Sales Force Automation Software Market Report

Published Date: 31 January 2026 | Report Code: sales-force-automation-software

Sales Force Automation Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sales Force Automation Software market, covering essential insights, trends, and forecasts from 2023 to 2033. Key data points include market size, regional breakdowns, and industry segmentation to inform stakeholders of current dynamics and future opportunities.

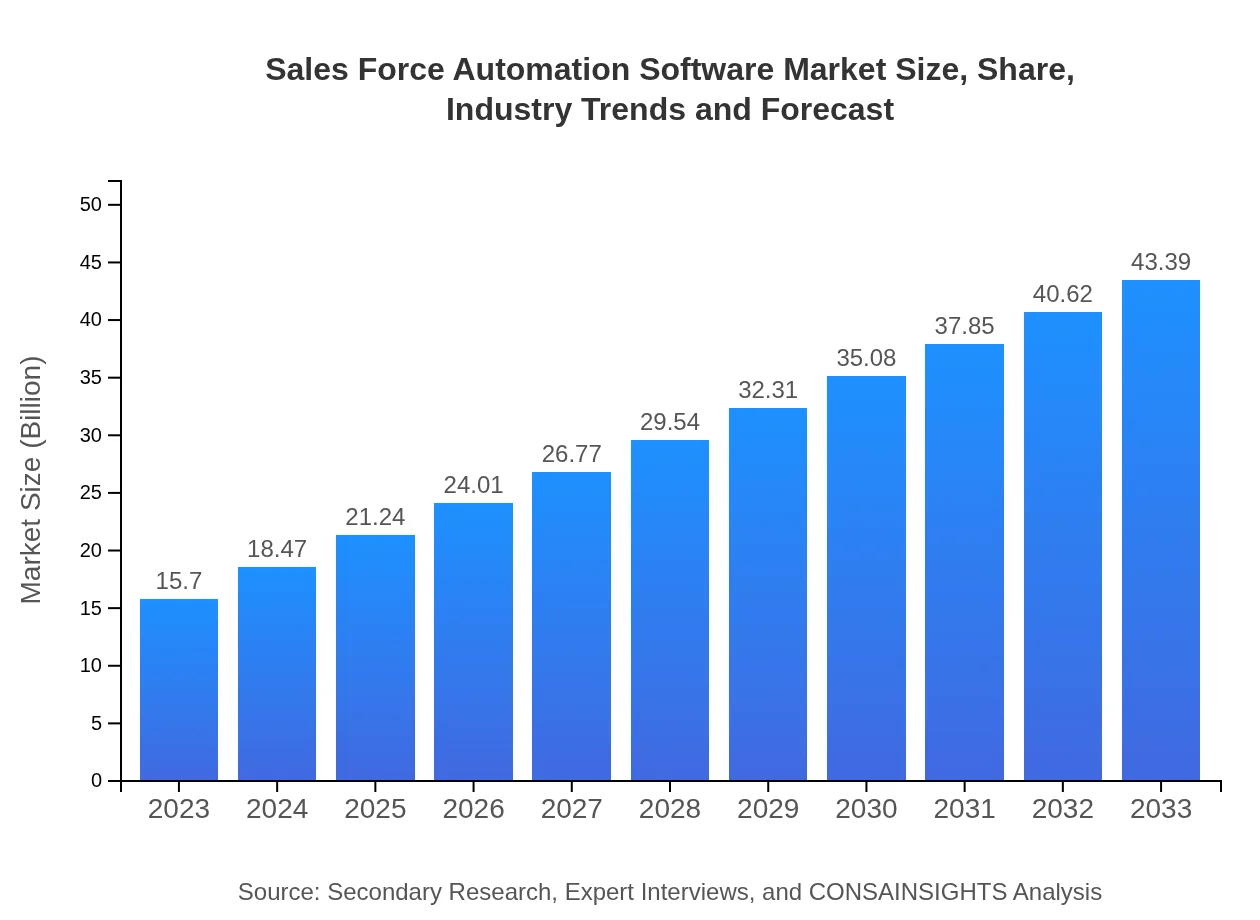

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 10.3% |

| 2033 Market Size | $43.39 Billion |

| Top Companies | Salesforce, Microsoft Dynamics 365, HubSpot, Zoho CRM, Oracle |

| Last Modified Date | 31 January 2026 |

Sales Force Automation Software Market Overview

Customize Sales Force Automation Software Market Report market research report

- ✔ Get in-depth analysis of Sales Force Automation Software market size, growth, and forecasts.

