Satellite Manufacturing And Launch Systems Market Report

Published Date: 03 February 2026 | Report Code: satellite-manufacturing-and-launch-systems

Satellite Manufacturing And Launch Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Satellite Manufacturing And Launch Systems market, covering current trends, market forecasts from 2023 to 2033, and detailed insights into industry developments, segmentation, and regional dynamics.

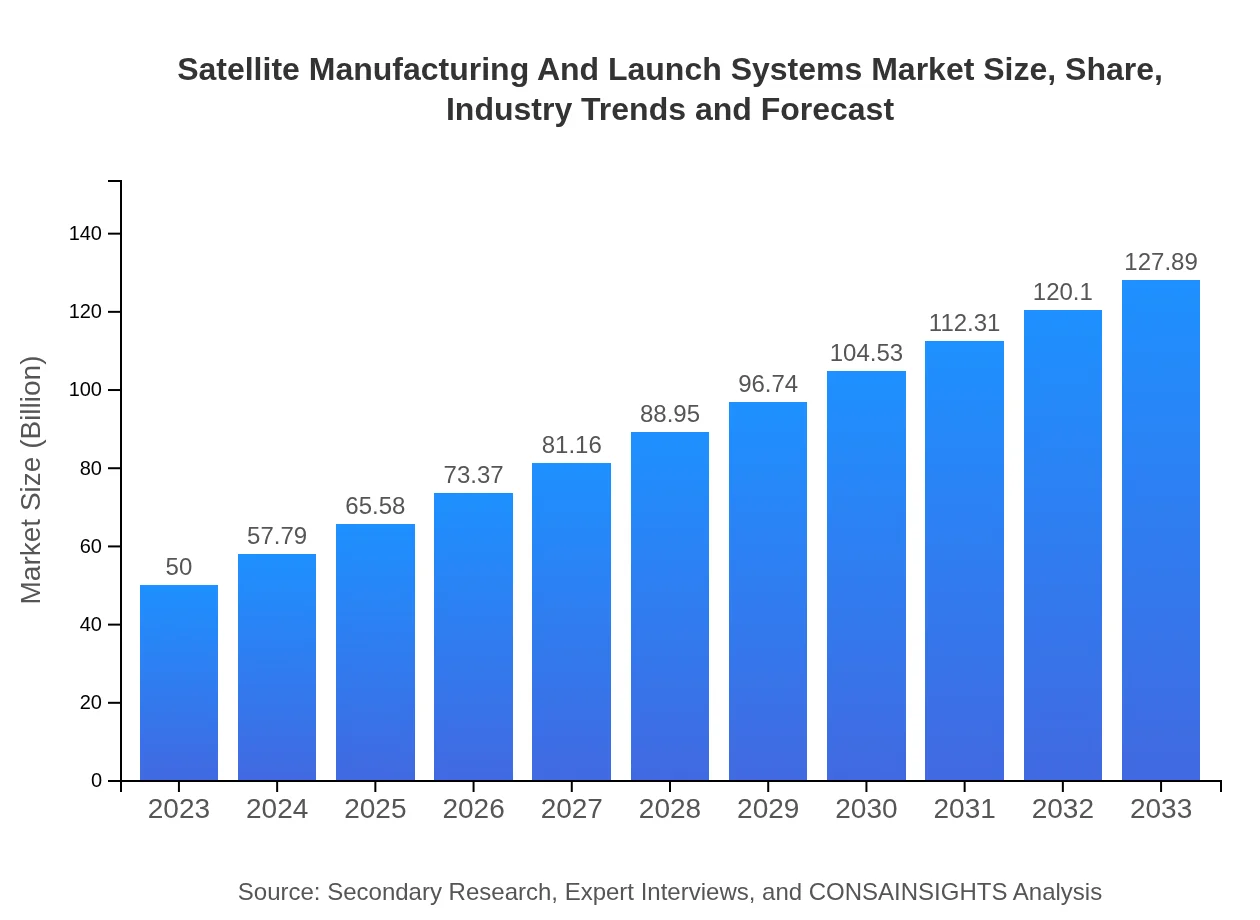

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $127.89 Billion |

| Top Companies | Boeing , Lockheed Martin, Northrop Grumman, SpaceX, Airbus |

| Last Modified Date | 03 February 2026 |

Satellite Manufacturing And Launch Systems Market Overview

Customize Satellite Manufacturing And Launch Systems Market Report market research report

- ✔ Get in-depth analysis of Satellite Manufacturing And Launch Systems market size, growth, and forecasts.

