Road Construction Machinery Market Report

Published Date: 02 February 2026 | Report Code: road-construction-machinery

Road Construction Machinery Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Road Construction Machinery sector, highlighting market size, growth trends, and insights on future forecasting from 2023 to 2033.

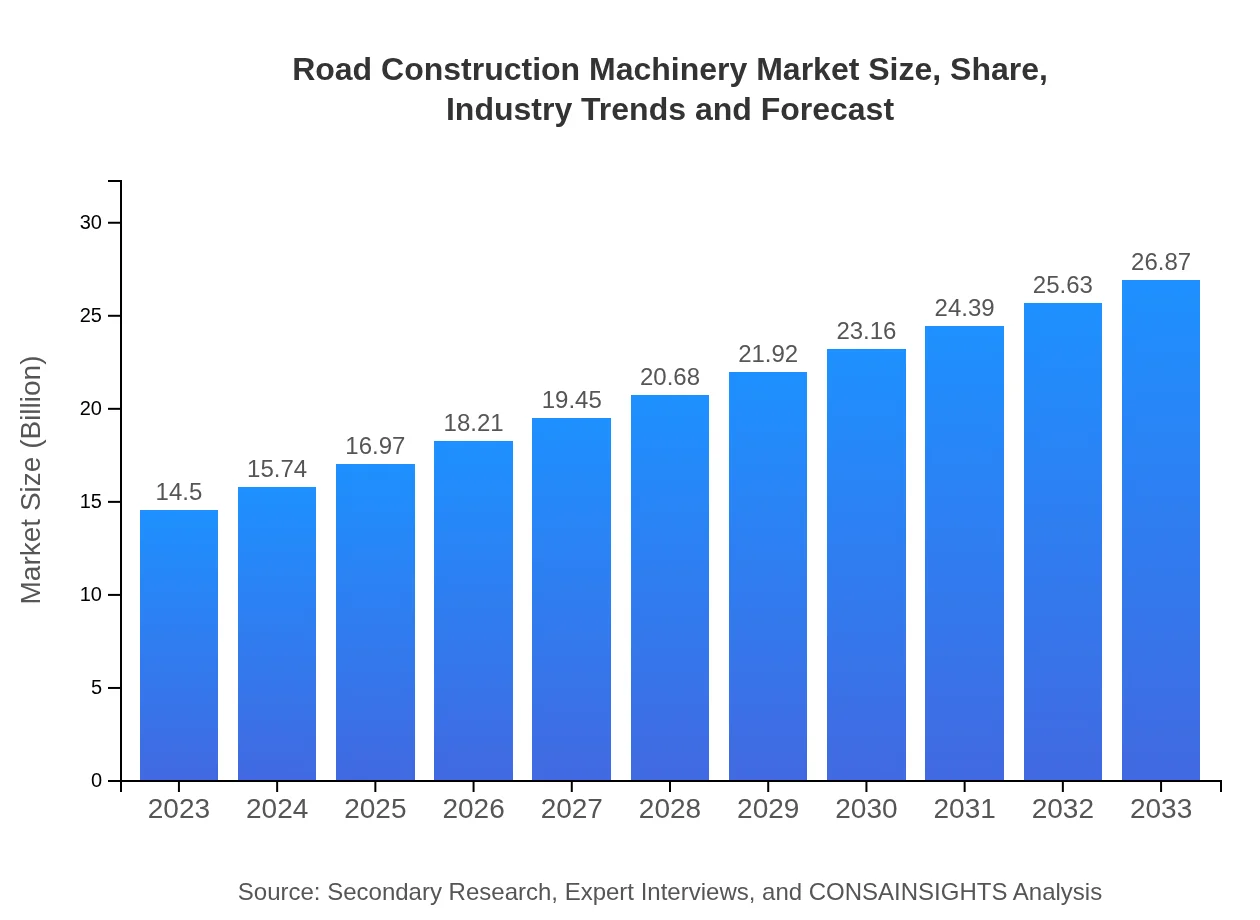

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $26.87 Billion |

| Top Companies | Caterpillar Inc., Volvo Construction Equipment, Komatsu Ltd., Case Construction Equipment |

| Last Modified Date | 02 February 2026 |

Road Construction Machinery Market Overview

Customize Road Construction Machinery Market Report market research report

- ✔ Get in-depth analysis of Road Construction Machinery market size, growth, and forecasts.

