Salts And Flavored Salts Market Report

Published Date: 31 January 2026 | Report Code: salts-and-flavored-salts

Salts And Flavored Salts Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Salts and Flavored Salts market, encompassing market dynamics, segmentation, and forecasts for the period from 2023 to 2033. Insights include market size, industry trends, regional analysis, and key player contributions.

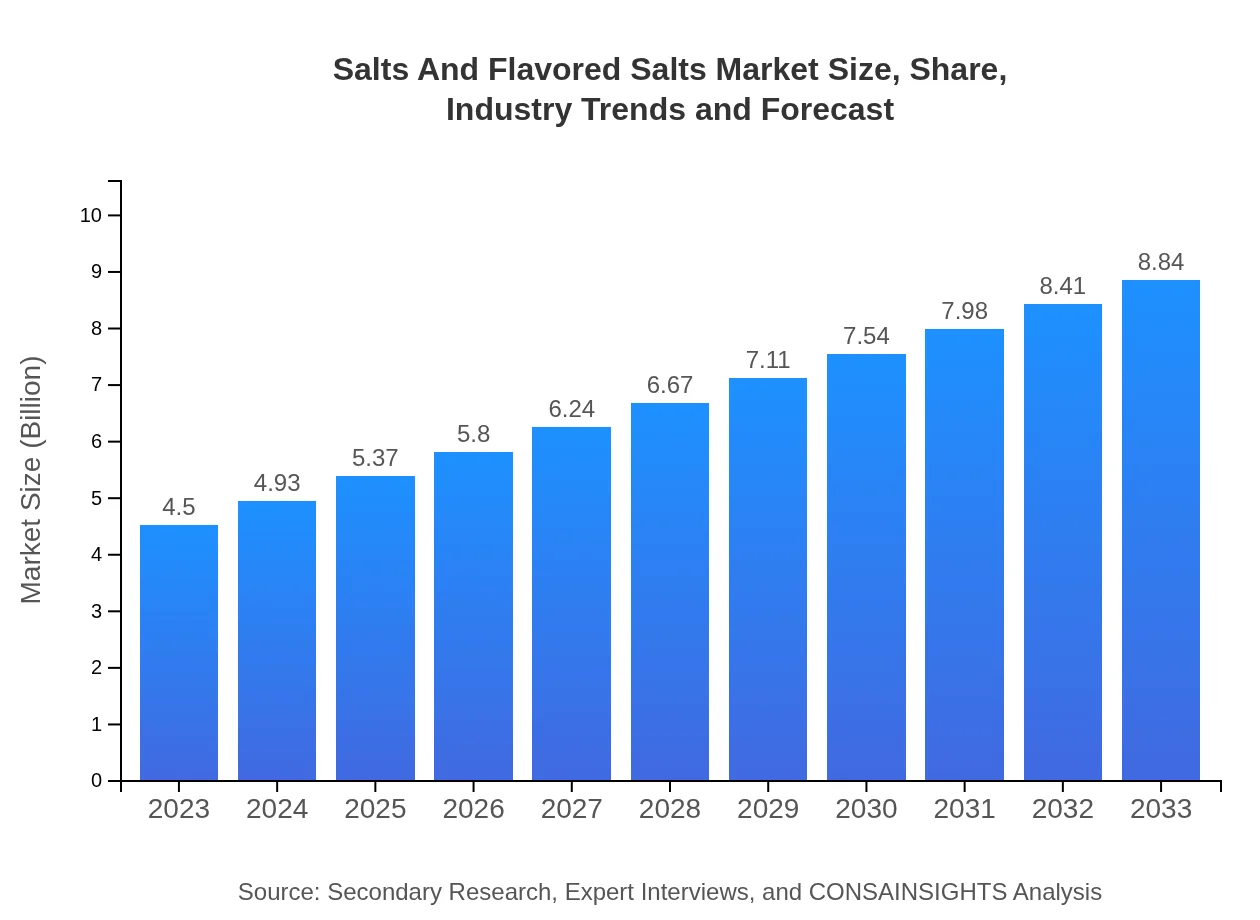

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Maldon Salt Company, Himalayan Pink Salt Company |

| Last Modified Date | 31 January 2026 |

Salts And Flavored Salts Market Overview

Customize Salts And Flavored Salts Market Report market research report

- ✔ Get in-depth analysis of Salts And Flavored Salts market size, growth, and forecasts.

