Rum Market Report

Published Date: 31 January 2026 | Report Code: rum

Rum Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers the Rum market, providing insights into market trends, projections, and analysis from 2023 to 2033. It highlights segmentation, regional performance, industry analysis, major players, and forecasts to help stakeholders make informed decisions.

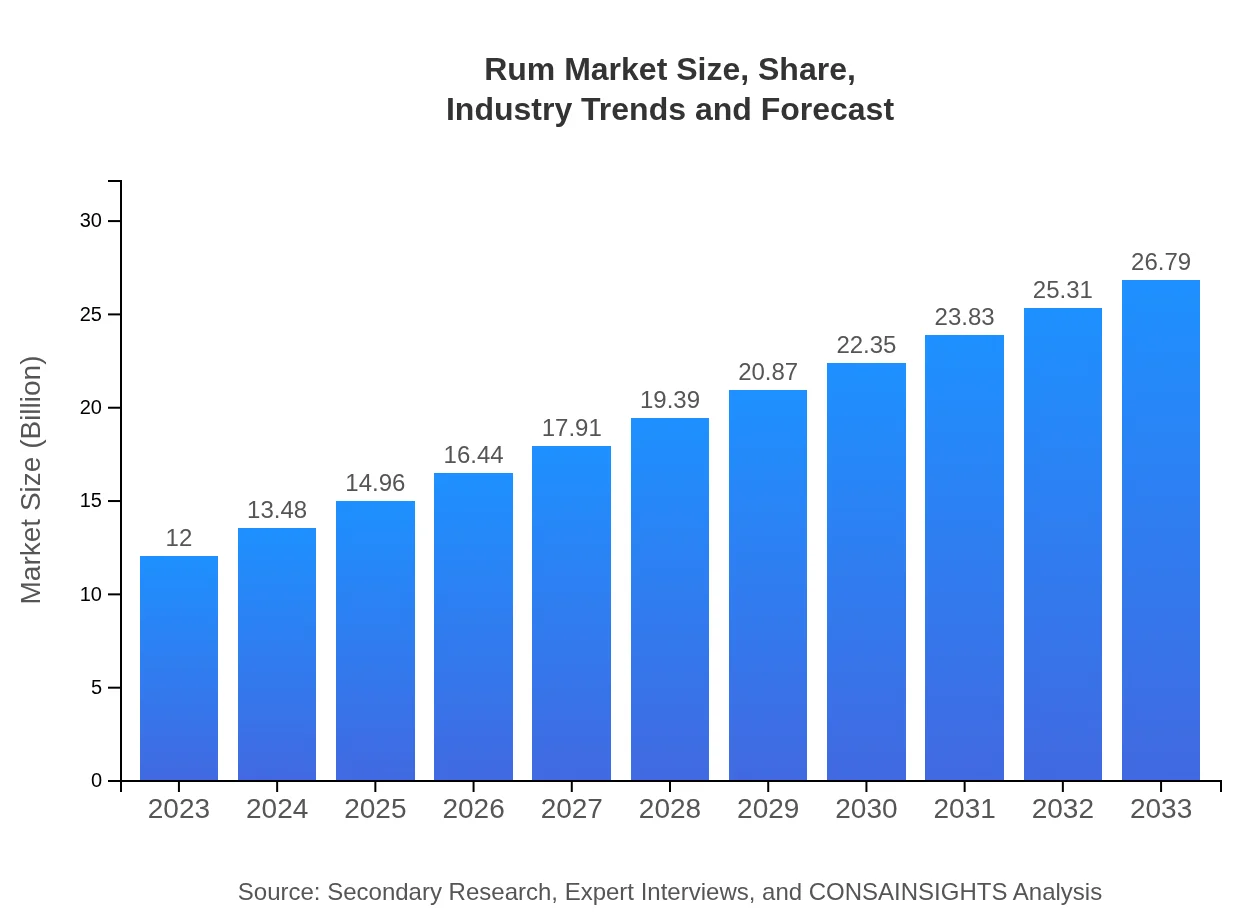

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 8.1% |

| 2033 Market Size | $26.79 Billion |

| Top Companies | Diageo, Pernod Ricard, Bacardi, Moët Hennessy |

| Last Modified Date | 31 January 2026 |

Rum Market Overview

Customize Rum Market Report market research report

- ✔ Get in-depth analysis of Rum market size, growth, and forecasts.

