Scada Oil And Gas Market Report

Published Date: 31 January 2026 | Report Code: scada-oil-and-gas

Scada Oil And Gas Market Size, Share, Industry Trends and Forecast to 2033

This report covers an in-depth analysis of the Scada Oil and Gas market including market size, share, technology analysis, and forecasts up to the year 2033. It provides insights into key segments and regional performance to guide stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

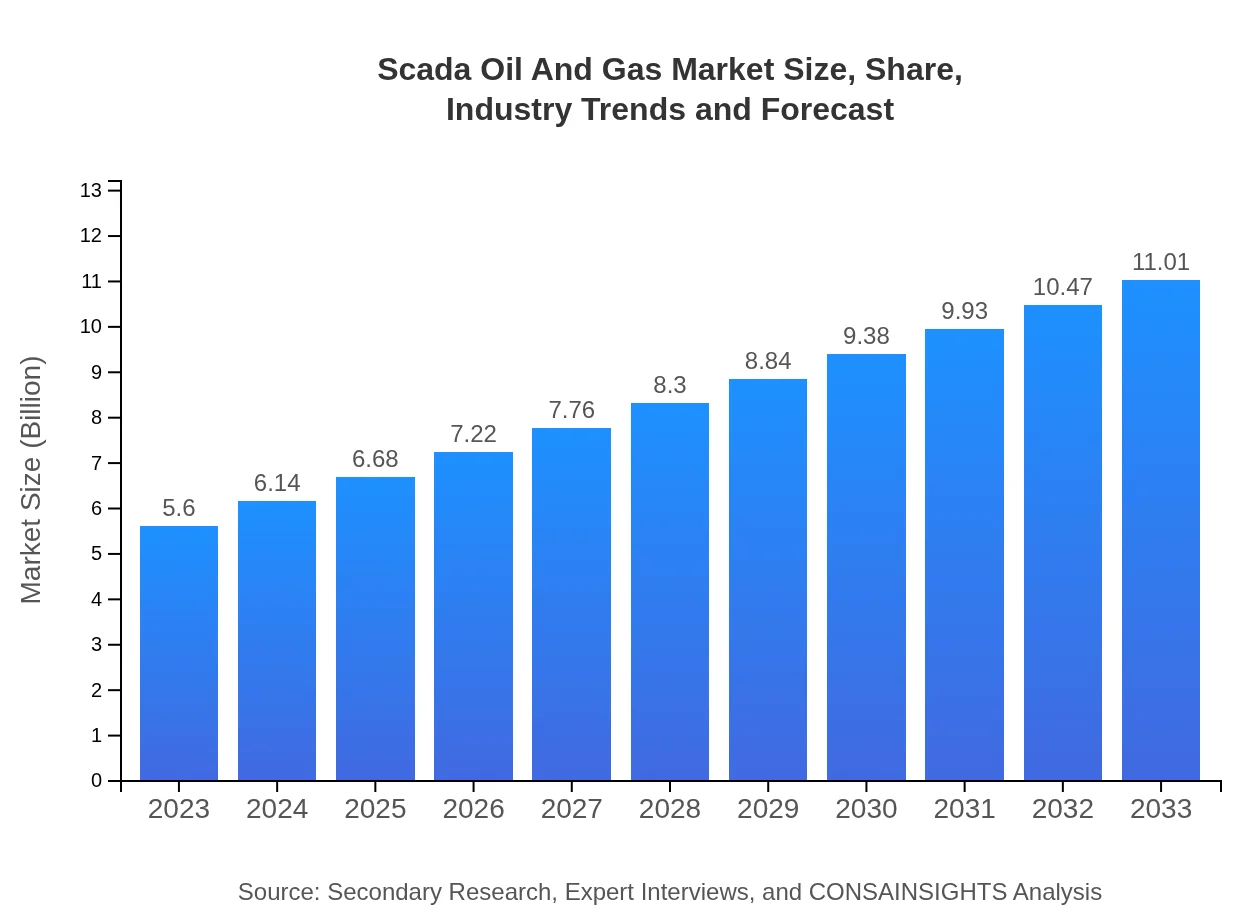

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Schneider Electric, Honeywell International Inc., Emerson Electric Co., Siemens AG |

| Last Modified Date | 31 January 2026 |

Scada Oil And Gas Market Overview

Customize Scada Oil And Gas Market Report market research report

- ✔ Get in-depth analysis of Scada Oil And Gas market size, growth, and forecasts.

