Satellite Payloads Market Report

Published Date: 31 January 2026 | Report Code: satellite-payloads

Satellite Payloads Market Size, Share, Industry Trends and Forecast to 2033

This report covers the Satellite Payloads market, offering insights and detailed data from 2023 to 2033. It explores various factors influencing growth, regional dynamics, industry analysis, and emerging trends within the sector.

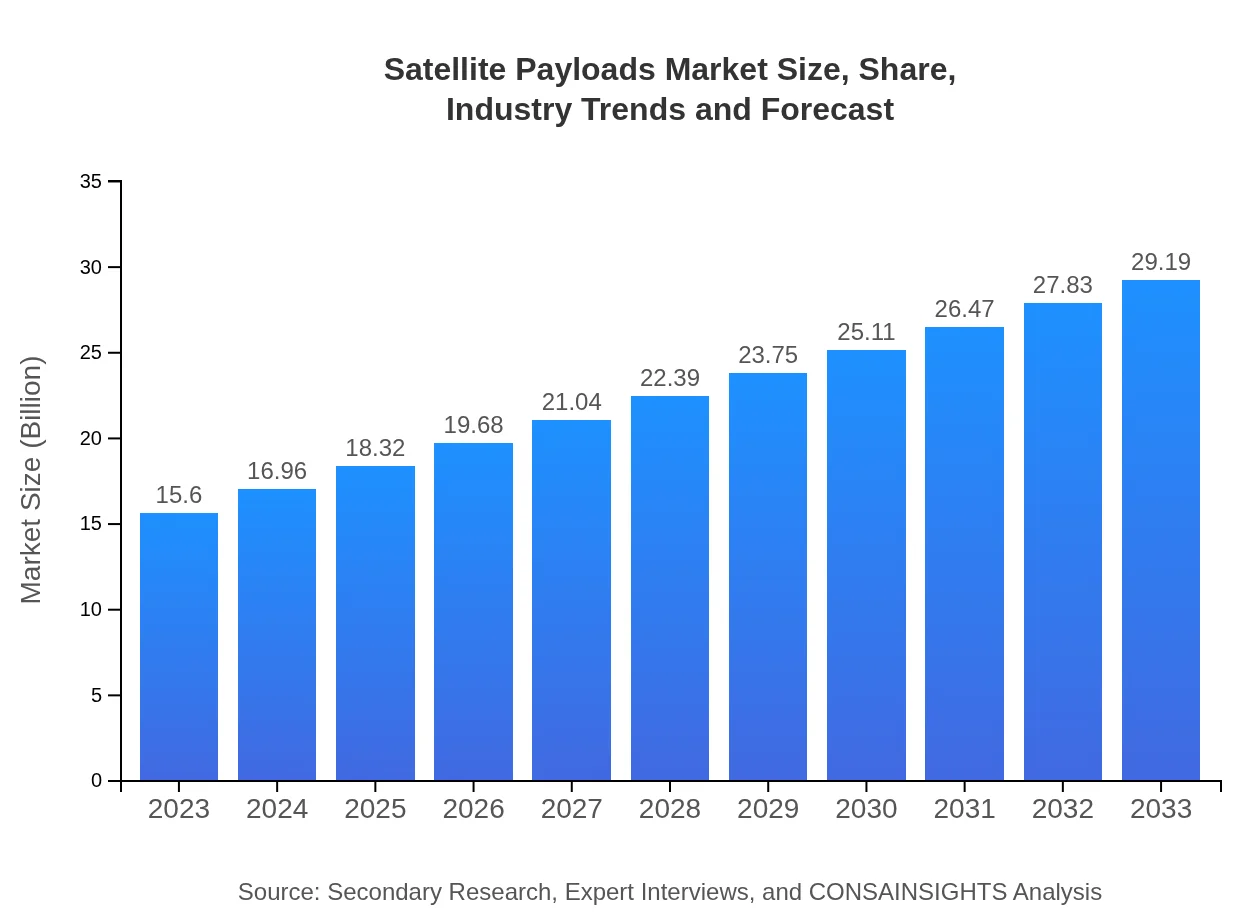

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $29.19 Billion |

| Top Companies | Lockheed Martin, Northrop Grumman, Airbus, Boeing |

| Last Modified Date | 31 January 2026 |

Satellite Payloads Market Overview

Customize Satellite Payloads Market Report market research report

- ✔ Get in-depth analysis of Satellite Payloads market size, growth, and forecasts.

