Seafood Processing Equipment Market Report

Published Date: 31 January 2026 | Report Code: seafood-processing-equipment

Seafood Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Seafood Processing Equipment market from 2023 to 2033, highlighting market trends, size, segmentation, regional insights, and industry leaders, thereby offering valuable insights for stakeholders in the seafood processing industry.

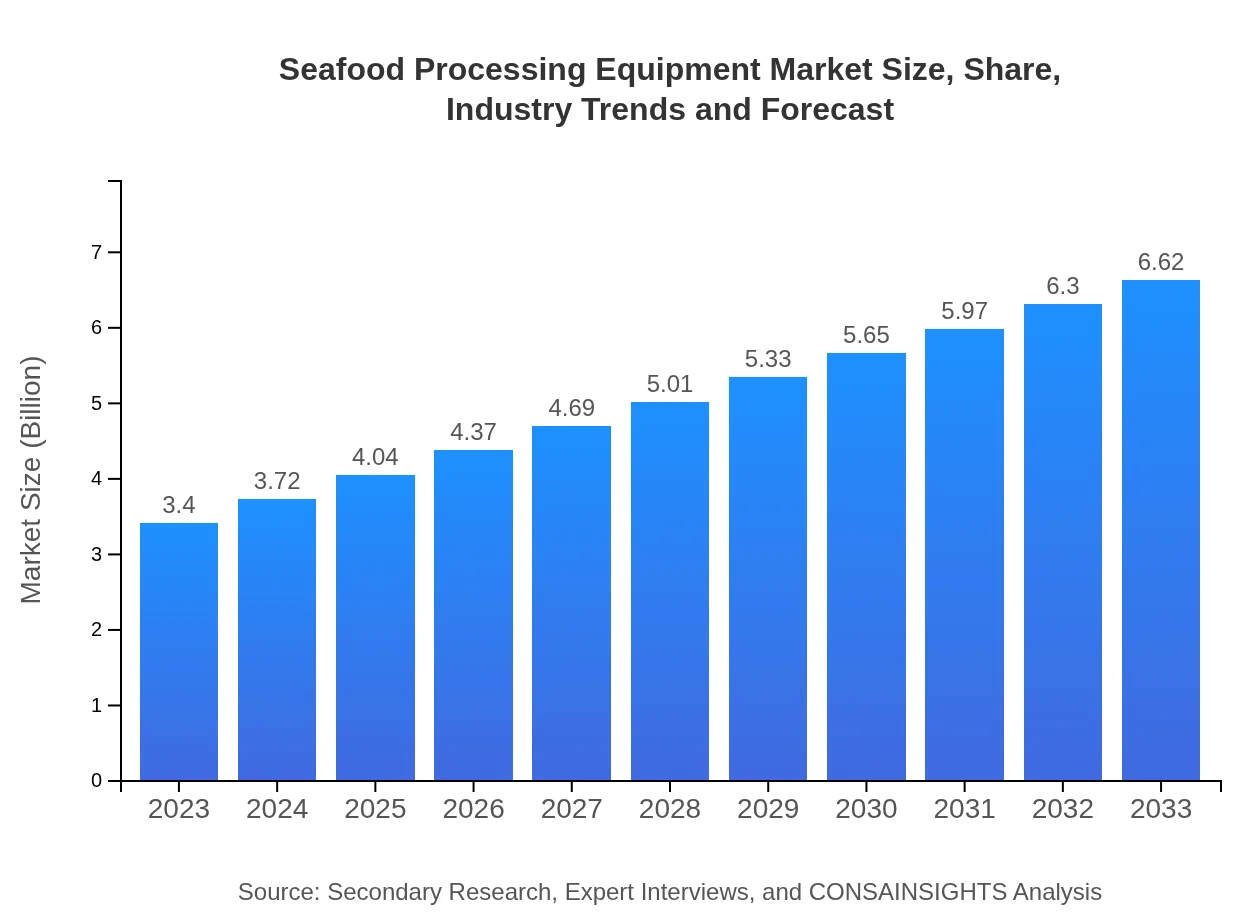

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $6.62 Billion |

| Top Companies | Marel, Baader, JBT Corporation, Stork Food & Dairy Systems |

| Last Modified Date | 31 January 2026 |

Seafood Processing Equipment Market Overview

Customize Seafood Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Seafood Processing Equipment market size, growth, and forecasts.

