Satellite Communication Equipment Market Report

Published Date: 31 January 2026 | Report Code: satellite-communication-equipment

Satellite Communication Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Satellite Communication Equipment market from 2023 to 2033, covering market size, growth drivers, regional insights, and key industry trends impacting the sector throughout the forecast period.

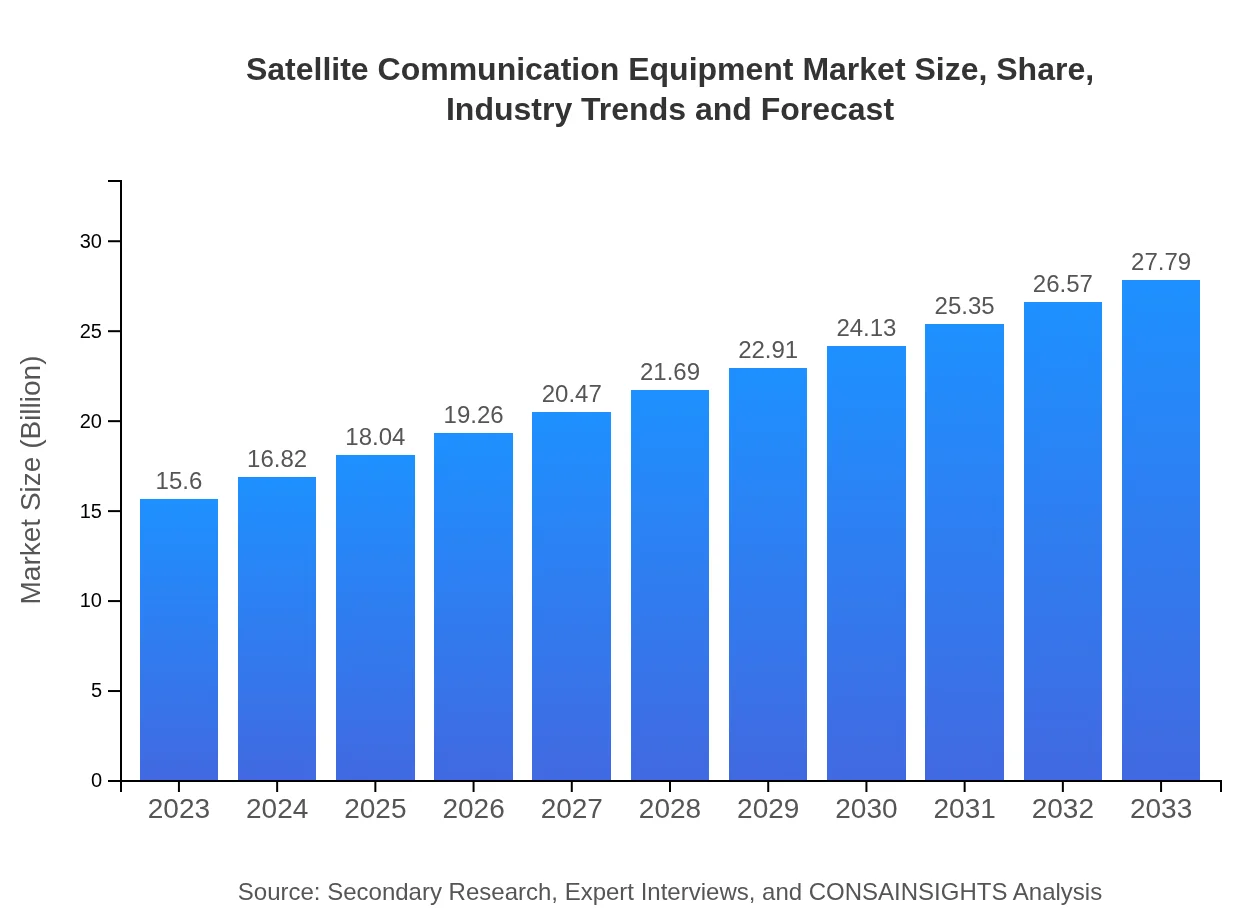

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Hughes Network Systems, LLC, Intelsat S.A., SES S.A., Viasat, Inc., Gilat Satellite Networks Ltd. |

| Last Modified Date | 31 January 2026 |

Satellite Communication Equipment Market Overview

Customize Satellite Communication Equipment Market Report market research report

- ✔ Get in-depth analysis of Satellite Communication Equipment market size, growth, and forecasts.

