Sea Based Military Electro Optical And Infrared Systems Market Report

Published Date: 03 February 2026 | Report Code: sea-based-military-electro-optical-and-infrared-systems

Sea Based Military Electro Optical And Infrared Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Sea Based Military Electro Optical And Infrared Systems market from 2023 to 2033, including market trends, insights, and detailed regional analyses aimed at stakeholders and decision-makers.

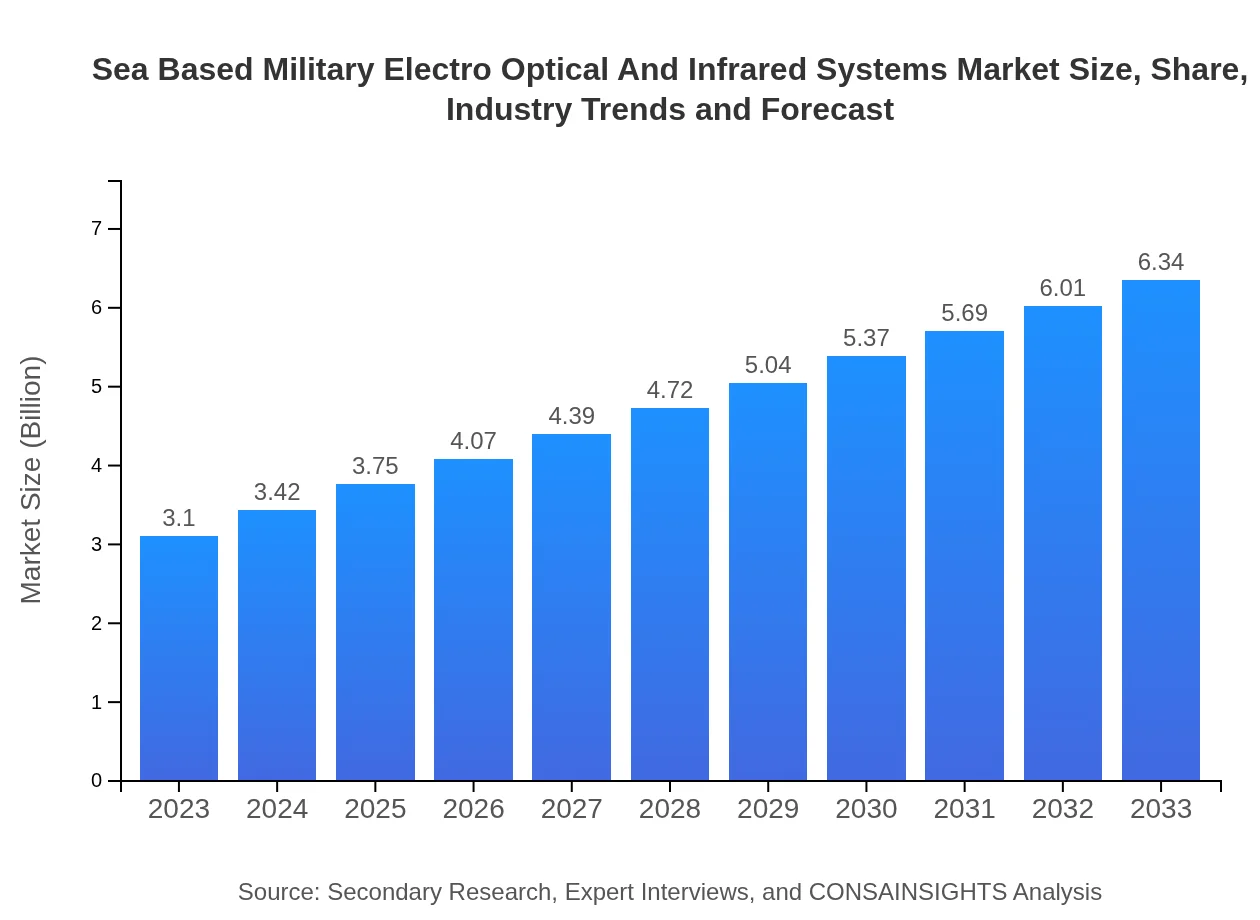

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.10 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $6.34 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, Thales Group, Leonardo S.p.A |

| Last Modified Date | 03 February 2026 |

Sea Based Military Electro Optical And Infrared Systems Market Overview

Customize Sea Based Military Electro Optical And Infrared Systems Market Report market research report

- ✔ Get in-depth analysis of Sea Based Military Electro Optical And Infrared Systems market size, growth, and forecasts.

