Sauces Condiments And Dressings Market Report

Published Date: 31 January 2026 | Report Code: sauces-condiments-and-dressings

Sauces Condiments And Dressings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sauces, Condiments, and Dressings market from 2023 to 2033, focusing on market trends, size, growth rates, regional analysis, and competitive landscape to offer valuable insights for stakeholders.

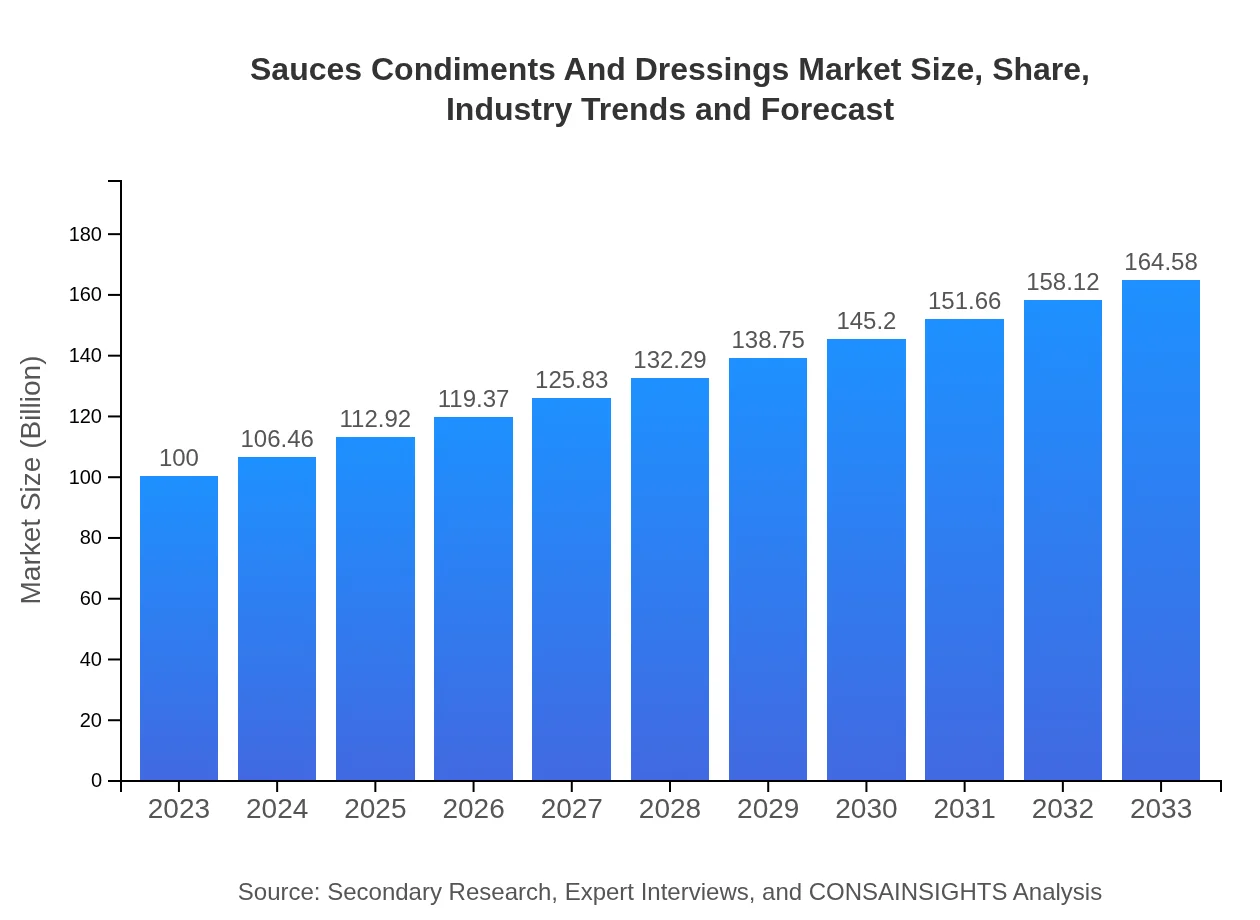

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Unilever, Kraft Heinz, Nestlé, McCormick & Company, General Mills |

| Last Modified Date | 31 January 2026 |

Sauces Condiments And Dressings Market Overview

Customize Sauces Condiments And Dressings Market Report market research report

- ✔ Get in-depth analysis of Sauces Condiments And Dressings market size, growth, and forecasts.

