Robo Advisory Services Market Report

Published Date: 22 January 2026 | Report Code: robo-advisory-services

Robo Advisory Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Robo Advisory Services market, covering market size, growth trends, segmentation, and regional insights, with forecasts spanning from 2023 to 2033.

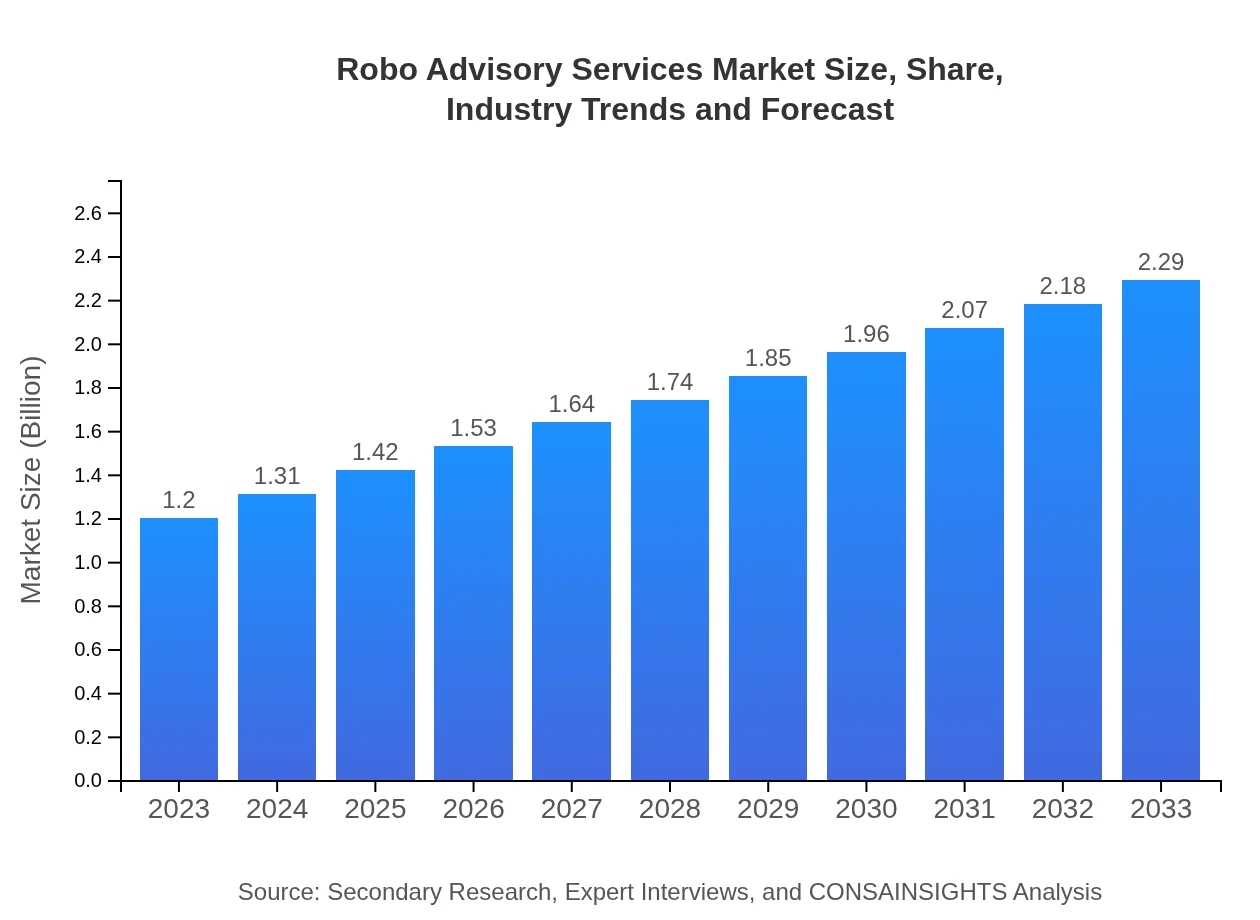

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $2.29 Billion |

| Top Companies | Wealthfront, Betterment, Schwab Intelligent Portfolios, NerdWallet |

| Last Modified Date | 22 January 2026 |

Robo Advisory Services Market Overview

Customize Robo Advisory Services Market Report market research report

- ✔ Get in-depth analysis of Robo Advisory Services market size, growth, and forecasts.

