Rocket And Missile Market Report

Published Date: 03 February 2026 | Report Code: rocket-and-missile

Rocket And Missile Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Rocket And Missile market from 2023 to 2033, detailing market trends, size, industry insights, segmentation, regional performance, and forecasts for upcoming years.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

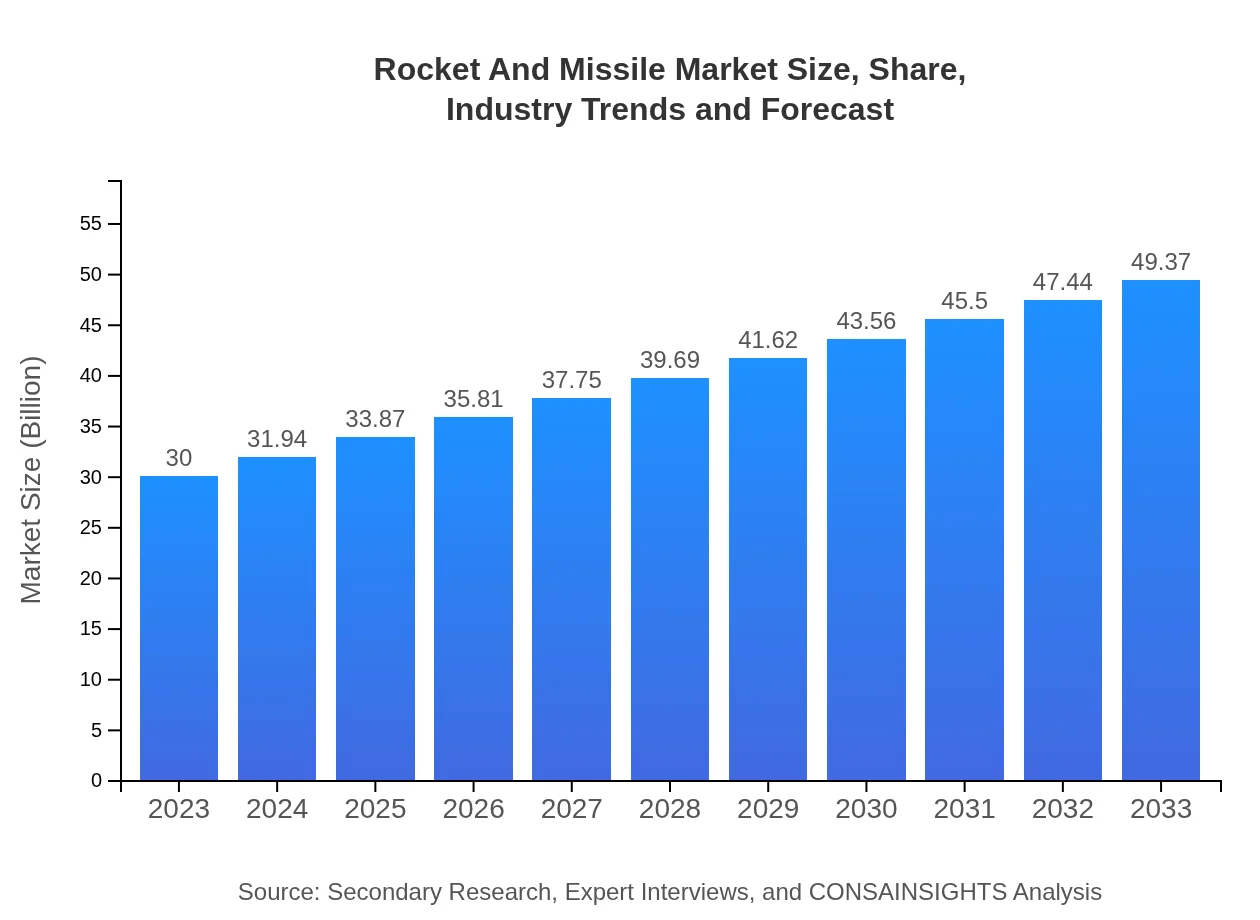

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $49.37 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems, Airbus Defence and Space |

| Last Modified Date | 03 February 2026 |

Rocket And Missile Market Overview

Customize Rocket And Missile Market Report market research report

- ✔ Get in-depth analysis of Rocket And Missile market size, growth, and forecasts.

