Satellite Transponder Market Report

Published Date: 31 January 2026 | Report Code: satellite-transponder

Satellite Transponder Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Satellite Transponder market from 2023 to 2033, including market size, growth rates, regional insights, technology advancements, and trends shaping the industry.

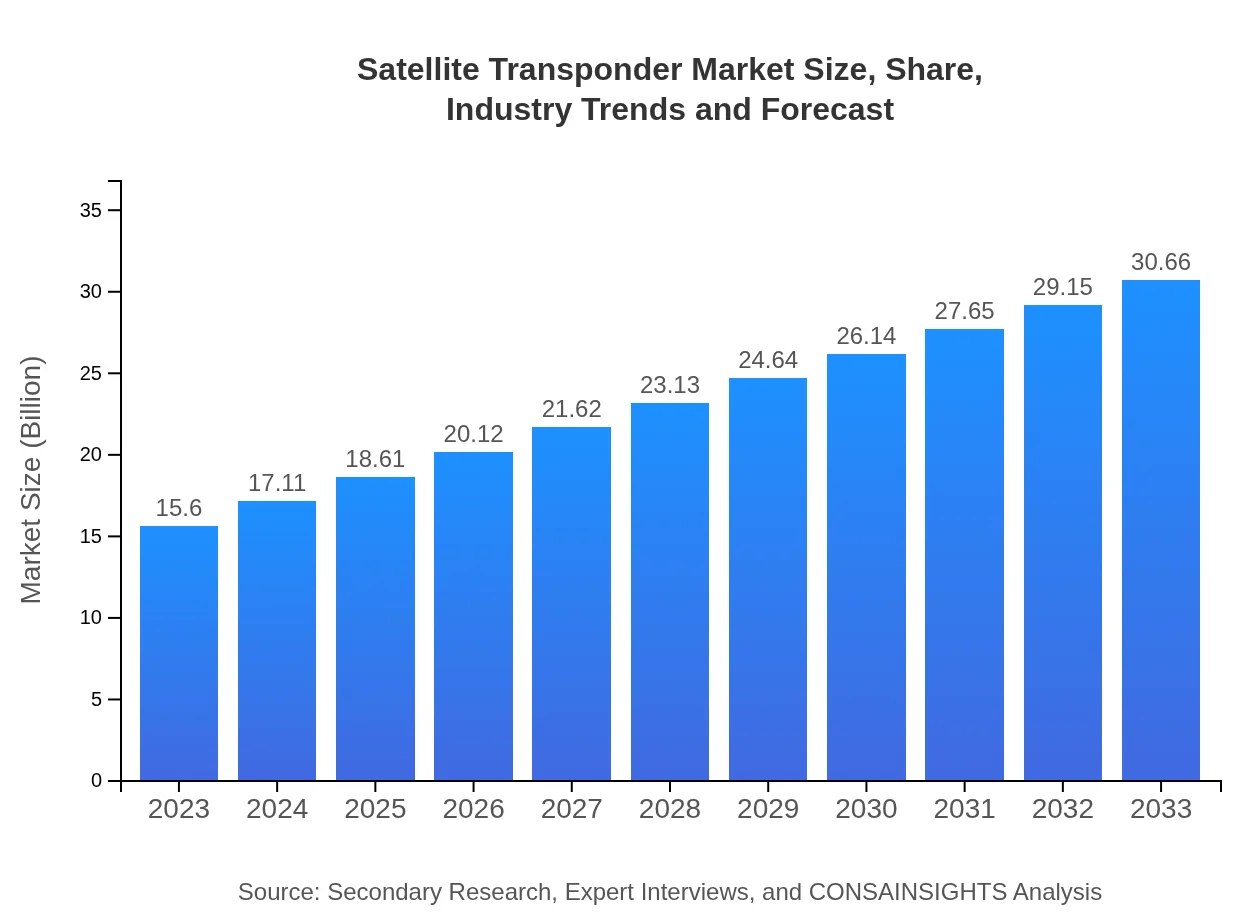

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | SES S.A., Intelsat S.A., Eutelsat Communications, China Satellite Communications, Telesat |

| Last Modified Date | 31 January 2026 |

Satellite Transponder Market Overview

Customize Satellite Transponder Market Report market research report

- ✔ Get in-depth analysis of Satellite Transponder market size, growth, and forecasts.

