Rtds In Food Beverage Market Report

Published Date: 31 January 2026 | Report Code: rtds-in-food-beverage

Rtds In Food Beverage Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ready-to-Drink (RTD) market within the Food & Beverage sector, highlighting crucial insights and forecasts from 2023 to 2033, including market sizes, trends, and regional dynamics.

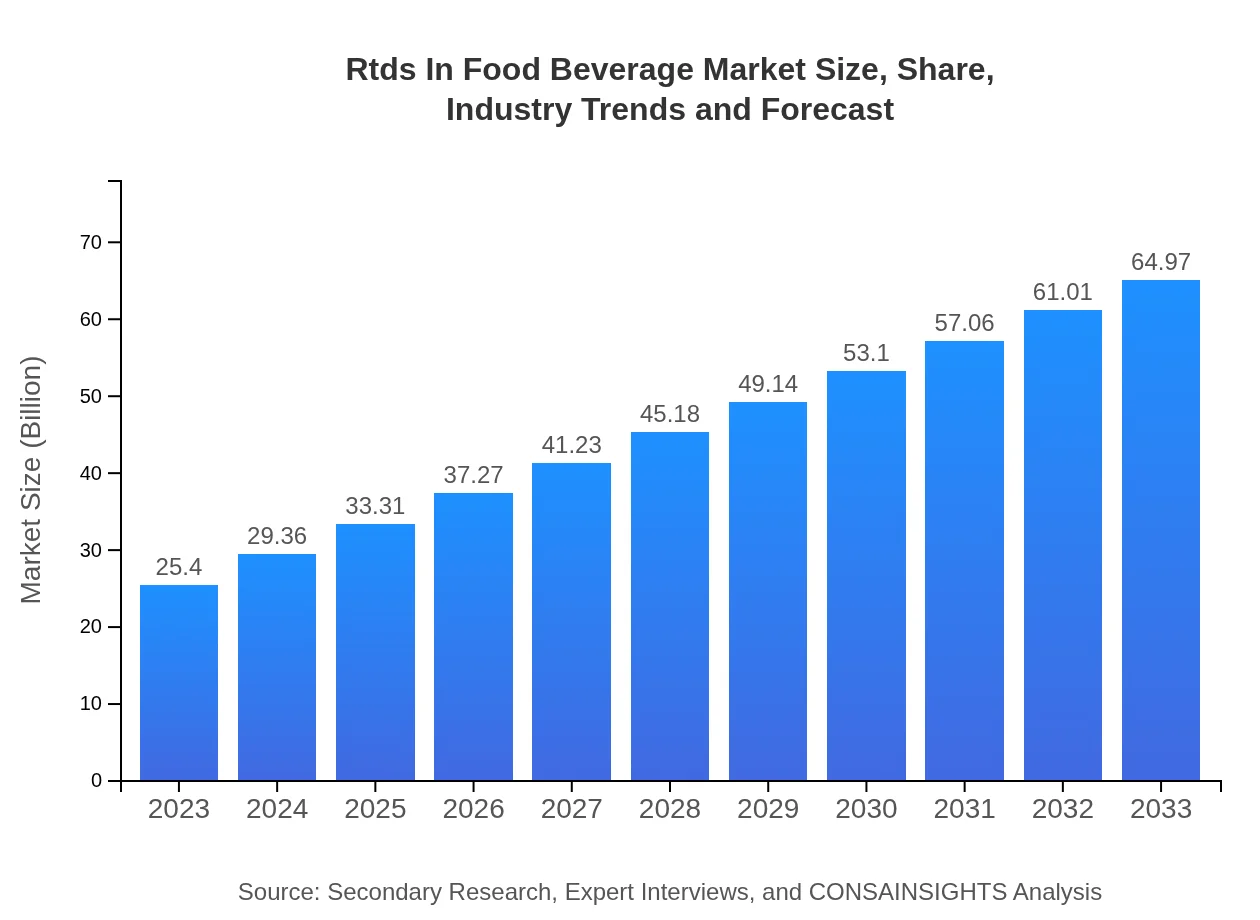

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.40 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $64.97 Billion |

| Top Companies | Coca-Cola Company, PepsiCo, Nestlé, Diageo, Anheuser-Busch InBev |

| Last Modified Date | 31 January 2026 |

Rtds In Food Beverage Market Overview

Customize Rtds In Food Beverage Market Report market research report

- ✔ Get in-depth analysis of Rtds In Food Beverage market size, growth, and forecasts.