- ✔ Understand Rocket And Missile's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rocket And Missile

What is the Market Size & CAGR of Rocket And Missile market in 2023?

Rocket And Missile Industry Analysis

Rocket And Missile Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rocket And Missile Market Analysis Report by Region

Europe Rocket And Missile Market Report:

Europe's market is projected to expand from $7.96 billion in 2023 to $13.09 billion by 2033, as European nations implement collaborative defense projects and enhance their military capabilities.Asia Pacific Rocket And Missile Market Report:

The Asia Pacific region is gaining momentum with significant investments in missile defense systems and advancements in space technologies, projected to grow from $5.89 billion in 2023 to $9.69 billion by 2033.North America Rocket And Missile Market Report:

North America remains the largest market, expected to escalate from $9.88 billion in 2023 to $16.26 billion in 2033. The ongoing modernization of defense systems and counter-terrorism efforts are key growth drivers.South America Rocket And Missile Market Report:

In South America, the market is anticipated to grow modestly, reflecting an increase from $2.16 billion in 2023 to $3.56 billion in 2033, largely driven by rising defense budgets in key countries.Middle East & Africa Rocket And Missile Market Report:

The Middle East and Africa market is expected to grow from $4.12 billion in 2023 to $6.77 billion in 2033, driven by geopolitical tensions and the need for enhanced defense capabilities.Tell us your focus area and get a customized research report.

