Safety Sensors Market Report

Published Date: 31 January 2026 | Report Code: safety-sensors

Safety Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Safety Sensors market, covering market dynamics, historical data, trends, and projections from 2023 to 2033. Insights include market sizing, segmentation, regional analysis, and key player strategies critical for stakeholders in this evolving industry.

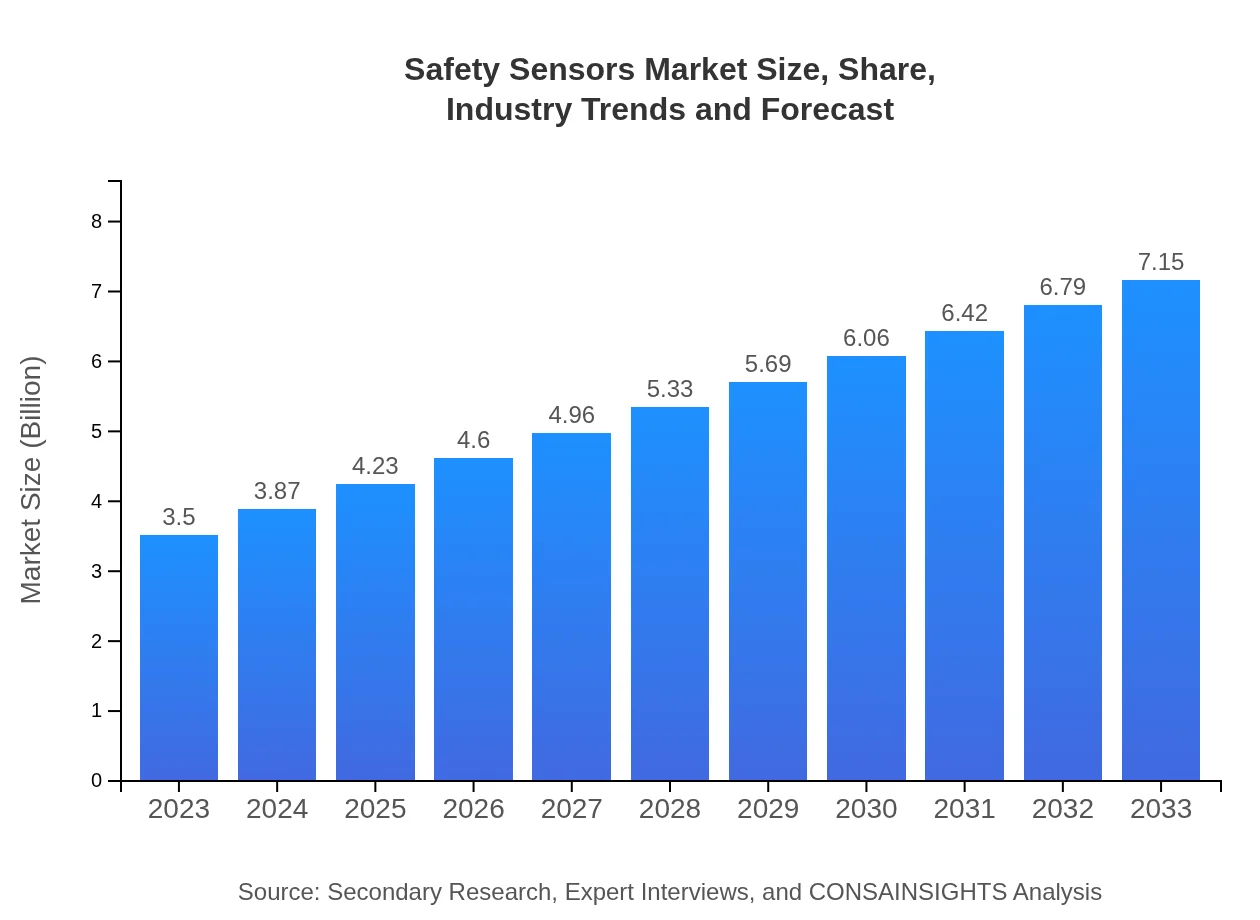

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Pepperl+Fuchs GmbH, Emerson Electric Co. |

| Last Modified Date | 31 January 2026 |

Safety Sensors Market Overview

Customize Safety Sensors Market Report market research report

- ✔ Get in-depth analysis of Safety Sensors market size, growth, and forecasts.

