Ruminant Feed Market Report

Published Date: 31 January 2026 | Report Code: ruminant-feed

Ruminant Feed Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ruminant Feed market, including insights on market size, trends, and segmentation, with forecasts from 2023 to 2033.

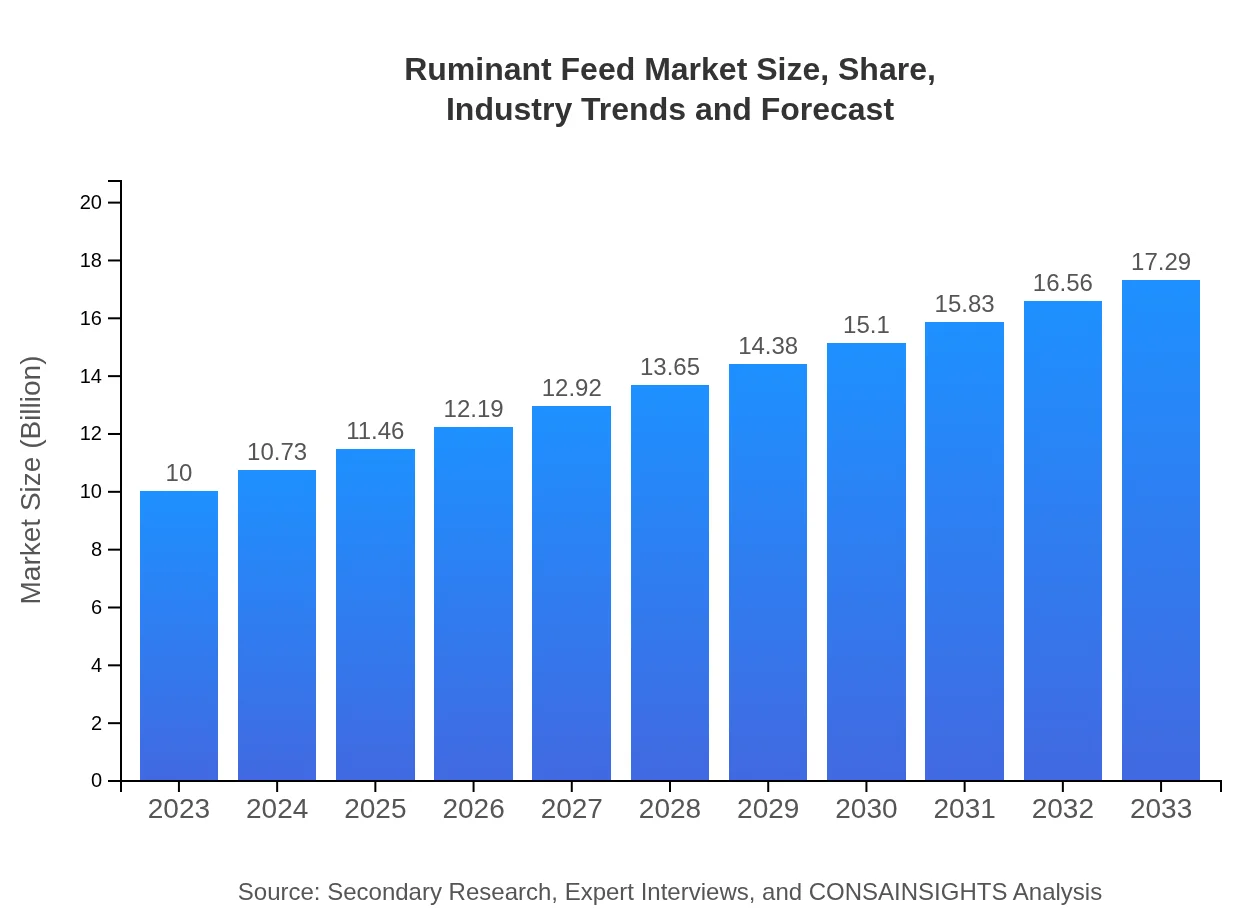

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $17.29 Billion |

| Top Companies | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Alltech, Inc., Nutreco N.V. |

| Last Modified Date | 31 January 2026 |

Ruminant Feed Market Overview

Customize Ruminant Feed Market Report market research report

- ✔ Get in-depth analysis of Ruminant Feed market size, growth, and forecasts.

