Roofing Systems Market Report

Published Date: 22 January 2026 | Report Code: roofing-systems

Roofing Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Roofing Systems market from 2023 to 2033, including market size, growth trends, segment analysis, and insights into major regional markets, key players, and future forecasts.

| Metric | Value |

|---|---|

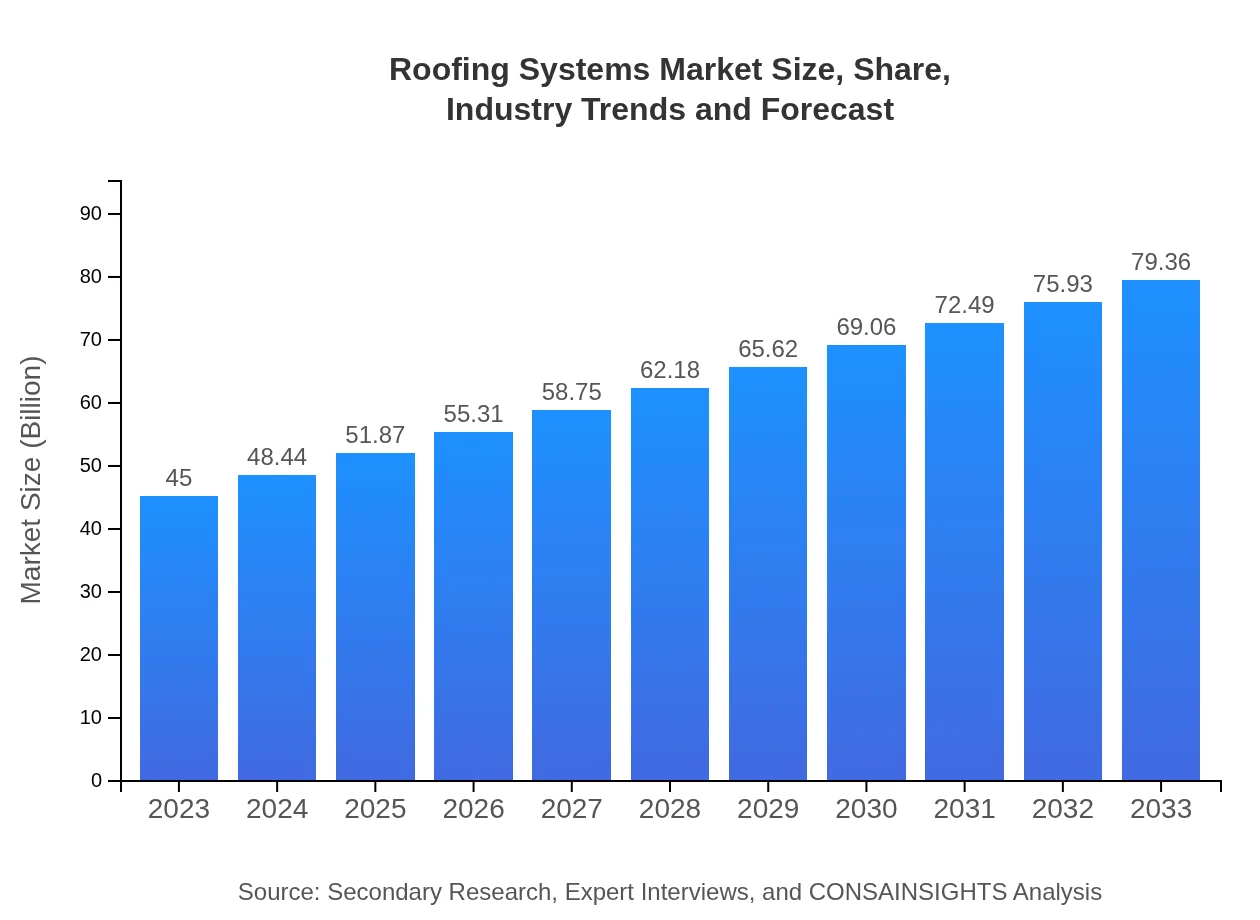

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $79.36 Billion |

| Top Companies | Owens Corning, CertainTeed, GAF Materials Corporation, TPO Roofing |

| Last Modified Date | 22 January 2026 |

Roofing Systems Market Overview

Customize Roofing Systems Market Report market research report

- ✔ Get in-depth analysis of Roofing Systems market size, growth, and forecasts.