- ✔ Understand Road Construction Machinery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Road Construction Machinery

What is the Market Size & CAGR of the Road Construction Machinery market in 2023?

Road Construction Machinery Industry Analysis

Road Construction Machinery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Road Construction Machinery Market Analysis Report by Region

Europe Road Construction Machinery Market Report:

The European market is projected to grow from $5.15 billion in 2023 to $9.55 billion by 2033, demonstrating a CAGR of 6.5%. The high regulatory standards and technological advances in construction equipment encourage market expansion. Sustainable construction practices are also expected to shape future machinery designs.Asia Pacific Road Construction Machinery Market Report:

In the Asia Pacific region, the Road Construction Machinery market is expected to grow from $2.75 billion in 2023 to $5.09 billion by 2033 at a CAGR of 6.8%. Increasing urbanization and major infrastructure projects driven by government initiatives are central to this growth. Countries like China and India are significantly investing in road development projects, which enhances demand for advanced construction machinery.North America Road Construction Machinery Market Report:

North America holds a robust position in the Road Construction Machinery sector with a market size slated to grow from $4.98 billion in 2023 to $9.23 billion by 2033, at a CAGR of 6.5%. The U.S. government’s infrastructure bill focuses on road repair and expansion, thus increasing the demand for modern construction machinery.South America Road Construction Machinery Market Report:

The South American market, valued at $0.62 billion in 2023, is anticipated to reach $1.16 billion by 2033, growing at a CAGR of 6.7%. Growth drivers include public-private partnerships leading to more highway and urban infrastructure developments. Additionally, a renewed focus on transportation connectivity stimulates machinery demand.Middle East & Africa Road Construction Machinery Market Report:

In the Middle East and Africa, the Road Construction Machinery market is predicted to increase from $0.99 billion in 2023 to $1.84 billion by 2033 at a CAGR of 6.7%. Continuous investments in infrastructure, particularly in Gulf nations, along with preparations for upcoming international events like World Expo are expected to spur this growth.Tell us your focus area and get a customized research report.