- ✔ Understand Ruminant Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ruminant Feed

What is the Market Size & CAGR of Ruminant Feed market in 2023?

Ruminant Feed Industry Analysis

Ruminant Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ruminant Feed Market Analysis Report by Region

Europe Ruminant Feed Market Report:

The European market will experience growth from USD 2.59 billion in 2023 to USD 4.49 billion by 2033, reflecting a shift towards sustainable practices in livestock farming.Asia Pacific Ruminant Feed Market Report:

The Asia Pacific region is expected to witness significant growth in the Ruminant Feed market. In 2023, it stands at USD 1.91 billion and is projected to grow to USD 3.30 billion by 2033, fueled by rising livestock production and increasing demand for dairy and meat products.North America Ruminant Feed Market Report:

North America is the largest market, expected to increase from USD 3.61 billion in 2023 to USD 6.25 billion by 2033, backed by advanced feed technologies and a high demand for meat production.South America Ruminant Feed Market Report:

In South America, the market is projected to grow from USD 0.60 billion in 2023 to USD 1.04 billion by 2033, driven by increasing awareness of modern farming techniques and livestock management.Middle East & Africa Ruminant Feed Market Report:

In the Middle East and Africa, the Ruminant Feed market is poised to grow from USD 1.29 billion in 2023 to USD 2.22 billion by 2033, driven by rising livestock populations and improved nutritional standards.Tell us your focus area and get a customized research report.