- ✔ Understand Sauces Condiments And Dressings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sauces Condiments And Dressings

What is the Market Size & CAGR of Sauces Condiments And Dressings market in 2023?

Sauces Condiments And Dressings Industry Analysis

Sauces Condiments And Dressings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sauces Condiments And Dressings Market Analysis Report by Region

Europe Sauces Condiments And Dressings Market Report:

In Europe, the market is valued at approximately $31.67 billion in 2023, with projections indicating growth to $52.12 billion by 2033. The market benefits from a strong foodservice sector, growing demand for gourmet products, and innovative flavor profiles tailored to health-conscious consumers.Asia Pacific Sauces Condiments And Dressings Market Report:

In 2023, the Asia Pacific region's Sauces, Condiments, and Dressings market is valued at approximately $21.04 billion, and it is projected to grow to $34.63 billion by 2033. Significant growth drivers include population growth, increasing urbanization, and a rising middle-class population with disposable income willing to experiment with diverse cuisines and flavors.North America Sauces Condiments And Dressings Market Report:

The North American market's size in 2023 stands at $32.07 billion, anticipating growth to $52.78 billion by 2033. Factors driving this expansion include a high consumption rate of sauces in meals and the increasing incorporation of international flavors into mainstream American cuisines.South America Sauces Condiments And Dressings Market Report:

For South America, the market size in 2023 is around $3.90 billion, expected to rise to $6.42 billion by 2033. This growth is fueled by evolving culinary habits and the increasing demand for international flavors among consumers, particularly in urban areas.Middle East & Africa Sauces Condiments And Dressings Market Report:

In the Middle East and Africa, the market size is approximately $11.32 billion in 2023, with expectations to reach $18.63 billion by 2033. Cultural diversity and the growing acceptance of international cuisines contribute to the demand for varied sauces and condiments.Tell us your focus area and get a customized research report.

