Satellite Data Services Market Report

Published Date: 31 January 2026 | Report Code: satellite-data-services

Satellite Data Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Satellite Data Services market from 2023 to 2033, including market trends, size projections, regional insights, and an overview of key industry players, aiming to inform stakeholders for future strategic decisions.

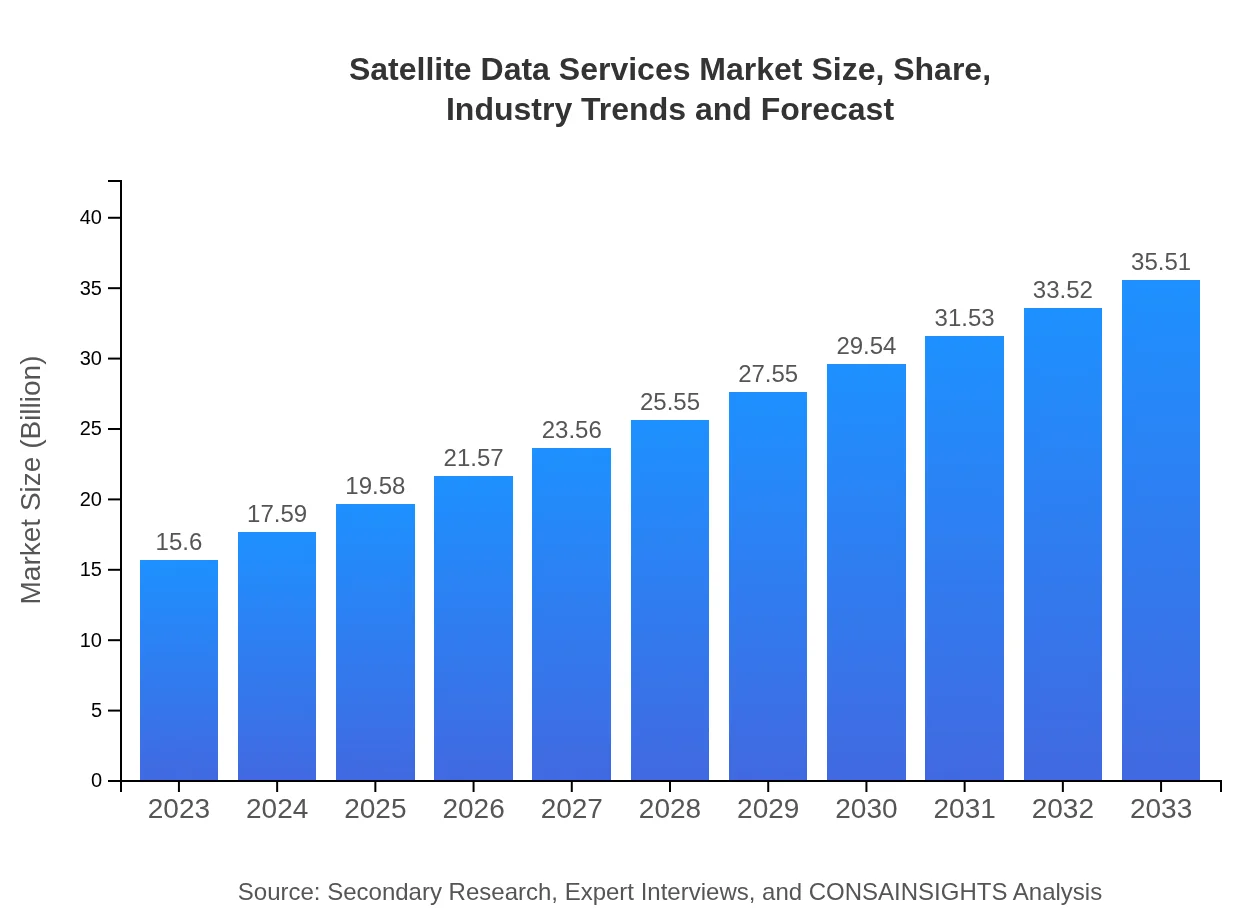

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $35.51 Billion |

| Top Companies | Maxar Technologies, Airbus Defence and Space, Planet Labs, Hexagon AB |

| Last Modified Date | 31 January 2026 |

Satellite Data Services Market Overview

Customize Satellite Data Services Market Report market research report

- ✔ Get in-depth analysis of Satellite Data Services market size, growth, and forecasts.

