Road Freight Transportation Market Report

Published Date: 31 January 2026 | Report Code: road-freight-transportation

Road Freight Transportation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Road Freight Transportation market, including trends, forecasts, and insights for 2023-2033. It covers market size, segmentation, regional analysis, and key players within the industry.

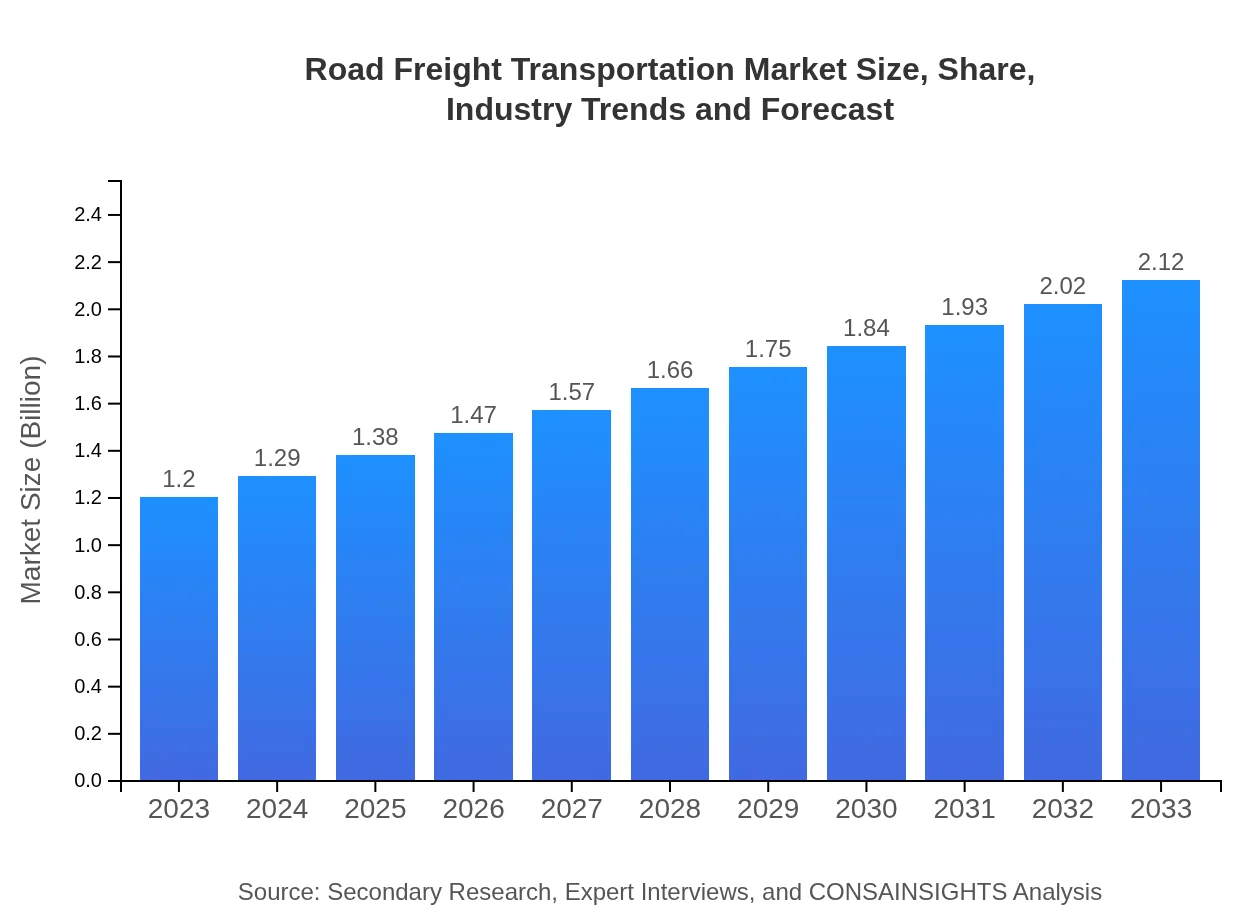

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $2.12 Trillion |

| Top Companies | DHL Supply Chain, FedEx Corp., UPS (United Parcel Service), XPO Logistics, Kuehne + Nagel |

| Last Modified Date | 31 January 2026 |

Road Freight Transportation Market Overview

Customize Road Freight Transportation Market Report market research report

- ✔ Get in-depth analysis of Road Freight Transportation market size, growth, and forecasts.