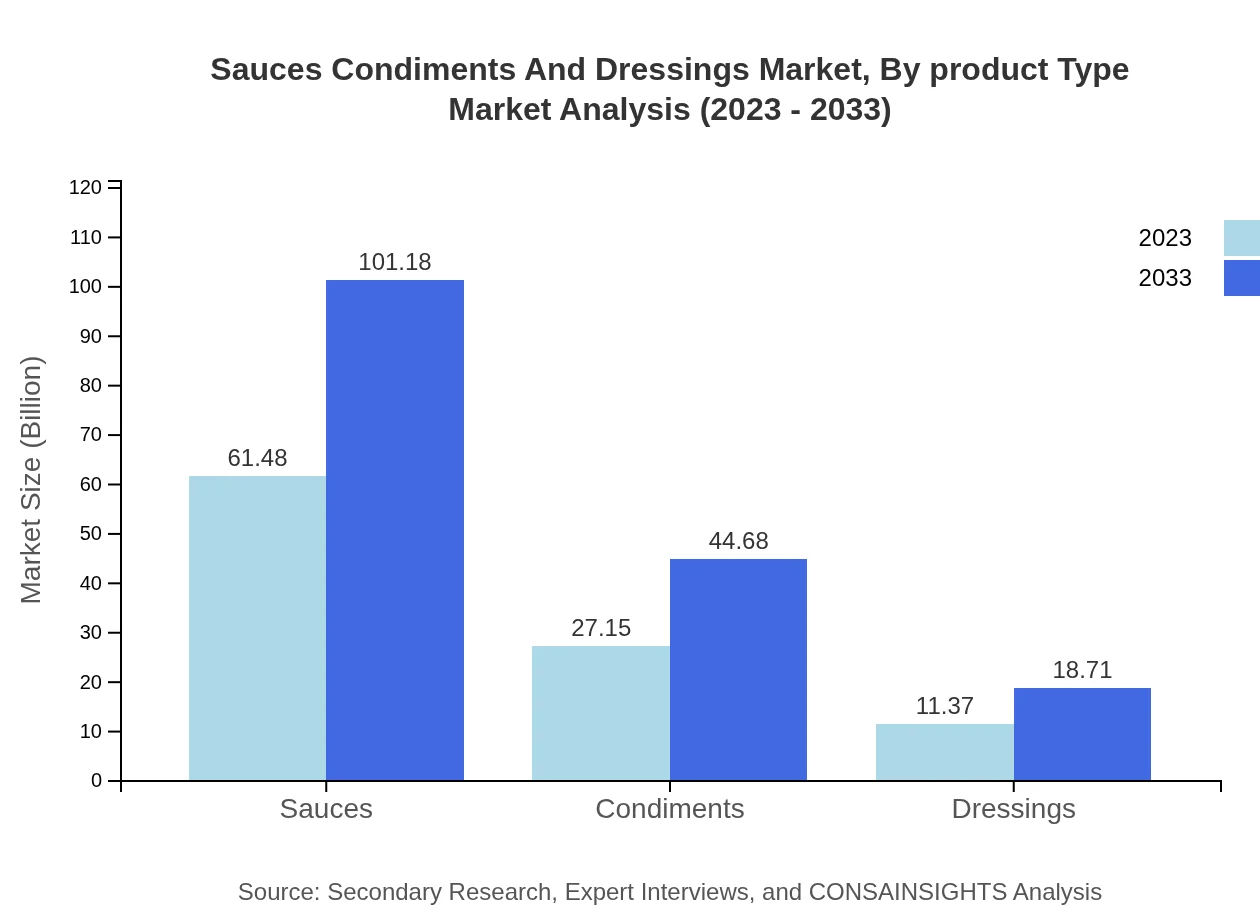

Sauces Condiments And Dressings Market Analysis By Product Type

The product type segmentation reveals that sauces lead the market, valued at $61.48 billion in 2023, growing to $101.18 billion by 2033. Condiments and dressings follow, with market sizes of $27.15 billion and $11.37 billion respectively in 2023, projected to reach $44.68 billion and $18.71 billion by 2033.

