Rutile Market Report

Published Date: 02 February 2026 | Report Code: rutile

Rutile Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Rutile market, covering vital insights, trends, and forecasts from 2023 to 2033. Key data regarding market size, segmentation, and industry dynamics are explored to help stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

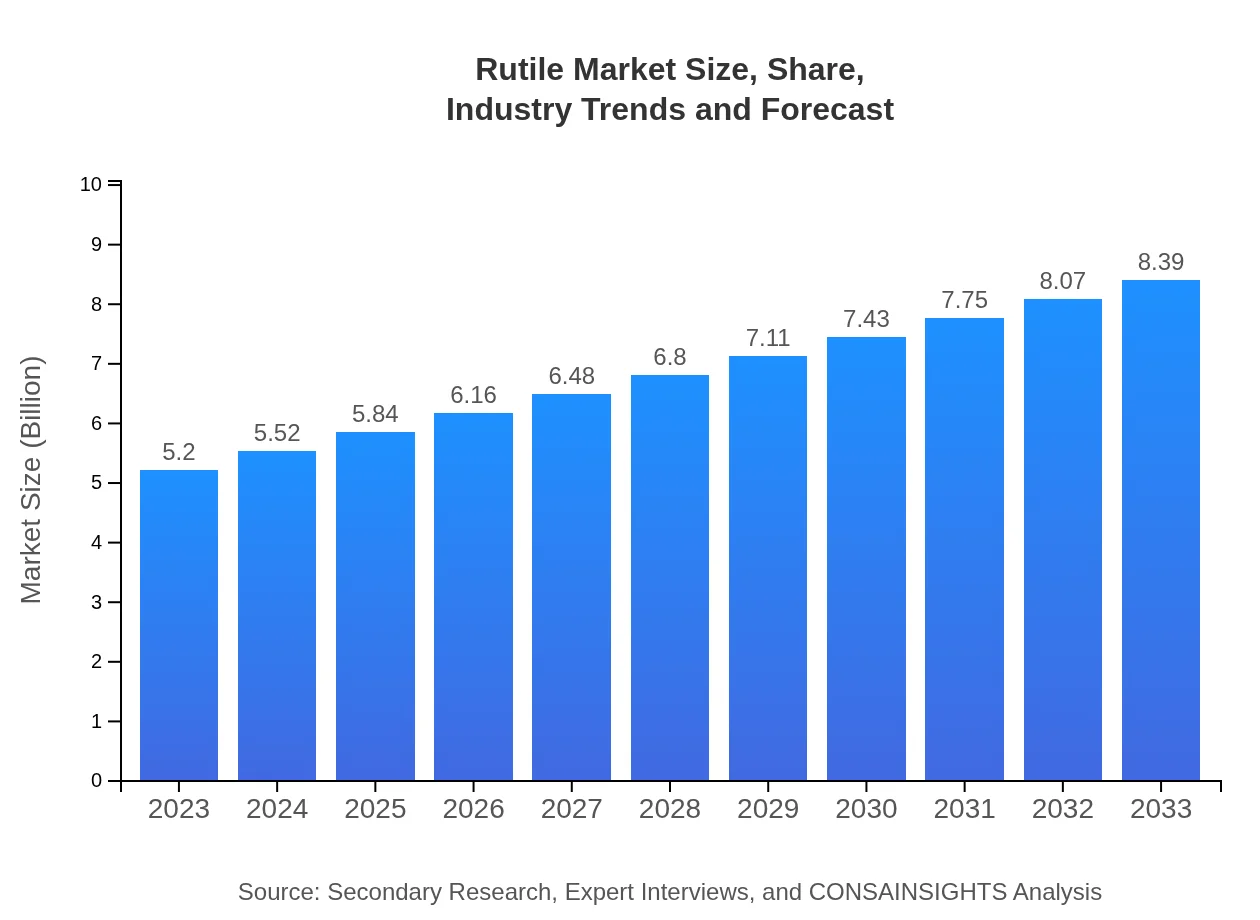

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $8.39 Billion |

| Top Companies | Iluka Resources, Rio Tinto, Tronox Holdings |

| Last Modified Date | 02 February 2026 |

Rutile Market Overview

Customize Rutile Market Report market research report

- ✔ Get in-depth analysis of Rutile market size, growth, and forecasts.