Ruminant Feed Market Analysis By Product Type

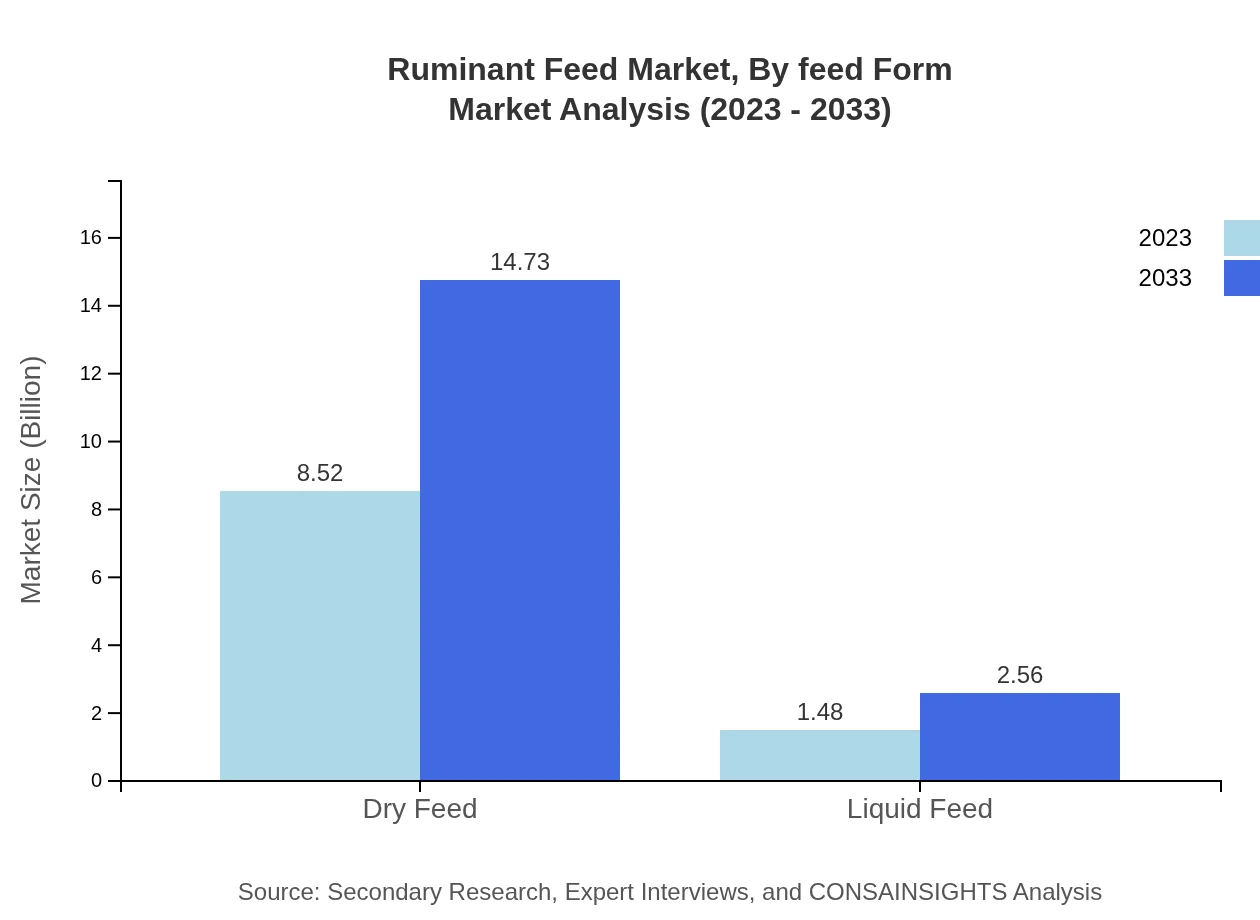

The Ruminant Feed market is primarily divided into two product types: Dry Feed and Liquid Feed. Dry Feed accounted for the majority of market share in 2023, valued at USD 8.52 billion and expected to grow significantly to USD 14.73 billion by 2033. Conversely, Liquid Feed remains crucial for certain nutritional needs, projected to grow from USD 1.48 billion to USD 2.56 billion within the same period.