- ✔ Understand Satellite Payloads's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Payloads

What is the Market Size & CAGR of Satellite Payloads market in 2023?

Satellite Payloads Industry Analysis

Satellite Payloads Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Payloads Market Analysis Report by Region

Europe Satellite Payloads Market Report:

In 2023, the European Satellite Payloads market is at $4.00 billion and will expand to $7.48 billion by 2033, spurred by innovation in satellite technologies and the European Space Agency’s initiatives to enhance satellite connectivity and capabilities.Asia Pacific Satellite Payloads Market Report:

In 2023, the Satellite Payloads market in Asia Pacific is valued at $3.18 billion and is projected to reach $5.96 billion by 2033, displaying a significant growth trajectory primarily driven by increased investment in satellite infrastructure for telecommunications and surveillance. Countries like India and China are leading the way in satellite launches and development, underpinning regional growth.North America Satellite Payloads Market Report:

North America holds the largest share of the Satellite Payloads market, valued at $5.82 billion in 2023, expected to reach $10.89 billion by 2033. The region benefits from robust governmental and commercial investment in advanced satellite technologies, significantly driven by military applications and the expansion of satellite communication services.South America Satellite Payloads Market Report:

The South American Satellite Payloads market is estimated at $0.85 billion in 2023, forecasted to grow to $1.60 billion by 2033. The growing emphasis on environmental monitoring and disaster relief initiatives is boosting demand, with countries like Brazil and Argentina investing in satellite technologies.Middle East & Africa Satellite Payloads Market Report:

The Middle East and Africa market is valued at $1.74 billion with a projection of $3.26 billion by 2033. The region's increasing focus on security and communications infrastructure is leading to higher investments in satellite payload technologies.Tell us your focus area and get a customized research report.