- ✔ Understand Robo Advisory Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Robo Advisory Services

What is the Market Size & CAGR of Robo Advisory Services market in 2023?

Robo Advisory Services Industry Analysis

Robo Advisory Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Robo Advisory Services Market Analysis Report by Region

Europe Robo Advisory Services Market Report:

The European market will likely experience growth from $310 million in 2023 to $590 million by 2033, bolstered by regulatory support and a cultural shift towards digital banking. Countries like the UK and Germany lead the charge in adopting robo advisory services as part of broader tech-driven financial solutions.Asia Pacific Robo Advisory Services Market Report:

In the Asia Pacific region, the Robo Advisory Services market is anticipated to grow from $260 million in 2023 to $500 million by 2033, driven by the rise of a tech-savvy population and increasing smartphone penetration which enhances access to digital financial services. The regulatory environment is also becoming more supportive, encouraging startups in the fintech sector.North America Robo Advisory Services Market Report:

North America holds the largest share of the market, expected to rise from $390 million in 2023 to $750 million in 2033. The established presence of major financial institutions and innovations in technology facilitate robust market dynamics. Moreover, venture capital investment in fintech solutions remains strong, further accelerating market adoption.South America Robo Advisory Services Market Report:

The South American market for Robo Advisory Services is projected to increase from $100 million in 2023 to $200 million by 2033. This growth will be supported by enhancing financial literacy among consumers and the expansion of fintech ecosystems in major economies such as Brazil and Argentina.Middle East & Africa Robo Advisory Services Market Report:

The Middle East and Africa market is expected to increase from $140 million in 2023 to $260 million by 2033, with increased investment in technology infrastructure and a push towards digital transformation in financial services creating new opportunities for robo-advisors.Tell us your focus area and get a customized research report.

