Satellite Modems Market Report

Published Date: 31 January 2026 | Report Code: satellite-modems

Satellite Modems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Satellite Modems market from 2023 to 2033, covering market size, growth forecasts, segmentation by technology and application, regional insights, and industry leaders, aimed at offering actionable insights for stakeholders.

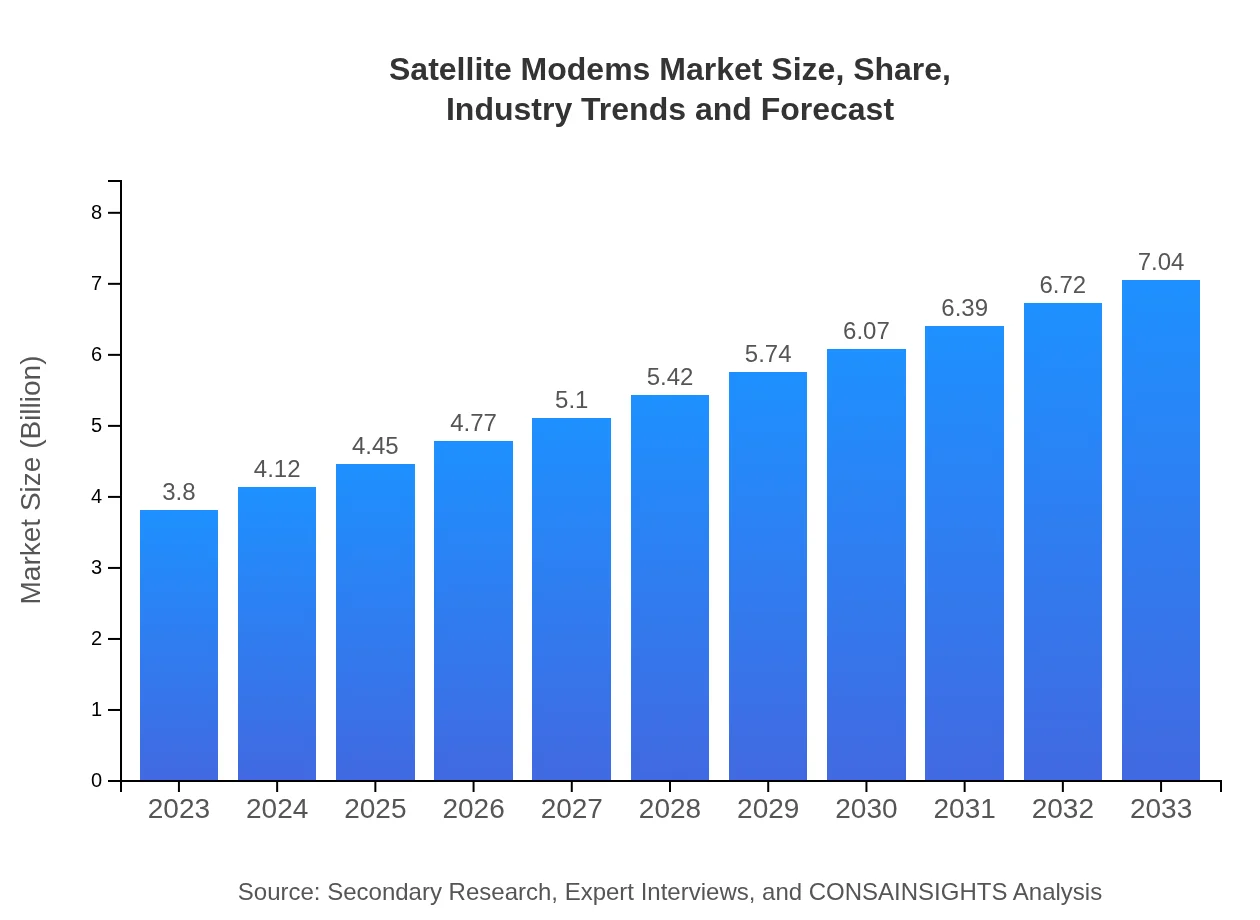

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $7.04 Billion |

| Top Companies | Hughes Network Systems, Viasat Inc., Gilat Satellite Networks Ltd., SES S.A., Comtech Telecommunications Corp. |

| Last Modified Date | 31 January 2026 |

Satellite Modems Market Overview

Customize Satellite Modems Market Report market research report

- ✔ Get in-depth analysis of Satellite Modems market size, growth, and forecasts.