Ruminant Feed Market Analysis By Livestock

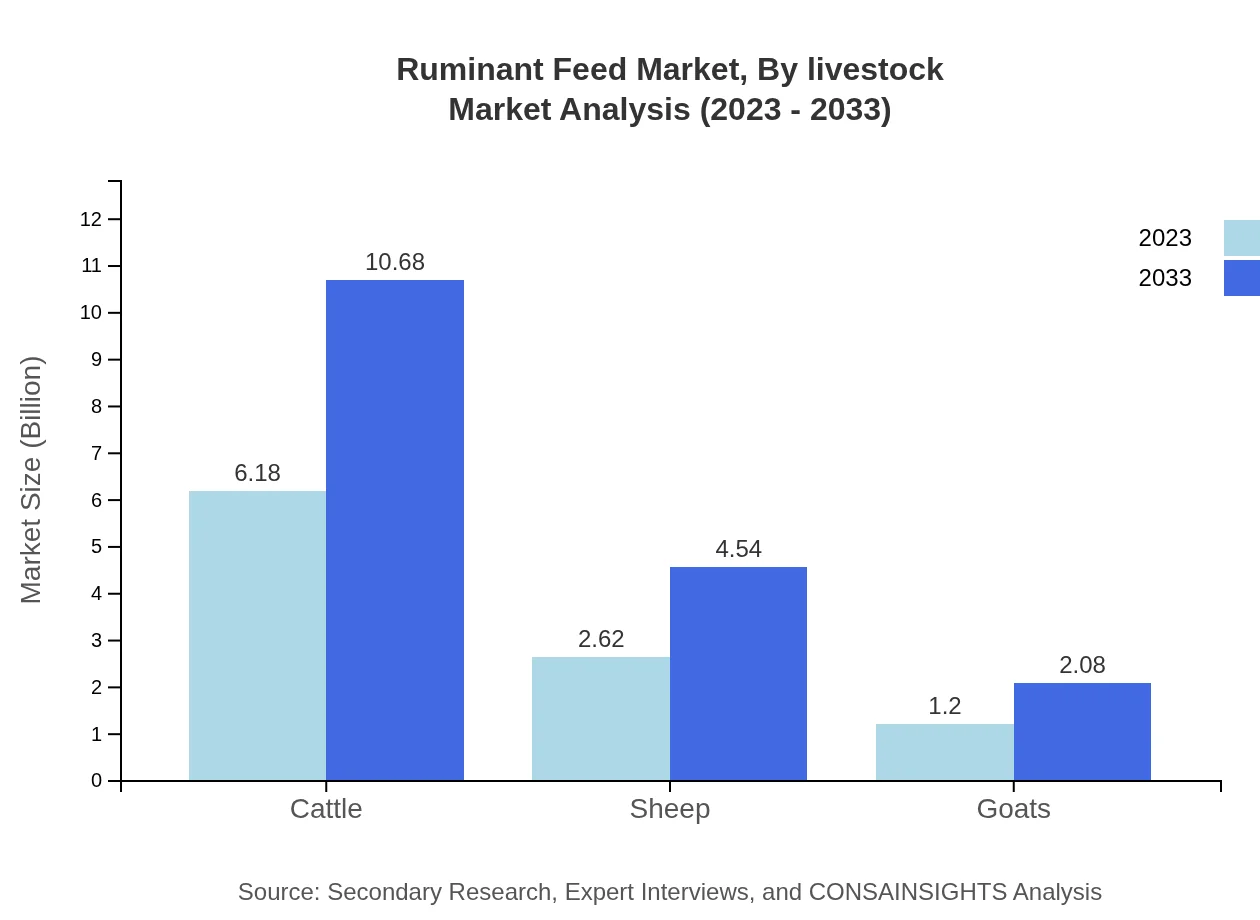

The livestock segment includes cattle, sheep, and goats. Cattle represent the largest share with a market value of USD 6.18 billion in 2023, anticipated to reach USD 10.68 billion by 2033. Sheep and goats follow closely, with markets projected to grow from USD 2.62 billion to USD 4.54 billion and USD 1.20 billion to USD 2.08 billion, respectively, highlighting the diversity in livestock feeding requirements.