- ✔ Understand Scada Oil And Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Scada Oil And Gas

What is the Market Size & CAGR of Scada Oil And Gas market in 2023?

Scada Oil And Gas Industry Analysis

Scada Oil And Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Scada Oil And Gas Market Analysis Report by Region

Europe Scada Oil And Gas Market Report:

The European market is expected to expand from $1.76 billion in 2023 to $3.46 billion by 2033 as companies invest in upgrading their SCADA systems to meet stricter regulatory requirements and improve operational performance.Asia Pacific Scada Oil And Gas Market Report:

The Asia-Pacific region is projected to grow from $1.05 billion in 2023 to $2.06 billion by 2033, driven by increasing exploration activities and investments in oil and gas infrastructure. Countries like China and India are key players, focusing on modernizing their energy sectors.North America Scada Oil And Gas Market Report:

North America, led by the U.S. and Canada, will see significant growth from $2.01 billion in 2023 to $3.95 billion in 2033. The growth is fueled by heightened demand for automation and operational efficiency in oil and gas operations.South America Scada Oil And Gas Market Report:

In South America, the SCADA Oil and Gas market is expected to double from $0.26 billion in 2023 to $0.52 billion in 2033, primarily due to growing investments in oil extraction and production technologies, especially in Brazil and Venezuela.Middle East & Africa Scada Oil And Gas Market Report:

The Middle East and Africa market is projected to grow from $0.51 billion in 2023 to $1.01 billion in 2033, spurred by oil-rich nations looking to enhance their oil extraction processes through advanced SCADA technologies.Tell us your focus area and get a customized research report.