- ✔ Understand Satellite Communication Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Communication Equipment

What is the Market Size & CAGR of Satellite Communication Equipment market in 2023?

Satellite Communication Equipment Industry Analysis

Satellite Communication Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Communication Equipment Market Analysis Report by Region

Europe Satellite Communication Equipment Market Report:

Europe's market is valued at $5.61 billion in 2023, projected to grow to $9.98 billion by 2033. The demand for advanced telecommunications, as well as regulatory support for satellite services, plays a pivotal role in driving market growth across the continent.Asia Pacific Satellite Communication Equipment Market Report:

In the Asia-Pacific region, the Satellite Communication Equipment market was valued at $2.63 billion in 2023 and is projected to grow to $4.69 billion by 2033. The rise in mobile connectivity and governmental investments in satellite services, particularly in countries like India and China, are key growth drivers in this region.North America Satellite Communication Equipment Market Report:

North America remains a stronghold for the Satellite Communication Equipment market, with a value of $5.04 billion in 2023, anticipated to rise to $8.97 billion by 2033. The market is supported by substantial investments from defense and aerospace sectors, along with growing demand for broadband connectivity in rural areas.South America Satellite Communication Equipment Market Report:

South America's Satellite Communication Equipment market is valued at $0.59 billion in 2023 and is expected to reach $1.05 billion by 2033. The increasing demand for broadband services and disaster management solutions is driving investments in satellite communications within the region.Middle East & Africa Satellite Communication Equipment Market Report:

The Middle East and Africa market for Satellite Communication Equipment is estimated at $1.74 billion in 2023 and is expected to reach $3.10 billion by 2033. Rising demand for military communications and satellite broadcasting services is boosting market expansion in this region.Tell us your focus area and get a customized research report.