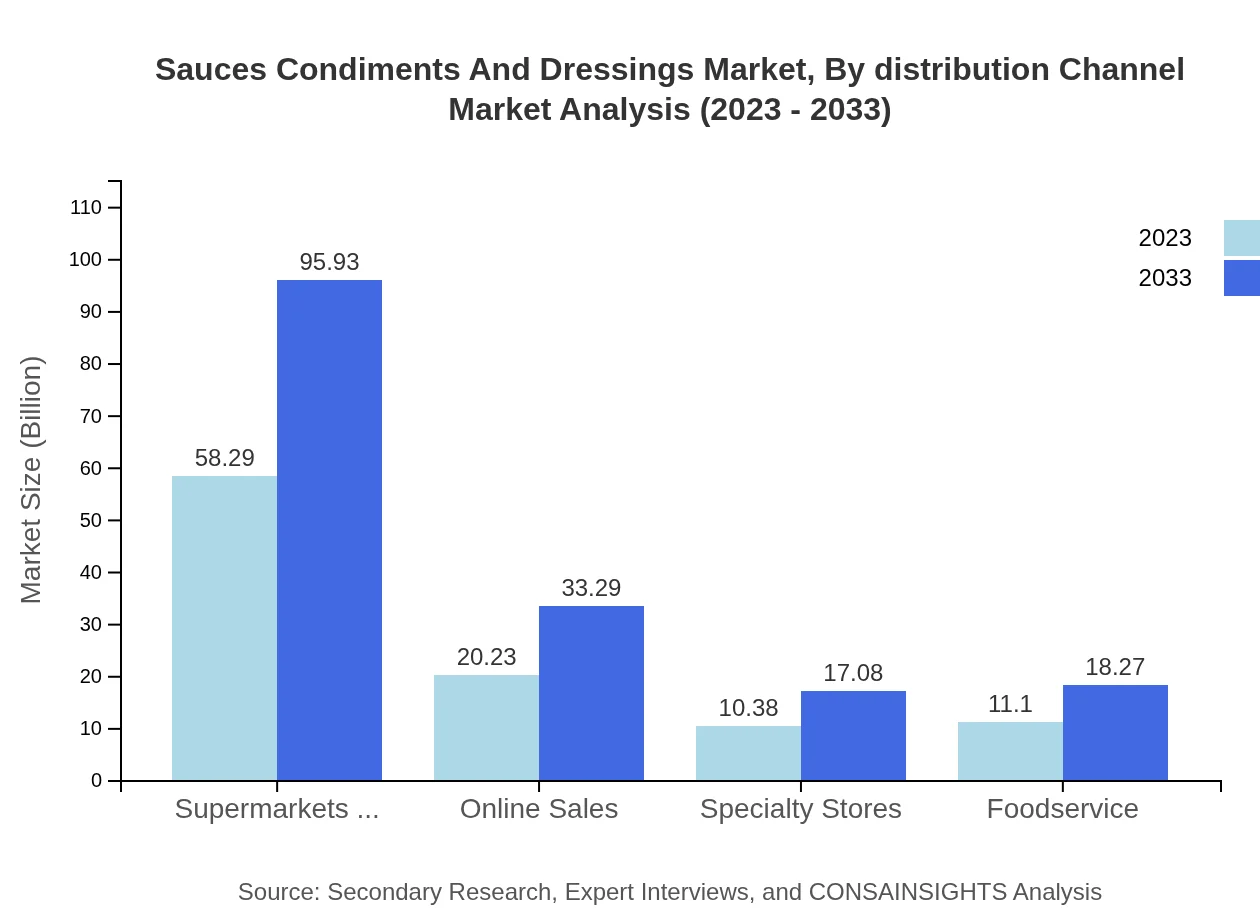

Sauces Condiments And Dressings Market Analysis By Distribution Channel

Distribution through supermarkets and hypermarkets held a market share of $58.29 billion in 2023, growing to $95.93 billion by 2033. Online sales are also significant, with sizes of $20.23 billion in 2023 and $33.29 billion in 2033, highlighting the shift towards e-commerce.