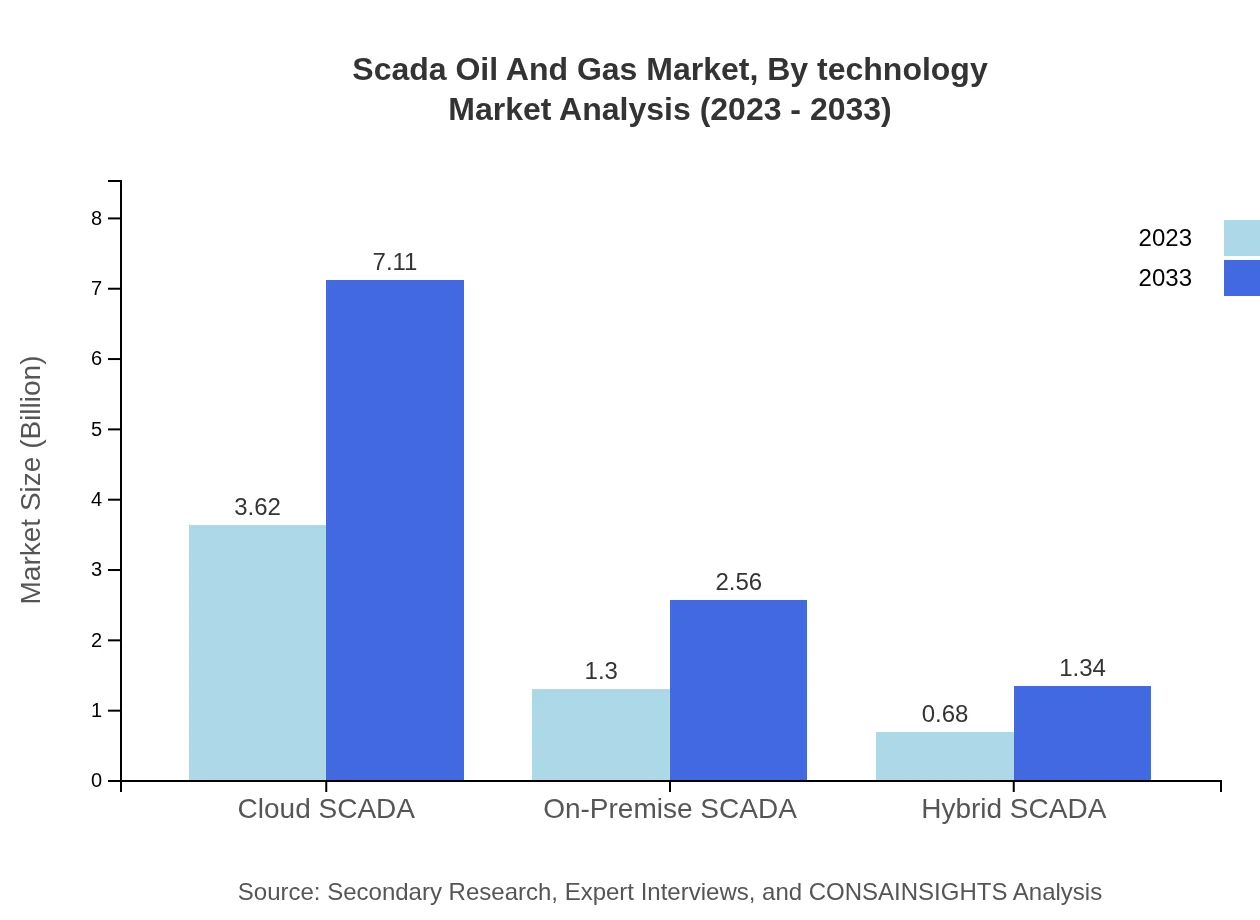

Scada Oil And Gas Market Analysis By Technology

The SCADA market in Oil and Gas by technology includes cloud-based and on-premises solutions. Cloud SCADA is dominating the market due to its flexibility and lower operational costs. In 2023, cloud deployment holds a market share of 81.18%. By 2033, the trend towards cloud technologies is expected to strengthen further, encompassing 81.18% of the market. On-premise solutions, while less favored, hold 18.82% of the market share, reflecting current hybrid approaches.