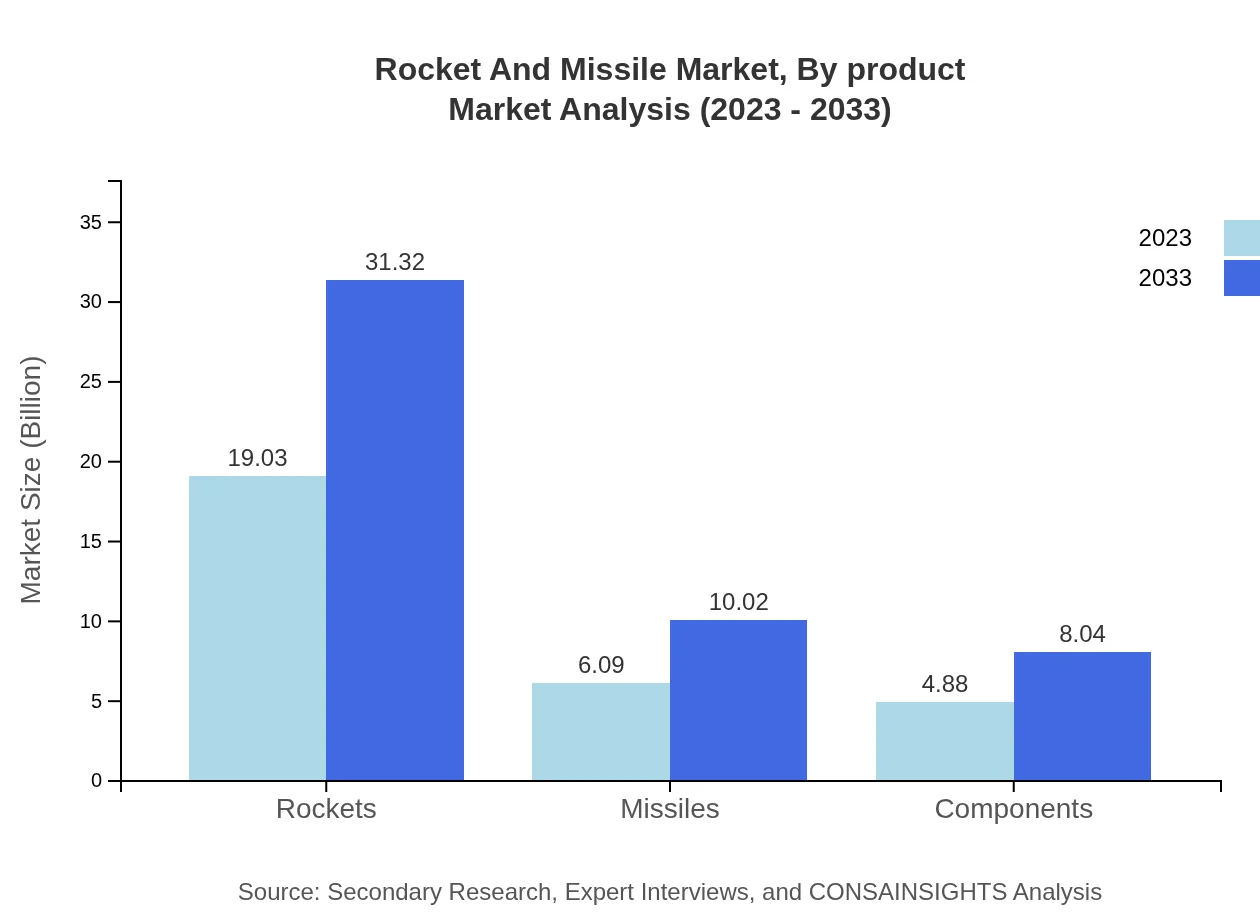

Rocket And Missile Market Analysis By Product

The product segment significantly influences overall market performance. The rocket market is projected to increase from $19.03 billion in 2023 to $31.32 billion in 2033, securing a 63.43% market share. The missile segment is also expected to rise from $6.09 billion to $10.02 billion, maintaining a 20.29% share, while components will grow from $4.88 billion to $8.04 billion, holding a 16.28% share.

