Salmon Market Report

Published Date: 02 February 2026 | Report Code: salmon

Salmon Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global Salmon market, highlighting key trends, market size and growth forecasts from 2023 to 2033. Insights on segmentation by region, product type, distribution channels, and leading companies in the industry are detailed, providing valuable information for investment and business strategy.

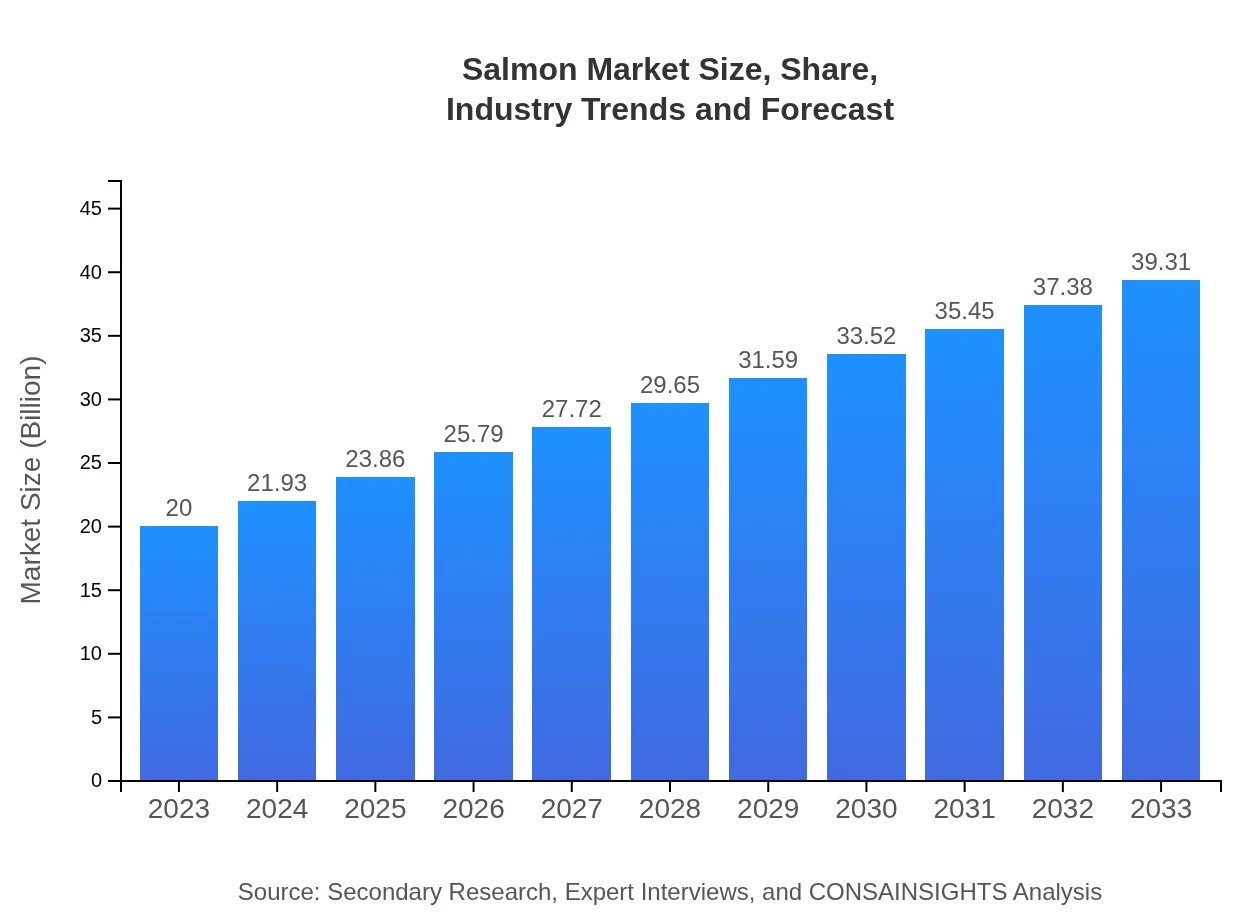

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $39.31 Billion |

| Top Companies | Marine Harvest, Salmones Camanchaca, Cermaq Group, Lerøy Seafood Group |

| Last Modified Date | 02 February 2026 |

Salmon Market Overview

Customize Salmon Market Report market research report

- ✔ Get in-depth analysis of Salmon market size, growth, and forecasts.