- ✔ Understand Road Freight Transportation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Road Freight Transportation

What is the Market Size & CAGR of Road Freight Transportation market in 2023?

Road Freight Transportation Industry Analysis

Road Freight Transportation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Road Freight Transportation Market Analysis Report by Region

Europe Road Freight Transportation Market Report:

The European market is valued at $0.35 trillion in 2023, projected to reach $0.62 trillion by 2033. Strict environmental regulations promote investment in sustainable transport solutions, while a high demand for logistics services shapes the market dynamics.Asia Pacific Road Freight Transportation Market Report:

In 2023, the Road Freight Transportation market in the Asia Pacific region is valued at $0.23 trillion and is expected to grow to $0.40 trillion by 2033. The region's growth is driven by booming economies, increasing urbanization, and a surge in e-commerce. China and India are predominant players, enhancing their logistics capabilities to support growing demand.North America Road Freight Transportation Market Report:

North America holds a strong position with a market size of $0.45 trillion in 2023, growing to $0.79 trillion by 2033. The presence of major logistics firms and advancements in technology for freight management and tracking systems drive this growth, significantly influenced by the United States' robust economy.South America Road Freight Transportation Market Report:

The South American market is smaller, with a size of $0.10 trillion in 2023, projected to reach $0.18 trillion by 2033. Economic recovery post-pandemic and investments in infrastructure are key to growth, although political stability and regulatory challenges remain significant hurdles.Middle East & Africa Road Freight Transportation Market Report:

With a market value of $0.08 trillion in 2023, projected to grow to $0.13 trillion by 2033, the Middle East and Africa region shows potential through growing trade links and infrastructure improvements. However, geopolitical instability in certain areas remains a challenge.Tell us your focus area and get a customized research report.