- ✔ Understand Satellite Manufacturing And Launch Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Manufacturing And Launch Systems

What is the Market Size & CAGR of Satellite Manufacturing And Launch Systems market in 2033?

Satellite Manufacturing And Launch Systems Industry Analysis

Satellite Manufacturing And Launch Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Manufacturing And Launch Systems Market Analysis Report by Region

Europe Satellite Manufacturing And Launch Systems Market Report:

The European market is projected to grow from $13.13 billion in 2023 to $33.60 billion by 2033, driven by various collaborative programs, including the European Space Agency initiatives and increasing commercial satellite launches.Asia Pacific Satellite Manufacturing And Launch Systems Market Report:

The Asia Pacific region is anticipated to witness rapid growth in the Satellite Manufacturing And Launch Systems market, projected to expand from $10.82 billion in 2023 to $27.68 billion by 2033. This growth is fueled by a surge in satellite launches and increasing demand for satellite services in countries like India and China, which are significantly investing in space exploration and satellite communications.North America Satellite Manufacturing And Launch Systems Market Report:

North America remains the largest market for Satellite Manufacturing And Launch Systems, with estimates to grow from $18.52 billion in 2023 to $47.38 billion by 2033. The presence of key players, increased funding from both government and private sectors, and growing demand for advanced satellite applications bolster this growth.South America Satellite Manufacturing And Launch Systems Market Report:

In South America, the market is expected to grow from $3.15 billion in 2023 to $8.07 billion by 2033. Countries like Brazil are focusing on satellite technology to improve regional communications and disaster management capabilities, making the market an attractive area for development and investment.Middle East & Africa Satellite Manufacturing And Launch Systems Market Report:

The Middle East and Africa market is forecasted to grow from $4.37 billion in 2023 to $11.17 billion by 2033, driven by burgeoning interest in satellite data for services like telecommunications and natural resource management.Tell us your focus area and get a customized research report.

