Road Roller Market Report

Published Date: 22 January 2026 | Report Code: road-roller

Road Roller Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Road Roller market from 2023 to 2033, including insights into market size, growth trends, segmentation, regional analysis, leading companies, and future forecasts.

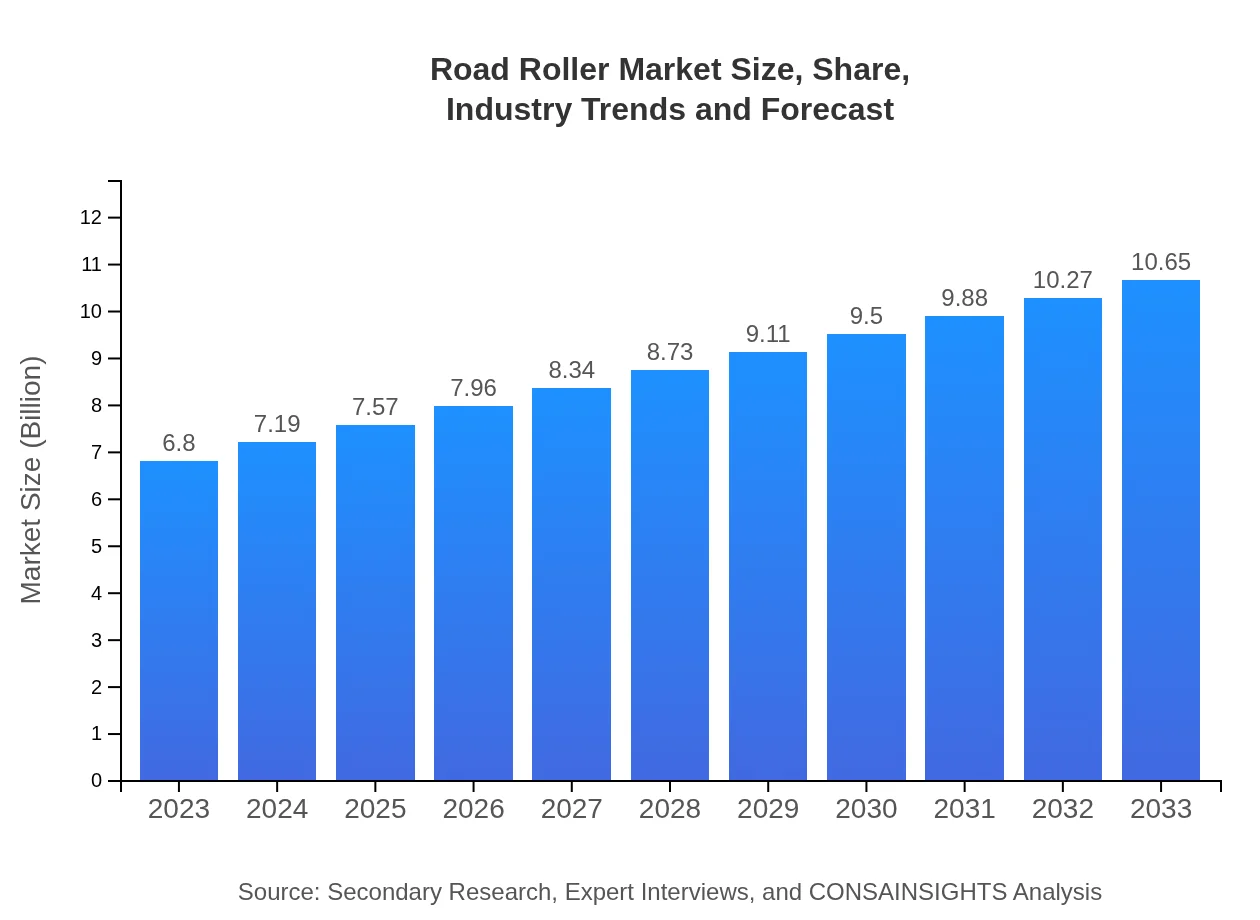

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $10.65 Billion |

| Top Companies | Caterpillar Inc., Volvo Construction Equipment, JCB, Komatsu Ltd., CASE Construction Equipment |

| Last Modified Date | 22 January 2026 |

Road Roller Market Overview

Customize Road Roller Market Report market research report

- ✔ Get in-depth analysis of Road Roller market size, growth, and forecasts.