- ✔ Understand Rum's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rum

What is the Market Size & CAGR of Rum market in 2023?

Rum Industry Analysis

Rum Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rum Market Analysis Report by Region

Europe Rum Market Report:

Europe's Rum market is currently valued at $3.18 billion, projected to grow to $7.09 billion by 2033. The trend of premiumization and the rise of cocktail culture across countries like the UK and Germany are boosting market growth.Asia Pacific Rum Market Report:

In the Asia-Pacific region, the Rum market was valued at $2.60 billion in 2023, with projections to reach $5.80 billion by 2033. Factors contributing to this growth include increased disposable income, growing popularity of cocktails, and a rise in social gatherings.North America Rum Market Report:

The North American Rum market stands at $4.03 billion in 2023, estimated to soar to $8.99 billion by 2033. The craft cocktail movement and the growing popularity of premium spirits drive significant market expansion in this region.South America Rum Market Report:

South America's Rum market is currently valued at $1.14 billion, anticipated to grow to $2.55 billion by 2033. The region's rich rum production traditions and culture drive growth, particularly in countries like Brazil and Venezuela.Middle East & Africa Rum Market Report:

The Rum market in the Middle East and Africa is estimated at $1.05 billion in 2023, set to increase to $2.35 billion by 2033. Diversifying consumer preferences and increasing tourism in the region are expected to enhance market dynamics.Tell us your focus area and get a customized research report.

