Scale Out Nas Market Report

Published Date: 31 January 2026 | Report Code: scale-out-nas

Scale Out Nas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Scale Out NAS market, highlighting key insights, market trends, and forecasts for the years 2023 to 2033. It covers market size, segmentation, regional analysis, and leading players in the industry.

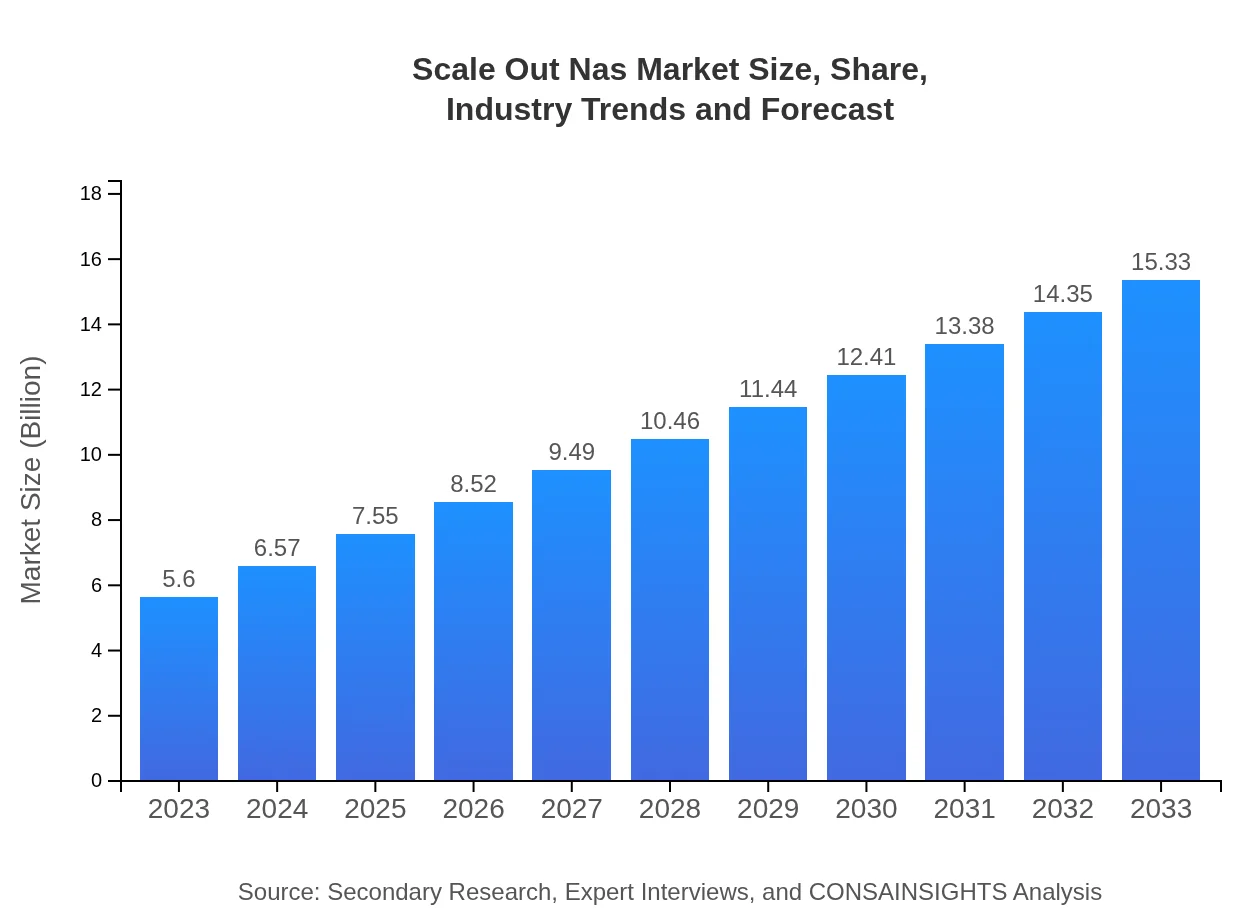

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | NetApp, Inc., Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, Western Digital Corporation |

| Last Modified Date | 31 January 2026 |

Scale Out NAS Market Overview

Customize Scale Out Nas Market Report market research report

- ✔ Get in-depth analysis of Scale Out Nas market size, growth, and forecasts.