- ✔ Understand Road Roller's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Road Roller

What is the Market Size & CAGR of Road Roller market in 2023 and 2033?

Road Roller Industry Analysis

Road Roller Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Road Roller Market Analysis Report by Region

Europe Road Roller Market Report:

The European Road Roller market is expected to witness growth from $2.20 billion in 2023 to $3.45 billion by 2033. This compounded growth is supported by the European Union’s investment in green infrastructure and sustainable road construction practices.Asia Pacific Road Roller Market Report:

In the Asia Pacific region, the Road Roller market was valued at $1.30 billion in 2023, projected to grow to $2.04 billion by 2033. This growth is driven by rapid urbanization, significant investments in infrastructural projects in emerging economies like India and China, and a surge in demand for modernized construction equipment.North America Road Roller Market Report:

North America holds a significant share of the Road Roller market, valued at $2.27 billion in 2023 and forecasted to reach $3.55 billion in 2033. Factors contributing to this growth include high construction activity driven by urban development projects, and a trend towards upgrading existing road facilities.South America Road Roller Market Report:

The South American market for Road Rollers is expected to grow from $0.15 billion in 2023 to $0.23 billion by 2033. The increase can be attributed to ongoing infrastructure initiatives across nations that are focused on improving road networks, alongside investments in tourism infrastructure.Middle East & Africa Road Roller Market Report:

The Road Roller market in the Middle East and Africa is anticipated to grow from $0.88 billion in 2023 to $1.38 billion by 2033. Key factors include rising infrastructure projects due to urban expansion and increased government spending on public works.Tell us your focus area and get a customized research report.