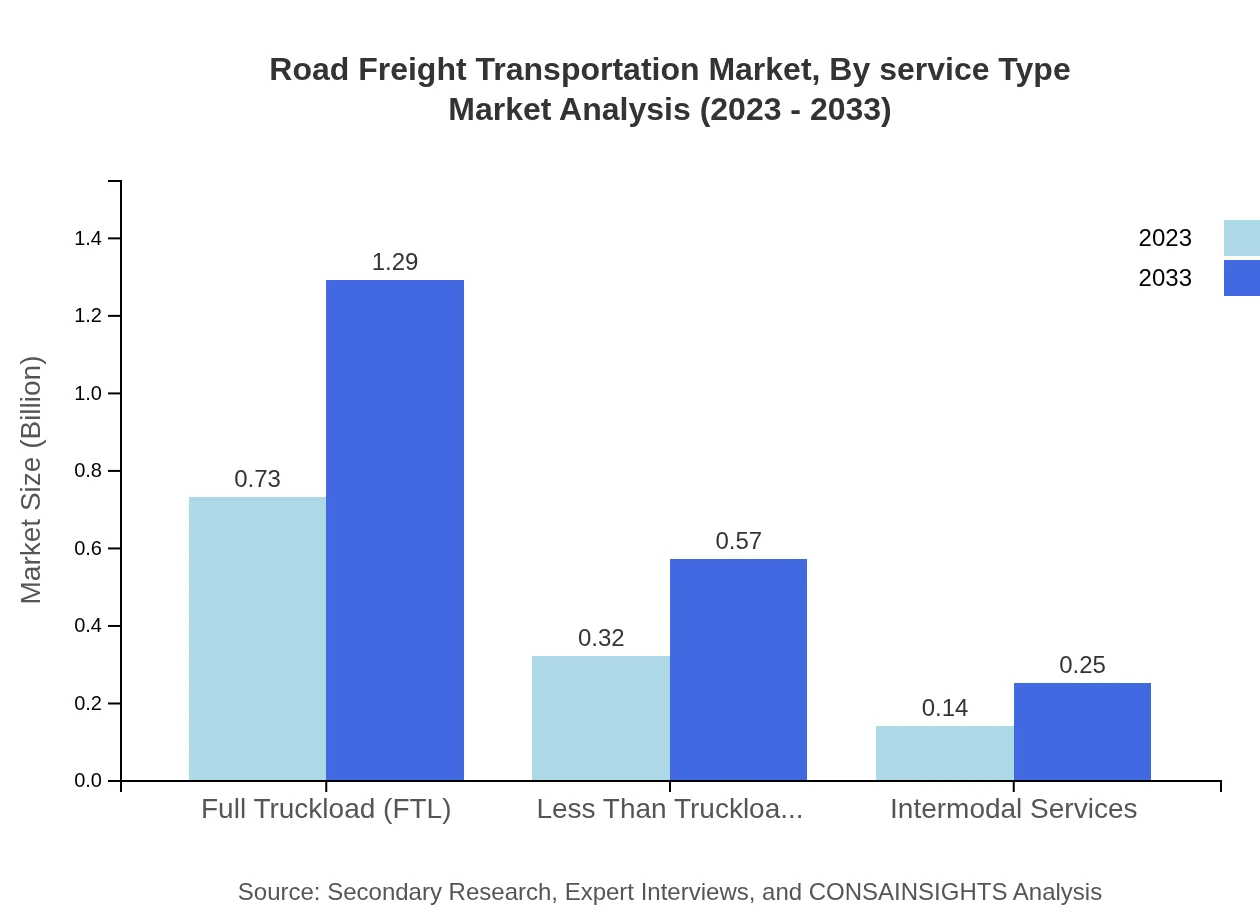

Road Freight Transportation Market Analysis By Service Type

The market segmentation by service type reveals that Traditional Transportation remains dominant, valued at $0.73 trillion in 2023 and expected to increase to $1.29 trillion by 2033, holding a 61.14% market share. E-commerce logistics are a significant growth driver, growing from $0.60 trillion to $1.07 trillion, maintaining a 50.41% share, as companies adapt to consumer expectations for quicker delivery.