- ✔ Understand Roofing Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Roofing Systems

What is the Market Size & CAGR of Roofing Systems market in 2023?

Roofing Systems Industry Analysis

Roofing Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Roofing Systems Market Analysis Report by Region

Europe Roofing Systems Market Report:

Europe's market is expected to expand from 15.46 billion USD in 2023 to 27.26 billion USD by 2033. Stringent regulations regarding energy efficiency and sustainability are pushing innovation and adoption of advanced roofing solutions.Asia Pacific Roofing Systems Market Report:

The Asia Pacific region is expected to witness considerable growth, with a market size projected to reach 13.97 billion USD by 2033 from 7.92 billion USD in 2023. Rapid urbanization and government initiatives promoting sustainable construction are key growth drivers in countries like China and India.North America Roofing Systems Market Report:

With a projected increase from 15.39 billion USD in 2023 to 27.14 billion USD by 2033, North America remains a dominant market. The demand for energy-efficient roofing solutions and the ongoing trend of home renovations are key market drivers.South America Roofing Systems Market Report:

In South America, the Roofing Systems market is anticipated to grow from 4.47 billion USD in 2023 to 7.88 billion USD by 2033. Infrastructure development fueled by economic growth and a rising middle class are significant contributors to this growth.Middle East & Africa Roofing Systems Market Report:

The Middle East and Africa market size is forecasted to grow from 1.76 billion USD in 2023 to 3.11 billion USD by 2033, driven by infrastructural investments and urban development initiatives throughout the region.Tell us your focus area and get a customized research report.