- ✔ Understand Scale Out Nas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Scale Out Nas

What is the Market Size & CAGR of Scale Out NAS market in 2023?

Scale Out NAS Industry Analysis

Scale Out NAS Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Scale Out NAS Market Analysis Report by Region

Europe Scale Out Nas Market Report:

The European market for Scale Out NAS is anticipated to grow from $1.67 billion in 2023 to $4.56 billion by 2033. European businesses are increasingly prioritizing data management and security, contributing to heightened investments in NAS solutions. Furthermore, regulatory frameworks around data privacy are prompting organizations to adopt more robust storage solutions.Asia Pacific Scale Out Nas Market Report:

The Asia Pacific region is projected to grow from $1.08 billion in 2023 to $2.97 billion by 2033. The rapid digitalization in countries like China and India, along with increasing investments in IT infrastructure, is fueling this growth. Additionally, the rise of cloud adoption and big data analytics in the region is contributing to the demand for scalable storage solutions.North America Scale Out Nas Market Report:

North America leads the Scale Out NAS market with a forecasted growth from $1.85 billion in 2023 to $5.07 billion by 2033. The presence of major technology companies and increasing adoption of advanced data analytics are key factors supporting market growth. Additionally, the demand for cloud services and scalable storage options continues to rise significantly.South America Scale Out Nas Market Report:

In South America, the Scale Out NAS market is expected to increase from $0.51 billion in 2023 to $1.40 billion by 2033. The growing emphasis on data protection measures and the need for reliable storage solutions in various sectors such as finance and education are driving market expansion in this region.Middle East & Africa Scale Out Nas Market Report:

In the Middle East and Africa, the Scale Out NAS market is projected to increase from $0.49 billion in 2023 to $1.33 billion by 2033. Emerging economies in the region are gradually enhancing their digital infrastructure, thus creating opportunities for scale-out storage solutions, particularly in sectors like telecommunications and finance.Tell us your focus area and get a customized research report.