- ✔ Understand Seafood Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Seafood Processing Equipment

What is the Market Size & CAGR of Seafood Processing Equipment market in 2023?

Seafood Processing Equipment Industry Analysis

Seafood Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Seafood Processing Equipment Market Analysis Report by Region

Europe Seafood Processing Equipment Market Report:

Europe’s market is projected to grow significantly from $0.94 billion in 2023 to $1.84 billion by 2033. This growth is influenced by stringent regulations on food safety and quality, alongside increasing consumer preference for seafood, particularly in countries like Norway and Spain.Asia Pacific Seafood Processing Equipment Market Report:

The Asia Pacific region is projected to grow from $0.67 billion in 2023 to $1.31 billion by 2033, driven by rising seafood consumption and increased exports. Countries like China, Japan, and Thailand are key contributors, focusing heavily on automation and improved processing technologies while addressing sustainability challenges.North America Seafood Processing Equipment Market Report:

North America maintains the largest market share with a projected growth from $1.25 billion in 2023 to $2.43 billion by 2033. The United States leads in technological innovations and sustainability practices, driven by high consumer demand for processed seafood products.South America Seafood Processing Equipment Market Report:

In South America, the Seafood Processing Equipment market is expected to grow from $0.11 billion in 2023 to $0.22 billion by 2033. This growth is propelled by increased investments in the fishing sector and the availability of diverse seafood products, especially from Brazil and Chile.Middle East & Africa Seafood Processing Equipment Market Report:

The Middle East and Africa region is expected to show moderate growth, from $0.42 billion in 2023 to $0.82 billion by 2033, driven by improvements in the fishing industry and supply chain efficiencies targeting local markets.Tell us your focus area and get a customized research report.