- ✔ Understand Sales Force Automation Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sales Force Automation Software

What is the Market Size & CAGR of Sales Force Automation Software market in 2023?

Sales Force Automation Software Industry Analysis

Sales Force Automation Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sales Force Automation Software Market Analysis Report by Region

Europe Sales Force Automation Software Market Report:

Europe is expected to witness significant growth, with the market increasing from USD 5.10 billion in 2023 to USD 14.09 billion by 2033. Factors such as regulatory compliance and demand for improved customer relationship management are propelling this growth.Asia Pacific Sales Force Automation Software Market Report:

In the Asia Pacific region, the Sales Force Automation Software market is anticipated to grow from USD 2.64 billion in 2023 to USD 7.28 billion by 2033. The growth is driven by increasing digital transformation initiatives and a rising number of small and medium-sized enterprises leveraging SFA tools to enhance their sales efficiency.North America Sales Force Automation Software Market Report:

In North America, the market size is projected to grow from USD 5.65 billion in 2023 to USD 15.62 billion by 2033, owing to high investments in technological advancements and the presence of leading SFA solution providers.South America Sales Force Automation Software Market Report:

The South American market for Sales Force Automation Software will increase from USD 0.87 billion in 2023 to USD 2.42 billion by 2033. Key drivers include digital adoption among local businesses and increased awareness of sales management solutions.Middle East & Africa Sales Force Automation Software Market Report:

The Middle East and Africa region will see growth from USD 1.44 billion in 2023 to USD 3.98 billion by 2033, driven by businesses recognizing the need for effective sales processes amidst growing competition.Tell us your focus area and get a customized research report.