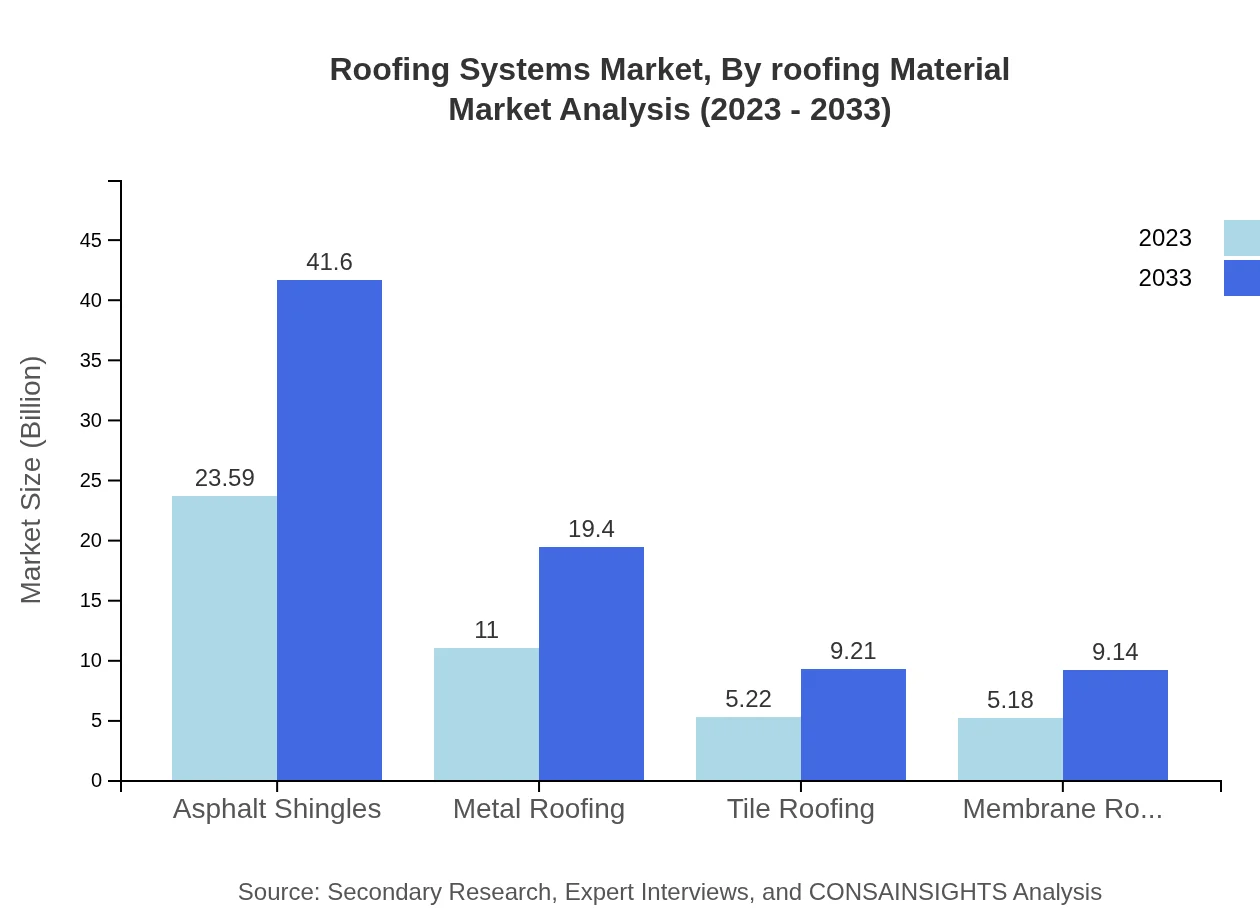

Roofing Systems Market Analysis By Roofing Material

The roofing material segment includes asphalt shingles, metal roofing, tile roofing, and membrane roofing. Asphalt shingles hold the largest market share due to their cost-effectiveness and wide availability. Metal roofing is gaining traction due to its longevity and energy efficiency, while tile and membrane roofing are preferred for specific applications due to their aesthetic appeal and waterproof qualities.