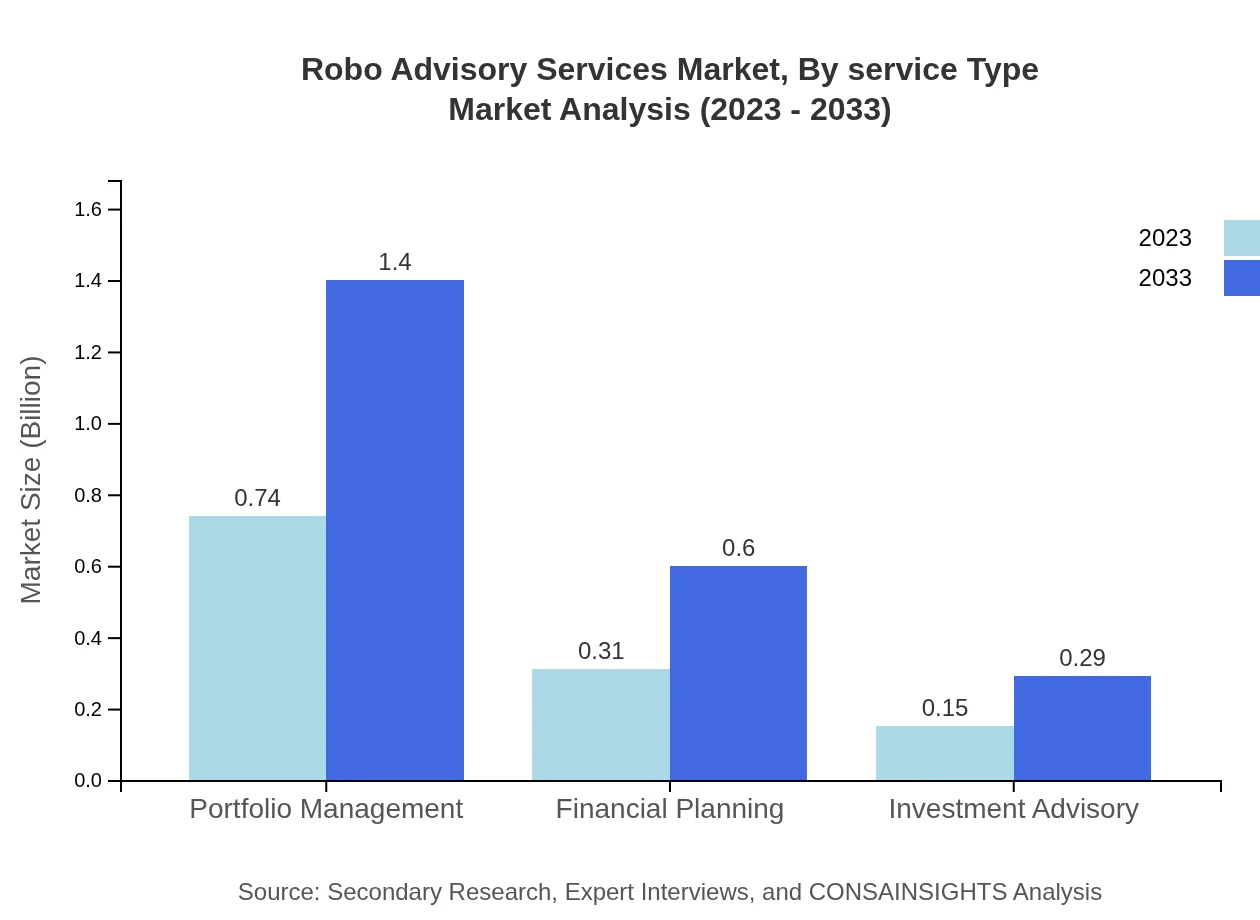

Robo Advisory Services Market Analysis By Service Type

The market is segmented by service type into portfolio management, financial planning, investment advisory, and more. Portfolio management remains the dominant segment, accounting for approximately 61.26% of the market share in 2023, valued at $740 million. By 2033, the segment's market share is expected to remain substantial, reflecting consumer preference for customized investment options.