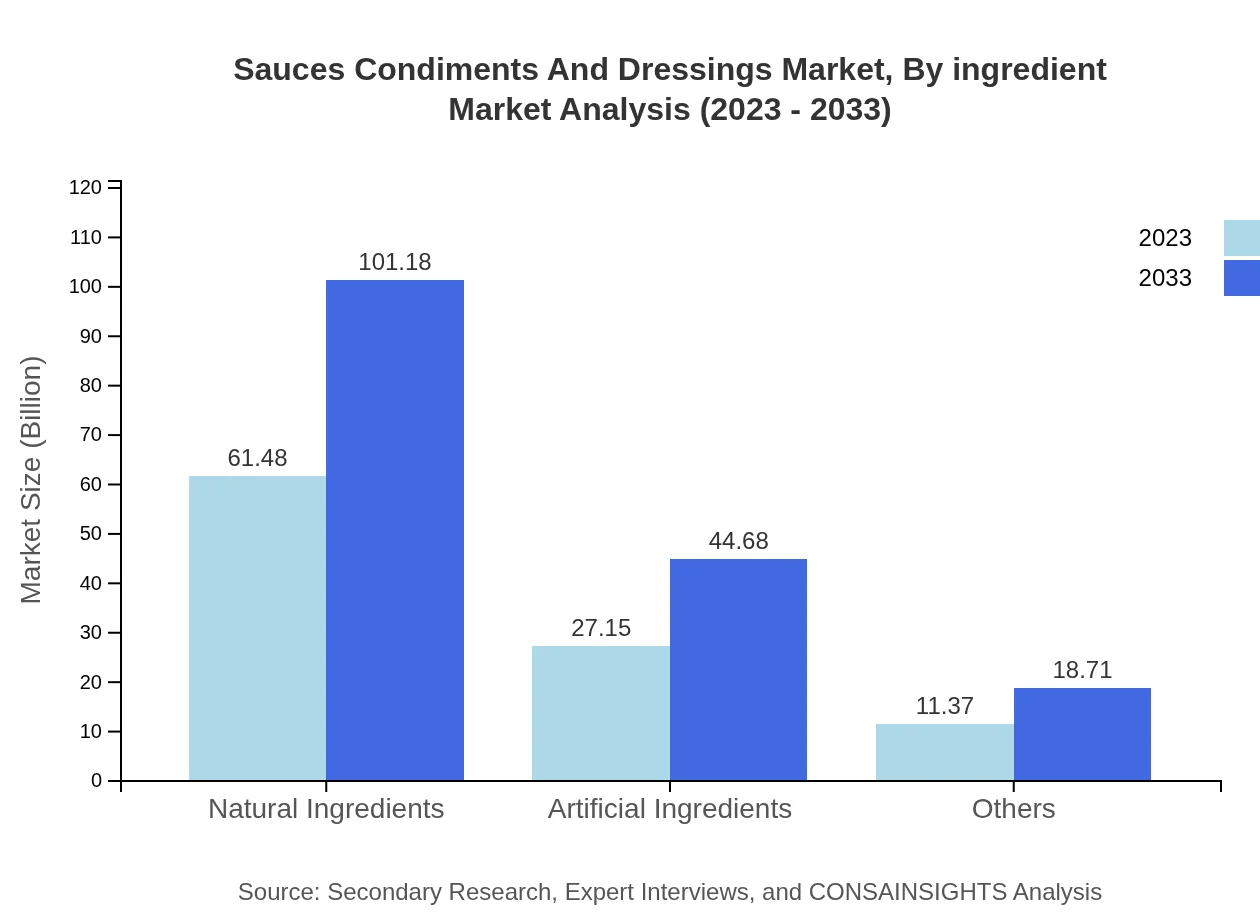

Sauces Condiments And Dressings Market Analysis By Ingredient

Natural ingredients dominate with a market size of $61.48 billion in 2023, expected to reach $101.18 billion by 2033. Artificial ingredient-based products are growing as well, with market values transitioning from $27.15 billion to $44.68 billion during the same period.

