Scalable Software Defined Networking Market Report

Published Date: 31 January 2026 | Report Code: scalable-software-defined-networking

Scalable Software Defined Networking Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Scalable Software Defined Networking market, including detailed analysis, segmentation, and forecasts from 2023 to 2033. It highlights market trends, sizes, regional breakdowns, key players, and future growth opportunities in the industry.

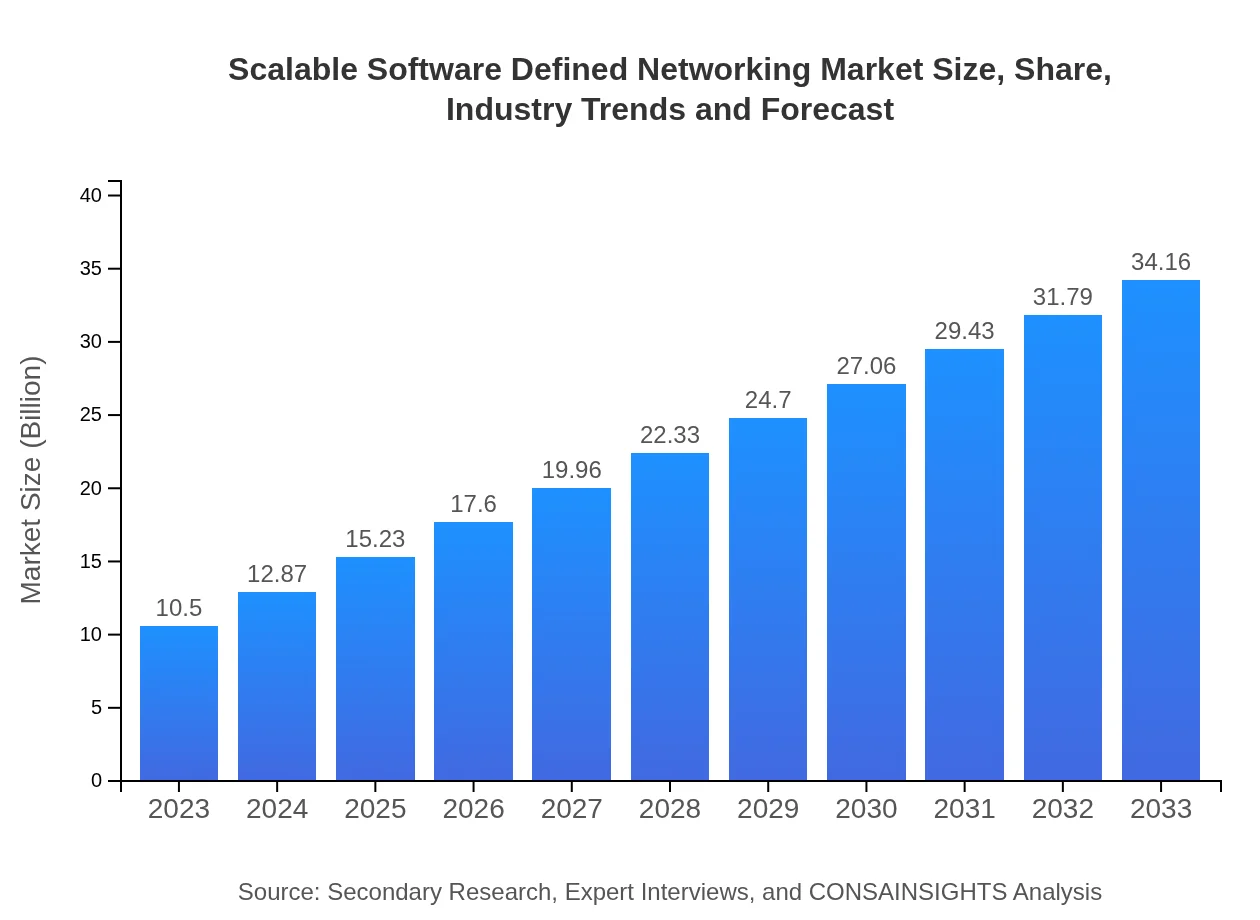

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $34.16 Billion |

| Top Companies | Cisco Systems, Inc., VMware, Inc., Juniper Networks, Inc., Arista Networks, Inc., Hewlett Packard Enterprise (HPE) |

| Last Modified Date | 31 January 2026 |

Scalable Software Defined Networking Market Overview

Customize Scalable Software Defined Networking Market Report market research report

- ✔ Get in-depth analysis of Scalable Software Defined Networking market size, growth, and forecasts.