- ✔ Understand Satellite Data Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Data Services

What is the Market Size & CAGR of Satellite Data Services market in 2023?

Satellite Data Services Industry Analysis

Satellite Data Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Data Services Market Analysis Report by Region

Europe Satellite Data Services Market Report:

Europe's market is anticipated to increase from USD 5.09 billion in 2023 to USD 11.58 billion by 2033, bolstered by advancements in satellite technologies and governmental support for data-driven initiatives.Asia Pacific Satellite Data Services Market Report:

In the Asia Pacific region, the Satellite Data Services market is anticipated to grow from USD 2.96 billion in 2023 to USD 6.75 billion by 2033. This growth is propelled by increasing investments in satellite technology and a rising demand for satellite imagery and broadband services.North America Satellite Data Services Market Report:

North America is projected to witness significant growth from USD 5.38 billion in 2023 to USD 12.24 billion by 2033. The region's strong technological infrastructure and emphasis on defense and security applications are prime drivers.South America Satellite Data Services Market Report:

The market in South America is expected to expand from USD 0.26 billion in 2023 to USD 0.59 billion by 2033. Countries are increasingly recognizing the need for satellite data services for environmental management and disaster response.Middle East & Africa Satellite Data Services Market Report:

The Middle East and Africa are set to experience growth from USD 1.91 billion in 2023 to USD 4.36 billion by 2033. Enhanced telecommunications infrastructure and growing interest in satellite applications for agriculture and security are key developments in this region.Tell us your focus area and get a customized research report.