Scada Oil And Gas Market Analysis By Component

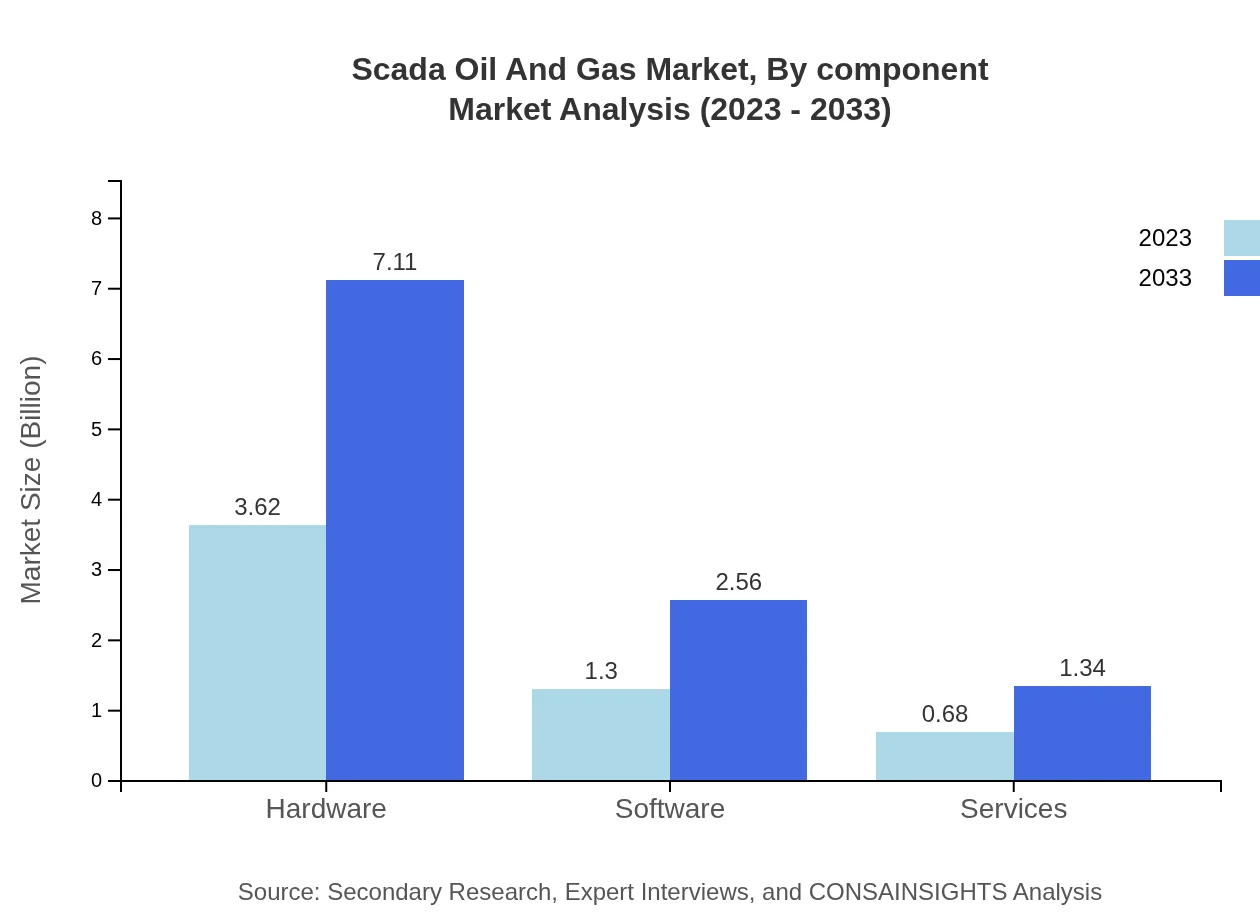

The components segment comprises hardware, software, and services. Hardware significantly leads this category, expected to grow from $3.62 billion in 2023 to $7.11 billion by 2033, maintaining a market share of 64.59%. Software solutions are crucial as well, with growth from $1.30 billion in 2023 to $2.56 billion by 2033, holding a market share of 23.28%. Services, while smaller, are expanding alongside technological advancements as more companies seek comprehensive SCADA solutions.