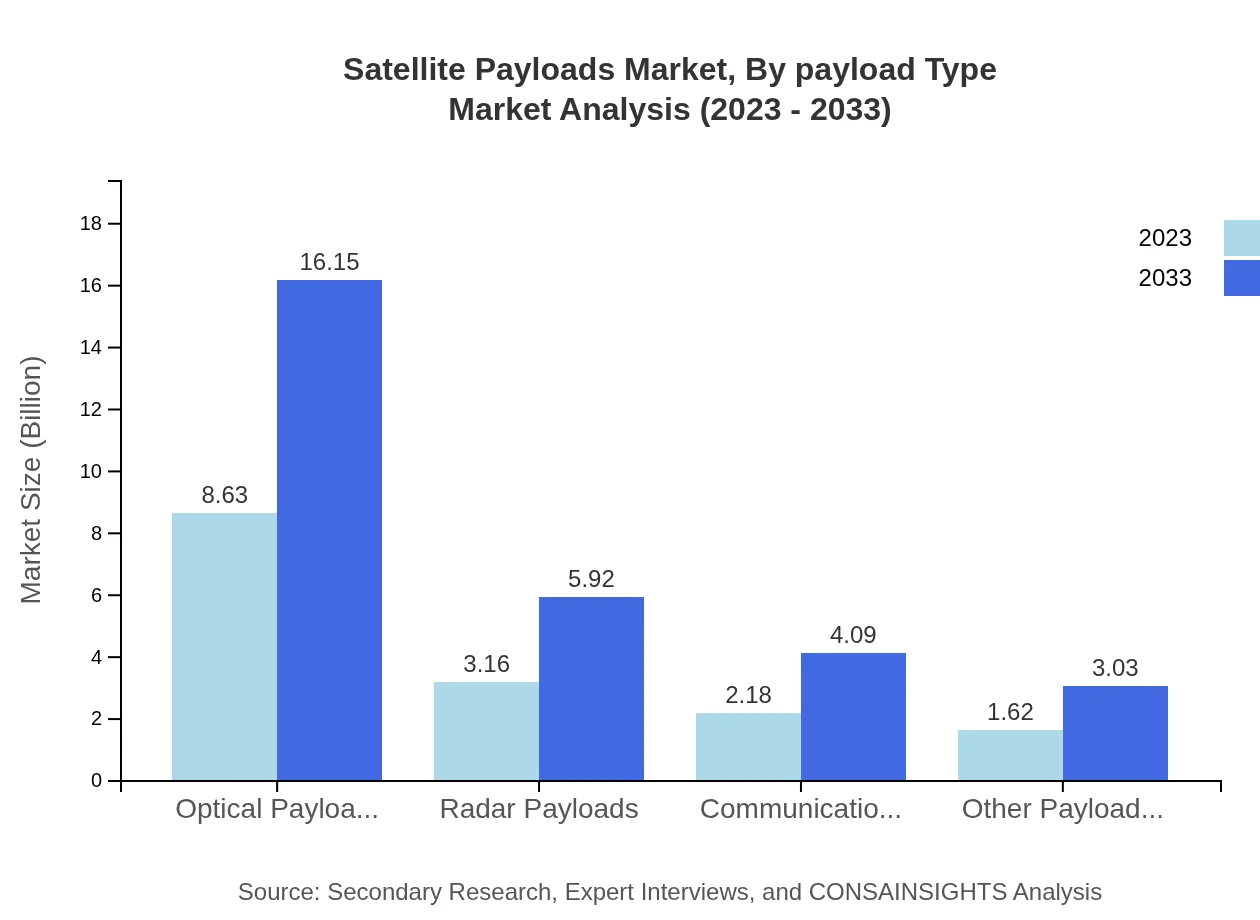

Satellite Payloads Market Analysis By Payload Type

The payload type segment reveals unique dynamics with Optical Payloads commanding a significant market size of $8.63 billion in 2023, expected to double by 2033. Radar Payloads encompass $3.16 billion in 2023, driven by military and atmospheric studies. Communication Payloads and other types show steady growth, catering to the business and societal needs for connectivity and data transmission.