- ✔ Understand Sea Based Military Electro Optical And Infrared Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sea Based Military Electro Optical And Infrared Systems

What is the Market Size & CAGR of Sea Based Military Electro Optical And Infrared Systems market in 2023?

Sea Based Military Electro Optical And Infrared Systems Industry Analysis

Sea Based Military Electro Optical And Infrared Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sea Based Military Electro Optical And Infrared Systems Market Analysis Report by Region

Europe Sea Based Military Electro Optical And Infrared Systems Market Report:

Europe's market is anticipated to grow from 0.84 billion USD in 2023 to 1.71 billion USD in 2033, spurred by NATO's ongoing initiatives and intergovernmental collaborations aimed at enhancing operational readiness amidst emerging threats.Asia Pacific Sea Based Military Electro Optical And Infrared Systems Market Report:

The Asia Pacific region's Sea Based Military Electro Optical and Infrared Systems market is forecasted to grow from 0.67 billion USD in 2023 to 1.36 billion USD in 2033. Increasing naval modernization initiatives in countries like China and India are driving demand, necessitating advanced surveillance and targeting systems.North America Sea Based Military Electro Optical And Infrared Systems Market Report:

The North American market, valued at 1.07 billion USD in 2023, is projected to rise to 2.20 billion USD by 2033. The U.S. Navy's substantial investments in next-generation systems and increasing collaboration with defense contractors highlight the region's pivotal role in shaping the future of military applications.South America Sea Based Military Electro Optical And Infrared Systems Market Report:

In South America, the market is expected to see growth from 0.14 billion USD in 2023 to 0.29 billion USD in 2033. Countries are increasingly recognizing the need for enhanced maritime security; however, budgetary constraints limit the pace of technology adoption.Middle East & Africa Sea Based Military Electro Optical And Infrared Systems Market Report:

The Middle East and Africa market is projected to expand from 0.38 billion USD in 2023 to 0.77 billion USD by 2033, driven by regional conflicts and the requirement for improved naval capabilities. Investments in maritime security are essential to counter piracy and terrorism.Tell us your focus area and get a customized research report.