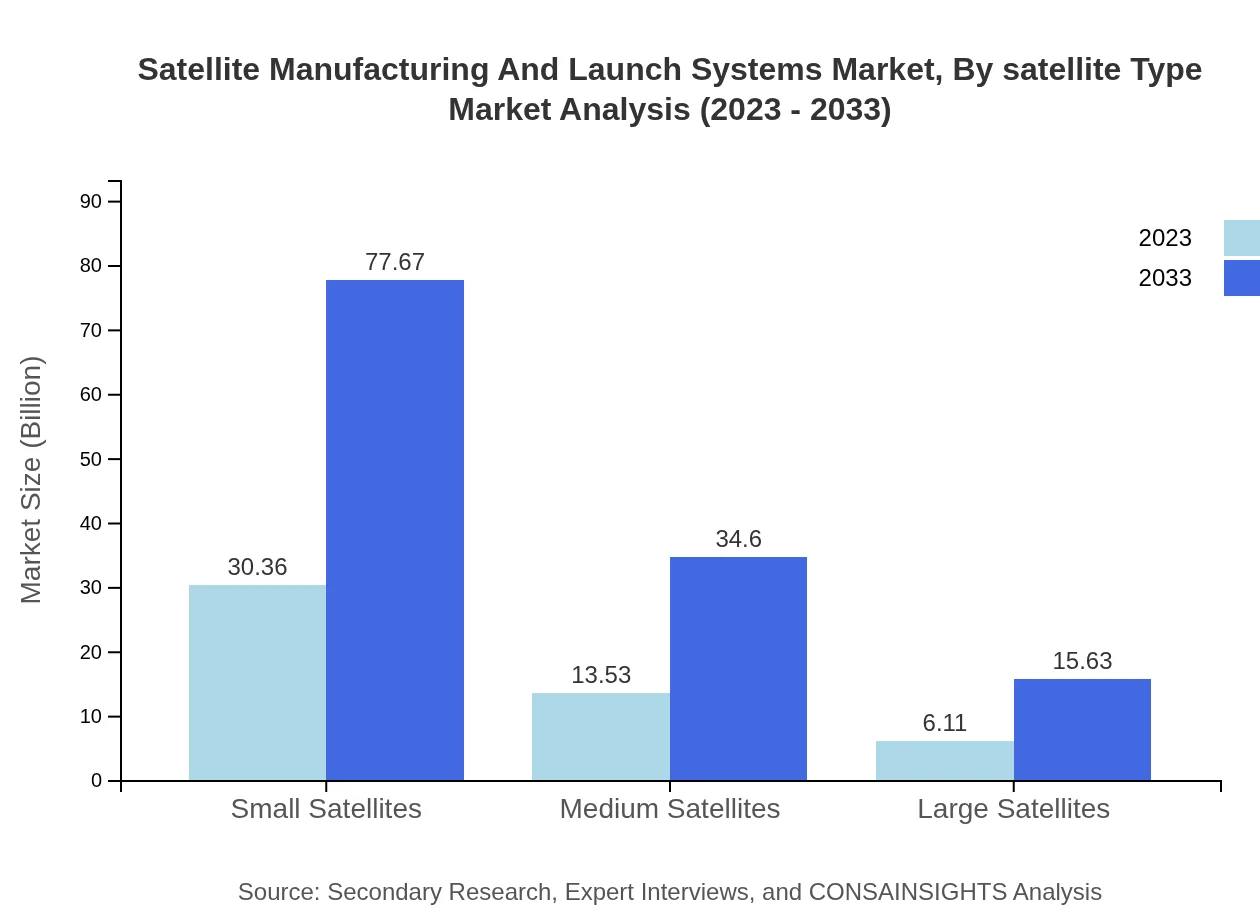

Satellite Manufacturing And Launch Systems Market Analysis By Satellite Type

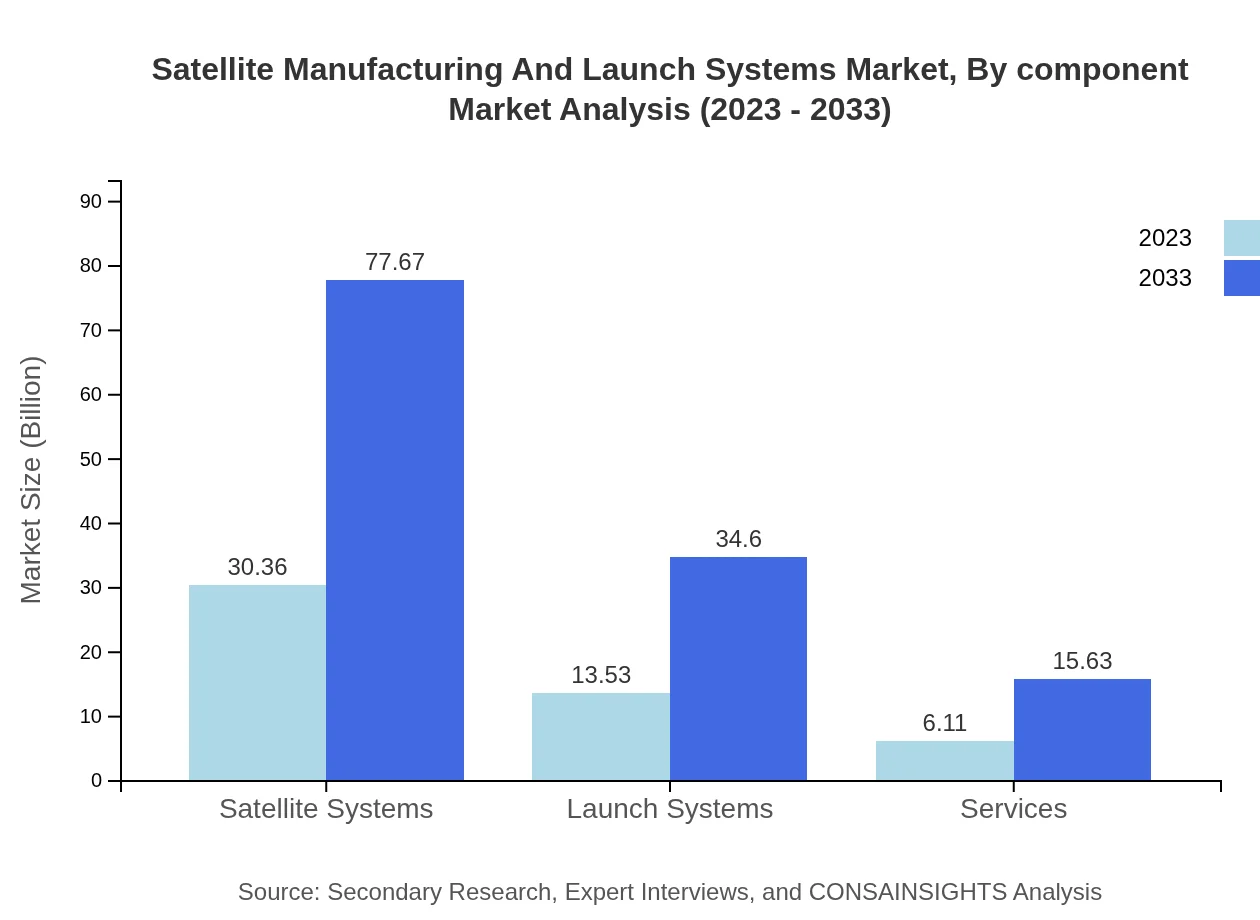

The segment of Satellite Manufacturing and Launch Systems by satellite type is experiencing significant growth. For instance, small satellites have surged in popularity, with market size escalating from $30.36 billion in 2023 to $77.67 billion in 2033. The growing demand for agile and cost-effective solutions motivates this trend. Similarly, medium satellites will increase from $13.53 billion to $34.60 billion, while large satellites are expected to grow from $6.11 billion to $15.63 billion, reflecting diverse applications for these technologies.