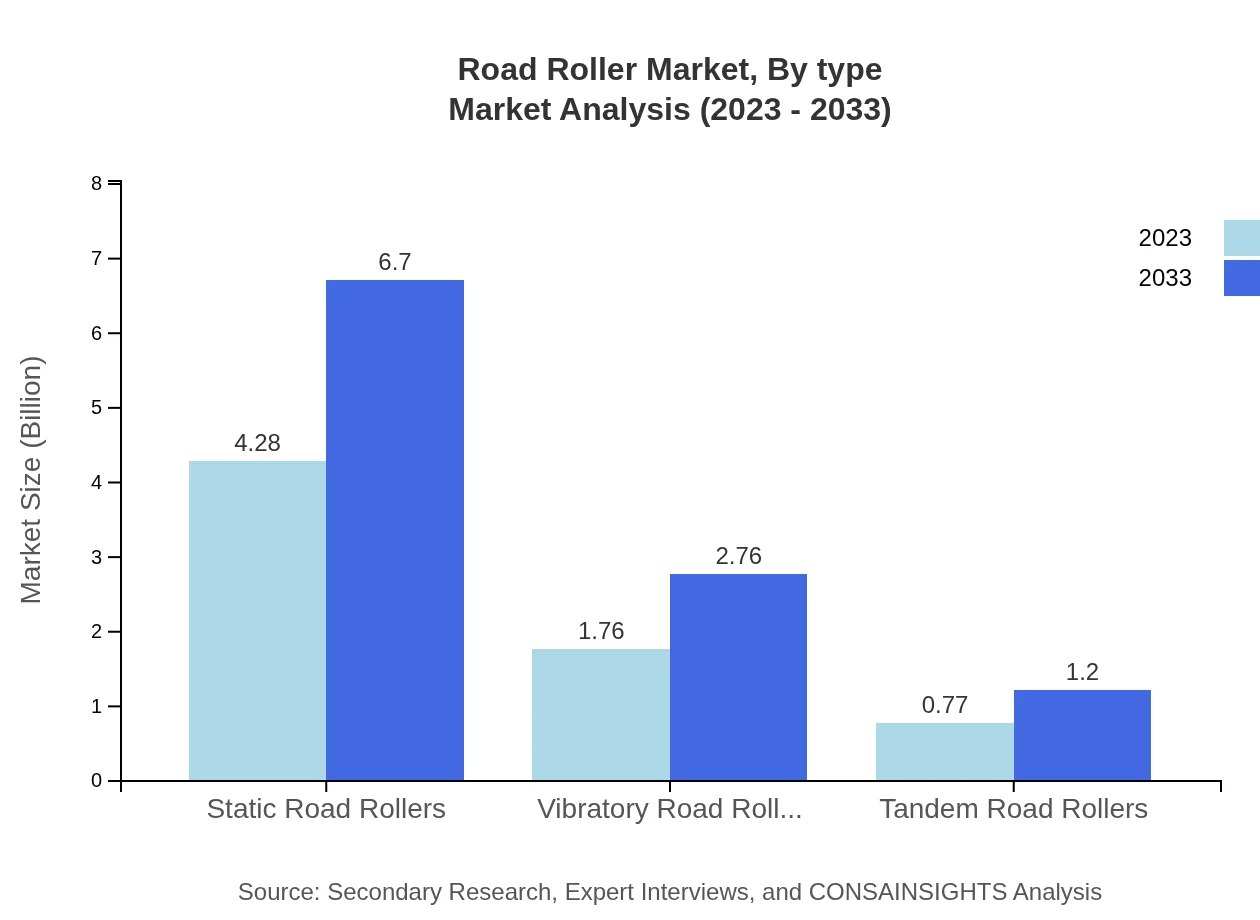

Road Roller Market Analysis By Type

The Road Roller market by type includes static, vibratory, and tandem road rollers. In 2023, static road rollers dominated the market with a size of $4.28 billion, expected to grow to $6.70 billion by 2033, capturing 62.88% of the market share. Vibratory road rollers, with an expected size growth from $1.76 billion to $2.76 billion (25.87%), and tandem road rollers from $0.77 billion to $1.20 billion (11.25%) also represent significant segments.