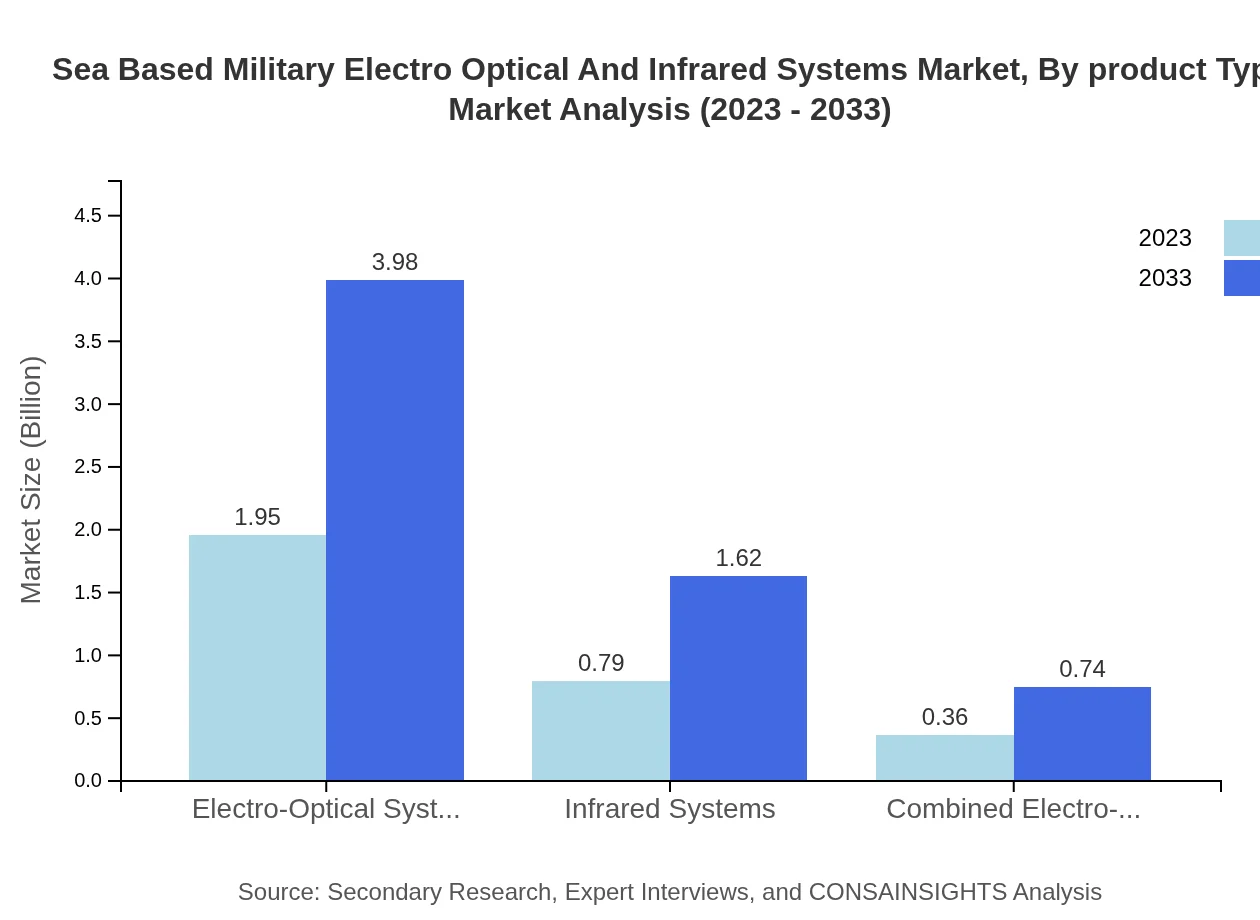

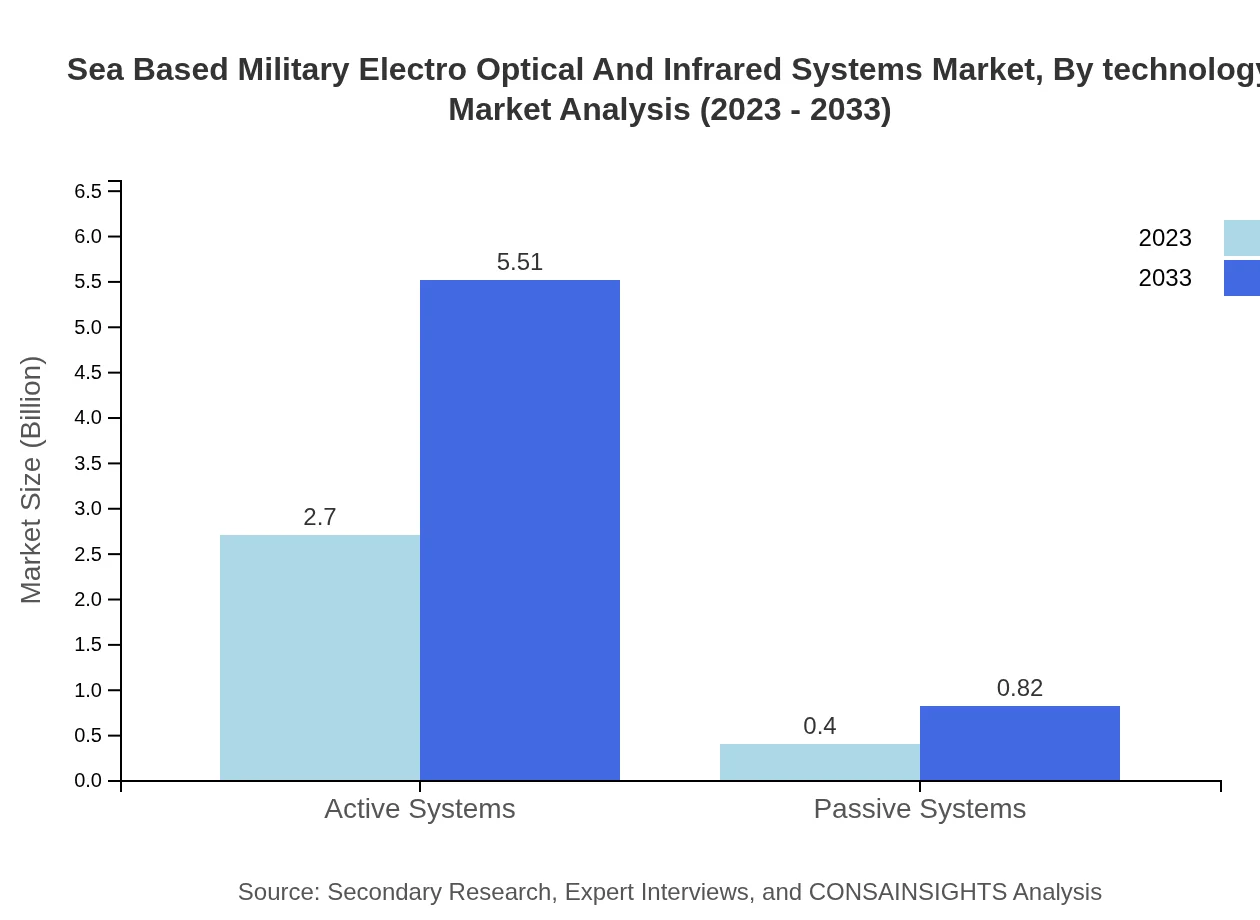

Sea Based Military Electro Optical And Infrared Systems Market Analysis By Product Type

The Sea Based Military Electro-Optical and Infrared Systems market by product type is dominated by Active Systems and Electro-Optical Systems, which collectively make up a significant share of the market. In 2023, Active Systems account for 87.03% of the market. This trend is expected to continue as operators demand systems that offer advanced detection and engagement capabilities.