- ✔ Understand Salts And Flavored Salts's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Salts And Flavored Salts

What is the Market Size & CAGR of Salts and Flavored Salts market between 2023 and 2033?

Salts And Flavored Salts Industry Analysis

Salts And Flavored Salts Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Salts And Flavored Salts Market Analysis Report by Region

Europe Salts And Flavored Salts Market Report:

Europe's market is expected to increase from $1.49 billion in 2023 to $2.92 billion by 2033. As one of the largest consumers of specialty salts, European countries emphasize clean labels and flavorful options in their culinary applications.Asia Pacific Salts And Flavored Salts Market Report:

In the Asia Pacific region, the market is projected to grow from $0.84 billion in 2023 to $1.65 billion by 2033. This region is characterized by a rich culinary heritage promoting diverse use of various salts, and the increasing influence of Western cuisines is driving the demand for flavored salts.North America Salts And Flavored Salts Market Report:

North America is projected to experience substantial growth from $1.51 billion in 2023 to $2.98 billion by 2033. The rise of health-conscious consumers and the trend towards gourmet cooking have boosted the popularity of flavored salts and specialty types.South America Salts And Flavored Salts Market Report:

The South American market is expected to rise from $0.33 billion in 2023 to $0.64 billion by 2033. A premium shift towards gourmet cooking and artisanal food preparation drives growth, with organic flavored salts gaining traction among consumers.Middle East & Africa Salts And Flavored Salts Market Report:

In the Middle East and Africa, the market is estimated to grow from $0.33 billion in 2023 to $0.66 billion by 2033. The unique culinary practices in this region often utilize a variety of salts, leading to an increasing demand for both traditional and flavored salts.Tell us your focus area and get a customized research report.

