Salicylic Acid Market Report

Published Date: 31 January 2026 | Report Code: salicylic-acid

Salicylic Acid Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the Salicylic Acid market from 2023 to 2033, providing insights on market trends, sizes, growth rates, and key segments across various applications and regions.

| Metric | Value |

|---|---|

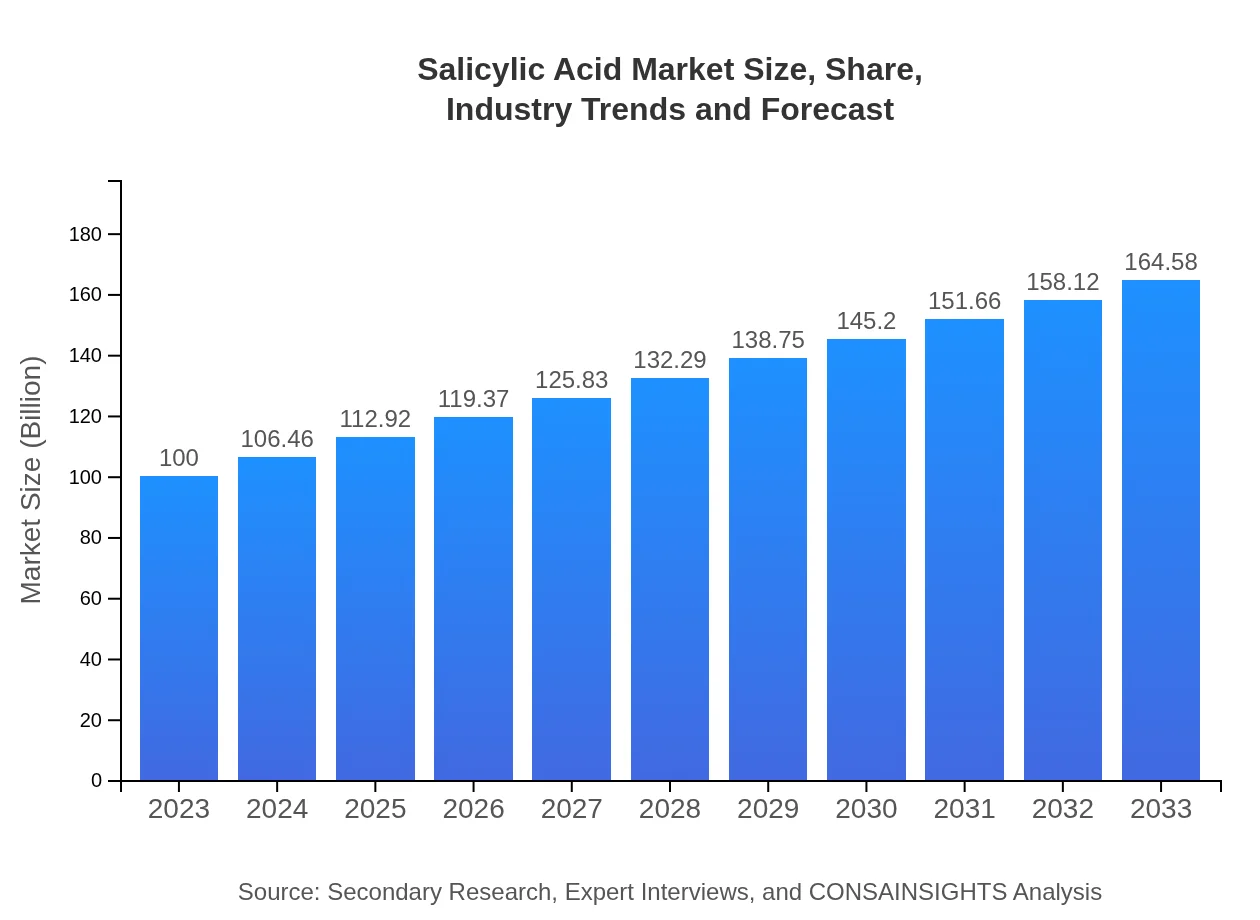

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | BASF SE, Taiga Chemicals, Sodium ProductsCompany |

| Last Modified Date | 31 January 2026 |

Salicylic Acid Market Overview

Customize Salicylic Acid Market Report market research report

- ✔ Get in-depth analysis of Salicylic Acid market size, growth, and forecasts.