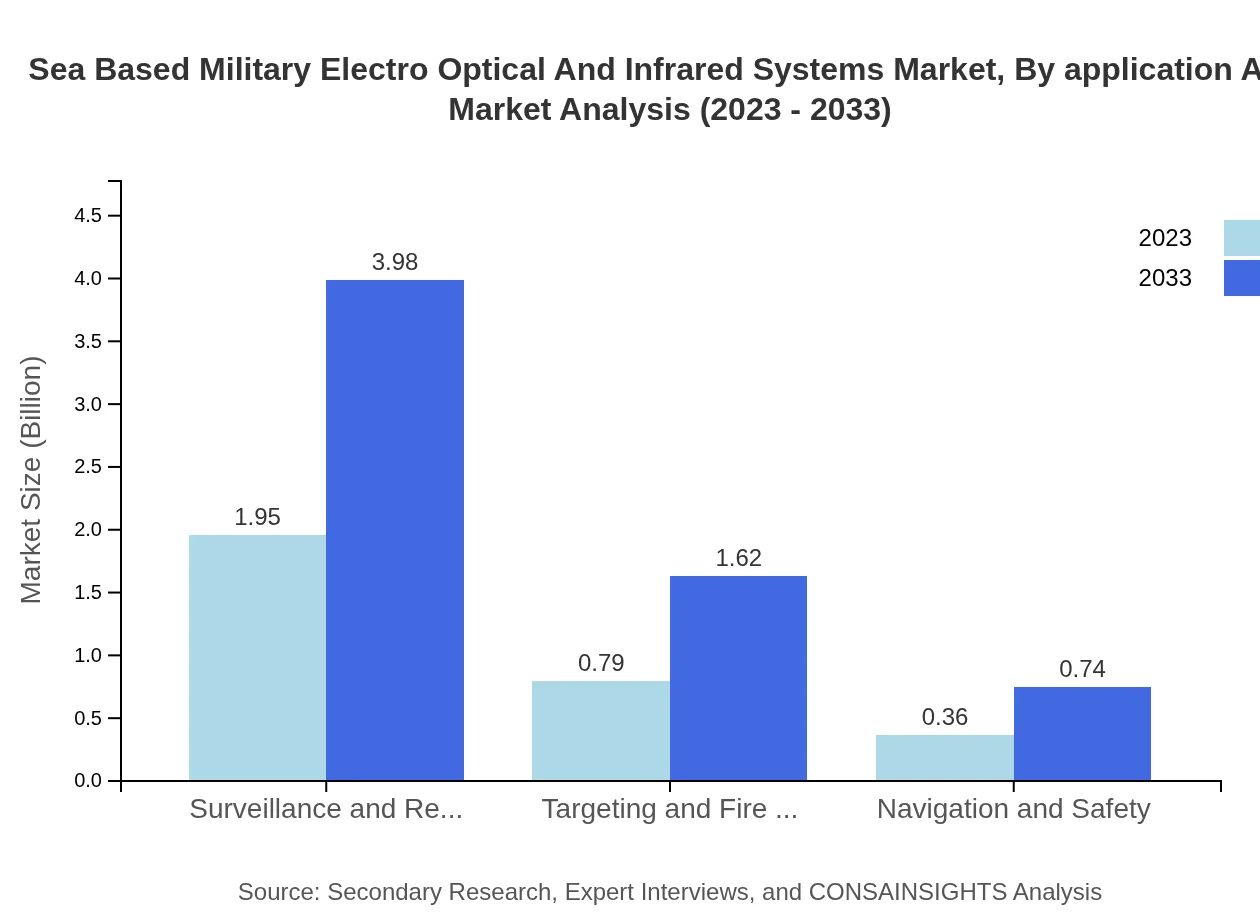

Sea Based Military Electro Optical And Infrared Systems Market Analysis By Application Area

Surveillance and reconnaissance applications dominate the market, capturing approximately 62.85% of the total by 2023, while targeting and fire control account for about 25.53%. The demand in these areas is fueled by ongoing military operations focusing on situational awareness and combat readiness.