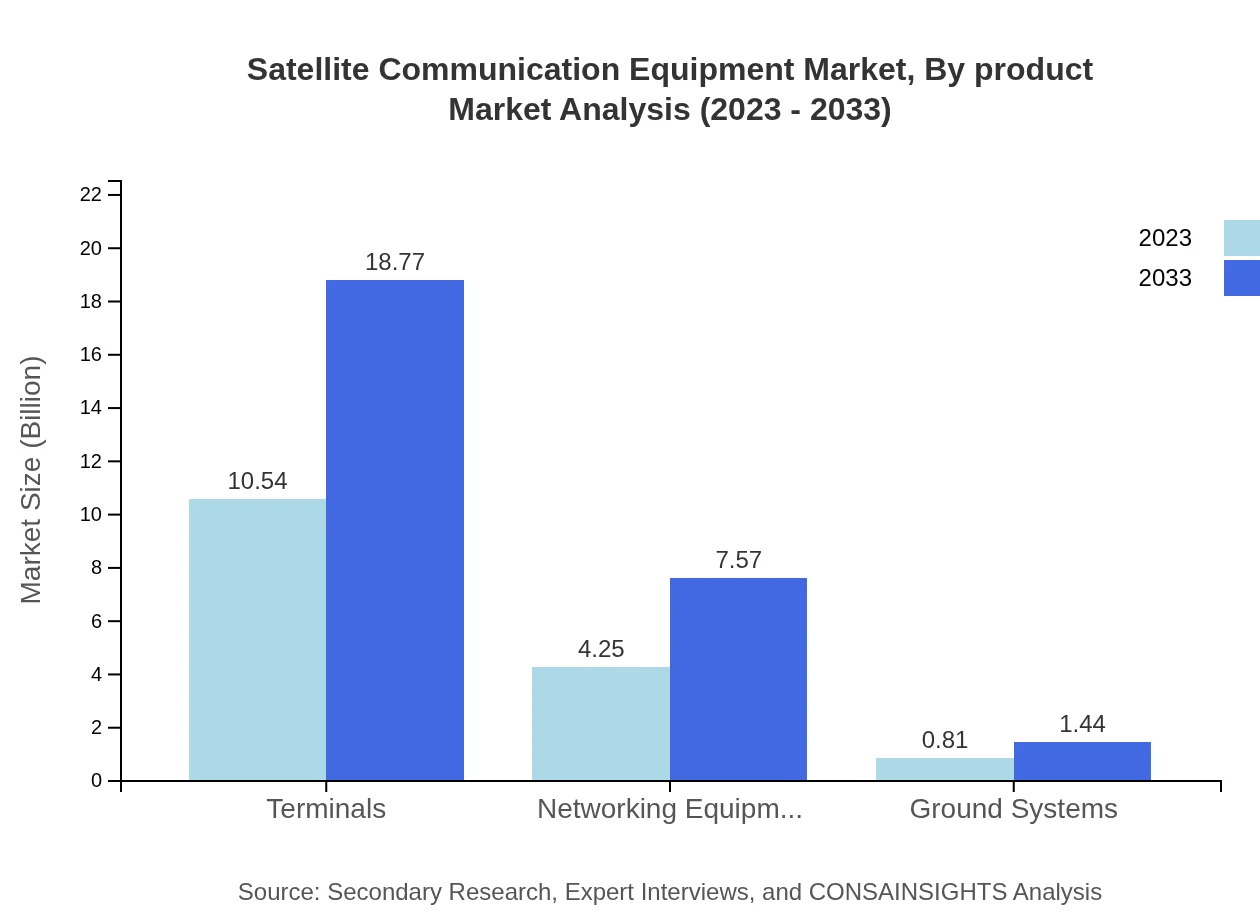

Satellite Communication Equipment Market Analysis By Product

The product segmentation of the Satellite Communication Equipment market includes: - Terminals: 2023 Market - $10.54 billion; 2033 Market - $18.77 billion - Networking Equipment: 2023 Market - $4.25 billion; 2033 Market - $7.57 billion - Ground Systems: 2023 Market - $0.81 billion; 2033 Market - $1.44 billion