- ✔ Understand Satellite Transponder's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Satellite Transponder

What is the Market Size & CAGR of Satellite Transponder market in 2023 and 2033?

Satellite Transponder Industry Analysis

Satellite Transponder Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Satellite Transponder Market Analysis Report by Region

Europe Satellite Transponder Market Report:

In Europe, the market is estimated at $4.14 billion in 2023, with projections reaching $8.13 billion by 2033. A strong focus on innovation and regulatory support for satellite communications contributes to steady growth.Asia Pacific Satellite Transponder Market Report:

In the Asia Pacific region, the market size stood at $3.36 billion in 2023 and is forecasted to reach $6.60 billion by 2033. Rapid urbanization, coupled with increased internet penetration and demand for broadcasting services, drives the growth in this region.North America Satellite Transponder Market Report:

North America leads with a market size of $5.09 billion in 2023 and expected growth to $10.01 billion by 2033. This growth is attributed to a mature telecommunications infrastructure and rising demand for digital content.South America Satellite Transponder Market Report:

The South American market was valued at $1.03 billion in 2023, with projections indicating growth to $2.03 billion by 2033. The region is experiencing increased investments in satellite technology, particularly for improving connectivity in rural areas.Middle East & Africa Satellite Transponder Market Report:

The Middle East and Africa market was valued at $1.97 billion in 2023 and is expected to grow to $3.88 billion by 2033, driven by government investment in satellite communications for security and public service applications.Tell us your focus area and get a customized research report.