- ✔ Understand Rtds In Food Beverage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rtds In Food Beverage

What is the Market Size & CAGR of Rtds In Food Beverage market in 2023?

Rtds In Food Beverage Industry Analysis

Rtds In Food Beverage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rtds In Food Beverage Market Analysis Report by Region

Europe Rtds In Food Beverage Market Report:

Europe's RTD sector is set to grow from $6.26 billion in 2023 to $16.02 billion by 2033. The demand for diverse flavor profiles and premium products has surged, with countries like the UK and Germany at the forefront of this trend.Asia Pacific Rtds In Food Beverage Market Report:

In the Asia Pacific region, the RTD market is projected to expand from $5.48 billion in 2023 to $14.02 billion by 2033. This growth is primarily driven by urbanization, a young population, and evolving consumption trends favoring on-the-go beverages, particularly in countries like China and India.North America Rtds In Food Beverage Market Report:

North America is anticipated to see a substantial increase from $9.01 billion in 2023 to $23.05 billion by 2033, led by high consumer demand for alcoholic RTDs and the ongoing health trend pushing brands to innovate with functional beverages.South America Rtds In Food Beverage Market Report:

The South American RTD market is expected to grow from $1.52 billion in 2023 to $3.89 billion by 2033. This rise is attributed to increasing disposable incomes and a growing preference for ready-to-consume options in urban areas.Middle East & Africa Rtds In Food Beverage Market Report:

The Middle East and Africa region is projected to rise from $3.12 billion in 2023 to $7.99 billion by 2033, fueled by growing urban populations and a rising preference for ready-to-drink beverages among the younger demographic.Tell us your focus area and get a customized research report.

