Risk Based Monitoring Software Market Report

Published Date: 31 January 2026 | Report Code: risk-based-monitoring-software

Risk Based Monitoring Software Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Risk Based Monitoring Software market, detailing market dynamics, segmentation, regional insights, and future forecasts for the years 2023 to 2033.

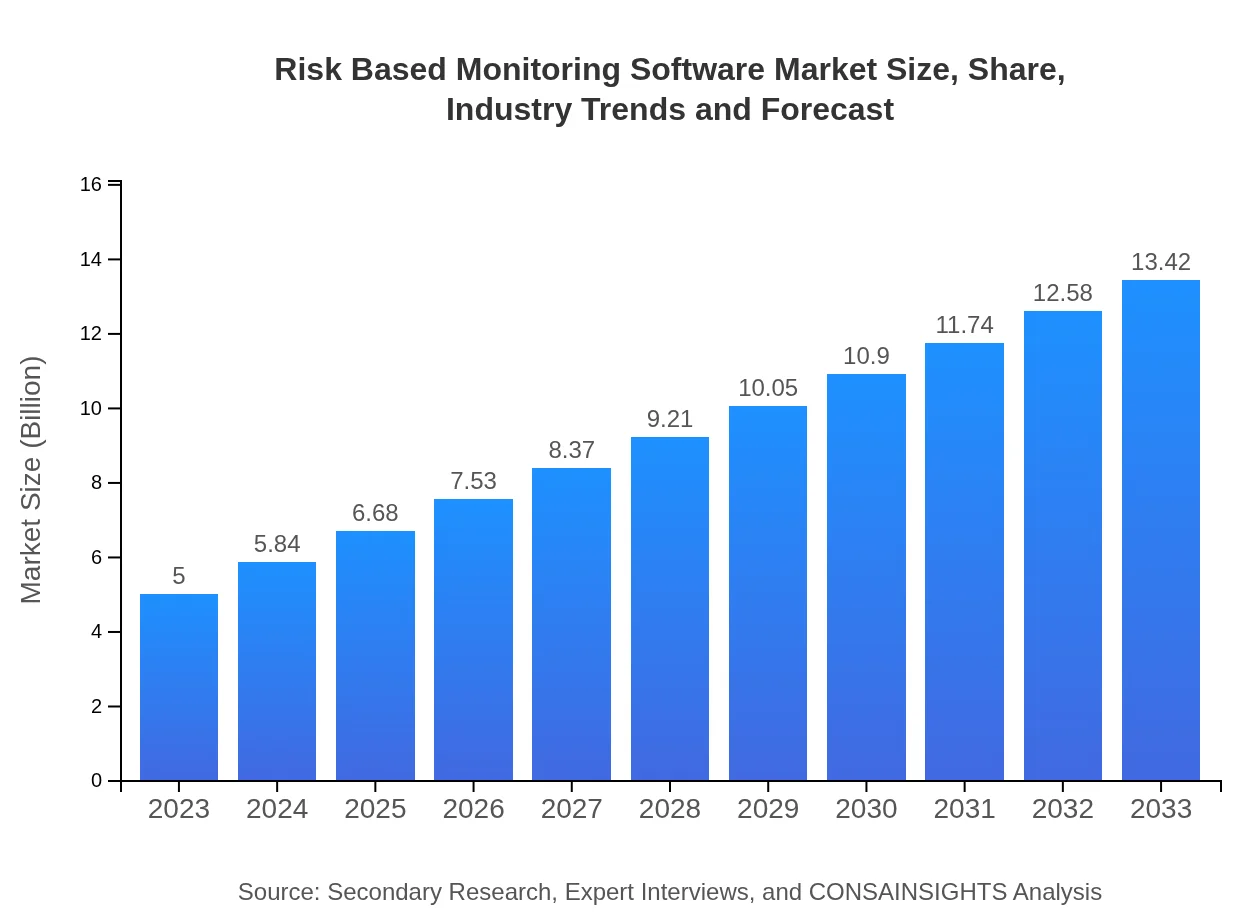

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $13.42 Billion |

| Top Companies | Medidata Solutions, Oracle Corporation, Veeva Systems, IBM Watson Health |

| Last Modified Date | 31 January 2026 |

Risk Based Monitoring Software Market Overview

Customize Risk Based Monitoring Software Market Report market research report

- ✔ Get in-depth analysis of Risk Based Monitoring Software market size, growth, and forecasts.