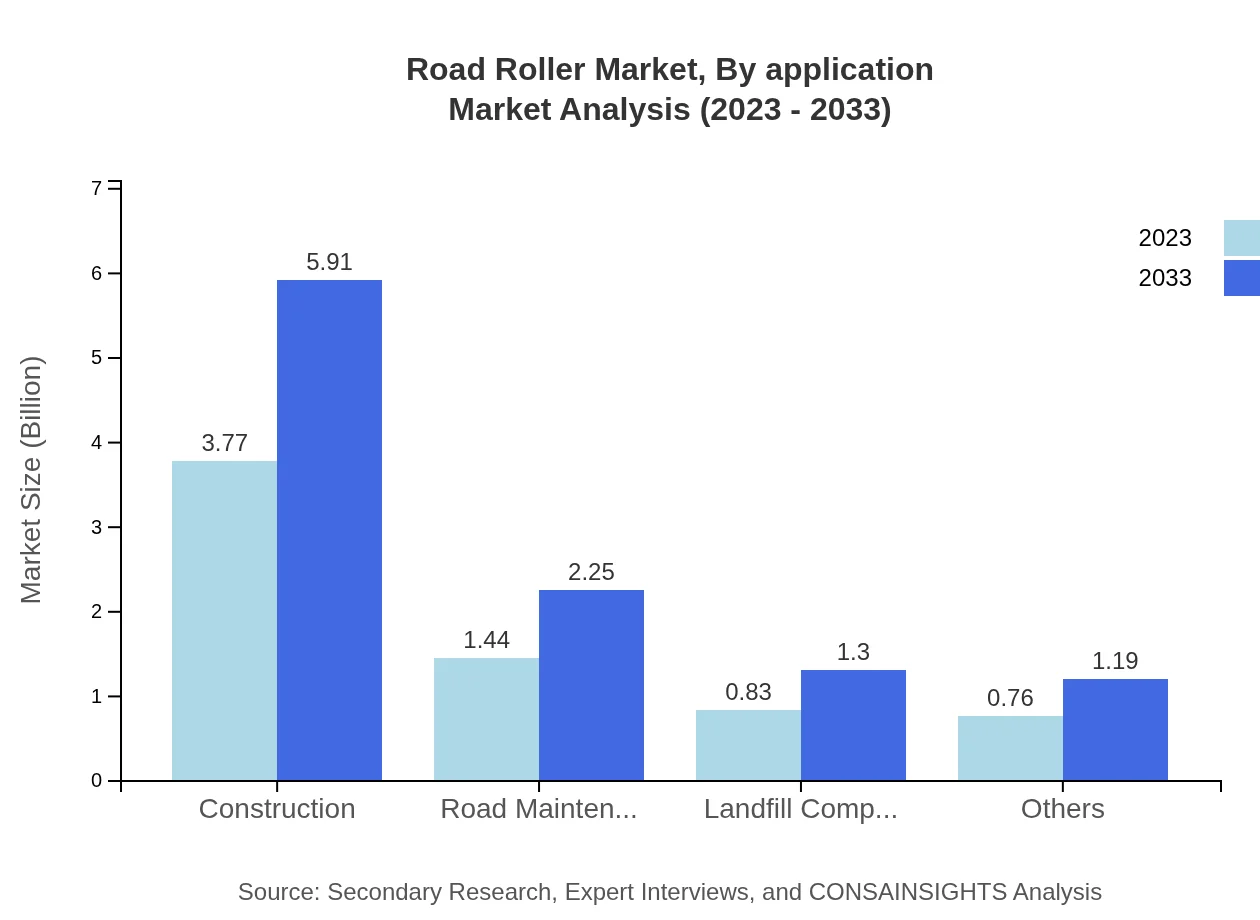

Road Roller Market Analysis By Application

In application segments, infrastructure development represents the largest market share, reaching $3.77 billion in 2023 and projected at $5.91 billion by 2033, maintaining a share of 55.47%. The construction, road maintenance, municipal waste management, and mining sectors also show considerable demand, reflecting the versatility of road rollers in various applications.

