Satellite Communication Market Report

Published Date: 31 January 2026 | Report Code: satellite-communication

Satellite Communication Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Satellite Communication market, focusing on key insights, market size, segmentation, and trends from 2023 to 2033. It aims to equip readers with valuable data and forecasts for informed strategic decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

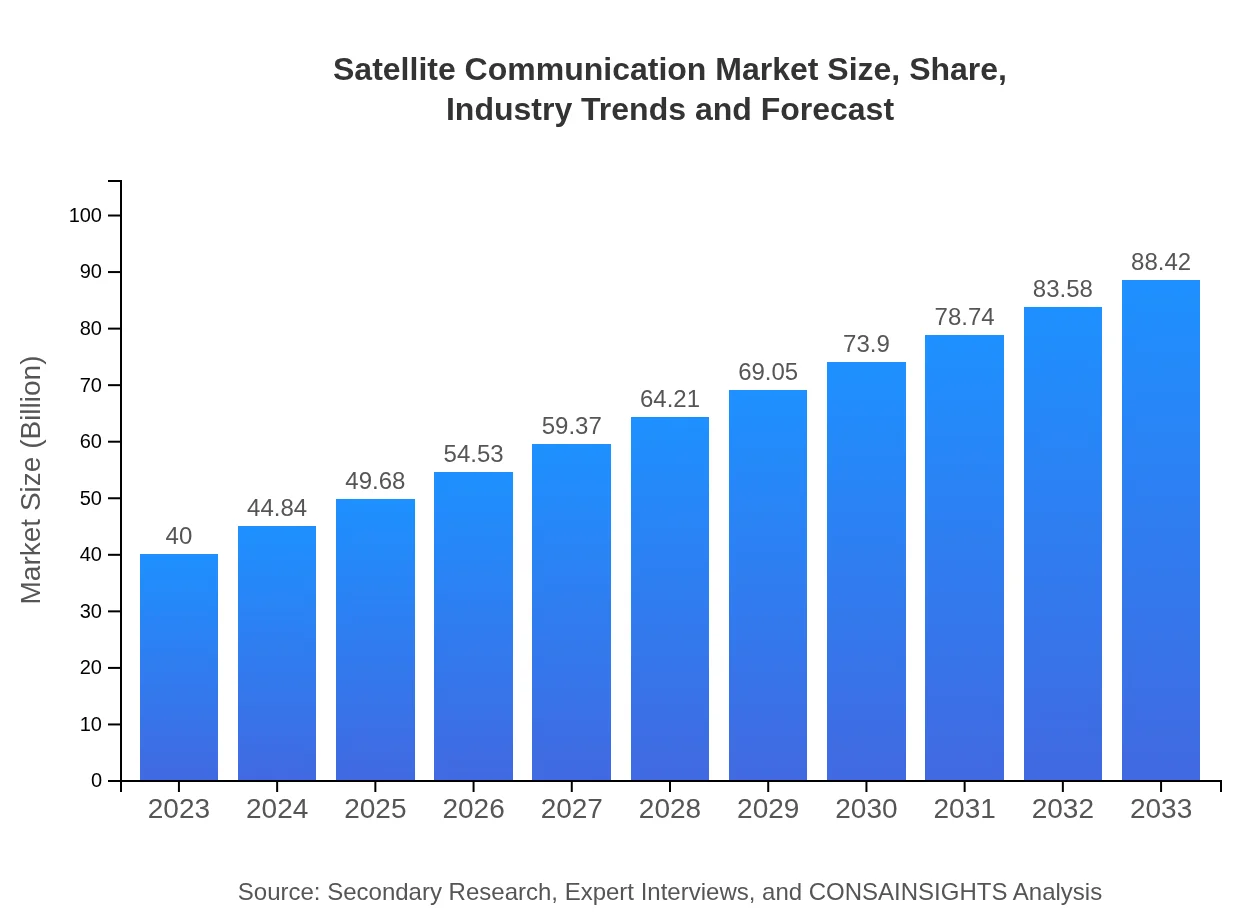

| 2023 Market Size | $40.00 Billion |

| CAGR (2023-2033) | 8% |

| 2033 Market Size | $88.42 Billion |

| Top Companies | SES SA, Intelsat, Inmarsat, Eutelsat, SpaceX (Starlink) |

| Last Modified Date | 31 January 2026 |

Satellite Communication Market Overview

Customize Satellite Communication Market Report market research report

- ✔ Get in-depth analysis of Satellite Communication market size, growth, and forecasts.