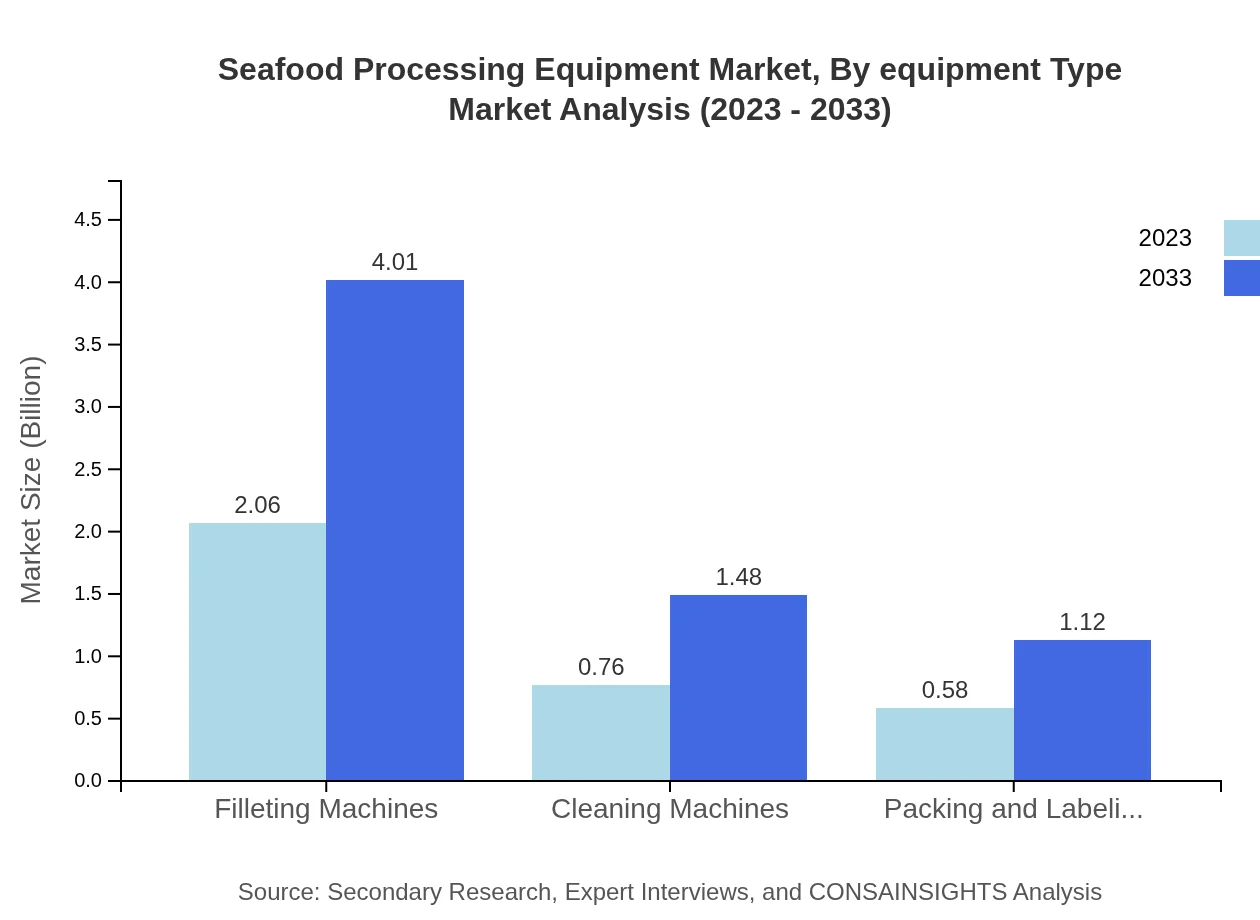

Seafood Processing Equipment Market Analysis By Equipment Type

The Seafood Processing Equipment market by equipment type includes significant contributors like Filleting Machines, contributing $2.06 billion in 2023 and expected to rise to $4.01 billion in 2033. Cleaning Machines account for $0.76 billion in 2023, with projections to reach $1.48 billion, while Packing and Labeling Equipment will grow from $0.58 billion to $1.12 billion within the same period.