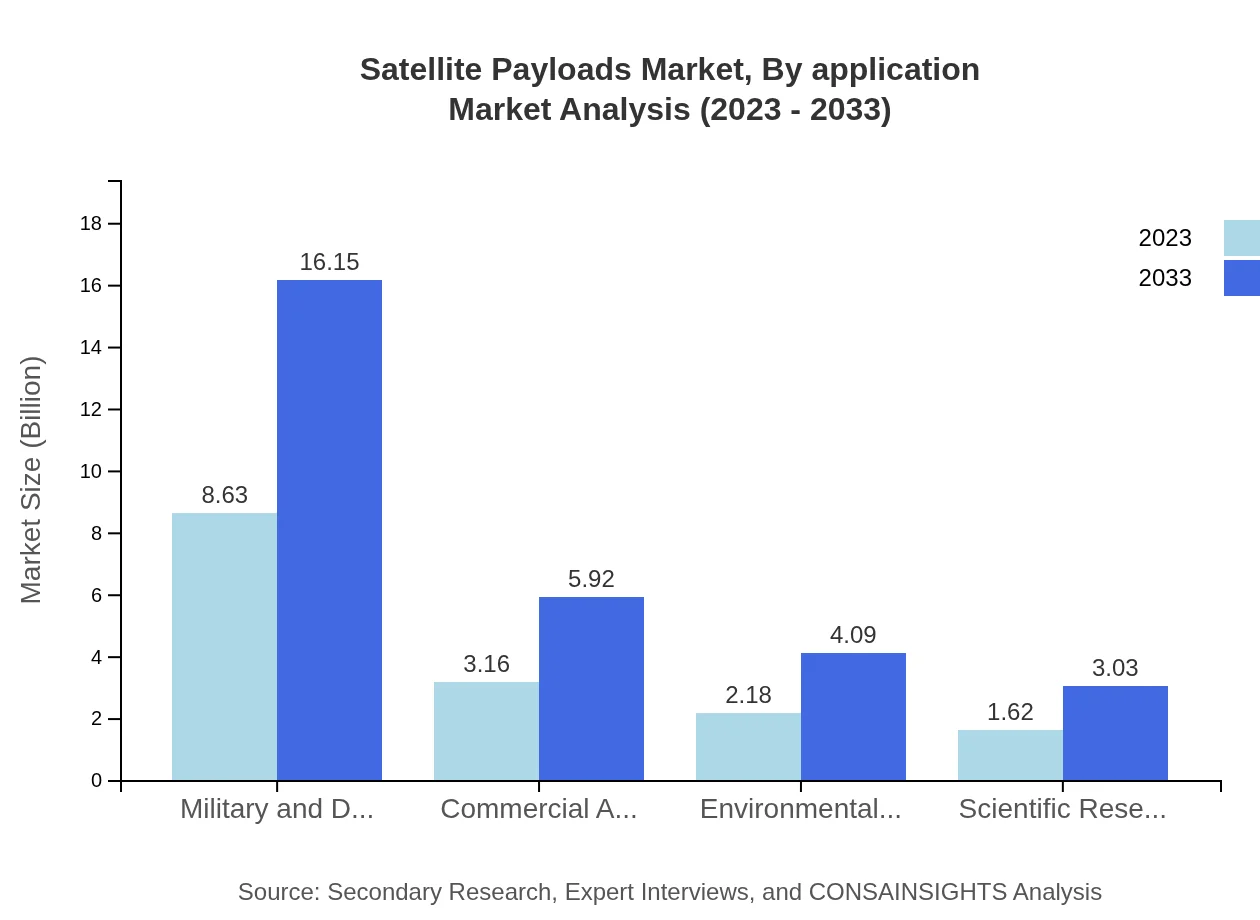

Satellite Payloads Market Analysis By Application

The application segmentation emphasizes the robust growth in military and defense applications, with market size reaching $8.63 billion in 2023. Environmental monitoring and scientific research also command significant shares, targeting their respective government and academic institutions, thereby reinforcing the necessity of satellite technologies in diverse applications.