- ✔ Understand Satellite Communication's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Communication

What is the Market Size & CAGR of Satellite Communication market in 2023?

Satellite Communication Industry Analysis

Satellite Communication Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Communication Market Analysis Report by Region

Europe Satellite Communication Market Report:

The European market is poised at $10.04 billion in 2023, projected to grow to $22.19 billion by 2033. This increase can be attributed to digital transformation initiatives, investment in space technologies, and strong demand for satellite services in both commercial and government sectors.Asia Pacific Satellite Communication Market Report:

In 2023, the Asia Pacific Satellite Communication market is valued at $8.04 billion, expected to reach $17.78 billion by 2033. This growth is driven by increasing internet penetration, investments in next-generation satellite technology, and governmental initiatives to improve telecommunication infrastructure across emerging economies.North America Satellite Communication Market Report:

Valued at $14.51 billion in 2023, the North American Satellite Communication market is anticipated to expand to $32.08 billion by 2033. Strong demand for broadband services, robust defense expenditure, and innovations from major players are the pivotal factors driving growth in this region.South America Satellite Communication Market Report:

The South American market stands at $2.54 billion in 2023, with projections reaching $5.61 billion by 2033. Growth is propelled by an increasing focus on enhancing regional connectivity and broadcasting services, alongside significant partnerships within the telecommunications sector.Middle East & Africa Satellite Communication Market Report:

The Middle East and Africa Satellite Communication market is valued at $4.87 billion in 2023, expected to grow to $10.77 billion by 2033. Factors such as a rising number of satellite launches by regional operators and increasing demand for connectivity in isolated areas drive growth within this region.Tell us your focus area and get a customized research report.