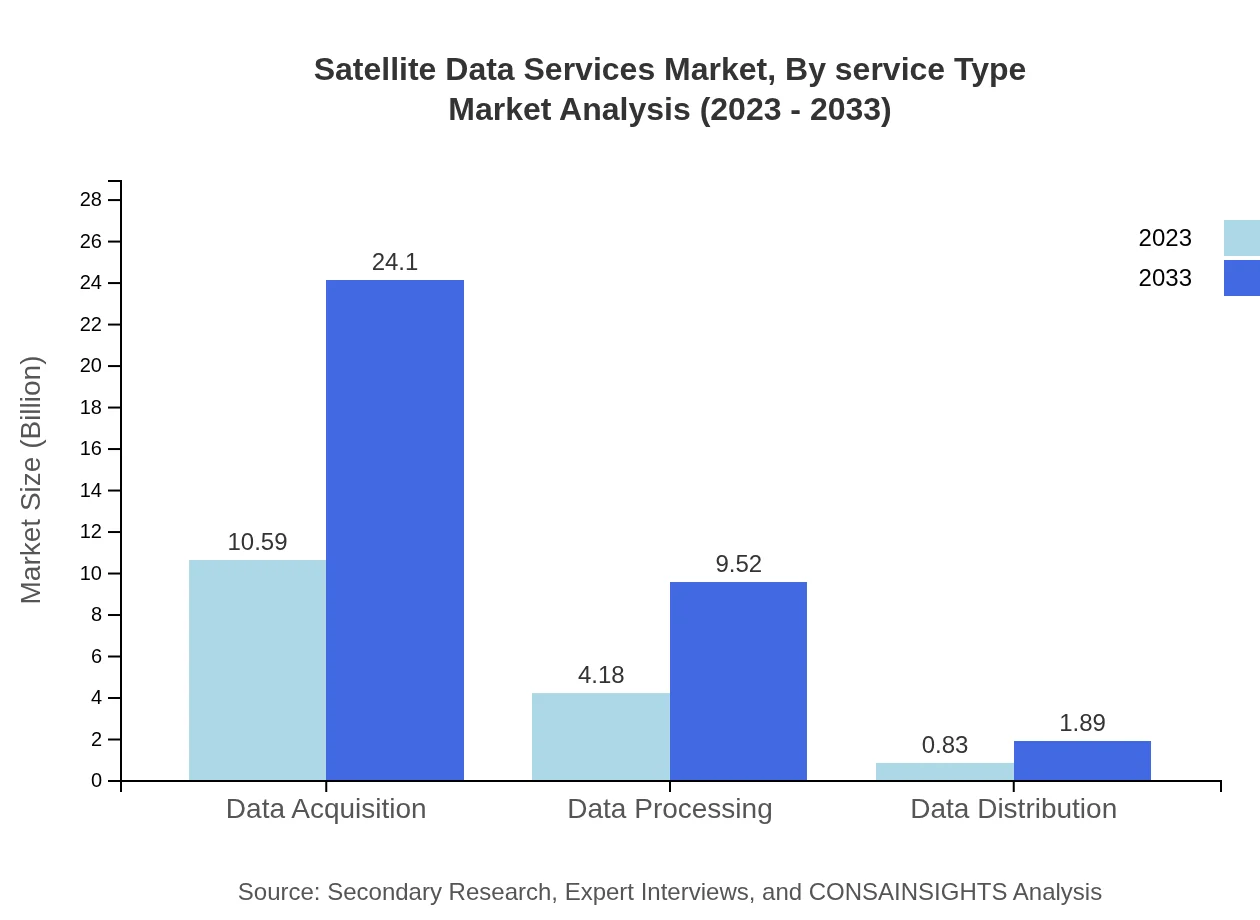

Satellite Data Services Market Analysis By Service Type

The Satellite Data Services segment comprises various service types like data acquisition, processing, and distribution. Data acquisition leads with a significant market size, projected at USD 10.59 billion in 2023, increasing to USD 24.10 billion by 2033, reflecting a share of 67.88%. Complementing this, data processing and analytics services are also experiencing growth owing to the rising need for actionable insights from raw data.