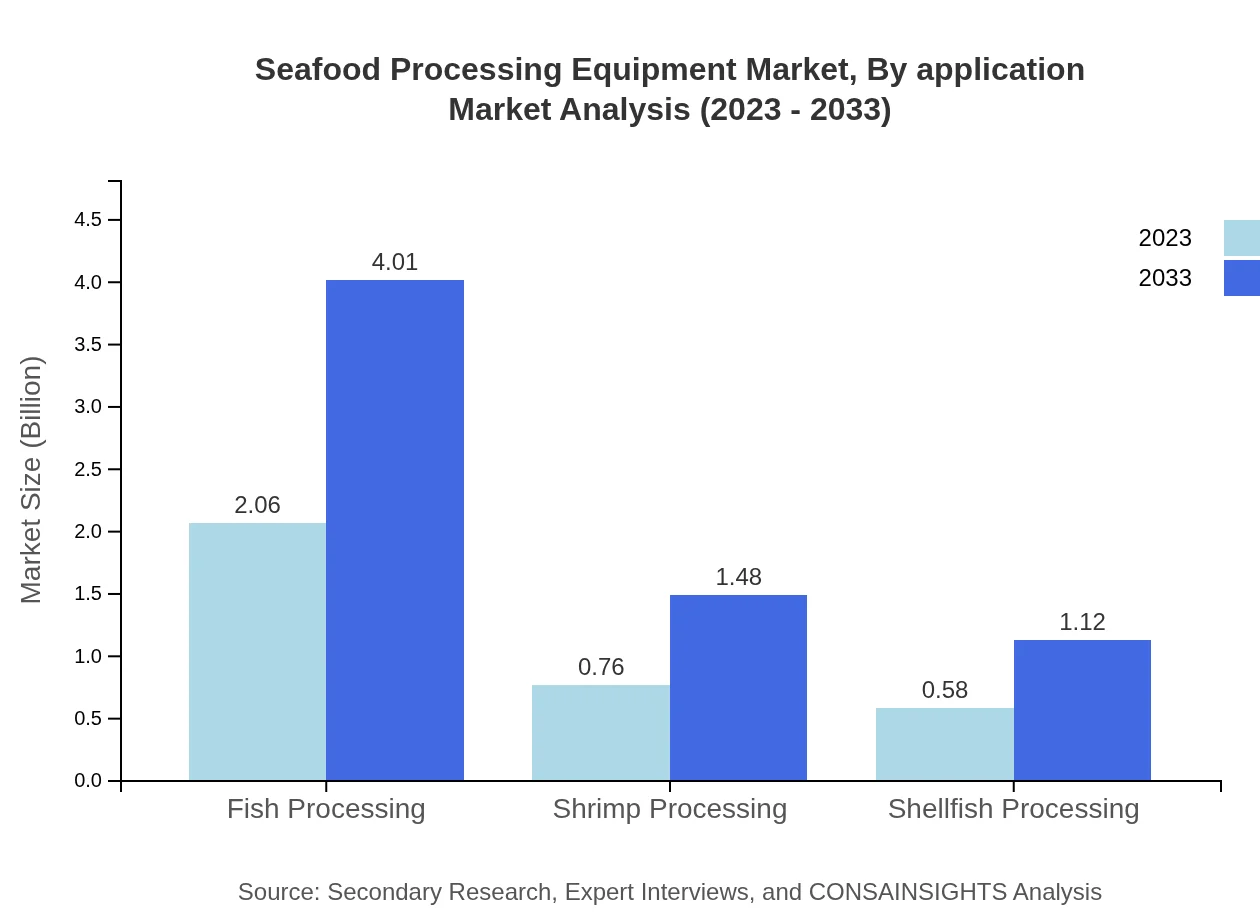

Seafood Processing Equipment Market Analysis By Application

The Fish Processing segment dominates the market, valued at $2.06 billion in 2023 and anticipated to rise to $4.01 billion by 2033, making up 60.63% of the total market share. The Shrimp and Shellfish Processing segments have smaller shares, with growth from $0.76 billion to $1.48 billion and from $0.58 billion to $1.12 billion, respectively.