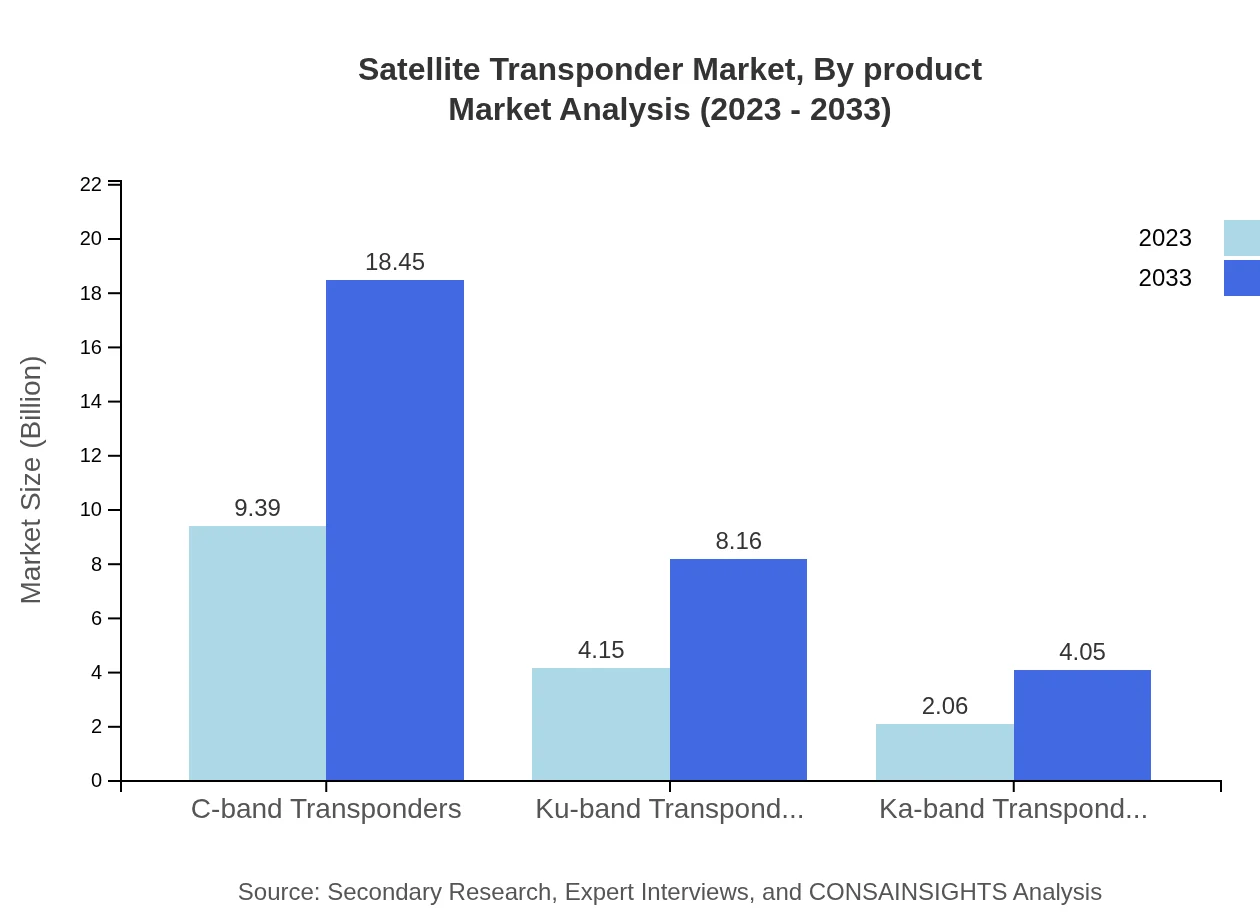

Satellite Transponder Market Analysis By Product

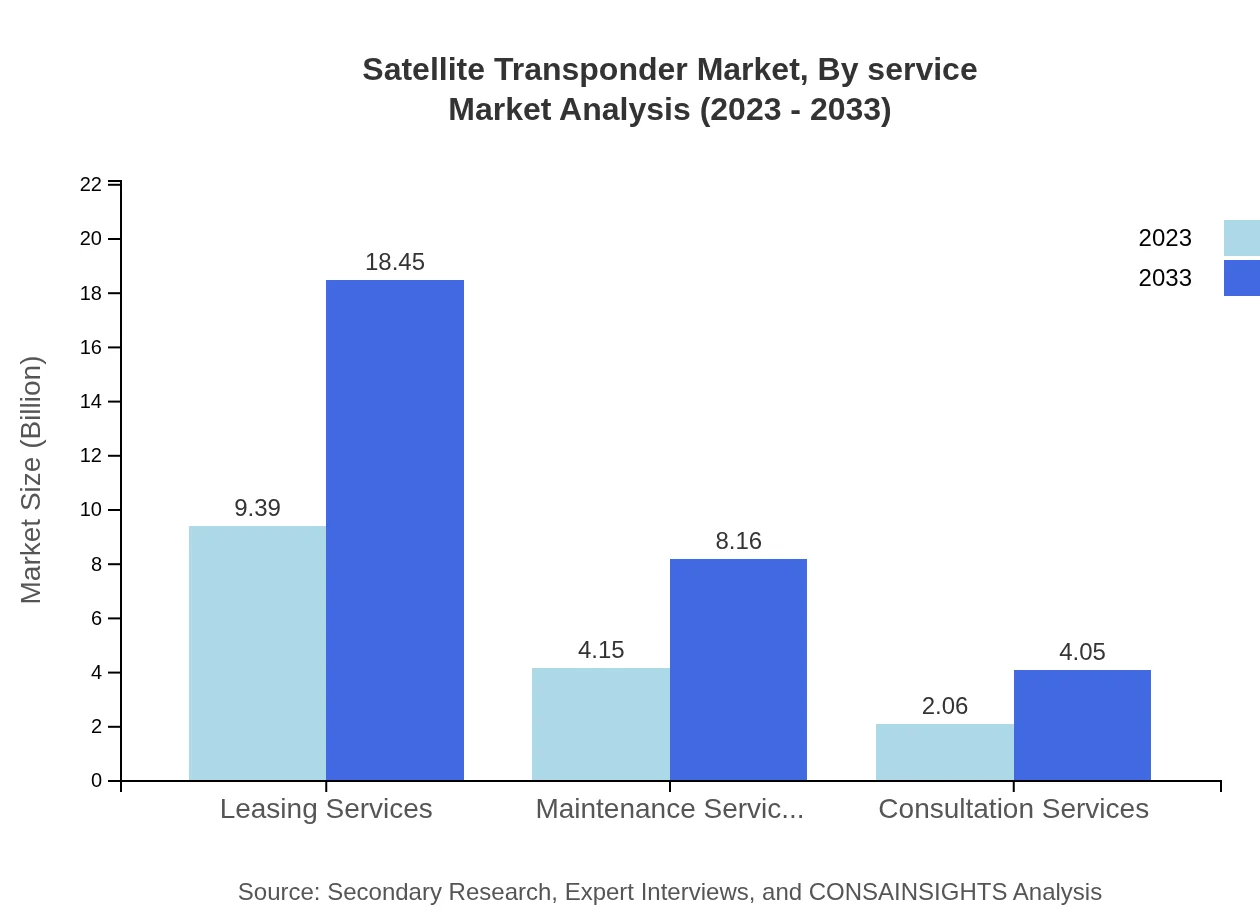

C-band Transponders dominate the market, projected at $9.39 billion in 2023 and $18.45 billion by 2033, holding a significant 60.18% market share. Ku-band and Ka-band transponders follow with respective market sizes of $4.15 billion to $8.16 billion and $2.06 billion to $4.05 billion, reflecting their vital roles in broadcasting and broadband services.