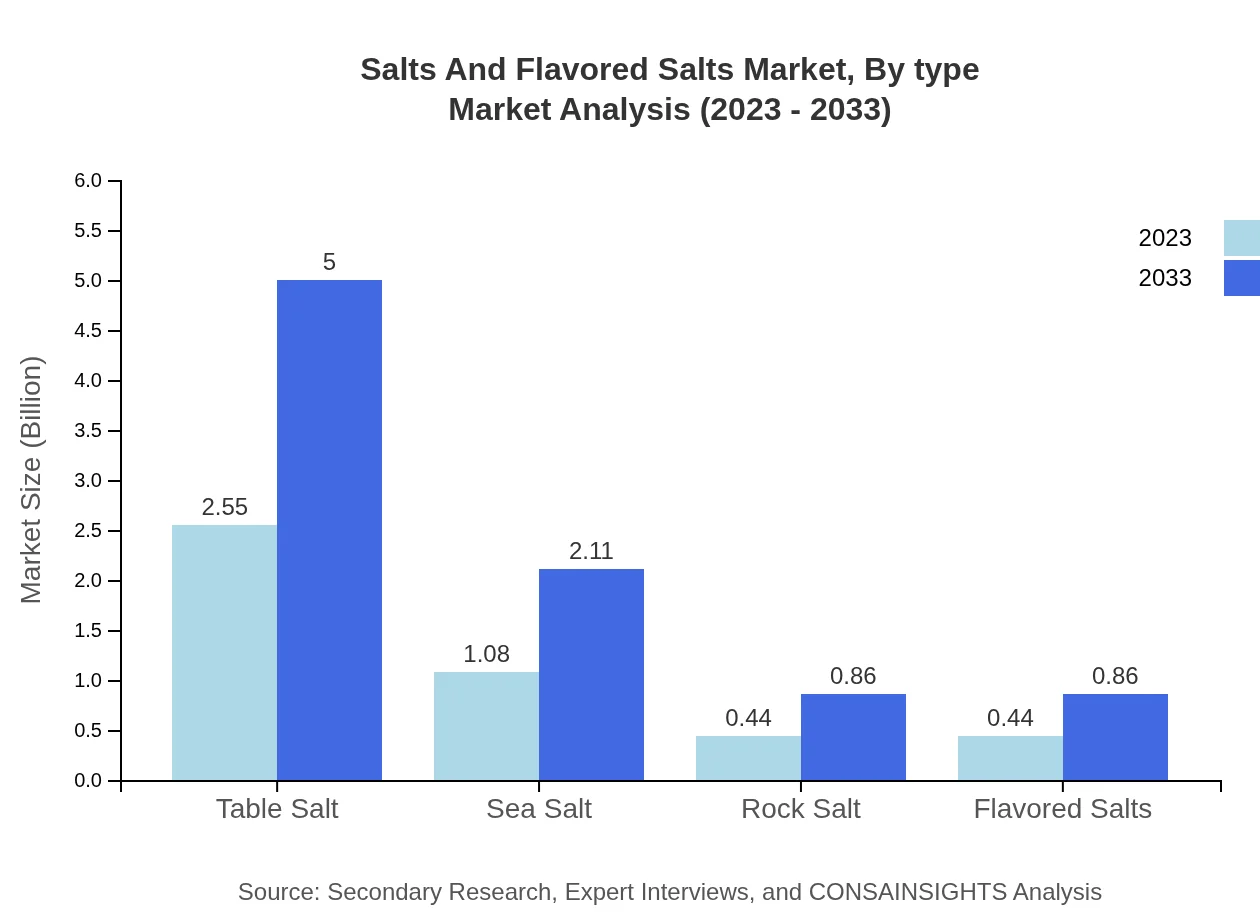

Salts And Flavored Salts Market Analysis By Type

The types of salts include Table Salt, Sea Salt, Rock Salt, and Flavored Salts. Table Salt dominates the market, with projected growth from $2.55 billion in 2023 to $5.00 billion by 2033. Sea Salt follows with a growth from $1.08 billion to $2.11 billion, and Rock Salt from $0.44 billion to $0.86 billion. Flavored Salts are also gaining traction, growing from $0.44 billion to $0.86 billion, representing a diverse offering in the culinary sector.