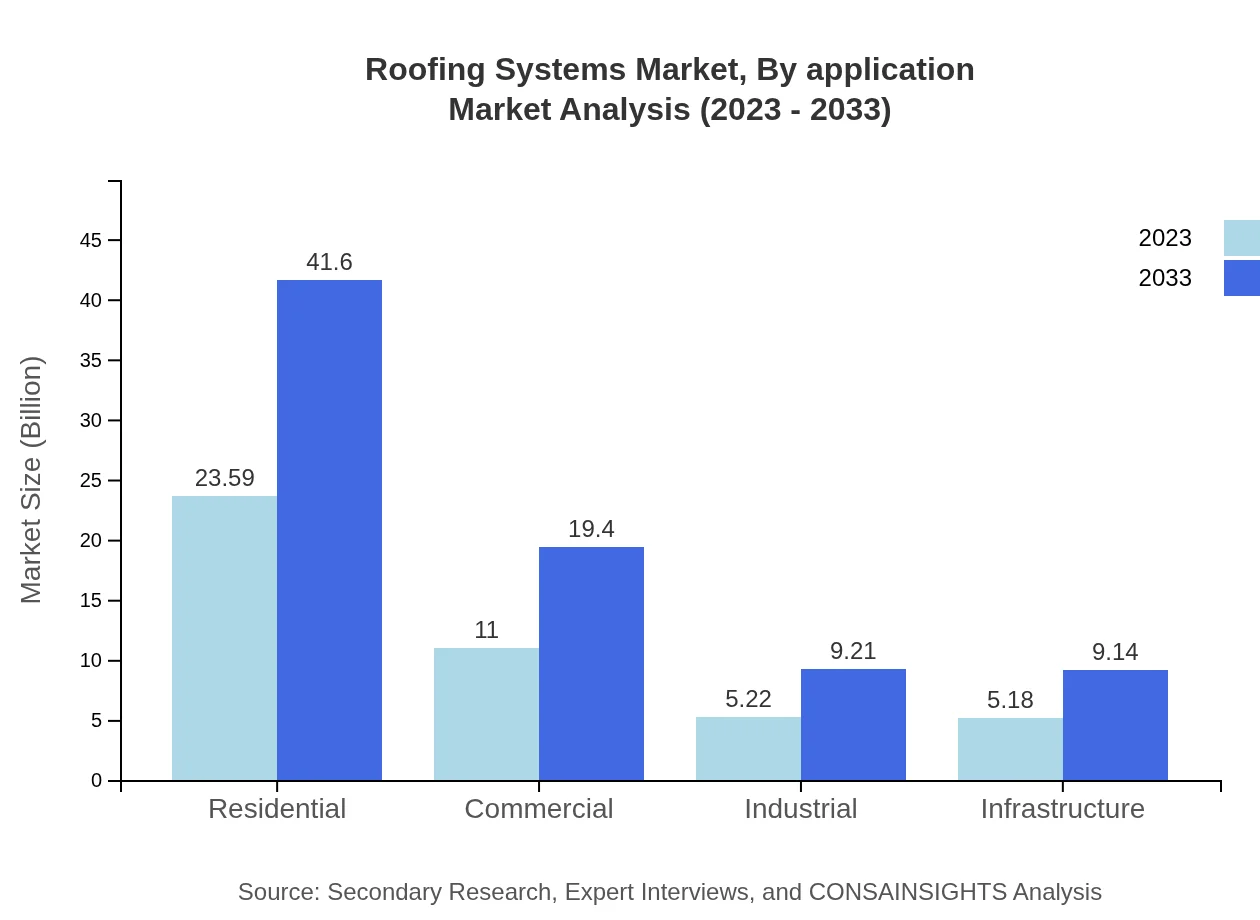

Roofing Systems Market Analysis By Application

Applications in residential, commercial, industrial, and infrastructure sectors highlight the versatility of roofing systems. Residential applications account for the largest share due to the increasing demand for housing and home renovations, whereas commercial applications are growing due to the rise in new building constructions requiring durable roofing solutions.