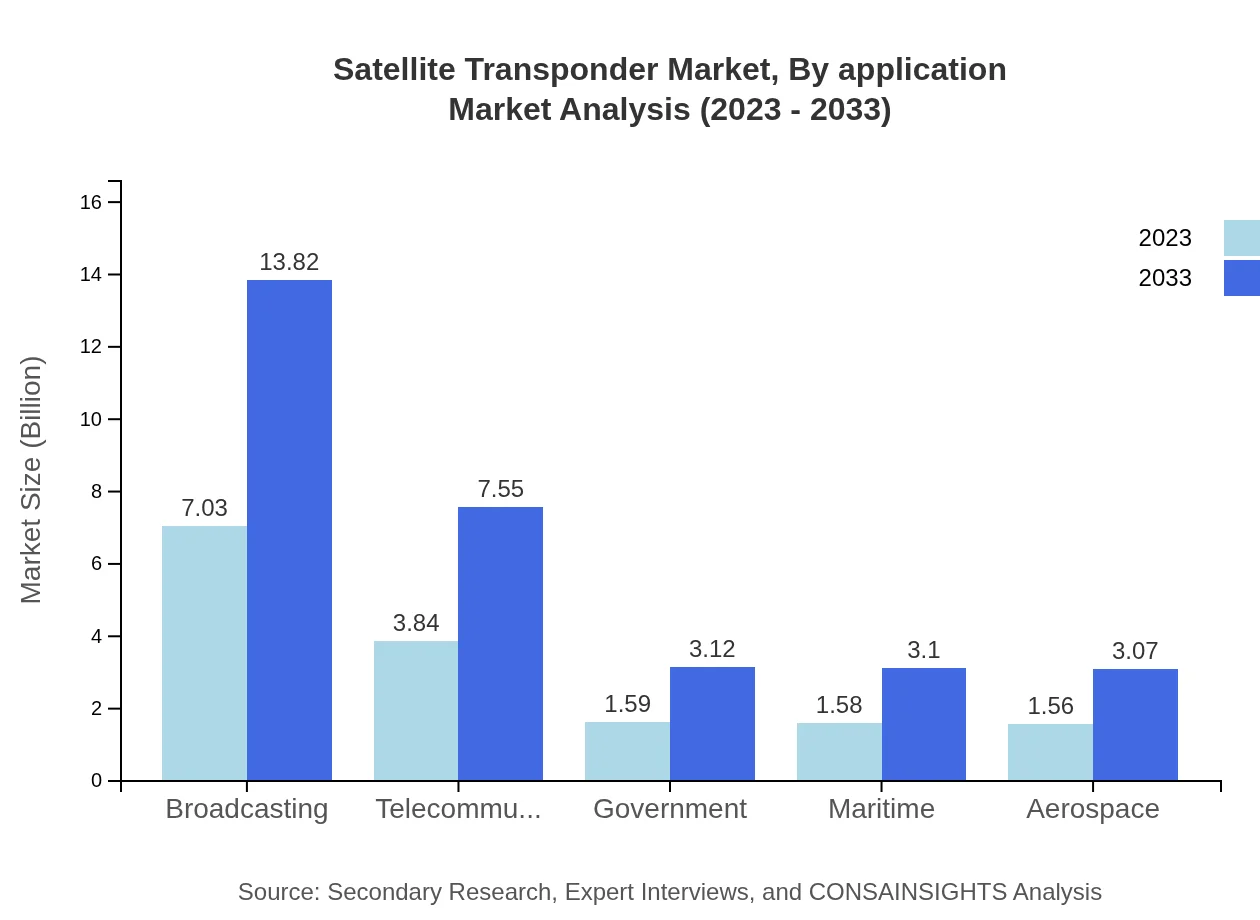

Satellite Transponder Market Analysis By Application

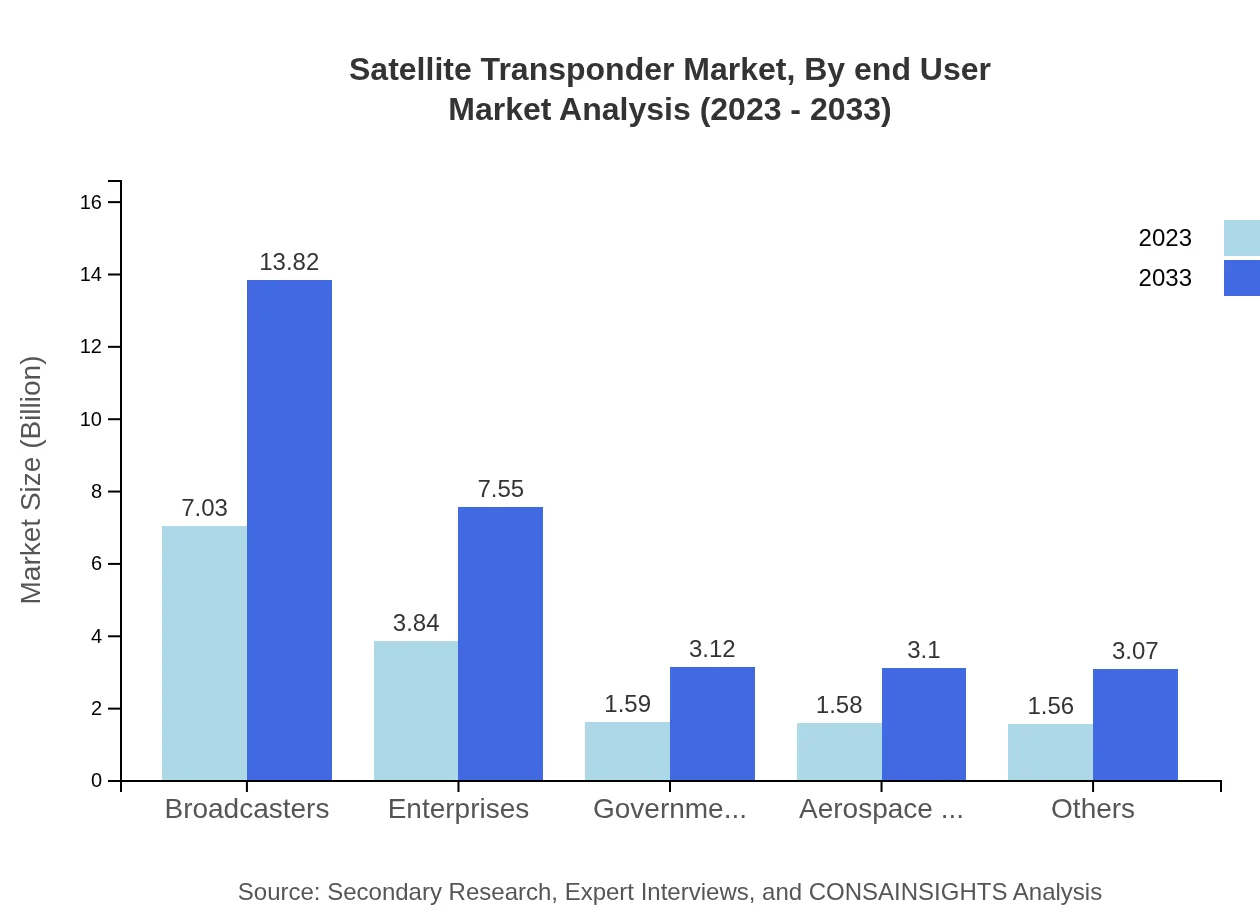

The Broadcasting segment emerges as a primary application area, with a market size of $7.03 billion in 2023, set to reach $13.82 billion by 2033. Telecommunications and government applications also represent significant shares, underscoring the versatility of satellite technology.