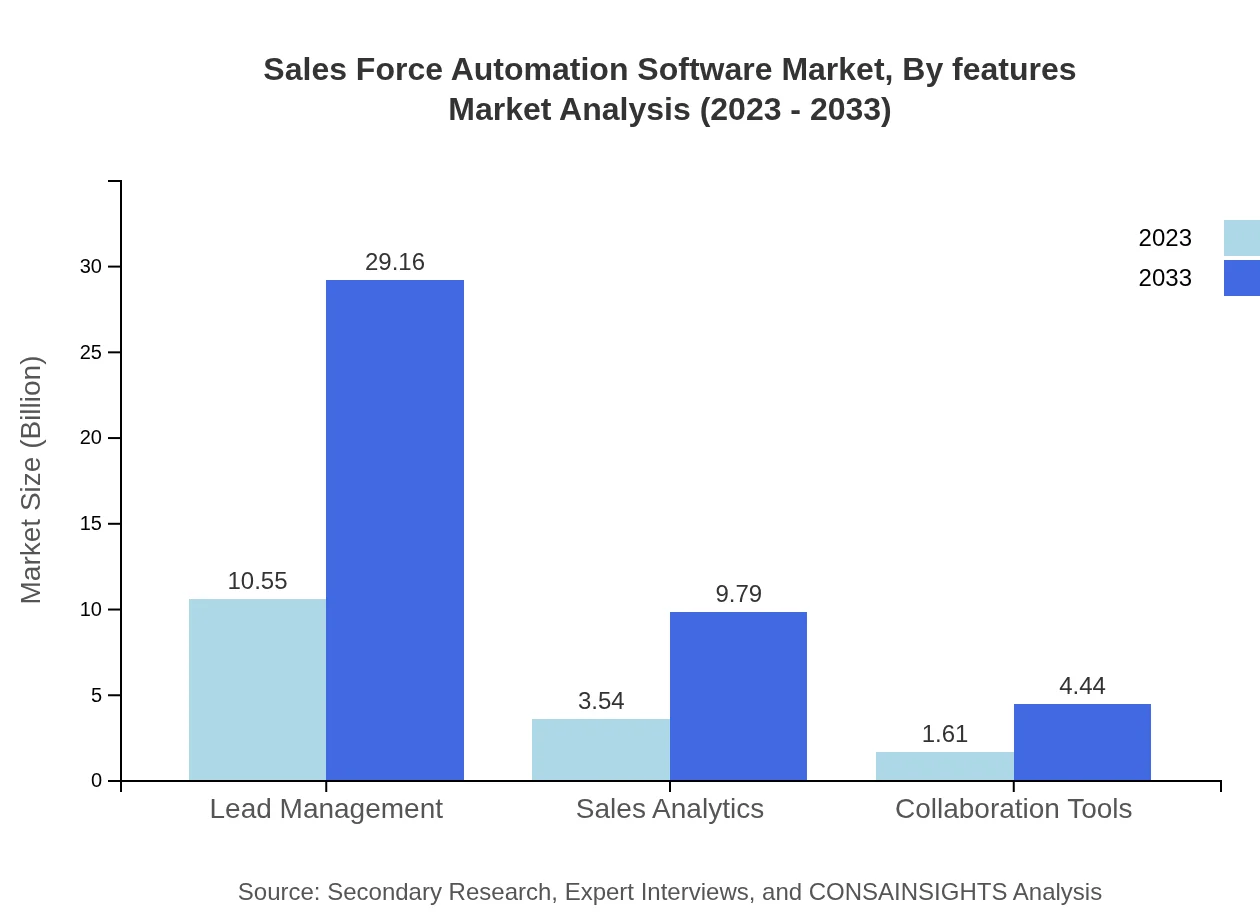

Sales Force Automation Software Market Analysis By Features

The lead management segment dominates the market, projected to grow from USD 10.55 billion in 2023 to USD 29.16 billion in 2033, holding 67.21% market share. Following lead management, sales analytics will expand from USD 3.54 billion to USD 9.79 billion, maintaining a 22.56% share, while collaboration tools will grow from USD 1.61 billion to USD 4.44 billion, holding a 10.23% share.