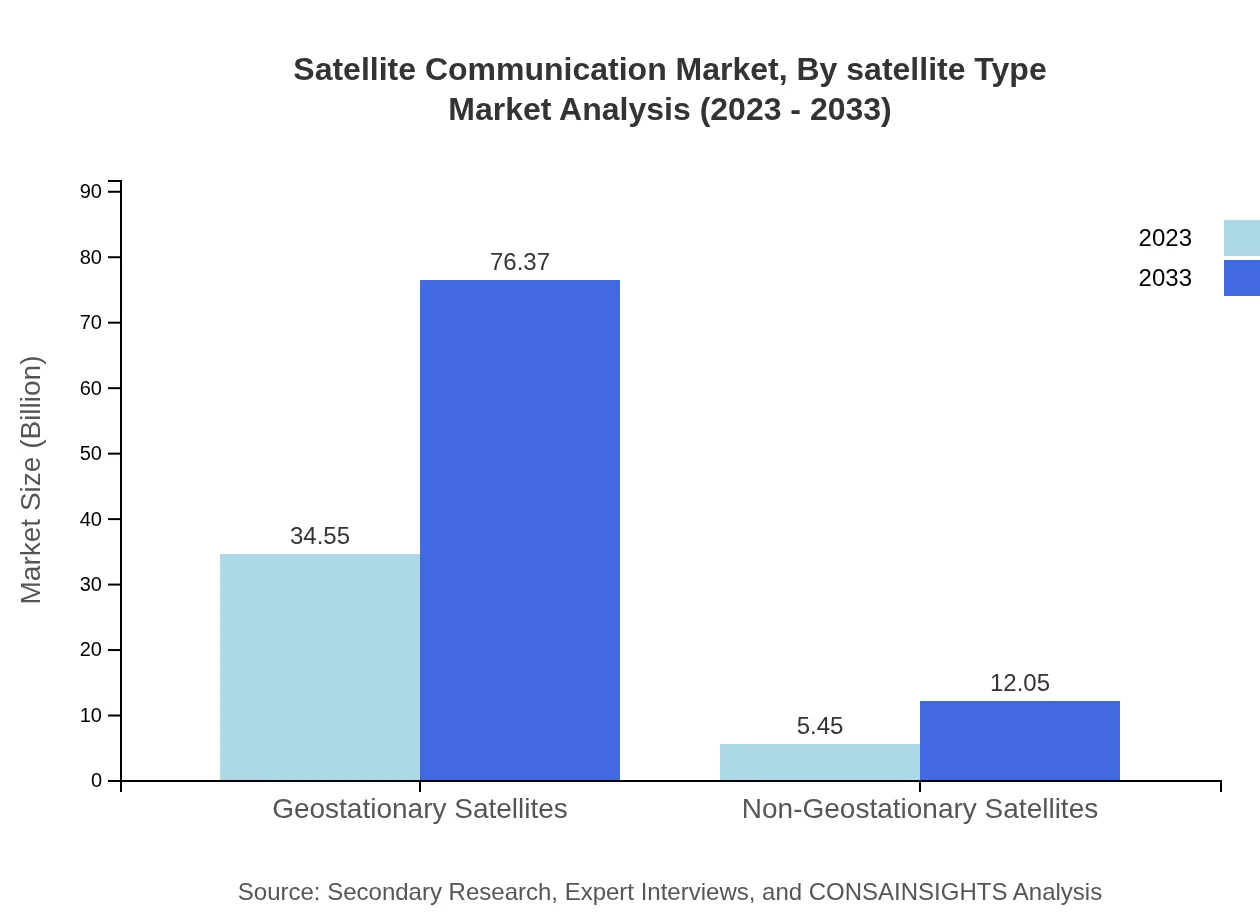

Satellite Communication Market Analysis By Satellite Type

The market can be categorized into Geostationary Satellites, which hold a dominant share with a market size of $34.55 billion in 2023 and are expected to grow to $76.37 billion by 2033, representing 86.37% market share. Conversely, Non-Geostationary Satellites represent a smaller yet steadily growing segment, starting from $5.45 billion in 2023 to $12.05 billion by 2033, capturing approximately 13.63% share.