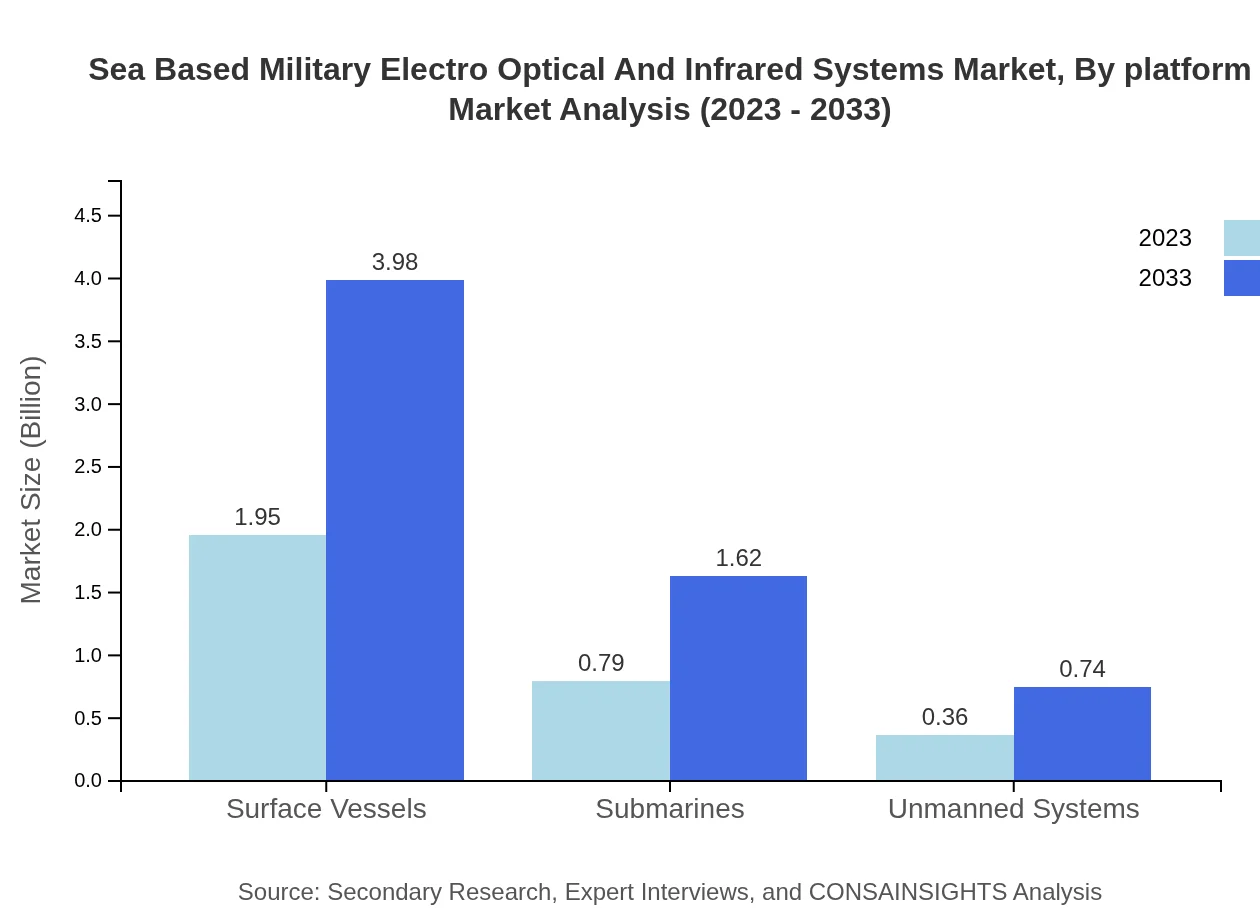

Sea Based Military Electro Optical And Infrared Systems Market Analysis By Platform

In terms of platforms, Surface Vessels lead with a market share of 62.85% in 2023, followed by Submarines and Unmanned Systems at 25.53% and 11.62%, respectively. The rise in surface maritime operations is anticipated to drive further integration of sophisticated optical and infrared systems.

Sea Based Military Electro Optical And Infrared Systems Market Analysis By Technology

The market demonstrates a distinct preference for Electro-Optical Systems, representing 62.85% market share in 2023. The combined use of both Electro-Optical and Infrared systems is proving effective for multifunctional operational strategies.