- ✔ Understand Scalable Software Defined Networking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Scalable Software Defined Networking

What is the Market Size & CAGR of Scalable Software Defined Networking market in 2023?

Scalable Software Defined Networking Industry Analysis

Scalable Software Defined Networking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Scalable Software Defined Networking Market Analysis Report by Region

Europe Scalable Software Defined Networking Market Report:

The European market is poised to grow from $2.57 billion in 2023 to $8.36 billion by 2033. Strong regulatory frameworks and a focus on cybersecurity in network management contribute to the region's growth, adding impetus to SDN implementations.Asia Pacific Scalable Software Defined Networking Market Report:

The Asia-Pacific region, valued at approximately $2.19 billion in 2023, is expected to grow to $7.13 billion by 2033. The region's growth is driven by increasing investment in digital transformation, along with a rising demand for cloud applications and bandwidth-intensive services across various sectors.North America Scalable Software Defined Networking Market Report:

North America leads the SDN market with a valuation of $3.66 billion in 2023, anticipated to reach $11.91 billion by 2033. The region benefits from a mature technological landscape and a high concentration of key industry players driving innovation in SDN solutions.South America Scalable Software Defined Networking Market Report:

In South America, the SDN market stood at $1.02 billion in 2023 and is projected to reach $3.31 billion by 2033. Growing internet penetration, coupled with government initiatives to enhance IT infrastructure, propels market expansion in this region.Middle East & Africa Scalable Software Defined Networking Market Report:

The Middle East and Africa market, valued at $1.06 billion in 2023, is expected to reach $3.45 billion by 2033. The region is experiencing increased demand for advanced networking solutions driven by rapid industrial development and urbanization.Tell us your focus area and get a customized research report.