- ✔ Understand Safety Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Safety Sensors

What is the Market Size & CAGR of Safety Sensors market in 2023?

Safety Sensors Industry Analysis

Safety Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Safety Sensors Market Analysis Report by Region

Europe Safety Sensors Market Report:

The European Safety Sensors market is projected to expand from USD 1.20 billion in 2023 to USD 2.46 billion by 2033. With strict EU regulations on workplace safety and increased investment in advanced manufacturing, Europe is a key player in sensor technology development.Asia Pacific Safety Sensors Market Report:

In the Asia Pacific region, the Safety Sensors market was valued at USD 0.61 billion in 2023 and is expected to grow to USD 1.25 billion by 2033. The growth is fueled by rapid industrialization, increased safety regulations, and the rising adoption of automation technologies in countries like China and India.North America Safety Sensors Market Report:

North America remains a significant market, with a size of USD 1.22 billion in 2023, anticipated to grow to USD 2.50 billion by 2033. The high demand for safety solutions in manufacturing and automotive sectors, coupled with rigorous regulatory frameworks, supports this growth.South America Safety Sensors Market Report:

For South America, the market size of Safety Sensors stood at USD 0.28 billion in 2023, projected to reach USD 0.58 billion by 2033. This region is focusing on enhancing safety protocols in industries such as oil and gas and mining, driven by increasing investments in infrastructure development.Middle East & Africa Safety Sensors Market Report:

In the Middle East and Africa region, the market is relatively smaller, valued at USD 0.18 billion in 2023 and projected to grow to USD 0.38 billion by 2033. However, increasing awareness of workplace safety and growth in sectors such as construction and oil and gas are driving demand.Tell us your focus area and get a customized research report.