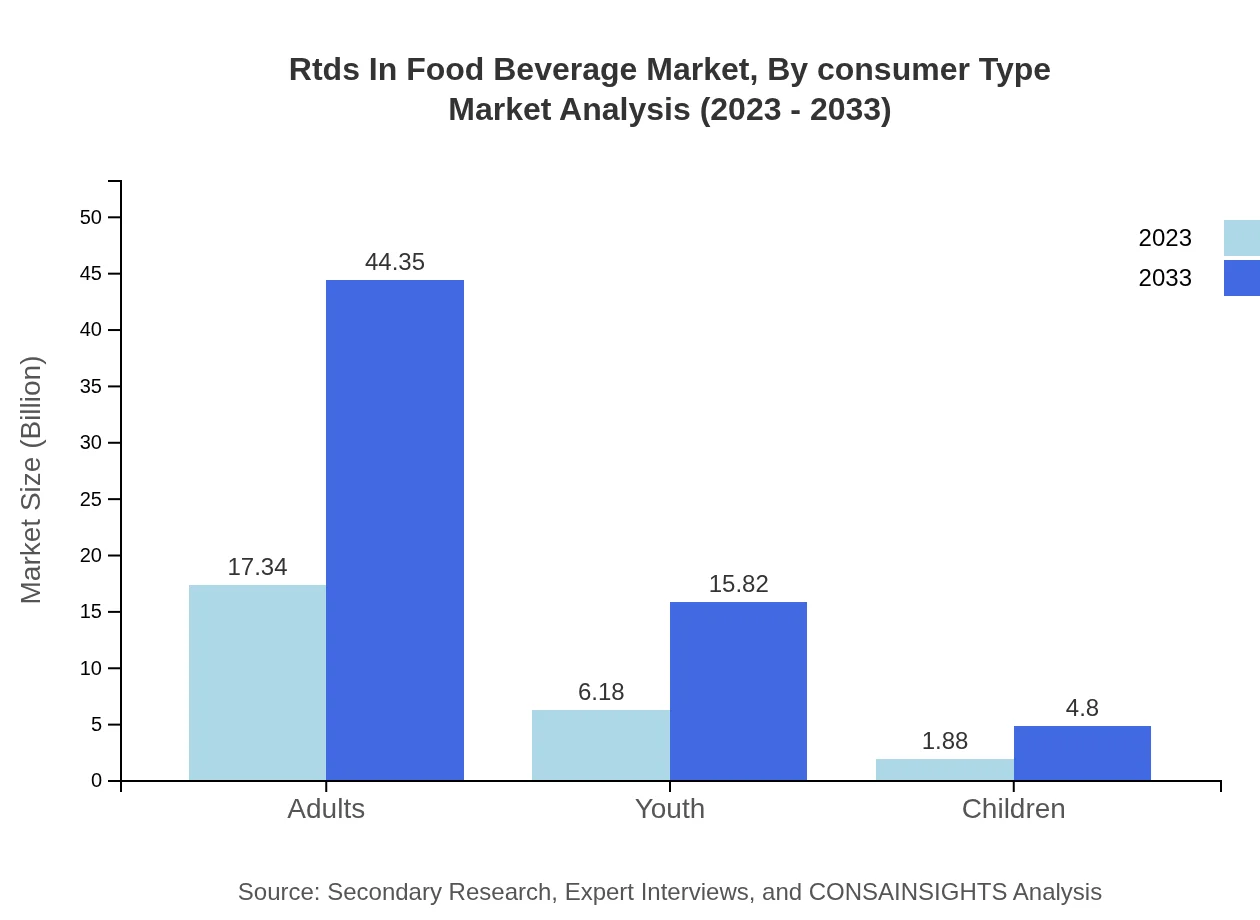

Rtds In Food Beverage Market Analysis By Consumer Type

The market for RTDs by consumer type is predominantly driven by adults, who represented a market size of $17.34 billion in 2023. This segment is projected to grow to $44.35 billion by 2033, showcasing adults' continuous embrace of RTD beverages. Youth, consuming $6.18 billion worth of RTDs in 2023, is expected to rise to $15.82 billion as brands seek to cater to younger tastes, while the segment for children currently stands at $1.88 billion, increasing to $4.80 billion, reflecting a growing market for family-friendly products.