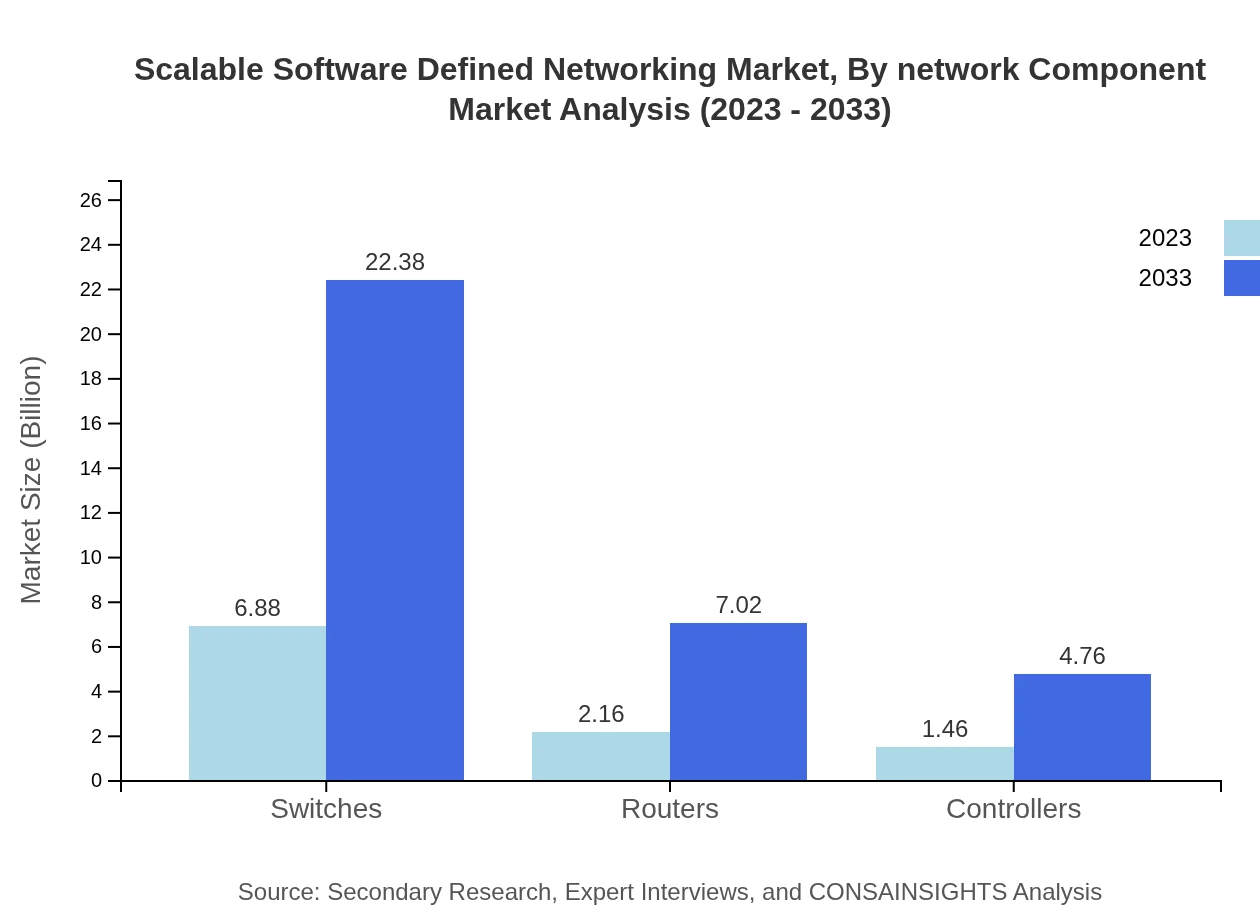

Scalable Software Defined Networking Market Analysis By Network Component

The network component segment includes switches, routers, and controllers, which play a pivotal role in SDN architecture. The switch segment is anticipated to dominate, growing from $6.88 billion in 2023 to $22.38 billion in 2033, holding a significant share of 65.53%.