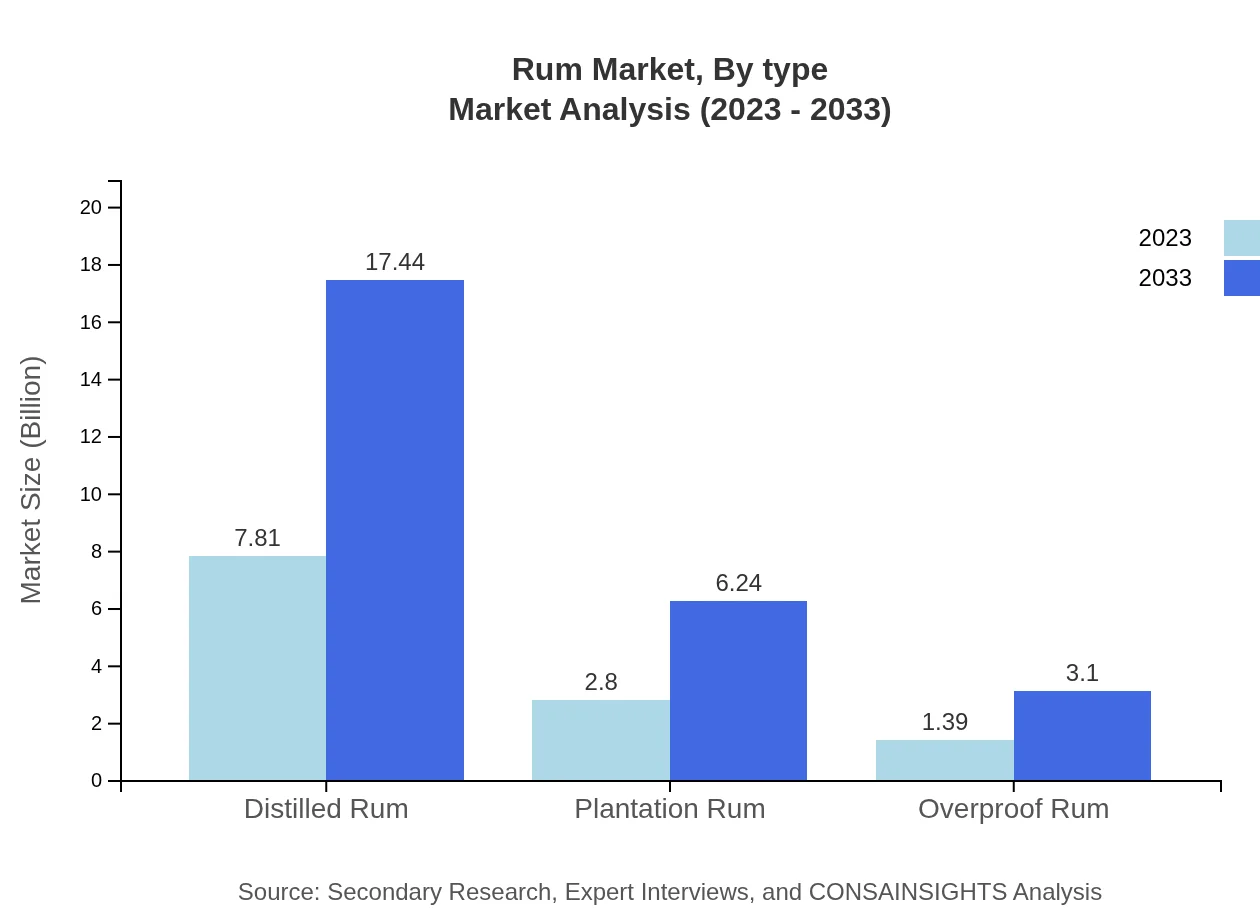

Rum Market Analysis By Product

In 2023, the Distilled Rum market is expected to dominate with a size of $7.81 billion and is projected to reach $17.44 billion by 2033. Plantation Rum is also gaining traction, growing from $2.80 billion in 2023 to $6.24 billion by 2033. Light Rum continues to hold a significant market share due to its versatility.