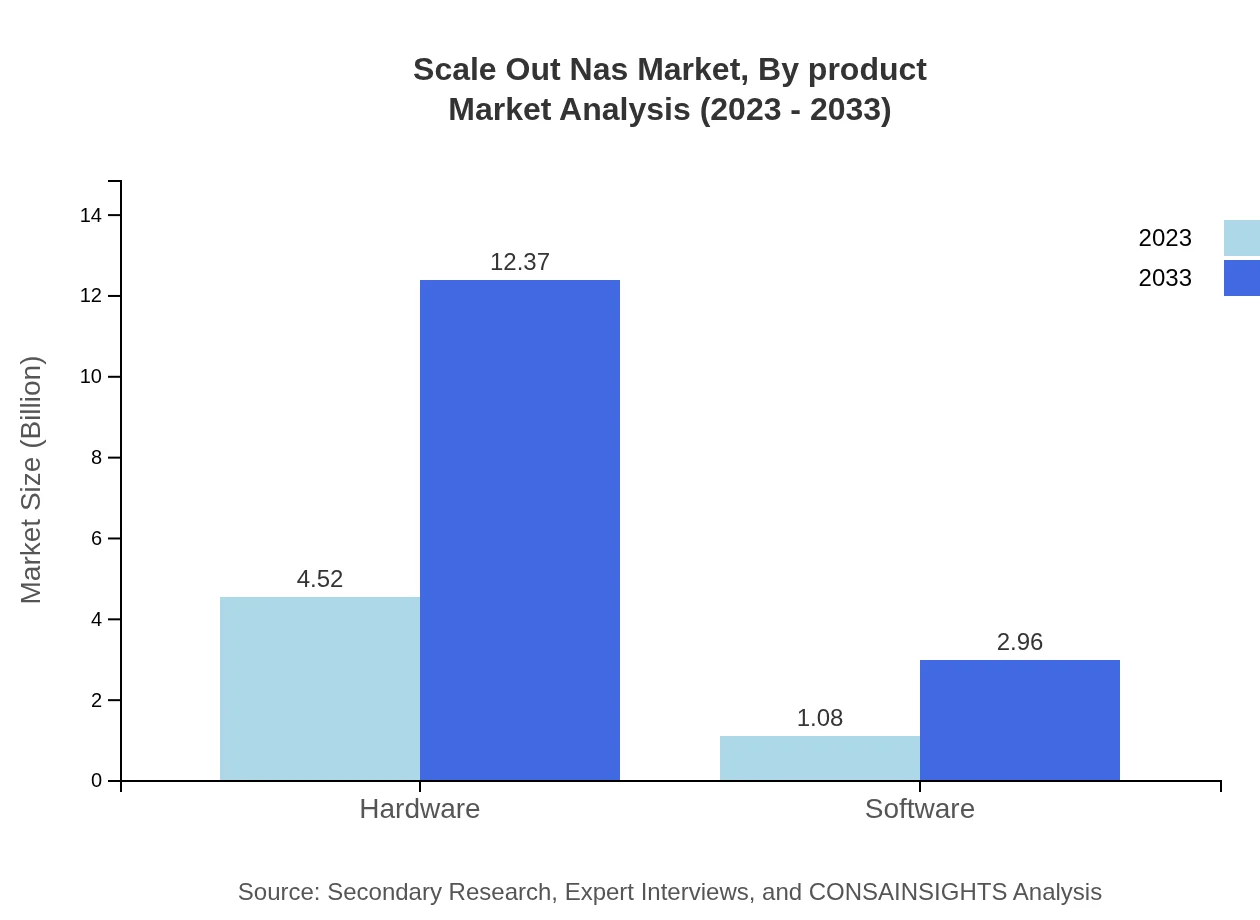

Scale Out Nas Market Analysis By Product

The product segment is dominated by hardware, expected to grow from $4.52 billion in 2023 to $12.37 billion by 2033. Software solutions are projected to expand from $1.08 billion to $2.96 billion during the same period, emphasizing the crucial role of both in the NAS ecosystem.