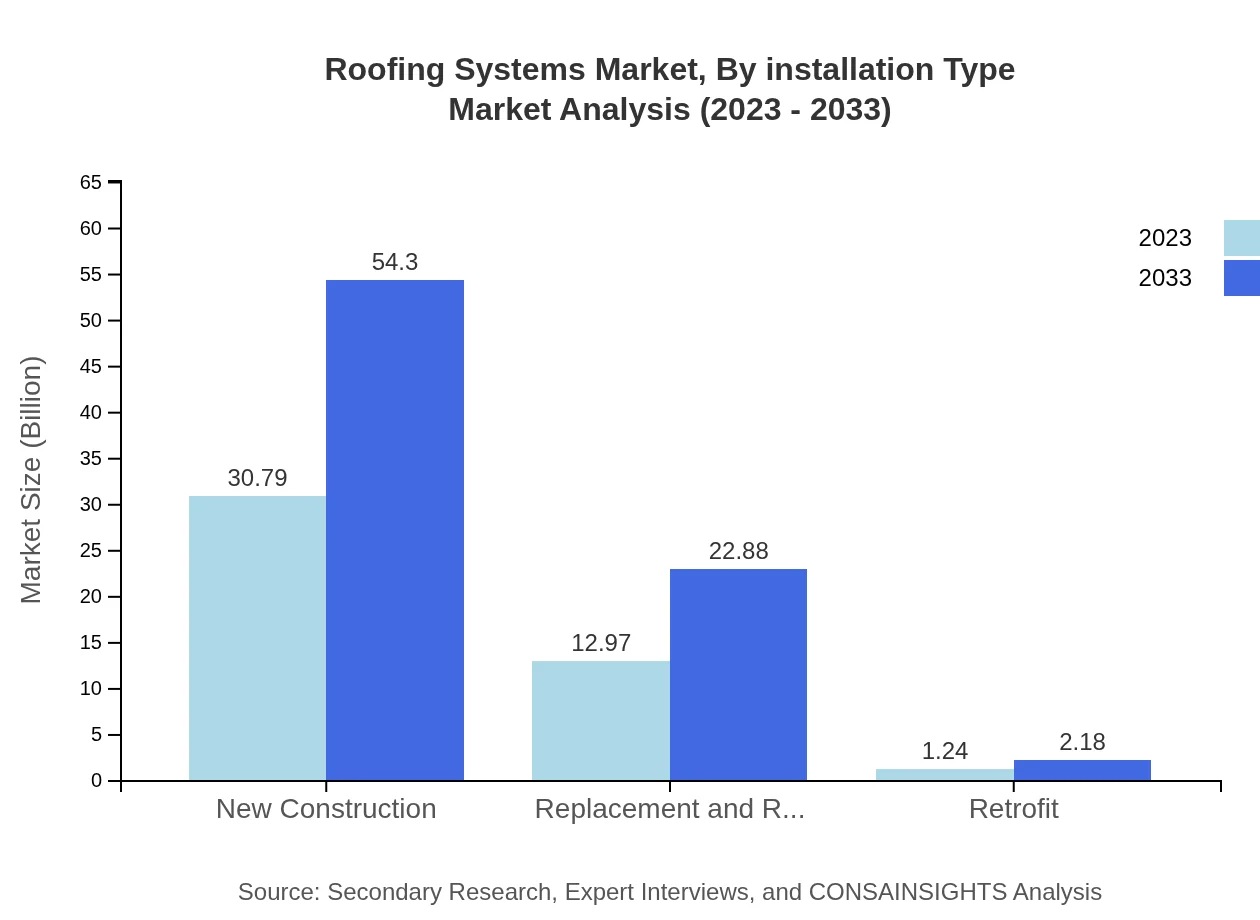

Roofing Systems Market Analysis By Installation Type

Installation types are divided into new construction, replacement and renovation, and retrofit. The new construction segment constitutes the majority of market demand, driven by increased construction activities. The replacement and renovation segments are also significant, as property owners seek to upgrade and maintain existing roofs.