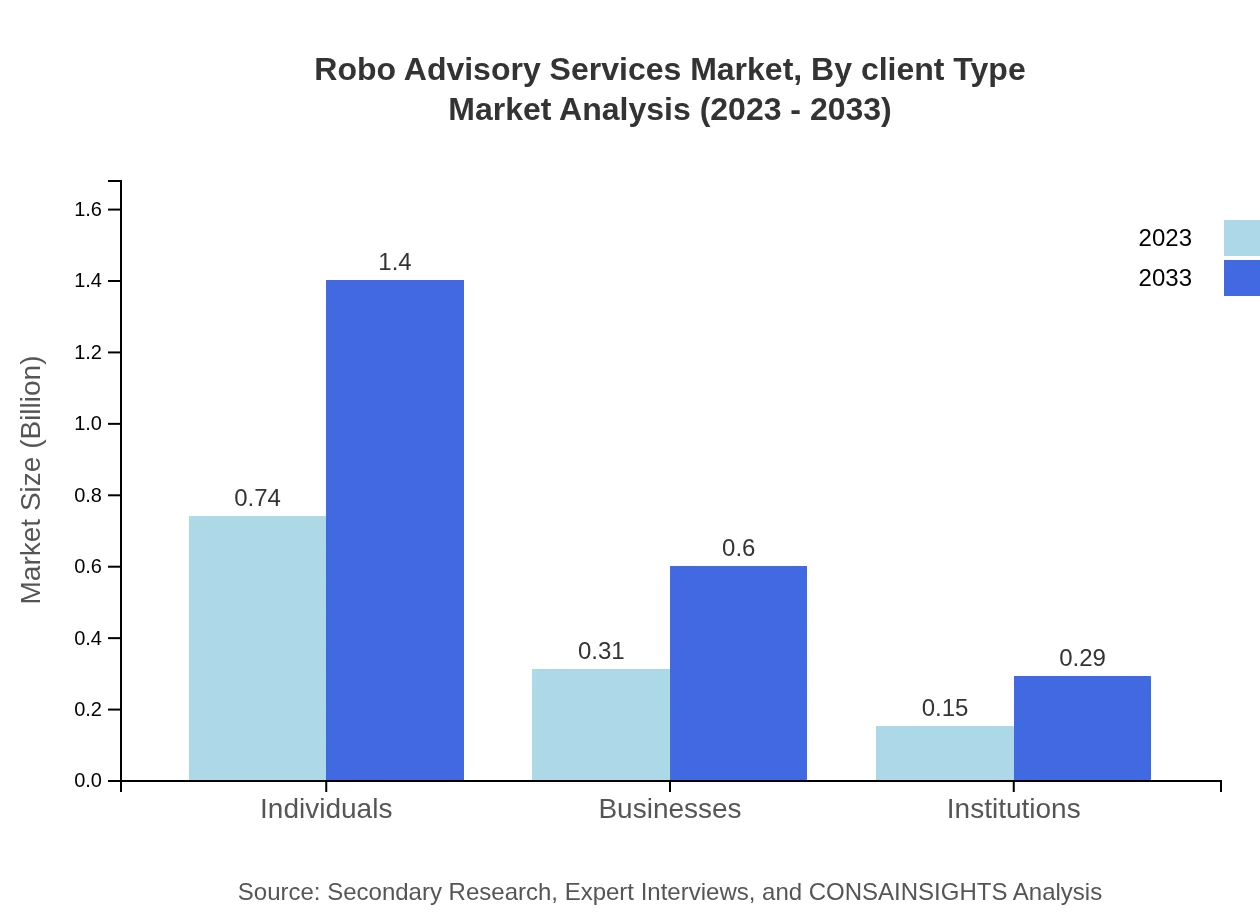

Robo Advisory Services Market Analysis By Client Type

The client type segmentation splits the market into individuals, businesses, and institutions. Individual investors account for the largest market share at 61.26% in 2023, reflecting the growing trend of self-directed investment among consumers. Businesses, benefiting from lower costs and improved financial efficiency, make up a significant share as well.