- ✔ Understand Satellite Modems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Modems

What is the Market Size & CAGR of Satellite Modems market in 2023?

Satellite Modems Industry Analysis

Satellite Modems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Modems Market Analysis Report by Region

Europe Satellite Modems Market Report:

Europe is anticipated to grow from USD 1.06 billion in 2023 to USD 1.96 billion by 2033. The market is driven by government initiatives to enhance broadband access and the increasing utilization of satellite modems for broadcasting and streaming services.Asia Pacific Satellite Modems Market Report:

In the Asia Pacific region, the Satellite Modems market is expected to grow from USD 0.73 billion in 2023 to USD 1.35 billion by 2033, driven by rapid infrastructure development and increasing demand for communication services in remote locations. Countries like India and China are adopting satellite technologies to bridge the digital divide.North America Satellite Modems Market Report:

North America is one of the leading markets, with its size expected to increase from USD 1.41 billion in 2023 to USD 2.61 billion by 2033. This growth is propelled by significant investments in satellite communication infrastructure, advancements in 5G technology, and the presence of major technology companies in the satellite domain.South America Satellite Modems Market Report:

The South American market, although smaller, is projected to grow from USD 0.13 billion in 2023 to USD 0.24 billion by 2033. The expansion is supported by investments in satellite broadband services aimed at improving connectivity in rural and remote areas, particularly in Brazil and Argentina.Middle East & Africa Satellite Modems Market Report:

The Middle East and Africa region will see a market growth from USD 0.48 billion in 2023 to USD 0.88 billion by 2033, fueled by developing telecommunications infrastructure and rising demand for broadband connectivity, particularly in the UAE and South Africa.Tell us your focus area and get a customized research report.