- ✔ Understand Rutile's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rutile

What is the Market Size & CAGR of Rutile market in 2023?

Rutile Industry Analysis

Rutile Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rutile Market Analysis Report by Region

Europe Rutile Market Report:

The European Rutile market is anticipated to grow from $1.67 billion in 2023 to $2.69 billion by 2033. The region's strict regulatory framework on imports and its emphasis on sustainability are nurturing growth in local production and processing capabilities.Asia Pacific Rutile Market Report:

The Asia Pacific region, with a market size of $0.90 billion in 2023, is projected to grow to $1.46 billion by 2033. This growth is driven by increasing industrial activities, especially in China and India, where demand for titanium products, particularly in construction and manufacturing, is surging.North America Rutile Market Report:

North America shows a promising increase, with market values expected to rise from $1.86 billion in 2023 to $3.00 billion by 2033. The United States is focusing heavily on sustainable mining practices and has a robust aerospace and automotive sector that drives Rutile demand.South America Rutile Market Report:

In South America, the Rutile market is expected to expand from $0.34 billion in 2023 to $0.55 billion by 2033. Brazil and Chile are key players, leveraging their mining capabilities and seeking to tap into the growing demand for Rutile in various applications.Middle East & Africa Rutile Market Report:

In the Middle East and Africa, the market size is expected to rise from $0.44 billion in 2023 to $0.70 billion by 2033. Countries like South Africa are capitalizing on their rich mineral deposits and the increasing demand for Rutile in various sectors.Tell us your focus area and get a customized research report.