- ✔ Understand Risk Based Monitoring Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Risk Based Monitoring Software

What is the Market Size & CAGR of Risk Based Monitoring Software market in 2023?

Risk Based Monitoring Software Industry Analysis

Risk Based Monitoring Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Risk Based Monitoring Software Market Analysis Report by Region

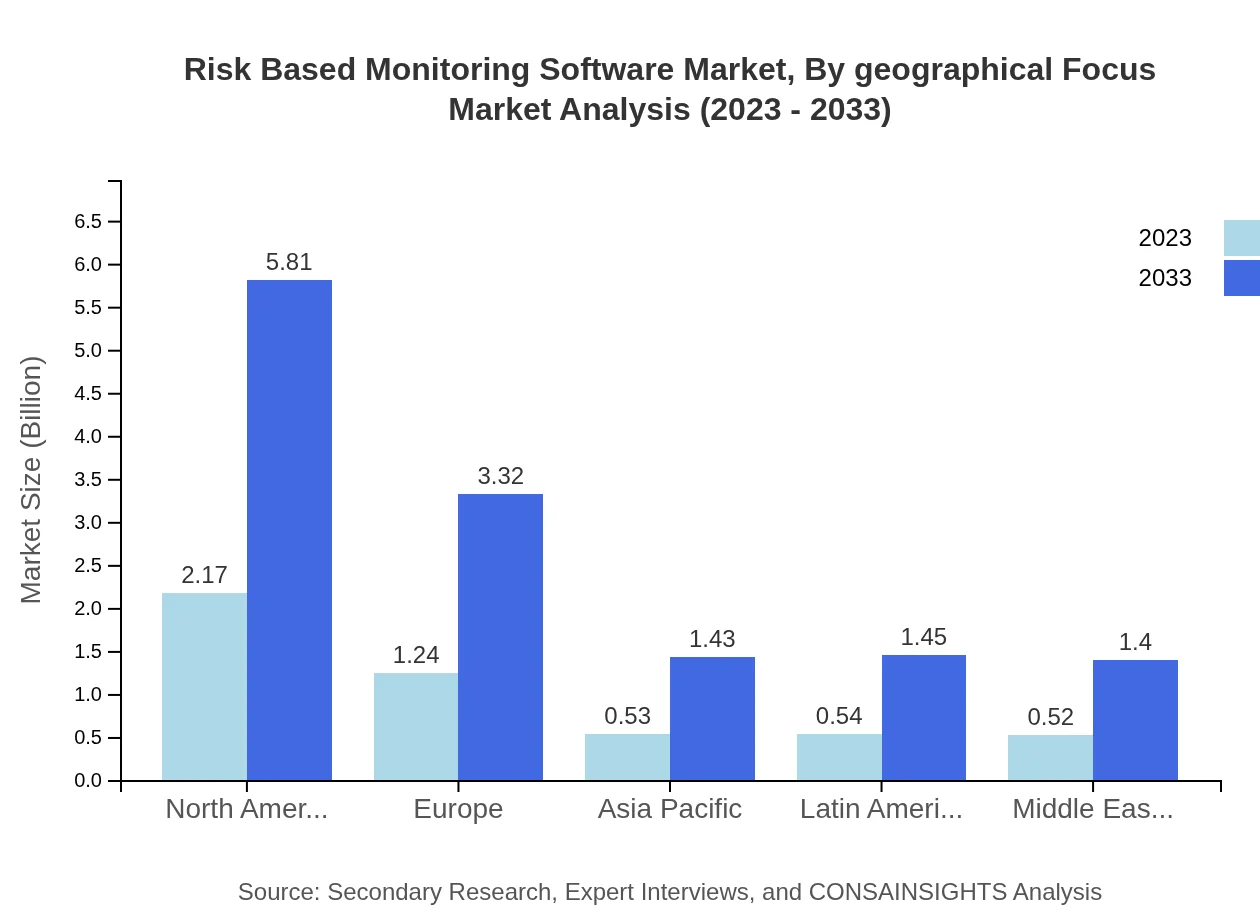

Europe Risk Based Monitoring Software Market Report:

The European market, valued at USD 1.26 billion in 2023, is anticipated to grow significantly, reaching USD 3.38 billion by 2033, owing to stringent regulatory standards and the adoption of advanced monitoring solutions across the region, especially in the UK, Germany, and France.Asia Pacific Risk Based Monitoring Software Market Report:

The Asia Pacific region showcases a rapidly growing market for Risk Based Monitoring Software, valued at USD 1 billion in 2023 and projected to reach USD 2.7 billion by 2033. Fueled by escalating clinical trial activities alongside healthcare digitalization initiatives, major markets include countries like China and India, which are attracting significant investments in research and development.North America Risk Based Monitoring Software Market Report:

North America remains the largest market for Risk Based Monitoring Software, valued at USD 1.68 billion in 2023, expected to reach USD 4.52 billion by 2033. High demand is propelled by the presence of leading pharmaceutical and biotechnology companies and increasing investments in clinical research operations.South America Risk Based Monitoring Software Market Report:

In South America, the Risk Based Monitoring Software market is projected to grow from USD 0.42 billion in 2023 to USD 1.13 billion by 2033, driven by increasing government focus on improving healthcare infrastructure and expanding clinical trials, particularly in Brazil and Argentina.Middle East & Africa Risk Based Monitoring Software Market Report:

The Middle East and Africa market is estimated to grow from USD 0.63 billion in 2023 to USD 1.69 billion by 2033, supported by rising healthcare expenditures and efforts to enhance clinical trial infrastructure across the region.Tell us your focus area and get a customized research report.