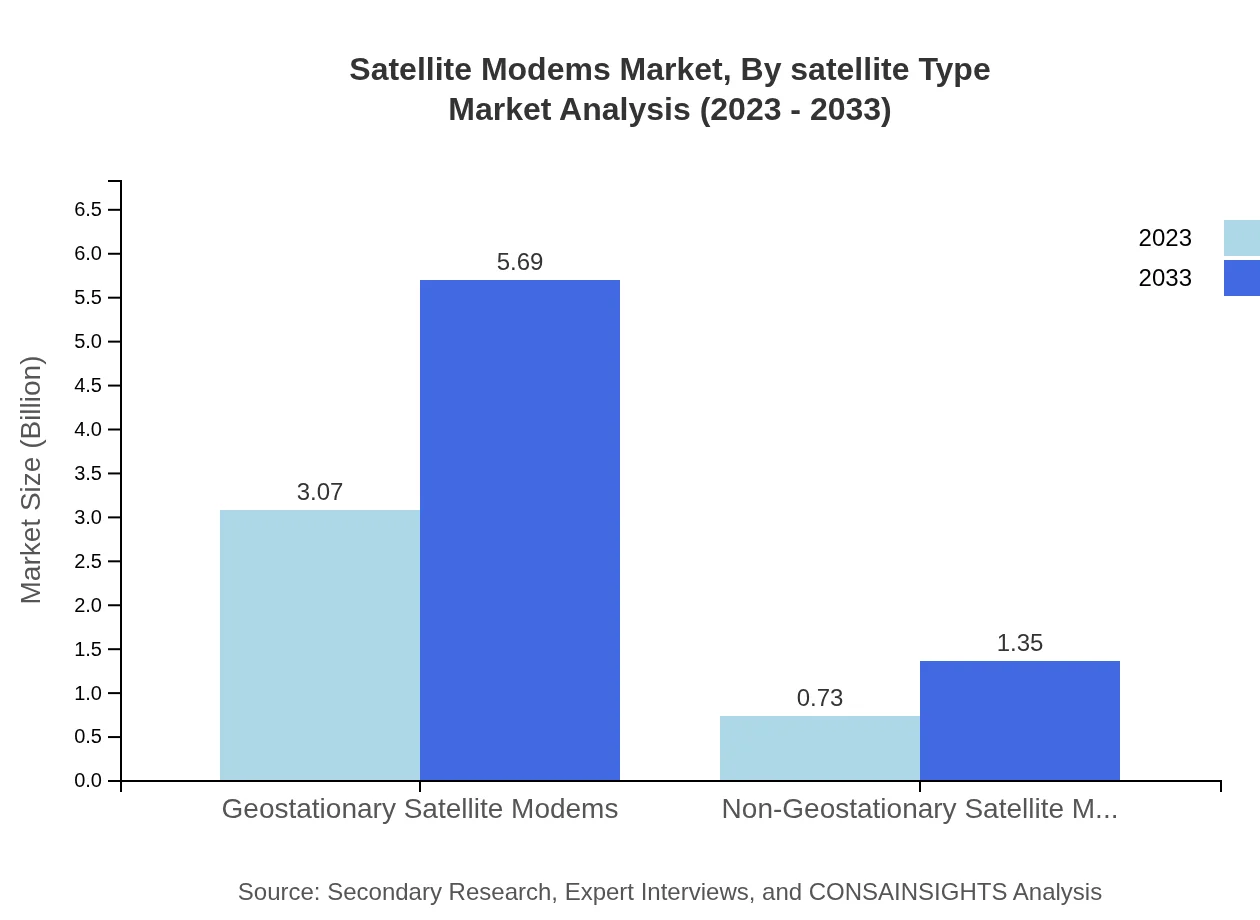

Satellite Modems Market Analysis By Satellite Type

The market is predominantly occupied by Geostationary Satellite Modems, which hold a share of 80.84%. In 2023, this segment is valued at USD 3.07 billion and is expected to reach USD 5.69 billion by 2033. In contrast, Non-Geostationary Satellite Modems are gaining traction with market values of USD 0.73 billion in 2023 and projected growth to USD 1.35 billion by 2033.