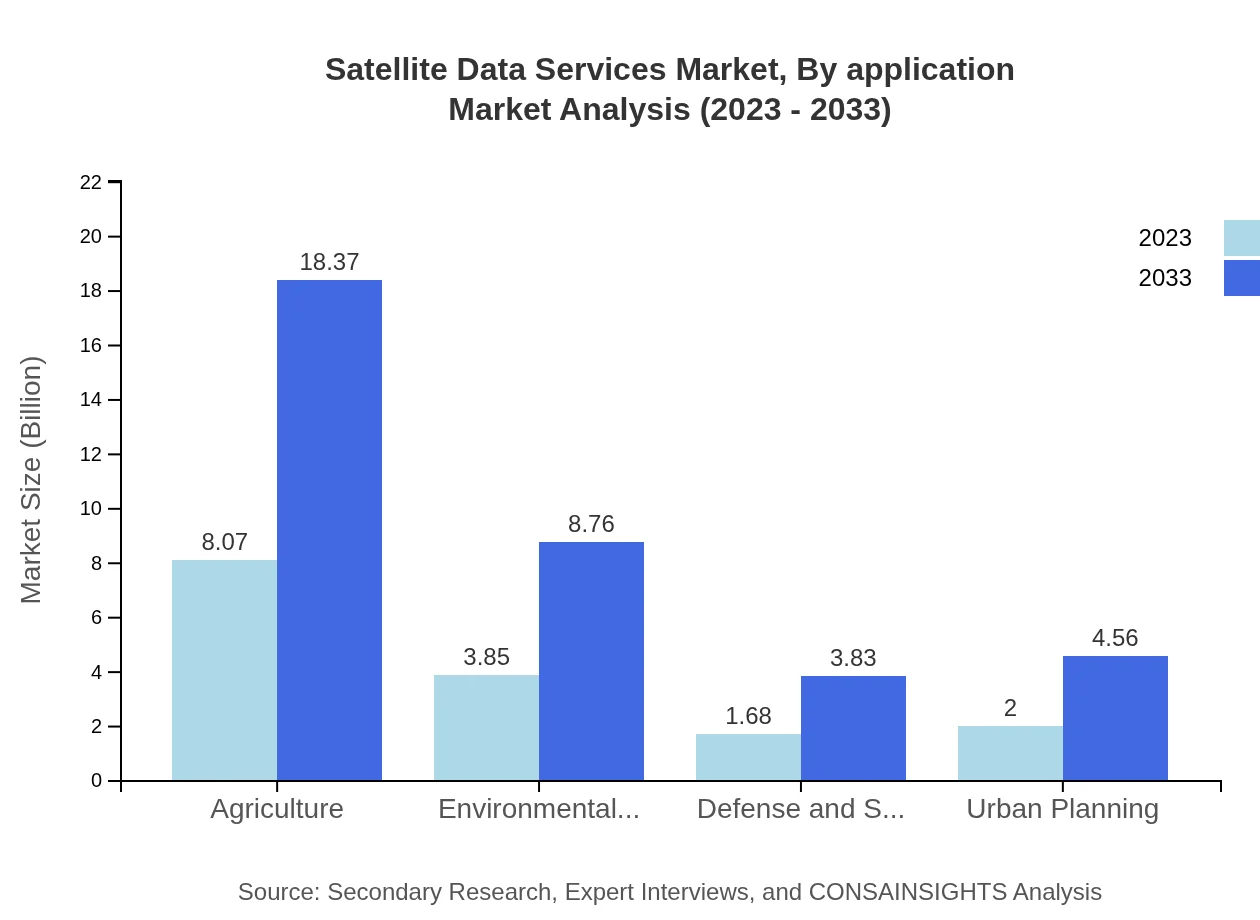

Satellite Data Services Market Analysis By Application

In the application segment, agriculture dominates with a market size of USD 8.07 billion in 2023, expected to reach USD 18.37 billion by 2033 (51.72% market share). Environmental monitoring is also integral, growing from USD 3.85 billion to USD 8.76 billion (24.66%). Other important applications include urban planning and defense, which continue to attract investments.