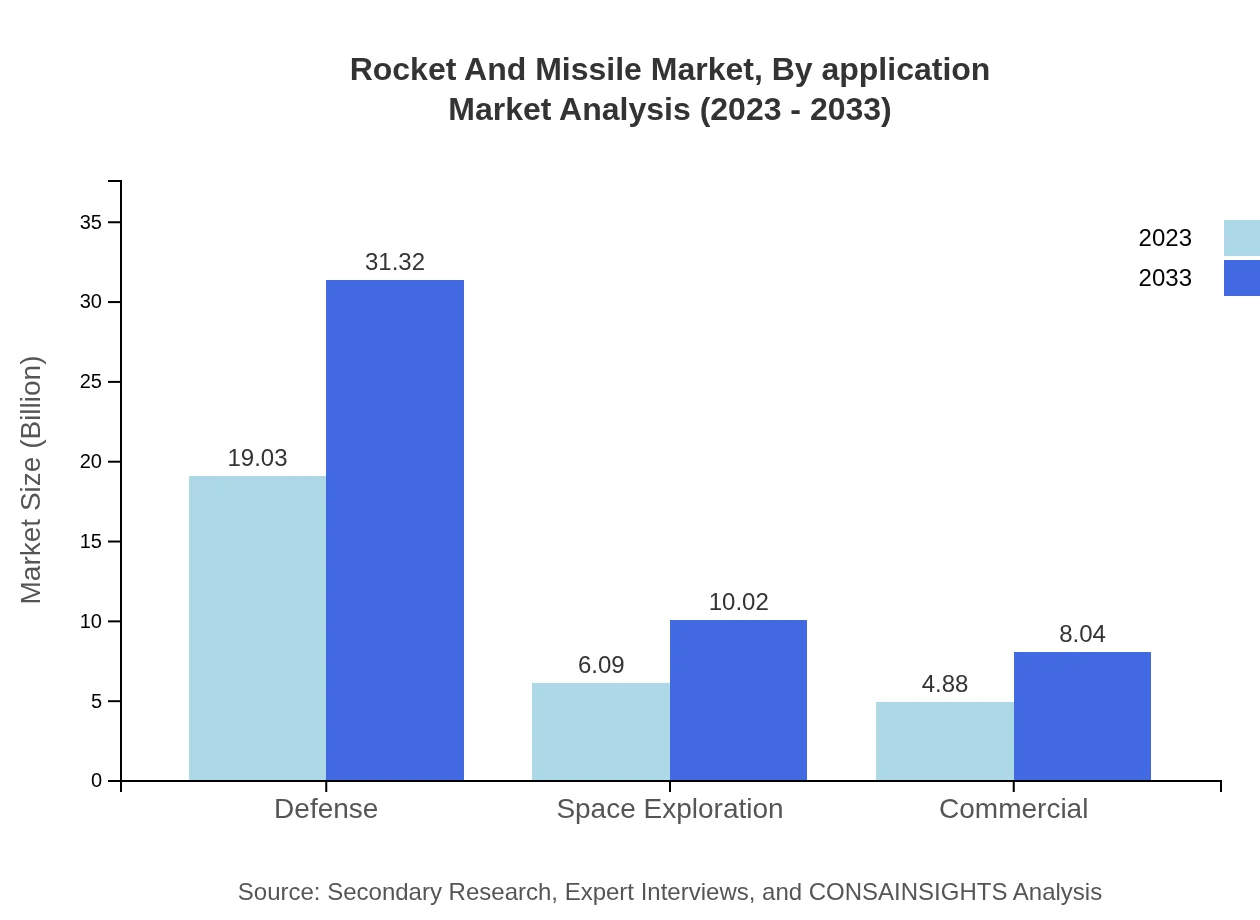

Rocket And Missile Market Analysis By Application

The application segment shows robust growth potential with defense, space exploration, and commercial uses. Defense applications dominate the market with a size expected to exceed $31.32 billion by 2033, while space exploration applications grow from $6.09 billion to $10.02 billion, forecasting significant expansion in satellite and deep space missions.