- ✔ Understand Salicylic Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Salicylic Acid

What is the Market Size & CAGR of Salicylic Acid market in 2023 and 2033?

Salicylic Acid Industry Analysis

Salicylic Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

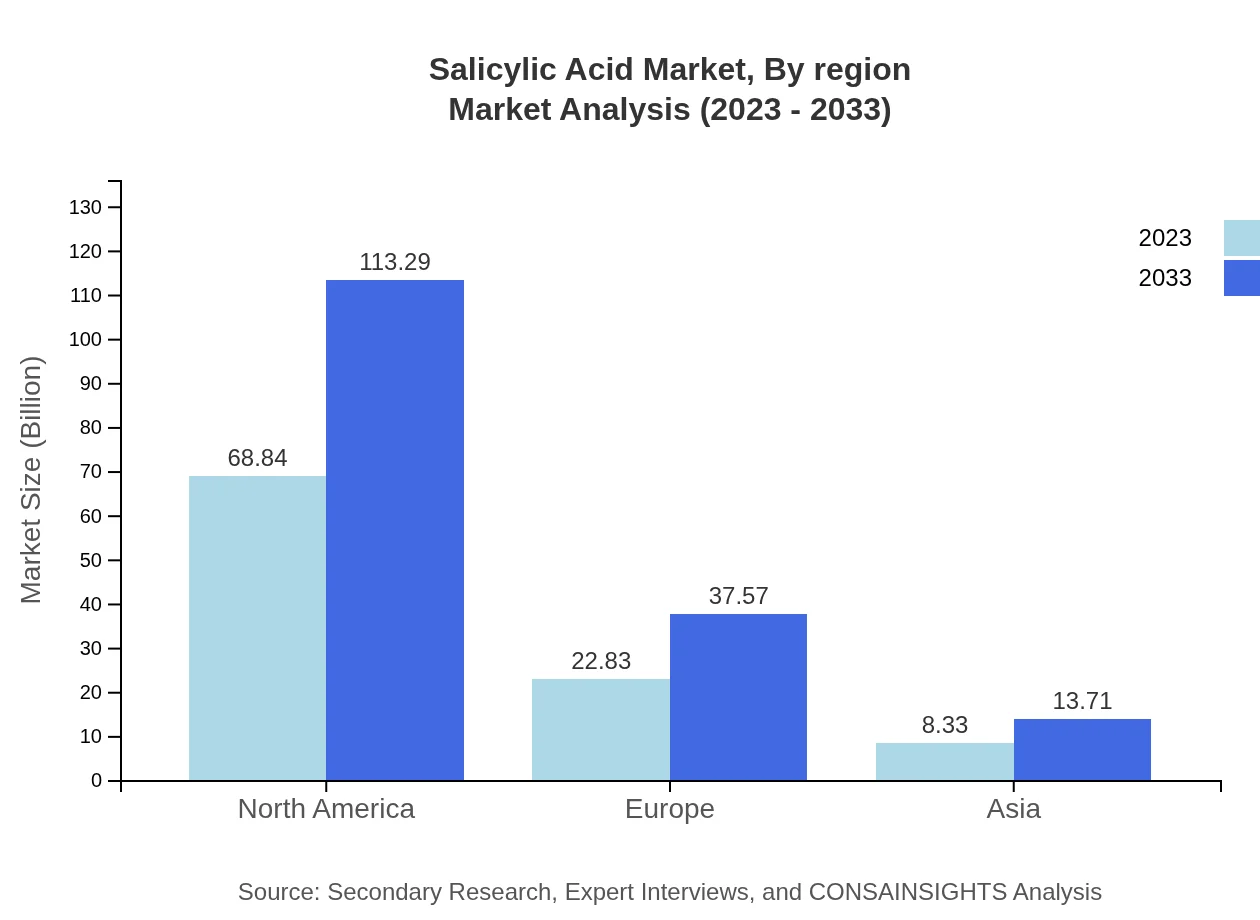

Salicylic Acid Market Analysis Report by Region

Europe Salicylic Acid Market Report:

The European market for Salicylic Acid stands at about $32.84 million in 2023, expected to grow to $54.05 million by 2033. This growth is propelled by stringent regulations favoring high-quality personal care products and rising health consciousness among consumers.Asia Pacific Salicylic Acid Market Report:

The Asia Pacific region, with an estimated market value of $19.37 million in 2023, is projected to grow to $31.88 million by 2033. The growth can be attributed to rising per capita income, increasing awareness of personal care, and the booming cosmetic industry, primarily driven by countries like India and China.North America Salicylic Acid Market Report:

The North American market is significant, valued at $32.21 million in 2023 and set to reach $53.01 million by 2033. The region's growth is primarily driven by widespread product adoption in pharmaceuticals and advanced cosmetic formulations, with the U.S. leading the market.South America Salicylic Acid Market Report:

In South America, the market value in 2023 is approximately $7.48 million, expected to rise to $12.31 million by 2033. The growth is supported by increasing investments in skincare and growing consumer interest in organic and natural products.Middle East & Africa Salicylic Acid Market Report:

The Middle East and Africa region currently holds a market value of $8.10 million, forecast to elevate to $13.33 million by 2033. Market expansion is fuelled by increasing awareness about skin health and rising demand for effective skincare solutions.Tell us your focus area and get a customized research report.