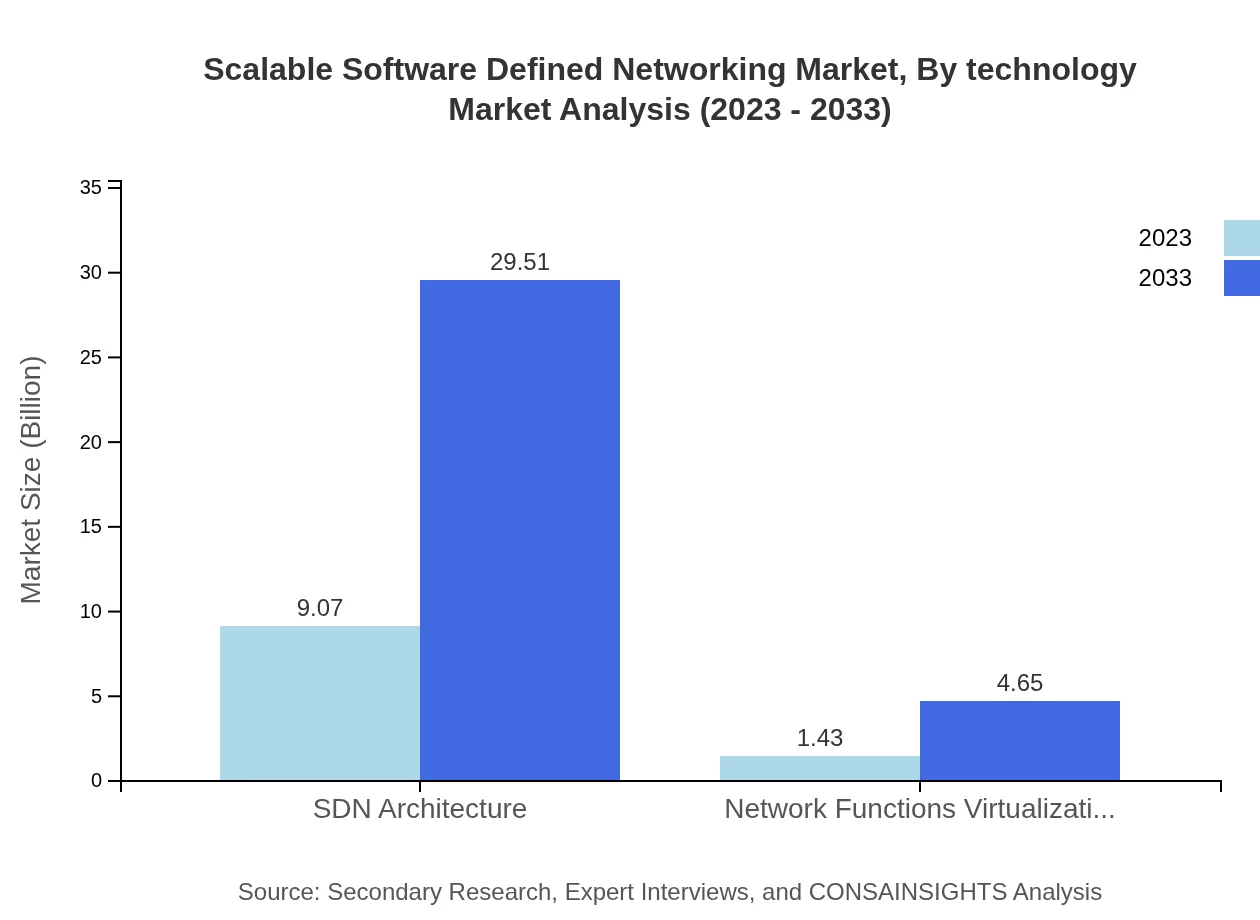

Scalable Software Defined Networking Market Analysis By Technology

The technology segment includes various architectures like SDN and NFV. SDN architecture is expected to grow from $9.07 billion in 2023 to $29.51 billion in 2033, maintaining a dominant share of 86.4% across the forecast period.