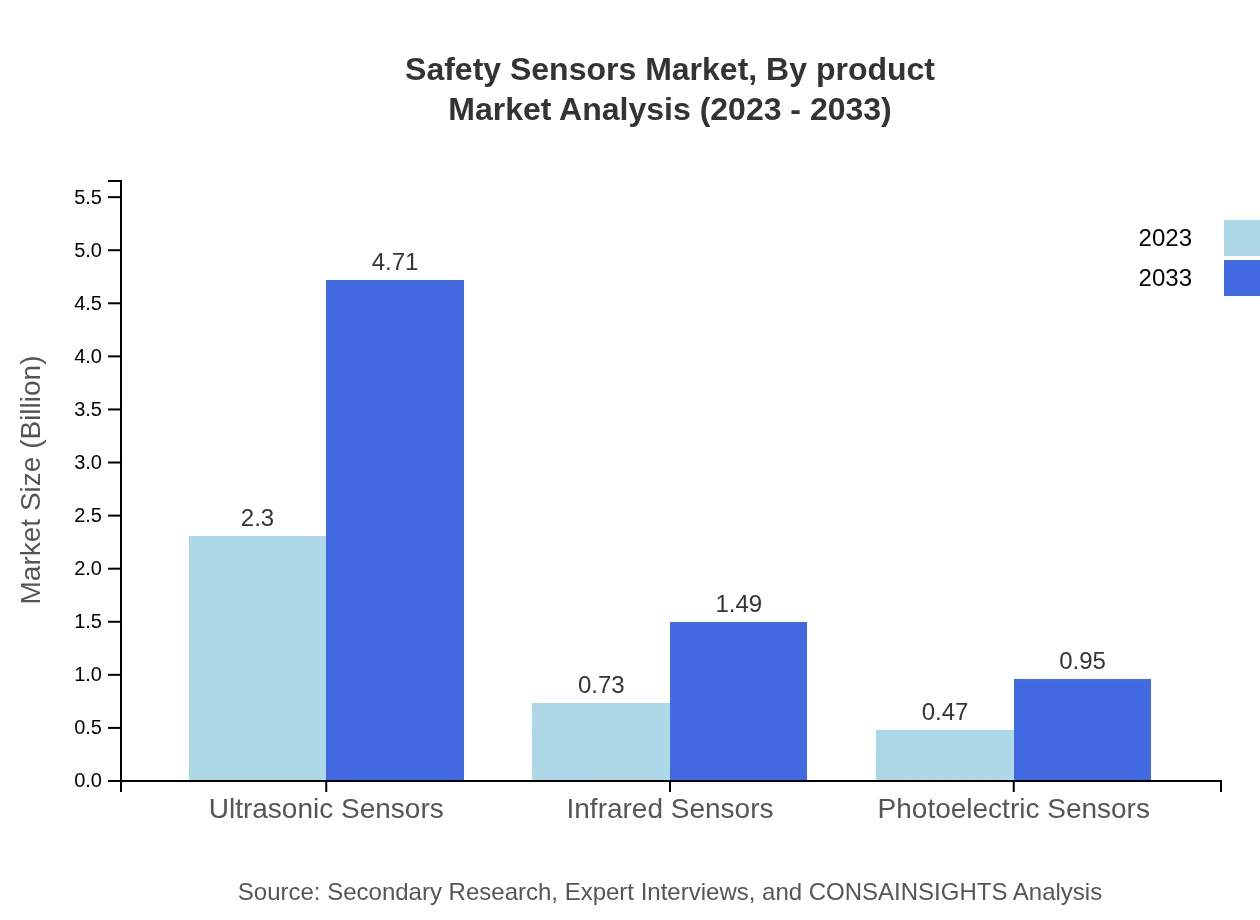

Safety Sensors Market Analysis By Product

Ultrasonic sensors dominate the Safety Sensors market, contributing USD 2.30 billion in 2023 with a projected increase to USD 4.71 billion by 2033, accounting for 65.84% of the market share. Infrared sensors are also noteworthy, with a growth from USD 0.73 billion to USD 1.49 billion, holding a 20.86% market share. Photoelectric sensors contribute significantly as well, with sizes of USD 0.47 billion in 2023 to USD 0.95 billion by 2033, accounting for 13.3% of market share.