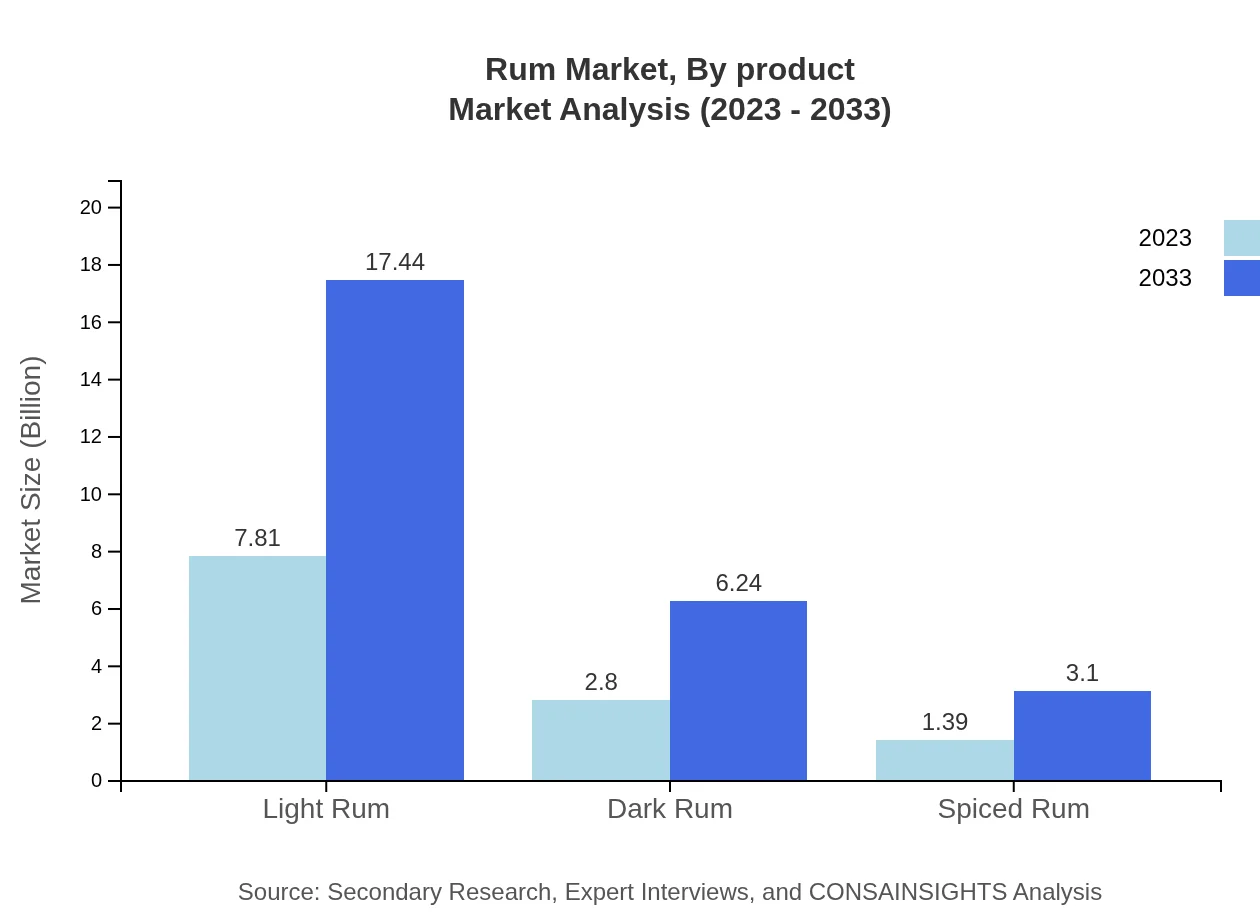

Rum Market Analysis By Type

The market analysis focuses on various types of rum including Light Rum, Dark Rum, and Spiced Rum. Light Rum accounted for a significant share of 65.12% in 2023, while Dark and Spiced Rums represented 23.3% and 11.58% respectively, showcasing their importance in diversifying consumer tastes.