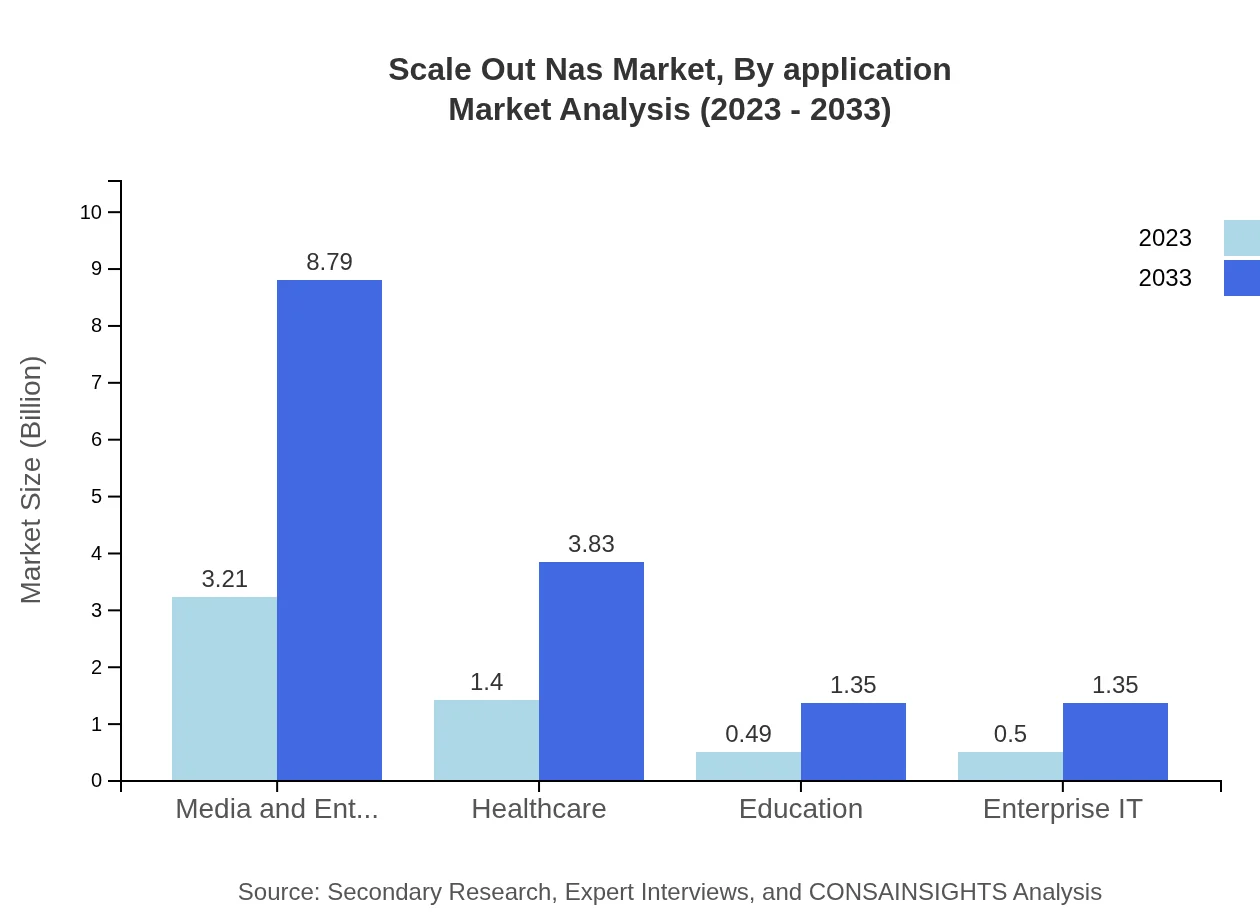

Scale Out Nas Market Analysis By Application

The media and entertainment sector represents a significant share, expected to hold approximately 57.37% of the market in 2023. This segment is anticipated to grow from $3.21 billion to $8.79 billion by 2033, driven by increasing content creation and consumption.