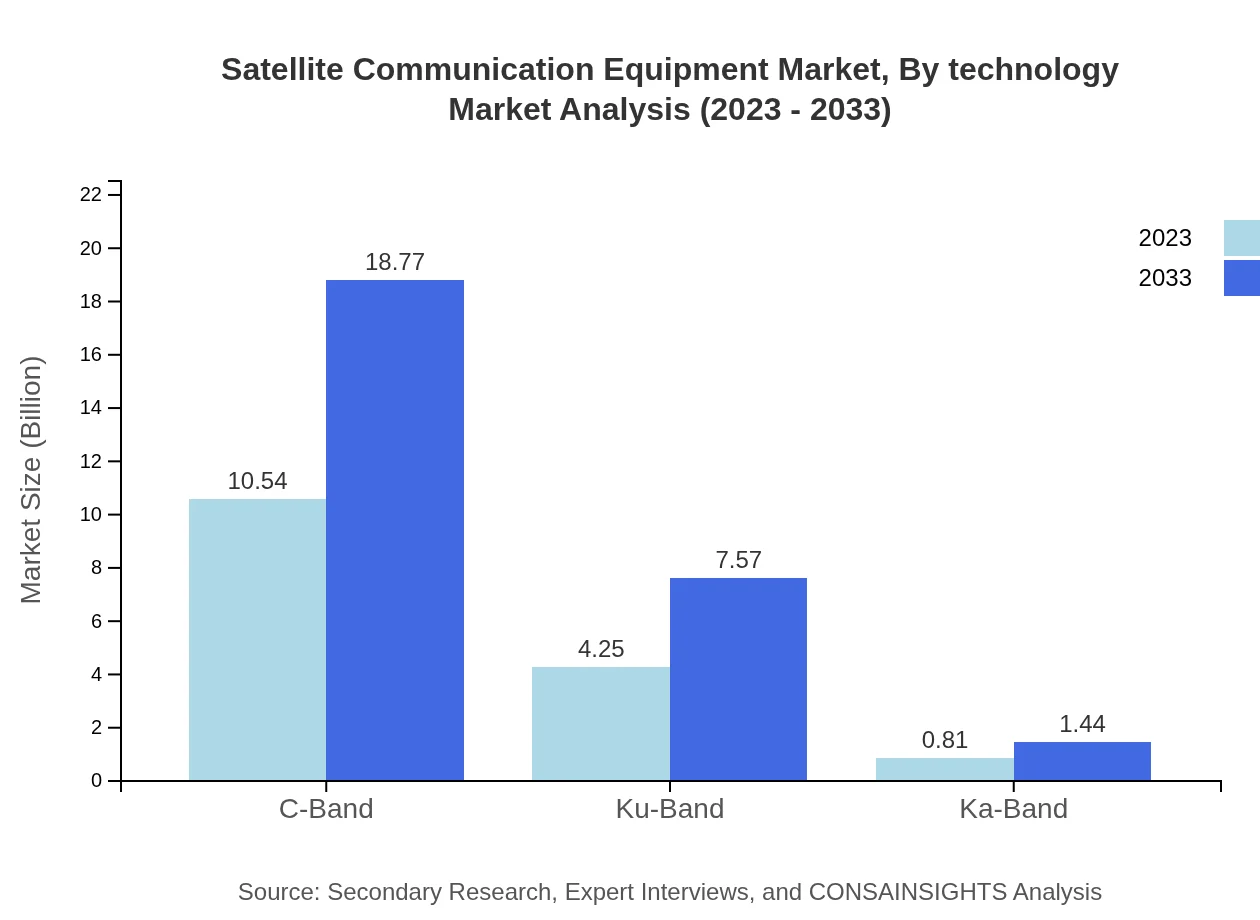

Satellite Communication Equipment Market Analysis By Technology

The technology segmentation of the market includes: - C-Band: 2023 Market - $10.54 billion; 2033 Market - $18.77 billion - Ku-Band: 2023 Market - $4.25 billion; 2033 Market - $7.57 billion - Ka-Band: 2023 Market - $0.81 billion; 2033 Market - $1.44 billion