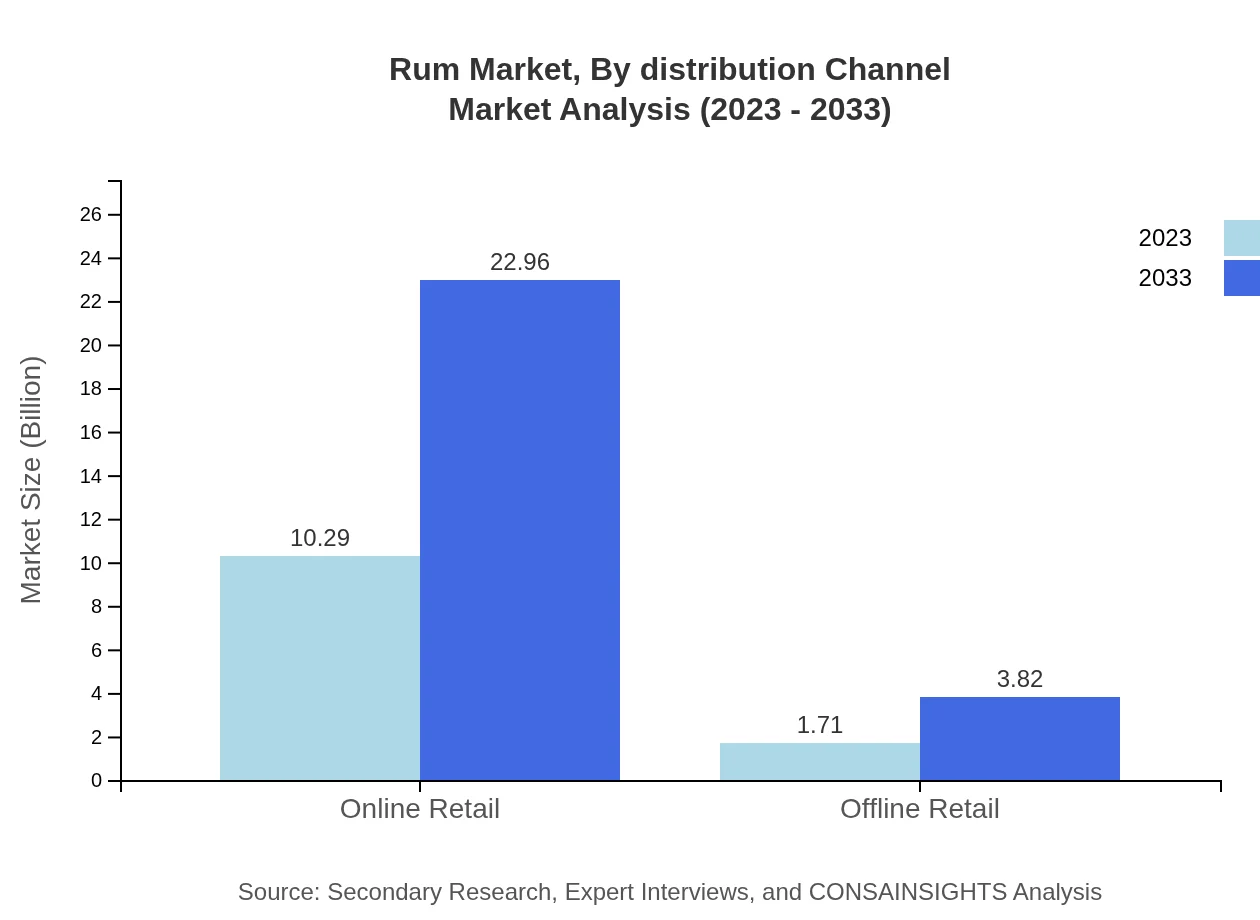

Rum Market Analysis By Distribution Channel

The online retail channel is expected to grow significantly, valued at $10.29 billion in 2023 and projected to reach $22.96 billion by 2033. In contrast, offline retail demonstrates a stable growth trajectory, albeit at a slower pace, from $1.71 billion to $3.82 billion in the same period.