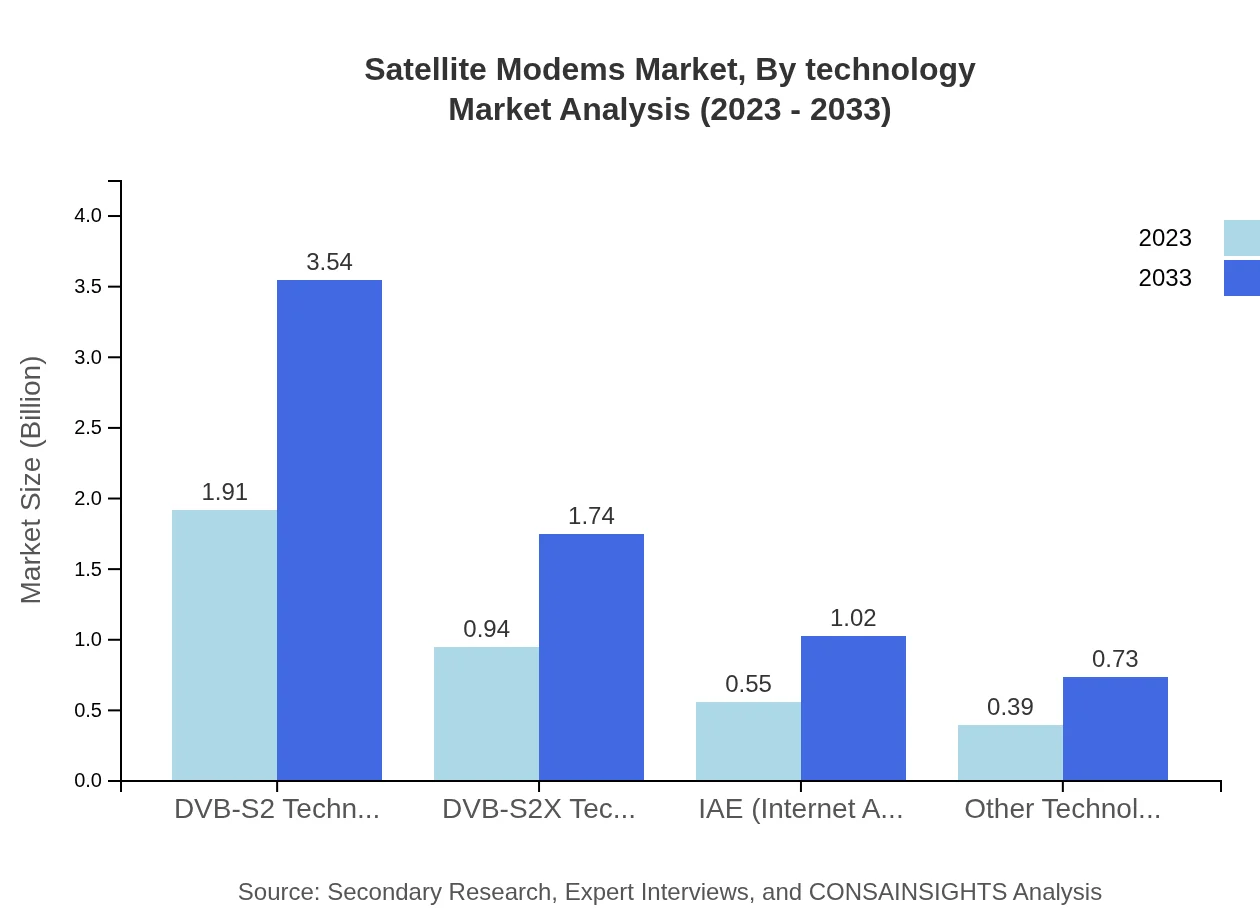

Satellite Modems Market Analysis By Technology

DVB-S2 Technology presently holds a significant share of 50.34% in the Satellite Modems market, with a projected size of USD 1.91 billion in 2023, expanding to USD 3.54 billion by 2033. Meanwhile, DVB-S2X Technology, sharing approximately 24.77% of the market, is anticipated to reach USD 1.74 billion from USD 0.94 billion over the same period.