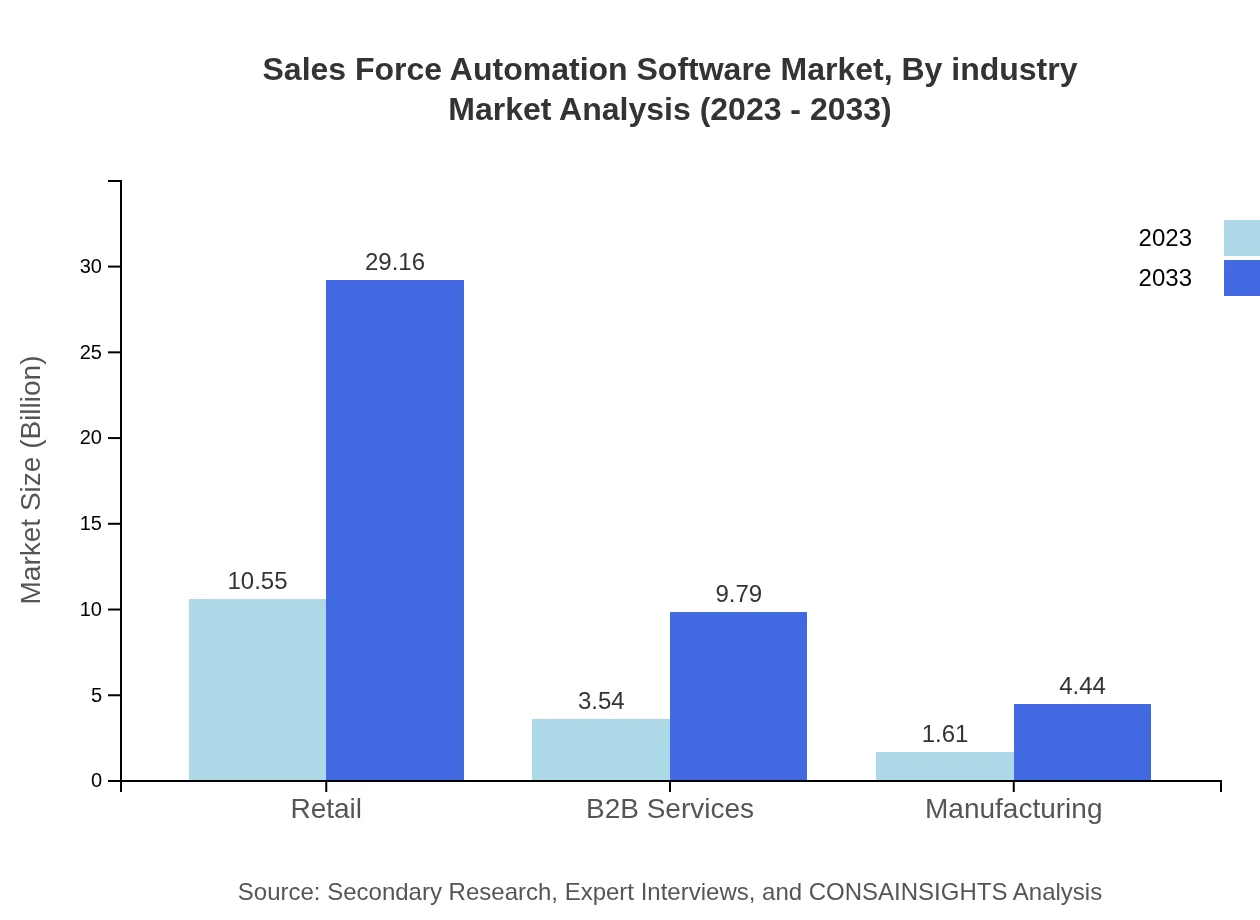

Sales Force Automation Software Market Analysis By Industry

Industries like retail and B2B services lead the market, with retail expected to grow from USD 10.55 billion to USD 29.16 billion by 2033. B2B services will experience growth from USD 3.54 billion to USD 9.79 billion, highlighting the importance of SFA tools in improving sales efficacy across sectors.