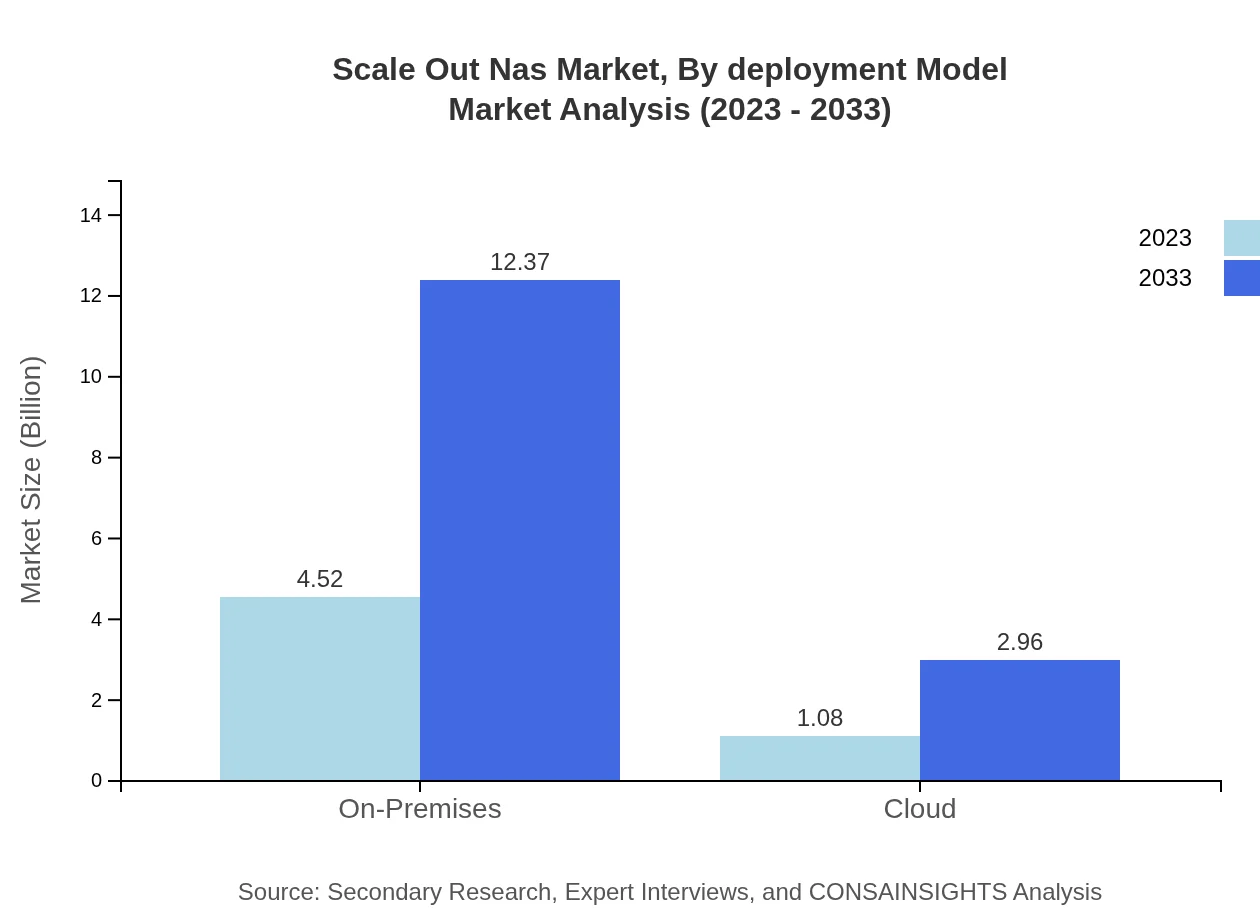

Scale Out Nas Market Analysis By Deployment Model

The on-premises deployment model remains dominant, maintaining an 80.69% market share from 2023 to 2033. However, cloud deployment is gaining traction, growing from $1.08 billion to $2.96 billion as organizations look for more flexible storage options.