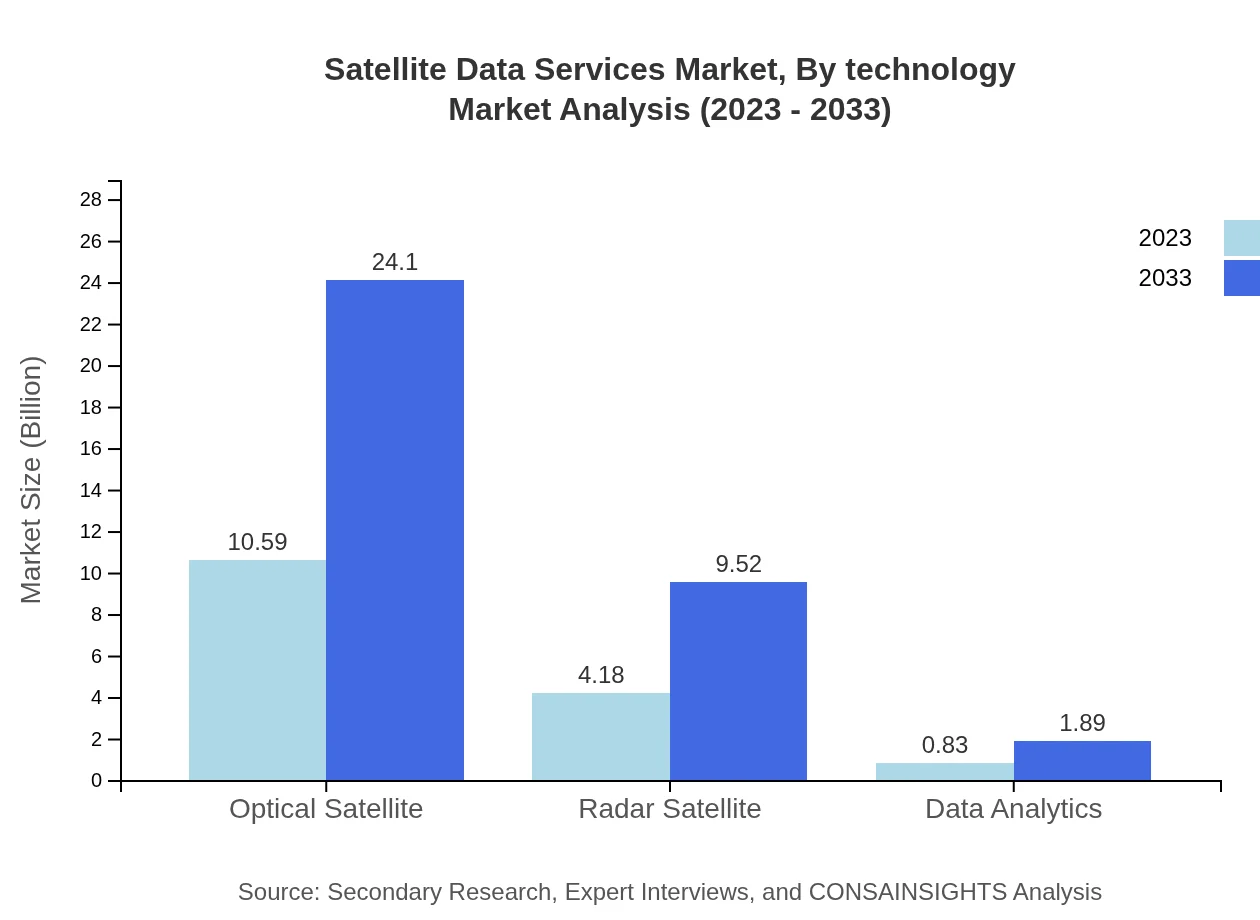

Satellite Data Services Market Analysis By Technology

The technologies involved in Satellite Data Services include Optical and Radar Satellites. Optical satellites dominate with a market size of USD 10.59 billion in 2023, expected to grow to USD 24.10 billion by 2033 (67.88% share). Radar satellites, while smaller, are growing from USD 4.18 billion to USD 9.52 billion during the same period (26.80%).