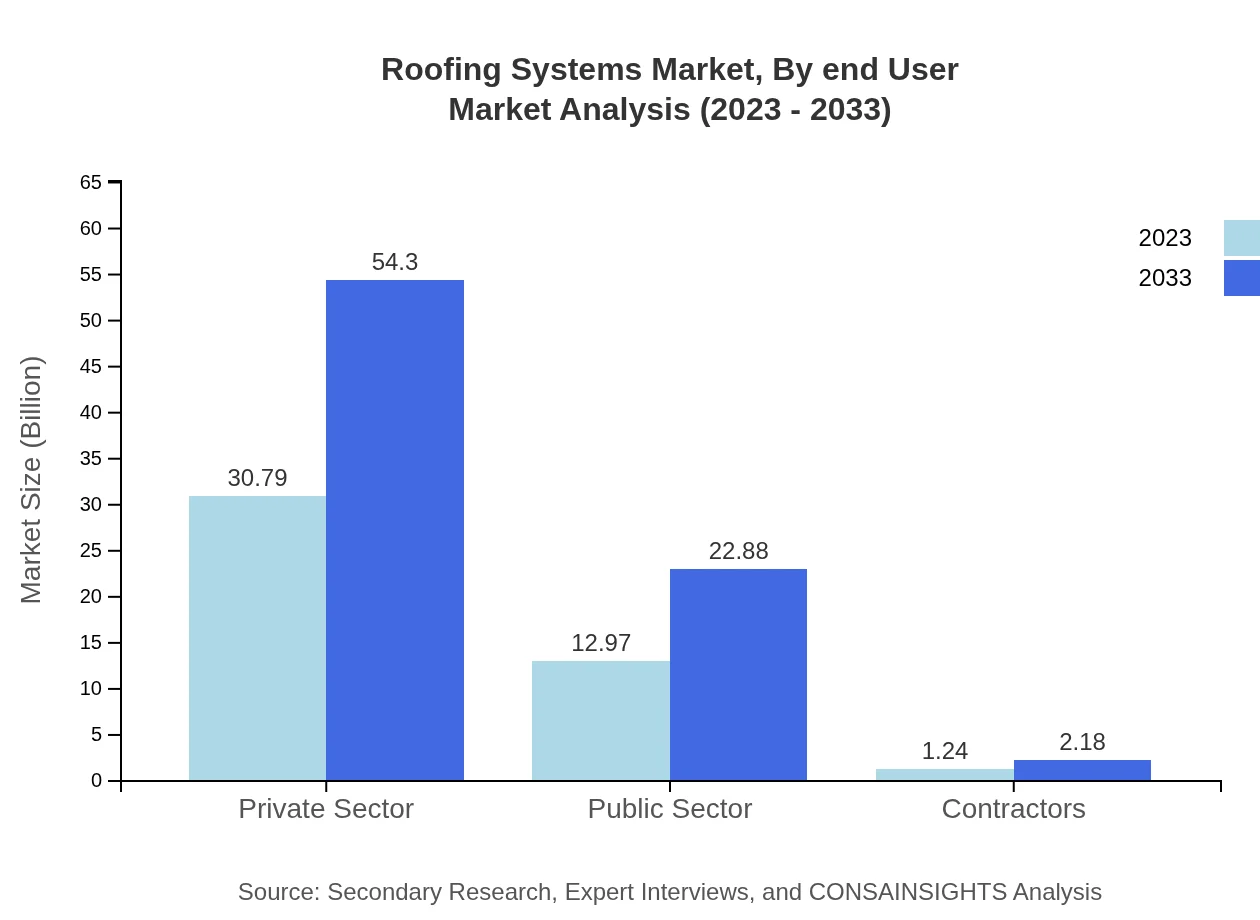

Roofing Systems Market Analysis By End User

The end-user segment categorizes consumers into private and public sectors. The private sector dominates with a market size expected to grow from 30.79 billion USD in 2023 to 54.30 billion USD by 2033. The public sector is also growing, albeit at a slower pace, due to ongoing infrastructure projects and public building upgrades.

Roofing Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Roofing Systems Industry

Owens Corning:

A leading manufacturer of fiberglass composites and insulation, Owens Corning excels in the production of asphalt shingles and roofing accessories.CertainTeed:

A subsidiary of Saint-Gobain, CertainTeed offers a comprehensive range of roofing materials, including shingles, membranes, and accessories widely used in both residential and commercial settings.GAF Materials Corporation:

GAF is a prominent roofing manufacturer in North America known for its innovative products including roofing shingles and systems designed for durability and performance.TPO Roofing:

Specializing in Thermoplastic Polyolefin (TPO) roofing systems, TPO Roofing provides energy-efficient solutions that are particularly popular in commercial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of roofing systems?

The global roofing systems market is valued at approximately $45 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.7% through 2033, indicating significant growth potential in this sector.

What are the key market players or companies in the roofing systems industry?

Key market players in the roofing systems industry include major manufacturers and service providers who are recognized for their innovative roofing solutions, technological advancements, and strong supply chain capabilities.

What are the primary factors driving the growth in the roofing systems industry?

The growth of the roofing systems industry is primarily driven by rising construction activities, increasing demand for energy-efficient solutions, technological innovations, and regulatory changes promoting sustainable building practices.

Which region is the fastest Growing in the roofing systems?

The fastest-growing region in the roofing systems market is forecasted to be Europe, expecting an increase from $15.46 billion in 2023 to $27.26 billion by 2033, showcasing strong market traction.

Does ConsaInsights provide customized market report data for the roofing systems industry?

Yes, ConsaInsights offers customized market report data for the roofing systems industry, tailored to specific client needs, ensuring relevant insights and data analytics.

What deliverables can I expect from this roofing systems market research project?

From this roofing systems market research project, clients can expect comprehensive reports, detailed market analyses, forecasts, and actionable insights tailored to their business objectives.

What are the market trends of roofing systems?

Key trends in the roofing systems market include a shift toward sustainable materials, adoption of smart roofing technologies, and increased demand for residential and commercial roofing solutions.