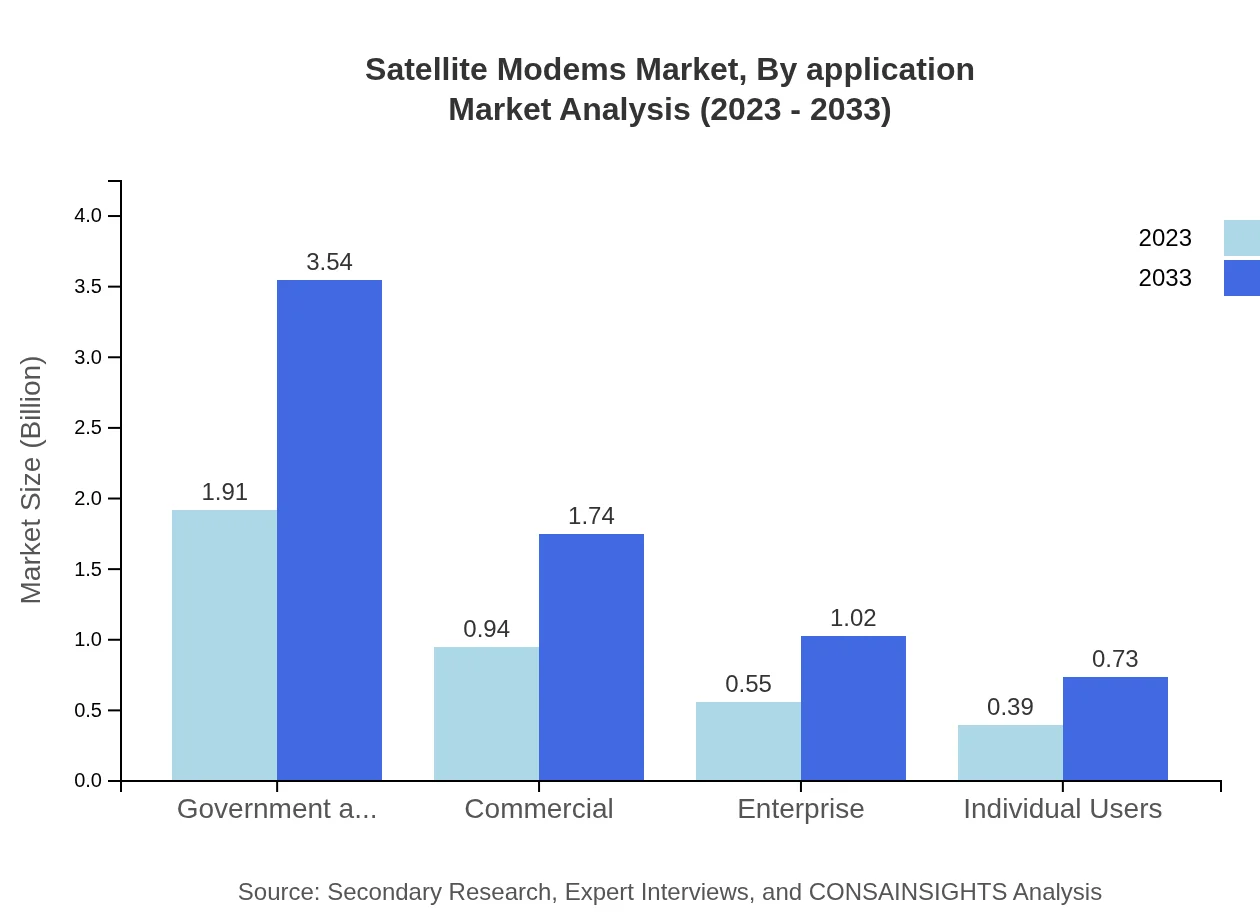

Satellite Modems Market Analysis By Application

The Government and Military application segment dominates with a market size of USD 1.91 billion in 2023, expected to grow to USD 3.54 billion by 2033. The Commercial segment contributes USD 0.94 billion currently, forecasting to rise to USD 1.74 billion, while the Individual Users segment holds a smaller portion, valued at USD 0.39 billion, projected to grow to USD 0.73 billion.