Ruminant Feed Market Analysis By Feed Form

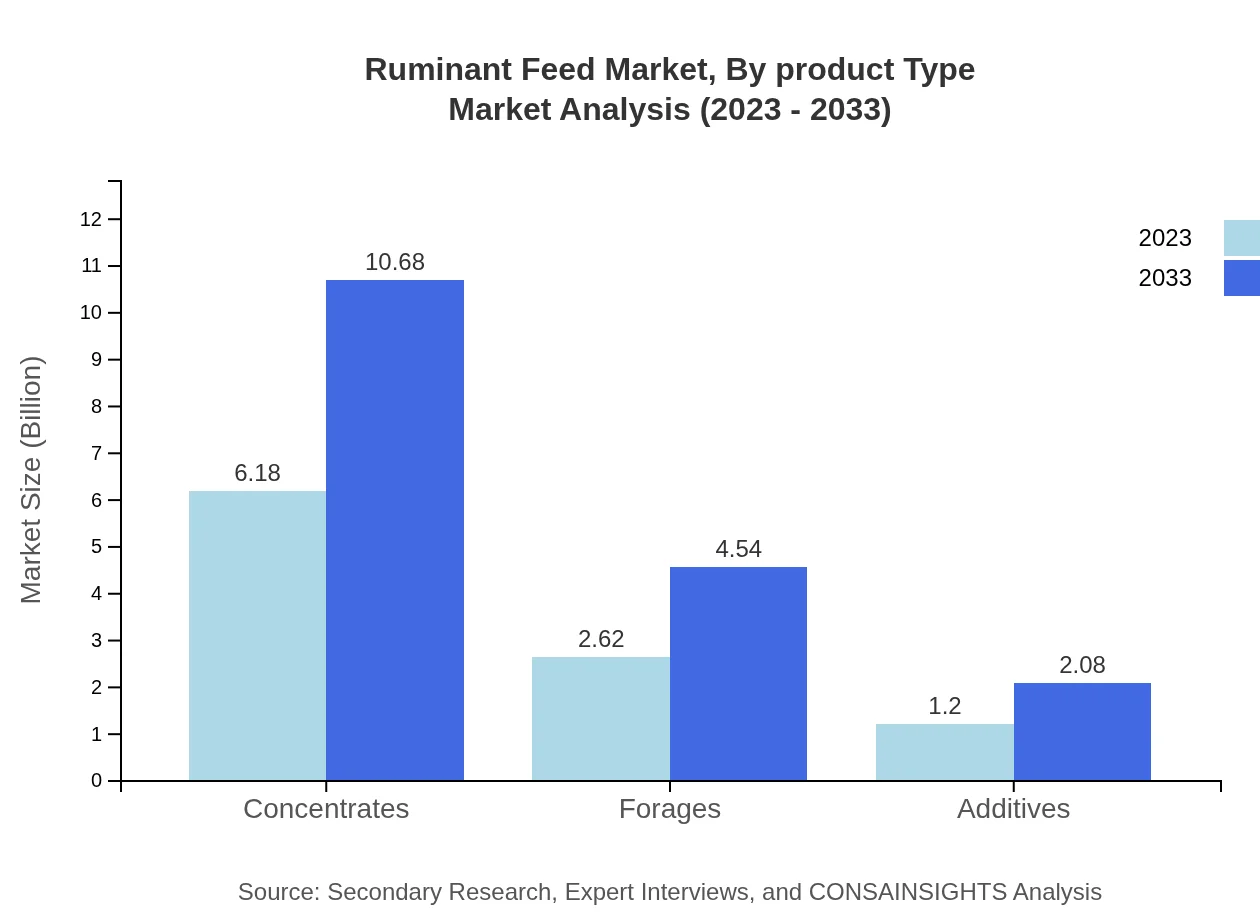

The market by feed form includes Concentrates and Forages. Concentrates are expected to maintain a stronghold in the market, growing from USD 6.18 billion in 2023 to USD 10.68 billion by 2033, supported by their high nutritional value. Meanwhile, Forages will also see growth from USD 2.62 billion to USD 4.54 billion, emphasizing the balance needed in ruminant diets.