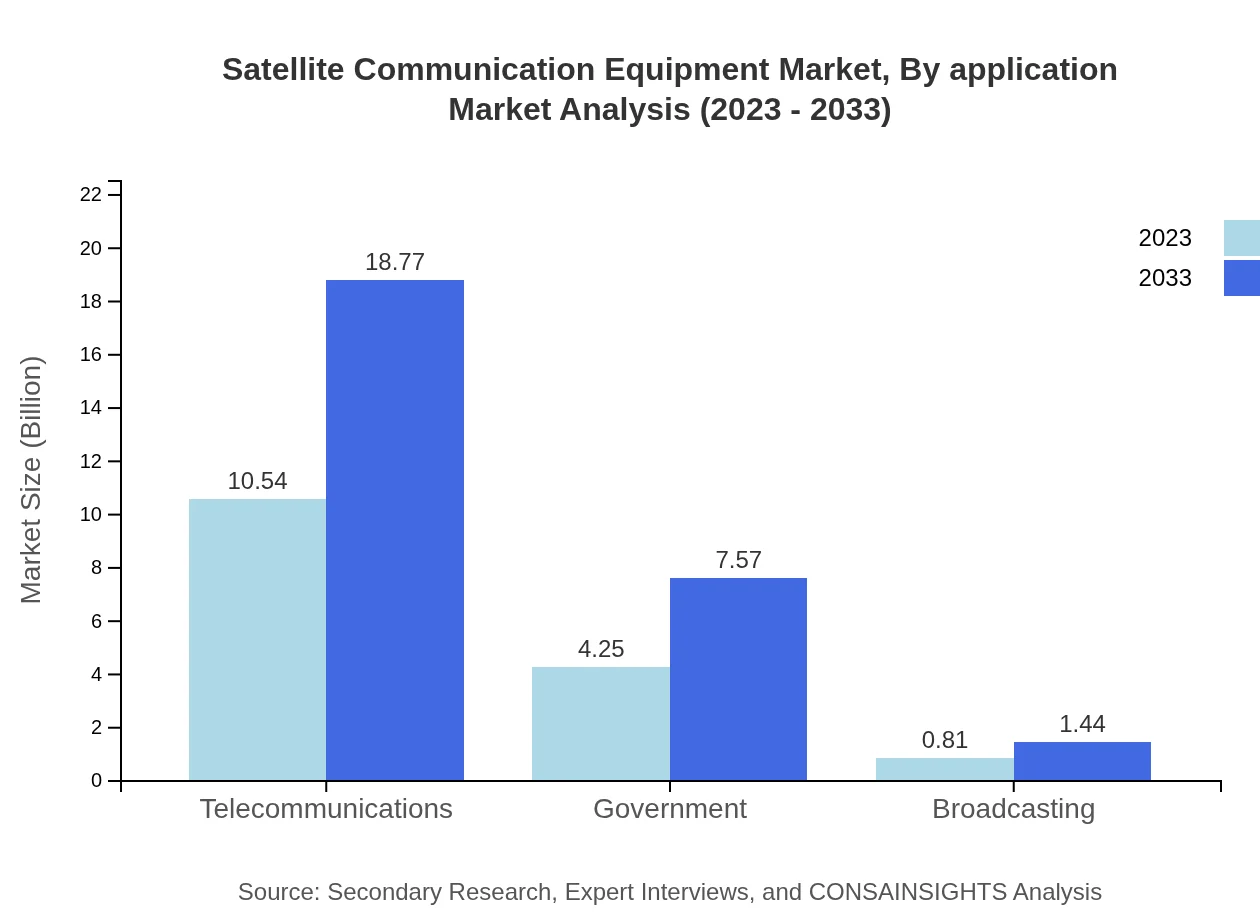

Satellite Communication Equipment Market Analysis By Application

The application segments in the market include: - Telecommunications: 2023 Market - $10.54 billion; 2033 Market - $18.77 billion - Broadcasting: 2023 Market - $0.81 billion; 2033 Market - $1.44 billion