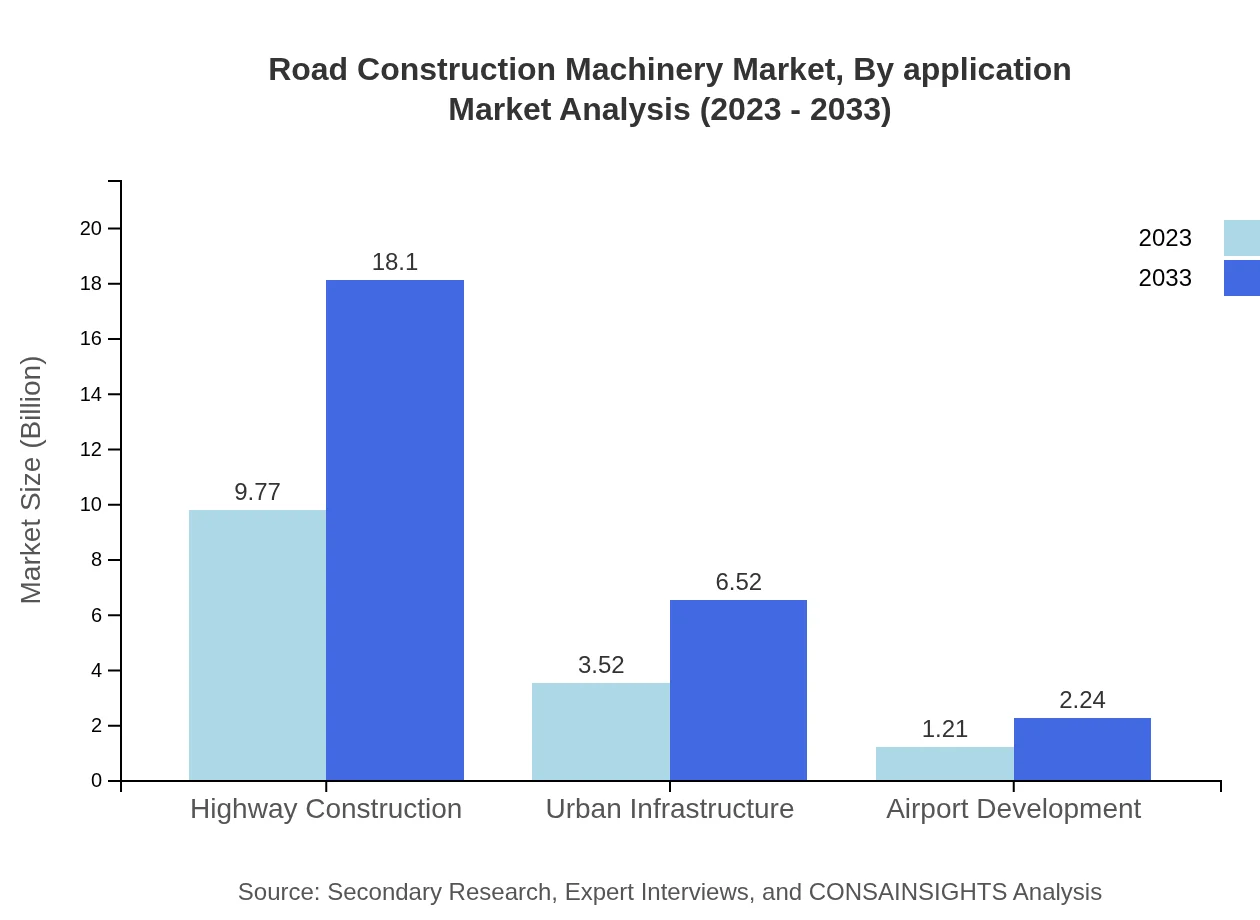

Road Construction Machinery Market Analysis By Application

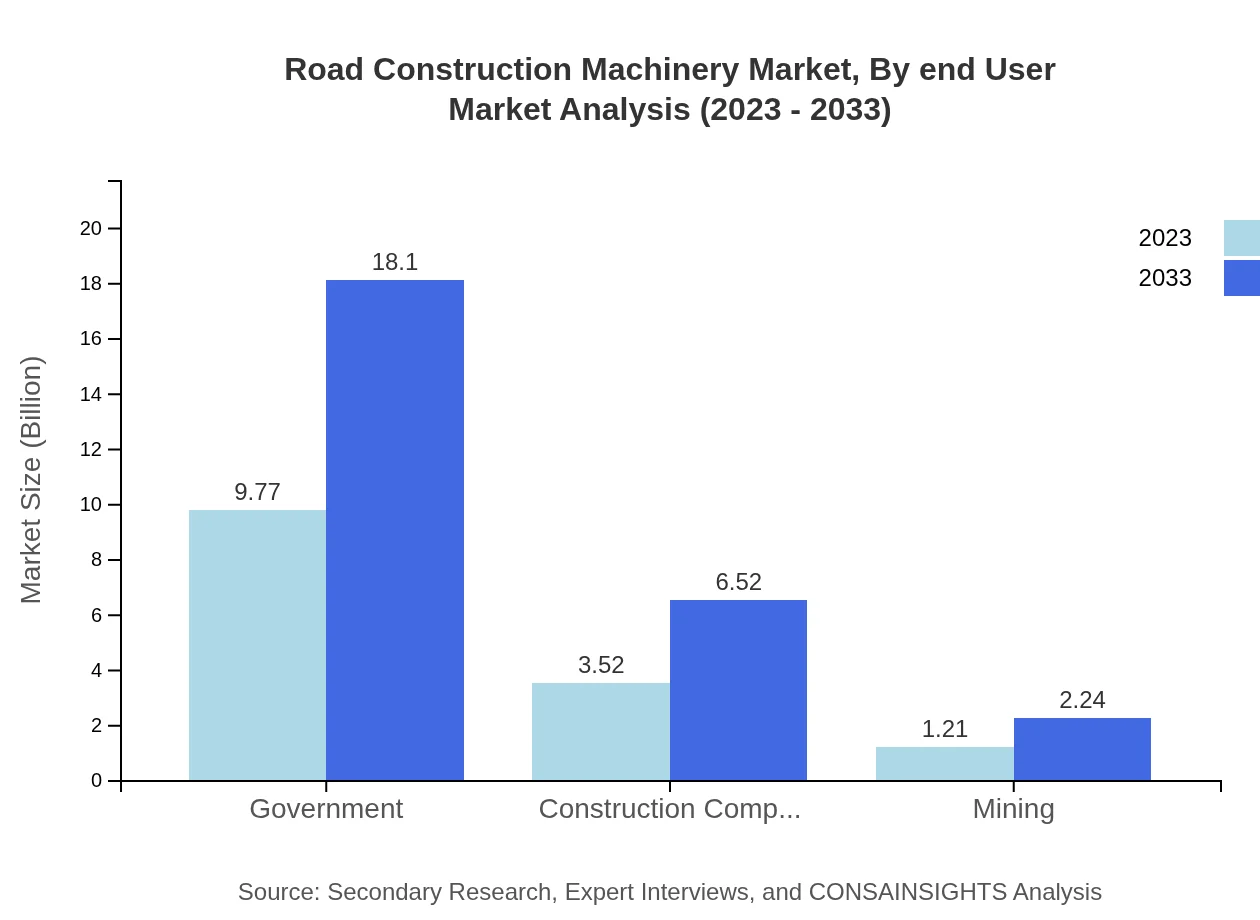

In 2023, the government sector dominates the market with a size of $9.77 billion, expected to reach $18.10 billion by 2033, maintaining a consistent market share of 67.39%. Construction companies represent the second most significant segment, with a market size of $3.52 billion forecasted to rise to $6.52 billion, capturing 24.28% of the market share. The mining sector, though smaller at $1.21 billion in 2023, is projected to grow to $2.24 billion, holding 8.33% market share.

