billion to $5.61 billion, respectively.

Risk Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Risk Analytics Industry

SAS Institute:

SAS Institute is a leader in analytics, providing software and solutions that enhance risk modeling and management processes across industries.IBM:

IBM offers AI-driven risk analytics solutions to manage threats efficiently, focusing on integrating advanced analytics within enterprise infrastructures.FICO:

FICO provides analytics solutions specialized in risks associated with credit and fraud management, enabling clients to make data-driven decisions.Oracle:

Oracle delivers comprehensive risk management solutions that combine technology with industry best practices for optimal risk assessment.We're grateful to work with incredible clients.

FAQs

What is the market size of Risk Analytics?

The global risk analytics market is valued at approximately $15.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 10.2% from 2023 to 2033, indicating robust growth in response to increasing risk awareness.

What are the key market players or companies in this Risk Analytics industry?

Key players in the risk analytics market include SAS Institute, IBM Corporation, Oracle, and FICO. These companies lead through innovative solutions and technological advancements, shaping the market landscape significantly.

What are the primary factors driving the growth in the Risk Analytics industry?

The growth in the risk analytics industry is driven by increasing regulatory requirements, growing awareness of risk management, and advancements in data analytics technologies. Businesses increasingly adopt these solutions to enhance decision-making and mitigate risks effectively.

Which region is the fastest Growing in the Risk Analytics?

The fastest-growing region in the risk analytics market is forecasted to be North America, with market size expected to increase from $5.32 billion in 2023 to $14.56 billion by 2033, reflecting strong demand and investment in analytics solutions.

Does ConsaInsights provide customized market report data for the Risk Analytics industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the risk analytics industry, ensuring clients receive relevant insights and data that align with their strategic goals and market challenges.

What deliverables can I expect from this Risk Analytics market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, segmented data by industry and geography, trends, forecasts, and actionable insights tailored to enhance strategic decision-making.

What are the market trends of Risk Analytics?

Current trends in the risk analytics market include the shift towards cloud-based solutions, increased use of AI and machine learning, and a growing emphasis on integrating alternative data sources for better risk assessment.