- ✔ Understand Salmon's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Salmon

What is the Market Size & CAGR of Salmon market in 2023?

Salmon Industry Analysis

Salmon Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Salmon Market Analysis Report by Region

Europe Salmon Market Report:

The European Salmon market represents a key segment, currently valued at $5.78 billion, expected to grow to $11.36 billion by 2033. Countries such as Norway and Scotland dominate production, with a strong emphasis on sustainability and quality standards, appealing to health-conscious consumers.Asia Pacific Salmon Market Report:

The Asia Pacific region is expected to see substantial growth in the Salmon market, with an estimated market size of $3.94 billion in 2023, projected to reach $7.75 billion by 2033. Increased popularity of seafood among health-conscious consumers and rising disposable incomes are primary growth drivers. Countries like China, Japan, and South Korea are leading in demand.North America Salmon Market Report:

North America is one of the largest markets for Salmon, valued at $6.92 billion in 2023, with projections of reaching $13.60 billion by 2033. The increasing focus on healthy eating and strong culinary preferences for salmon contribute to this growth, alongside the rise of e-commerce for seafood sales.South America Salmon Market Report:

In South America, the Salmon market is modest, currently valued at $0.85 billion in 2023 and expected to grow to $1.68 billion by 2033. Chile is a significant contributor, being one of the largest salmon producers globally, influenced by export demands from North America and Europe.Middle East & Africa Salmon Market Report:

The Middle East and Africa region has a growing Salmon market valued at $2.51 billion in 2023, anticipated to reach $4.93 billion by 2033. Increased seafood consumption in urban centers and the expansion of distribution networks are expected to drive this sector's growth.Tell us your focus area and get a customized research report.