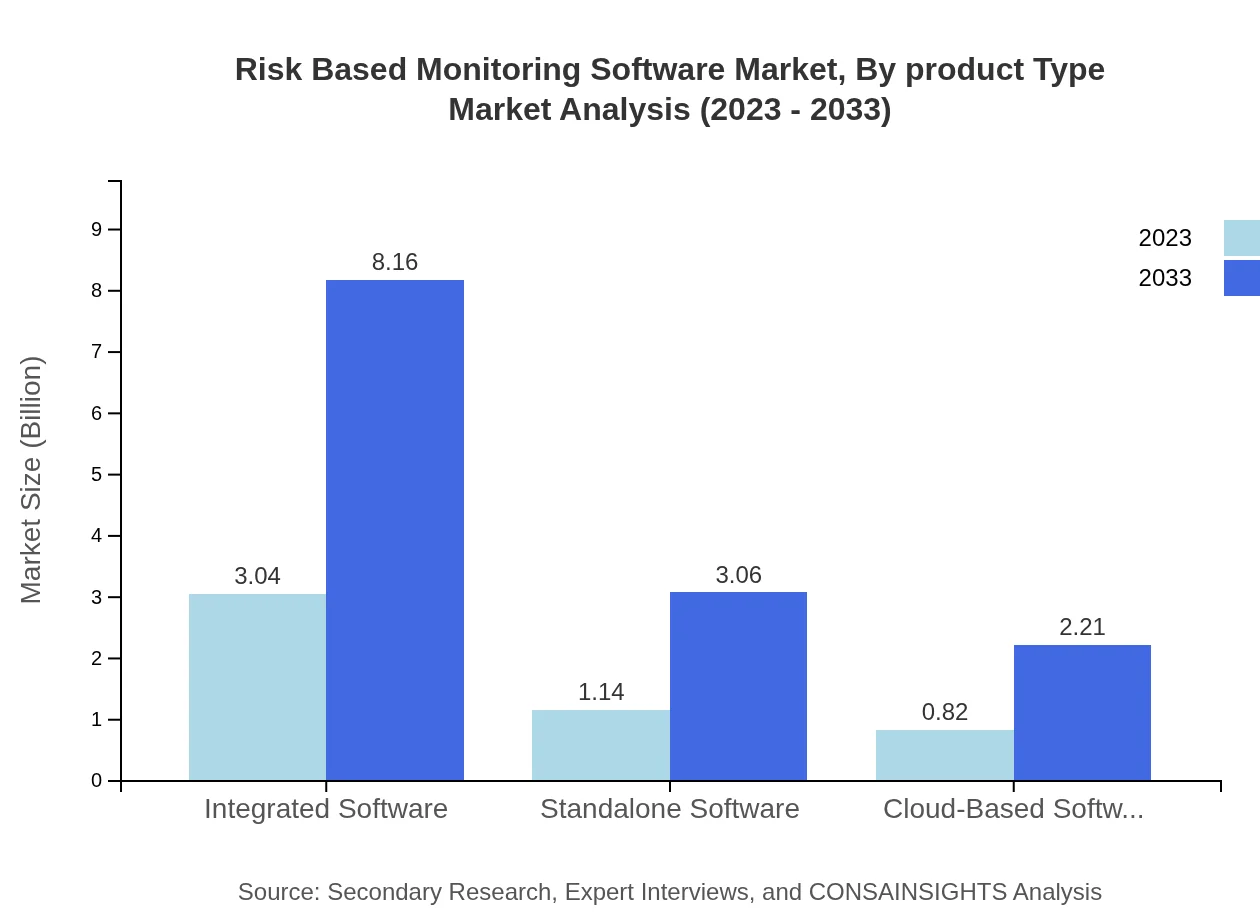

Risk Based Monitoring Software Market Analysis By Product Type

The product type segment of the Risk-Based Monitoring Software market is categorized into Integrated Software, Standalone Software, and Cloud-Based Software. Integrated Software dominates the market, accounting for 60.78% in 2023 and projected to maintain a significant share as organizations increasingly seek comprehensive solutions. Standalone Software is expected to grow from USD 1.14 billion to USD 3.06 billion during the forecast period, representing 22.78% of the market. Cloud-Based Software, though currently lower in share, shows strong potential for growth, enhancing accessibility and offering flexibility for organizations.