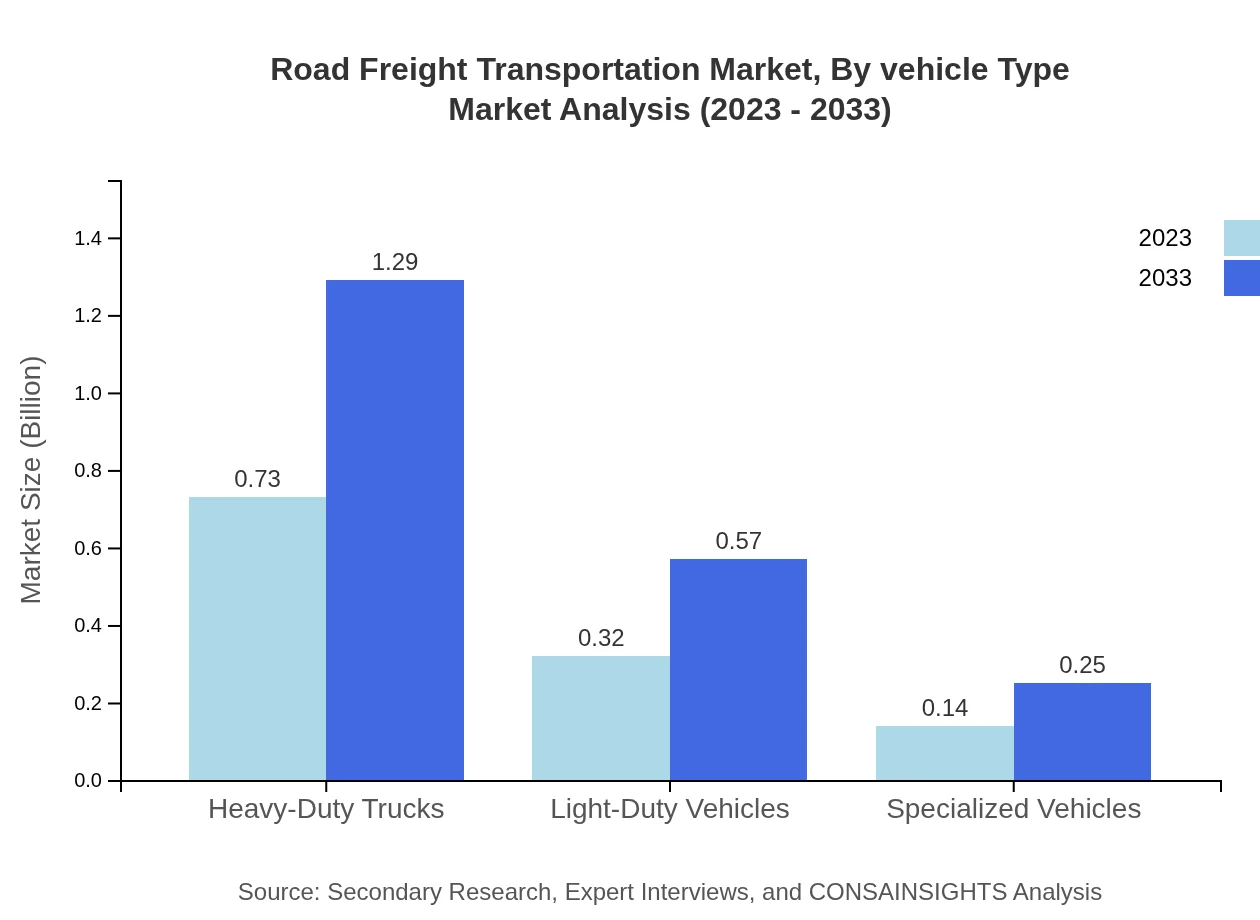

Road Freight Transportation Market Analysis By Vehicle Type

Heavy-Duty Trucks comprise the largest segment within vehicle types, valued at $0.73 trillion in 2023 and projected to grow to $1.29 trillion by 2033, also holding a 61.14% market share. Light-Duty Vehicles and Specialized Vehicles follow, aligning with trends that show increased demand for diverse freight solutions.