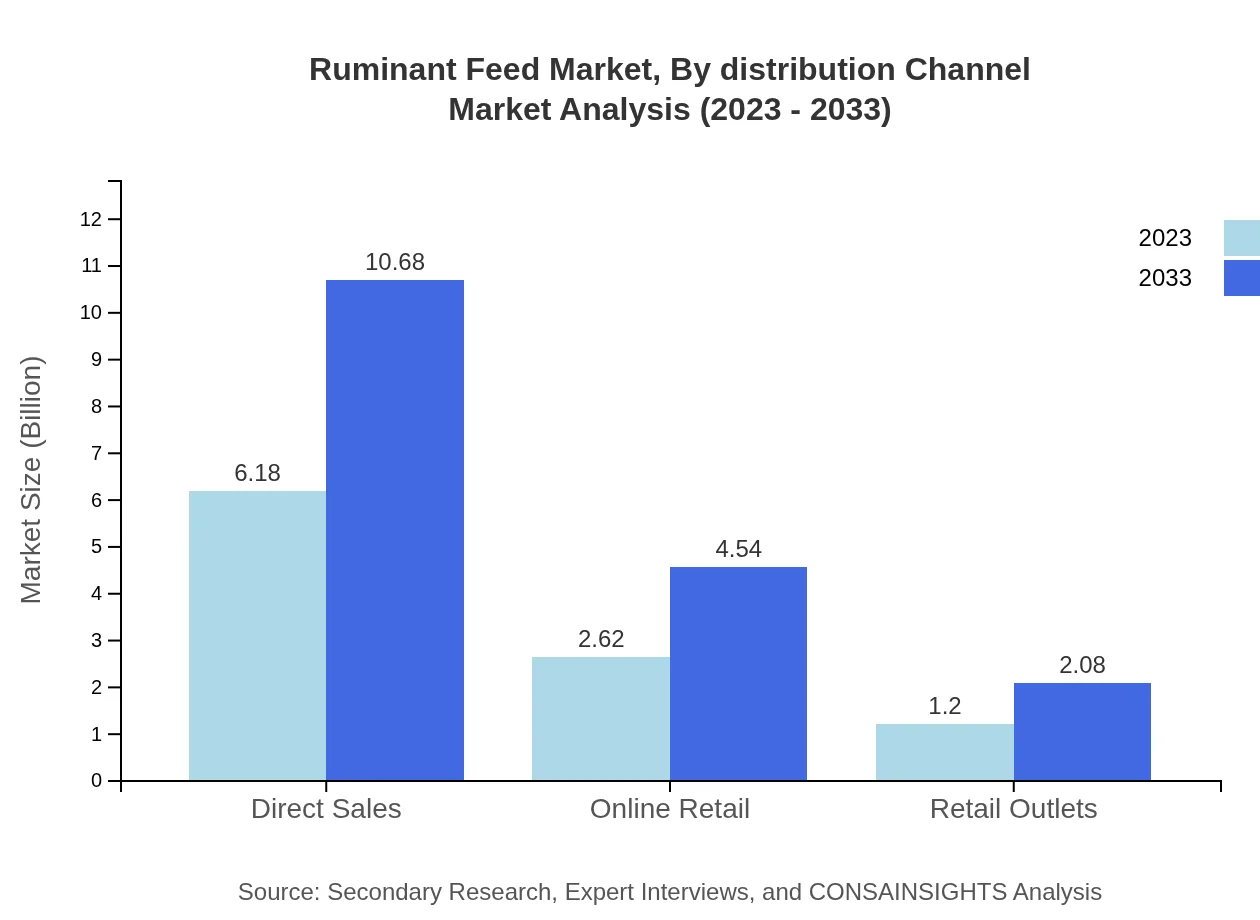

Ruminant Feed Market Analysis By Distribution Channel

Distribution channels include Direct Sales, Online Retail, and Retail Outlets. Direct Sales lead the market with a value of USD 6.18 billion in 2023, projected to rise to USD 10.68 billion by 2033, as farmers prefer direct sourcing. Online Retail is emerging quickly, expected to grow from USD 2.62 billion to USD 4.54 billion, catering to the tech-savvy segment of the market.