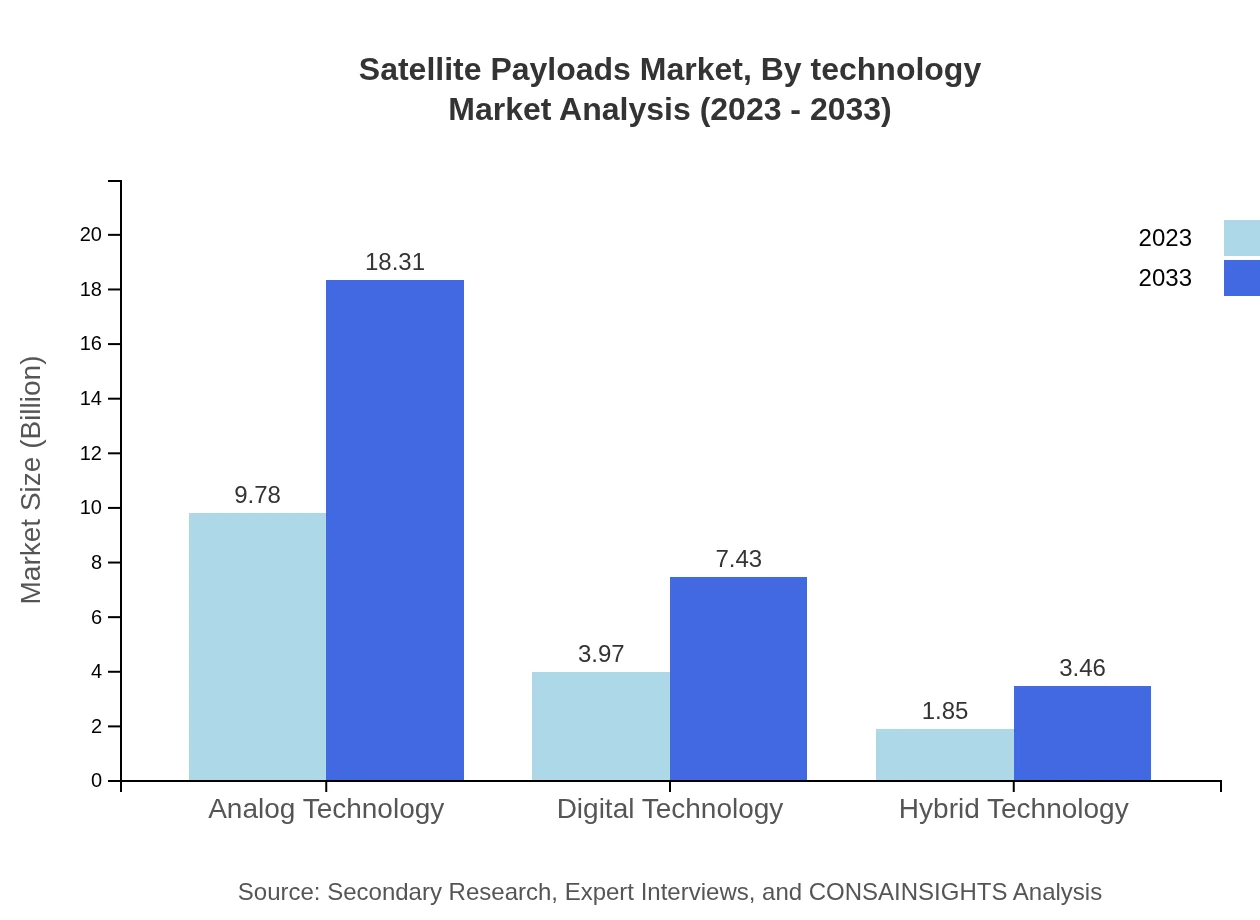

Satellite Payloads Market Analysis By Technology

In terms of technology, analog technology dominates with a market size of $9.78 billion in 2023, while digital technology is at $3.97 billion. Hybrid technologies are emerging at $1.85 billion, reshaping the landscape through innovative breakthroughs and efficient solutions that combine the advantages of both analog and digital functionalities.