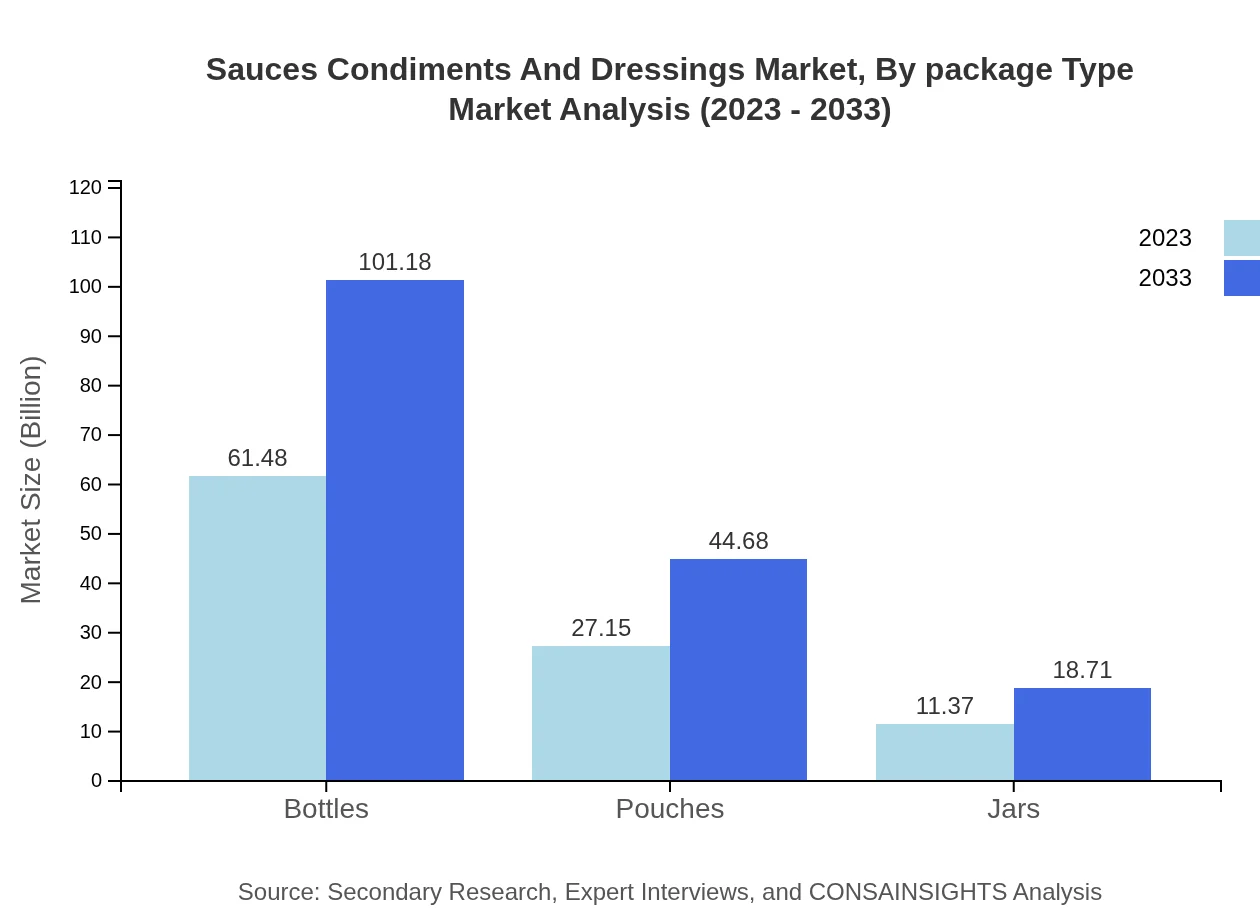

Sauces Condiments And Dressings Market Analysis By Package Type

Bottled products are leading with $61.48 billion market size in 2023, forecasted to grow to $101.18 billion by 2033. Pouches and jars are also relevant, showing growth as consumer convenience and product freshness secure their appeal.