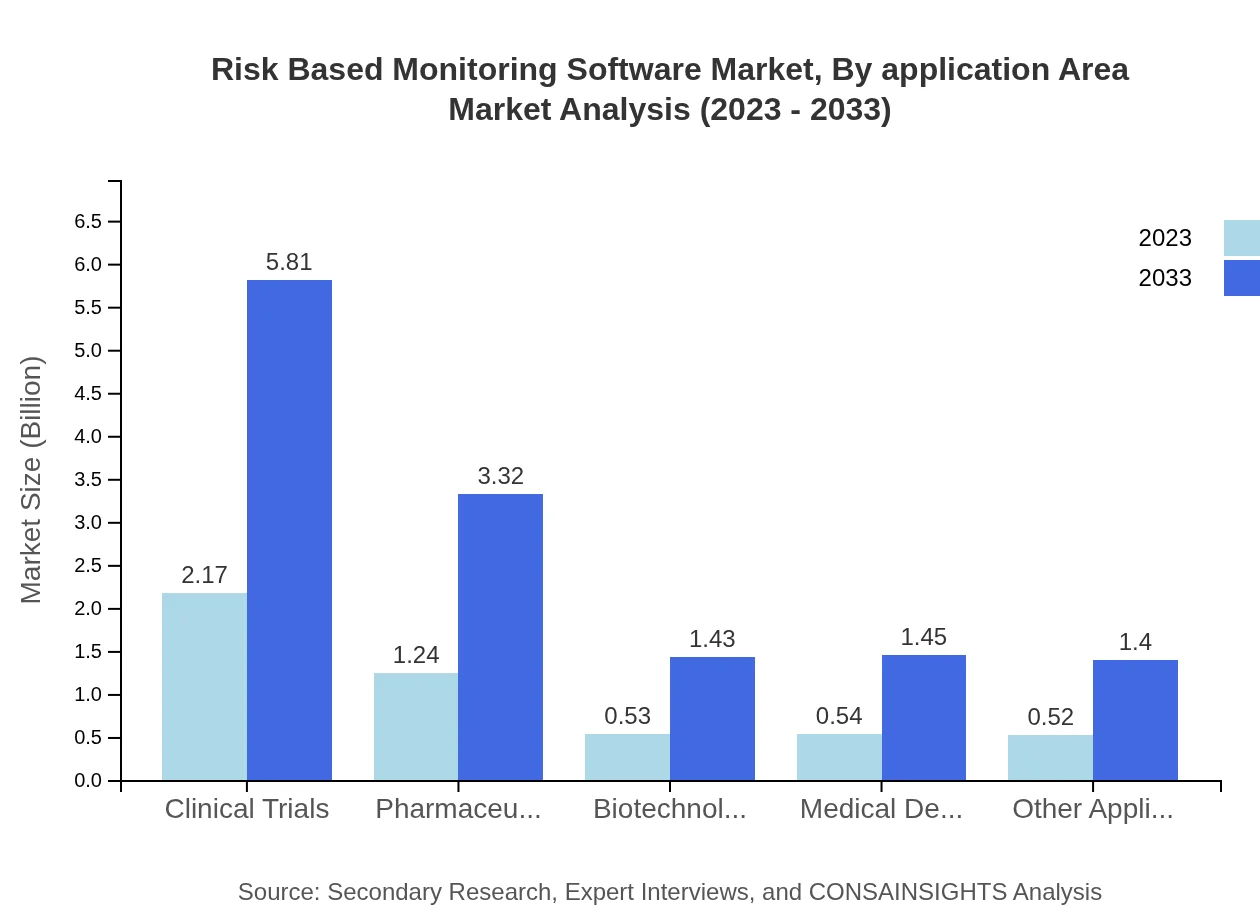

Risk Based Monitoring Software Market Analysis By Application Area

The segmentation based on application area highlights varying demand across sectors. Clinical Trials hold the largest share at 43.31% in 2023, reflecting the critical necessity for effective monitoring in research. Pharmaceuticals and Biotechnology sectors are significant contributors, projected to necessitate enhanced monitoring as new molecular entities are developed. Other application areas like Medical Devices and Research Institutes are also gaining traction as more entities recognize the need for advanced risk assessment and monitoring capabilities.