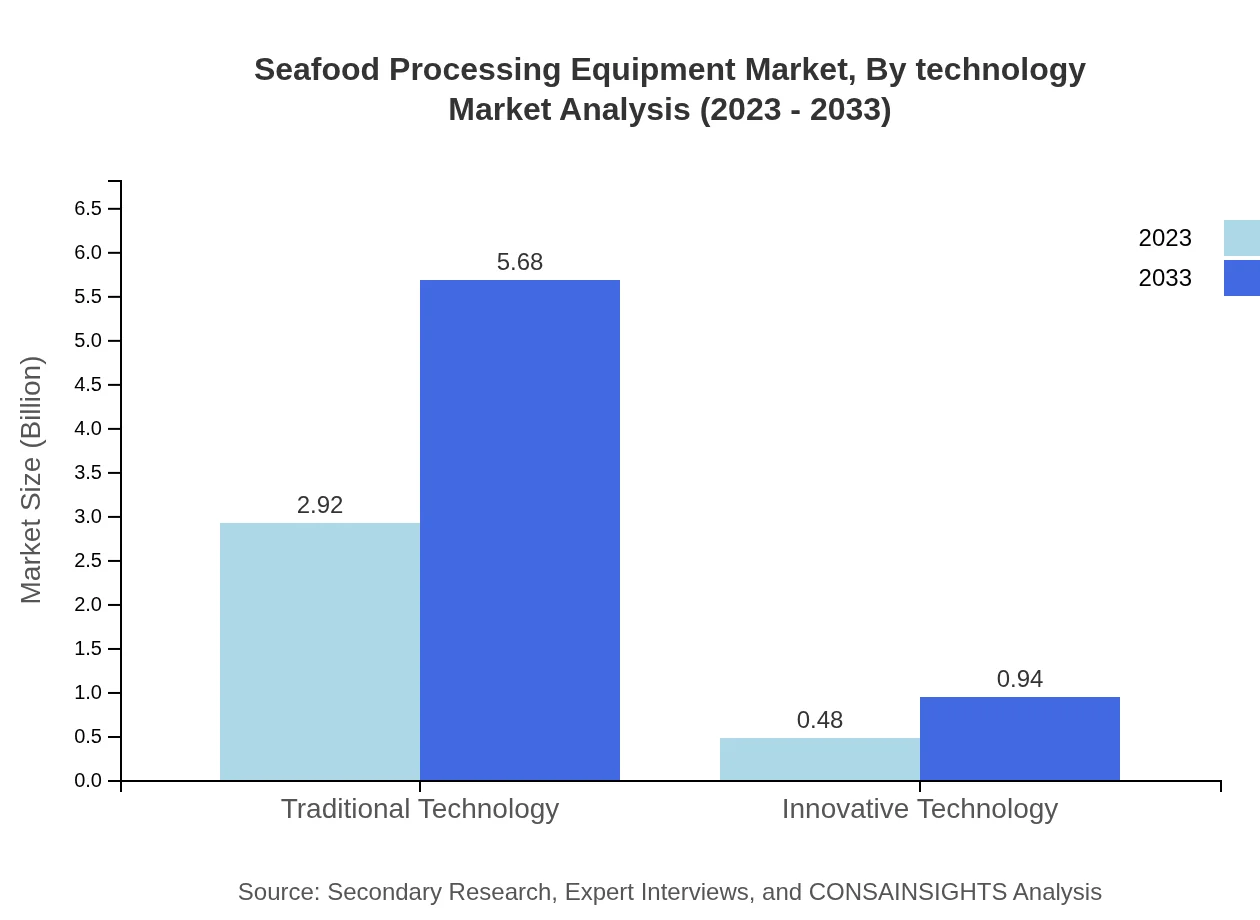

Seafood Processing Equipment Market Analysis By Technology

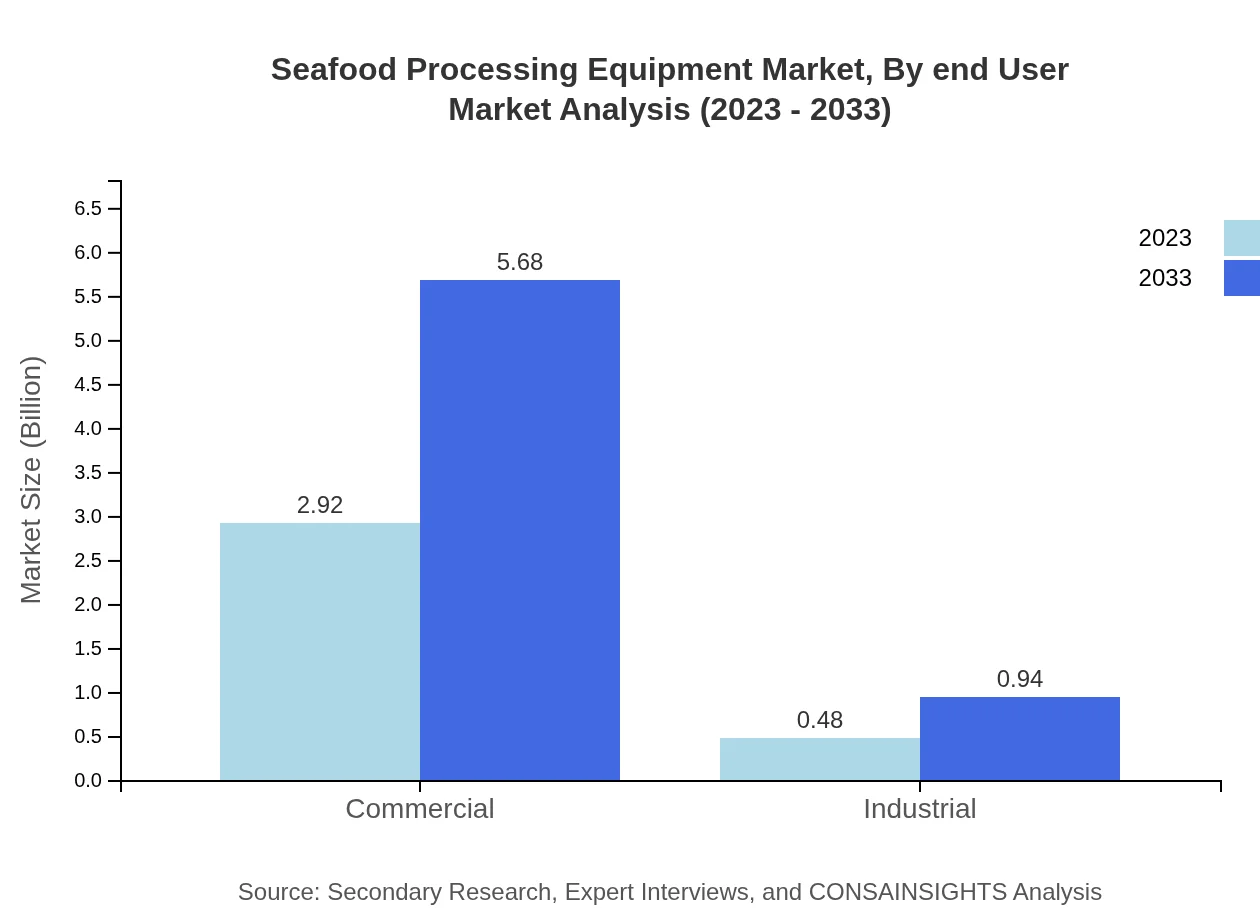

The market is also segmented by technology, with Traditional Technology maintaining a stronghold at 85.78% share in 2023. It is expected to grow from $2.92 billion to $5.68 billion, while Innovative Technology, though smaller, will see growth from $0.48 billion to $0.94 billion, representing an increasing shift towards modern processing solutions.