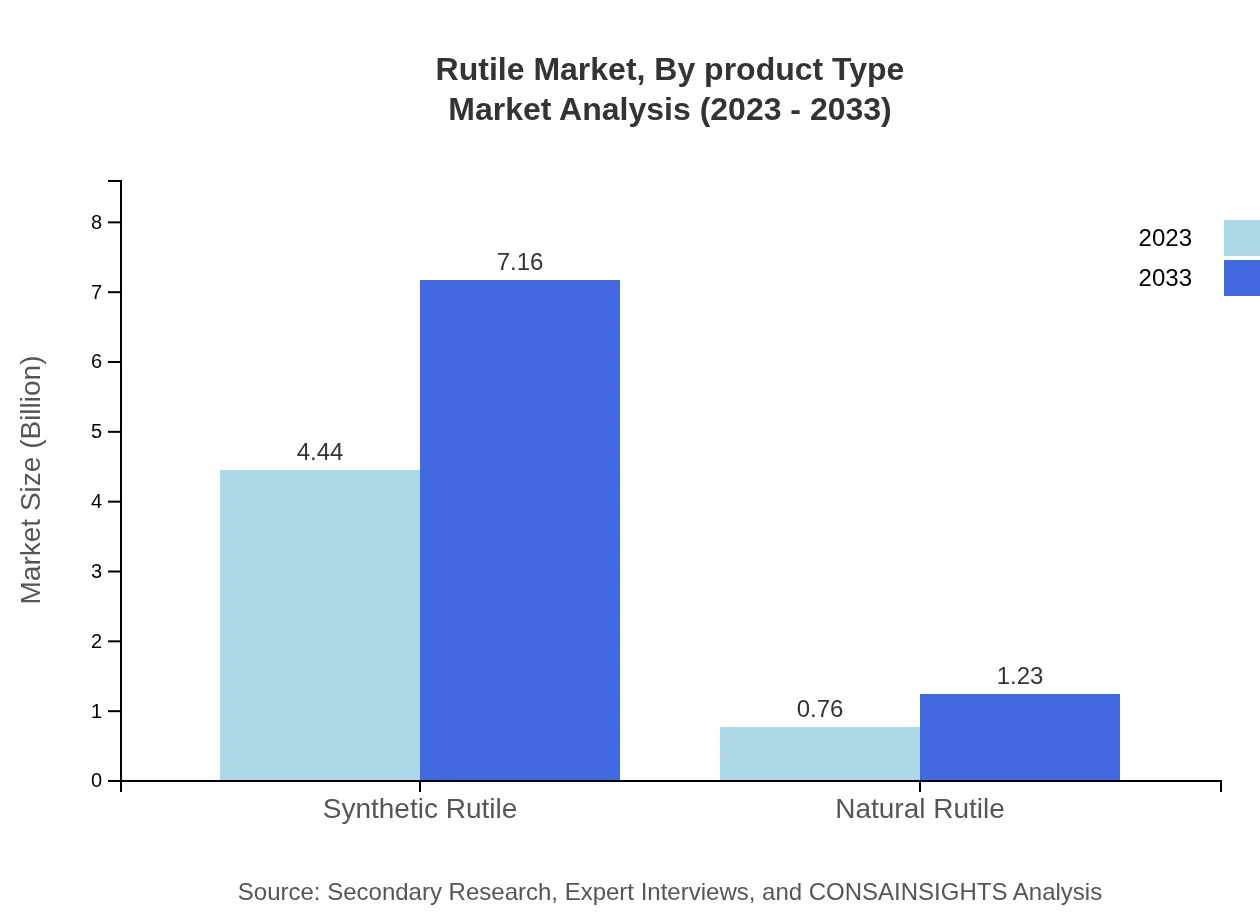

Rutile Market Analysis By Product Type

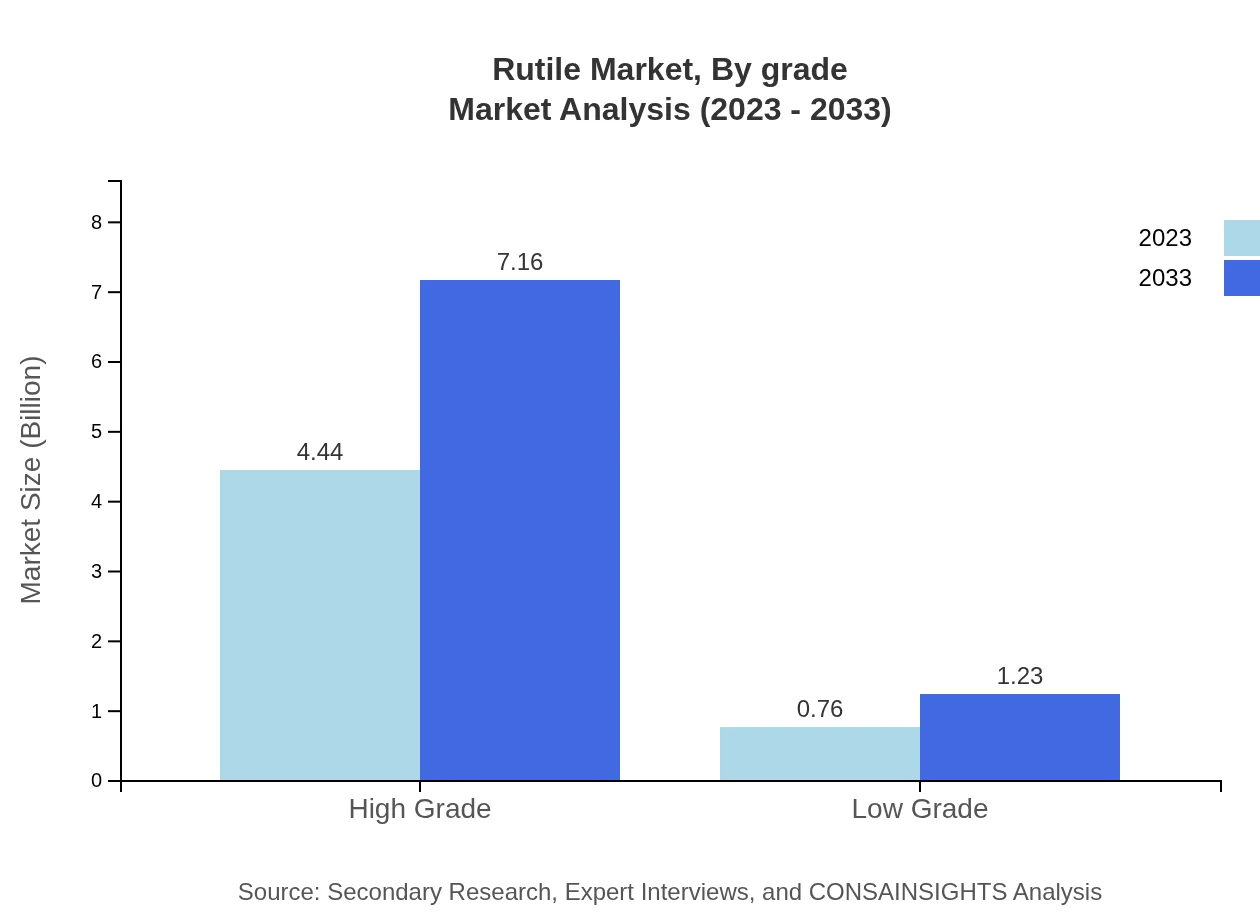

The Rutile market is primarily segmented into high-grade and low-grade Rutile. In 2023, high-grade Rutile holds a market value of $4.44 billion, anticipated to rise to $7.16 billion by 2033, maintaining a consistent market share of 85.32%. Low-grade Rutile, with a starting value of $0.76 billion in 2023, is projected to reach $1.23 billion by 2033, holding 14.68% market share.