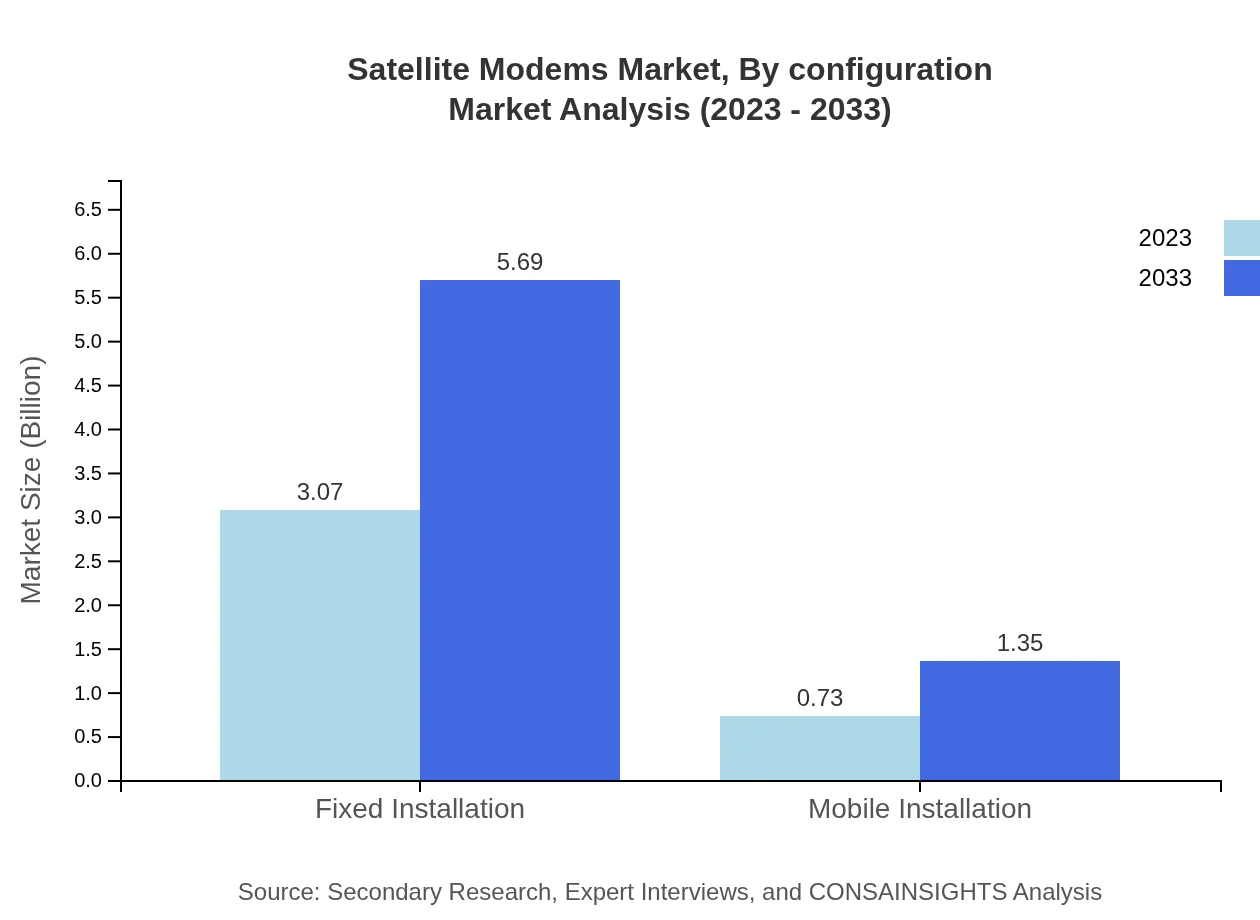

Satellite Modems Market Analysis By Configuration

Fixed Installation types dominate the segment, accounting for 80.84% of the market share, with a size of USD 3.07 billion today and an anticipated growth to USD 5.69 billion by 2033. Mobile Installation, representing 19.16%, is projected to grow from USD 0.73 billion to USD 1.35 billion.