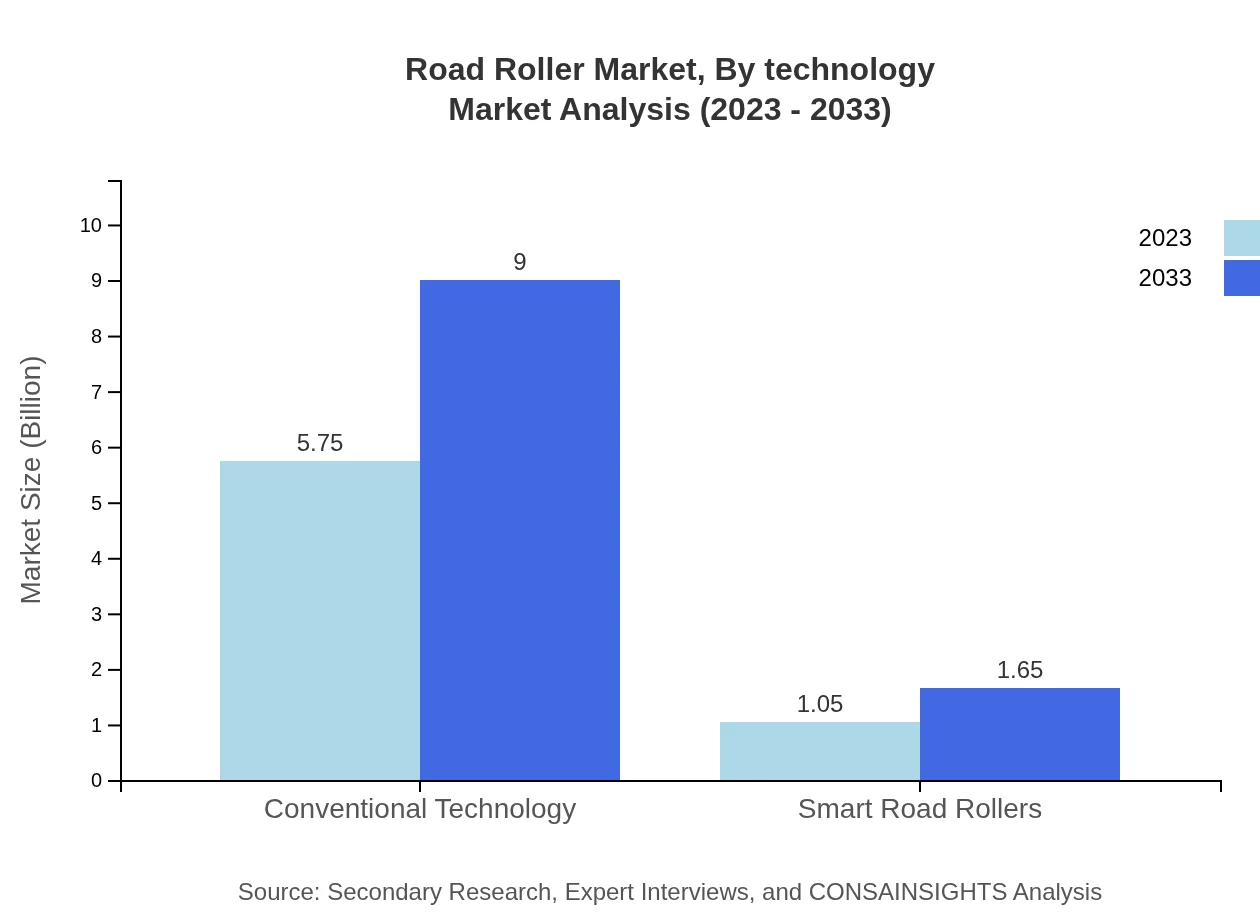

Road Roller Market Analysis By Technology

The technology segment divides into conventional and smart road rollers. As of 2023, conventional technology holds a larger market size at $5.75 billion (84.55%), anticipated to reach $9.00 billion by 2033. In contrast, smart road rollers, valued at $1.05 billion in 2023, are projected to grow to $1.65 billion, reflecting a growing interest in integrating technologies for better operational accuracy and efficiency.