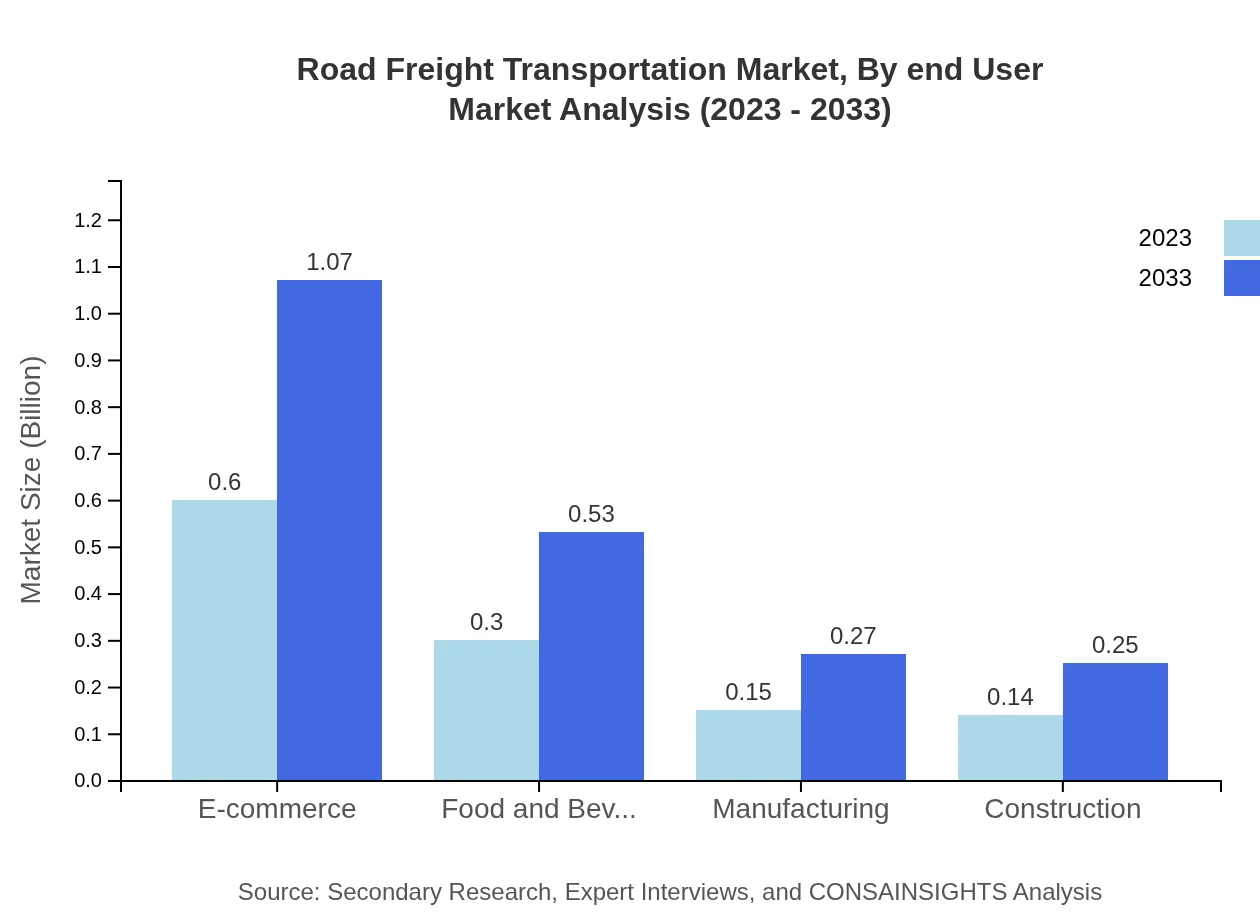

Road Freight Transportation Market Analysis By End User

The Food and Beverage sector plays a pivotal role, valued at $0.30 trillion in 2023, anticipated to grow to $0.53 trillion by 2033, sustaining a 24.89% market share. The E-commerce sector, due to its rapid expansion, is set for substantial growth, underscoring changing consumer behaviors.