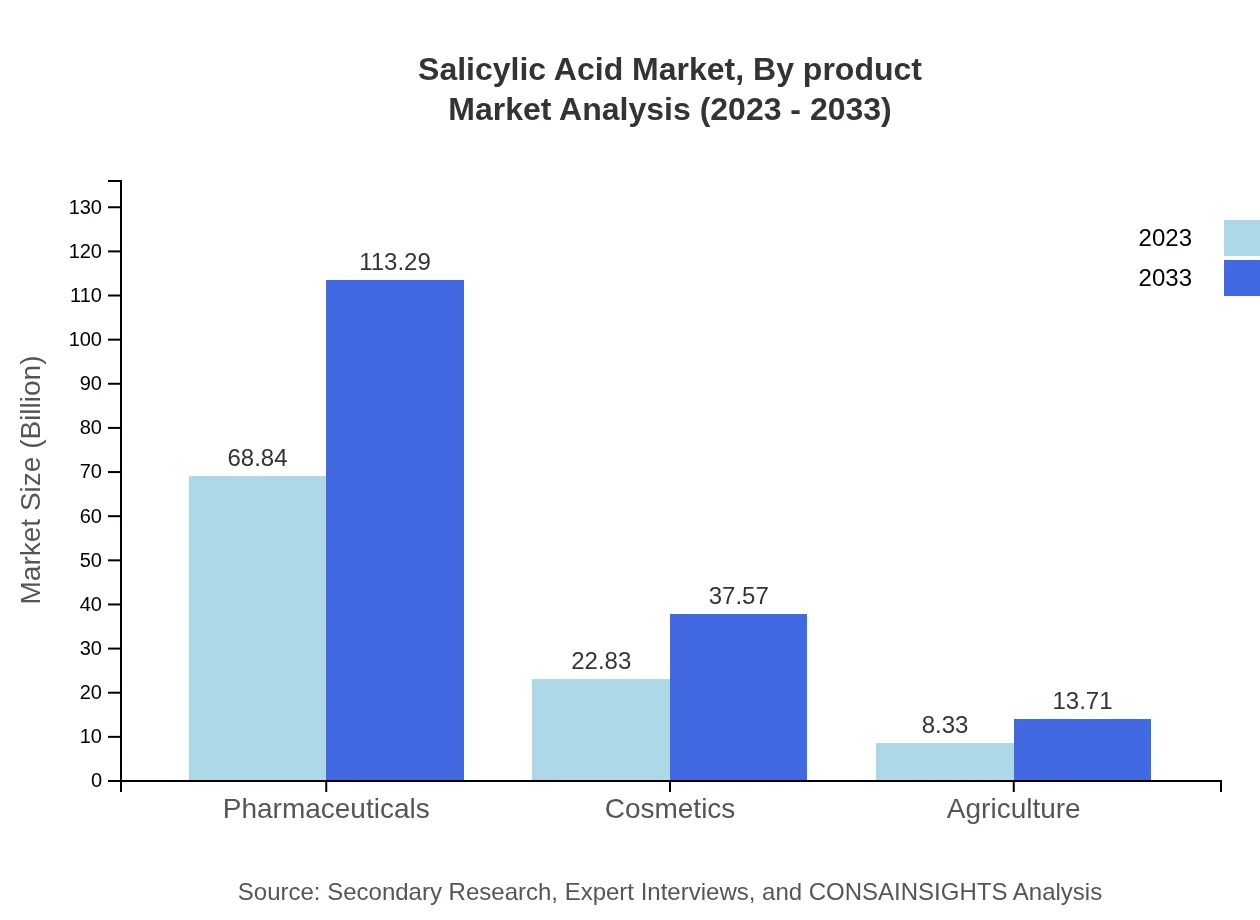

Salicylic Acid Market Analysis By Product

The major products in the Salicylic Acid market include powder and liquid forms. The powdered form dominates, favored for ease of use in formulation and packaging. Future trends indicate a rise in demand for liquid forms due to their convenience in industrial applications.