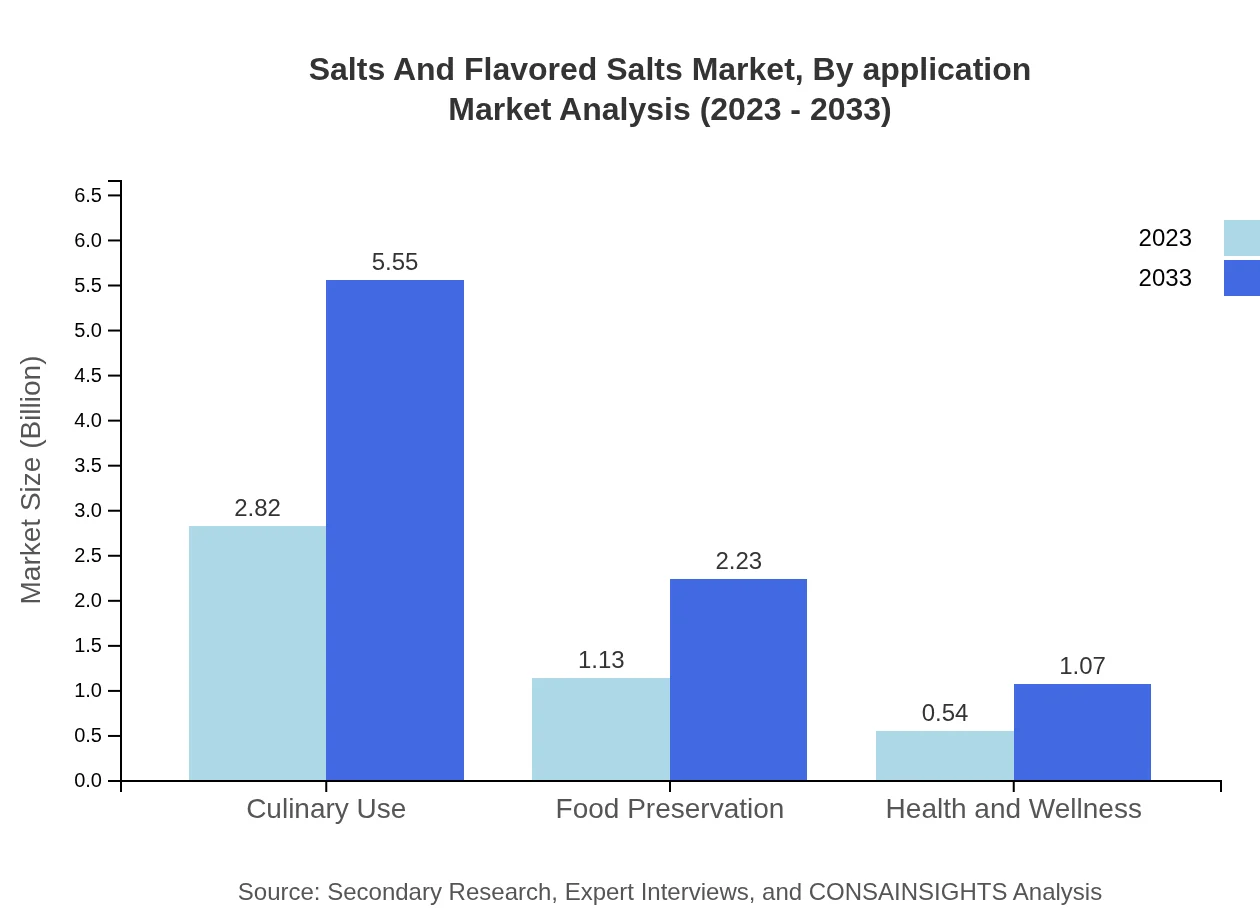

Salts And Flavored Salts Market Analysis By Application

The applications of Salts and Flavored Salts include Culinary Use, Food Preservation, and Health and Wellness. Culinary Use holds the largest market share, with growth from $2.82 billion in 2023 to $5.55 billion by 2033. Food Preservation and Health and Wellness applications are also essential, with projections of $1.13 billion to $2.23 billion and $0.54 billion to $1.07 billion, respectively.