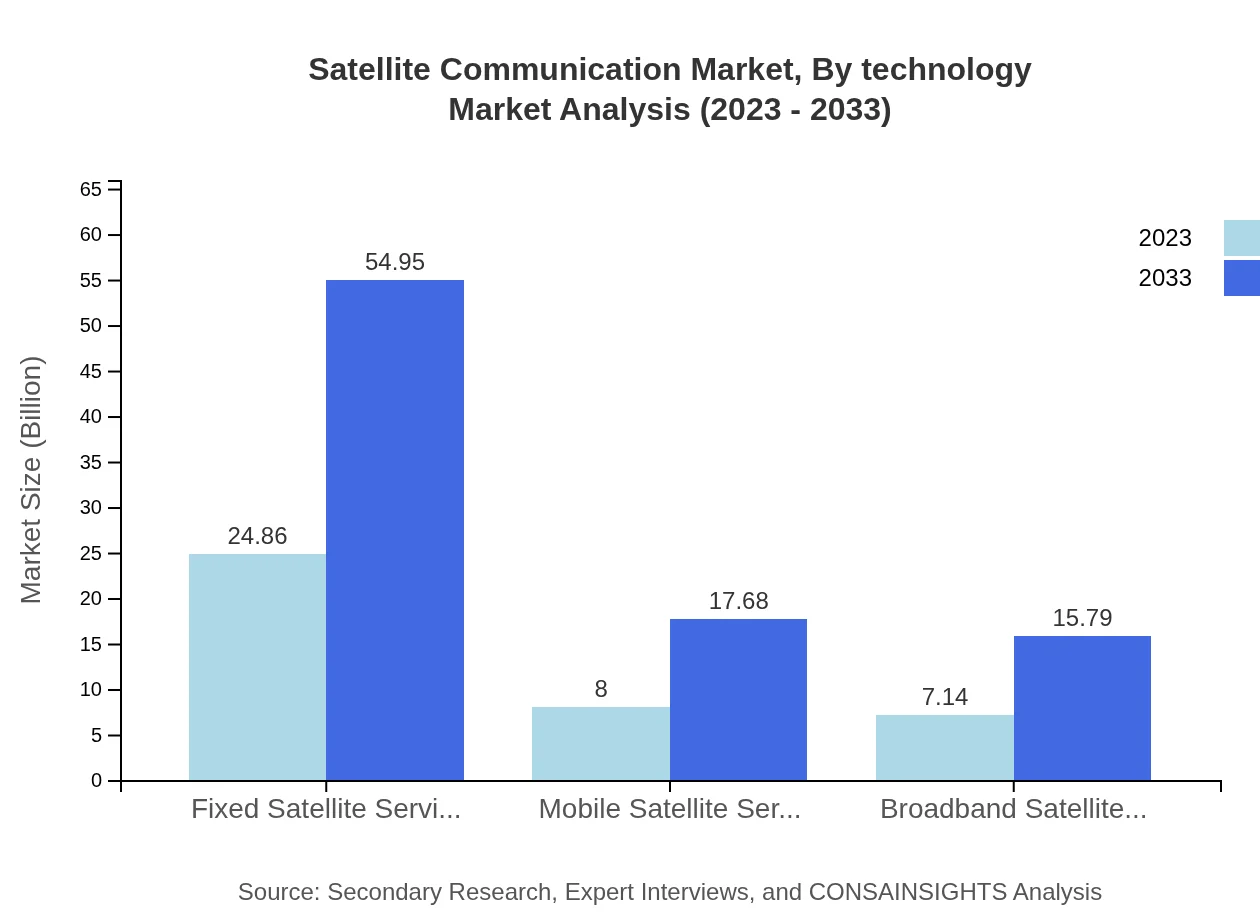

Satellite Communication Market Analysis By Technology

Key technologies include traditional satellite communication systems and advanced technologies such as photonic satellites, nanotechnology-based satellites, and HTS. These new technologies are expected to revolutionize data capacity utilization, significantly enhancing communication capabilities.