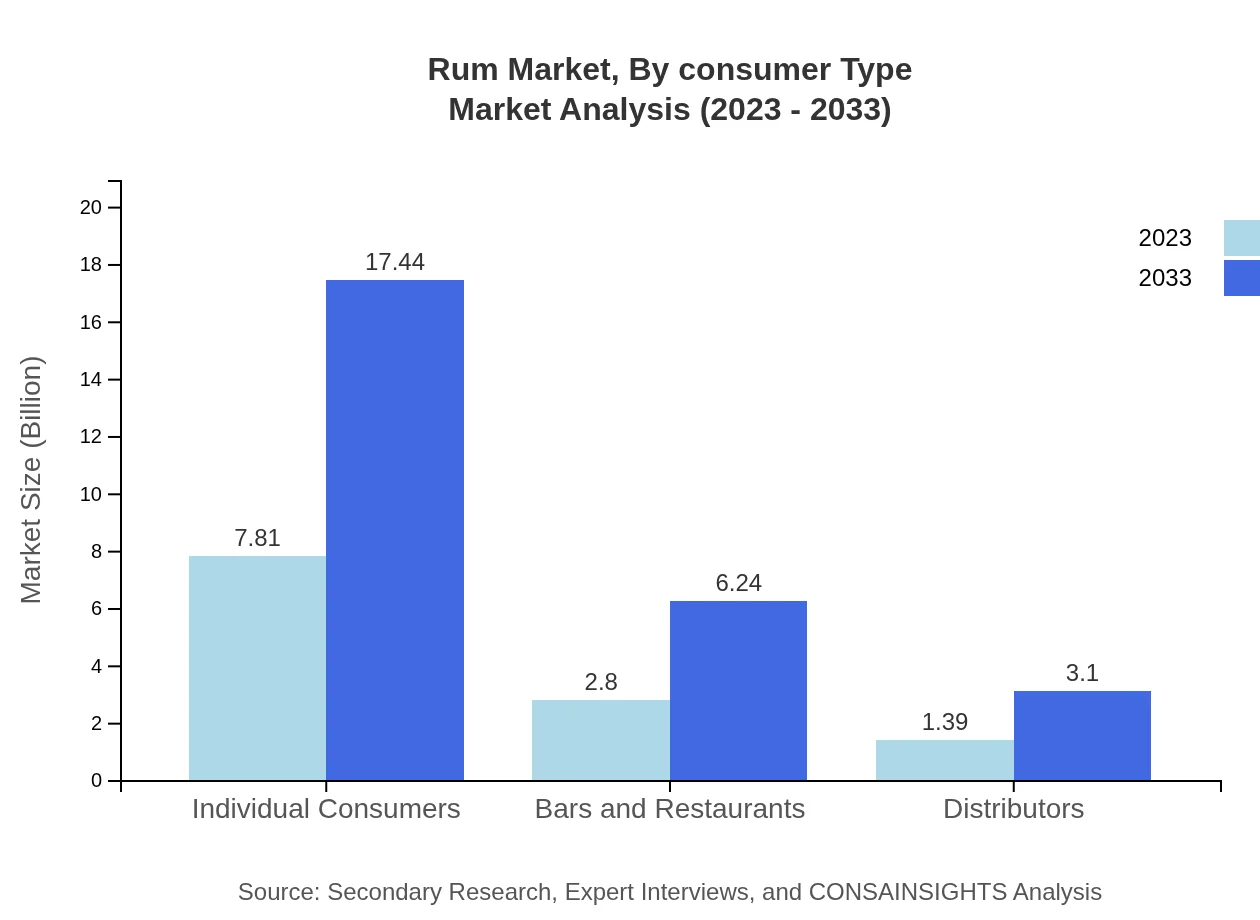

Rum Market Analysis By Consumer Type

Individual consumers dominate the Rum market with a size of $7.81 billion in 2023, growing to $17.44 billion by 2033. The market for bars and restaurants is also significant, growing from $2.80 billion to $6.24 billion, illustrating the importance of social drinking and the hospitality industry.

