Saasbased It Security Market Report

Published Date: 31 January 2026 | Report Code: saasbased-it-security

Saasbased It Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Saasbased IT Security market, covering key trends, market dynamics, regional insights, and forecasts from 2023 to 2033. It offers valuable data on market size, CAGR, segmentation, and the competitive landscape, aiming to equip stakeholders with actionable insights.

| Metric | Value |

|---|---|

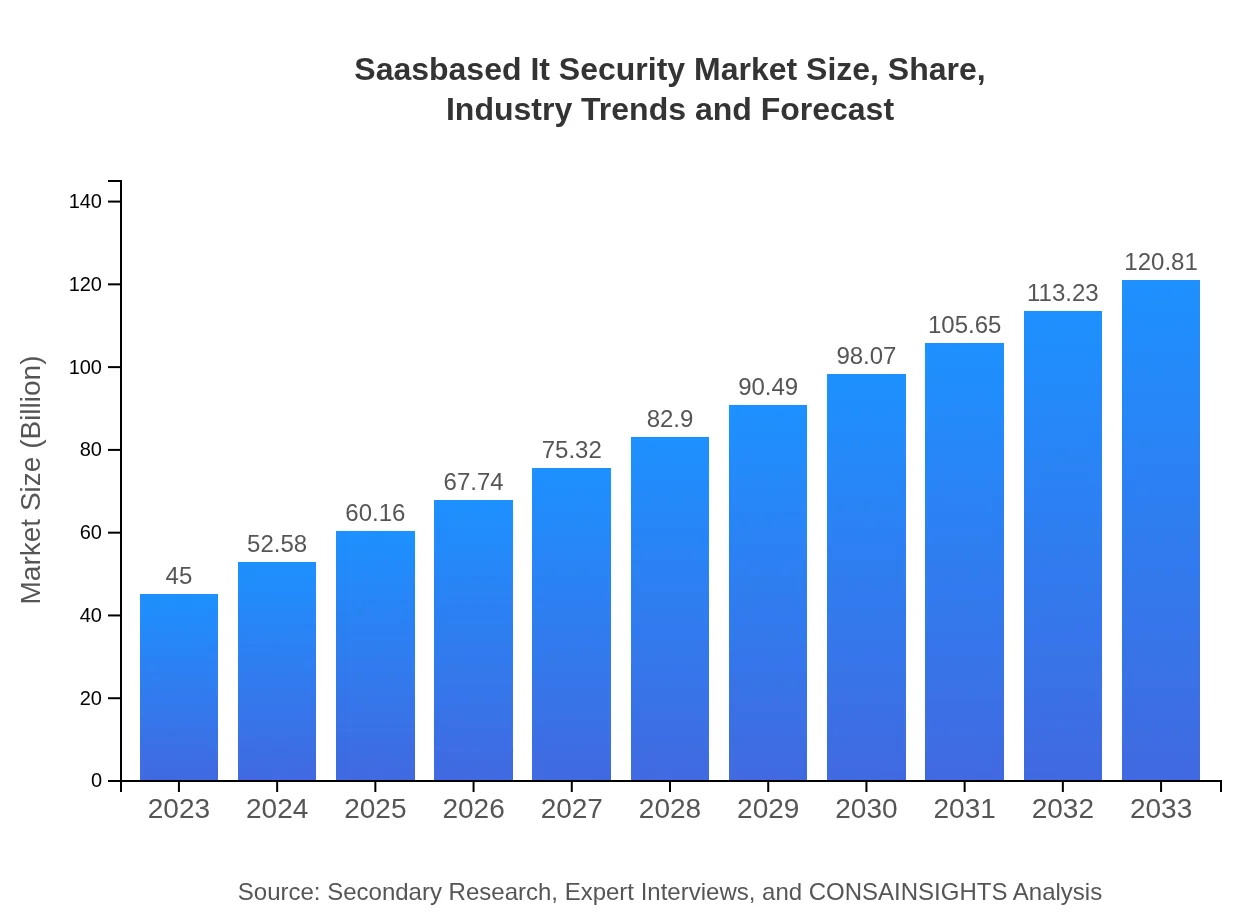

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $120.81 Billion |

| Top Companies | Palo Alto Networks, McAfee, Cisco Systems, Check Point Software Technologies |

| Last Modified Date | 31 January 2026 |

Saasbased IT Security Market Overview

Customize Saasbased It Security Market Report market research report

- ✔ Get in-depth analysis of Saasbased It Security market size, growth, and forecasts.

- ✔ Understand Saasbased It Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Saasbased It Security

What is the Market Size & CAGR of Saasbased IT Security market in 2023?