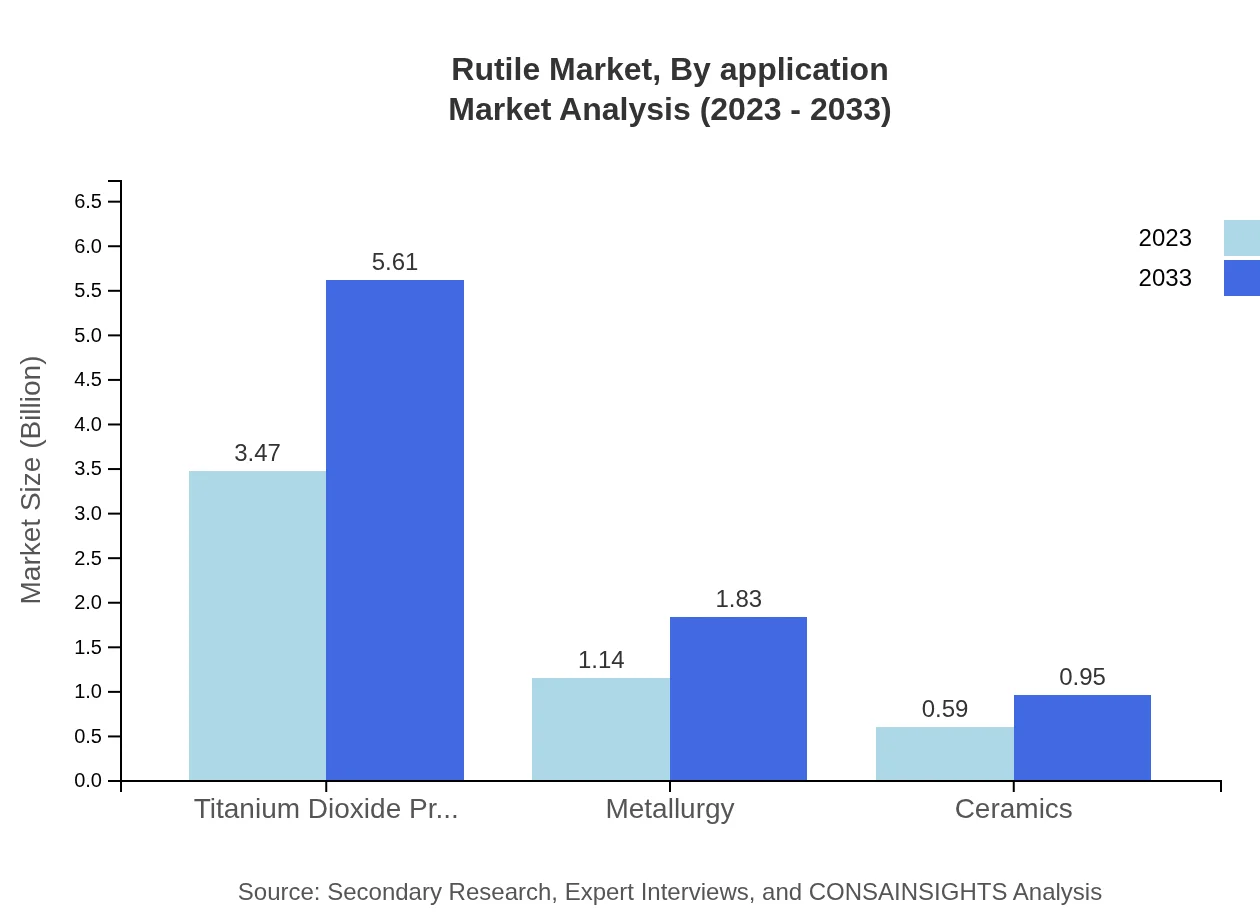

Rutile Market Analysis By Application

In terms of application, Titanium Dioxide production dominates with a market size of $3.47 billion in 2023, expected to grow to $5.61 billion by 2033, capturing 66.81% market share. Other significant applications include metallurgy, ceramics, and construction, with respective shares of 21.84% and 52.56%.