Scada Oil And Gas Market Analysis By Application

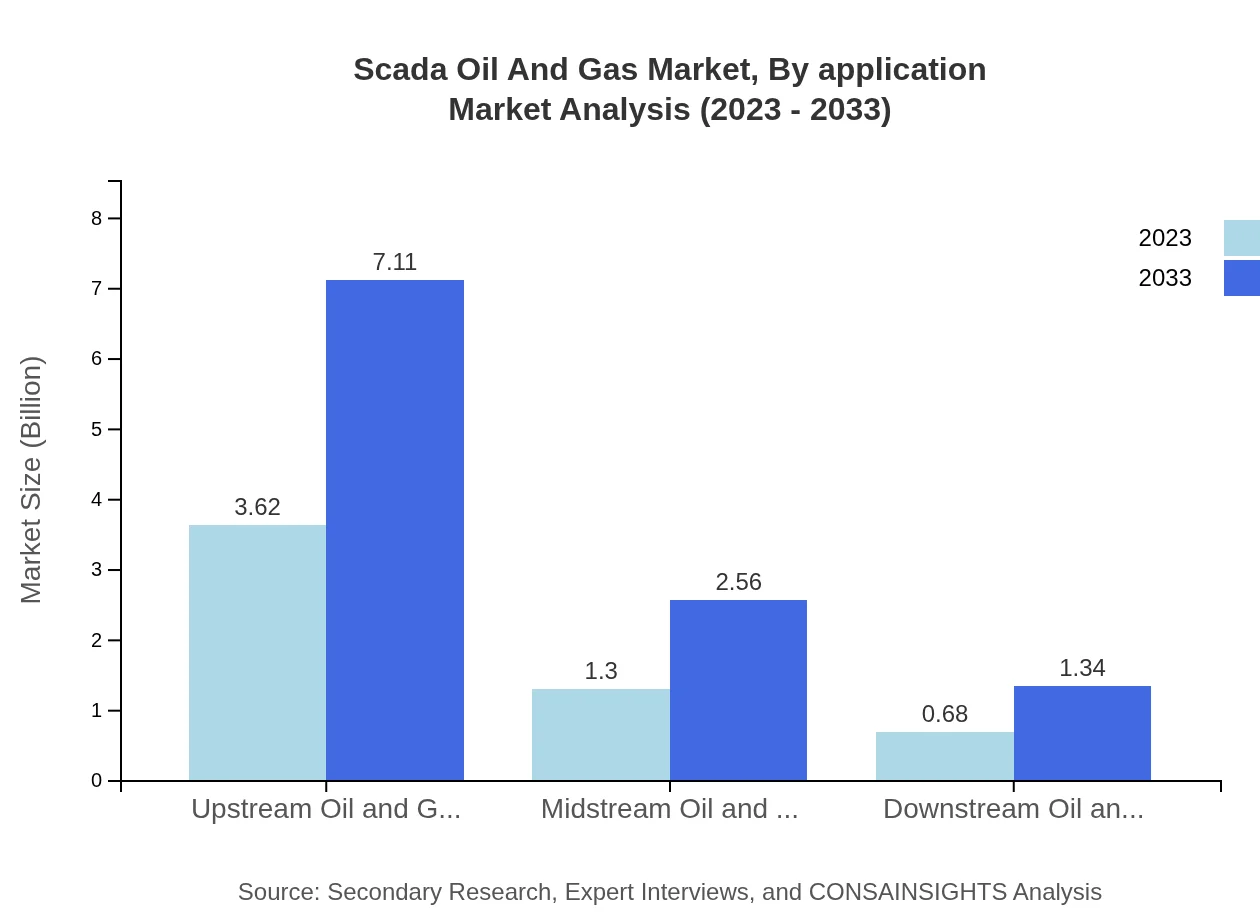

Segmented by application into upstream, midstream, and downstream, the upstream oil and gas segment is leading with a market size of $3.62 billion in 2023, growing to $7.11 billion by 2033 and representing 64.59% of the market. Midstream applications are expected to grow from $1.30 billion to $2.56 billion during the same period. Downstream applications are witnessing growth, moving from $0.68 billion to $1.34 billion, with an increasing share as companies integrate SCADA systems for efficiency.