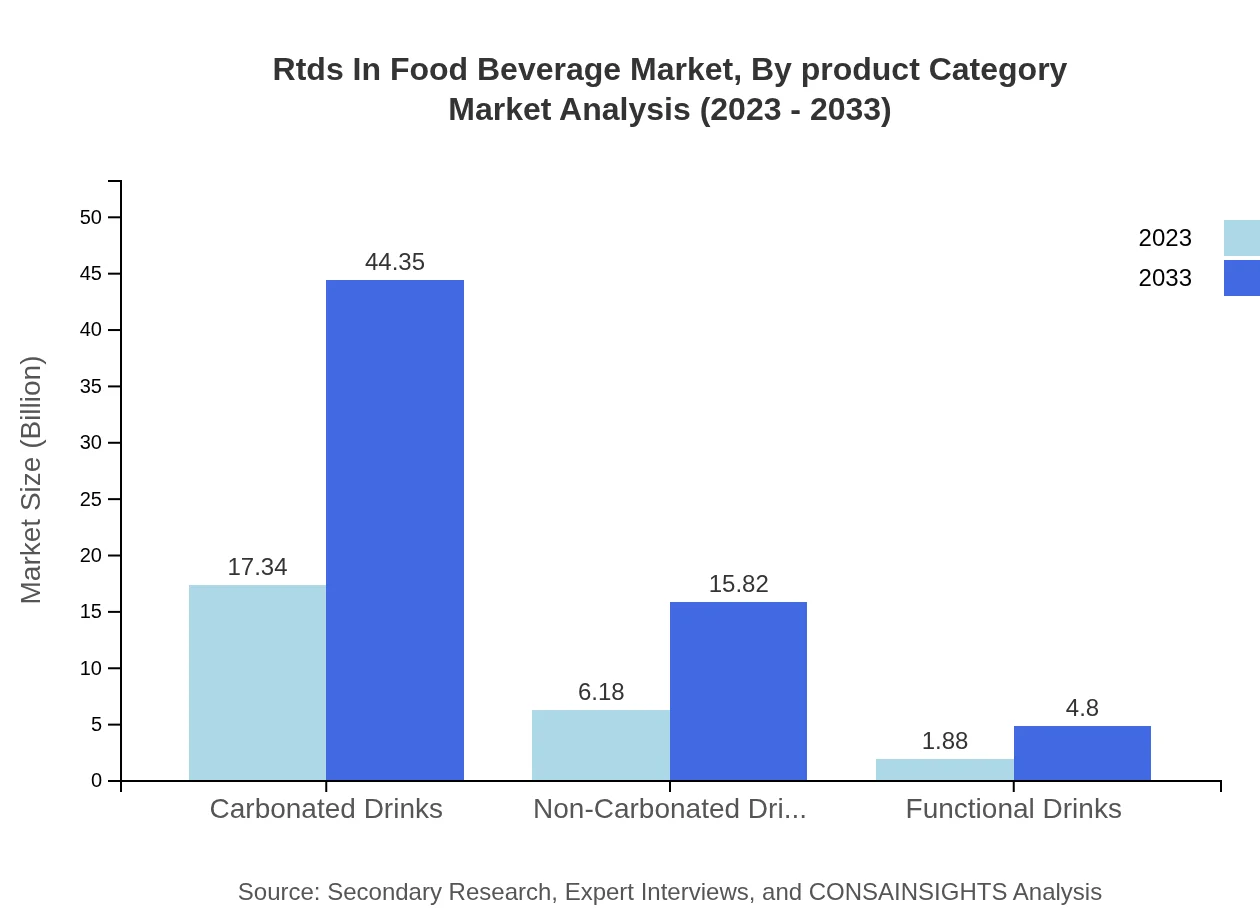

Rtds In Food Beverage Market Analysis By Product Category

As delineated by product category, carbonated drinks lead the market with a size of $17.34 billion in 2023, projecting to $44.35 billion by 2033. Non-carbonated drinks follow, starting at $6.18 billion and expected to reach $15.82 billion. Functional drinks, while smaller at $1.88 billion, will rise to $4.80 billion, indicating increasing consumer focus on health functionalities.