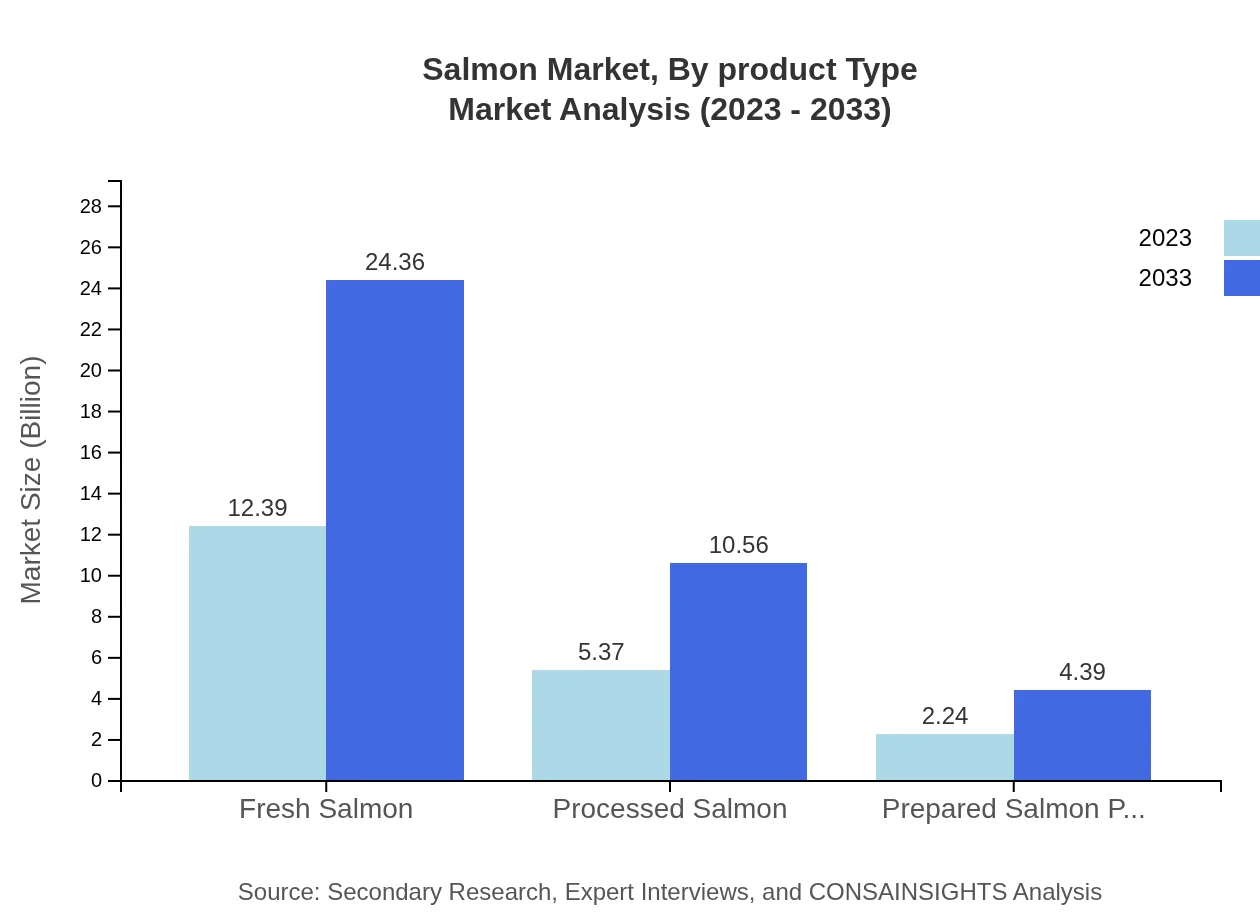

Salmon Market Analysis By Product Type

The Salmon market is prominently categorized into three main product types: Fresh Salmon, Processed Salmon, and Prepared Salmon Products. Fresh Salmon dominates the market, with a size of $12.39 billion in 2023 and projected to grow to $24.36 billion by 2033, accounting for 61.96% market share. Processed Salmon follows with a size of $5.37 billion in 2023, and is expected to reach $10.56 billion by 2033, maintaining a share of 26.86%. Prepared Salmon Products, while smaller with a size of $2.24 billion in 2023, is anticipated to grow to $4.39 billion by 2033, holding an 11.18% share.