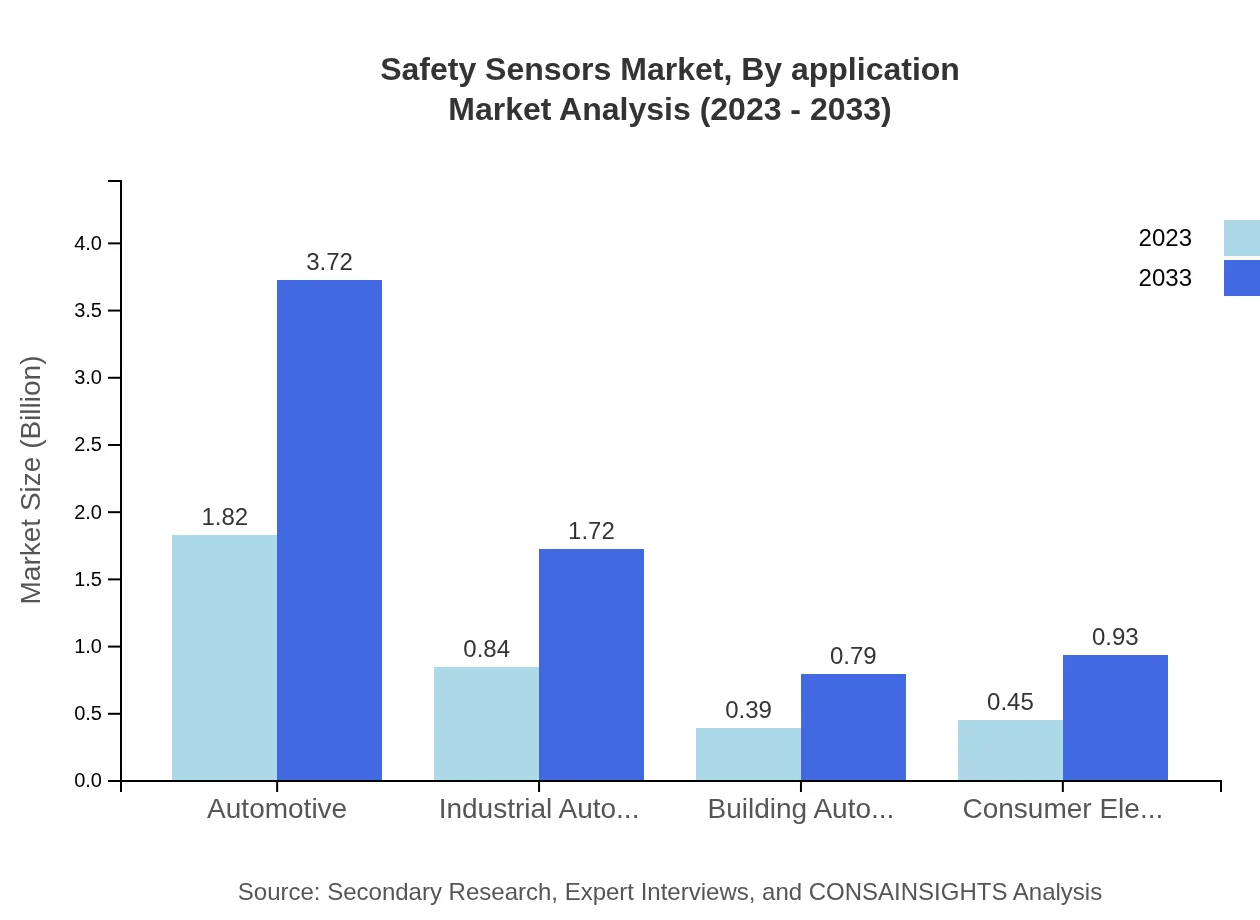

Safety Sensors Market Analysis By Application

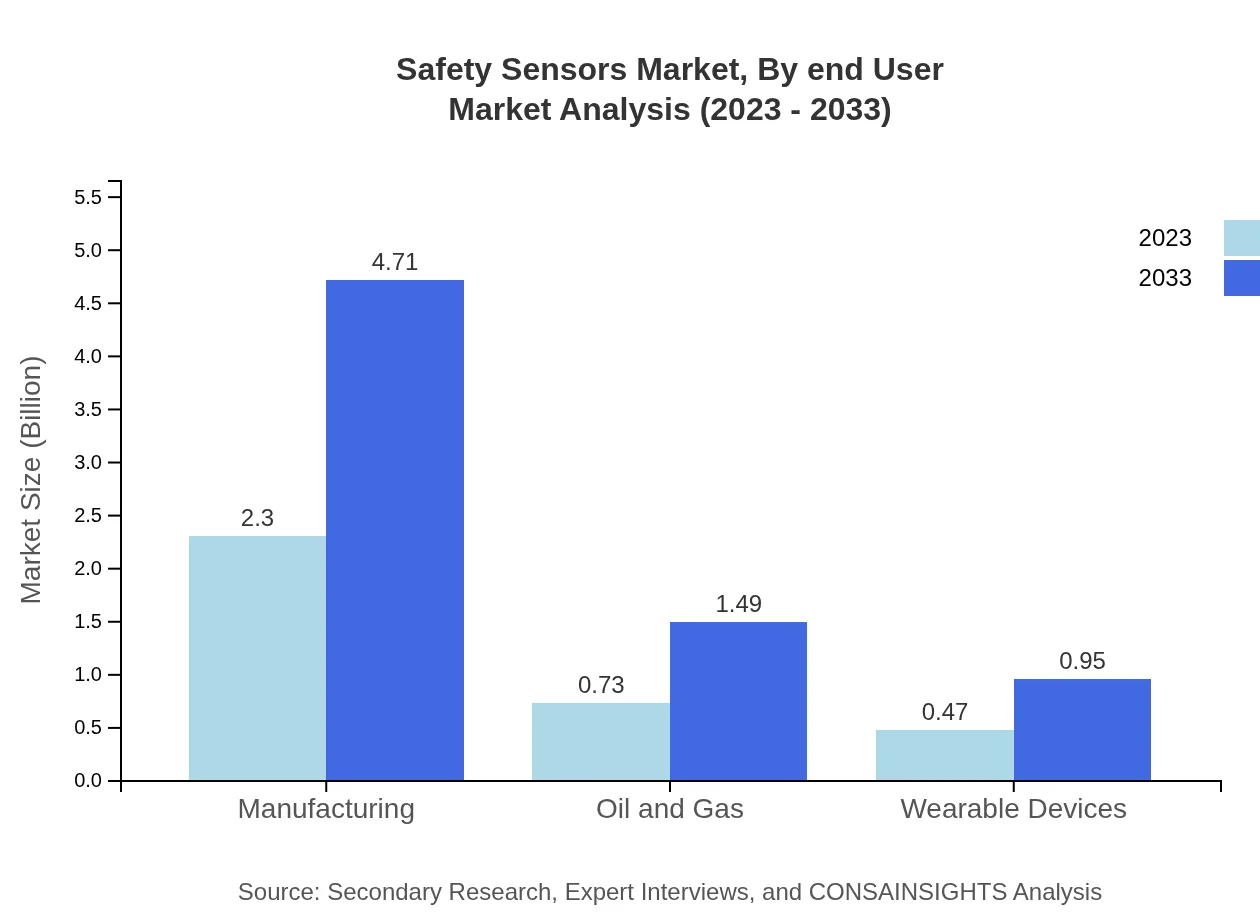

Notable applications of Safety Sensors include manufacturing, automotive, oil and gas, and consumer electronics. The manufacturing sector leads with a market size of USD 2.30 billion in 2023 and is projected to grow significantly. The automotive sector contributes with USD 1.82 billion, driven by the demand for enhanced vehicle safety features.