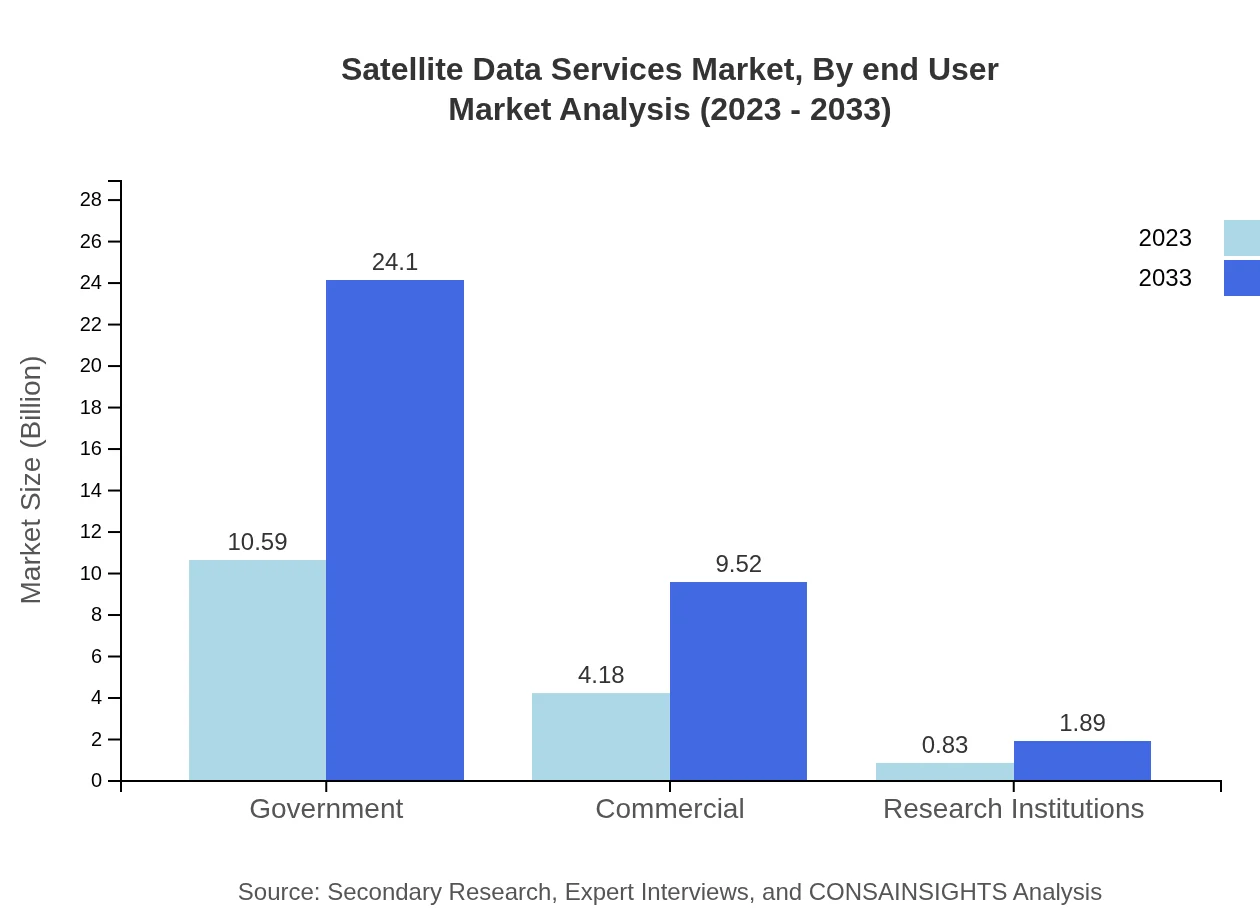

Satellite Data Services Market Analysis By End User

The end-user analysis highlights government as the leading segment with a market size of USD 10.59 billion in 2023, reaching USD 24.10 billion by 2033 (67.88%). Commercial users follow with substantial growth, moving from USD 4.18 billion to USD 9.52 billion (26.80%). Research institutions, although smaller, are also expected to rise from USD 0.83 billion to USD 1.89 billion.

Satellite Data Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Data Services Industry

Maxar Technologies:

A leader in earth imagery and geospatial analysis services, providing high-resolution satellite imagery and solutions for various applications.Airbus Defence and Space:

Offers comprehensive satellite data services, leveraging advanced technology for defense, civil, and commercial sectors globally.Planet Labs:

Pioneers of a fleet of earth-imaging satellites, providing daily insights for agriculture, monitoring, and urban planning applications.Hexagon AB:

A global leader in digital solutions, Hexagon integrates satellite data to enhance decision-making processes across industry verticals.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite Data Services?

The satellite data services market is valued at approximately $15.6 billion in 2023 and is projected to grow at a CAGR of 8.3%, potentially reaching much larger figures by 2033 as demand increases across various sectors.

What are the key market players or companies in this satellite Data Services industry?

Key players in the satellite data services industry include companies specializing in satellite technology, data analytics, and related services. These include firms known for utilizing satellite data for applications in agriculture, environmental monitoring, and urban planning.

What are the primary factors driving the growth in the satellite Data Services industry?

Growth in the satellite data services industry is primarily driven by technological advancements in satellite imagery and data analytics, increasing demand for real-time data in sectors like agriculture, urban planning, and environmental monitoring, and enhanced governmental support for satellite research.

Which region is the fastest Growing in the satellite Data Services?

The fastest-growing region in the satellite data services market is Europe, expected to expand from $5.09 billion in 2023 to $11.58 billion by 2033, reflecting significant investments and advancements in satellite technology.

Does ConsaInsights provide customized market report data for the satellite Data Services industry?

Yes, ConsaInsights provides customized market report data tailored to client needs within the satellite data services industry, ensuring you have the most relevant insights for strategic decision-making.

What deliverables can I expect from this satellite Data Services market research project?

Deliverables from the satellite data services market research project typically include comprehensive reports, market forecasts, competitive analysis, and insights on emerging trends to inform strategy and investment decisions.

What are the market trends of satellite Data Services?

Current trends in the satellite data services sector include increased emphasis on data analytics, the rise of optical and radar satellites, and growing applications in agriculture and environmental monitoring, as industries leverage satellite data for advanced insights.