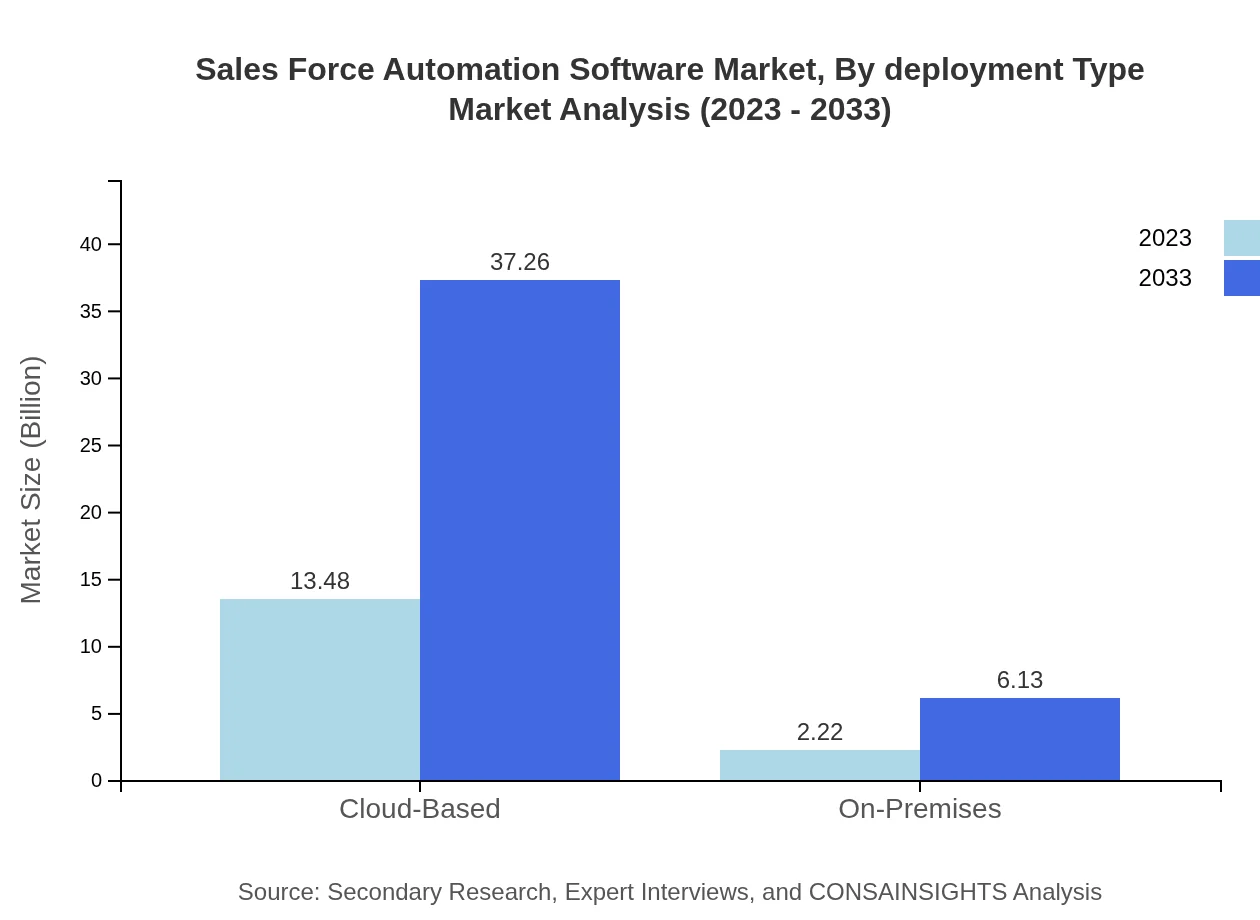

Sales Force Automation Software Market Analysis By Deployment Type

The cloud-based deployment segment will dominate, expected to rise from USD 13.48 billion in 2023 to USD 37.26 billion by 2033, accounting for 85.87% of the market share. In contrast, the on-premises segment will see slower growth from USD 2.22 billion to USD 6.13 billion, capturing a 14.13% share.