Saasbased IT Security Industry Analysis

Saasbased IT Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Saasbased IT Security Market Analysis Report by Region

Europe Saasbased It Security Market Report:

The European Saasbased IT Security market is anticipated to expand from $15.68 billion in 2023 to $42.10 billion by 2033. GDPR regulations and heightened data protection concerns are driving organizations towards adopting comprehensive SaaS solutions.Asia Pacific Saasbased It Security Market Report:

In 2023, the Asia Pacific Saasbased IT Security market is valued at $8.03 billion and is projected to grow to $21.56 billion by 2033, reflecting a strong demand driven by increasing internet penetration and a rise in cloud adoption. Countries like India and China are emerging as major markets due to their vast digital landscape and growing cybersecurity concerns.North America Saasbased It Security Market Report:

North America holds a significant share in the Saasbased IT Security market with a size of $14.72 billion in 2023 projected to reach $39.53 billion by 2033. This growth is largely attributed to a high rate of technological advancement, presence of major cybersecurity firms, and stringent regulatory requirements pertaining to data security.South America Saasbased It Security Market Report:

The South American market for Saasbased IT Security is expected to grow from $4.13 billion in 2023 to $11.08 billion by 2033. This growth is stimulated by increasing awareness of cybersecurity threats and the varying adoption of regulations around data protection, particularly in Brazil and Argentina.Middle East & Africa Saasbased It Security Market Report:

In the Middle East and Africa, the Saasbased IT Security market is estimated to grow from $2.43 billion in 2023 to $6.54 billion by 2033. Growth is fueled by increasing digitization and government initiatives aimed at improving cybersecurity frameworks in various sectors.Tell us your focus area and get a customized research report.

Saasbased It Security Market Analysis Security_software

Global SaaS-Based IT Security Market, By Product Market Analysis (2023 - 2033)

The security software segment dominates the SaaS IT Security landscape with a market size of $39.31 billion in 2023, expected to grow to $105.54 billion by 2033, accounting for approximately 87.36% market share throughout the forecast period. This growth owes to rising necessities for software solutions that provide real-time threat detection and incident response.

Saasbased It Security Market Analysis Security_services

Global SaaS-Based IT Security Market, By Services Market Analysis (2023 - 2033)

Security services play a vital role in the Saasbased IT Security market, growing from $5.69 billion in 2023 to $15.27 billion by 2033, making up about 12.64% of the market. Managed security services are gaining traction as organizations seek to outsource their security functions to experienced providers.

Saasbased It Security Market Analysis It_and_telecom

Global SaaS-Based IT Security Market, By Application Market Analysis (2023 - 2033)

The IT and Telecom segment leads the market with a size of $26.01 billion in 2023, projected to reach $69.82 billion by 2033, representing a 57.79% market share. This sector's growth is bolstered by the necessity for robust security protocols to protect sensitive information and infrastructure.

Saasbased It Security Market Analysis Healthcare

Global SaaS-Based IT Security Market, By End-User Industry Market Analysis (2023 - 2033)

The healthcare segment is experiencing significant growth, with market size moving from $9.18 billion in 2023 to $24.66 billion by 2033, representing 20.41% of the market. The increasing digitization of health records and the rise of telehealth services are major factors contributing to this growth.

Saasbased IT Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Saasbased IT Security Industry

Palo Alto Networks:

Palo Alto Networks is a leading cybersecurity provider, renowned for its innovative security solutions including next-generation firewalls and cloud-based security applications.McAfee:

McAfee offers comprehensive cybersecurity solutions to protect user data and privacy across various platforms, including SaaS environments.Cisco Systems:

Cisco is known for its robust cybersecurity frameworks that enhance enterprise security through SaaS-based offerings and services.Check Point Software Technologies:

Check Point delivers a wide array of SaaS cybersecurity solutions tailored to meet the needs of businesses of all sizes, focusing on threat prevention and management.We're grateful to work with incredible clients.

FAQs

What is the market size of saasbased It Security?

The SaaS-based IT Security market was valued at $45 billion in 2023 and is projected to grow at a CAGR of 10%, reaching significant sizes by 2033.

What are the key market players or companies in this saasbased It Security industry?

Key market players in the SaaS-based IT Security industry include Symantec, McAfee, Cisco, and Palo Alto Networks, which provide leading security solutions and services.

What are the primary factors driving the growth in the saasbased It Security industry?

Growth drivers for the SaaS-based IT Security industry include increasing cyber threats, growing cloud adoption, regulatory compliance requirements, and a rising need for enterprise data protection.

Which region is the fastest Growing in the saasbased It Security?

The Asia Pacific region is the fastest-growing for SaaS-based IT Security, expanding from $8.03 billion in 2023 to $21.56 billion by 2033, driven by digital transformation initiatives.

Does ConsaInsights provide customized market report data for the saasbased It Security industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the SaaS-based IT Security industry, facilitating unique insights and analysis.

What deliverables can I expect from this saasbased It Security market research project?

Deliverables from this market research include comprehensive reports, data analytics, trend analysis, segmentation insights, and forecasts for the SaaS-based IT Security market.

What are the market trends of saasbased It Security?

Key trends include increased focus on identity and access management, rapid adoption of threat intelligence solutions, and the shift towards hybrid cloud security implementations.