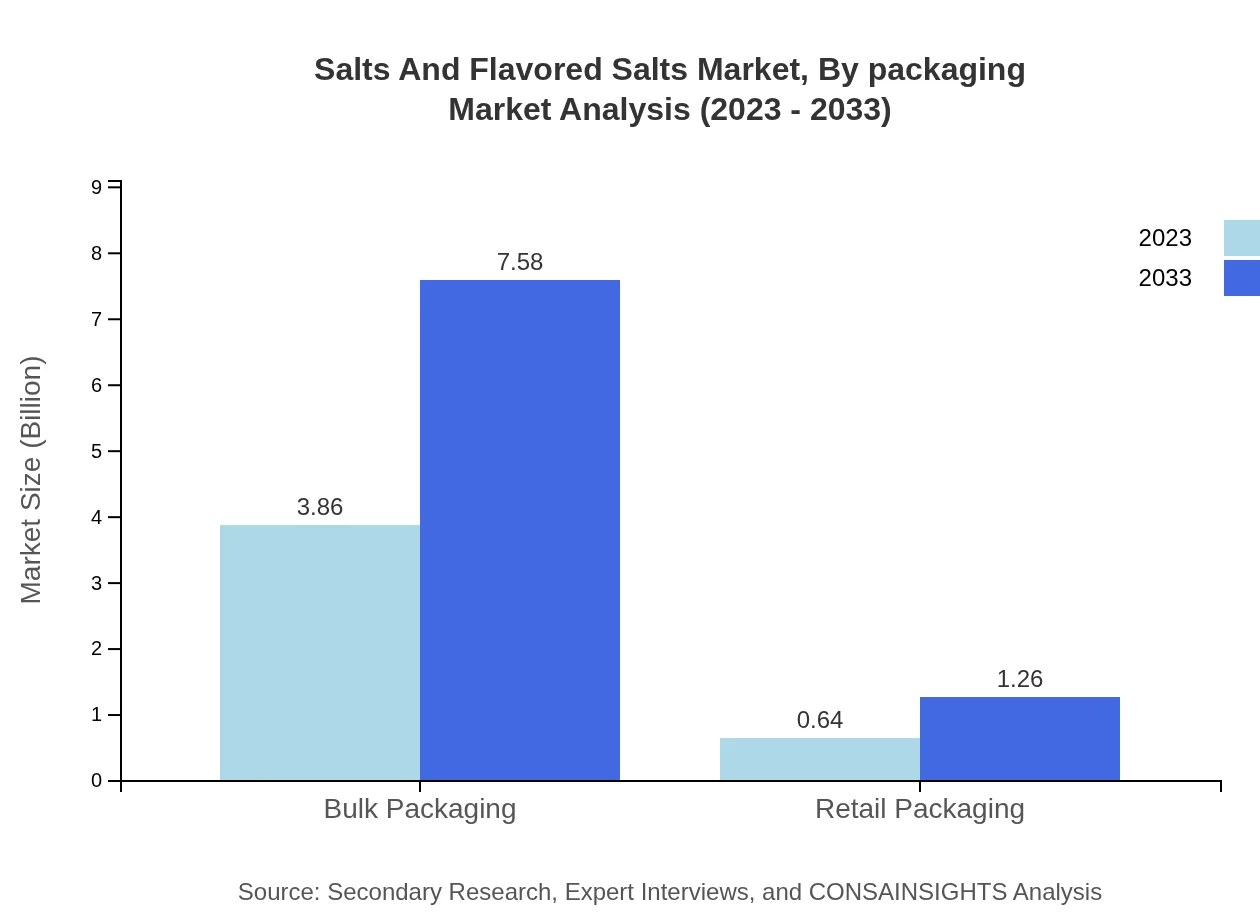

Salts And Flavored Salts Market Analysis By Packaging

In terms of packaging, Bulk Packaging dominates the market, expected to grow from $3.86 billion in 2023 to $7.58 billion by 2033. Retail Packaging accounts for a smaller portion but has potential for growth from $0.64 billion to $1.26 billion due to rising consumer demand for more convenient packaging options.