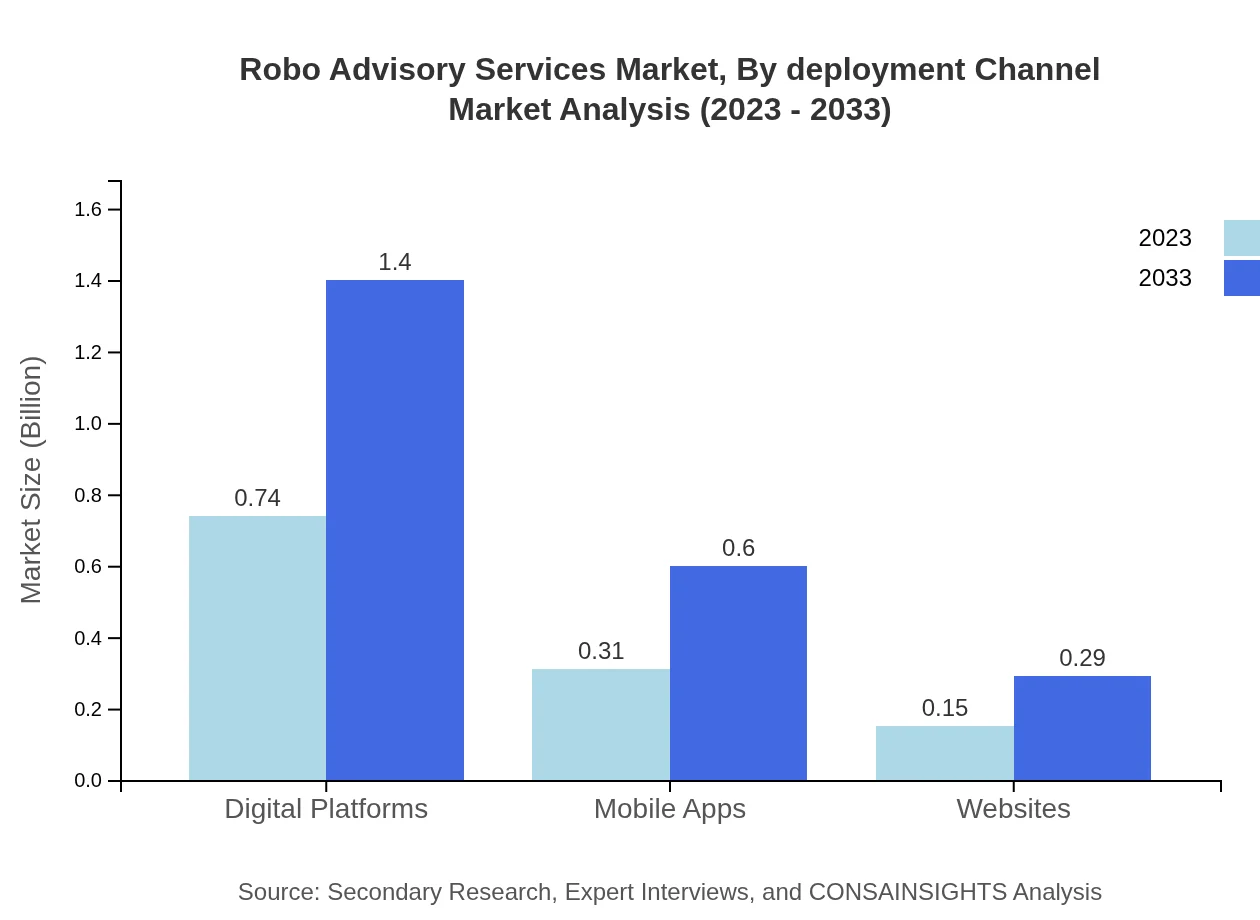

Robo Advisory Services Market Analysis By Deployment Channel

Deployment channels include digital platforms, mobile applications, and websites. Digital platforms lead as the most utilized channel, capturing 61.26% of the market in 2023. This trend is expected to continue as more consumers prefer seamless, online access to financial services.