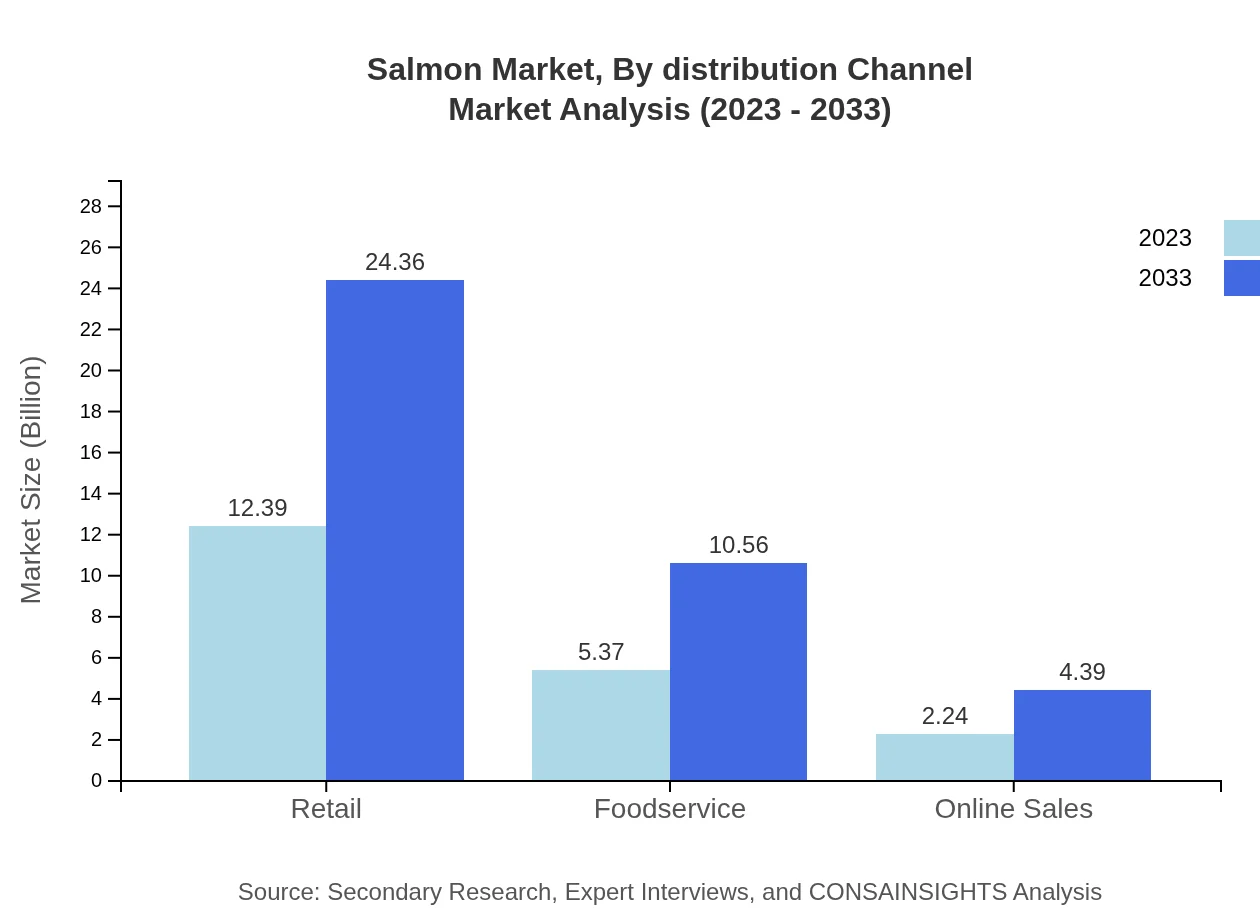

Salmon Market Analysis By Distribution Channel

In the Salmon market, distribution channels play a critical role in accessibility and consumer reach. The key channels include retail, foodservice, and online sales. Retail accounts for a significant share with a value of $12.39 billion in 2023, set to double by 2033. Foodservice is also growing, valued at $5.37 billion in 2023, projected to reach $10.56 billion by 2033. Online sales, though currently smaller at $2.24 billion in 2023, are expanding rapidly, emphasizing changing consumer purchasing behaviors.