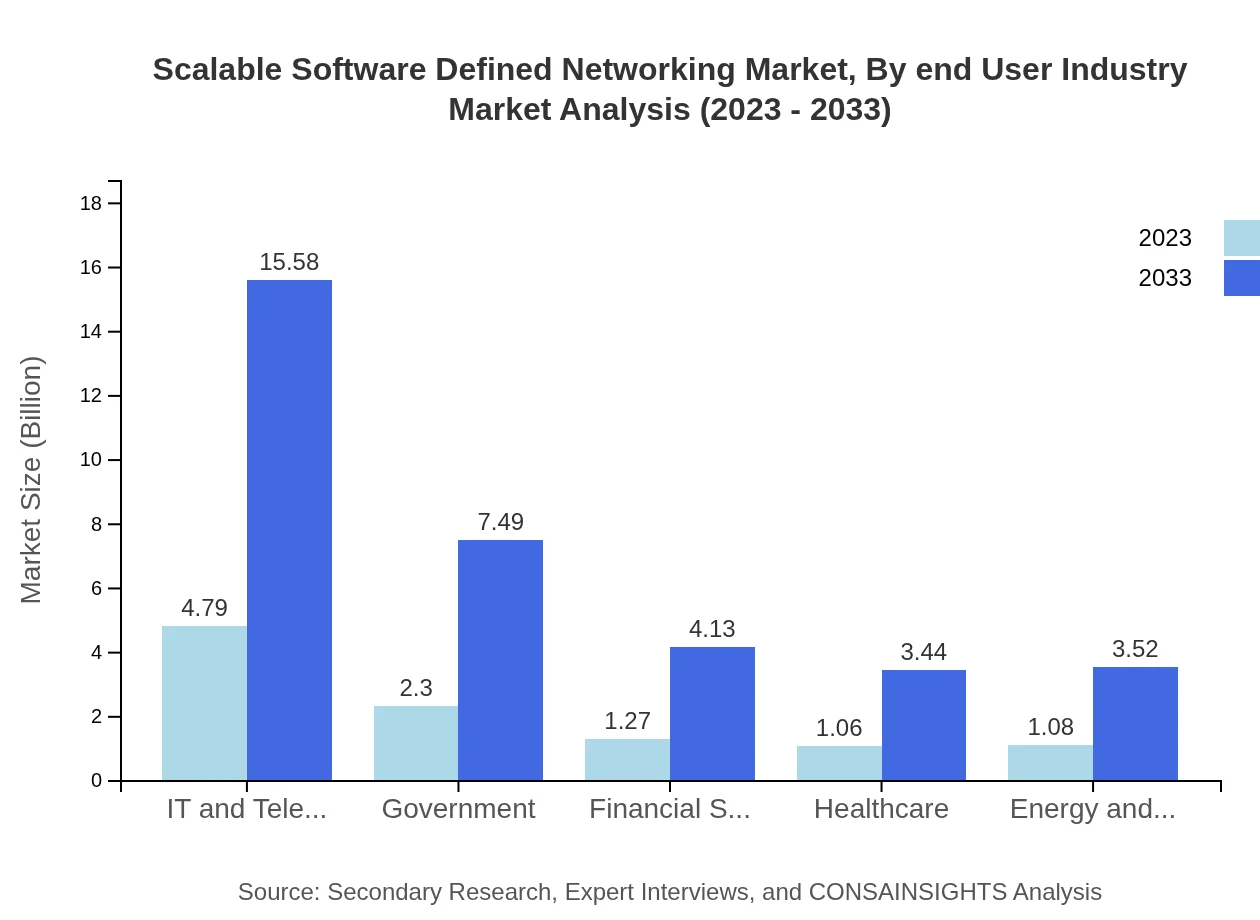

Scalable Software Defined Networking Market Analysis By End User Industry

Key industries employing SDN include IT and telecom, government, and healthcare, with IT and telecom leading at $4.79 billion in 2023, projected to reach $15.58 billion by 2033, holding a 45.61% market share.