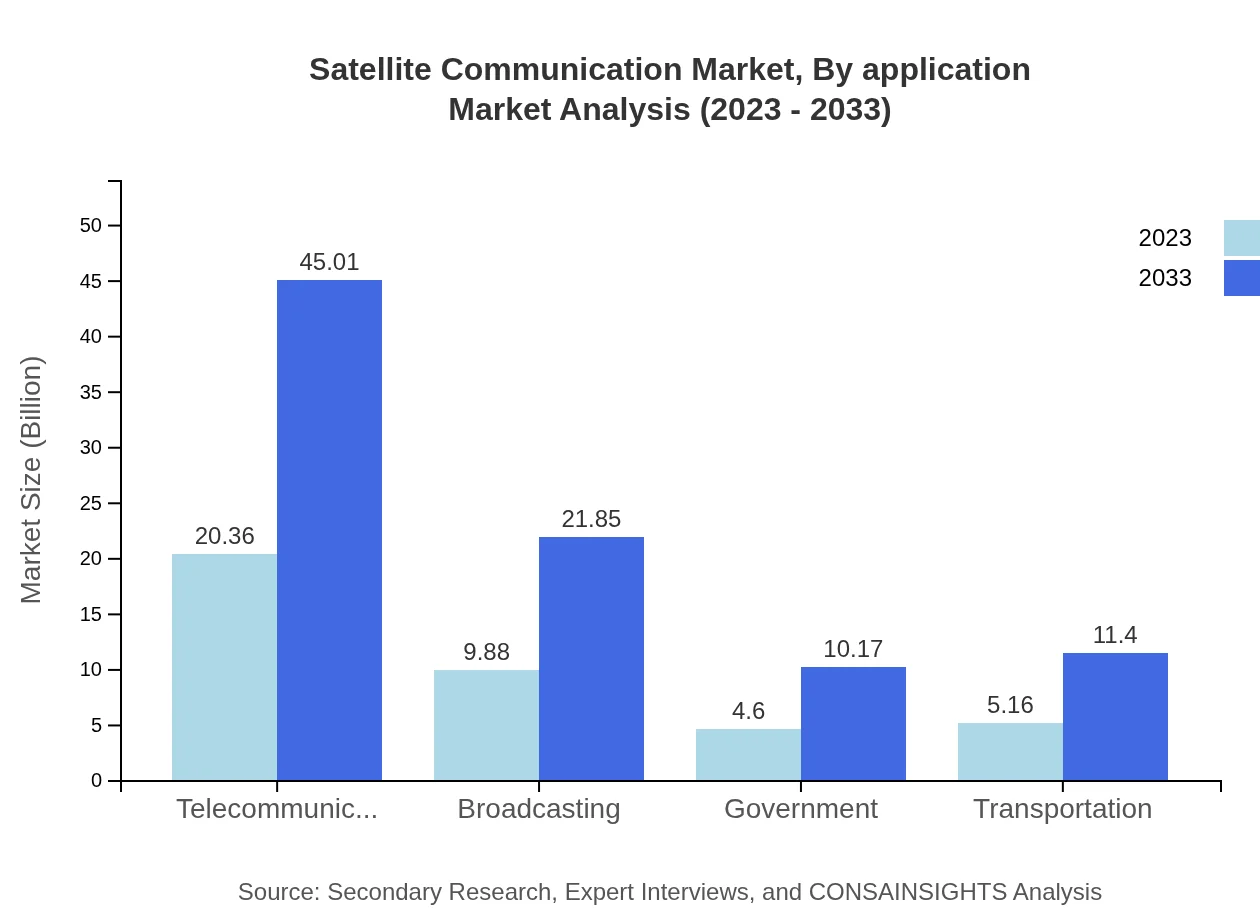

Satellite Communication Market Analysis By Application

The application of satellite communication spans several key areas including broadcasting services ($24.86 billion in 2023), telecommunications ($20.36 billion), and governmental services ($8 billion). Data services and consumer satellite applications are also on the rise, reflecting the demand for widespread connectivity.