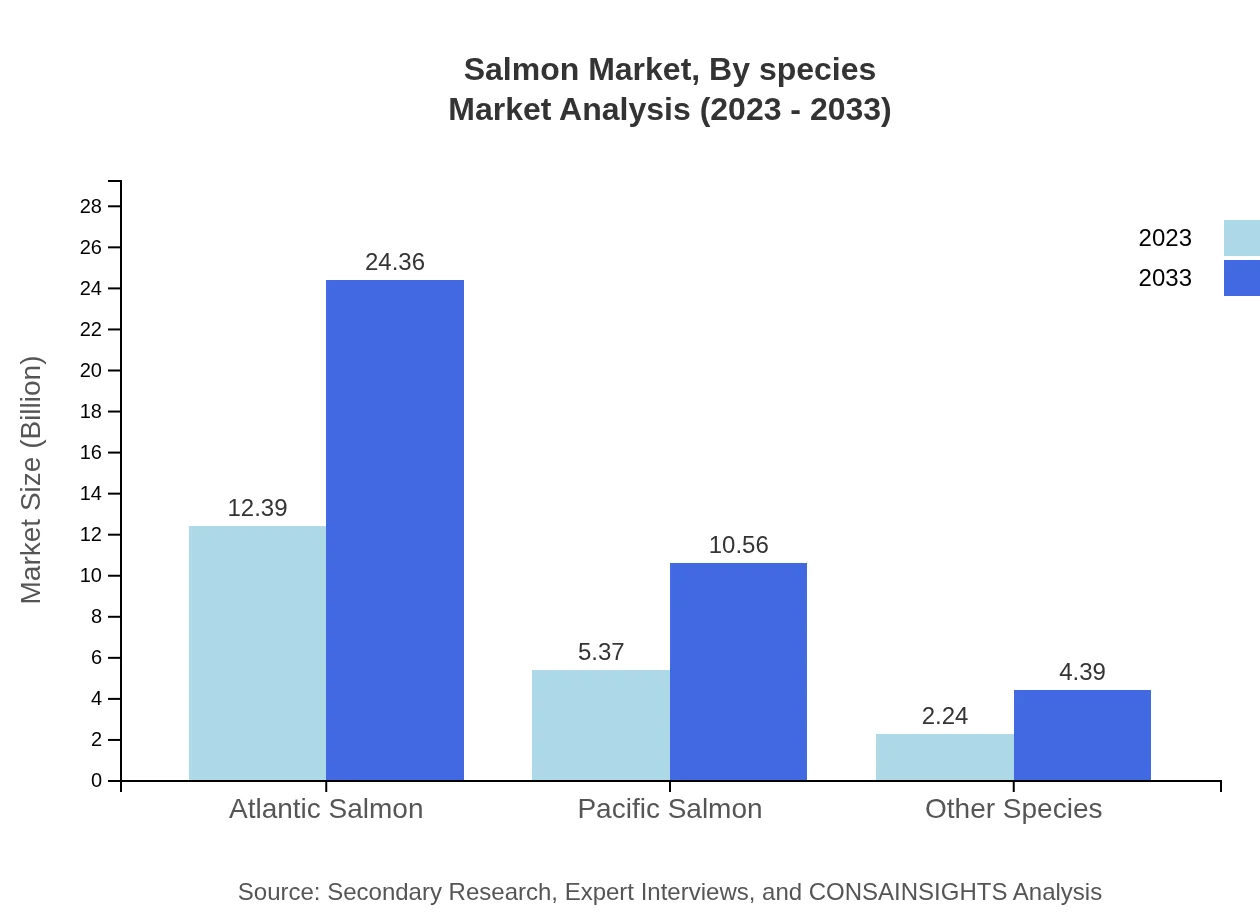

Salmon Market Analysis By Species

The Salmon market is mainly segmented by species, with Atlantic Salmon taking the largest share. In 2023, Atlantic Salmon holds a market size of $12.39 billion, expected to grow to $24.36 billion by 2033, maintaining a stable hold of 61.96% market share. Pacific Salmon, while smaller, has a current size of $5.37 billion in 2023 and is anticipated to reach $10.56 billion by 2033, accounting for 26.86% market share. Other Species represent a niche market with sizes of $2.24 billion in 2023, projected to grow to $4.39 billion by 2033.