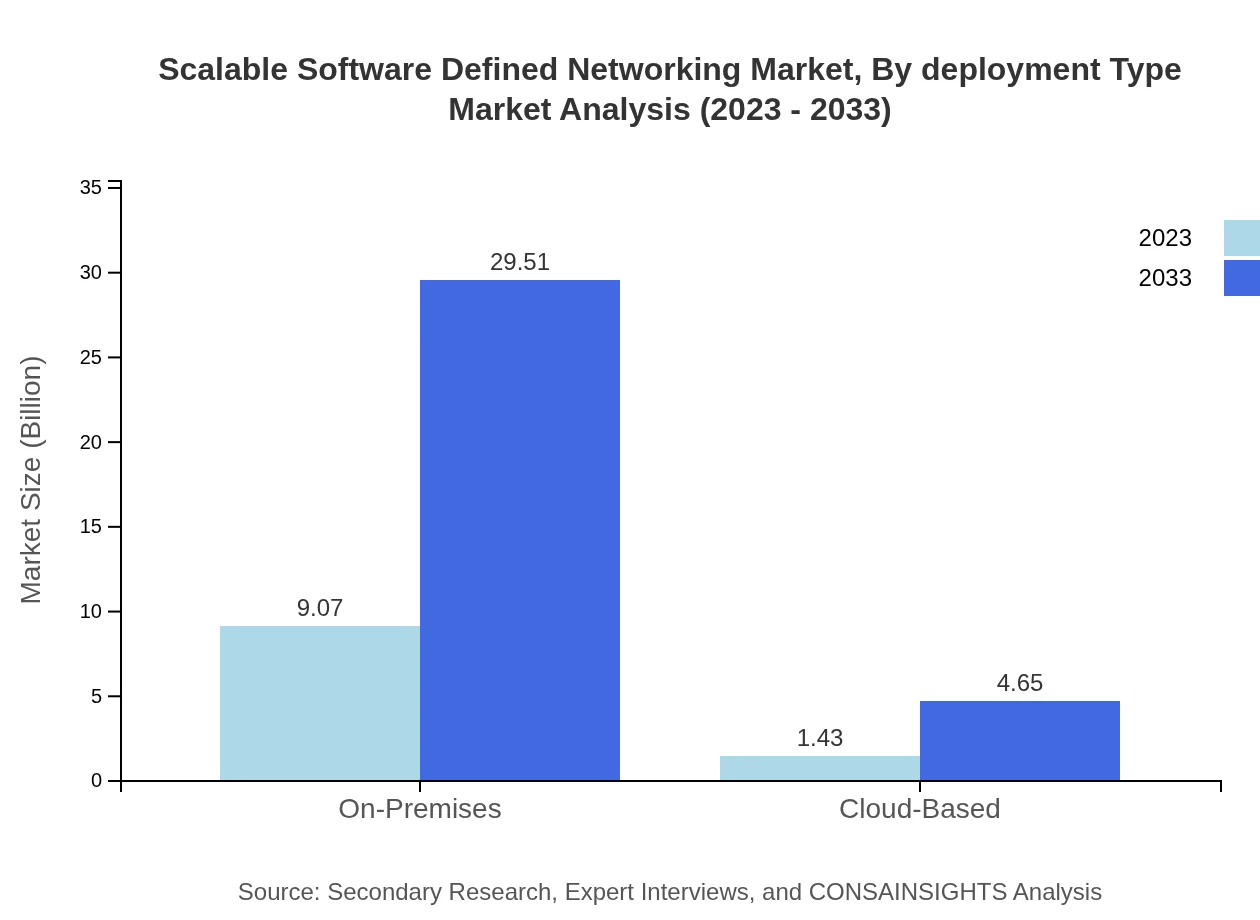

Scalable Software Defined Networking Market Analysis By Deployment Type

Deployment types include on-premises and cloud-based solutions. On-premises SDN solutions are set to grow extensively from $9.07 billion in 2023 to $29.51 billion in 2033, sustaining an 86.4% share throughout the forecast period.