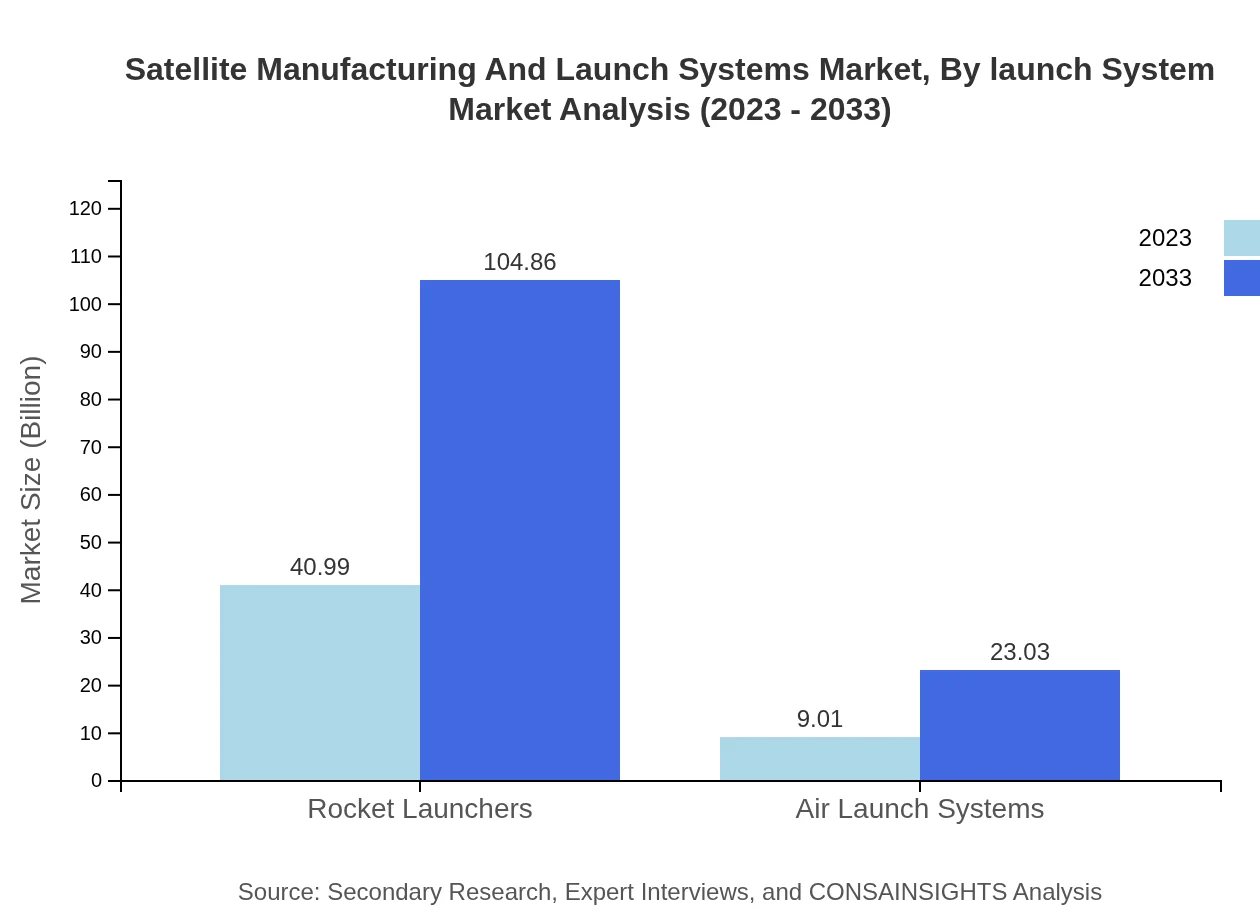

Satellite Manufacturing And Launch Systems Market Analysis By Launch System

The launch system segment holds notable market shares, with rocket launchers dominating this category, projected to grow from $40.99 billion in 2023 to $104.86 billion in 2033. Alternative launch systems, such as air launch systems, also demonstrate promising growth from $9.01 billion to $23.03 billion, showcasing the evolving dynamics of the launch landscape.