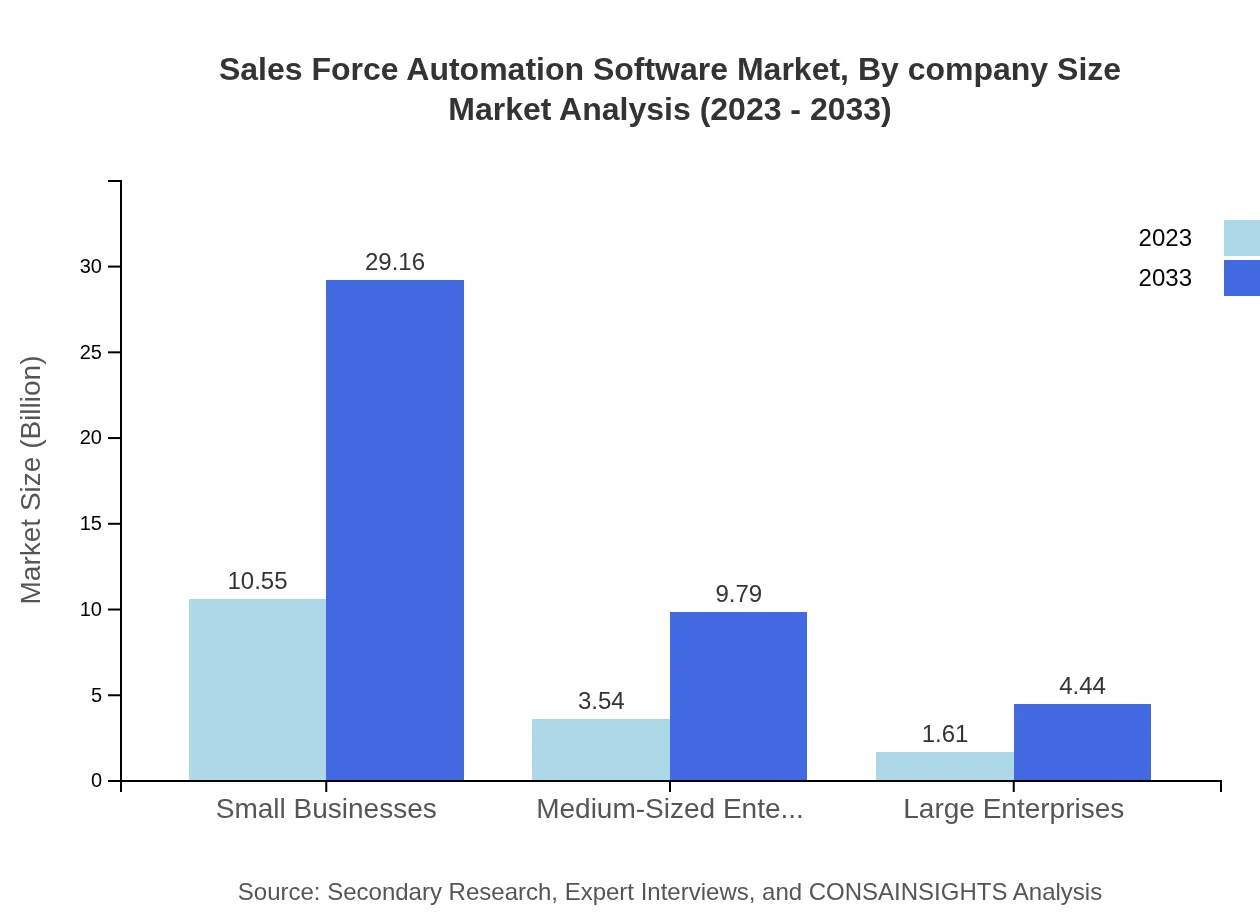

Sales Force Automation Software Market Analysis By Company Size

Small businesses are expected to lead the market with growth from USD 10.55 billion to USD 29.16 billion by 2033, capturing 67.21% share, while medium-sized enterprises will rise from USD 3.54 billion to USD 9.79 billion, maintaining a 22.56% share. Large enterprises will grow from USD 1.61 billion to USD 4.44 billion, holding 10.23% share.

Sales Force Automation Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sales Force Automation Software Industry

Salesforce:

A leading provider of cloud-based CRM solutions, Salesforce offers comprehensive SFA tools that help businesses manage their sales processes effectively.Microsoft Dynamics 365:

Part of Microsoft's suite of business applications, Dynamics 365 includes robust sales automation features integrated with other key business processes.HubSpot:

Known for its inbound marketing solutions, HubSpot also provides powerful SFA tools designed for small and medium-sized enterprises.Zoho CRM:

Zoho offers an affordable suite of SFA tools that cater to startups and SMEs, focusing on automating and simplifying sales processes.Oracle:

Oracle's advanced SFA solutions are integrated into its ERP systems, providing comprehensive sales management capabilities to large enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of sales Force Automation Software?

The sales force automation software market is valued at approximately $15.7 billion in 2023, with a projected compound annual growth rate (CAGR) of 10.3% expected, reflecting its increasing adoption across various industries and sectors.

What are the key market players or companies in the sales Force Automation Software industry?

Key players in the sales force automation software industry include Salesforce, Microsoft Dynamics 365, SAP Sales Cloud, Oracle Sales Cloud, and HubSpot, each contributing significantly to market innovations and solutions in automating sales processes.

What are the primary factors driving the growth in the sales Force Automation Software industry?

Growth in the sales force automation software industry is driven by increasing demand for efficient sales processes, advancements in AI technologies, the need for enhanced customer relationship management, and rising competition across various market sectors.

Which region is the fastest Growing in the sales Force Automation Software market?

The Asia Pacific region is the fastest-growing in the sales-force-automation-software market, expected to grow from $2.64 billion in 2023 to $7.28 billion by 2033, indicating strong market potential driven by increasing digital transformation initiatives.

Does ConsaInsights provide customized market report data for the sales Force Automation Software industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the sales-force-automation-software industry, providing insights that cater specifically to unique business requirements and market dynamics.

What deliverables can I expect from this sales Force Automation Software market research project?

Clients can expect comprehensive deliverables including detailed market analysis reports, segment insights, regional breakdowns, trend identification, competitive analysis, and actionable recommendations aimed at enhancing strategic decision-making.

What are the market trends of sales Force Automation Software?

Current trends in the sales-force-automation-software market include increased integration with artificial intelligence, greater focus on mobile accessibility, a shift towards cloud-based solutions, and growing emphasis on data analytics to drive sales strategies.