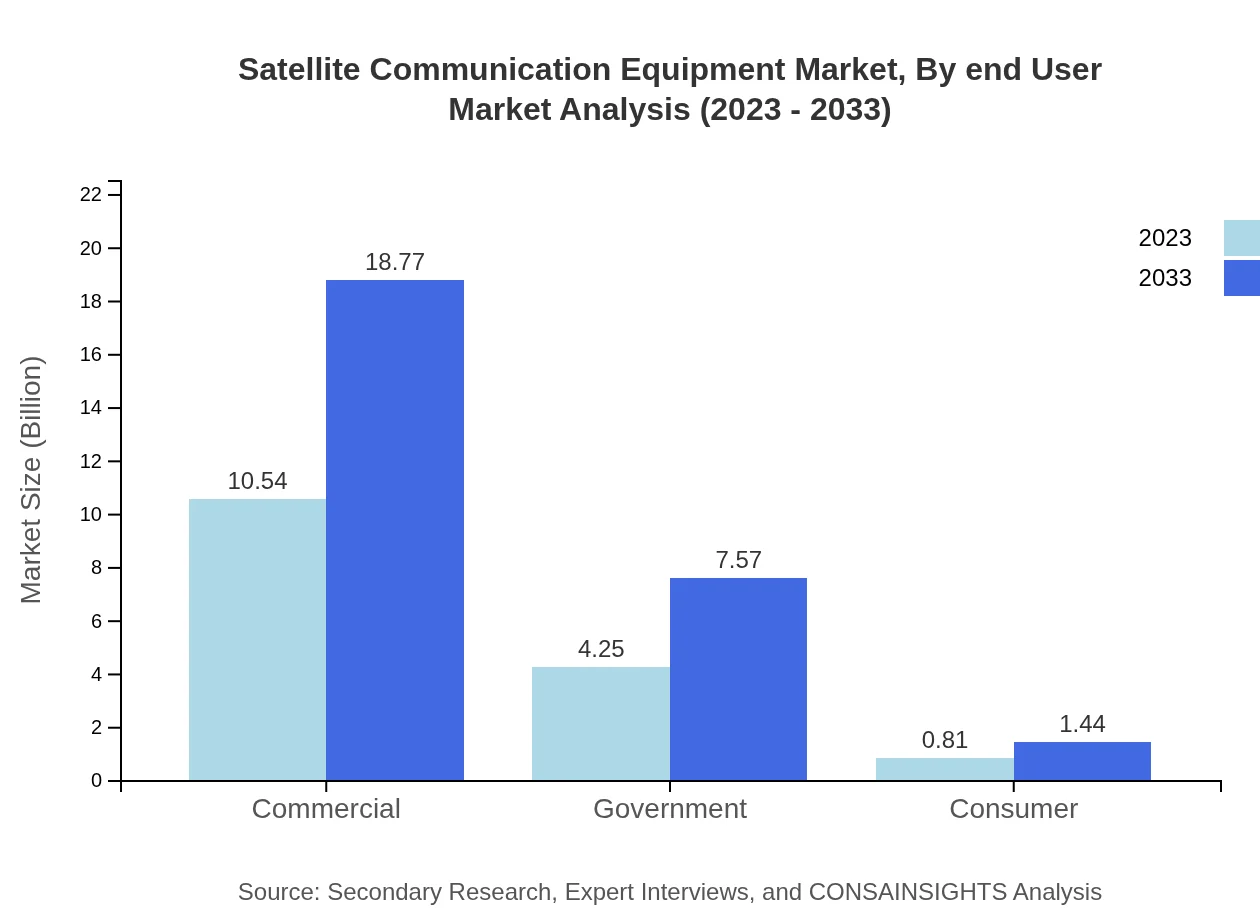

Satellite Communication Equipment Market Analysis By End User

The end-user segmentation highlights: - Commercial: 2023 Market - $10.54 billion; 2033 Market - $18.77 billion - Government: 2023 Market - $4.25 billion; 2033 Market - $7.57 billion - Consumer: 2023 Market - $0.81 billion; 2033 Market - $1.44 billion