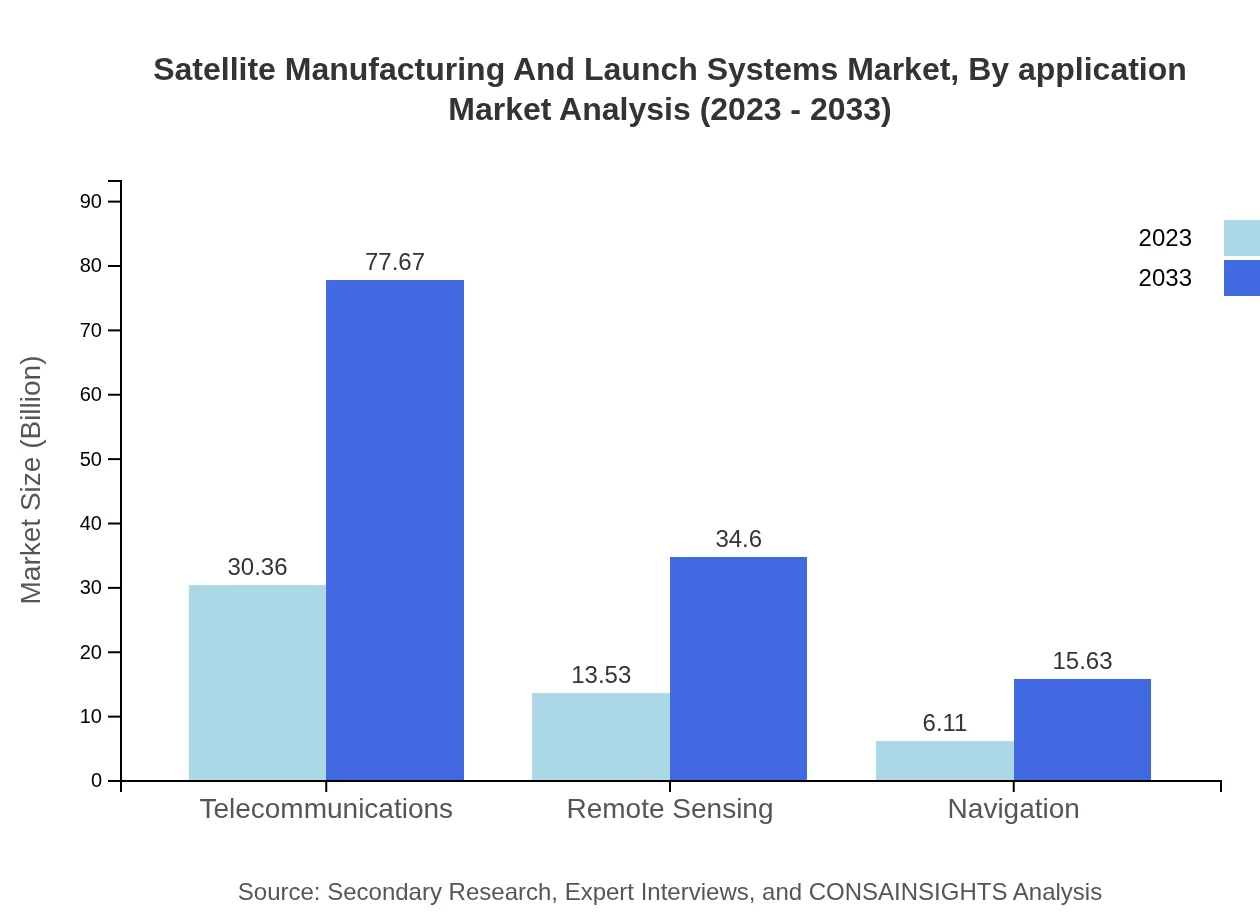

Satellite Manufacturing And Launch Systems Market Analysis By Application

By application, the telecommunications segment leads the market, expected to grow from $30.36 billion in 2023 to $77.67 billion in 2033. This is fueled by increasing internet connectivity needs globally. Remote sensing and navigation applications equally show growth, moving from $13.53 billion and $6.11 billion in 2023 to $34.60 billion and $15.63 billion respectively, as these technologies broaden their reach in various industry sectors.

Satellite Manufacturing And Launch Systems Market Analysis By Component

The market is further segmented by components, focusing on hardware, software, and services. Hardware remains a critical part, with continual innovations enhancing satellite performance while services are also evolving to offer sustained support post-launch. The total components market is on the rise owing to increased focus on customized satellite platforms to reduce cost and time for launches.

Satellite Manufacturing And Launch Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Manufacturing And Launch Systems Industry

Boeing :

A leading aerospace company that provides satellite systems and services, contributing significantly to NASA missions and commercial satellite launches.Lockheed Martin:

A global security and aerospace company, involved in the design and manufacturing of satellites while also engaging in numerous government satellite initiatives.Northrop Grumman:

Specializes in satellite systems and solutions, particularly in the defense sector, addressing national security considerations.SpaceX:

Innovative leader in commercial space flight and satellite operations, famously known for their reusable rocket technology and Starlink satellite constellation.Airbus:

A prominent player in satellite production and design, with a strong footprint in both commercial and governmental satellite services worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite Manufacturing And Launch Systems?

The satellite manufacturing and launch systems market is anticipated to be valued at approximately $50 billion in 2023, and it is projected to grow at a CAGR of 9.5% over the next decade, indicating robust industry expansion.

What are the key market players or companies in this satellite Manufacturing And Launch Systems industry?

Key players in the satellite manufacturing and launch systems industry include major aerospace and defense companies like SpaceX, Boeing, Airbus Defense and Space, Lockheed Martin, and Northrop Grumman, which dominate the market through innovation and extensive manufacturing capabilities.

What are the primary factors driving the growth in the satellite Manufacturing And Launch Systems industry?

Growth drivers for the satellite manufacturing and launch systems market encompass the increasing demand for satellite-based services, advancements in technology, expanding applications in telecommunications, Earth observation, and navigation, along with a push towards reduced launch costs.

Which region is the fastest Growing in the satellite Manufacturing And Launch Systems?

The fastest-growing region in the satellite manufacturing and launch systems market is North America, where the market is expected to increase from $18.52 billion in 2023 to $47.38 billion in 2033, reflecting significant regional investment in aerospace technology and infrastructure.

Does ConsaInsights provide customized market report data for the satellite Manufacturing And Launch Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the satellite manufacturing and launch systems industry, allowing clients to gain specific insights based on unique requirements and deepen their understanding of market dynamics.

What deliverables can I expect from this satellite Manufacturing And Launch Systems market research project?

Deliverables from the satellite manufacturing and launch systems market research project typically include detailed market analysis reports, insights into market trends, forecasts, competitive landscape evaluations, and recommendations for strategic planning.

What are the market trends of satellite Manufacturing And Launch Systems?

Current trends in the satellite manufacturing and launch systems market include the increasing miniaturization of satellites, the rise of small satellite launches, growth in global satellite internet services, and the adoption of reusable launch vehicles to decrease operational costs.