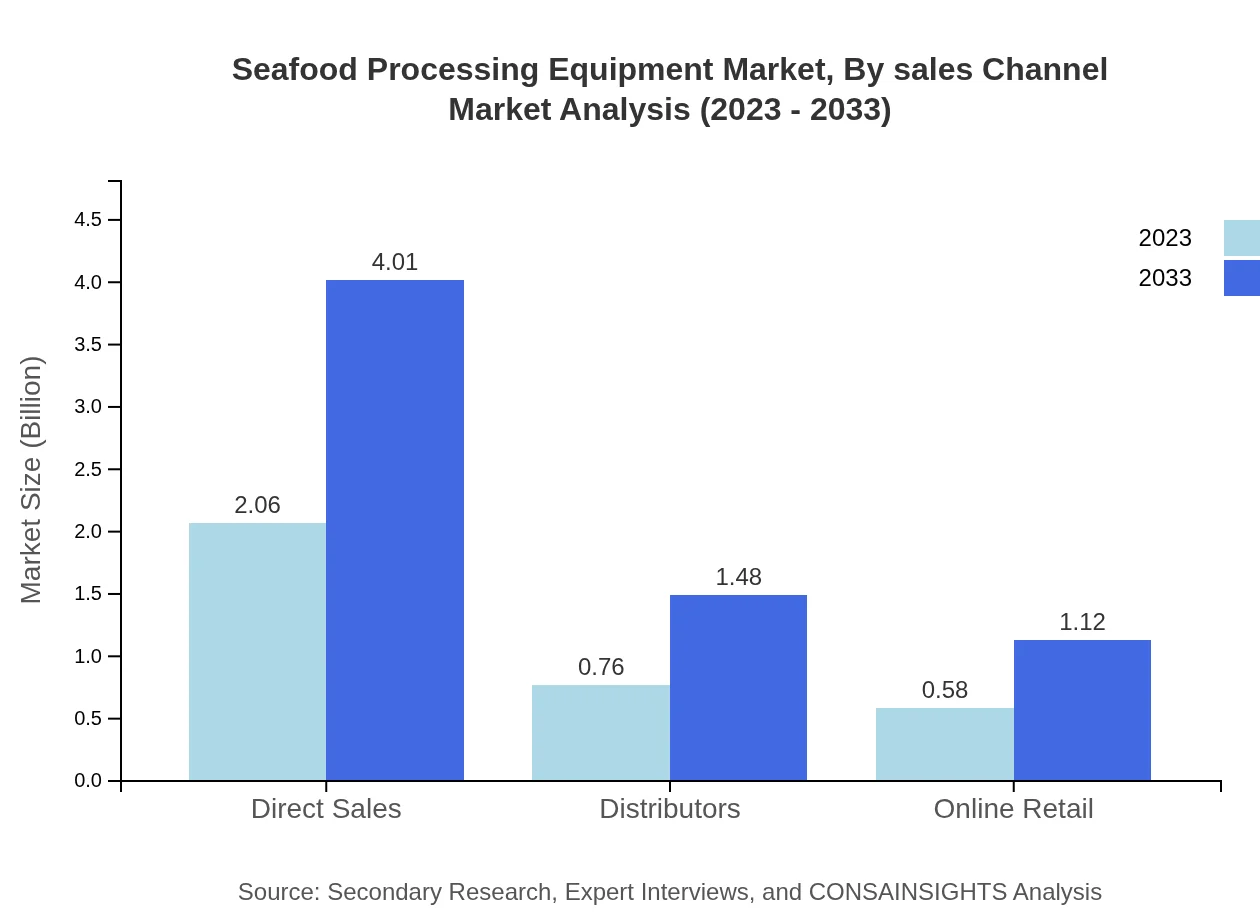

Seafood Processing Equipment Market Analysis By Sales Channel

In terms of sales channels, Direct Sales lead with a share of 60.63%, forecasted to remain stable as it grows from $2.06 billion to $4.01 billion. Distributors and Online Retail segments will see growth, from $0.76 billion to $1.48 billion and from $0.58 billion to $1.12 billion, respectively.

Seafood Processing Equipment Market Analysis By End User

The Commercial sector dominates with a market size of $2.92 billion in 2023, expanding to $5.68 billion, making up 85.78% of the overall market share. The Industrial sector, while smaller, will see growth from $0.48 billion to $0.94 billion, representing 14.22% of the market.

Seafood Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Seafood Processing Equipment Industry

Marel:

Marel is a global leader in advanced food processing systems, focusing on the seafood industry with innovative solutions that optimize efficiency and sustainability.Baader:

Baader is known for its comprehensive range of seafood processing equipment and solutions, enhancing processing efficiency through high-quality machinery.JBT Corporation:

JBT Corporation specializes in food processing solutions, offering innovative technologies that improve the quality and efficiency of seafood processing.Stork Food & Dairy Systems:

Stork is recognized for its versatile processing systems, providing tailored equipment for the seafood industry that meet diverse processing needs.We're grateful to work with incredible clients.

FAQs

What is the market size of seafood Processing Equipment?

The seafood processing equipment market is valued at approximately $3.4 billion in 2023, with a projected CAGR of 6.7% from 2023 to 2033, indicating a robust growth trajectory within this industry.

What are the key market players or companies in this seafood processing equipment industry?

Key players in the seafood processing equipment market include industry leaders and innovators known for their advanced technologies and comprehensive solutions tailored for seafood processing, contributing significantly to market dynamics.

What are the primary factors driving the growth in the seafood processing equipment industry?

Growth is driven by increasing seafood consumption, technological advancements, government regulations on food safety, and the demand for efficient processing solutions to meet global quality standards.

Which region is the fastest Growing in the seafood processing equipment?

North America is the fastest-growing region, with market size projected to increase from $1.25 billion in 2023 to $2.43 billion by 2033, fueled by demand for processed seafood products.

Does Consainsights provide customized market report data for the seafood processing equipment industry?

Yes, Consainsights offers customized market report data, allowing clients to tailor reports specific to their business needs, including detailed insights and analytics on the seafood processing equipment industry.

What deliverables can I expect from this seafood processing equipment market research project?

Expect comprehensive deliverables including market size analysis, growth forecasts, competitive landscape insights, and detailed reports on segments and regional performance within the seafood processing equipment market.

What are the market trends of seafood processing equipment?

The market trends include increased automation in processing, a shift towards sustainable practices, innovations in cold chain logistics, and the rise of e-commerce platforms for seafood distribution.