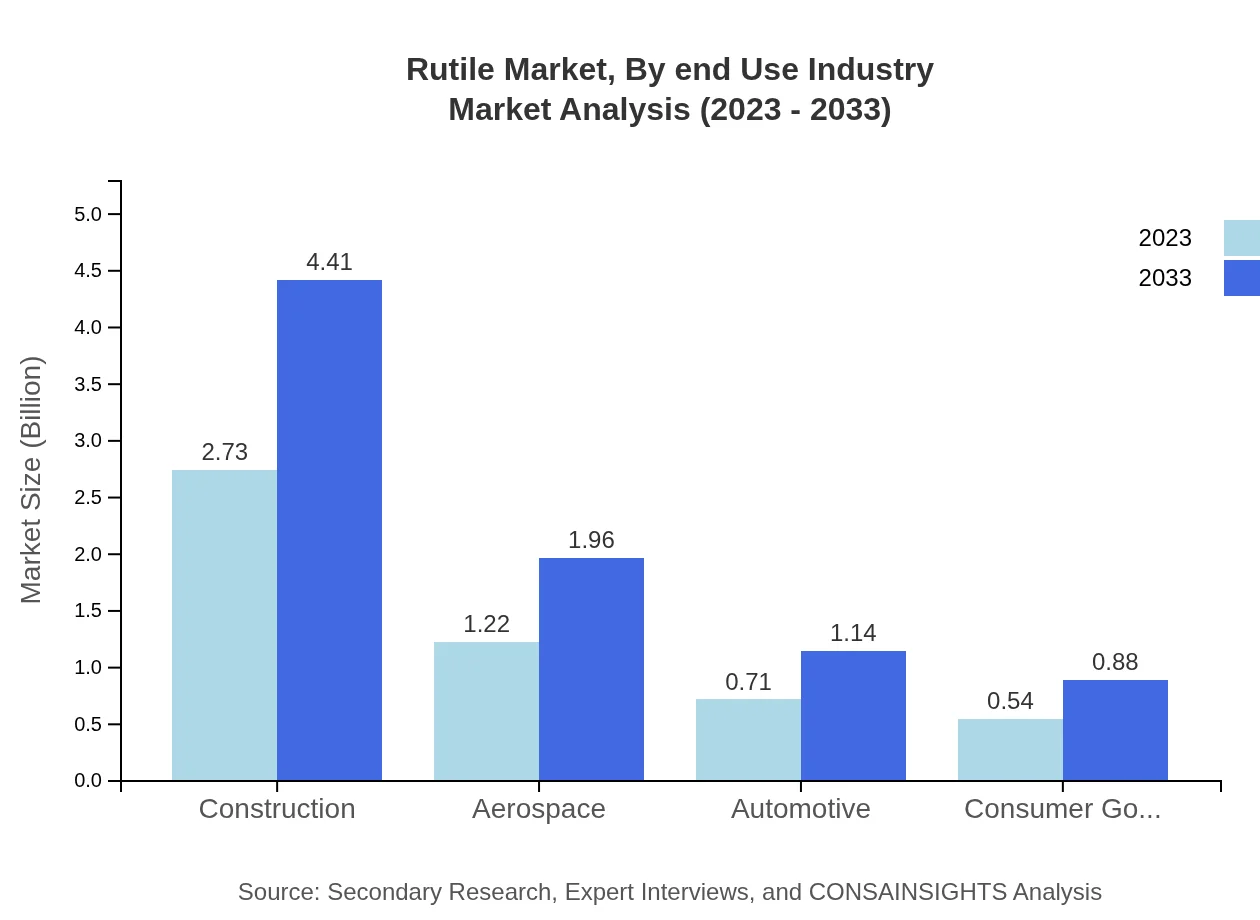

Rutile Market Analysis By End Use Industry

The end-use industries segment highlights construction as the largest consumer of Rutile, holding a market size of $2.73 billion in 2023 and forecasted to grow to $4.41 billion by 2033 (52.56% share). Aerospace and automotive are also notable, with market sizes of $1.22 billion and $0.71 billion, respectively, in 2023.