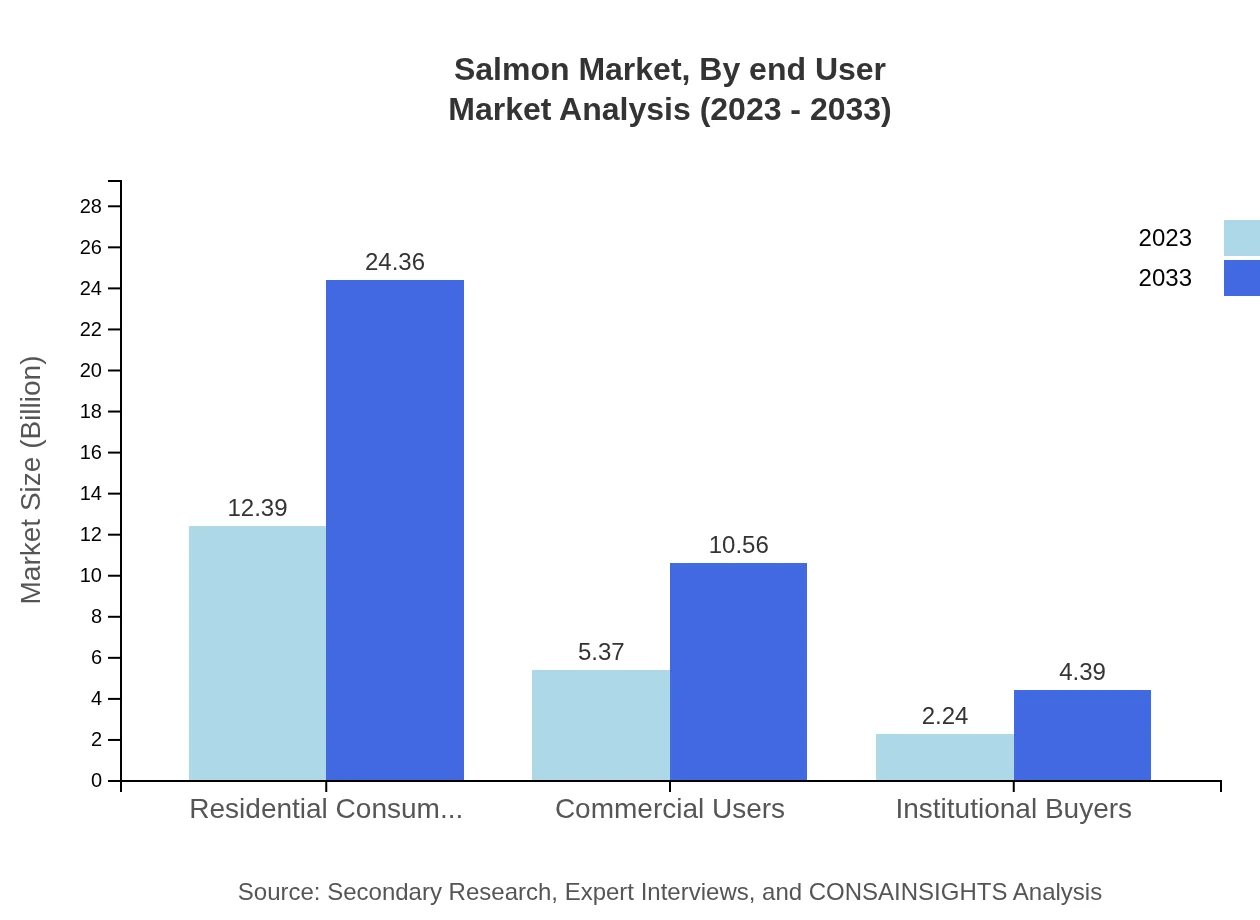

Salmon Market Analysis By End User

Demand for Salmon is categorized by end users, including residential consumers, commercial users, and institutional buyers. Residential Consumers lead the market with $12.39 billion in 2023, growing to $24.36 billion by 2033, reflecting an unwavering share of 61.96%. Commercial Users follow at $5.37 billion in 2023, expected to hit $10.56 billion by 2033, comprising 26.86% share. Institutional Buyers, while currently at $2.24 billion in 2023, will achieve $4.39 billion by 2033 with an 11.18% share.

Salmon Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Salmon Industry

Marine Harvest:

One of the largest global producers of farmed salmon, Marine Harvest, now known as Mowi, focuses on sustainable farming practices and innovative ways to enhance aquaculture.Salmones Camanchaca:

Based in Chile, Salmones Camanchaca is a leader in salmon production, emphasizing sustainability and quality, exporting products worldwide.Cermaq Group:

A global supplier of salmon products, Cermaq is dedicated to sustainability in aquaculture and has a strong focus on responsible farming techniques.Lerøy Seafood Group:

With operations in Norway and other regions, Lerøy Seafood Group is involved in the production, processing, and distribution of seafood products, including salmon.We're grateful to work with incredible clients.

FAQs

What is the market size of salmon?

The global salmon market is projected to reach approximately $20 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from 2023 to 2033, indicating robust growth opportunities in the seafood sector.

What are the key market players or companies in the salmon industry?

Key companies in the salmon industry include Marine Harvest, Grieg Seafood, and SalMar ASA, which significantly contribute to market dynamics through innovations in aquaculture and sustainable practices, impacting global supply chains.

What are the primary factors driving the growth in the salmon industry?

Growth in the salmon industry is driven by rising health consciousness among consumers, increasing demand for protein-rich diets, and advancements in aquaculture technology, enhancing production efficiency and sustainability.

Which region is the fastest Growing in the salmon market?

Europe is the fastest-growing region for the salmon market, with projections showing growth from $5.78 billion in 2023 to $11.36 billion by 2033, indicating a strong consumer preference for salmon in this region.

Does Consainsights provide customized market report data for the salmon industry?

Yes, Consainsights offers customized market report data for the salmon industry, catering to specific needs by providing tailored insights, regional analysis, and sector-based data crucial for strategic planning.

What deliverables can I expect from this salmon market research project?

From the salmon market research project, you can expect detailed reports including market size estimates, growth forecasts, competitive analysis, and segmented data across various categories for informed decision-making.

What are the market trends of salmon?

Current trends in the salmon market include a shift towards organic and sustainable farming practices, increased online sales, and a growing preference for ready-to-eat prepared salmon products, reflecting changing consumer lifestyles.