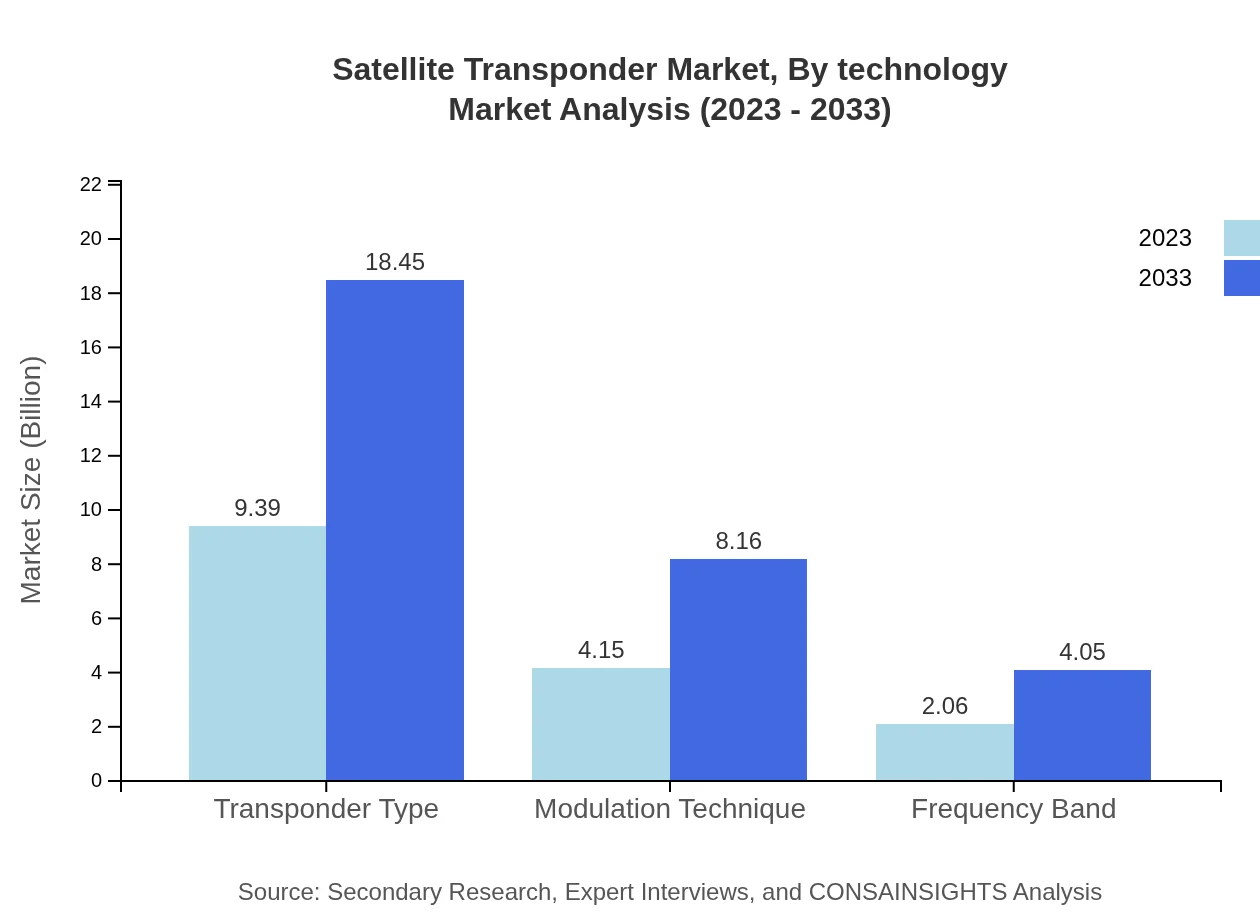

Satellite Transponder Market Analysis By Technology

Market trends highlight a shift toward digital and high-throughput satellites (HTS), fostering growth in data capacity and efficiency. The technology segment emphasizes these innovations, optimizing bandwidth utilization and enhancing service quality for end-users.

Satellite Transponder Market Analysis By End User

Key end-users include Broadcasters, Enterprises, and Government Agencies. The Broadcasters segment is projected to grow from $7.03 billion in 2023 to $13.82 billion by 2033, driven by the increasing demand for content across multiple platforms.

Satellite Transponder Market Analysis By Service

Leasing Services dominate with a 60.18% market share, growing from $9.39 billion in 2023 to $18.45 billion by 2033, while Consultation and Maintenance Services also contribute significantly to market stability and growth.

Satellite Transponder Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Satellite Transponder Industry

SES S.A.:

SES is a global satellite operator providing satellite communication services to broadcasters, telecommunications companies, and governments across the world.Intelsat S.A.:

Intelsat operates one of the largest satellite networks, providing communication technologies and services critical to both commercial and government customers.Eutelsat Communications:

Eutelsat is a leading satellite operator in Europe, offering capacity across multiple bands to various sectors, including television and internet services.China Satellite Communications:

A key player in the satellite telecom industry, providing services in various frequency bands and contributing to China’s emerging satellite capabilities.Telesat:

Telesat is a satellite operator fostering global connectivity with advanced satellite technologies and services tailored for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of satellite transponder?

The global satellite transponder market is projected to reach a size of $15.6 billion by 2033, growing at a CAGR of 6.8% from its current valuation. This growth reflects the increasing demand for satellite communication across various sectors.

What are the key market players or companies in the satellite transponder industry?

Key players in the satellite transponder industry include major companies offering advanced satellite communication technologies, such as Inmarsat, SES S.A., Intelsat S.A., and Eutelsat. These companies are leading the market with their innovative solutions and extensive service offerings.

What are the primary factors driving the growth in the satellite transponder industry?

The growth of the satellite transponder industry is driven by the increasing demand for high-speed internet, advances in technology, and the expansion of telecommunication networks. Enhanced broadcasting services and government investments in satellite communication infrastructure also play significant roles.

Which region is the fastest Growing in the satellite transponder market?

North America is the fastest-growing region in the satellite transponder market, with a projected market size of $10.01 billion by 2033, increasing from $5.09 billion in 2023. This growth is attributed to the vast presence of telecom companies and technological advancements.

Does ConsaInsights provide customized market report data for the satellite transponder industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the satellite transponder industry. This includes bespoke insights into market trends, forecasts, and competitive analysis suited for individual business requirements.

What deliverables can I expect from this satellite transponder market research project?

Upon completion of the market research project, you can expect detailed reports including market size analysis, growth forecasts, competitive landscape insights, and regional performance data, along with strategic recommendations for market entry or expansion.

What are the market trends of satellite transponder?

Key trends in the satellite transponder market include the growing adoption of Ka-band transponders, a shift towards cloud-based satellite solutions, and increased usage in telecommunication and broadcasting sectors. These trends highlight the ongoing evolution and expansion of satellite technologies.