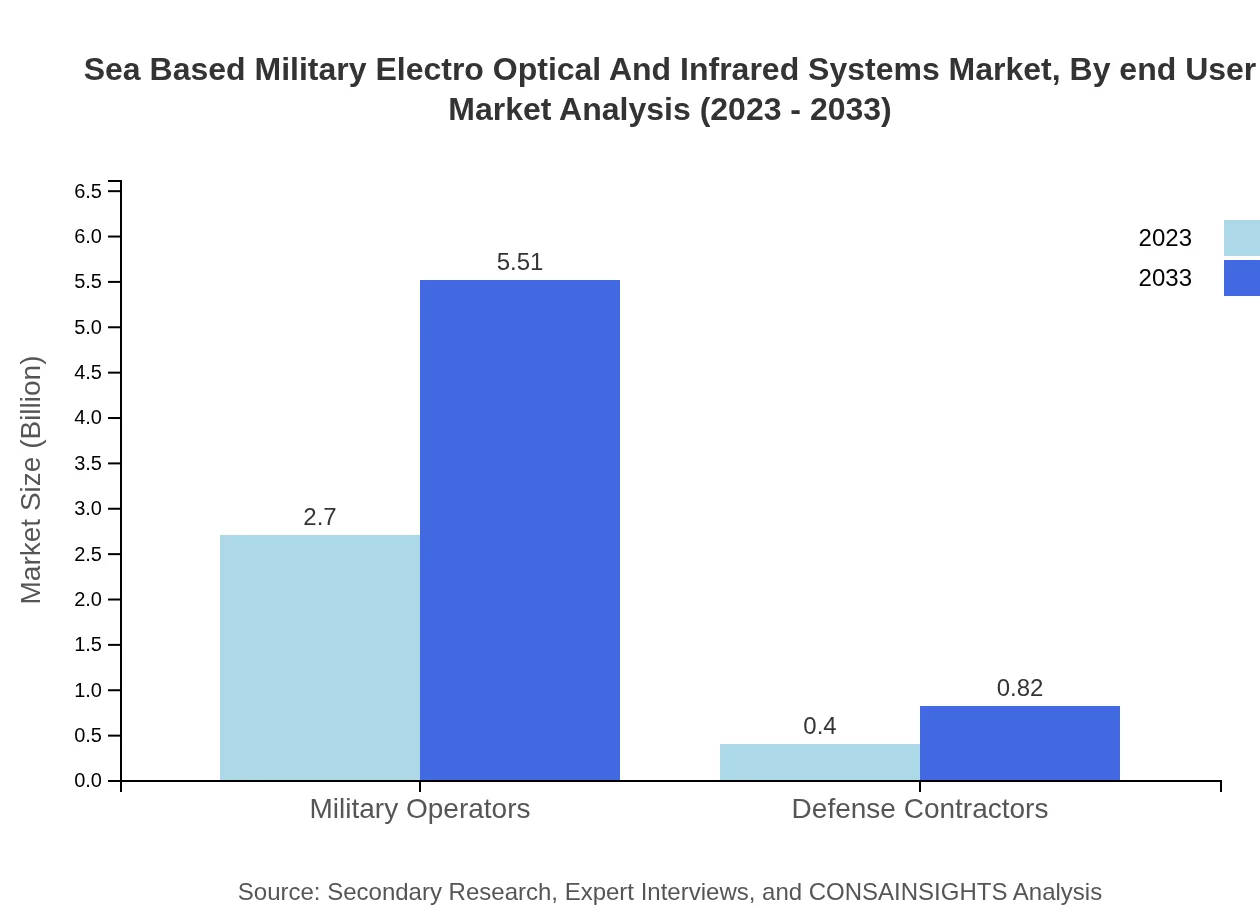

Sea Based Military Electro Optical And Infrared Systems Market Analysis By End User

Military Operators control 87.03% of the market share in 2023, reflective of the governmental and defense interests in advancing their capabilities. Defense Contractors, encompassing 12.97%, play a crucial role through innovations and supply chain management.

Sea Based Military Electro Optical And Infrared Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sea Based Military Electro Optical And Infrared Systems Industry

Lockheed Martin:

Lockheed Martin is a leading global aerospace, defense, security, and advanced technologies company. They have been at the forefront of developing innovative sea-based electro-optical and infrared systems for naval applications.Raytheon Technologies:

Raytheon Technologies specializes in defense and aerospace systems, including advanced sensors and systems for naval forces, supporting various military operations and strategies.Northrop Grumman:

Northrop Grumman offers a wide range of advanced technologies, including sophisticated thermal imaging and electro-optical systems that are critical for modern naval warfare.Thales Group:

Thales Group provides various advanced technological solutions, particularly in defense and security markets, with critical contributions to electro-optical and infrared systems.Leonardo S.p.A:

Leonardo S.p.A specializes in aerospace, defense, and security sectors, with a focus on advanced electro-optical systems for maritime applications.We're grateful to work with incredible clients.

FAQs

What is the market size of sea Based military electro Optical and infrared systems?

The sea-based military electro-optical and infrared systems market size is valued at $3.1 billion in 2023, with a projected CAGR of 7.2% over the next decade.

What are the key market players or companies in the sea Based military electro Optical and infrared systems industry?

The market features key players including Raytheon Technologies, Northrop Grumman, Lockheed Martin, Thales Group, and Leonardo S.p.A., each contributing substantial technological advancements and competitive strategies.

What are the primary factors driving the growth in the sea Based military electro Optical and infrared systems industry?

Growth drivers include increasing military spending, advancements in imaging technologies, rapid modernization of naval fleets, rising global geopolitical tensions, and a heightened focus on situational awareness in maritime operations.

Which region is the fastest Growing in the sea Based military electro Optical and infrared systems?

The fastest-growing region is North America, with market growth from $1.07 billion in 2023 to $2.20 billion by 2033, driven by significant investments in defense technologies.

Does ConsaInsights provide customized market report data for the sea Based military electro Optical and infrared systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the sea-based military electro-optical and infrared systems industry, ensuring comprehensive insights and analyses.

What deliverables can I expect from this sea Based military electro Optical and infrared systems market research project?

Expected deliverables include detailed market analyses, trend reports, competitive landscape reviews, expert insights, and forecasts, along with regional and segment data for strategic planning.

What are the market trends of sea Based military electro Optical and infrared systems?

Trending aspects include enhanced focus on integrated systems, increased deployment of unmanned platforms, advancements in miniaturized technology, and growing demand for multi-sensor capabilities in naval operations.