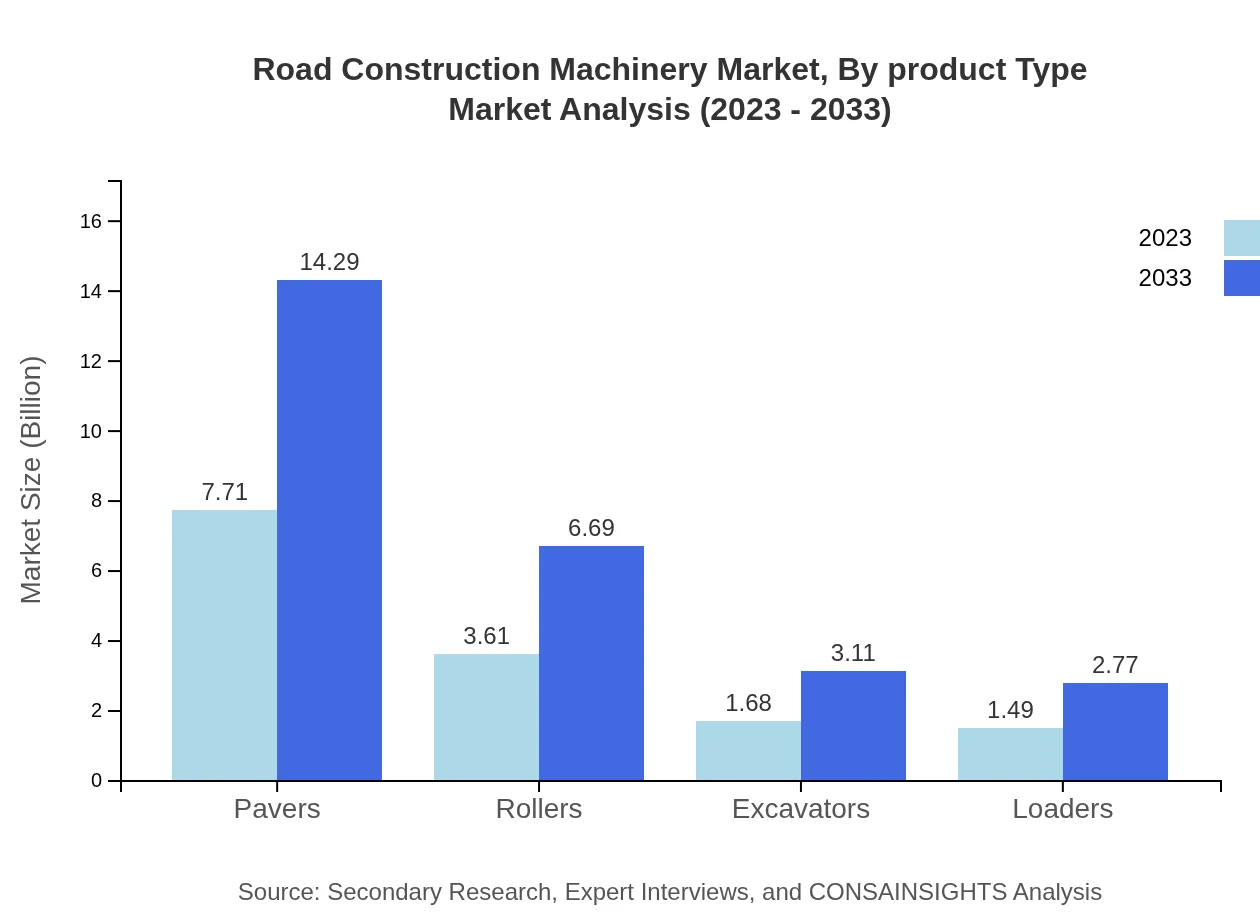

Road Construction Machinery Market Analysis By Product Type

For product types, pavers lead the market with a size of $7.71 billion in 2023, growing to $14.29 billion by 2033, which equates to a 53.2% market share. Following closely, rollers are set to grow from $3.61 billion to $6.69 billion, while excavators and loaders each showcase promising growth trajectories, reaching $3.11 billion and $2.77 billion respectively by the end of the forecast period.