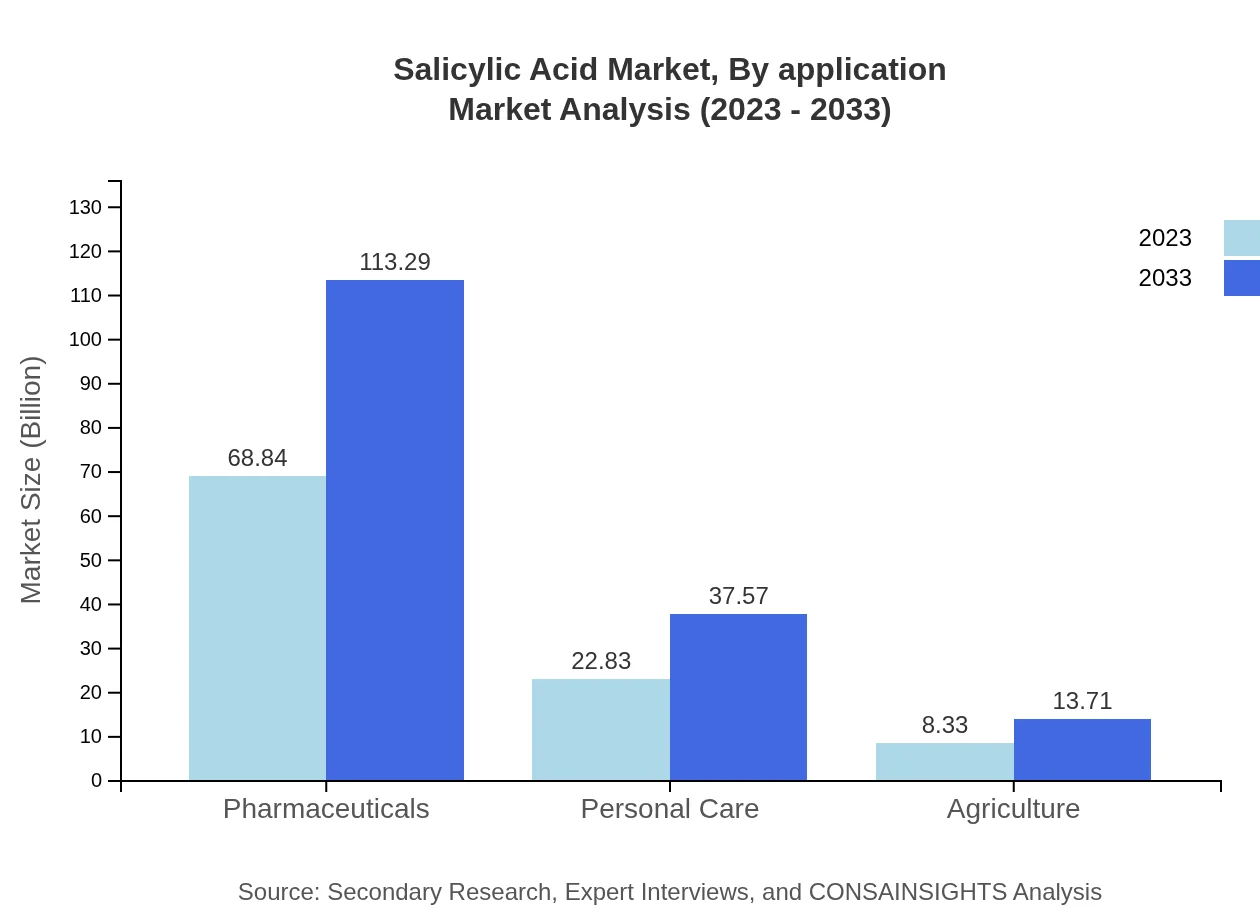

Salicylic Acid Market Analysis By Application

The largest application segment for Salicylic Acid is pharmaceuticals, accounting for around 68.84% market share in 2023, especially for treating acne. The cosmetics segment follows, with a 22.83% share, influenced by the growing demand for innovative skincare solutions.