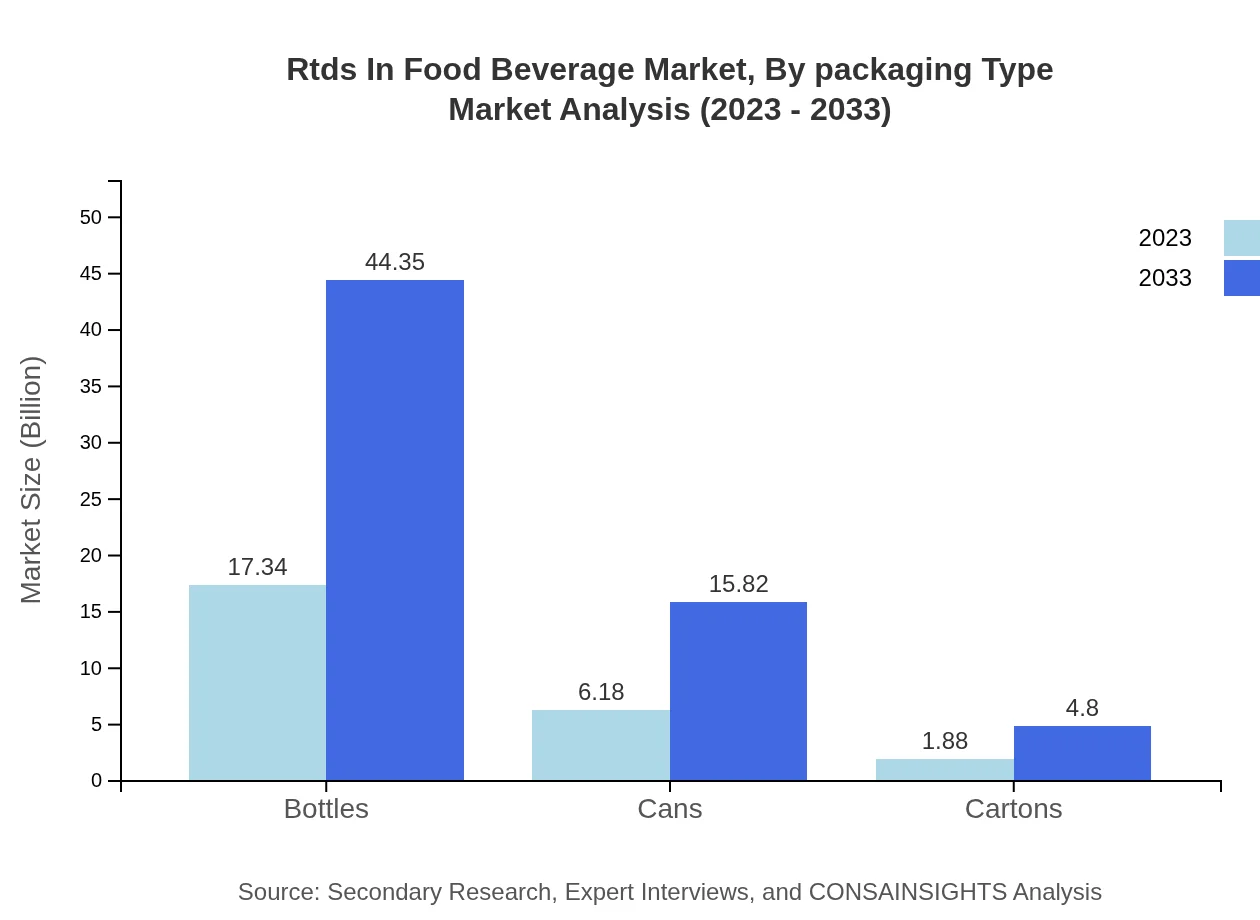

Rtds In Food Beverage Market Analysis By Packaging Type

The packaging type analysis reveals bottles occupying the largest market share at $17.34 billion in 2023, projected to grow to $44.35 billion by 2033, favored for their premium perception. Cans, with a market of $6.18 billion, are gaining ground owing to their convenience, reaching $15.82 billion. Cartons, while smaller, are also growing from $1.88 billion to $4.80 billion, appealing to specific demographics.