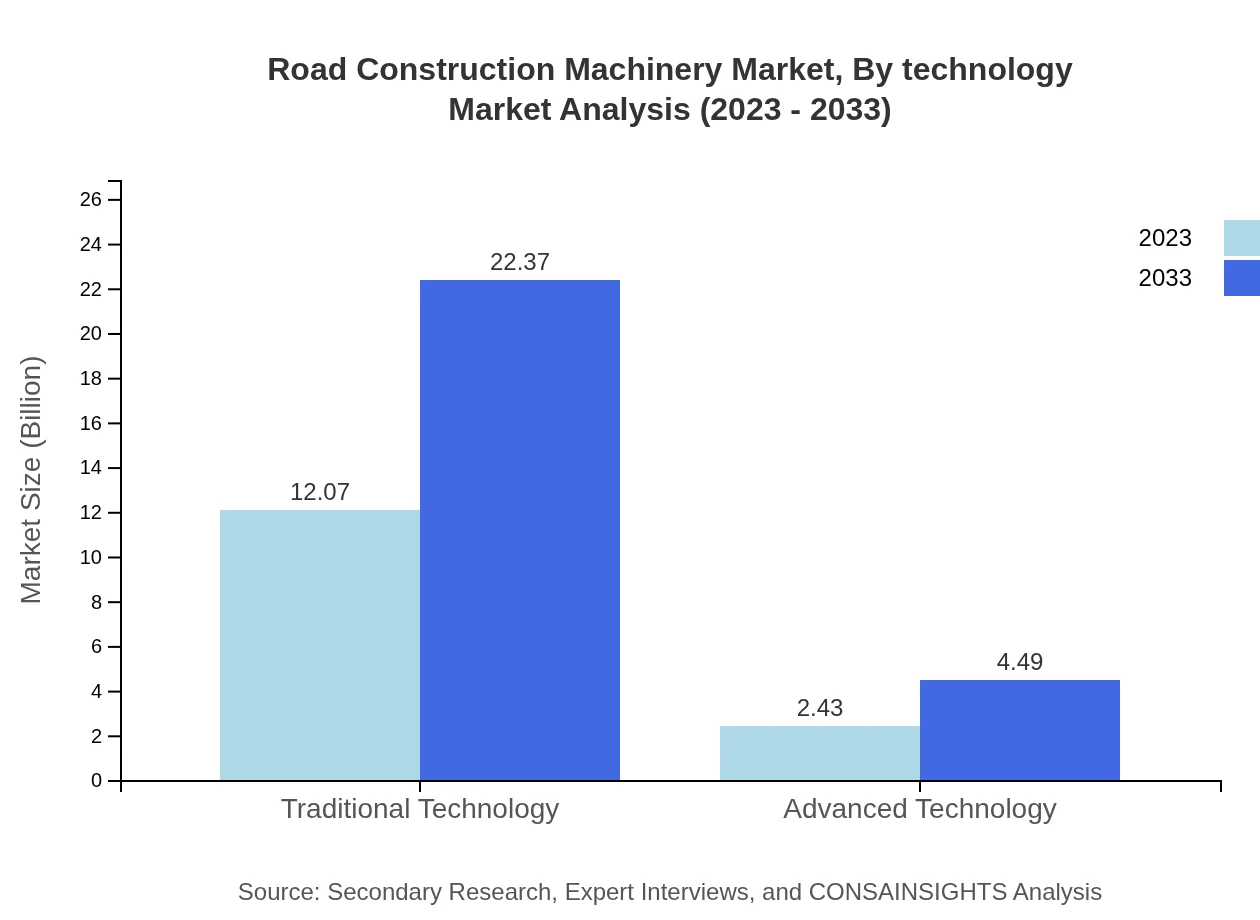

Road Construction Machinery Market Analysis By Technology

The market is segmented by technology types into traditional and advanced technology. Traditional technology accounts for a large portion, valued at $12.07 billion in 2023. It is projected to grow to $22.37 billion, maintaining 83.27% market share. In contrast, advanced technology products are valued at $2.43 billion and expected to rise to $4.49 billion, capturing a smaller yet growing market share of 16.73%.

Road Construction Machinery Market Analysis By End User

The end-user segmentation indicates a significant role of public sector projects, particularly in highway construction and urban infrastructure. Sales growth in urban infrastructure reflects increasing urban mobility initiatives, with a market size of $3.52 billion in 2023 forecasted to grow to $6.52 billion. Additionally, airport development projects are expected to see steady growth, as demand for efficient transport methods continues to rise.

Road Construction Machinery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Road Construction Machinery Industry

Caterpillar Inc.:

A leading manufacturer of construction and mining equipment, Caterpillar offers a comprehensive range of road construction machinery that combines efficiency with advanced technologies. Their focus on sustainability and innovation positions them prominently in the global market.Volvo Construction Equipment:

Volvo is committed to sustainable practices while producing a variety of road construction machinery. With a strong emphasis on technology and efficiency, Volvo offers solutions that enhance productivity while minimizing environmental impacts.Komatsu Ltd.:

A key player in the road construction machinery market, Komatsu provides an extensive range of equipment known for their durability and advanced features. The company is dedicated to innovation and sustainability in construction practices.Case Construction Equipment:

Part of CNH Industrial, Case is known for its robust machinery products specializing in road construction. Their innovative machinery focuses on improving efficiency and performance on construction sites.We're grateful to work with incredible clients.

FAQs

What is the market size of road Construction Machinery?

The global road construction machinery market is projected to reach $14.5 billion by 2033, growing at a CAGR of 6.2%. In 2023, the market is valued at approximately $14.5 billion, reflecting significant demand and investment in infrastructure development.

What are the key market players or companies in this road Construction Machinery industry?

Key players in the road construction machinery market include Caterpillar Inc., Volvo Construction Equipment, Komatsu Ltd., and JCB. These companies are known for their innovative products and strong market presence, driving advancements in machinery technology.

What are the primary factors driving the growth in the road Construction Machinery industry?

The growth of the road construction machinery market is primarily driven by increasing urbanization, government infrastructure initiatives, and advancements in technologies. Moreover, the need for improved transportation networks further boosts demand for these machines.

Which region is the fastest Growing in the road Construction Machinery?

The Asia-Pacific region is the fastest-growing market for road construction machinery. Projected growth from $2.75 billion in 2023 to $5.09 billion in 2033 indicates a robust investment in infrastructure development and road projects across countries in this region.

Does ConsaInsights provide customized market report data for the road Construction Machinery industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the road construction machinery industry. This includes segmented data and in-depth analysis to support strategic decision-making.

What deliverables can I expect from this road Construction Machinery market research project?

Deliverables from the road construction machinery market research include comprehensive market analysis reports, trend insights, segmented data, competitive landscape summaries, and forecasts to support strategic business planning.

What are the market trends of road Construction Machinery?

Current trends in the road construction machinery market include a shift towards advanced technology solutions, increased automation, and sustainable practices. There is also a notable focus on energy-efficient machinery and smart construction technologies.