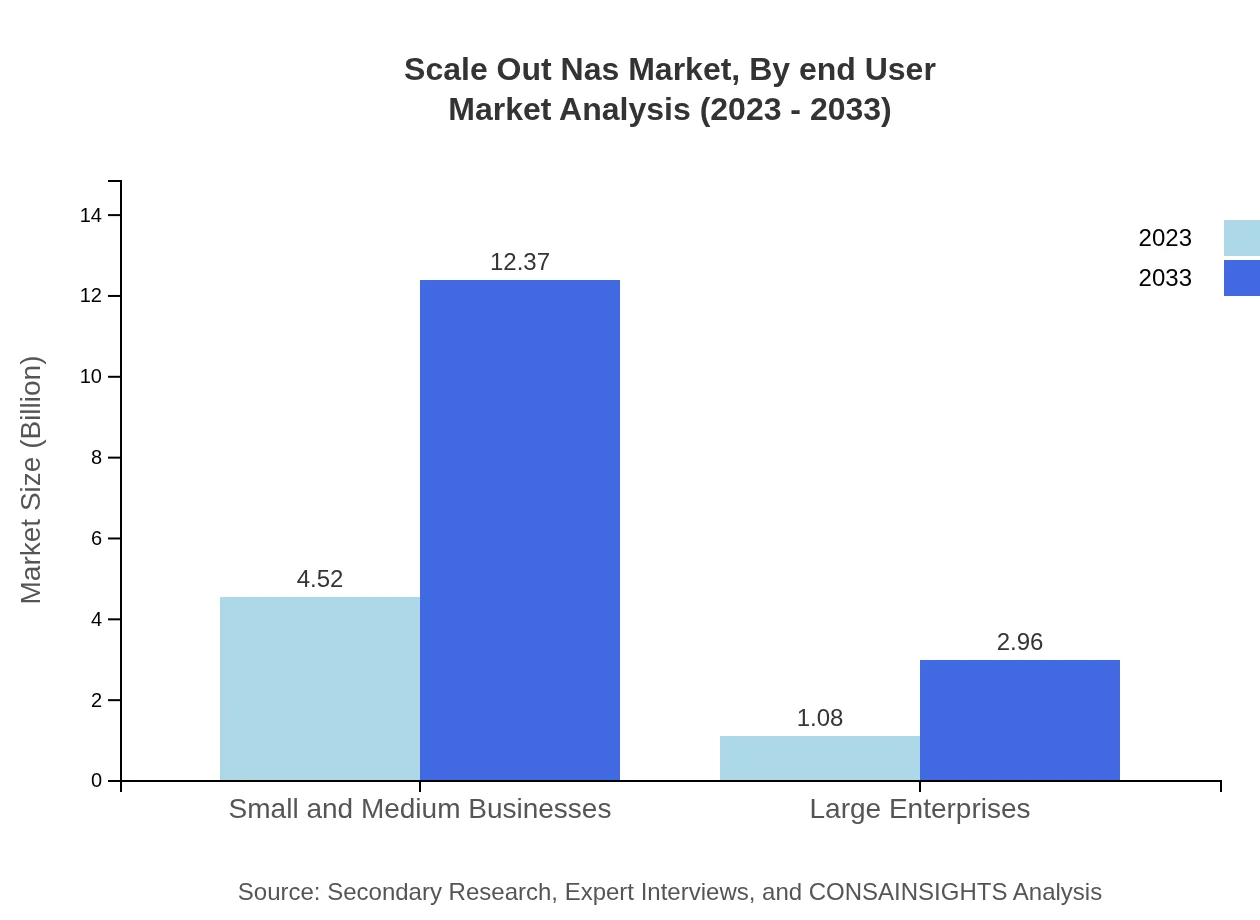

Scale Out Nas Market Analysis By End User

The end-user segment highlights significant contributions from both small and medium businesses (SMBs) and large enterprises, with SMBs expected to dominate the market due to their increasing data storage needs and limited IT budgets.