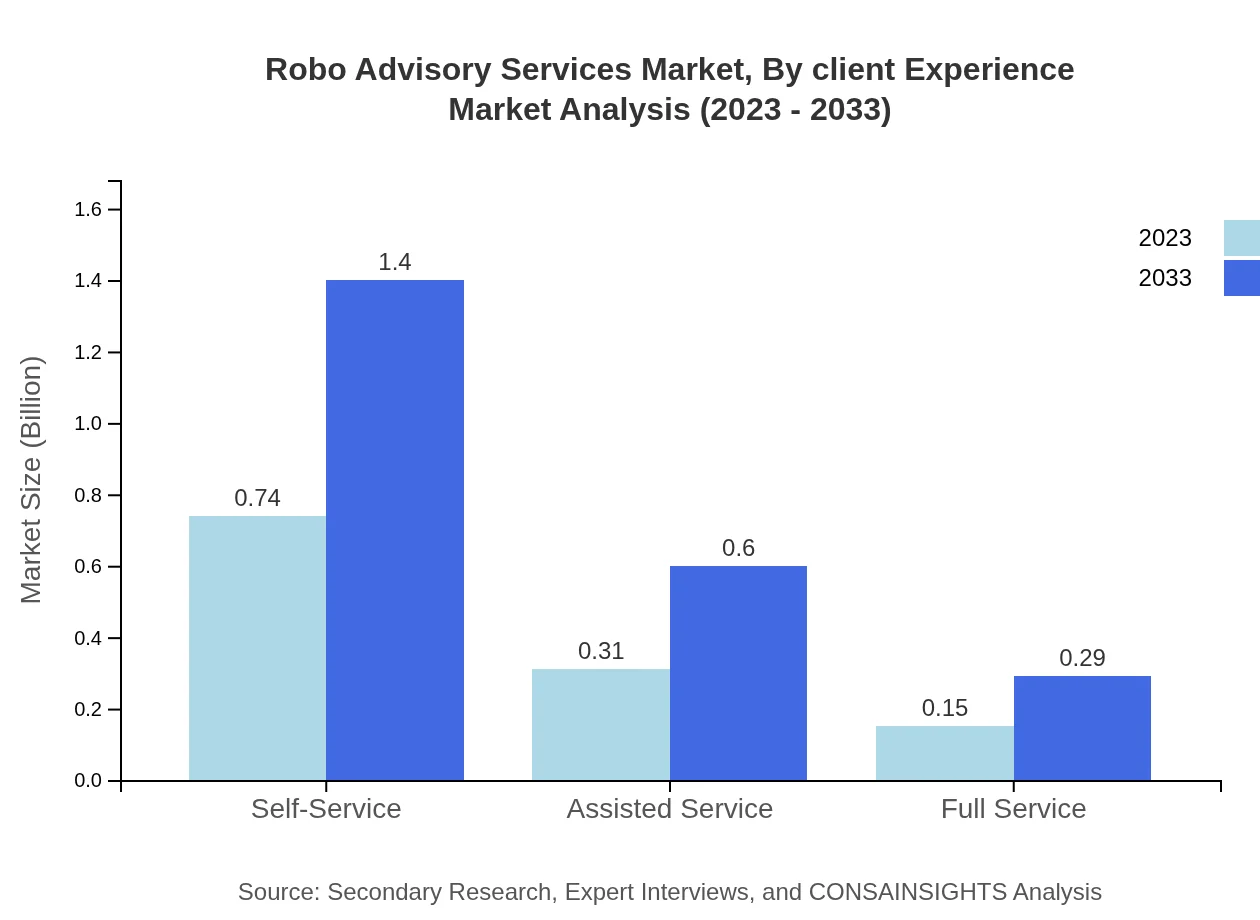

Robo Advisory Services Market Analysis By Client Experience

Client experience is segmented into self-service, assisted service, and full service. Self-service is the preferred mode, commanding a market share of 61.26% in 2023. As consumers value autonomy in managing their investments, this segment is projected to expand in the coming years.