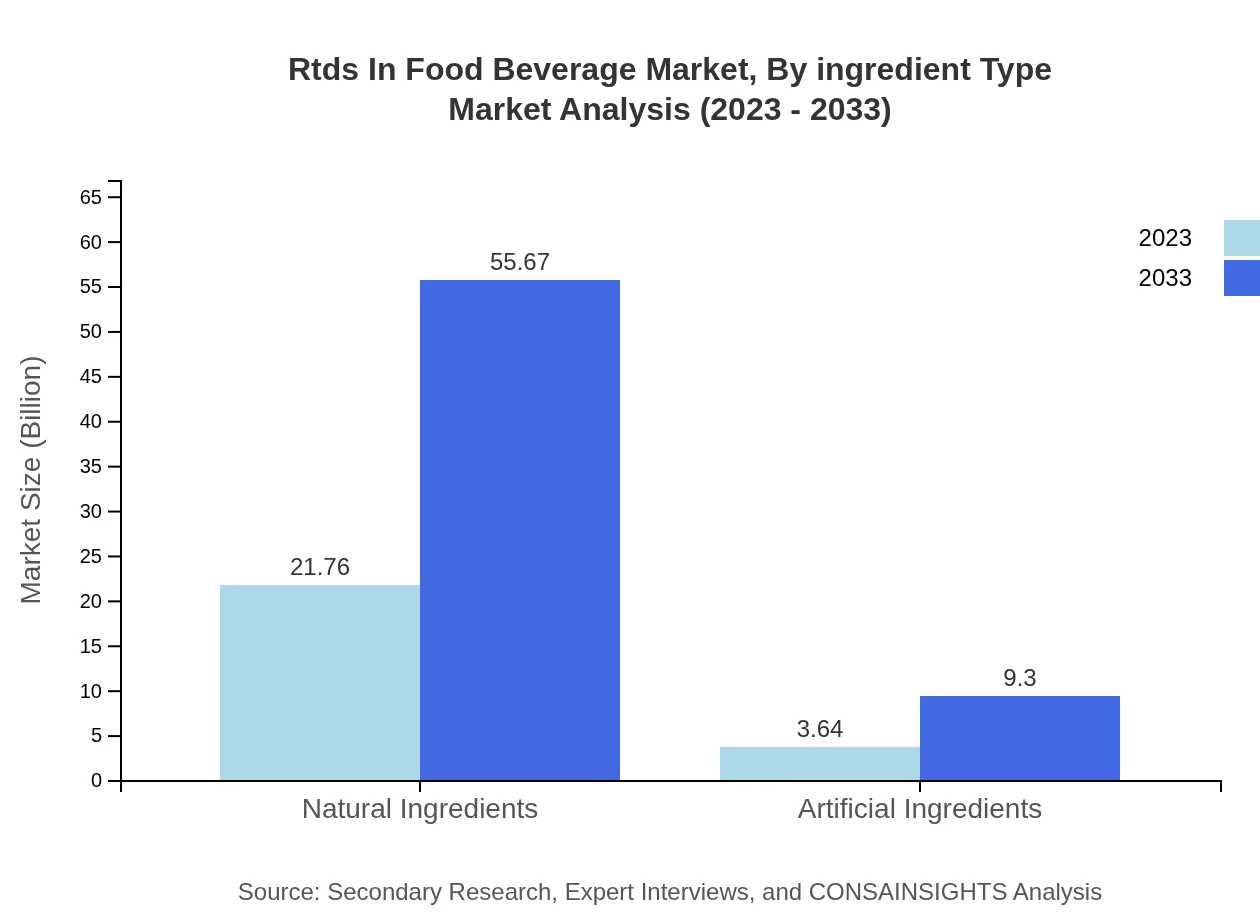

Rtds In Food Beverage Market Analysis By Ingredient Type

Natural ingredients dominate the ingredient type segment, valued at $21.76 billion in 2023 and projected to reach $55.67 billion by 2033, driven by health-conscious consumers. Artificial ingredients, while smaller at $3.64 billion, are expected to see modest growth to $9.30 billion, highlighting a bifurcation in consumer preferences.