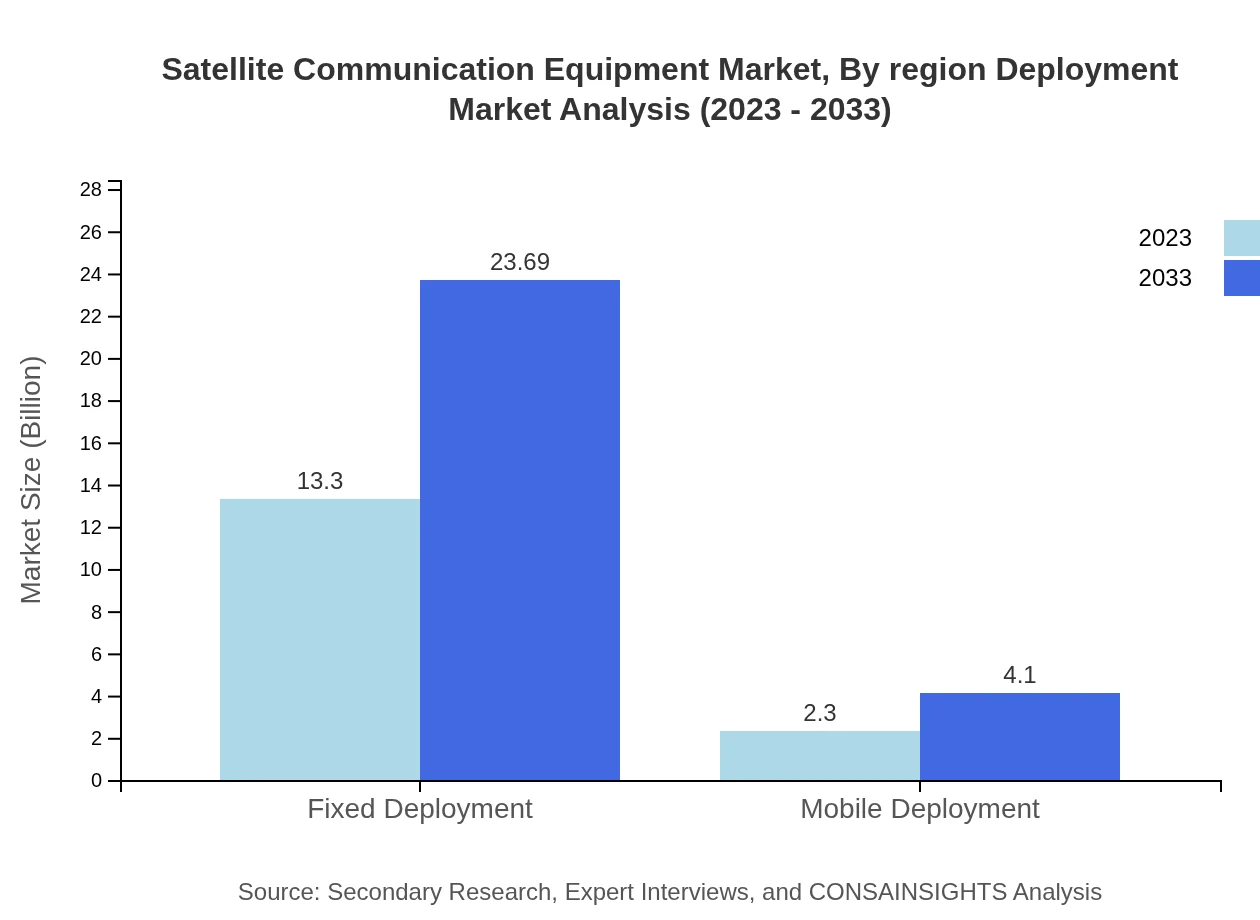

Satellite Communication Equipment Market Analysis By Region Deployment

Deployment type analysis indicates: - Fixed Deployment: 2023 Market - $13.30 billion; 2033 Market - $23.69 billion - Mobile Deployment: 2023 Market - $2.30 billion; 2033 Market - $4.10 billion

Satellite Communication Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Communication Equipment Industry

Hughes Network Systems, LLC:

A leader in satellite broadband services and technology, providing innovative solutions for both residential and business customers worldwide.Intelsat S.A.:

A global leader in satellite communications, providing services that enhance connectivity and data transmission across various sectors including media, enterprise, and government.SES S.A.:

A global satellite operator, SES delivers innovative solutions for video and data services across its high-performance satellite fleet.Viasat, Inc.:

Known for high-speed satellite broadband services, Viasat offers innovative solutions in government and commercial markets.Gilat Satellite Networks Ltd.:

Engaged in satellite-based communications and broadband services, focusing on high-performance solutions for diverse markets including enterprise and governmental.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite Communication Equipment?

The satellite communication equipment market is estimated to be worth approximately $15.6 billion in 2023, with a projected CAGR of 5.8%, expected to grow significantly over the next decade.

What are the key market players or companies in this satellite Communication Equipment industry?

Leading companies in the satellite communication equipment industry include major players such as Boeing, Lockheed Martin, Thales Group, and SES S.A., each contributing to advancements and competitiveness.

What are the primary factors driving the growth in the satellite Communication Equipment industry?

Key drivers include the increasing demand for satellite-based communication services, advancements in technology, growing investments in space exploration, and the rising requirement for enhanced connectivity across various sectors.

Which region is the fastest Growing in the satellite Communication Equipment?

Asia Pacific is the fastest-growing region in the satellite communication equipment market, expected to expand from $2.63 billion in 2023 to $4.69 billion by 2033, reflecting a strong growth trajectory.

Does ConsaInsights provide customized market report data for the satellite Communication Equipment industry?

Yes, ConsaInsights offers tailored market reports that cater specifically to the unique needs of clients in the satellite communication equipment sector, allowing for detailed insights and data.

What deliverables can I expect from this satellite Communication Equipment market research project?

Deliverables typically include comprehensive reports, data sets, market predictions, regional analyses, and strategic insights based on thorough market research and evaluations.

What are the market trends of satellite Communication Equipment?

Current trends include a shift towards more efficient satellite technologies, increasing adoption of Ka-band satellites for high-speed data transmission, and growing interest in small satellite deployments and services.