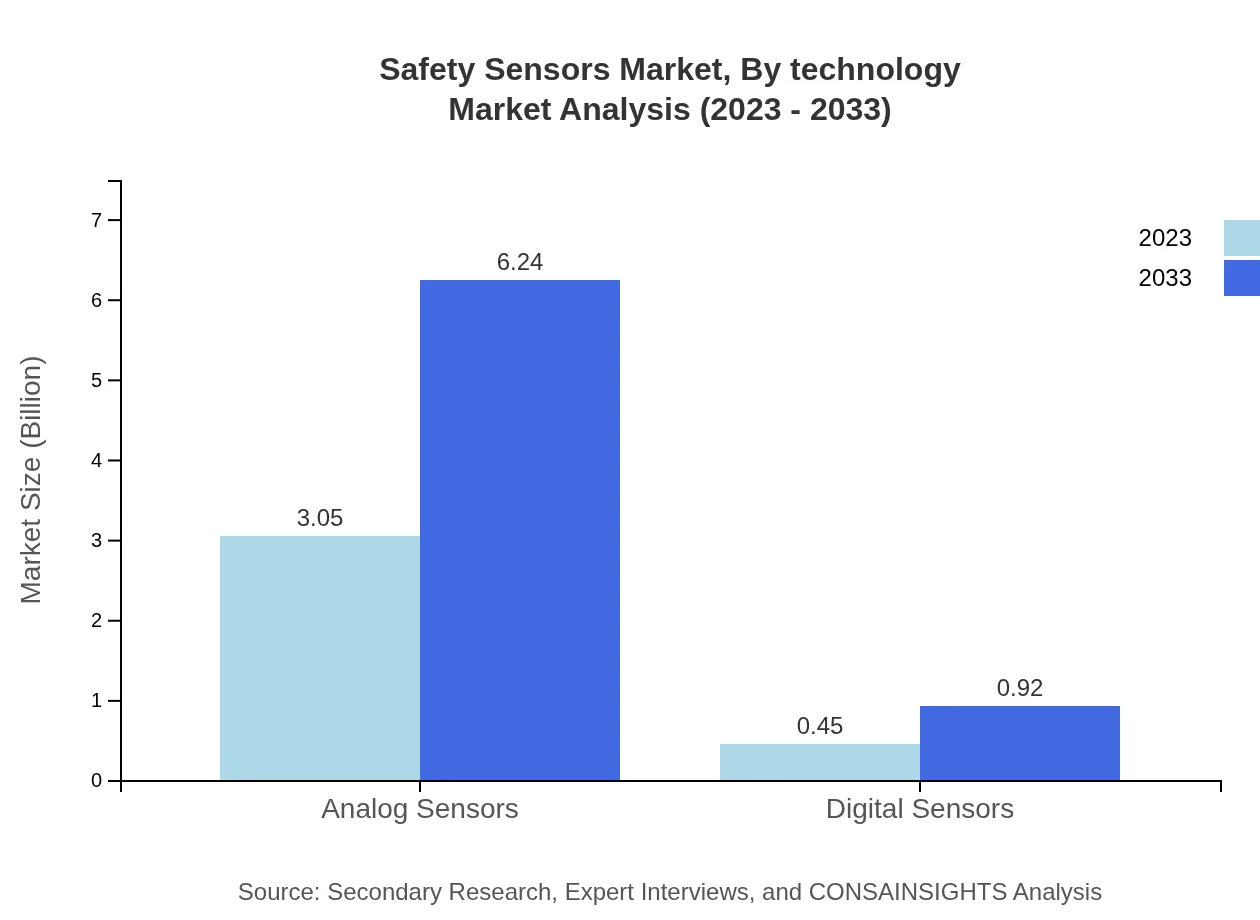

Safety Sensors Market Analysis By Technology

Innovation in technology is evident as digital sensors grow from USD 0.45 billion in 2023 to USD 0.92 billion by 2033, capturing a 12.83% market share. Analog sensors maintain dominance with a high share of 87.17%, reflecting the ongoing demand for tried and tested solutions.

Safety Sensors Market Analysis By End User

Key end-users include the automotive industry, which holds a significant share at 51.97%, reflecting the sector's focus on integrating safety technologies. Industrial automation follows as a crucial user at 24.03%, and building automation represents 11.07% of the market.