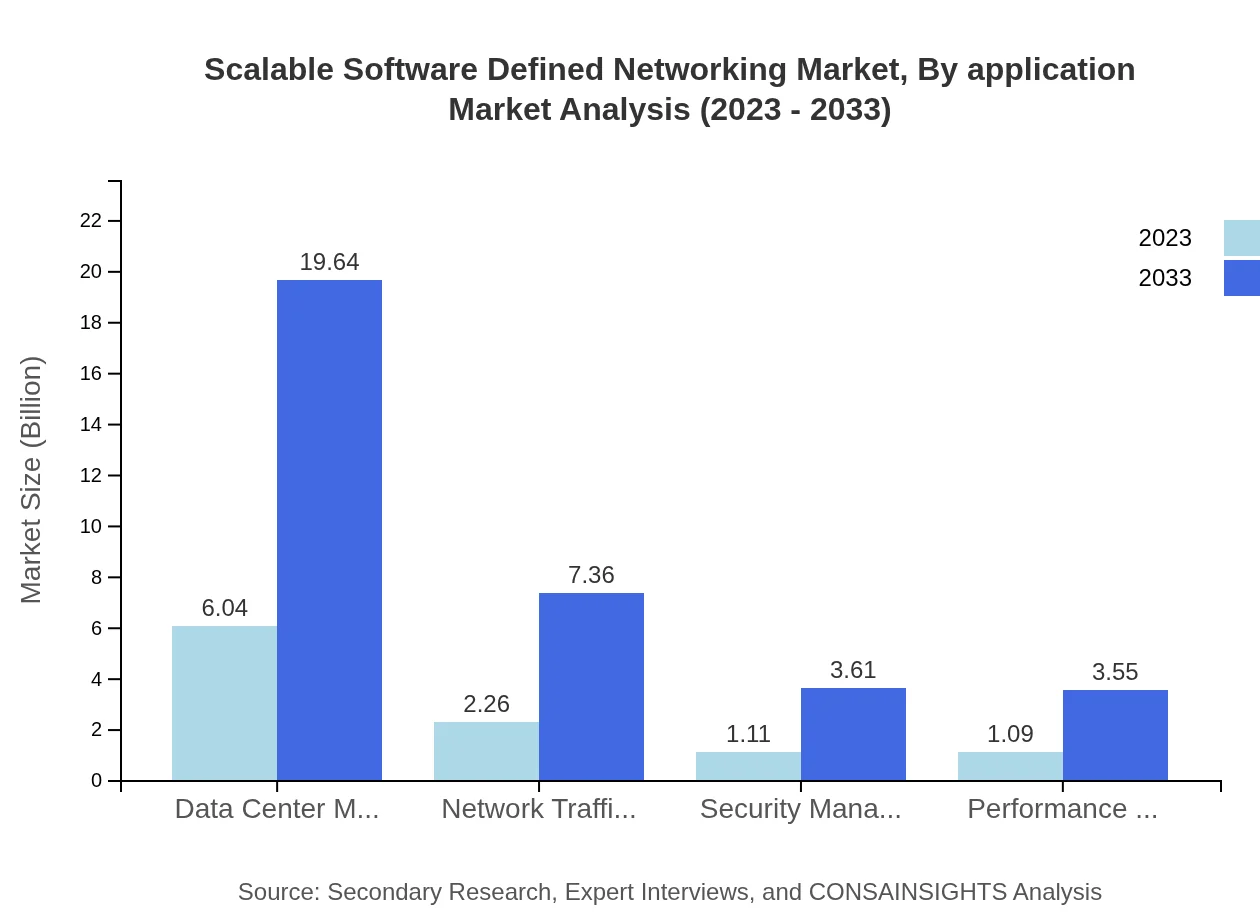

Scalable Software Defined Networking Market Analysis By Application

Applications of SDN encompass network traffic management, security, and performance monitoring. Network traffic management grew to $2.26 billion in 2023, anticipating a jump to $7.36 billion by 2033, capturing a 21.54% market share.

Scalable Software Defined Networking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Scalable Software Defined Networking Industry

Cisco Systems, Inc.:

Cisco is a leading player in the SDN market, providing a comprehensive range of networking solutions and cloud-based services that enhance operational efficiency and security.VMware, Inc.:

VMware offers advanced virtualization and SDN technologies that enable enterprises to streamline network management and improve agility.Juniper Networks, Inc.:

Juniper Networks delivers high-performance networking solutions and innovative SDN technologies that facilitate efficient data flow in large-scale environments.Arista Networks, Inc.:

Arista Networks focuses on cloud networking solutions, leveraging SDN to optimize data center operations and enhance overall network performance.Hewlett Packard Enterprise (HPE):

HPE integrates SDN into its portfolio, offering solutions that provide businesses with automated and secure networking capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of scalable Software Defined Networking?

The scalable software-defined networking market is valued at approximately $10.5 billion in 2023, with an anticipated growth rate of 12% CAGR projected to 2033, indicating substantial industry evolution and investment opportunities.

What are the key market players or companies in this scalable Software Defined Networking industry?

Key players in the scalable software-defined networking market include Cisco Systems, VMware, A10 Networks, and Arista Networks, known for their innovative solutions driving the SDN architecture and enhancing network efficiency.

What are the primary factors driving the growth in the scalable Software Defined Networking industry?

The growth in the scalable software-defined networking industry is driven by increasing demand for cloud services, rapid digital transformation, enhanced network management capabilities, and the need for improved security and performance in enterprise networks.

Which region is the fastest Growing in the scalable Software Defined Networking?

The North American region is the fastest-growing in the scalable software-defined networking market, projected to rise from $3.66 billion in 2023 to $11.91 billion by 2033, reflecting significant investment and advancements in technology.

Does ConsaInsights provide customized market report data for the scalable Software Defined Networking industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the scalable software-defined networking industry, ensuring comprehensive insights and precise analytics for strategic decision-making.

What deliverables can I expect from this scalable Software Defined Networking market research project?

Deliverables from the scalable software-defined networking market research project include a detailed report, market forecasts, competitive analysis, segmentation insights, and strategic recommendations for stakeholders to facilitate informed decision-making.

What are the market trends of scalable Software Defined Networking?

Current trends in the scalable software-defined networking market include increased adoption of cloud-based solutions, integration of AI in network management, enhanced security protocols, and a shift towards automated network operations for efficient resource allocation.