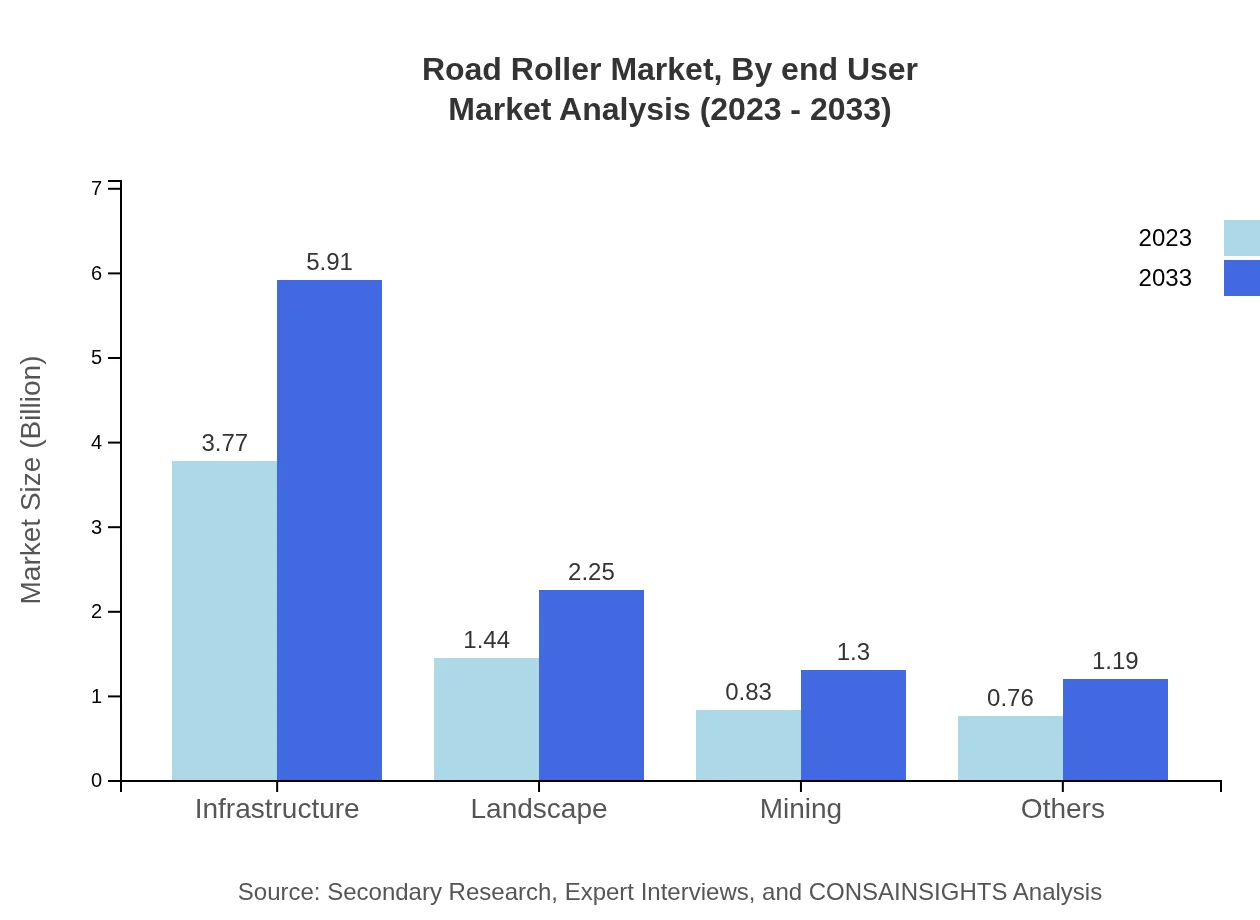

Road Roller Market Analysis By End User

The end-user segment includes construction companies, government agencies, and private contractors. Construction industries, valued at $3.77 billion (55.47%) in 2023, are critical for road roller demand. Ongoing advancements and increasing construction activities are anticipated to push the sector growth, driving further demand.