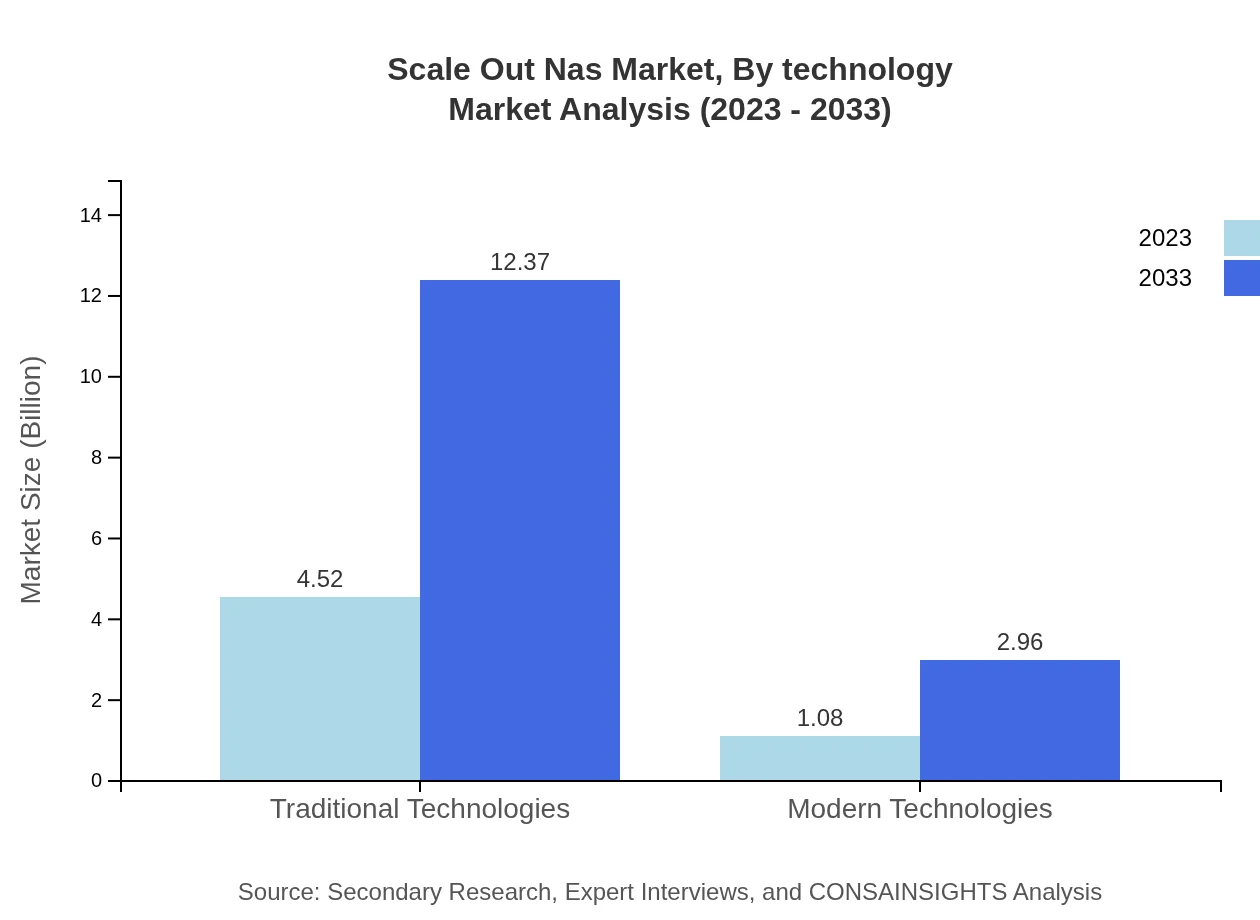

Scale Out Nas Market Analysis By Technology

The segment encompasses both traditional and modern technologies. Traditional technologies maintain an 80.69% market share, while modern technologies are on an upward trend, favored for their scalability and performance benefits.

Scale Out NAS Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Scale Out NAS Industry

NetApp, Inc.:

NetApp provides innovative cloud data services and data management solutions that enable customers to remain agile and optimize their storage resources effectively.Dell Technologies:

Dell Technologies excels in providing scalable storage solutions, with a focus on enhancing data accessibility and ensuring customers can integrate their operations seamlessly.Hewlett Packard Enterprise (HPE):

HPE offers a broad portfolio of storage solutions that cater to a diverse range of business needs, focusing on high performance, security, and manageability.IBM Corporation:

IBM specializes in providing hybrid cloud infrastructure solutions and advanced data storage systems, driving innovation in data management technologies.Western Digital Corporation:

Western Digital is known for its extensive line of storage devices and solutions that support both consumer and enterprise NAS applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Scale-Out NAS?

The Scale-Out NAS market is currently valued at approximately $5.6 billion in 2023. It is expected to expand significantly, achieving a compound annual growth rate (CAGR) of 10.2% over the next decade.

What are the key market players or companies in the Scale-Out NAS industry?

Key players in the Scale-Out NAS industry include major technology companies known for their data storage solutions, software-defined storage technologies, and cloud-based services, which contribute to a competitive landscape driving innovation and service expansion.

What are the primary factors driving the growth in the Scale-Out NAS industry?

Growth in the Scale-Out NAS industry is driven by increasing data volume generated by businesses, demand for scalable storage solutions, the rise of cloud computing, and the need for efficient data management in sectors like media, healthcare, and enterprise IT.

Which region is the fastest Growing in the Scale-Out NAS?

The fastest-growing region in the Scale-Out NAS market is Europe, projecting growth from $1.67 billion in 2023 to approximately $4.56 billion by 2033, indicating a robust demand for advanced storage solutions in various industries.

Does ConsaInsights provide customized market report data for the Scale-Out NAS industry?

Yes, ConsaInsights offers customized market report data for the Scale-Out NAS industry, tailored to specific business needs, allowing clients to gain insights pertinent to their market and operational strategies.

What deliverables can I expect from this Scale-Out NAS market research project?

Deliverables from the Scale-Out NAS market research project include comprehensive market analysis reports, detailed insights on regional trends, segment performance, competitive landscape assessments, and forecasts to guide strategic decision-making.

What are the market trends of Scale-Out NAS?

Current market trends in Scale-Out NAS include increasing adoption of cloud storage solutions, advancements in hybrid storage technology, integration of AI for data management, and a focus on scalability and flexibility to meet dynamic business needs.