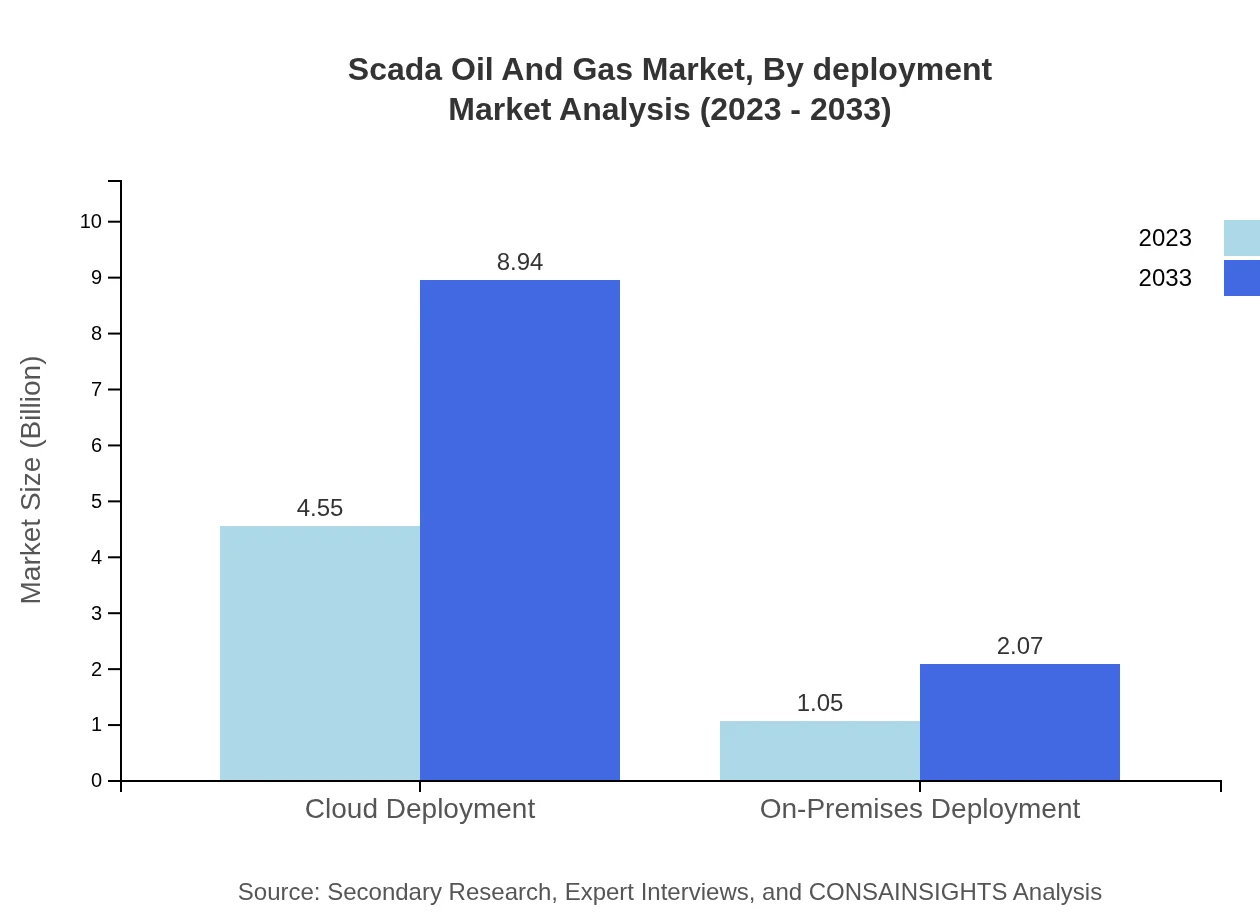

Scada Oil And Gas Market Analysis By Deployment

In terms of deployment, cloud SCADA is anticipated to dominate the market. In 2023, it accounts for $4.55 billion and is expected to reach $8.94 billion by 2033, indicating its essential role in the SCADA market. Conversely, on-premises solutions are still relevant, showing growth from $1.05 billion in 2023 to $2.07 billion in 2033, as companies balance between cloud and on-premises methods for their operations.

Scada Oil And Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Scada Oil And Gas Industry

Schneider Electric:

A global leader in energy and automation solutions, Schneider Electric offers a comprehensive range of SCADA systems tailored for the oil and gas industry, enhancing efficiency and safety.Honeywell International Inc.:

Honeywell provides SCADA solutions that help maximize production in the oil and gas sector, focusing on real-time data collection and advanced control systems.Emerson Electric Co.:

Emerson specializes in automation solutions and their SCADA systems are designed to enhance the operational efficiency and safety of oil and gas operations.Siemens AG:

Siemens offers advanced SCADA technology solutions that facilitate efficient operations in the oil and gas industry, driving innovation and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of SCADA-Oil And-Gas?

The SCADA-Oil-and-Gas market is projected to reach a size of approximately $5.6 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from 2023. This growth reflects the increasing demand for automation in the oil and gas sector.

What are the key market players or companies in this SCADA-Oil And-Gas industry?

Key players in the SCADA-Oil-and-Gas industry include major corporations specializing in industrial automation and control solutions. They focus on delivering innovative SCADA systems designed to optimize operations in the oil and gas sector, enhancing efficiency and safety.

What are the primary factors driving the growth in the SCADA-Oil And-Gas industry?

Growth in the SCADA-Oil-and-Gas industry is primarily driven by rising operational efficiency needs, regulatory compliance, advancements in IoT technologies, and increased investments in automation solutions. Additionally, the growing demand for real-time data analytics is fueling market expansion.

Which region is the fastest Growing in the SCADA-Oil And-Gas?

The fastest-growing region in the SCADA-Oil-and-Gas market is anticipated to be Europe, with market size expected to grow from $1.76 billion in 2023 to $3.46 billion by 2033. Other rapid growth regions include Asia Pacific and North America.

Does ConsaInsights provide customized market report data for the SCADA-Oil And-Gas industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the SCADA-Oil-and-Gas industry. Clients can request detailed insights and analyses focusing on niche areas or segments to better inform their business strategies.

What deliverables can I expect from this SCADA-Oil And-Gas market research project?

Deliverables from the SCADA-Oil-and-Gas market research project typically include comprehensive market reports, segment analysis, competitive landscape assessment, trend analysis, and forecasts. These insights are critical for strategic decision-making.

What are the market trends of SCADA-Oil And-Gas?

Key market trends in the SCADA-Oil-and-Gas industry include a shift towards cloud-based deployment, increasing integration of AI and machine learning, enhanced cybersecurity measures, and a focus on sustainability. These trends are shaping the future landscape of the industry.