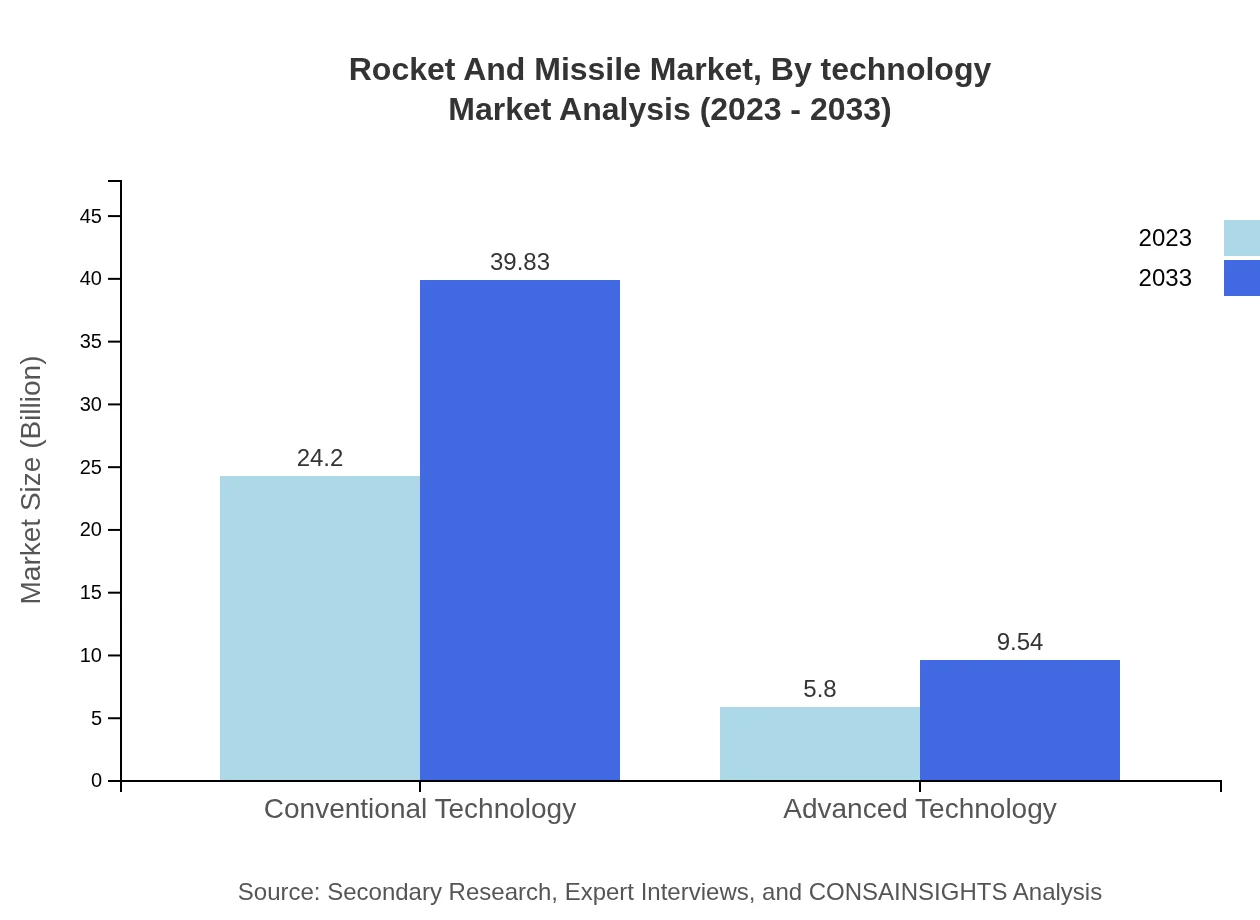

Rocket And Missile Market Analysis By Technology

Technological advancements in the Rocket and Missile space include a transition from conventional to advanced technologies. The conventional technology market is forecasted to rise from $24.20 billion to $39.83 billion with an 80.67% share, whereas advanced technologies are projected to grow from $5.80 billion to $9.54 billion, capturing 19.33% of the market.