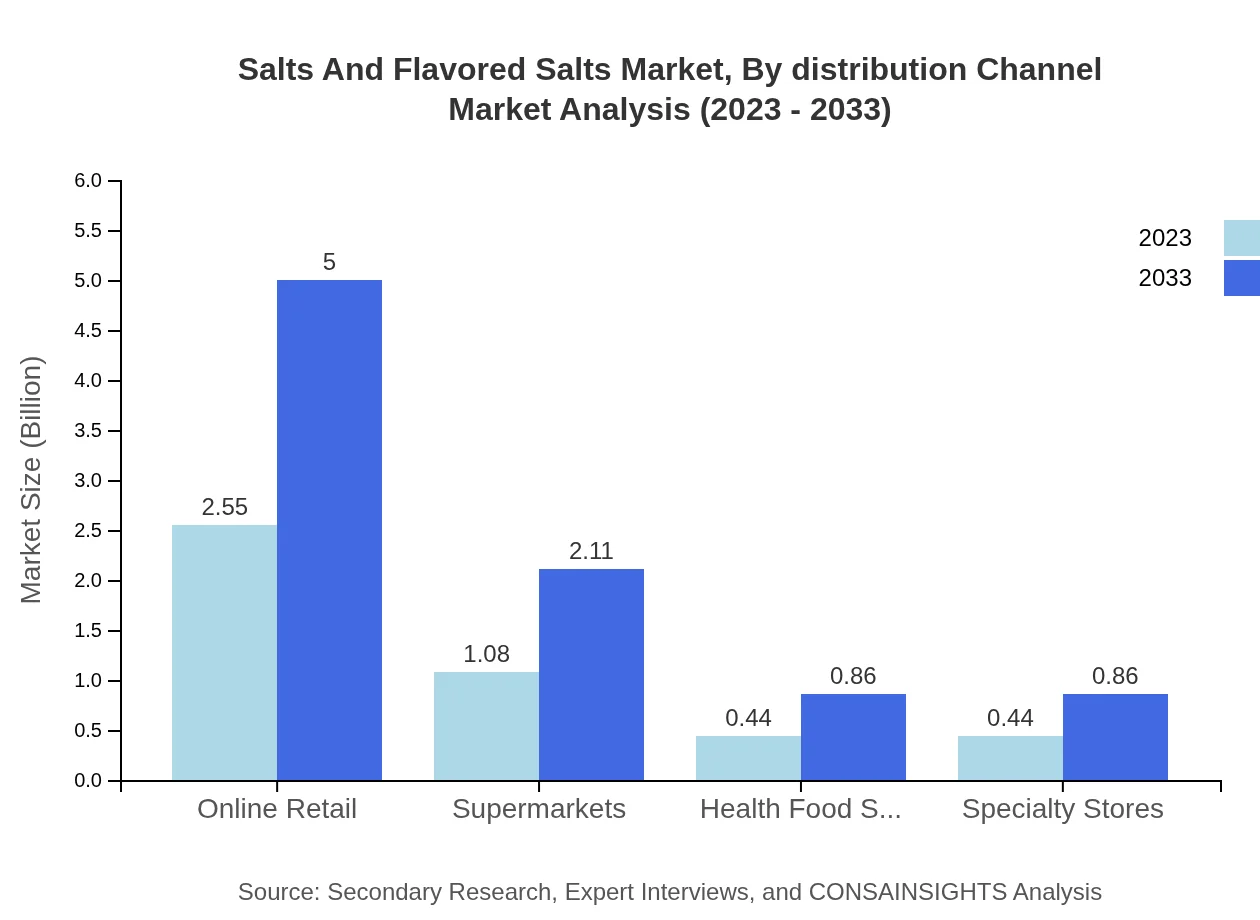

Salts And Flavored Salts Market Analysis By Distribution Channel

The primary distribution channels include Online Retail, Supermarkets, Health Food Stores, and Specialty Stores. Online Retail is the leading channel, expected to increase from $2.55 billion in 2023 to $5.00 billion by 2033, driven by the convenience of online shopping. Supermarkets also play a significant role with a growth from $1.08 billion to $2.11 billion.

Salts And Flavored Salts Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Salts And Flavored Salts Industry

Maldon Salt Company:

Known for its high-quality sea salts and unique flakes, Maldon is a reputable brand effective in innovating and expanding the flavored salts market segment.Himalayan Pink Salt Company:

Specializing in rock salts, particularly Himalayan salt, this company has significantly contributed to consumer awareness of health benefits and gourmet qualities of natural salts.We're grateful to work with incredible clients.

FAQs

What is the market size of salts And Flavored Salts?

The salts and flavored salts market is currently valued at approximately $4.5 billion in 2023, with a projected CAGR of 6.8% over the next decade, indicating robust growth and increasing market demand.

What are the key market players or companies in this salts And Flavored Salts industry?

Key players in the salts and flavored salts industry include multinational corporations like Morton Salt, Cargill Inc., and McCormick & Company, which lead through product innovation and diversification.

What are the primary factors driving the growth in the salts And Flavored Salts industry?

Growth in the salts and flavored salts market is driven by increasing consumer preference for gourmet and natural flavors, rising health awareness, and the expanding culinary usage of flavored salts in food preparation.

Which region is the fastest Growing in the salts And Flavored Salts?

Asia Pacific is the fastest-growing region in the salts and flavored salts market, with growth from $0.84 billion in 2023 to potentially $1.65 billion by 2033, driven by rising culinary interests.

Does ConsaInsights provide customized market report data for the salts And Flavored Salts industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the salts and flavored salts industry, enabling businesses to make informed strategic decisions.

What deliverables can I expect from this salts And Flavored Salts market research project?

Deliverables from this project include comprehensive market analysis, trend identification, competitive landscape assessment, and detailed segmentation data with insights into evolving market dynamics.

What are the market trends of salts And Flavored Salts?

Current trends in the salts and flavored salts market include a shift towards natural and organic options, increasing use in health-conscious food products, and the popularity of diverse packaging formats like bulk and retail.