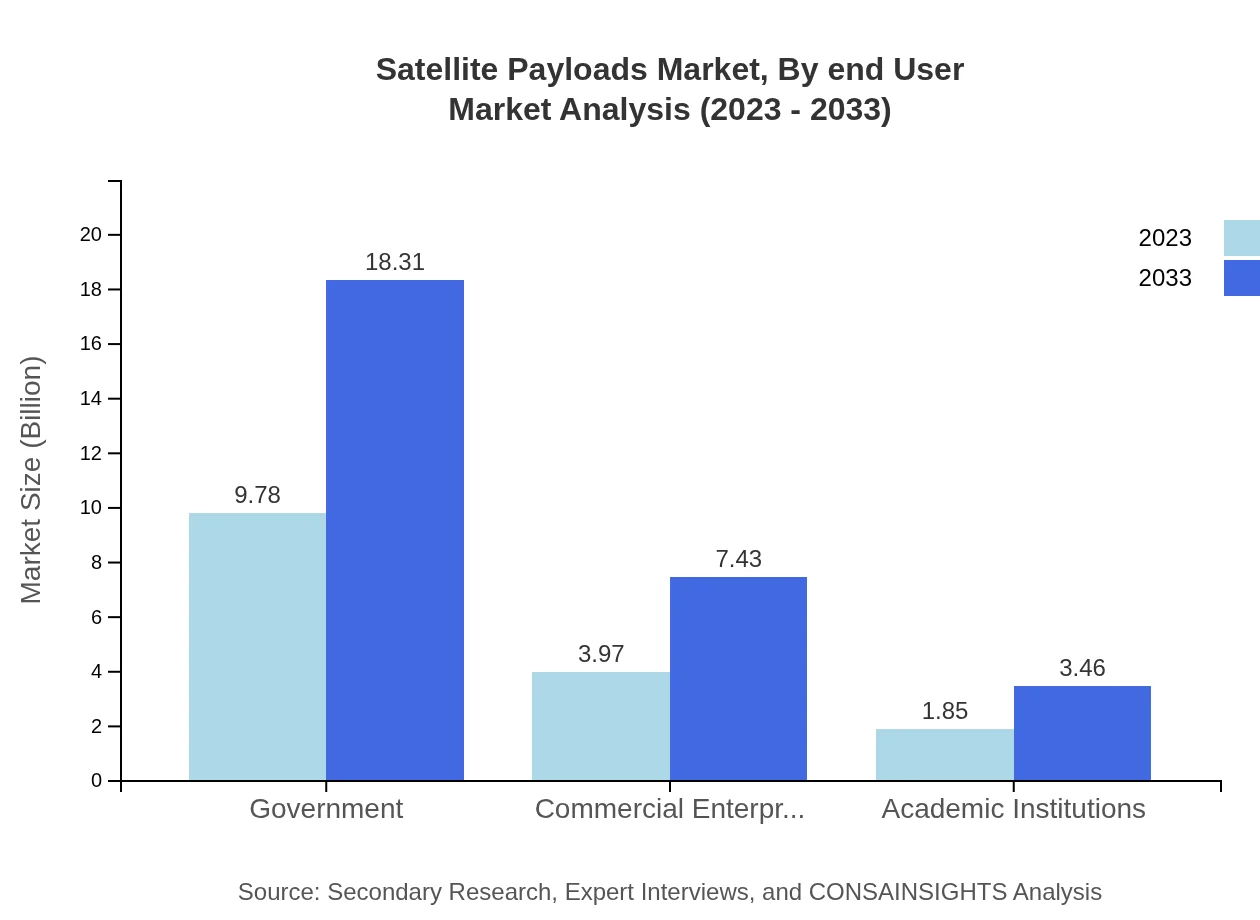

Satellite Payloads Market Analysis By End User

Government agencies are pivotal end-users, accounting for over 62% of market share in 2023, related to national security and research initiatives. Commercial enterprises and academic institutions follow, reflecting the growing reliance on satellite payload functionalities for various operations and research methodologies.

Satellite Payloads Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Payloads Industry

Lockheed Martin:

Lockheed Martin is a leader in aerospace and defense technologies, specifically known for its advanced satellite payload systems that enhance military operations and national security.Northrop Grumman:

Northrop Grumman specializes in space technologies, including satellite manufacturing and innovative payload solutions designed for intelligence and reconnaissance purposes.Airbus:

Airbus is a prominent player in the satellite industry, known for integrating advanced technology into payloads that serve commercial and scientific communities.Boeing :

Boeing has extensive experience in satellite systems and payloads, focusing on enhancing capabilities in communication and navigation sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite Payloads?

The global satellite payloads market is projected to reach approximately $15.6 billion by 2033 with a CAGR of 6.3%. This growth reflects increasing demand for advanced satellite technologies and applications in various sectors, including telecommunications, defense, and environmental monitoring.

What are the key market players or companies in the satellite Payloads industry?

Key players in the satellite payloads industry include established companies such as Boeing, Lockheed Martin, Airbus, Northrop Grumman, and Thales Alenia Space, which offer a range of payloads and satellite solutions for military, commercial, and scientific applications.

What are the primary factors driving the growth in the satellite Payloads industry?

Major factors driving growth include heightened demand for advanced communication services, environmental monitoring needs, and increased investments in military satellites. Additionally, emerging technologies and partnerships among companies are facilitating innovative satellite payload developments.

Which region is the fastest Growing in the satellite Payloads industry?

From 2023 to 2033, North America is forecasted as the fastest-growing region, expanding from $5.82 billion to $10.89 billion. Key contributors are robust military investments and technological advancements in satellite communications and global positioning systems.

Does ConsaInsights provide customized market report data for the satellite Payloads industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to access targeted data and analyses that address unique market inquiries and trends in the satellite-payloads industry.

What deliverables can I expect from this satellite Payloads market research project?

Deliverables include detailed market analysis reports, forecasts, regional growth insights, competitive landscape assessments, and segmented data breakdowns, which provide an in-depth understanding of the satellite payloads market dynamics.

What are the market trends of satellite Payloads?

Current trends include the shift towards small satellite technologies, increased adoption of hybrid payloads, and growing applications in earth observation, which indicate a dynamic market landscape aimed at meeting specific needs across various industries.