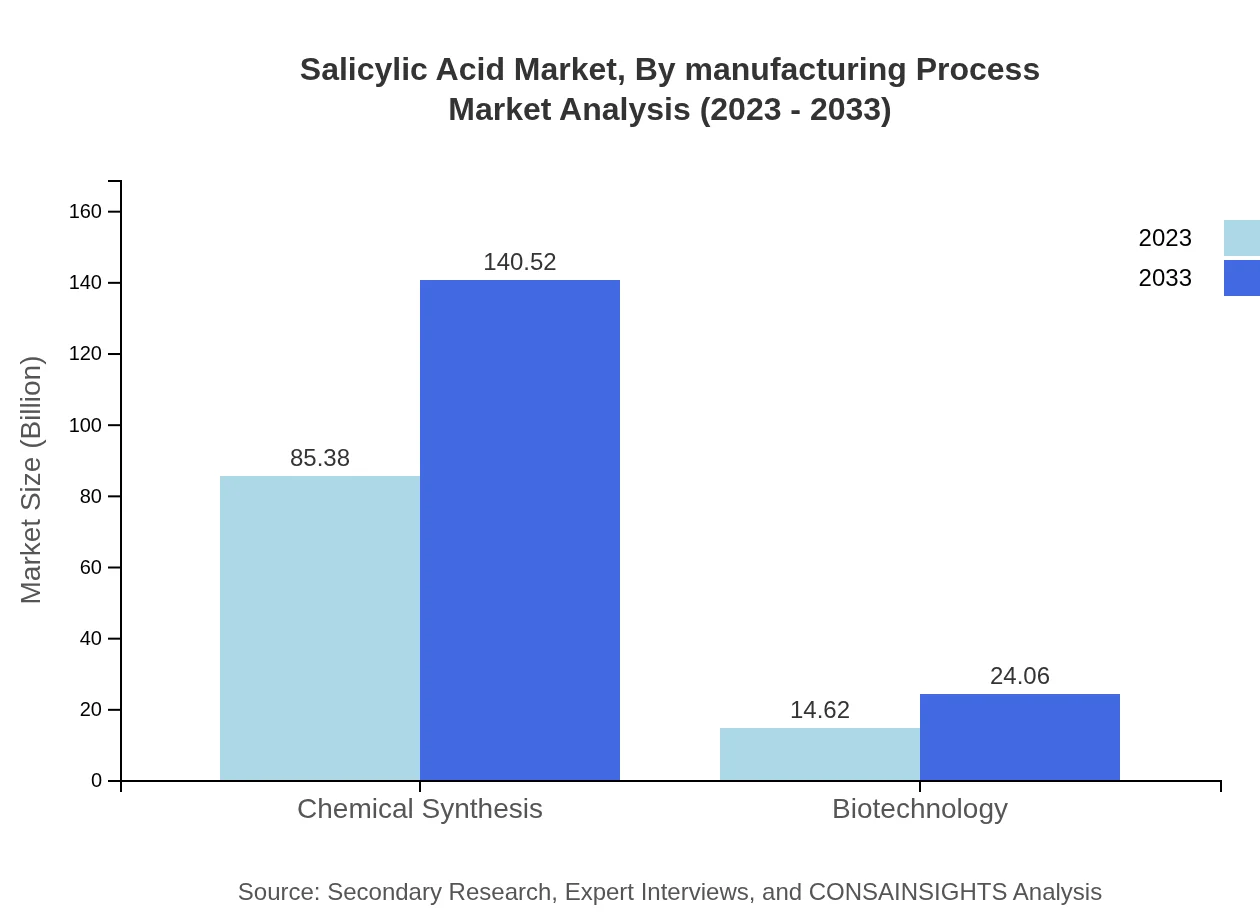

Salicylic Acid Market Analysis By Manufacturing Process

Major manufacturing processes include Chemical Synthesis and Biotechnology. The Chemical Synthesis process dominates the market with a share of 85.38% due to cost-effectiveness. Biotechnology is emerging as a greener alternative, capturing attention for its sustainable practices.

Salicylic Acid Market Analysis By Region

Regional analysis reveals North America leading the market followed by Europe and Asia Pacific. Each region showcases unique consumer behaviors and growth strategies that inform localized marketing approaches for Salicylic Acid products.

Salicylic Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Salicylic Acid Industry

BASF SE:

A leading chemical company, BASF SE provides innovative solutions and is recognized for its commitment to sustainability, playing a pivotal role in Salicylic Acid production.Taiga Chemicals:

Specializing in organic chemicals, Taiga Chemicals offers a range of Salicylic Acid products with a focus on high quality and customer satisfaction in diverse markets.Sodium ProductsCompany:

Known for its reliability, Sodium Products Company is a major player in the Salicylic Acid sector, emphasizing safe manufacturing and customer-oriented solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of salicylic acid?

The salicylic acid market is projected to reach approximately $100 million in 2023, with a CAGR of 5% anticipated over the next decade. By 2033, the market size will significantly increase, reflecting robust demand across various sectors.

What are the key market players or companies in the salicylic acid industry?

Key players in the salicylic acid market include major pharmaceutical corporations and cosmetic companies which specialize in chemical synthesis and biotechnology. These players drive innovations and contribute to market growth through strategic partnerships and product diversification.

What are the primary factors driving the growth in the salicylic acid industry?

Growth in the salicylic acid market is driven by increasing demand in pharmaceuticals and cosmetics, awareness of skincare, and advancements in agricultural applications. Additionally, the rising incidence of acne and skin disorders fuels the market's expansion.

Which region is the fastest Growing in the salicylic acid market?

The fastest-growing region in the salicylic acid market is projected to be Europe, with market sizes expanding from $32.84 million in 2023 to $54.05 million by 2033. North America and Asia Pacific also exhibit significant growth trends.

Does ConsaInsights provide customized market report data for the salicylic acid industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the salicylic acid industry. This includes detailed regional analyses, segment breakdowns, and insights aligned with your unique business objectives.

What deliverables can I expect from this salicylic acid market research project?

Expect comprehensive deliverables including market size estimations, growth forecasts, competitive analysis, regional insights, key trends, and strategic recommendations based on the latest industry data and expert analysis.

What are the market trends of salicylic acid?

Current trends in the salicylic acid market include the rising preference for natural and organic formulations, increased investments in biotech innovations, and the expansion of e-commerce platforms that enhance product accessibility to consumers.