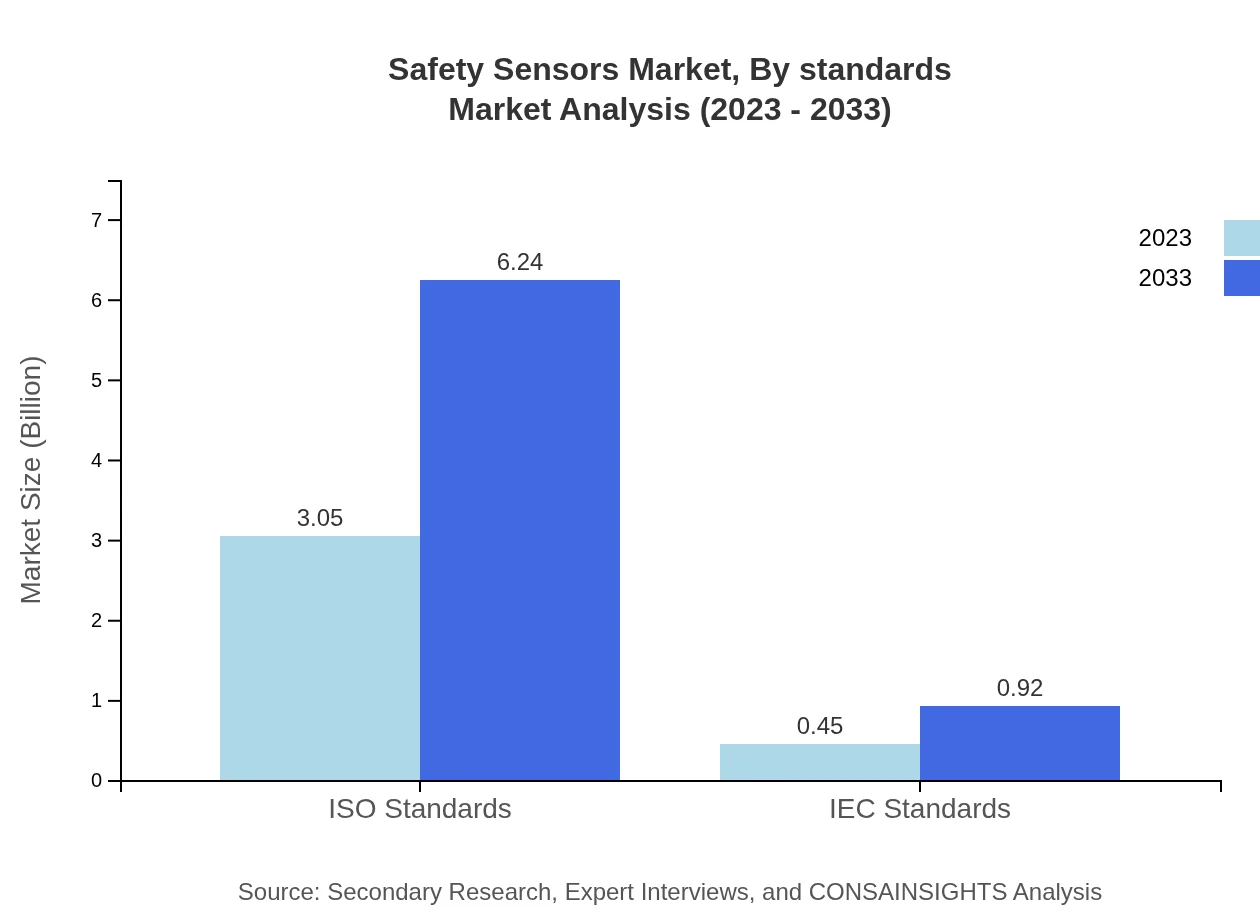

Safety Sensors Market Analysis By Standards

Compliance with ISO standards is a hallmark of this market, reflecting a considerable 87.17% share. As regulations evolve, firms that comply with international standards are likely to capture greater market opportunities.

Safety Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Safety Sensors Industry

Siemens AG:

A global leader in industrial automation, Siemens specializes in product offerings that enhance safety systems in manufacturing and construction.Honeywell International Inc.:

Honeywell focuses on advanced sensor technologies, offering innovative safety solutions across multiple industries, including aerospace and automotive.Pepperl+Fuchs GmbH:

Specializing in explosion protection, Pepperl+Fuchs is a recognized name in the safety sensor market, supporting various industrial applications.Emerson Electric Co.:

Emerson provides a wide range of sensors and automation solutions, enhancing safety and efficiency in complex industrial environments.We're grateful to work with incredible clients.

FAQs

What is the market size of safety sensors?

The global safety sensors market is valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2% through 2033, indicating steady growth in demand for safety monitoring solutions.

What are the key market players or companies in the safety sensors industry?

Key players in the safety sensor market include major global companies such as Honeywell, Siemens, and Rockwell Automation, which are instrumental in driving innovation and market expansion through advanced technology offerings.

What are the primary factors driving the growth in the safety sensors industry?

Growth in the safety sensors sector is primarily driven by increasing safety regulations, technological advancements, and rising awareness of workplace safety across various industries, promoting the adoption of safety monitoring technologies.

Which region is the fastest Growing in the safety sensors market?

The fastest-growing region for safety sensors from 2023 to 2033 is Europe, expected to escalate from $1.20 billion to $2.46 billion, due to stringent safety regulations and increasing industrial automation.

Does ConsaInsights provide customized market report data for the safety sensors industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the safety sensors industry, allowing them to gain insights specific to their business objectives and target market.

What deliverables can I expect from this safety sensors market research project?

From a safety sensors market research project, expect comprehensive reports, market forecasts, competitive analyses, and detailed segment insights, enabling informed decision-making and strategic planning for clients.

What are the market trends of safety sensors?

Current market trends in safety sensors include increased demand for ultrasonic sensors, which dominate the market at a share of 65.84%, and a shift towards compliance with ISO and IEC standards driving product development.