Rtds In Food Beverage Market Analysis By Distribution Channel

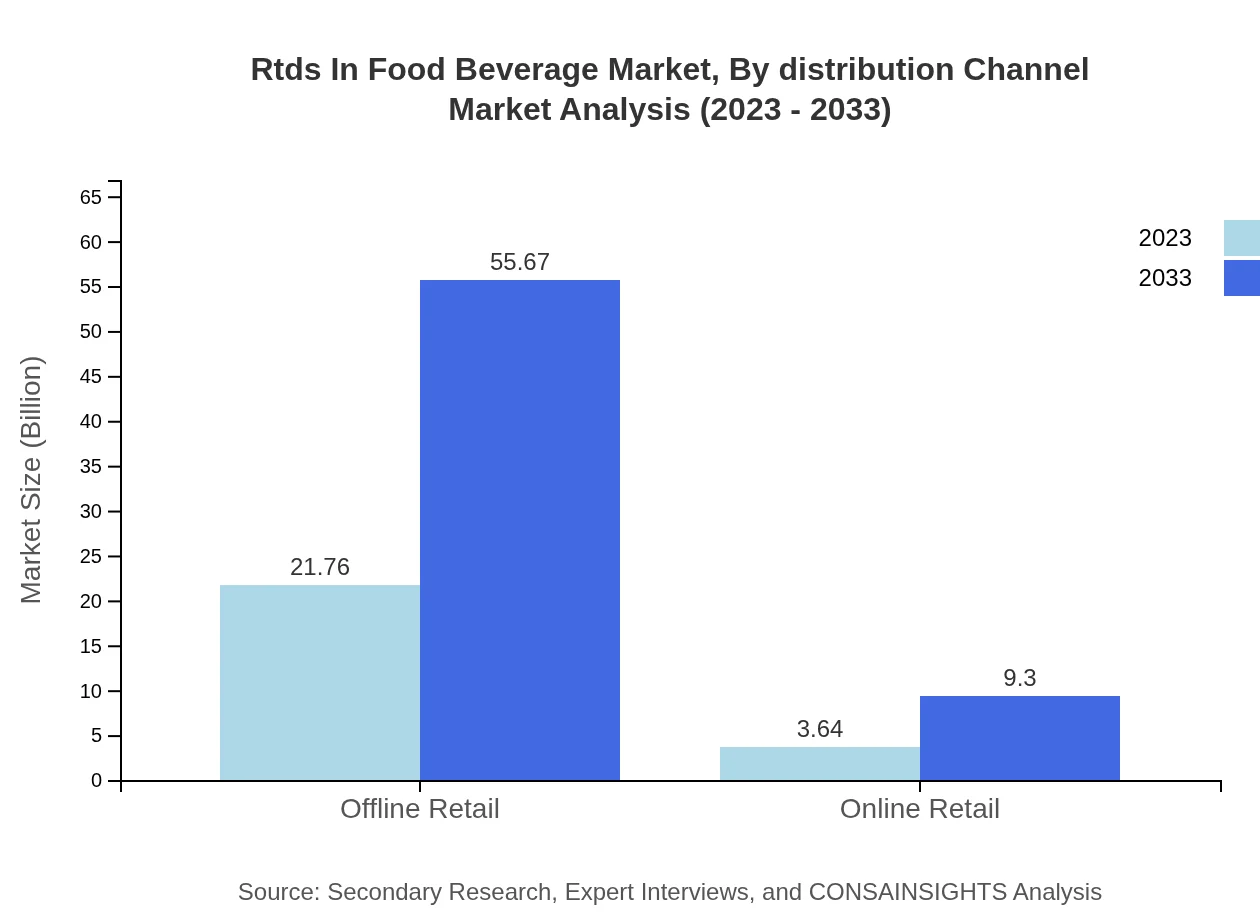

Offline retail, currently at $21.76 billion, captures the largest share of the RTD market and is projected to grow to $55.67 billion by 2033. Conversely, online retail, valued at $3.64 billion, is projected to rise to $9.30 billion, marking the increasing importance of digital platforms for beverage purchases.

Rtds In Food Beverage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rtds In Food Beverage Industry

Coca-Cola Company:

As a leading player in the beverage industry, Coca-Cola has expanded its RTD beverage offerings significantly, focusing on innovative flavors and health-oriented options.PepsiCo:

PepsiCo continues to be a competitive player through its diverse RTD product portfolio, including non-alcoholic and alcoholic beverages, adapting to market trends and consumer preferences.Nestlé:

Nestlé's entry into the RTD beverage market emphasizes health, nutrition, and premium quality, catering to a growing demographic interested in functional drinks.Diageo:

Diageo is significantly impacting the RTD segment with its wide array of ready-to-drink cocktails, capitalizing on the consumer trend of convenience and premium experiences.Anheuser-Busch InBev:

With its leadership in the alcoholic beverages sector, Anheuser-Busch InBev is vigorously pushing its RTD products to satisfy a growing base of consumers preferring ready-made cocktails and mixed drinks.We're grateful to work with incredible clients.

FAQs

What is the market size of rtds In Food Beverage?

The RTDs in Food & Beverage market is valued at approximately $25.4 billion in 2023, with a projected CAGR of 9.5%. By 2033, the market is expected to grow significantly, showcasing the increasing demand for convenient beverage options.

What are the key market players or companies in this rtds In Food Beverage industry?

Key players in the RTDs in the Food & Beverage industry include major beverage corporations, innovative startups, and those focusing on organic products. They are driving the market through unique offerings and strategic partnerships.

What are the primary factors driving the growth in the rtds In Food Beverage industry?

The growth in the RTDs market is driven by convenience, changing consumer lifestyles, increasing demand for ready-to-drink beverages, and health-conscious trends. Innovative flavors and packaging also contribute significantly to market expansion.

Which region is the fastest Growing in the rtds In Food Beverage?

The fastest-growing region for RTDs in Food & Beverage is expected to be North America, increasing from $9.01 billion in 2023 to $23.05 billion by 2033, having a growing consumer base and evolving preferences.

Does ConsaInsights provide customized market report data for the rtds In Food Beverage industry?

Yes, ConsaInsights offers customizable market report data tailored to specific needs within the RTDs in Food & Beverage industry, allowing insights into niche segments and regional dynamics.

What deliverables can I expect from this rtds In Food Beverage market research project?

Deliverables from the RTDs market research project include comprehensive reports, market trends analysis, competitive landscape assessments, and actionable insights tailored to strategic decision-making.

What are the market trends of rtds In Food Beverage?

Current trends in the RTDs market include a focus on natural and organic ingredients, increased health consciousness among consumers, the rise of functional beverages, and a shift towards online retail platforms.