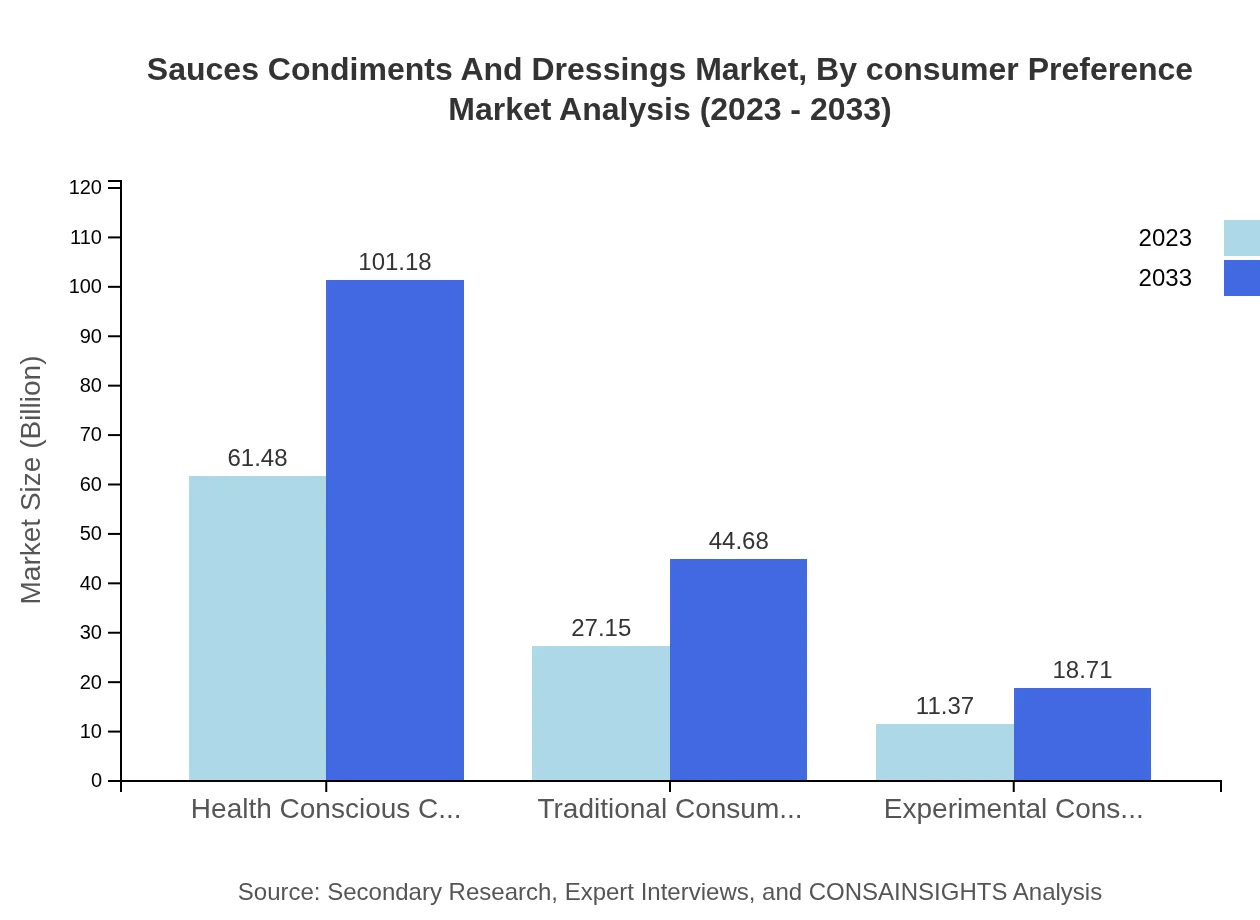

Sauces Condiments And Dressings Market Analysis By Consumer Preference

Health-conscious consumers represent a significant segment, valued at $61.48 billion in 2023, rising to $101.18 billion by 2033, while traditional and experimental consumers are projected to grow from $27.15 billion to $44.68 billion and $11.37 billion to $18.71 billion respectively.

Sauces Condiments And Dressings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sauces Condiments And Dressings Industry

Unilever:

A global leader in consumer goods, Unilever offers a diverse range of sauces and dressings under well-known brands, driving innovation in healthy and gourmet options.Kraft Heinz:

Kraft Heinz is a major player in the food and beverage sector, known for its popular condiments and dressings, combining traditional and modern flavors.Nestlé:

Nestlé holds a significant position in the sauces and dressings market, with its broad portfolio focusing on health and nutrition.McCormick & Company:

Recognized for its spice and seasoning expertise, McCormick provides a range of sauces that enhance global cuisines.General Mills:

General Mills offers a variety of sauces and dressings, catering to evolving consumer tastes and dietary trends.We're grateful to work with incredible clients.

FAQs

What is the market size of sauces Condiments And Dressings?

As of 2023, the sauces, condiments, and dressings market is valued at approximately $100 million and is projected to grow at a CAGR of 5% through 2033. This indicates a robust upward trend in consumer demand.

What are the key market players or companies in the sauces Condiments And Dressings industry?

Key market players include major food corporations such as Kraft Heinz Company, Unilever, McCormick & Company, Nestle S.A., and General Mills. These companies dominate the market through innovative product lines and extensive distribution networks.

What are the primary factors driving the growth in the sauces Condiments And Dressings industry?

Driving factors include the rising trends in health-conscious eating, increasing demand for diverse flavor profiles, and the growing preference for natural ingredients. Additionally, the expansion of online food retail drives product accessibility.

Which region is the fastest Growing in the sauces Condiments And Dressings?

The fastest-growing region is Europe, with a market size of approximately $31.67 million in 2023, projected to reach $52.12 million by 2033. Other rapidly growing regions include Asia Pacific and North America.

Does ConsaInsights provide customized market report data for the sauces Condiments And Dressings industry?

Yes, ConsaInsights offers tailored market report data for the sauces, condiments, and dressings industry. Custom reports can be developed to focus on specific segments or geographical areas of interest.

What deliverables can I expect from this sauces Condiments And Dressings market research project?

Deliverables include comprehensive market analysis reports, insights on consumer trends, growth forecasts, competitor analysis, segmentation details, and actionable recommendations tailored to your business needs.

What are the market trends of sauces Condiments And Dressings?

Current trends include the rising demand for natural and organic products, innovative flavor combinations, increased online sales, and a shift towards healthier options among consumers. Sustainability is also a growing concern.