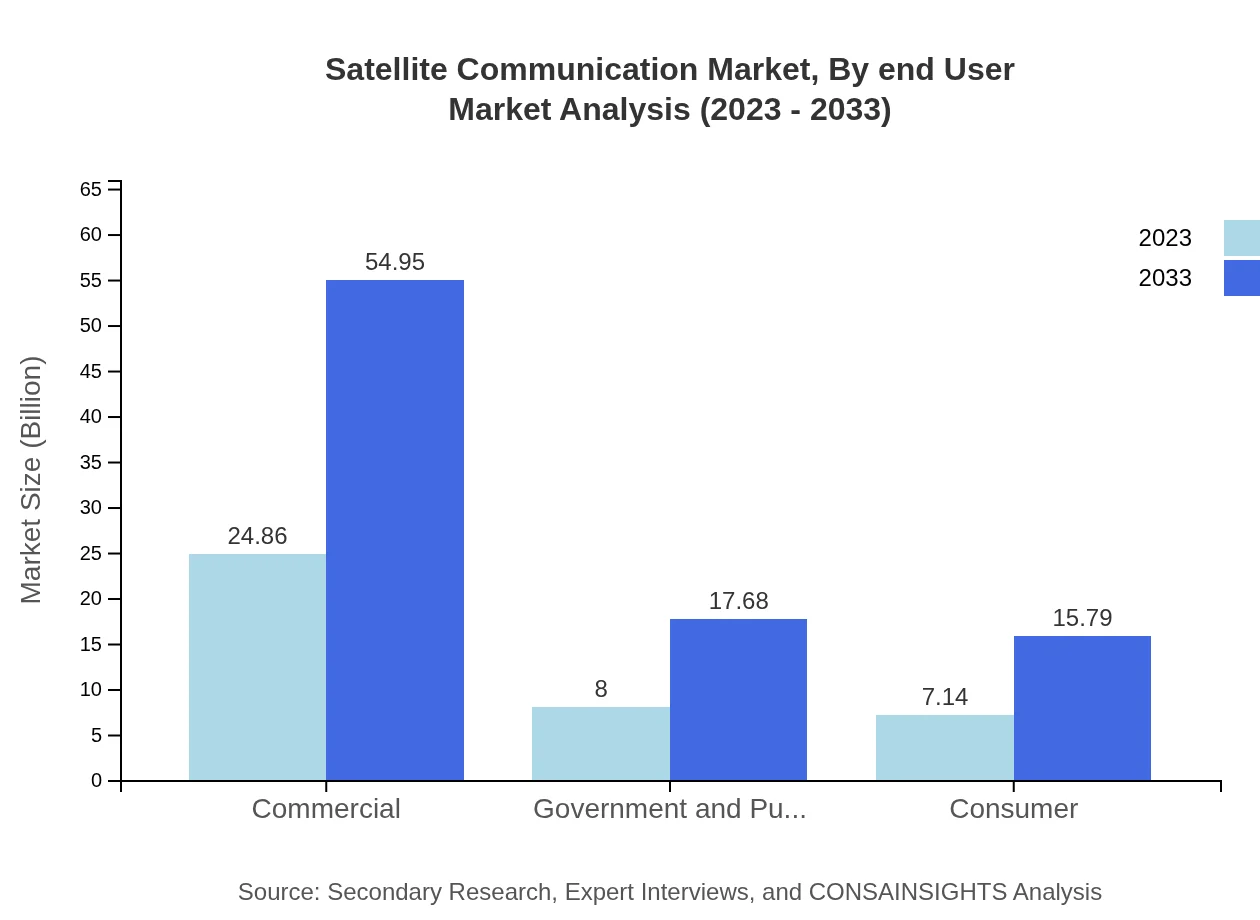

Satellite Communication Market Analysis By End User

End-users include commercial sectors ($24.86 billion) and government entities ($8 billion), with both segments demonstrating robust participation in satellite communication services aimed at facilitating essential services and maintaining competitive advantage.