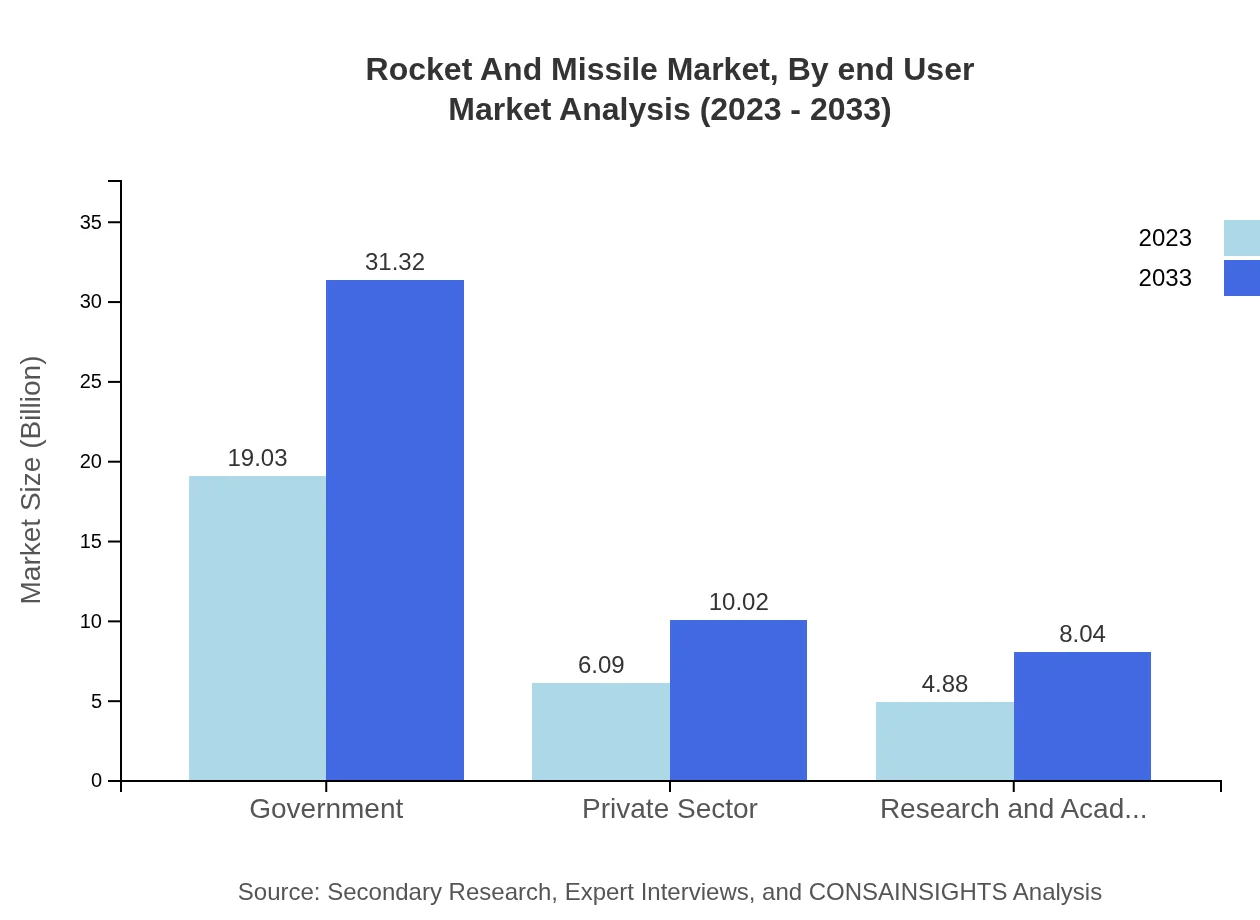

Rocket And Missile Market Analysis By End User

The end-user segment includes government, private sectors, and research academia. The government sector, projected from $19.03 billion to $31.32 billion (63.43% share), leads the market, followed by the private sector from $6.09 billion to $10.02 billion (20.29% share), and research academia expanding from $4.88 billion to $8.04 billion (16.28% share).

Rocket And Missile Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rocket And Missile Industry

Lockheed Martin:

A global leader in aerospace and defense, Lockheed Martin is renowned for its advanced missile platforms and systems, including the Patriot missile system.Raytheon Technologies:

Raytheon Technologies specializes in missile defense systems and precision-guided munitions, driving innovations in defense technology.Northrop Grumman:

Northrop Grumman is a major player in aerospace and defense, focusing on developing advanced rockets and missiles for military and space applications.BAE Systems:

BAE Systems is engaged in missile technology and development, providing sophisticated solutions for defense and security applications.Airbus Defence and Space:

Airbus leads in both aerospace and defense sectors, with a strong portfolio in launch vehicles and military missiles.We're grateful to work with incredible clients.

FAQs

What is the market size of rocket And Missile?

The rocket and missile market is currently valued at approximately $30 billion and is projected to grow at a CAGR of 5% from 2023 to 2033.

What are the key market players or companies in this rocket And Missile industry?

Key players in the rocket and missile industry include Lockheed Martin, Northrop Grumman, Raytheon Technologies, Boeing Defense, and Thales Group, all of which are critical in shaping market dynamics.

What are the primary factors driving the growth in the rocket And Missile industry?

The primary growth drivers include increased defense budgets globally, technological advancements in missile systems, and rising geopolitical tensions prompting nations to enhance their defense capabilities.

Which region is the fastest Growing in the rocket And Missile market?

The fastest-growing region in the rocket and missile market is North America, expected to rise from $9.88 billion in 2023 to $16.26 billion by 2033, indicating a strong demand for advanced defense systems.

Does ConsaInsights provide customized market report data for the rocket And Missile industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the rocket-and-missile industry, enabling in-depth analysis and insights for clients.

What deliverables can I expect from this rocket And Missile market research project?

Deliverables from the rocket-and-missile market research include comprehensive reports, data analysis, market forecasts, competitive landscape assessment, and insights on emerging trends and opportunities.

What are the market trends of rocket And Missile?

Currently, trends include a shift towards advanced technology development, increasing collaboration between defense agencies and private sectors, and a rising focus on space exploration capabilities.