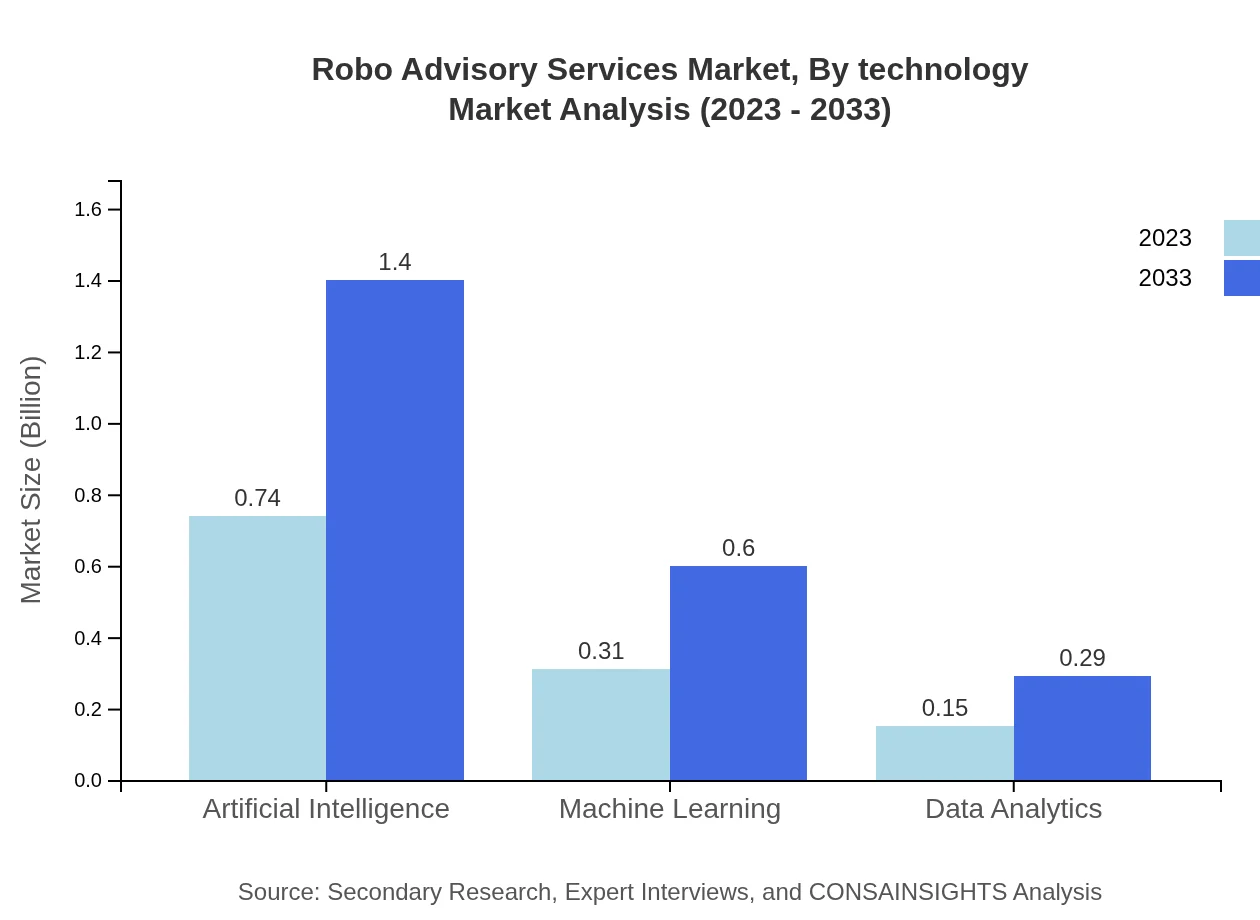

Robo Advisory Services Market Analysis By Technology

The technology segment includes artificial intelligence, machine learning, and data analytics. AI stands out, with a market size of $740 million in 2023 and an expected growth trajectory reaffirmed by its ability to personalize services at scale. Machine learning follow suit with $310 million, indicating its growing importance in predicting market trends and consumer needs.

Robo Advisory Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Robo Advisory Services Industry

Wealthfront:

Wealthfront is a leading robo-advisor that offers automated wealth management services with a strong focus on long-term financial planning. Their platform is widely recognized for its user-friendly interface and tax optimization features.Betterment:

Betterment provides personalized financial advice and investment management leveraging cutting-edge technology. They are known for their smart technology that adapts portfolios based on market conditions.Schwab Intelligent Portfolios:

Schwab Intelligent Portfolios offers clients a sophisticated robo advisory experience, emphasizing low-cost investing and financial goal-setting. Their no-fee structure has attracted a large customer base.NerdWallet:

NerdWallet combines finance literacy with robo advisory services, offering tailored investment advice based on individual financial situations and objectives.We're grateful to work with incredible clients.

FAQs

What is the market size of robo Advisory services?

The global market size for robo-advisory services is approximately $1.2 billion in 2023, with a projected CAGR of 6.5%, aiming to significantly expand over the next decade.

What are the key market players or companies in the robo Advisory services industry?

Key players in the robo-advisory services industry include Wealthfront, Betterment, Personal Capital, and Nutmeg, which are known for their innovative technologies and client-centric services in the automated investment management sector.

What are the primary factors driving the growth in the robo Advisory services industry?

The growth in the robo-advisory services industry is primarily driven by the increasing adoption of digital platforms, growing consumer preference for automated financial solutions, and rising awareness regarding investment opportunities among millennials.

Which region is the fastest Growing in the robo Advisory services market?

North America is the fastest-growing region in the robo-advisory services market, with a projected market size increase from $0.39 billion in 2023 to $0.75 billion by 2033, driven by technological advancements and robust financial ecosystems.

Does ConsaInsights provide customized market report data for the robo Advisory services industry?

Yes, ConsaInsights offers customized market reporting services for the robo-advisory services industry, catering to specific client requirements and tailoring insights to informed decision-making for businesses.

What deliverables can I expect from this robo Advisory services market research project?

From the robo-advisory services market research project, you can expect comprehensive deliverables including detailed market analysis, trend identification, competitive landscape evaluation, and strategic recommendations for future growth.

What are the market trends of robo Advisory services?

Current market trends in robo-advisory services include the integration of artificial intelligence, increased focus on personalized investment strategies, and a shift towards hybrid models that combine automated with human advisory services.