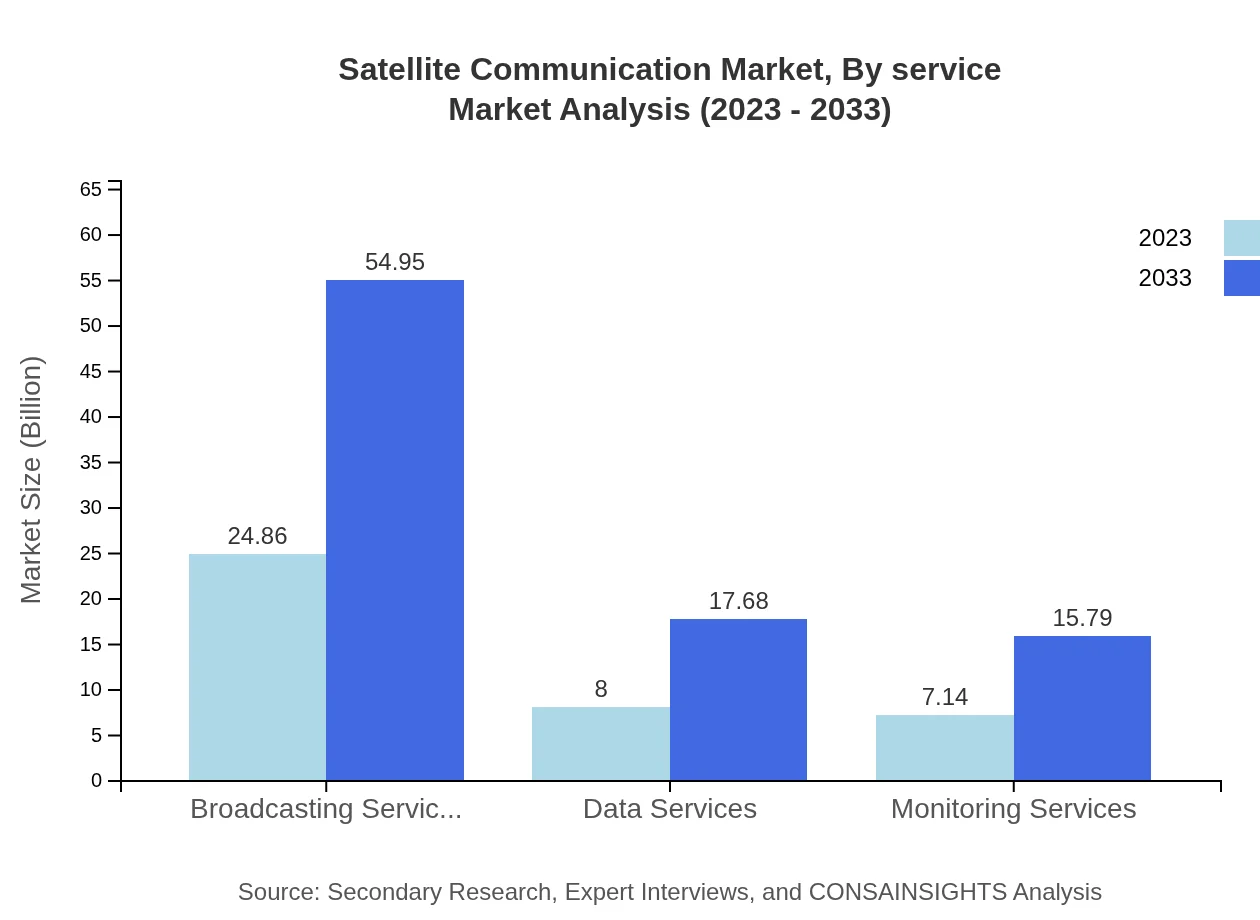

Satellite Communication Market Analysis By Service

The service offerings within the market include Fixed Satellite Services, valued at $24.86 billion in 2023, and Mobile Satellite Services at $8 billion. Both segments are expected to maintain their significance as user demands evolve and technology advances.

Satellite Communication Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Communication Industry

SES SA:

A leading global satellite operator providing services for a wide range of sectors, including telecommunications, broadcast, and government communications.Intelsat:

Known for its extensive satellite network, Intelsat offers a range of satellite and communication services to enterprises, governments, and telecommunications providers.Inmarsat:

Specializing in mobile satellite communications, Inmarsat delivers a range of services across maritime, aviation, and enterprise sectors.Eutelsat:

Eutelsat operates a fleet of satellites, providing data and video services across Europe, the Middle East, and Africa, emphasizing innovative satellite technologies.SpaceX (Starlink):

A pioneer in satellite internet services via its Starlink project, SpaceX aims to provide high-speed internet across global markets, particularly in underserved regions.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite communication?

The satellite communication market size is projected to reach $40 billion by 2033, with a CAGR of 8% from 2023. As technology advances, the industry's potential continues to expand globally, reflecting exponential growth in various sectors.

What are the key market players or companies in the satellite communication industry?

Key players in the satellite communication industry include major corporations such as Intelsat, SES S.A., and Eutelsat, focusing on various services like broadcasting, data transmissions, and government communications.

What are the primary factors driving the growth in the satellite communication industry?

Growth in the satellite communication industry is driven by increasing demand for broadband services, advancements in satellite technology, and the rising need for reliable communication in remote areas and emergency situations.

Which region is the fastest Growing in the satellite communication market?

North America is the fastest-growing region in the satellite communication market, expected to rise from $14.51 billion in 2023 to $32.08 billion by 2033. This significant growth is attributed to technological advancements and high demand.

Does ConsaInsights provide customized market report data for the satellite communication industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs within the satellite communication industry, ensuring relevant, accurate insights that align with market demands.

What deliverables can I expect from this satellite communication market research project?

Deliverables from the satellite communication market research project include detailed reports on market size, growth trends, segment analysis, and competitive landscape assessments to help stakeholders make informed decisions.

What are the market trends of satellite communication?

Current trends in satellite communication include the emergence of non-geostationary satellites, increasing investments in broadband services, and a shift towards more integrated communication solutions to address evolving customer requirements.