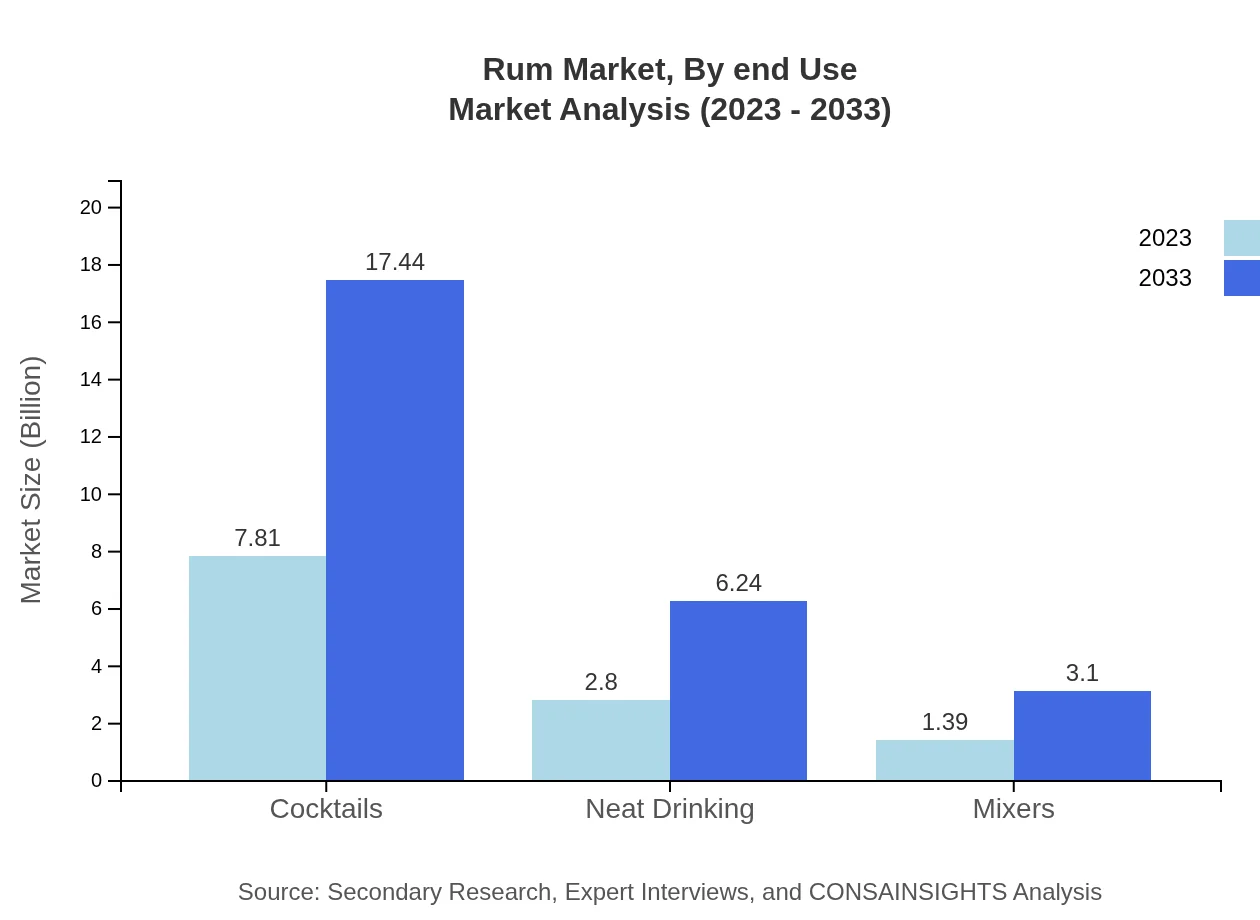

Rum Market Analysis By End Use

Rum is used significantly in cocktail preparation, constituting a large portion of the market share. Cocktails alone make up the majority, with both neat drinking and mixers gaining notable segments as consumer preferences shift towards mixed beverage experiences.

Rum Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rum Industry

Diageo:

A leading global beverage alcohol company producing renowned rum brands like Captain Morgan and Zacapa.Pernod Ricard:

The company owns iconic brands such as Havana Club and Malibu, focusing on premium offerings and sustainable growth.Bacardi:

Known for its top-selling Bacardi rum, it emphasizes innovation and brand heritage in the Rum category.Moët Hennessy:

Part of LVMH, this company focuses on high-end spirits, including the Ron Diplomatico brand, targeting affluent consumers.We're grateful to work with incredible clients.

FAQs

What is the market size of rum?

The global rum market is valued at approximately $12 billion in 2023, projected to grow at a CAGR of 8.1% through 2033. This growth indicates a vibrant demand for rum worldwide, making it a significant segment in the beverage industry.

What are the key market players or companies in the rum industry?

Key players in the rum industry include notable brands and distilleries that dominate the market. While specific names were not provided, it is typically dominated by major beverage companies that specialize in spirits and have a strong international distribution network.

What are the primary factors driving the growth in the rum industry?

Factors driving growth in the rum industry include the rising demand for premium and craft spirits, increasing popularity of rum-based cocktails, and expanding consumer preferences for diverse flavors. Additionally, effective marketing strategies and growing tourism contribute significantly to market expansion.

Which region is the fastest Growing in the rum market?

The fastest-growing region in the rum market is North America, where the market is expected to rise from $4.03 billion in 2023 to $8.99 billion by 2033. Other regions like Europe and Asia Pacific are also growing significantly, fueled by changing consumer habits.

Does ConsaInsights provide customized market report data for the rum industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the rum industry. This includes analysis of market size, trends, competitive landscape, and regional insights, ensuring stakeholders have access to relevant information to make informed decisions.

What deliverables can I expect from this rum market research project?

From the rum market research project, you can expect comprehensive deliverables including detailed market analysis reports, growth forecasts, competitive landscape evaluations, and insights into consumer behavior and preferences, tailored to your specific business objectives and needs.

What are the market trends of rum?

Current trends in the rum market include a surge in popularity for artisanal and flavored rums, growth in online retail channels, and increasing interest in rum cocktails. Sustainability and health-conscious products are also emerging trends shaping consumer choices in the rum market.