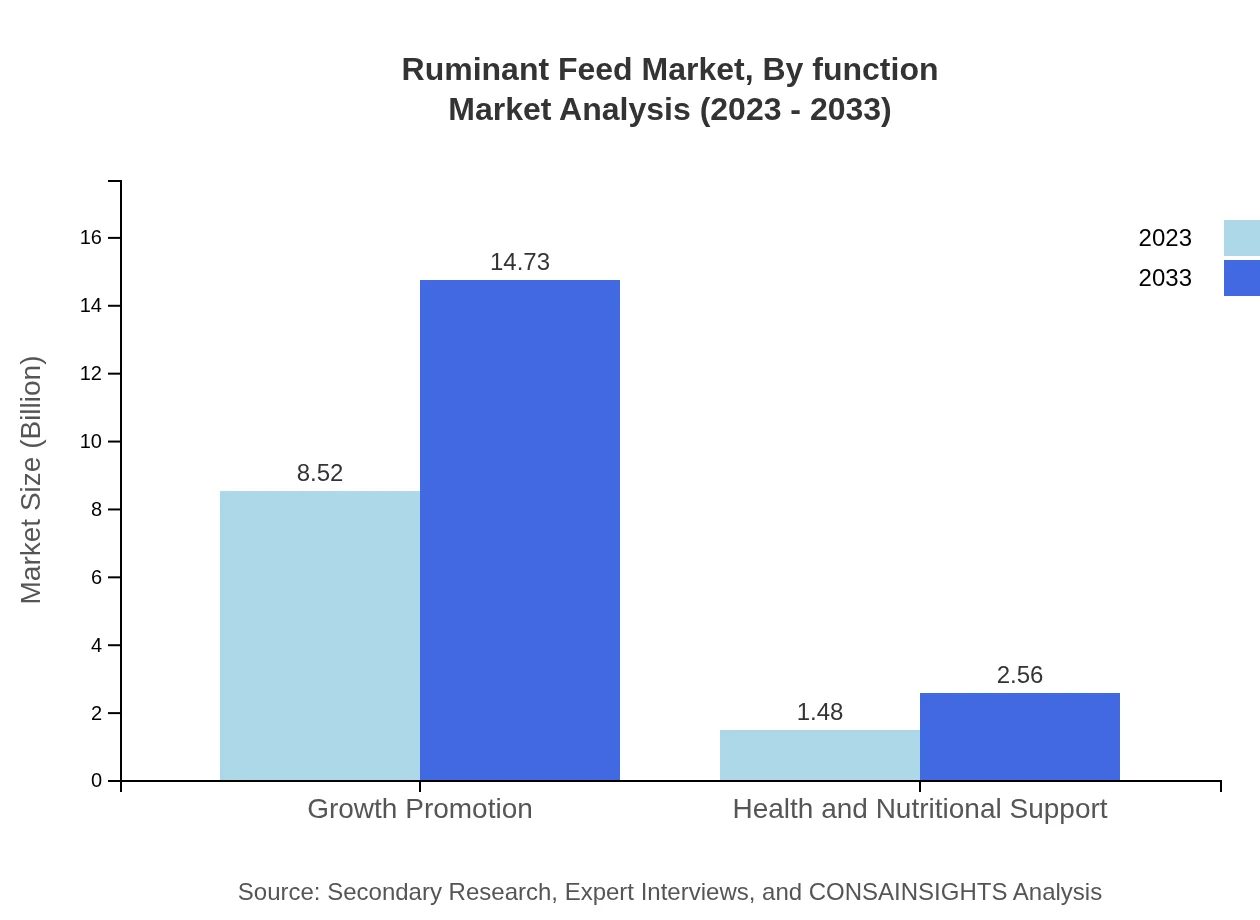

Ruminant Feed Market Analysis By Function

The Ruminant Feed market functionally segments into Growth Promotion and Health and Nutritional Support. Growth Promotion dominates with a significant size of USD 8.52 billion in 2023, increasing to USD 14.73 billion by 2033. Health and Nutritional Support, while a smaller segment, is essential, expected to grow from USD 1.48 billion to USD 2.56 billion, reflecting a growing emphasis on animal welfare.

Ruminant Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ruminant Feed Industry

Cargill, Incorporated:

A global leader in agriculture and food production, Cargill provides innovative ruminant feed solutions to enhance livestock productivity and health.Archer Daniels Midland Company (ADM):

ADM is a prominent player in the Ruminant Feed sector, offering a diverse range of feed products aimed at optimizing livestock nutrition and performance.Alltech, Inc.:

Alltech specializes in animal nutrition and health products, integrating science and innovation to improve ruminant feed formulations and efficacy.Nutreco N.V.:

Nutreco is a leading feed company that focuses on sustainable animal nutrition, providing essential ruminant feed solutions tailored to enhance animal health.We're grateful to work with incredible clients.

FAQs

What is the market size of Ruminant Feed?

The global ruminant feed market is valued at approximately $10 billion in 2023, with a projected growth rate of 5.5% CAGR, indicating significant opportunities for expansion in the coming years.

What are the key market players or companies in the Ruminant Feed industry?

Key players in the ruminant feed industry include Cargill, Archer Daniels Midland Company, and BASF. These companies lead in innovation and provide a diverse range of products to meet the demands of livestock farmers worldwide.

What are the primary factors driving the growth in the Ruminant Feed industry?

Major growth drivers include increasing meat consumption, rising awareness of animal nutrition, and technological advancements in feed efficiency. These elements collectively foster a growth-oriented environment for ruminant feed products globally.

Which region is the fastest Growing in the Ruminant Feed market?

The fastest growth is projected in Asia-Pacific, where the ruminant feed market will expand from $1.91 billion in 2023 to $3.30 billion by 2033, reflecting an increasing focus on livestock production to meet food demands.

Does ConsaInsights provide customized market report data for the Ruminant Feed industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs in the ruminant feed industry, enabling clients to gain insights and strategic advantages based on their unique market dynamics.

What deliverables can I expect from this Ruminant Feed market research project?

Deliverables include comprehensive market analysis reports, segmentation data, regional insights, and trend forecasts, providing critical information for stakeholders to make informed decisions in the ruminant feed sector.

What are the market trends of Ruminant Feed?

Trending in the ruminant feed market are innovations in feed formulations, a shift toward organic and natural feed options, and enhanced focus on sustainable farming practices, all of which aim to improve animal health and productivity.