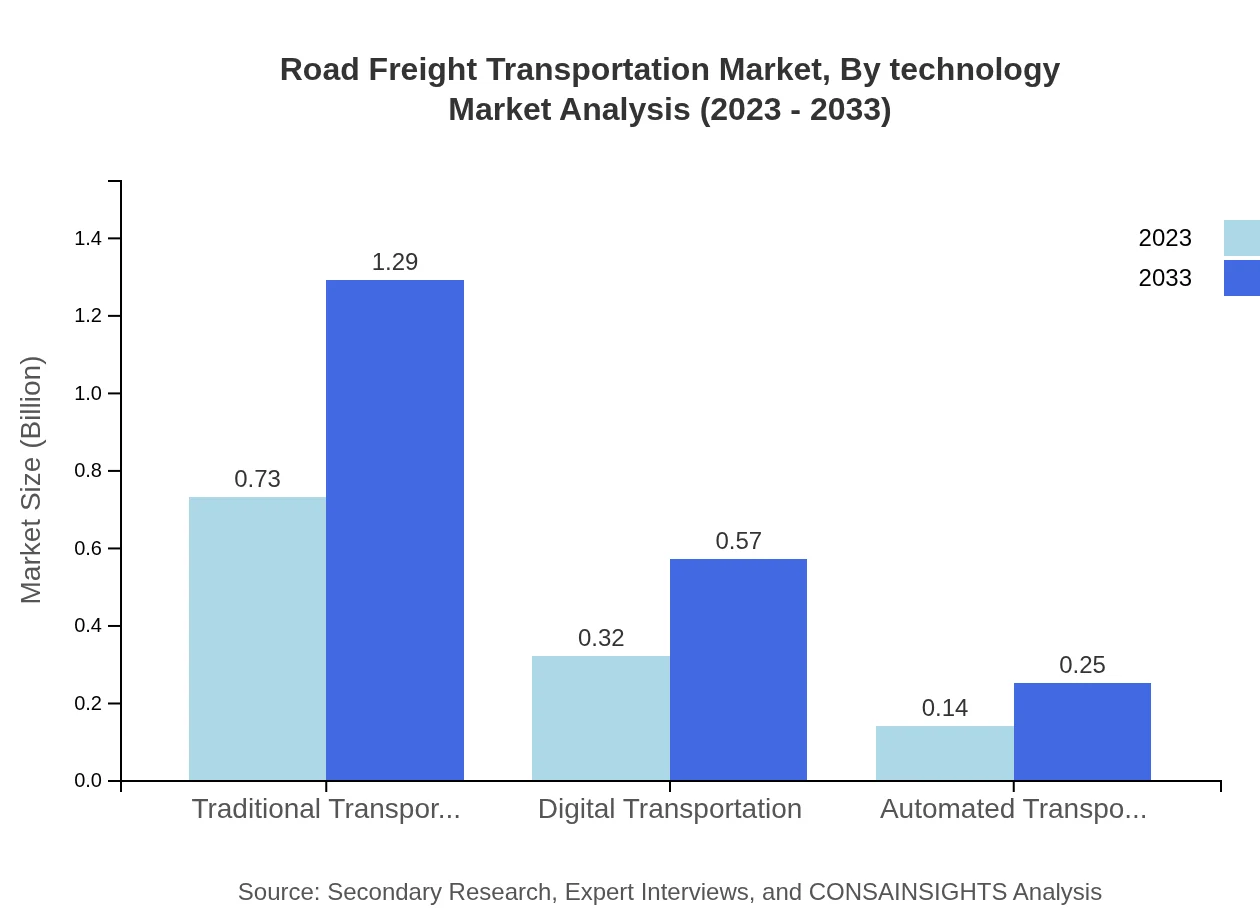

Road Freight Transportation Market Analysis By Technology

Digital Transportation is gaining momentum, valued at $0.32 trillion in 2023 and projected to reach $0.57 trillion by 2033, capturing a 26.95% market share. Innovations in automated systems and logistics software are transforming traditional models, enhancing efficiency and tracking abilities.