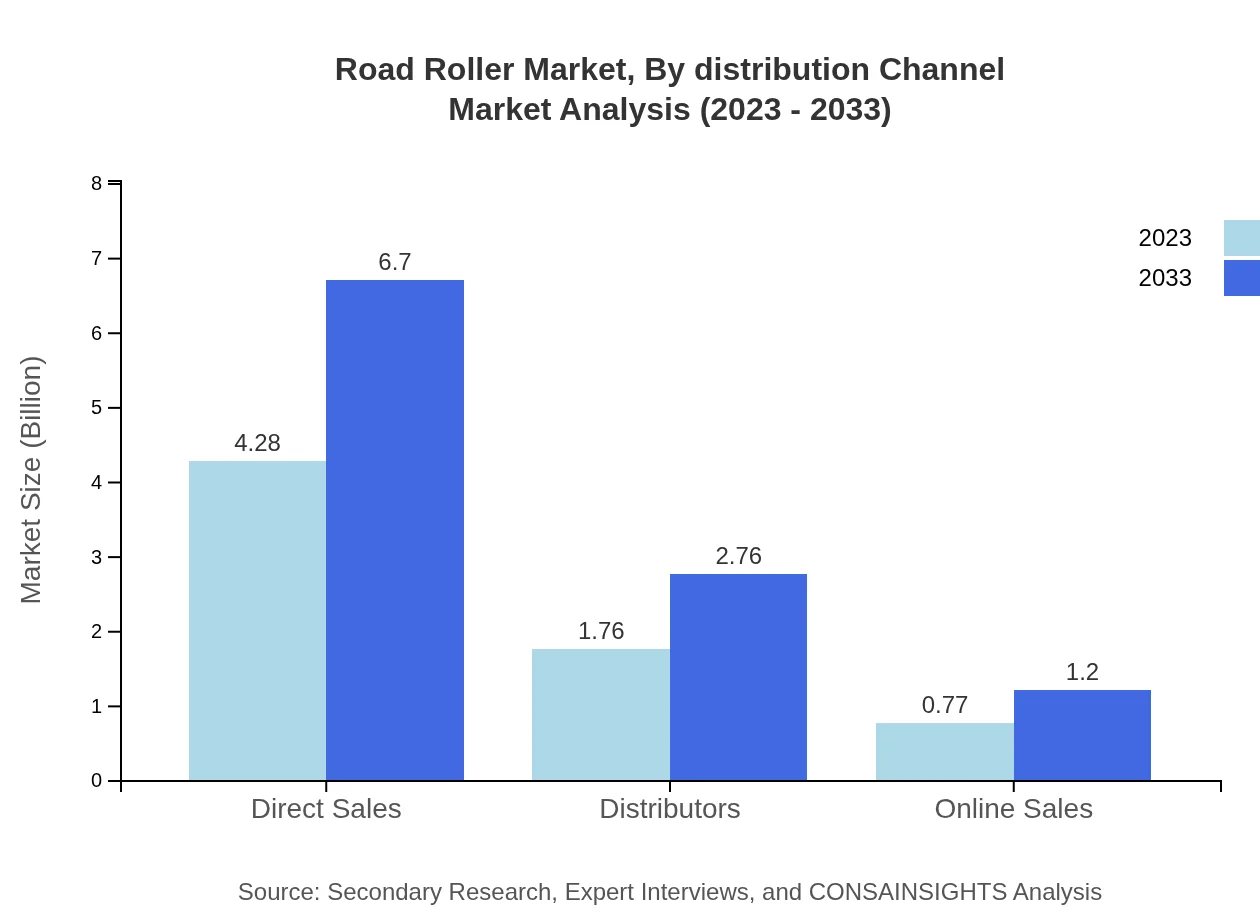

Road Roller Market Analysis By Distribution Channel

Distribution channels for road rollers primarily involve direct sales, distributors, and online platforms. Direct sales held a market size of $4.28 billion (62.88%) in 2023, while sales through distributors and online sales are gaining traction, reflecting changes in purchasing behaviors in the construction equipment sector.

Road Roller Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Road Roller Industry

Caterpillar Inc.:

Caterpillar is a leading manufacturer of construction and mining equipment, renowned for its innovative road rollers and commitment to sustainability.Volvo Construction Equipment:

Volvo CE specializes in heavy equipment, providing advanced road rollers with a focus on low emissions and high performance.JCB:

JCB is known for designing and manufacturing reliable road rollers that cater to both construction and specialized applications.Komatsu Ltd.:

Komatsu is a global leader in construction machinery, offering a wide range of equipment including high-quality road rollers.CASE Construction Equipment:

CASE provides comprehensive solutions for road construction, emphasizing efficiency and quality through its road rollers.We're grateful to work with incredible clients.

FAQs

What is the market size of road Roller?

The road roller market is estimated to be valued at approximately $6.8 billion in 2023, with a forecasted CAGR of 4.5% through 2033, indicating steady growth driven by construction activities worldwide.

What are the key market players or companies in this road Roller industry?

Key players in the road roller industry include manufacturers such as Caterpillar, Volvo Construction Equipment, and JCB. These companies ensure innovative product development and leverage advanced technology to maintain a competitive edge in the market.

What are the primary factors driving the growth in the road Roller industry?

Growth in the road roller market is primarily driven by increased infrastructure projects, urbanization, and government investments in transportation. Additionally, advancements in technology improve efficiency, promoting adoption among construction contractors.

Which region is the fastest Growing in the road Roller?

The Asia Pacific region is the fastest-growing in the road roller market, projected to grow from $1.30 billion in 2023 to $2.04 billion by 2033, fueled by rising urbanization and infrastructure development initiatives.

Does ConsaInsights provide customized market report data for the road Roller industry?

Yes, ConsaInsights offers tailored market reports for the road roller industry, allowing clients to access specific data, insights, and forecasts that meet their unique business requirements and strategic objectives.

What deliverables can I expect from this road Roller market research project?

Expected deliverables from the road roller market research project include comprehensive market analysis reports, segmentation data, growth forecasts, key player profiles, and actionable insights to support strategic decision-making.

What are the market trends of road Roller?

Current trends in the road roller market include the rise of smart road rollers, eco-friendly technology adoption, and a focus on automation to enhance operational efficiency. Additionally, a shift towards direct sales channels is notable.