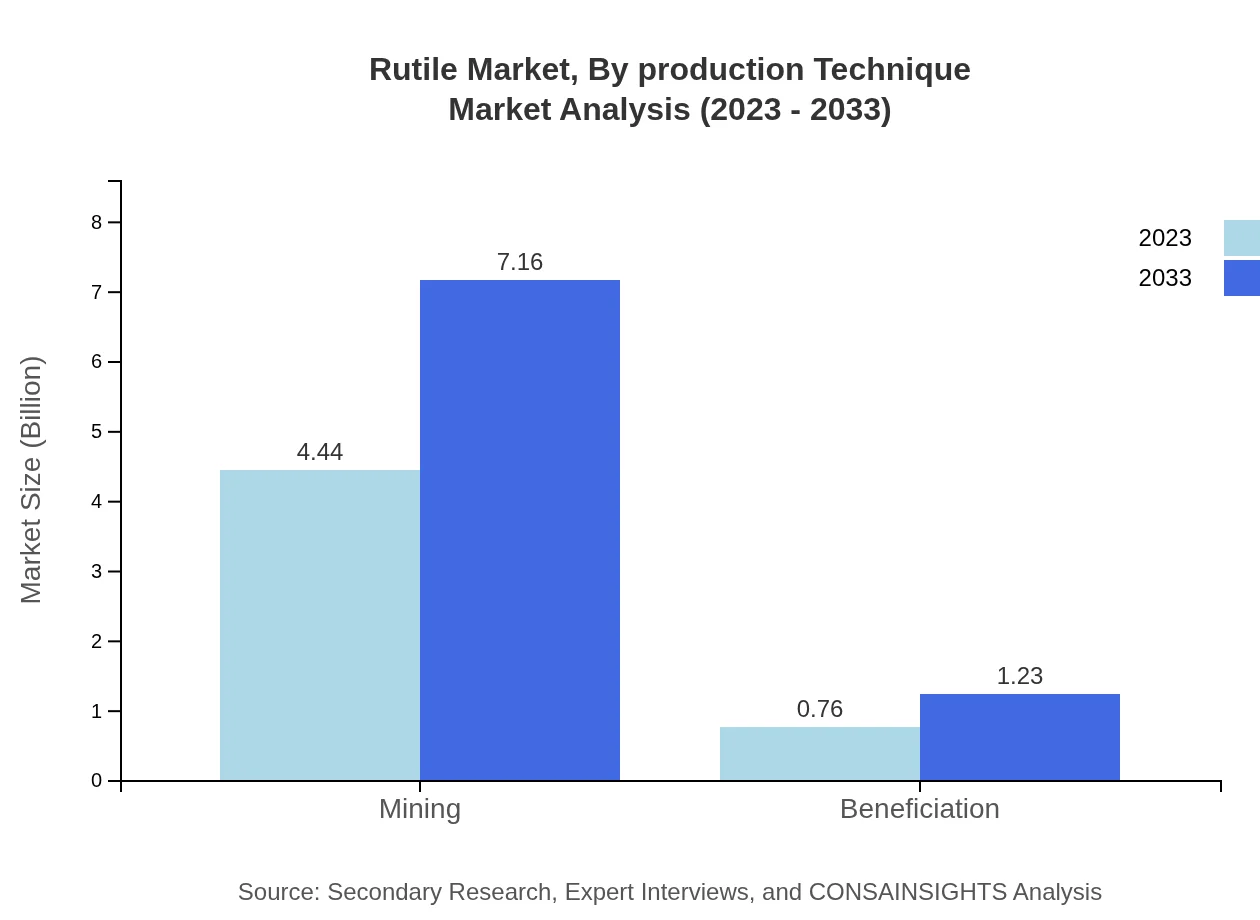

Rutile Market Analysis By Production Technique

Rutile production techniques encompass both synthetic and natural methods. Synthetic Rutile is showing robust growth prospects, driven by a technological shift towards enhanced production methods. Natural Rutile continues to hold a key share, ensuring the market remains balanced.

Rutile Market Analysis By Grade

Grade plays a critical role in determining Rutile applications. High-grade Rutile remains the preference for industries requiring high purity, showing consistent demand across high-performance sectors.

Rutile Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rutile Industry

Iluka Resources:

A leading Australian company specializing in mineral sands, Iluka Resources focuses on producing high-grade titanium dioxide and has enhanced its supply chain efficiency.Rio Tinto:

Rio Tinto is a major global mining company with significant operations in titanium and Rutile production, committed to sustainable mining practices.Tronox Holdings:

One of the largest producers of titanium dioxide globally, Tronox also plays a crucial role in Rutile mining and processing, focusing on innovation and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of rutile?

The global rutile market is currently valued at approximately $5.2 billion and is projected to grow at a CAGR of 4.8% from 2023 to 2033, indicating strong demand and expansion in various applications.

What are the key market players or companies in the rutile industry?

Key players in the rutile market include major mining companies and producers specializing in titanium minerals. These companies focus on high-grade rutile production and invest in technological advancements to enhance efficiency and output.

What are the primary factors driving the growth in the rutile industry?

Growth in the rutile market is driven by increased demand in titanium dioxide production, construction, aerospace, and automotive sectors. Rising industrial activity and technological advancements further promote rutile consumption across various applications.

Which region is the fastest Growing in the rutile market?

North America is the fastest-growing region in the rutile market, projected to increase from $1.86 billion in 2023 to $3.00 billion by 2033. Strong industrial activity and infrastructure development support this growth.

Does ConsaInsights provide customized market report data for the rutile industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the rutile industry, ensuring relevant insights and data that align with evolving market trends and strategic objectives.

What deliverables can I expect from this rutile market research project?

You can expect detailed market analysis reports, segment insights, and forecasts, including competitive analysis, regional breakdowns, and market trends, that provide a comprehensive understanding of the rutile market landscape.

What are the market trends of rutile?

Current trends indicate a shift towards sustainable rutile sourcing, increased automation in production, and growing investments in titanium applications, reflecting a robust outlook for the rutile market in the coming years.