Road Freight Transportation Market Analysis By Regulatory Factors

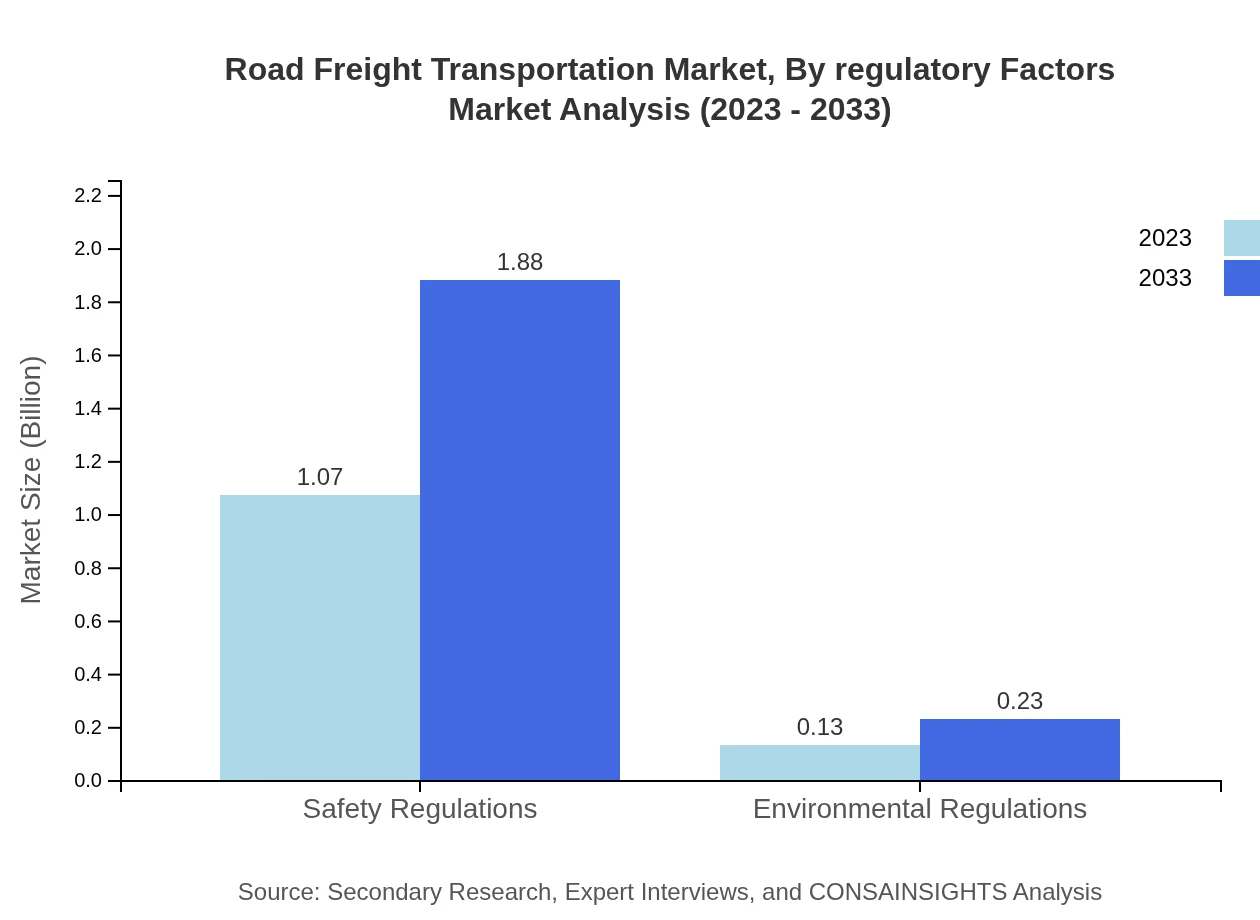

Safety Regulations dominate the regulatory factors segment, with a projected market value of $1.07 trillion in 2023 and anticipated growth to $1.88 trillion by 2033, holding 88.94% of the focus in regulatory compliance. Environmental regulations, while smaller, are increasingly shaping industry practices, necessitating investment in green technologies.

Road Freight Transportation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Road Freight Transportation Industry

DHL Supply Chain:

A global leader in logistics solutions, DHL Supply Chain focuses on optimized supply chain management and road transportation solutions, contributing significantly to the road freight sector.FedEx Corp.:

FedEx is renowned for its express transportation services. The company leverages advanced technology in logistics and delivery, enhancing operational efficiency in road freight.UPS (United Parcel Service):

UPS provides comprehensive logistics and parcel delivery services worldwide, focusing on driving efficiencies in road freight through innovative technologies.XPO Logistics:

XPO Logistics offers supply chain solutions with a strong focus on transportation, leveraging technology to improve productivity and flexibility in freight operations.Kuehne + Nagel:

As a major international logistics company, Kuehne + Nagel specializes in enhancing road freight operations through integrated services and digital solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of road Freight Transportation?

The road freight transportation market is valued at approximately $1.2 trillion in 2023, with a projected compound annual growth rate (CAGR) of 5.7% through 2033. This reflects a robust demand for freight services across various sectors.

What are the key market players or companies in this road Freight Transportation industry?

Key market players in the road freight transportation industry include major logistics companies and carriers, industry leaders with extensive fleets, and innovative startups enhancing last-mile delivery solutions. These companies significantly impact market dynamics through technology and efficient service offerings.

What are the primary factors driving the growth in the road Freight Transportation industry?

Significant drivers of growth in the road freight transportation industry include the rise of e-commerce, increasing global trade, advancements in logistics technology, regulatory frameworks ensuring safety, and heightened demand for timely delivery services across various sectors.

Which region is the fastest Growing in the road Freight Transportation?

The Asia Pacific region stands out as the fastest-growing in the road freight transportation sector, with market growth from $0.23 trillion in 2023 to $0.40 trillion by 2033. This trend is spurred by rising consumer demand and infrastructural improvements.

Does ConsaInsights provide customized market report data for the road Freight Transportation industry?

Yes, ConsaInsights offers tailored market report data for the road freight transportation industry, catering to specific client needs, allowing for in-depth analysis and customized insights that support strategic decision-making.

What deliverables can I expect from this road Freight Transportation market research project?

Deliverables from our road freight transportation market research project include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, segmentation data, and actionable insights to guide business strategies and investment decisions.

What are the market trends of road Freight Transportation?

Key trends in the road freight transportation market include digital transformation, automation of logistics processes, increasing sustainability initiatives, and the growing importance of safety regulations. These trends shape industry practices and influence future growth trajectories.