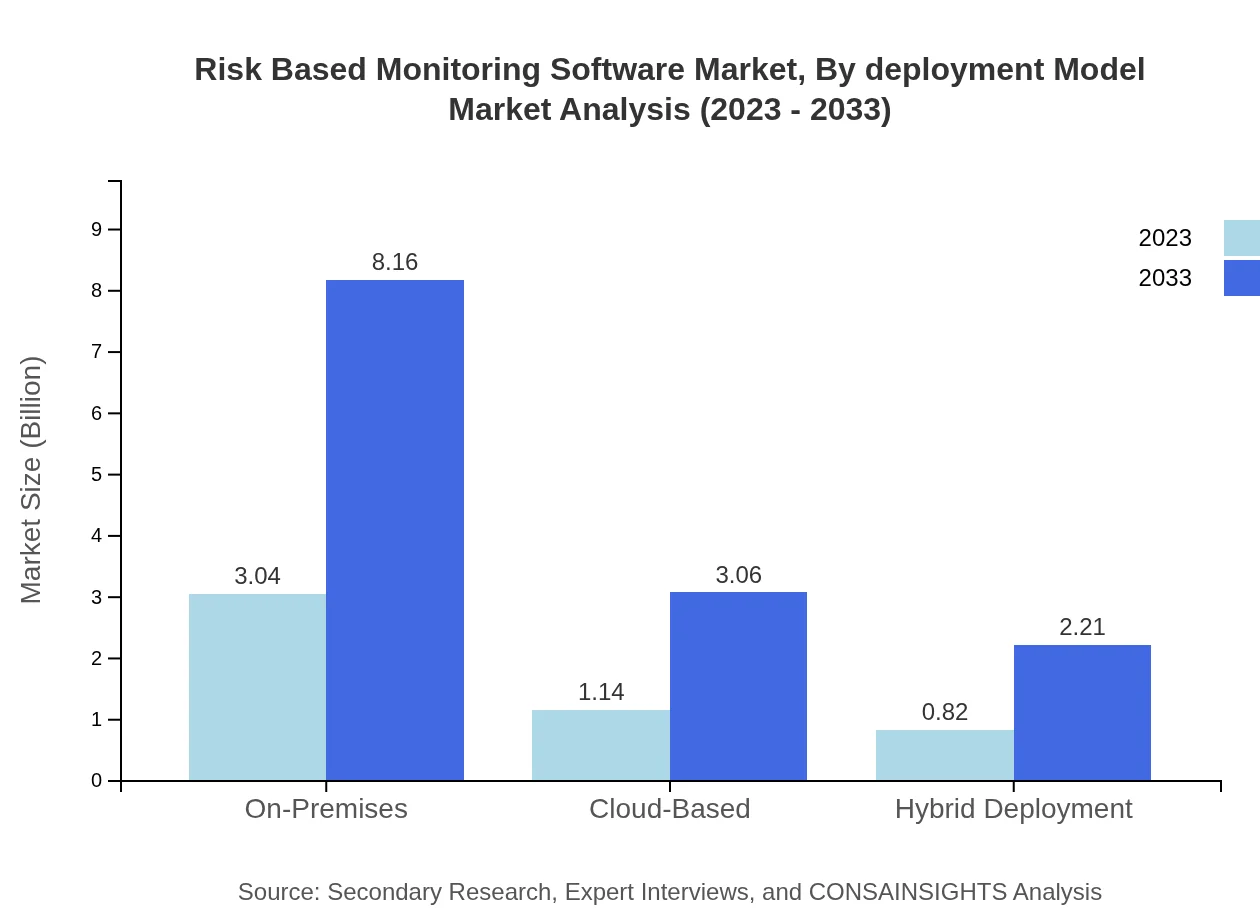

Risk Based Monitoring Software Market Analysis By Deployment Model

Deployment models have branched into On-Premises, Cloud-Based, and Hybrid Deployment. On-Premises solutions presently lead the market, retaining a share of 60.78%, but as organizations move towards digital transformation, Cloud-Based Software deployment is gaining popularity, anticipated to grow from 16.44% to a significant share by 2033. Hybrid Deployment, leveraging both on-premises and cloud solutions, is also on the rise as it offers businesses flexibility in managing resources and costs.