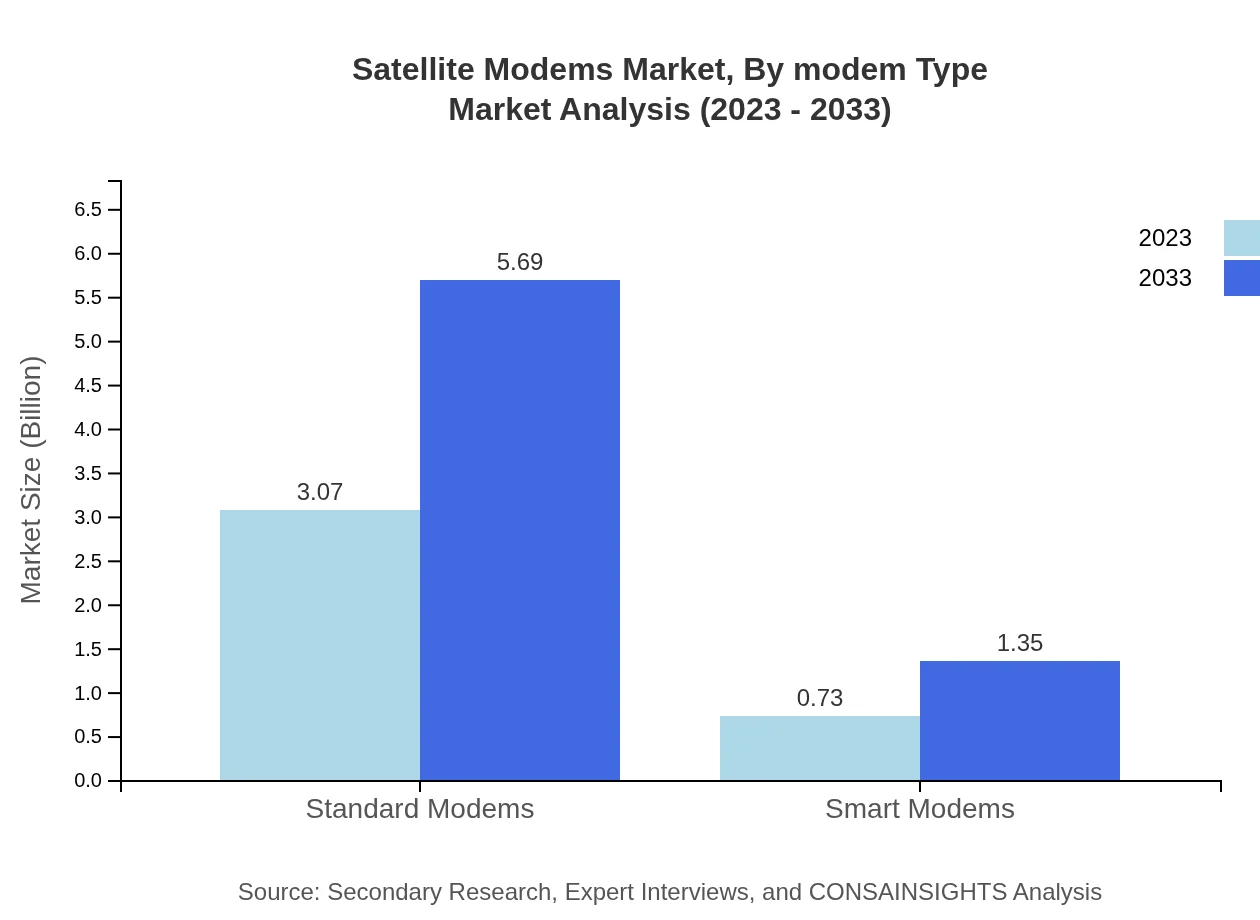

Satellite Modems Market Analysis By Modem Type

Standard Modems command a significant share with a market size of USD 3.07 billion in 2023, expected to grow to USD 5.69 billion over ten years. In contrast, Smart Modems currently valued at USD 0.73 billion are projected to increase to USD 1.35 billion, indicating growing interest in advanced modem technologies.

Satellite Modems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Modems Industry

Hughes Network Systems:

A pioneer in satellite broadband services, Hughes Network Systems provides a range of modems optimized for various applications, including satellite internet for residential and commercial use.Viasat Inc.:

Viasat specializes in high-performance satellite communication systems and modems, ensuring high-speed internet connectivity across various sectors, including aviation and government services.Gilat Satellite Networks Ltd.:

Gilat offers end-to-end satellite networking solutions and modems, focusing on delivering broadband connectivity to remote locations globally.SES S.A.:

SES is a notable player in satellite communications, providing innovative solutions and satellite modems for a wide range of applications, enhancing global connectivity.Comtech Telecommunications Corp.:

Comtech designs and develops satellite modems and communication equipment, contributing significantly to the defense and commercial sectors with versatile connectivity solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite Modems?

The satellite modems market is currently valued at approximately $3.8 billion and is projected to grow at a CAGR of 6.2% over the next decade, indicating strong demand and potential investment opportunities.

What are the key market players or companies in the satellite Modems industry?

Key players in the satellite-modems industry include major companies such as Hughes Network Systems, Viasat, Inmarsat, and Modemtech, driving innovation and competition within the market.

What are the primary factors driving the growth in the satellite modems industry?

Factors driving growth in the satellite modems industry include increased demand for broadband connectivity, expanding Internet of Things (IoT) applications, and advancements in satellite technology enhancing communication capabilities.

Which region is the fastest Growing in the satellite Modems market?

The Asia Pacific region is the fastest-growing in the satellite-modems market, projected to expand from $0.73 billion in 2023 to $1.35 billion by 2033, driven by increasing connectivity requirements and infrastructure development.

Does ConsInsights provide customized market report data for the satellite Modems industry?

Yes, ConsInsights offers customized market report data tailored to client specifications, allowing businesses to gain insights specific to the satellite-modems industry and drive informed decision-making.

What deliverables can I expect from this satellite Modems market research project?

Clients can expect comprehensive deliverables including market analysis, growth forecasts, regional insights, competitive landscape assessments, and detailed segment analyses, providing a holistic view of the satellite-modems market.

What are the market trends of satellite Modems?

Current market trends in satellite modems include the rise of smart modems, the transition to DVB-S2X technology, increased demand for mobile installations, and the expansion of market segments in government, military, and commercial applications.