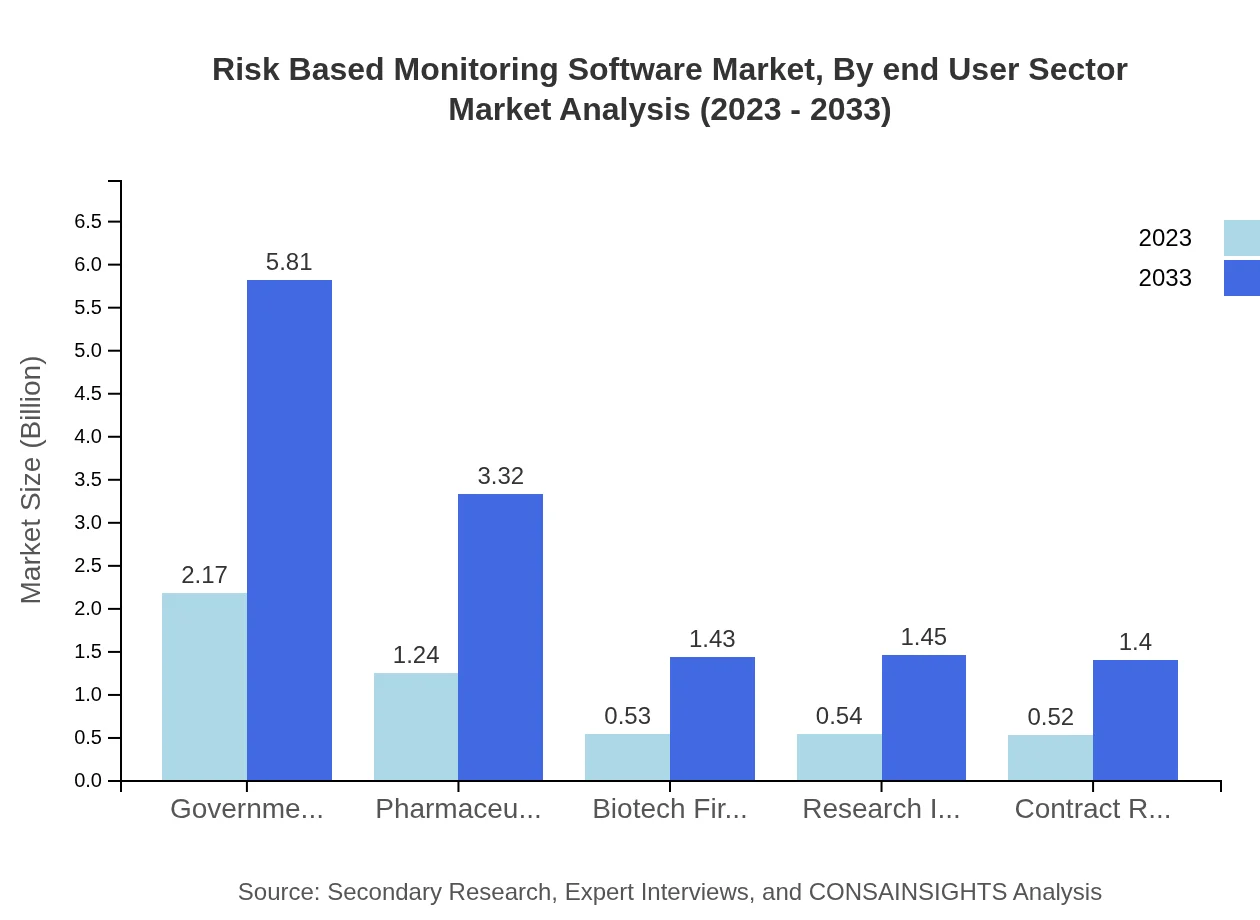

Risk Based Monitoring Software Market Analysis By End User Sector

End-user sectors primarily include Government & Regulatory Bodies, Pharmaceuticals, Biotechnology, and CROs. The Government & Regulatory Bodies segment commands the largest market share at 43.31% in 2023, driven by stringent regulations necessitating effective monitoring systems. Pharmaceuticals and Biotechnology sectors also contribute significantly, with their shares expected to be stable, reflecting the ongoing need for monitoring throughout the drug development lifecycle.

Risk Based Monitoring Software Market Analysis By Geographical Focus

Geographical focus involves understanding the market distribution across regions like North America, Europe, Asia Pacific, South America, and Middle East & Africa. North America shows the highest market potential, while Asia Pacific is rapidly expanding, indicating a shift in research activities towards regions with growing clinical trial infrastructures and favorable regulatory environments.

Risk Based Monitoring Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Risk Based Monitoring Software Industry

Medidata Solutions:

Medidata offers a suite of cloud-based solutions focused on enhancing clinical trial performance and operational efficiency through innovative monitoring tools.Oracle Corporation:

Oracle provides comprehensive software solutions for clinical trial management, including risk-based monitoring applications, leveraging advanced analytics and data management capabilities.Veeva Systems:

Veeva specializes in cloud-based software for the global life sciences industry, focusing on improving operational efficiencies and compliance in clinical trials.IBM Watson Health:

IBM Watson Health incorporates AI-driven analytics in its solutions, offering risk-based monitoring tools that provide valuable insights throughout the clinical trial process.We're grateful to work with incredible clients.

FAQs

What is the market size of risk Based Monitoring Software?

The global market size for risk-based monitoring software stood at approximately $5 billion in 2023, with a projected CAGR of 10%, indicating significant growth potential in the coming decade as the market evolves through 2033.

What are the key market players or companies in this risk Based Monitoring Software industry?

Key players in the risk-based monitoring software market include prominent technology firms and specialized software developers. Their solutions drive competitive differentiation and innovation, offering advanced features tailored to the needs of regulatory compliance and efficient trial management.

What are the primary factors driving the growth in the risk Based Monitoring Software industry?

Growth in the risk-based monitoring software market is driven by the increasing adoption of technology in clinical trials, a focus on patient safety, regulatory requirements, and the need for efficient data management to enhance trial performance and reduce costs.

Which region is the fastest Growing in the risk Based Monitoring Software?

The North American region is expected to grow the fastest in the risk-based monitoring software market, with projected market size expanding from $1.68 billion in 2023 to $4.52 billion by 2033, representing extensive investment and adoption in advanced technology solutions.

Does ConsaInsights provide customized market report data for the risk Based Monitoring Software industry?

Yes, ConsaInsights offers customized market report solutions that cater to specific needs in the risk-based monitoring software industry, enabling clients to gain tailored insights and data relevant to their strategic decision-making.

What deliverables can I expect from this risk Based Monitoring Software market research project?

Deliverables for this market research project will include comprehensive market analysis reports, detailed segmentation data, competitive landscapes, and actionable insights focused on growth opportunities and trends within the risk-based monitoring software market.

What are the market trends of risk Based Monitoring Software?

Current trends in the risk-based monitoring software market include increasing reliance on cloud-based platforms, integration of AI and machine learning, heightened focus on patient-centric approaches, and a growing emphasis on regulatory compliance in clinical trials.